bullrun2024bro

Legendary

Offline Offline

Activity: 1582

Merit: 4328

|

|

February 03, 2021, 03:17:24 PM |

|

Thank,s I think we covered this news here. Anyway, thanks Ah, you're absolutely right. It looks like I missed your post, sorry! Indeed, sounds quite good, even if they slowed a little bit lately, let's see if it is a temporary bump in a smooth ride, or it is something more structural.

That's the one million dollar question. But in my opinion, even the smoothest ride has some bumps and therefore, we should not be unsettled at this point in time. I am very curious to see what the quarterly report for 1Q21 will look like. The best may still be ahead of us.  |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

|

|

|

|

Be very wary of relying on JavaScript for security on crypto sites. The site can change the JavaScript at any time unless you take unusual precautions, and browsers are not generally known for their airtight security.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15381

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 05, 2021, 07:45:51 AM

Last edit: May 16, 2023, 12:31:58 AM by fillippone |

|

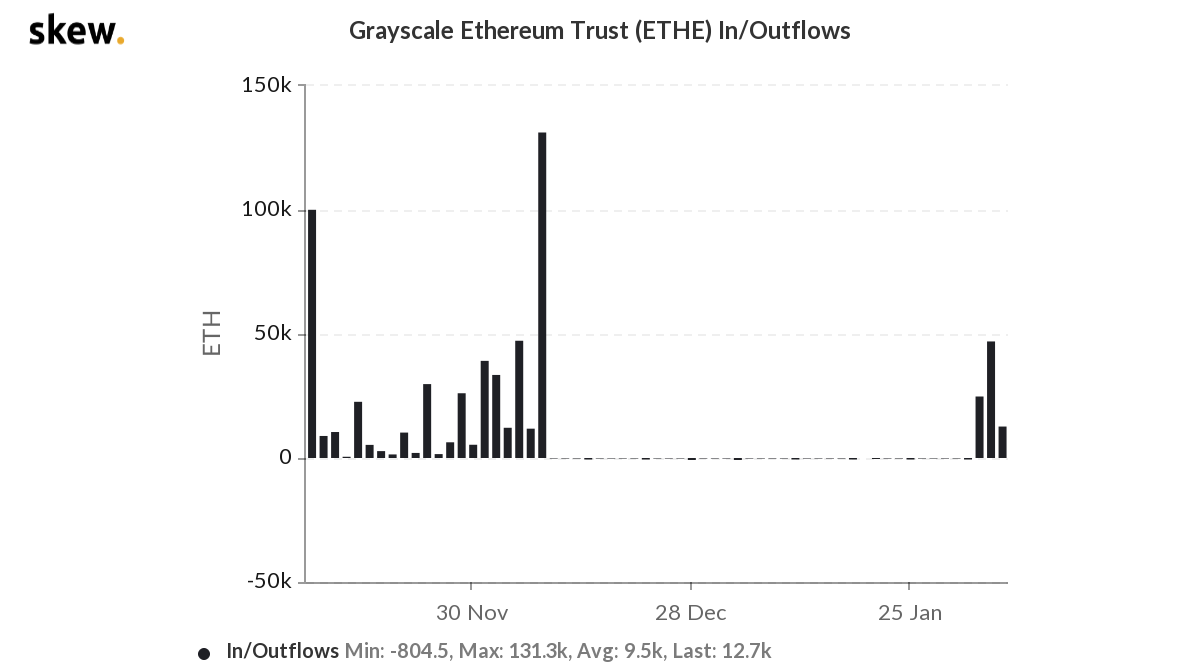

Yesterday Grayscale hit the lowest BTC inflow in the last 6 months: only 8 BTC, before the daily fees, that reduced the net daily inflow to actually -26 BTC Jut me speculating, but as ETHER futures are approaching, maybe investors are trying to capitalise the bullish momentum they are witnessing. Here the ETH inflows:  They have been outpacing bitcoin inflows. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5625

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

February 05, 2021, 03:17:44 PM |

|

Grayscale inflow hit the lowest level, Ruffer sold BTC worth as much as $750 million, and Elon Musk removed "Bitcoin" from Twitter bio - I wonder what is the reason that the price of BTC is suddenly rising towards $40k? Just one more in a series of bull traps maybe  |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15381

