fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

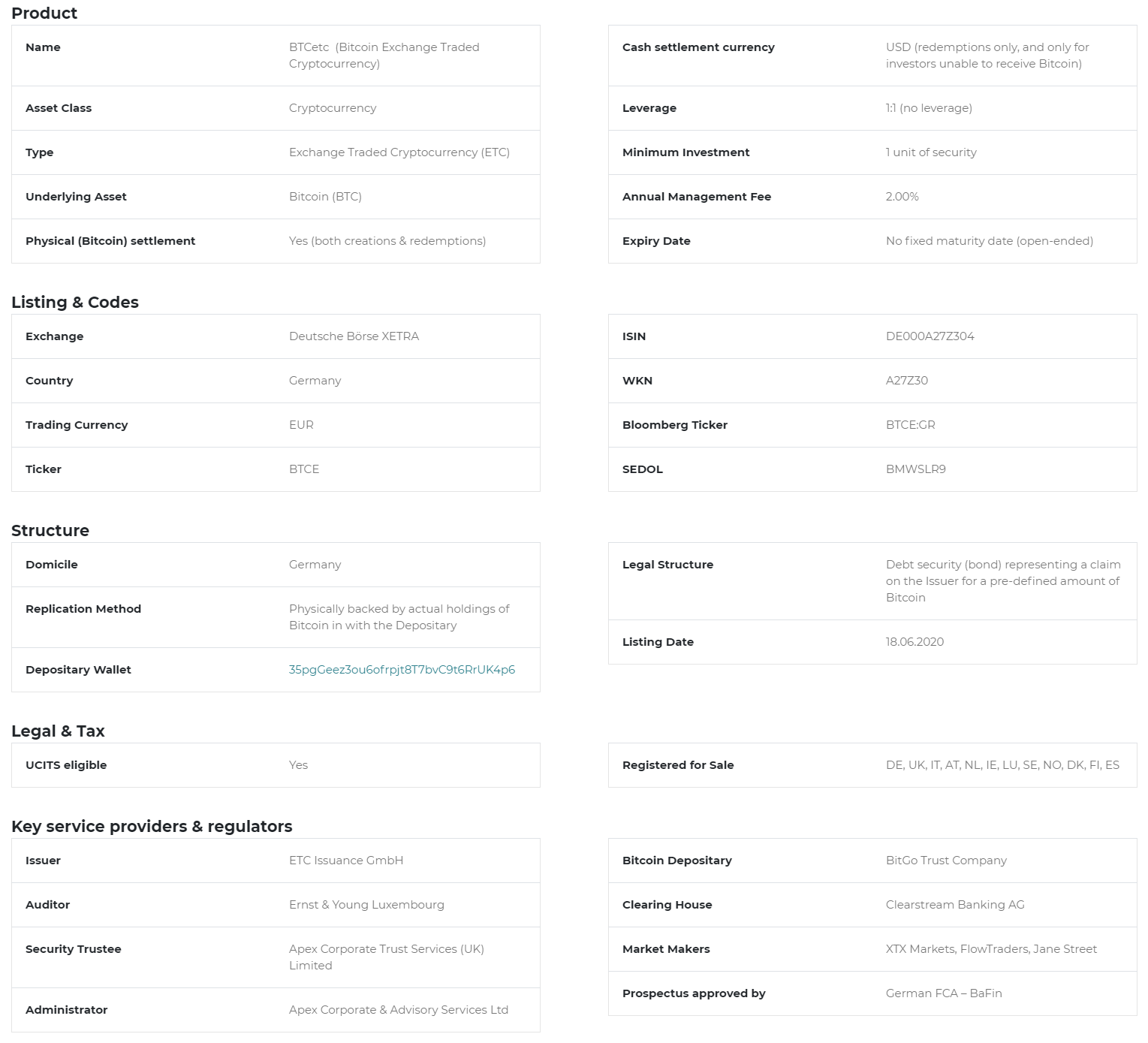

Bitcoin Exchange-traded products are arriving in Germany's Xetra. This will give to German, Austrian Italian and UK investors the ability to get price exposure to Bitcoin, with the possibility to eventually redeem their own Bitcoin. ETC Group to launch bitcoin ETP on Deutsche Boerse via HANetfETC Group is set to list the first cryptocurrency exchange-traded product (ETP) on Xetra via white-label platform HANetf.

