fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15383

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 29, 2019, 03:20:37 PM

Last edit: May 16, 2023, 07:08:37 AM by fillippone |

|

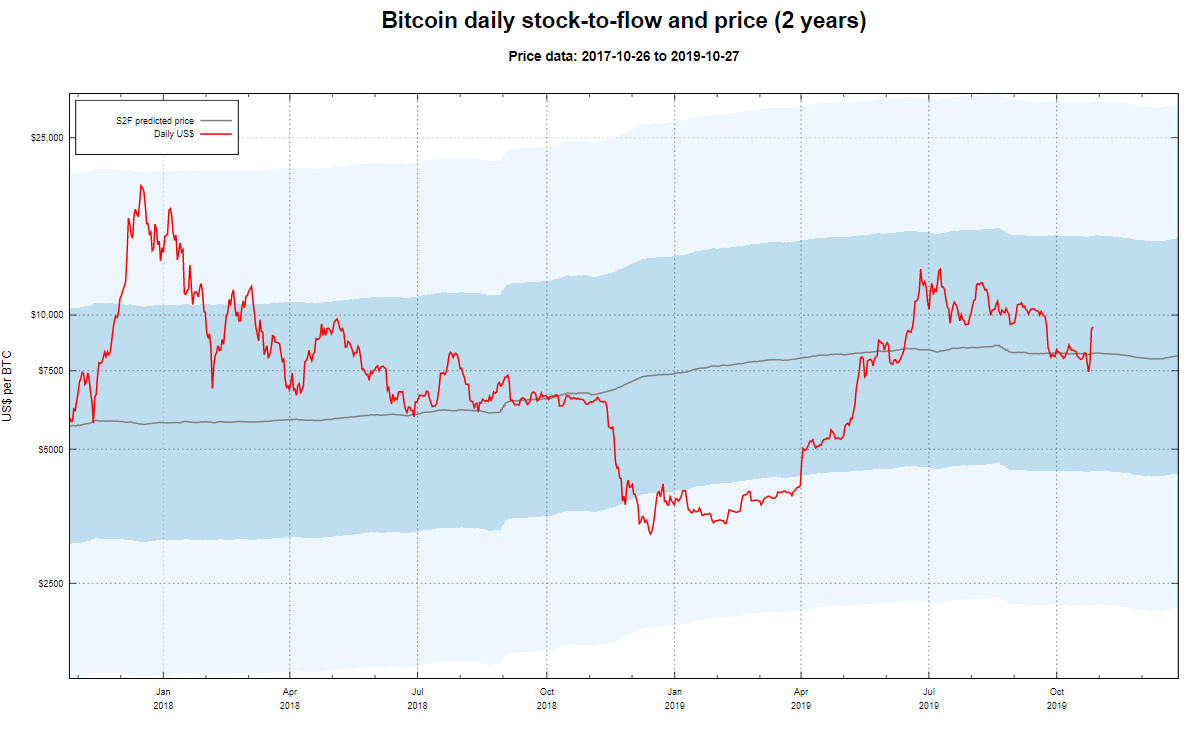

New addition to real time Stock to Flow graphics: Daily updated charts of Bitcoin's stock-to-flow vs price Pretty standard implementation at first: This page contains a chart showing the relation between the average US$ price of bitcoin (available from blockchain.com and Bitcoin's stock-to-flow ratio. The stock at a specified date is the number of bitcoins that are mined at that date and the flow is the number of coins in a year that lead to that stock. The division between both is the stock-to-flow ratio. There is a strong correlation between the logarithm of the stock-to-flow ratio and the logarithm of the price (see third graph).

These charts are updated daily.

There is a nice addition: The dark blue area represents one standard error (2D version of standard deviation) from the predicted price and the light blue area represents two standard errors. The predicted price is extended into the future based on the parameters until Jan 1st 2027.

So IF the error of the price is distributed as a normal around the model price, it should be inside the dark blue band for the 68% of the time, inside the light blue area for the 95% of the time ( learn more here). |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

Each block is stacked on top of the previous one. Adding another block to the top makes all lower blocks more difficult to remove: there is more "weight" above each block. A transaction in a block 6 blocks deep (6 confirmations) will be very difficult to remove.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15383

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 02, 2019, 12:14:01 PM |

|

Very nice thread found on Twitter: 🌊 A “stock-to-flow debacle” has taken crypto-twitter by storm.

The meme achieved superior performance in nocoiner conversion…

…and flooded your timeline with 🔢math, 💎minerals and 🔥heated opinions you may not understand.

