fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 01, 2019, 10:58:29 PM |

|

Not everyone can buy and hold bitcoin.

Institutional money need a walled garden to manage their positions because of regulatory/compliance/auditing constraints.

All those constrain dont mean anything for Bitcoin, let alone for you!

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

|

|

It is a common myth that Bitcoin is ruled by a majority of miners. This is not true. Bitcoin miners "vote" on the ordering of transactions, but that's all they do. They can't vote to change the network rules.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

Hueristic

Legendary

Offline Offline

Activity: 3794

Merit: 4863

Doomed to see the future and unable to prevent it

|

|

October 02, 2019, 02:00:31 AM |

|

Not everyone can buy and hold bitcoin.

Institutional money need a walled garden to manage their positions because of regulatory/compliance/auditing constraints.

All those constrain dont mean anything for Bitcoin, let alone for you!

They need to own the rules so they can game the system.  |

Bad men need nothing more to compass their ends, than that good men should look on and do nothing.

|

|

|

Kakmakr

Legendary

Offline Offline

Activity: 3430

Merit: 1957

Leading Crypto Sports Betting & Casino Platform

|

|

October 02, 2019, 06:25:11 AM |

|

Can you also explain why the investors prefer cash settled futures and not asset settled futures like the offering from Bakkt? I think this is one of the main reasons why other cash settled futures did much better than Bakkt. Also, do you think institutional investors will eventually come around to investing more into Bakkt with it's asset settled futures or will they shy away from it? What time frame are we talking about for investors to understand what the Bitcoin asset is, compared to other physical asset futures that are on offer? <Do you think investors are wary to invest in something they cannot visualize or are they scared of manipulation and Bitcoin's volatility?>  |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

HairyMaclairy

Legendary

Offline Offline

Activity: 1414

Merit: 2174

Degenerate bull hatter & Bitcoin monotheist

|

|

October 02, 2019, 09:17:16 PM |

|

Can you also explain why the investors prefer cash settled futures and not asset settled futures like the offering from Bakkt? I think this is one of the main reasons why other cash settled futures did much better than Bakkt. Also, do you think institutional investors will eventually come around to investing more into Bakkt with it's asset settled futures or will they shy away from it? What time frame are we talking about for investors to understand what the Bitcoin asset is, compared to other physical asset futures that are on offer? <Do you think investors are wary to invest in something they cannot visualize or are they scared of manipulation and Bitcoin's volatility?>  I prefer cash settled futures when I am shorting an asset. I dont want to be paid in the asset when the value of the asset is falling, I want to be paid in cash. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 03, 2019, 12:28:24 PM |

|

Can you also explain why the investors prefer cash settled futures and not asset settled futures like the offering from Bakkt? I think this is one of the main reasons why other cash settled futures did much better than Bakkt. Also, do you think institutional investors will eventually come around to investing more into Bakkt with it's asset settled futures or will they shy away from it? What time frame are we talking about for investors to understand what the Bitcoin asset is, compared to other physical asset futures that are on offer? <Do you think investors are wary to invest in something they cannot visualize or are they scared of manipulation and Bitcoin's volatility?>  Regarding Bitcoin futures the main difference is custody. For the vast majority of future subscribers the holding of a "physical bitcoin", is simply impossible, being it too complicated from a regulatory/compliance point of view and often beyond investment mandate. This is why CME launched cash settled futures first: this product perfectly integrate in the post trading workflow of any given future investor. Also future investors never get in "touch" with actual bitcoins, saving them from a lot of troubles when investing. This is also why BAKKT future is so important: this means that bitcoin is not a financially valuable assets, but an asset that has some properties valuable beyond the price dynamic. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 04, 2019, 02:23:52 PM |

|

I don't understand why you said nothing about the CoT (Commitments of Traders) ? It's very important in futures markets.