The BTCetc Bitcoin Exchange Traded Crypto (BTCE) is set to launch on Xetra later this month after receiving approval from BaFin, the German financial regulator.

Physically-backed, BTCE tracks the price of bitcoin and has a total expense ratio (TER) of 2%.

Trading bitcoin through an ETP structure removes the technical challenges associated with cryptocurrencies such as setting up a wallet or trading or unregulated exchanges.

It also removes the need to manage cryptographic keys or engage with blockchain technology.

One interesting aspect is the possibility to redeem the physical bitcoin: “With BTCE, we are transporting bitcoin into the fold of mainstream, regulated financial markets. Investors get the benefits of trading and owning bitcoin through a regulated security while having the optionality of redeeming bitcoin if they choose.”

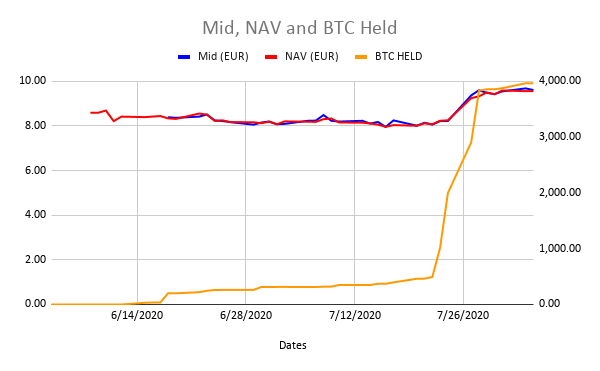

A product that allows institutional subjects to gain exposure to bitcoin, without all the regulatory, fiscal and compliance nightmare implications of owning physical bitcoin, is a more than welcome news.  Listed on Xetra starting from 17th Jun 2020. It is possible to track the Official BTC Depositary Wallet via the blockchain: https://bitinfocharts.com/bitcoin/address/35pgGeez3ou6ofrpjt8T7bvC9t6RrUK4p6 In this spreadsheet I computed the BTC held under the fund: as said, there was a massive growth until the present value of more than 3870 BTC:  Please note the premium is confirmed to be really low, and the impressive growth of BTC held. More information can be found here: HanETF BTCetc Product deck: World’s First Centrally Cleared Bitcoin Exchange Traded Product to list on Deutsche Börse World’s First Centrally Cleared Bitcoin Exchange Traded Product to list on Deutsche BörseA brief description on how a ETP is different from a Trust and a Future.  Official websites: https://btc-etc.com/product.htmlhttps://www.hanetf.com/product/8/fund/btcetc-bitcoin-exchange-traded-crypto-btce |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

|

|

|

|

The block chain is the main innovation of Bitcoin. It is the

first distributed timestamping system.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

Upgrade00

Legendary

Offline Offline

Activity: 2016

Merit: 2168

Professional Community manager

|

|

June 09, 2020, 11:24:07 AM |

|

It is a welcome news. The impact of ETF on the cryptocurrency market would be huge. The U.S Securities and Exchange Commission (SEC) has been delaying it's approval, but other countries have been adopting cryptocurrency and putting policies in place to support it's growth. One interesting aspect is the possibility to redeem the physical bitcoin:

This could encourage their investors to learn about the technical aspects of holding and securing bitcoins, if there is an opportunity to redeem them

I just tried to access the updated link - ( https://www.hanetf.com/article/409/worlds-first-centrally-cleared-bitcoin-exchange-traded-product-to-list-on-deutsche-brse) but couldn't, is it only accessible to specific regions? |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 09, 2020, 11:30:02 AM