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 06, 2021, 10:08:47 AM |

|

Grayscale inflow hit the lowest level, Ruffer sold BTC worth as much as $750 million, and Elon Musk removed "Bitcoin" from Twitter bio - I wonder what is the reason that the price of BTC is suddenly rising towards $40k? Just one more in a series of bull traps maybe  Ruffer sold part of their investment. They are still invested. Market was happy to absorb these buys, and this is a good news. Not everybody shares the "indefinite hodl" strategy à la Micheal Saylor. This is a good news because sooner or later we will have to start pondering about the elephant in the room (taking back the discussion in topic). The real question is: what happens with GBTC selling their BTC? For now, we never experienced real OUTFLOWS from Grayscale. If you want to exit from GBTC, Grayscale does not provide a repurchase agreement. So you have to sell your shares in the open market. For the moment this happens at a hefty premium, so no big issue here. But what happens when an ETF gets approved in the US? Probably this ETF will sport a lower fee than grayscale. So investors will start selling their shares in GBTC to switch from GBTC to this new ETF. Probably grayscale shares will have a discount on the NAV, and arbitrageur would kick in only at a discount sufficient to repay them for the higher commissions than the ETF. Probably Grayscale would have to reduce the number of shares, selling their bitcoins. This selling pressure would be countered by the buying pressure from the new ETF (assuming a perfect switch from the two entities the total effects should be negligible). Nevertheless, differences in timing between the two operations could induce greater volatility in the market. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15381

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 06, 2021, 10:18:44 AM Merited by JayJuanGee (1) |

|

Investors are still resorting to GBTC to gain exposure to Bitcoin. according to The block: Miller Opportunity Trust signals investment in Grayscale's Bitcoin TrustHere's the full quote from Friday's filing by Miller Opportunity Trust (emphasis added): "The Fund may seek investment exposure to bitcoin indirectly by investing in the Grayscale Bitcoin Trust, an entity that holds bitcoin. Grayscale Bitcoin Trust is a privately offered investment vehicle, the shares of which are also available over-the-counter. Bitcoin is a digital commodity that is not issued by a government, bank, or central organization. Bitcoin exists on an online, peer-to-peer computer network that hosts a public transaction ledger where bitcoin transfers are recorded (the “Blockchain”). Bitcoin has no physical existence beyond the record of transactions on the Blockchain. The Grayscale Bitcoin Trust invests principally in bitcoin. The Fund will not make any additional investments in the Grayscale Bitcoin Trust if, as a result of the investment, its aggregate investment in bitcoin exposure would be more than 15% of its assets at the time of investment." This fund has more than 2 billion in AUM. Investing the 5% of this in bitcoin (allowing for a nice price target of 120K) would be 60 million investments. Something that could go unnoticed in the daily December inflows, but probably would raise a flag today. For sure if I were a subscriber of this fund I certainly would ask Miller if there weren't more effective ways of getting exposure to BTC rather than pay 2% to Grayscale. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10143

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 06, 2021, 05:57:57 PM |

|

Grayscale inflow hit the lowest level, Ruffer sold BTC worth as much as $750 million, and Elon Musk removed "Bitcoin" from Twitter bio - I wonder what is the reason that the price of BTC is suddenly rising towards $40k? Just one more in a series of bull traps maybe  Ruffer sold part of their investment. They are still invested. Market was happy to absorb these buys, and this is a good news. Not everybody shares the "indefinite hodl" strategy à la Micheal Saylor. This is a good news because sooner or later we will have to start pondering about the elephant in the room (taking back the discussion in topic). The real question is: what happens with GBTC selling their BTC? For now, we never experienced real OUTFLOWS from Grayscale. If you want to exit from GBTC, Grayscale does not provide a repurchase agreement. So you have to sell your shares in the open market. For the moment this happens at a hefty premium, so no big issue here. But what happens when an ETF gets approved in the US? Probably this ETF will sport a lower fee than grayscale. So investors will start selling their shares in GBTC to switch from GBTC to this new ETF. Probably grayscale shares will have a discount on the NAV, and arbitrageur would kick in only at a discount sufficient to repay them for the higher commissions than the ETF. Probably Grayscale would have to reduce the number of shares, selling their bitcoins. This selling pressure would be countered by the buying pressure from the new ETF (assuming a perfect switch from the two entities the total effects should be negligible). Nevertheless, differences in timing between the two operations could induce greater volatility in the market. I was about to send you a merit, fillippone, but the overall gist of your comment is not really resonating with me for some strange reason... #nohomo.   What you are describing (or speculating upon) is almost like a BIG so fucking what. On an ongoing basis, we have money flowing from one asset into other assets based on arbitrage possibilities, but in the end, any new BTC financialization product such as an ETF, would likely cause greater interest (and demand) upon BTC supply rather than merely being some assessment of movement between one third party custodian and another. The devil is likely in the details, yet with no real information that ongoing demand for BTC is either going to shrink or remain flat even if there is movement between third party custodians. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15381

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 06, 2021, 06:12:28 PM Merited by JayJuanGee (1) |

|

What you are describing (or speculating upon) is almost like a BIG so fucking what.