There my friend. I just added a paragraph detailing how to properly read a CoT report. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 04, 2019, 03:02:42 PM |

|

Intercontinental Exchange Says First Block Trade of Bakkt Bitcoin Futures Executed

(MT Newswires)

Intercontinental Exchange (ICE) said Friday that the first block trade of Bakkt Bitcoin Futures submitted to ICE Futures US was executed.

The Bakkt Bitcoin Futures block trade was executed between Galaxy Digital and XBTO on Oct. 1, which was cleared by ED&F Man.

Price: 92.59, Change: +1.24, Percent Change: +1.36 BLOCK TRADE: A block trade is the sale or purchase of a large number of securities. A block trade involves a significantly large number of equities or bonds being traded at an arranged price between two parties. Block trades are sometimes done outside of the open markets to lessen the impact on the security price. So basically, it's some sort of "pre-arranged" trade between two counterparties who decide not to trad this in the open market, because it would have caused price disruption due to poor liquidity. This trade so is arranged and then it goes through the market infrastructure. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

wwzsocki

Legendary

Offline Offline

Activity: 2730

Merit: 1706

First 100% Liquid Stablecoin Backed by Gold

|

|

October 04, 2019, 04:16:07 PM Merited by fillippone (1) |

|

If you think there's a more appropriate section for this thread, please make a proposal...

It might be better suited in the same section I had my thread regarding bakkt before it officially launched: https://bitcointalk.org/index.php?topic=5186550After I have read the OP and later all comments in this thread my first thought about the proper section for such a detailed article was the Economics board. There are already a couple of threads about Bakkt just like this one quoted above. I am sure this very detailed article is too overwhelming for beginners and even more, advanced traders have to read it a couple of times to understand the BTC futures subject correctly. One has to have already a lot of trading experience with multiple BTC products to understand all these technical details. I just want to add that this is the best explanation of BTC futures I have read on Bitcointalk so far. I really have a lot of respect for the author's knowledge. |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 04, 2019, 04:22:16 PM |

|

Ok, understood, thanks for your feedback.

Due to your inputs, I am going to move this thread in the Economics Board then.

Hopefully that board is more suited to this post and beginners will eventually find their way to this thread.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

NathanJB

|

|

October 04, 2019, 04:59:12 PM |

|

This is it. Thank you OP for your initiative and effort in putting up such a long and sophisticated explanation of the overhyped Bakkt futures exchange. A lot of members are definitely hungry of this explanation, not just newbies for sure but also those with higher ranks, as high as legendary. Take note that high rank members are more afraid and shy to ask questions than newbies. And since you've read our minds, this thread is begotten.

The term "futures" is one of the most important keyword here and you've clearly explained it. Great job!

|

|

|

|

|

|

Pearls Before Swine

|

|

October 04, 2019, 05:10:40 PM |

|

Fantastic summary, fillippone. Before becoming interested in crypto I was extremely interested in the stock market and so was familiar with options, futures, and other derivatives. But I much preferred buying individual stocks outright instead of just betting on price movements, which is what futures are basically all about.

Futures also don't provide any income through dividends or any other benefits an investor gets by stock ownership. Its important that new traders realize this. Hedge funds and the rest of wall street use derivatives to hedge their positions, but I think its difficult for the average individual trader to make money with them (I could be mistaken, tho).

This all makes me wonder if any wall st firms are really getting into bitcoin by utilizing Bakkt. Reports around here seem to suggest that this isnt the case, but somehow I can't imagine investment firms not wanting to make money with crypto. When its hot, its hot and there's a lot of money to be made. Bet you when bitcoin starts accelerating toward $20,000 and past that to a new all time high, volume on Bakkt will explode.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 05, 2019, 01:05:41 PM |

|

Many investor afraid with bitcoin condition today, where many cases from bakkt still not get good respond for bitcoin and SEC still not allowing bitcoin become legal in United State, but you don't worry as you are an investor of bitcoin because bitcoin could be stronger than last two years when banned in China.