Time to slash FUD and review some of the #stats: https://twitter.com/felipether/status/1188814540802318337?s=21Lot of elaboration and mumblings SF model, clarifying many things: do you know the difference between correlation and cointegration? |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15383

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 05, 2019, 01:49:15 PM

Last edit: November 05, 2019, 03:06:57 PM by fillippone |

|

New Pocast is out: https://stephanlivera.com/episode/122/PlanB (Pseudonymous Bitcoin Quant) rejoins me in this episode to talk about the response to his seminal work, Modeling Bitcoin’s Value with Scarcity. There have been some responses to his Stock to Flow (S2F) modelling work, so we talk: - The response to his articles and translations

- What cointegration is and why it matters

- Responses to PlanB’s modelling work

- Cash and carry trade

- Where to from here

Listening to this pearl. Will provide transcript of any relevant part. EDIT: too many good parts. This post is going to be kilometric. Stephan Livera: That’s awesome. That sounds great. I’m really looking forward to hearing about what you’ve got coming up next. I suppose just as a final comment for the listeners, can you just let them know what should they be watching and thinking about just to understand if the model has broken down or is there anything else there? Any other people who you would like to hear from?

PlanB: Yeah, the model is it’s very simple. So ifthe cointegration is gone, if it doesn’t show in the next one or two years, if it’s gone, then the model breaks down. And so my point is a bit conservative. I’d like to see it earlier than that. But if a Bitcoin is not above a hundred thousand or the 55,000 depending on the model you’d like to use, if it’s not above that number before Christmas 2021, then yeah, the model is in real trouble. And I’m probably so am I because I made it, but yeah, it is a possibility. Of course. Let me finish with that. It’s just a model. It’s not a guarantee for quick profits. And it can be wrong, so yeah, please watch that.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

anon241469

Newbie

Offline Offline

Activity: 28

Merit: 5

|

|

November 06, 2019, 03:06:53 AM Merited by fillippone (1) |

|

Somebody on this forum suggested that I post my recent paper on this thread. Here it is in three formats, jpeg, pdf, and Medium.com. To summarize what the paper is about: make plan B's market value vs S/F regression but with daily data instead of monthly data, then express the market value as a multiple of that regression over time, view it on logarithmic scale, notice some patterns, do some math, apply some critical thinking, figure out the implications... read the paper: https://i.redd.it/erghlcv7lqw31.jpghttps://pdfhost.io/v/ym3kQ9QDy_On_the_Convergence_of_Bitcoinpdf.pdfhttps://medium.com/@AJC241469/on-the-apparent-convergence-of-bitcoins-usd-market-value-toward-the-stock-to-flow-valuation-model-7a9275ac2206 |

|

|

|

|

anon241469

Newbie

Offline Offline

Activity: 28

Merit: 5

|

|

November 06, 2019, 03:24:12 AM |

|

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15383

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 06, 2019, 01:10:34 PM |

|

R^2=99% is impressive. We know Bitcoin is digital gold, now we have the mathematical proof of it. “Cyber-money will no longer be denominated only in national units like the paper money of the industrial period. It probably will be defined in terms of ounces of gold.”

-The Sovereign Individual (1997) Davidson & Rees-Mogg

#bitcoin

https://twitter.com/100trillionUSD/status/1192032782912040960?s=20 https://twitter.com/100trillionUSD/status/1192032782912040960?s=20 |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

anon241469

Newbie

Offline Offline

Activity: 28

Merit: 5

|

|

November 06, 2019, 01:12:59 PM |

|

- that's hardly proof. Why does Plan B use so few data points? A high R^2 is quite useless if you only pick the points that fit on the line. there are thousands of other points! Just read my paper, he could have found what I found! |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15383

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 06, 2019, 01:25:41 PM |

|

<....>

- that's hardly proof. Why does Plan B use so few data points? A high R^2 is quite useless if you only pick the points that fit on the line. there are thousands of other points! Just read my paper, he could have found what I found!

He demonstrated that high stability in the parameters indipendently of the sample you use. I only diagonally read your paper, for the moment, sorry. You could better point out in the post what your conclusion are because they aren't clear reading abstract and conclusion paragraph, actually. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

anon241469

Newbie

Offline Offline

Activity: 28

Merit: 5

|

|

November 06, 2019, 02:00:15 PM |

|

<....>

- that's hardly proof. Why does Plan B use so few data points? A high R^2 is quite useless if you only pick the points that fit on the line. there are thousands of other points! Just read my paper, he could have found what I found!