Last edit: January 15, 2021, 03:13:52 PM by fillippone Merited by NotATether (1) |

|

This could encourage their investors to learn about the technical aspects of holding and securing bitcoins, if there is an opportunity to redeem them

True, but this is important also for institutional investors. Many of them simply cannot "touch" bitcoin, even if they are willing to. It's too complicated from a legal, fiscal and compliance point of view. It might also be outside their trading mandate. This kind of problem solves a lot of issue for them. Major loser: Grayscale, who won't be anymore able to sell their shares at an inflated premium to institutional desperate to get long Bitcoin. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Upgrade00

Legendary

Offline Offline

Activity: 2016

Merit: 2168

Professional Community manager

|

|

June 09, 2020, 12:22:22 PM |

|

Major loser: Grayscale, who won't be anymore able to sell their shares at an inflated premium to institutional desperate to get long Bitcoin.

In addition to not being able to market their shares, existing investors who hold them would be looking to sell them off at a lower premium to avoid being bad holders. This action could further drive the premium down causing more losses. |

|

|

|

hatshepsut93

Legendary

Offline Offline

Activity: 2954

Merit: 2144

|

|

June 09, 2020, 02:00:28 PM |

|

It is a welcome news. The impact of ETF on the cryptocurrency market would be huge. The U.S Securities and Exchange Commission (SEC) has been delaying it's approval, but other countries have been adopting cryptocurrency and putting policies in place to support it's growth.

I doubt it will be huge, we already have plenty of platforms for Bitcoin derivatives, and nothing big happened, unless there's a strong proof that the price rise during the 2017-2020 period can be attributed to them. It's great that more liquidity is coming, but let's not create false expectations, we've already had so much disappointment in the past with all the ETF hype, when people expected it to launch the price to the moon. |

|

|

|

Upgrade00

Legendary

Offline Offline

Activity: 2016

Merit: 2168

Professional Community manager

|

|

June 09, 2020, 03:00:50 PM |

|

we've already had so much disappointment in the past with all the ETF hype, when people expected it to launch the price to the moon.

I don't expect an immediate increase in price due, most of the purchases happen off exchanges and those that do happen on exchanges are done through an order routing process so there is no impact on the market price. It's difficult to ascertain what increases the price long term, but greater liquidity and adoption would be a welcome development. |

|

|

|

bitgolden

Legendary

Offline Offline

Activity: 2772

Merit: 1128

Leading Crypto Sports Betting & Casino Platform

|

|

June 09, 2020, 08:13:47 PM Merited by fillippone (2) |

|

Well, Germany is actually quite crypto friendly, they had laws from very early on and they have allowed people to buy and sell easily and even had tax in place, they are always that organized whatever the topic is so it wasn't really a shock. It was only a matter of time someone did something like this on a bigger deal and obviously it is going to be big when it starts.

Unfortunately people put too much into stuff like this and expect a ton, remember the Bakkt times? When it first started everyone was expecting billions of dollars but that wasn't the case so there was a big sell after that when people saw it, what happened? It got bigger and bigger over time and now it is quite good in my opinion, but they weren't able to wait for it and wanted this on the first day.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 09, 2020, 08:55:21 PM

Last edit: January 15, 2021, 03:14:27 PM by fillippone |

|

Both points are very true.

Germany has a very crypto-friendly regulation. They were the first in the euro area to adopt the AML5 European regulation, that enabled German banks to take custody and trade bitcoin with clients (only to be beaten on the release time by the Italian soft bank Hype).

Also very true the analogy with Bakkt. We expected the floodgate of institutional money to open and flood bitcoin with fresh funds. This didn’t happen with big disappointment and also with some pain by speculators.

Will this time be different? There is some difference, the instrument has a different target, more focused on retail, rather than speculators like the CME derivatives. Also, it is redeemable in physicals bitcoin. Something that it is surely not possible in traditional markets.