Bitcoin is legal in the US and never has been banned in China. Please dont spam this thread as we are all trying to learn things, not earn a few Satoshi per post. Thank you. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

magneto

|

|

October 06, 2019, 12:23:28 PM |

|

Extremely informative read.

My only real query that I'm still baffled by is that why anecdotally, BTC futures only exists in contango and never really in backwardation? Given the fact that there isn't really much of a cost of carrying BTC (you can just chuck it in a cold wallet and forget about it until maturity), is it solely due to market expectations of BTC price?

Dabs is right though, this ain't beginner stuff, but it's what intermediate traders desperately need to read even if they're just trading perps, imo.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 07, 2019, 07:43:59 AM |

|

Extremely informative read.

My only real query that I'm still baffled by is that why anecdotally, BTC futures only exists in contango and never really in backwardation? Given the fact that there isn't really much of a cost of carrying BTC (you can just chuck it in a cold wallet and forget about it until maturity), is it solely due to market expectations of BTC price?

Dabs is right though, this ain't beginner stuff, but it's what intermediate traders desperately need to read even if they're just trading perps, imo.

This is an interesting question. As I wrote in the OP at launch of CBOT futures the term structure was in contango. Of course the interpretation of this being a "forecast" of future prices is totally wrong, as I have explained. Term structure shape is definitely something to look after. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 07, 2019, 07:59:17 AM

Last edit: May 16, 2023, 07:11:43 AM by fillippone |

|

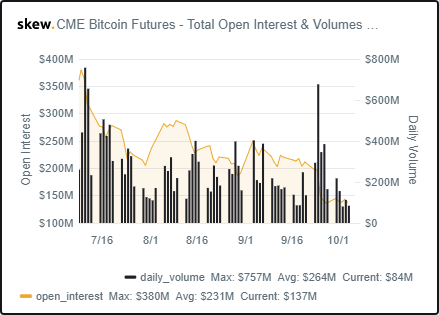

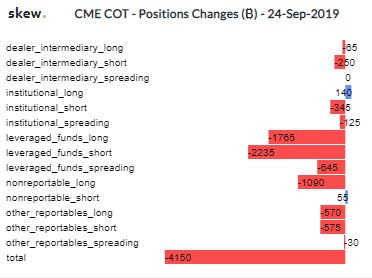

Speaking of Commitments of traders. There are many informative websites that periodically update and do analysis on this official document. One of this is www.skew.comThis is the total Volume and Open Interest chart over the past weeks:  This is the current Open Interest broken down to individual investor category  This is the change in Open Interest broken down to individual investor category  We see the open interest is now around 16,500 lots, with a weekly variation of -4,150 (down 20%). The category that reduced the most the open interest is the leverage short. So they bought back some short they opened. This can be interpreted in two ways: - BULLISH: the short closed their positions, the selling pressure has ended and there's now space for a rebound.

- BEARISH: the short reached their target, so they are not willing to buy the market in case of another leg down. Without buyer next leg down hence next movemement down could be bigger.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

barbara44

|

|

October 13, 2019, 08:30:58 AM |

|

It is not weird to be afraid of bitcoins price, everyone should be afraid of the price at all times when it is low or high, it is not the part where you are afraid you should be worried about it should be the lack of bravery when going into bitcoin, bravery is not the state of "not being afraid of anything", no, bravery is being afraid of something but doing it anyway because you want to, that is when you are brave and if you are not brave in bitcoin market then I am afraid you will never make money.