He demonstrated that high stability in the parameters indipendently of the sample you use. I only diagonally read your paper, for the moment, sorry. You could better point out in the post what your conclusion are because they aren't clear reading abstract and conclusion paragraph, actually. Yes, I know. But there is really no way to summarize it because it is difficult to explain, even in 4 pages. There is one reddit user who still doesn’t get it, even after I’ve tried to explain it further. |

|

|

|

|

Last of the V8s

Legendary

Offline Offline

Activity: 1652

Merit: 4392

Be a bank

|

|

November 06, 2019, 10:18:00 PM Merited by fillippone (1) |

|

Regarding the stack exchange expalination, I see a circular reference: he could have adjusted block reward to get different total amounts. What if started with 100 BTC as first reward? Or 60? We would end up having different maximum number of bitcoins. So it might be a miscalculation, or a little bit of luck, or a mi tire of the two, but I don’t buy the stack exchange post as an explanation on WHY 21 millions, rather than HOW...

So

quite right and I apologise for doubting you. Here's the real infos, showing the history: I remember this discussion, actually.

Finney, Satoshi, and I discussed how divisible a Bitcoin ought to be. Satoshi had already more or less decided on a 50-coin per block payout with halving every so often to add up to a 21M coin supply. Finney made the point that people should never need any currency division smaller than a US penny, and then somebody (I forget who) consulted some oracle somewhere like maybe Wikipedia and figured out what the entire world's M1 money supply at that time was.

We debated for a while about which measure of money Bitcoin most closely approximated; but M2, M3, and so on are all for debt-based currencies, so I agreed with Finney that M1 was probably the best measure.

21Million, times 10^8 subdivisions, meant that even if the whole word's money supply were replaced by the 21 million bitcoins the smallest unit (we weren't calling them Satoshis yet) would still be worth a bit less than a penny, so no matter what happened -- even if the entire economy of planet earth were measured in Bitcoin -- it would never inconvenience people by being too large a unit for convenience. |

|

|

|

Saint-loup

Legendary

Offline Offline

Activity: 2590

Merit: 2348

|

|

November 12, 2019, 06:10:37 PM |

|

Interesting article : Why Bitcoin’s Next ‘Halving’ May Not Pump the Price Like Last Timehttps://www.coindesk.com/why-bitcoins-next-halving-may-not-pump-the-price-like-last-timeAlso, in traditional markets, price is rarely a function of supply. It’s more influenced by demand, which the S2F model does not take into account. In the absence of an established and widespread fundamental use case (for now), demand in crypto markets is narrative-driven. |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

November 12, 2019, 06:41:06 PM |

|

Thanks for posting. It's an interesting analysis and I'm glad to see some counterpoints to the bullish halving narrative. While this model has its critics, it has undergone rigorous cross-examination, and it seems that the regression holds up. It also makes intuitive sense: a reduction in supply should enhance value, all else being equal. So why isn’t the price already heading up to that lofty level? The reduction in new supply hasn't even occurred yet. It's impossible to predict when the reduction would be "priced in" by market demand. Also, in traditional markets, price is rarely a function of supply. It’s more influenced by demand, which the S2F model does not take into account. In the absence of an established and widespread fundamental use case (for now), demand in crypto markets is narrative-driven. Constant demand (all else being equal) would lead to a price increase, so the author is implying there is or will be a decrease in demand. I'm not sure that's a well-founded assumption, given that the numbers of crypto users continue to swell: https://cointelegraph.com/news/number-of-crypto-users-nearly-doubled-in-2018-study-sayshttps://news.bitcoin.com/the-number-of-cryptocurrency-wallet-users-keeps-rising/ |

|

|

|

Saint-loup

Legendary

Offline Offline

Activity: 2590

Merit: 2348

|

|

November 12, 2019, 09:09:58 PM |

|

Also, in traditional markets, price is rarely a function of supply. It’s more influenced by demand, which the S2F model does not take into account. In the absence of an established and widespread fundamental use case (for now), demand in crypto markets is narrative-driven. Constant demand (all else being equal) would lead to a price increase, so the author is implying there is or will be a decrease in demand. I'm not sure that's a well-founded assumption, given that the numbers of crypto users continue to swell: Why constant demand would lead to a price increase? The supply won't decrease like for a token burn for example, it will just increase less quickly... |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