We will see.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3008

Welt Am Draht

|

|

June 09, 2020, 09:24:16 PM Merited by fillippone (2) |

|

I doubt it will be huge, we already have plenty of platforms for Bitcoin derivatives, and nothing big happened, unless there's a strong proof that the price rise during the 2017-2020 period can be attributed to them. It's great that more liquidity is coming, but let's not create false expectations, we've already had so much disappointment in the past with all the ETF hype, when people expected it to launch the price to the moon.

Like everything else that was going to 'save' us, it only counts when it counts. These things certainly do not create any hype, they will definitely empower the hype when it arrives from other sources. Anything that pops up on your legacy platform is many notches above having to photograph your arse to get on Yobit. |

|

|

|

|

squatz1

Legendary

Offline Offline

Activity: 1666

Merit: 1285

Flying Hellfish is a Commie

|

|

June 10, 2020, 04:10:44 AM Merited by fillippone (2) |

|

Very, very interesting to see -- though that expense ratio is TOUGH -- I guess that's the price you pay to have everything insured and held by BitGo. Just tough to see people not only giving up their coins (the good ole, not your keys not your coins), but also paying someone else to hold their coins.

Insurance, regulations, and all of that -- I get it.

Why not just go and buy a trezor, load some coins up onto it, and split your backup into some safe places. Probably cheaper then using this if you're putting in a substantial amount of money.

Still big news though, hopefully adoption and all that can follow! Would be great to be able to spend my BTC (and really any crypto, doesn't matter to me) in real life more often.

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 10, 2020, 07:58:43 AM

Last edit: January 15, 2021, 03:14:40 PM by fillippone |

|

An article on the same subject by Coindesk. Deutsche Borse Exchange to List New Bitcoin Exchange-Traded ProductThe interesting bit on this article is the amount of surcharge of this ETP compared to others: The novel security is also bound to cost slightly more than traditional ETFs, with an expense ratio of 2% compared to anywhere between 0.5 to 0.7% charged by most ETFs. So, basically, 1.3% to get rid of all the custody, fiscal and regulatory hassles of being long bitcoin. I think it's not a bad deal, in addition to that, competitive pressure will make this number go down in the future. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 11, 2020, 01:34:50 PM

Last edit: May 16, 2023, 01:49:39 AM by fillippone |

|

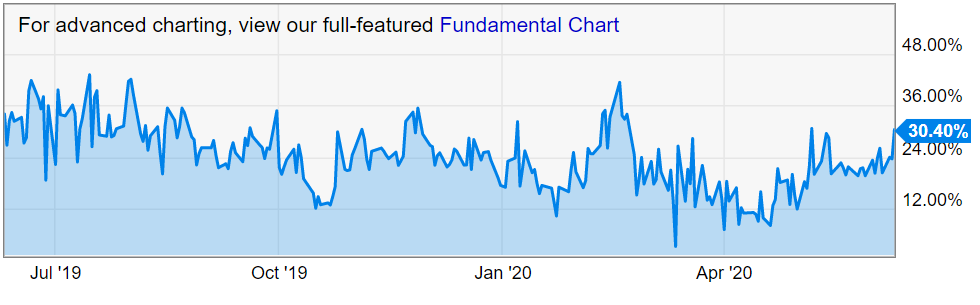

I see only one big loser in this story: Grayscale. They are selling their shares at an inflated premium against the NAV. This premium is quite consinstent:  Grayscale Bitcoin Trust Premium to NAV:30.40% for June 10, 2020 In the past, it has been consistently above 100% during BTC pumps back in 2017. This meant buying bitcoin at double the market price. So I think that paying 2% running cost against 30% upfront cost has some kind of rationale here. Also, this bodes badly for Grayscale, who won't be anymore able to pump the price of their shares too much without losing inflows from clients looking for cheaper options. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