You should be afraid and you should accept the fact that you will never know what the price of bitcoin will do and still invest anyway no matter what. Those type of people do lose money sometimes but they are also the ones who make the most profit out of crypto trading.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 06, 2019, 08:56:44 AM

Last edit: May 16, 2023, 07:06:30 AM by fillippone |

|

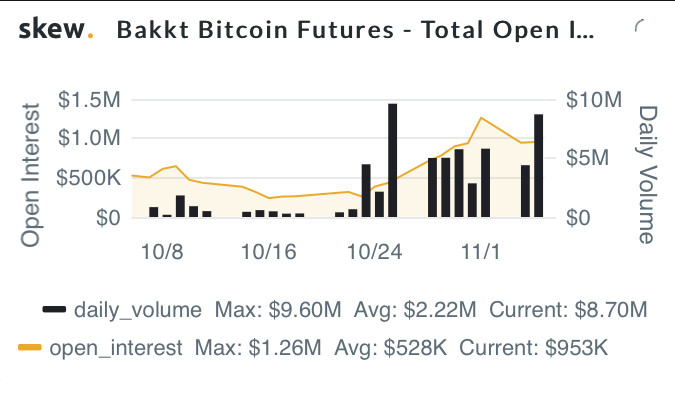

Bloomberg added BAKKT to their Professional service Bloomberg terminal. From here you can observe Open Interest, an information that is not widely available until now, as far as I know:  We see the rise in the volumes we observed in the last 10 days, probably due to more FCM (Full clearing members) onboarding in their warehouse, also was accompanied by a rise in the open interest. 72 lots of open interest might not look huge, compared to trading volumes, but probably is natural for a startup phase and due to the high volatility of underlying. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 06, 2019, 05:45:06 PM

Last edit: May 16, 2023, 07:06:19 AM by fillippone |

|

Again on Bakkt Open interest. They are now widely available at skew.com  |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15375