November 12, 2019, 10:21:02 PM |

|

Also, in traditional markets, price is rarely a function of supply. It’s more influenced by demand, which the S2F model does not take into account. In the absence of an established and widespread fundamental use case (for now), demand in crypto markets is narrative-driven. Constant demand (all else being equal) would lead to a price increase, so the author is implying there is or will be a decrease in demand. I'm not sure that's a well-founded assumption, given that the numbers of crypto users continue to swell: Why constant demand would lead to a price increase? The supply won't decrease like for a token burn for example, it will just increase less quickly... Price is not determined by the total supply, but rather the supply available for sale. Inflation = new available supply. If inflation is lowered, there will be less coins available for sale because some portion of mining rewards will always be sold (covering mining overheads/liabilities and profit taking). Constant demand + decreased supply = price increase. It's simple economics. |

|

|

|

Saint-loup

Legendary

Offline Offline

Activity: 2590

Merit: 2348

|

|

November 13, 2019, 12:06:15 AM |

|

Also, in traditional markets, price is rarely a function of supply. It’s more influenced by demand, which the S2F model does not take into account. In the absence of an established and widespread fundamental use case (for now), demand in crypto markets is narrative-driven. Constant demand (all else being equal) would lead to a price increase, so the author is implying there is or will be a decrease in demand. I'm not sure that's a well-founded assumption, given that the numbers of crypto users continue to swell: Why constant demand would lead to a price increase? The supply won't decrease like for a token burn for example, it will just increase less quickly... Price is not determined by the total supply, but rather the supply available for sale. Inflation = new available supply. If inflation is lowered, there will be less coins available for sale because some portion of mining rewards will always be sold (covering mining overheads/liabilities and profit taking). Constant demand + decreased supply = price increase. It's simple economics. I don't think it's really as "simple" as you say. Many people sell btc to buy altcoins for example, 300btc a day it's important but it's not the largest part of the sales. If it's as simple as that why we are at the same price as 2 years ago while we are only 5 months before the halving now? How do you explain that futures prices for the next year are so low? |

|

|

|

|

meanwords

|

|

November 13, 2019, 03:06:34 AM

Last edit: November 13, 2019, 12:00:39 PM by meanwords |

|

This thread itself is so deep. I never knew 2020 (which is next year) would have a great impact on the price flow of Bitcoin for the upcoming years. Merit to you sir. I don't understand some of the things since I'm not a native speaker and my knowledge of economics is not that deep but I do have questions.

I think the past halving was successful due to the fact that Bitcoin is still an infant. There's not much invested in it compared today and it isn't advertised as extensive as today. The last bull run was successful because of many factors like altcoins, ICO, even the scam Bitconnect, airdrops which is so extensive that even people without knowledge about Bitcoin gets to invest in it, and many more.

What if those factors didn't happen this year? does that mean the price of Bitcoin would decline significantly for the upcoming years? Why would more people buy Bitcoin just because it is halving? Well if we did get a Bull run up to 25k, will the model still continue or it's a fail?

|

|

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

November 13, 2019, 07:25:06 AM |

|

Price is not determined by the total supply, but rather the supply available for sale.

Inflation = new available supply. If inflation is lowered, there will be less coins available for sale because some portion of mining rewards will always be sold (covering mining overheads/liabilities and profit taking).

Constant demand + decreased supply = price increase. It's simple economics.

I don't think it's really as "simple" as you say. Many people sell btc to buy altcoins for example, 300btc a day it's important but it's not the largest part of the sales. Selling BTC for altcoins doesn't hurt BTCUSD prices. In fact, the altcoin markets are very bullish for BTC. Instead of selling for fiat, BTC traders move their supply to altcoin exchanges instead. This makes for less available BTC supply on fiat exchanges. Altcoin investors also buy BTC off fiat exchanges to send to altcoin exchanges. Both these dynamics drive BTCUSD prices up. If it's as simple as that why we are at the same price as 2 years ago while we are only 5 months before the halving now?

How do you explain that futures prices for the next year are so low?

Because markets take time to reverse from bear market to bull market. Bitcoin in particular moves in exaggerated boom-and-bust type cycles. We are 6 months out from the halving. At this point in 2015, the market was trading at a 60% loss from the ATH. The market is currently down 55% from the ATH. Everything looks pretty normal to me. |

|

|

|

Saint-loup

Legendary

Offline Offline

Activity: 2590

Merit: 2348

|

|

November 13, 2019, 10:19:30 AM |

|

Price is not determined by the total supply, but rather the supply available for sale.

Inflation = new available supply. If inflation is lowered, there will be less coins available for sale because some portion of mining rewards will always be sold (covering mining overheads/liabilities and profit taking).

Constant demand + decreased supply = price increase. It's simple economics.