squatz1

Legendary

Offline Offline

Activity: 1666

Merit: 1285

Flying Hellfish is a Commie

|

|

June 12, 2020, 02:00:22 AM |

|

An article on the same subject by Coindesk. Deutsche Borse Exchange to List New Bitcoin Exchange-Traded ProductThe interesting bit on this article is the amount of surcharge of this ETP compared to others: The novel security is also bound to cost slightly more than traditional ETFs, with an expense ratio of 2% compared to anywhere between 0.5 to 0.7% charged by most ETFs. So, basically 1.3% to get rid of all the custody, fiscal and regulatory hassles of being long bitcoin. I think it's not a bad deal, in addition to that, competitive pressure will make this number go down in the future. I know right off the bat BitGo is going to be charging somewhere in the realm of 1% for all fees every single year (transfer fees, custody fees, and so on) The other 1% is pretty steep, I'd understand if we were talking somewhere in the realm of 1.25 or 1.5 -- but 2%, ouch. We both totally know the type of person that is going to use this isn't going to worry about these slight differences, at least at first. But yeah, you're totally right in regards to competitive pressure is going to bring this down substantially in the future. Once their are a few more BitGo custody types and the demand is present in peoples regular retirement accounts. Btw -- traditional etf's may average in the realm of .5-.7% -- but that shouldn't be the baseline as those are literally robbing you. Fidelity/Vanguard/ETrade/Schwab/BlackRock all have funds that follow the direction of the US stock market and cost from 0-.1% (Yes, I wrote 0, Fidelity, lol) |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 12, 2020, 10:56:53 AM

Last edit: January 15, 2021, 03:15:15 PM by fillippone Merited by NeuroticFish (1) |

|

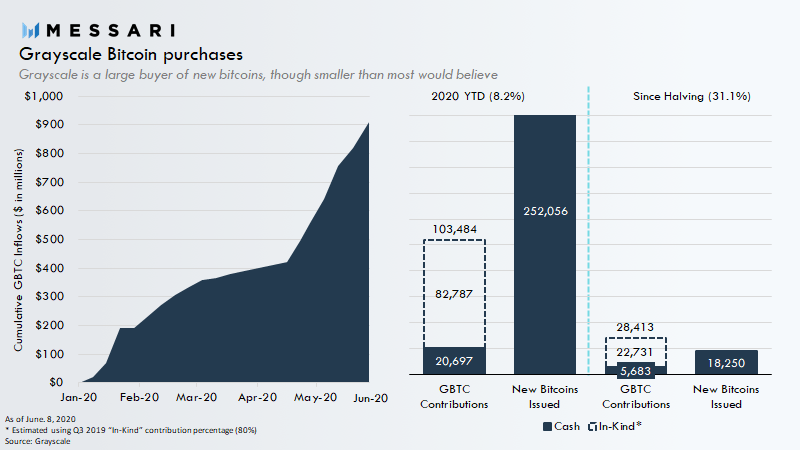

Grayscale is a poor investment choice. Basically, new entrants pay a higher premium to insiders, only to buy artificially scarce shares. Grayscale buys way less #Bitcoin than many would think.

Factoring in "in-kind" purchases, Grayscale has only bought 31% of all new bitcoins mined since the halving, far less than the 150%+ many have reported.

This is just one of many misconceptions about Grayscale's trusts.

1/  https://twitter.com/RyanWatkins_/status/1271097895308218369 https://twitter.com/RyanWatkins_/status/1271097895308218369An ETP is immune from this fraudulent mechanism. This is why 2% running fee is a steal! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

NeuroticFish

Legendary

Offline Offline

Activity: 3654

Merit: 6348

Looking for campaign manager? Contact icopress!

|

|

June 12, 2020, 12:11:05 PM |

|

Just as cross link, I've posted this into press too back then: https://bitcointalk.org/index.php?topic=5254440Since I see this as an European version of Bakkt, it's a great support for European institutional money flow into Bitcoin market. Thus cannot be bad, since it's truly backed with actual Bitcoin. This could have been one of the reasons for the current price movements too. "Buy on the rumors, sell on the news" (or maybe I'm wrong) |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3008

Welt Am Draht

|

|

June 12, 2020, 04:45:19 PM |

|

Grayscale is a poor investment choice.