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 07, 2019, 11:19:38 AM

Last edit: May 16, 2023, 07:05:58 AM by fillippone |

|

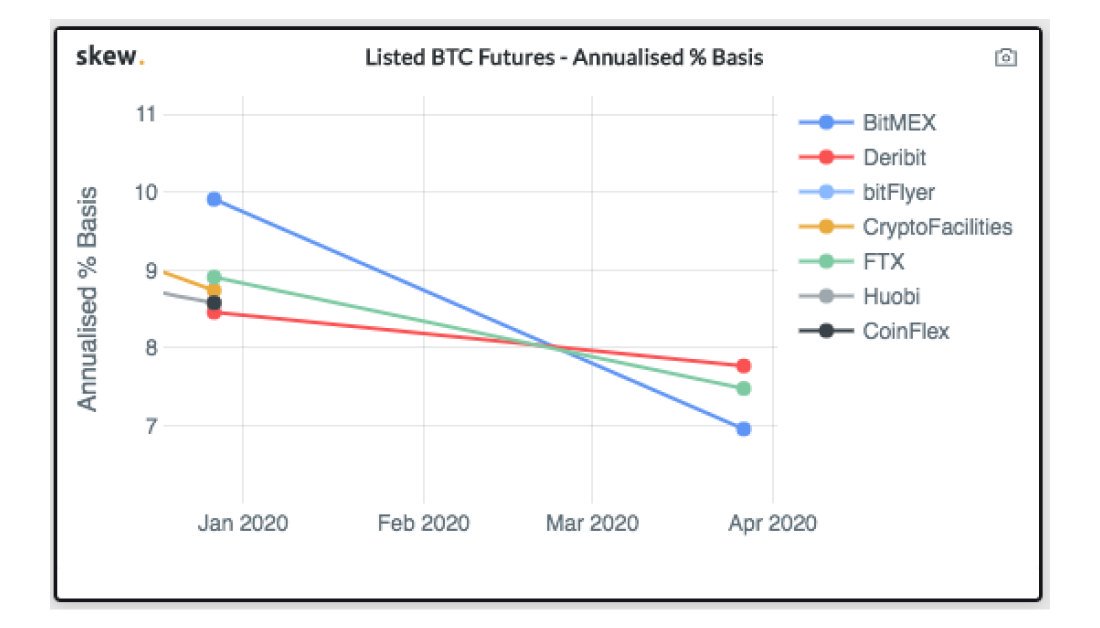

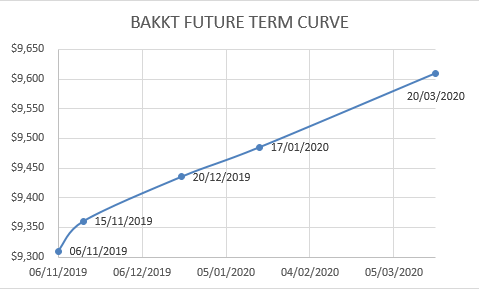

A few days ago PlanB made the following statement. Verification of what I said before: #bitcoin cash & carry (spot buying btc and simultaneously future selling for delivery in 1-6 months) will net you 7-10% annualized return .. almost risk free. @stephanlivera and I talk about this in the podcast that will be out later today. Cash & carry strategies can return up to 10% annualised ➡ï¸ Live curve on http://skew.comDisclaimer: Not investment advice  What does it means? Is it really possible to profit from this situation? Let's proceed in order and see what the facts are, concentrating only on BAkkt, for the sake of simplicity and because more similar to thread analysiss, but the reasoning is the same for every other future From the Bakkt website we gather the information on the prices of the futures currently traded.  I carefully selected a time where the last contract, the less liquid has the same timestamp of the first, so we have some reliable quotation for the examples. Others contract have a slightly different timestamps, so the calculation won't be actually very reliable, but it is something we must cope with until liquidity is good on all the instruments. At the time of trading the Spot price, (I used the CME Real Time Index, it's the bitcoin priced used by CME futures) was trading at $ 9,310. So the situation was the following one: | Expiry | Date | Price | | SPOT | 06 Nov 2019 | $9,310 | | NOV19 | 15 Nov 2019 | $9,360 | | DEC19 | 20 Dec 2019 | $9,435 | | JAN20 | 17 Jan 2020 | $9,485 | | MAR20 | 20 Mar 2020 | $9,610 |

or graphically:  We can see the future term structure exhibit a nice upward slowing curve: that is a contango: as explained in the op that is the situation when future price are above the forward price. So the idea is to profit from this situation selling a future, while at the same time buying a bitcoin on the spot market, to be held it until future expiry. In this way at the expiry you will have a bitcoin to be sold to your conterpart. Having bought the bitcoin at a lower price, you are actualy locking in the price difference you executed your trades. Let's see in the details Buy 1 BTC SPOT@9,310 USD Sell 1 BTC MAR20 Future @9,610 USD On 20 March 20 you will have to sell your Bitcoin to you counterpart at 9,610 USD. Having bought that bitcoin at 9,310 USD, wou are actually cashing in 300 USD as a pofit. 300 USD profit on a 9,610 investment, is 2,70% return. a 2,70% return over 135 days is roughly 8,70 on a yearly basis. This is pretty consistent with PlanB numbers. Please note that: - This is a market neutral strategy: you are not exposed to market risks, bitcoin can go up to 30,000 USD or crash to 1,000 SUD and your profit will stay the same, as you are buying and selling a bitcoin at the same time.

- We are neglecting the cost of carry: or the cost of holding a bitcoin untily trade expiry. I think this cost is pretty limited, you might considering insuring your investment, or you can even deposit your bitcoin in the BAKKT warehouse, that might charge you a cost for that.

- You are actually exposed to a credit risk versus the exchange: if the exchange defaults, you are holding a bitcoin versus nothing (in case you didn't deposit it in the warewhouse,, but this is adding another layer of complextiy not worth analysing here. Regulated exchanges are amongst the most liquid institutions in the financial markets as they carry very little risks due to margining of their positions.

- We didn't account for financing, margining and managing cash positions. Again I don't think they are goind to add much to this analyis.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

crazy-joe

Jr. Member

Offline Offline

Activity: 46

Merit: 4

|

|

November 13, 2019, 01:52:44 PM |

|

A few days ago PlanB made the following statement.

Hello How can we apply your strategy to futures on Bitmex? Because I can't trade on Bakkt. Why futures of March are above spot price and other futures? |

|

|

|

|

|