I don't think it's really as "simple" as you say. Many people sell btc to buy altcoins for example, 300btc a day it's important but it's not the largest part of the sales. Selling BTC for altcoins doesn't hurt BTCUSD prices. In fact, the altcoin markets are very bullish for BTC. Instead of selling for fiat, BTC traders move their supply to altcoin exchanges instead. This makes for less available BTC supply on fiat exchanges. Altcoin investors also buy BTC off fiat exchanges to send to altcoin exchanges. Both these dynamics drive BTCUSD prices up. But Coinmarketcap uses altcoin markets to calculate the BTC price (1) Price (Market Pair)

The price for each individual market pair is calculated by taking the unconverted price reported directly from the exchange and converting it to USD using CoinMarketCap’s existing reference prices. Let’s take LTC/BTC market as an example:

Let (E) be the price of LTC/BTC reported directly from the exchange.

Let (C) be the last known reference price of BTC from CoinMarketCap in USD.

Let (D) be the derived price reported on CoinMarketCap for the market pair.

For this example, let (E) = 0.01 BTC / 1 LTC and let (C) = 10,000 USD / 1 BTC.

D = E * C

D = (0.01 BTC / 1 LTC) * (10,000 USD / 1 BTC) = 100 USD / 1 LTC

Therefore, the derived price for LTC/BTC on this specific market pair is $100 USD. https://support.coinmarketcap.com/hc/en-us/articles/360034116491-Market-Data-Cryptoasset-Rankhttps://coinmarketcap.com/currencies/bitcoin/markets/If people sell btc for potatoes and potatoes worth 1$, of course it will affect the price discovery process. |

|

|

|

|

aardvark15

|

|

November 18, 2019, 02:27:49 PM |

|

Price is not determined by the total supply, but rather the supply available for sale.

Inflation = new available supply. If inflation is lowered, there will be less coins available for sale because some portion of mining rewards will always be sold (covering mining overheads/liabilities and profit taking).

Constant demand + decreased supply = price increase. It's simple economics.

I don't think it's really as "simple" as you say. Many people sell btc to buy altcoins for example, 300btc a day it's important but it's not the largest part of the sales. Selling BTC for altcoins doesn't hurt BTCUSD prices. In fact, the altcoin markets are very bullish for BTC. Instead of selling for fiat, BTC traders move their supply to altcoin exchanges instead. This makes for less available BTC supply on fiat exchanges. Altcoin investors also buy BTC off fiat exchanges to send to altcoin exchanges. Both these dynamics drive BTCUSD prices up. If it's as simple as that why we are at the same price as 2 years ago while we are only 5 months before the halving now?

How do you explain that futures prices for the next year are so low?

Because markets take time to reverse from bear market to bull market. Bitcoin in particular moves in exaggerated boom-and-bust type cycles. We are 6 months out from the halving. At this point in 2015, the market was trading at a 60% loss from the ATH. The market is currently down 55% from the ATH. Everything looks pretty normal to me. The current price could basically be the bottom of the next exponential bull run that will start right before the halving and potentially peak 12-18 months after the halving with a price bubble. That is what we saw in the last 2 halvings. |

|

|

|

|

|

Webetcoins

|

|

November 19, 2019, 01:04:46 PM |

|

Price is not determined by the total supply, but rather the supply available for sale.

Inflation = new available supply. If inflation is lowered, there will be less coins available for sale because some portion of mining rewards will always be sold (covering mining overheads/liabilities and profit taking).

Constant demand + decreased supply = price increase. It's simple economics.

I don't think it's really as "simple" as you say. Many people sell btc to buy altcoins for example, 300btc a day it's important but it's not the largest part of the sales. Selling BTC for altcoins doesn't hurt BTCUSD prices. In fact, the altcoin markets are very bullish for BTC. Instead of selling for fiat, BTC traders move their supply to altcoin exchanges instead. This makes for less available BTC supply on fiat exchanges. Altcoin investors also buy BTC off fiat exchanges to send to altcoin exchanges. Both these dynamics drive BTCUSD prices up. If it's as simple as that why we are at the same price as 2 years ago while we are only 5 months before the halving now?

How do you explain that futures prices for the next year are so low?

Because markets take time to reverse from bear market to bull market. Bitcoin in particular moves in exaggerated boom-and-bust type cycles. We are 6 months out from the halving. At this point in 2015, the market was trading at a 60% loss from the ATH. The market is currently down 55% from the ATH. Everything looks pretty normal to me. The current price could basically be the bottom of the next exponential bull run that will start right before the halving and potentially peak 12-18 months after the halving with a price bubble. That is what we saw in the last 2 halvings. So saying that investing in bitcoin at present moment is right thing to do, won’t be wrong at all. Better would be to say that this is the last chance to buy world’s most expensive asset at low value. We wont have same opportunity ever again. Halving brings good changes to all crypto currencies. This time will be the same also. So finally investors can stop waiting and complaining, and focus on getting more coins. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|