It's the tax advantages that are attracting people as much as anything. There's no other product at present that can do the same thing. That 2% and whatever whacky premiums there are pale in comparison to the tax bill on a monster rise. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 12, 2020, 10:04:29 PM

Last edit: January 15, 2021, 03:15:29 PM by fillippone |

|

Grayscale is a poor investment choice.

It's the tax advantages that are attracting people as much as anything. There's no other product at present that can do the same thing. That 2% and whatever whacky premiums there are pale in comparison to the tax bill on a monster rise. I am not sure I understand which tax advantage, specific of GrayScale, you are referring to. Because if it is not specific to Grayscale, if it can be replicated with lower fees, it would be vastly superior. If it's specific to Grayscale please make me clear why it is different from any other ETF. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3008

Welt Am Draht

|

|

June 13, 2020, 12:10:21 AM |

|

I am not sure I understand which tax advantage, specific of GrayScale, you are referring to. Because if it not specific to Grayscale, if it can be replicated with lower fees, it would be vastly superior. If it's specific to Grayscale please make me clear why it is different from any other ETF.

It's the one and only Bitcoin-related product you can have in US tax advantaged wrappers like 401ks and IRA accounts and so on. There's nothing else that's been built to be eligible for it. That makes it compelling in a way nothing else is at the moment - to Americans. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 13, 2020, 07:39:58 AM |

|

I am not sure I understand which tax advantage, specific of GrayScale, you are referring to. Because if it not specific to Grayscale, if it can be replicated with lower fees, it would be vastly superior. If it's specific to Grayscale please make me clear why it is different from any other ETF.

It's the one and only Bitcoin-related product you can have in US tax advantaged wrappers like 401ks and IRA accounts and so on. There's nothing else that's been built to be eligible for it. That makes it compelling in a way nothing else is at the moment - to Americans. Oh, sorry, I am italian, so it is not in my mind that you have to pay taxes on your crypto-gains. And also because I want to buy my coins in a KYC respectful way ( KYC is bad), and I adverse anti-bitcoin organisations who sell my data to the government. If you are referring to institutional investors, those who cannot dodge the legalised theft, well, yes. I do agree, but that is the only point of paying that huge premium. But again, competition will eventually lower this premium in the long term. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15341

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 13, 2020, 07:57:27 AM

Last edit: January 15, 2021, 03:16:03 PM by fillippone |

|

A few more detail on the more "institutional money relevant" aspects of this product. There is a nice read about this ETP from a traditional ETF news outlet: ETC Group to debut with bitcoin ETP on XetraThe ETP is the first centrally cleared bitcoin product. This is significant, potentially opening the door to institutional investors which are typically prevented from trading non-centrally-cleared instruments – a restriction that presently precludes direct transactions in bitcoin itself or in any of the other bitcoin ETPs that are currently available. Clearing through a central counterpart (CCP) system, as opposed to the bilateral settlement, reduces the counterpart risk that market participants are exposed to. First of all: what does it means centrally cleared? When you buy this product, you are not buying from the issuer, but from the German Stock Exchange, who in his turn, buys it from the issuer. So the exchange is acting like a clearing counterpart, who "untie" the credit relations between the two original counterparts, who are not facing themselves directly but are only facing the exchange. This means that if the issuer defaults, you are not facing a defaulted entity, but the central clearing counterpart (CCP) who is kept liquid. To sum up, the investors can actually get exposure tho this product neglecting counterpart risk, as the only counterpart they are facing is the German Xetra, which is one of the lowest risk counterparts in the world. Also, another interesting piece of information I could, discover elsewhere: It is also the first ETP to give holders of shares a claim on a predefined amount of bitcoin which they are entitled to redeem in bitcoin if they so wish – albeit with a fee of $2,500 if redeeming in bitcoin for an amount that is less than $250,000. Each share corresponds to 1/1000th of a bitcoin. So you are free to reclaim your physical bitcoin, but not really incentive to do so. Probably it is just a fail-safe mechanism to get hold of your possession in case there is a problem. If an investor wants to get long exposure to physical bitcoin I would think about BAKKT 1 day futures, for example, just to name something very closely related to legacy exchanges. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|