Funny thing here is this post didn’t resonate with me neither. As I tried to figure out the best possible scenario for which GBTC is offloading their BTC on the market and nothing happens as they flow to a more efficient vehicle. The only scenario where the price could be heavily impacted is, apart very hypothetical scenario of Bitcoin banning, is a shift in the very favourable fiscal regime granted to GBTC interactions. If GBTC get taxed Avery time they sell GBTC shares, something that is not currently happening as per my understanding, well the attractiveness of this vehicle would be greatly reduced. This would force Grayscale to buy back shares and sell BTC, and cause mayhem on the markets. Probability of this happening? Very low. If I were Barry Silver I would have been already using my 35 daily BTC to lobby g-men against this (and an ETF approval, of course). Hey @JJG are we resonating again now? Aren’t we? |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10143

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 06, 2021, 06:34:39 PM Merited by fillippone (1) |

|

What you are describing (or speculating upon) is almost like a BIG so fucking what.

Funny thing here is this post didn’t resonate with me neither. As I tried to figure out the best possible scenario for which GBTC is offloading their BTC on the market and nothing happens as they flow to a more efficient vehicle. The only scenario where the price could be heavily impacted is, apart very hypothetical scenario of Bitcoin banning, is a shift in the very favourable fiscal regime granted to GBTC interactions. If GBTC get taxed Avery time they sell GBTC shares, something that is not currently happening as per my understanding, well the attractiveness of this vehicle would be greatly reduced. This would force Grayscale to buy back shares and sell BTC, and cause mayhem on the markets. Probability of this happening? Very low. If I were Barry Silver I would have been already using my 35 daily BTC to lobby g-men against this (and an ETF approval, of course). Hey @JJG are we resonating again now? Aren’t we? Andiamo a risuonare insieme. (#no homo - ovviamente)   |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

acquafredda

Legendary

Offline Offline

Activity: 1316

Merit: 1481

|

JayJuanGee that speaks Italian! now that is some news!

Going back on-track I agree with you both because if something like that highly unlikely scenario would happen that could resonate like a massive volcano explosion on the bitcoin market. I do hope they have put some protection for it otherwise the magnitude of the event can be enormous.

|

|

|

|

|

calaber34p

Newbie

Offline Offline

Activity: 4

Merit: 3

|

|

February 13, 2021, 06:51:43 PM Merited by fillippone (2) |

|

I was talking to one of the representatives from Grayscale and they were saying that they aim to be the first btc ETF on US exchanges. They also mentioned they would put some sort of way for gbtc holders to transfer over their shares into etf shares. Would make things very interesting if that was the case. I think the SEC would be much more willing to approve a grayscale ETF versus some of the other lesser known companies applying. I have a feeling that they know approval is still unlikely so they and a few of the other big players aren't applying yet. I wouldn't be surprised if they have inside insight from their talks with the SEC.

With the premium pretty much dead at this point I don't think many people will be trading in kind for shares. Hopefully with an etf they will open up physical delivery again so those of us who bought in through brokerages have the chance to pull out if we so desire.

|

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15381

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 13, 2021, 11:13:30 PM |

|

I was talking to one of the representatives from Grayscale and they were saying that they aim to be the first btc ETF on US exchanges. They also mentioned they would put some sort of way for gbtc holders to transfer over their shares into etf shares. Would make things very interesting if that was the case. I think the SEC would be much more willing to approve a grayscale ETF versus some of the other lesser known companies applying. I have a feeling that they know approval is still unlikely so they and a few of the other big players aren't applying yet. I wouldn't be surprised if they have inside insight from their talks with the SEC.

With the premium pretty much dead at this point I don't think many people will be trading in kind for shares. Hopefully with an etf they will open up physical delivery again so those of us who bought in through brokerages have the chance to pull out if we so desire.

Very interesting piece of information. Still, I doubt that GreyScale would want to shit into an ETF, unless they see some kind of competition on that front. They will be ready to act if and when there is a competition on the ETF camp, not moving as a leader, rather than as a follower. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

cryptoboss2020

Member

Offline Offline

Activity: 322

Merit: 14

|

|

February 15, 2021, 11:22:00 PM |

|

Stop cheering

There is no proof grayscale is really invest anything.

They can Say or show their fake proofs.

I Don't belive it if I Don't see it with my own eyes.

And Where They get so much coins? If they are real?

We live in the World of lias...

Everything is fake Women's tits are fake I dont belive If I Don't see it.

In this world Can't belive anyone.

All of sudden Where this gravescale coming from?

The owners Back ground is unknown

The company just pop up from nowhere..

The website Looking shiet I done websites I make Ten times Better.

They Got so much money but website poor Looking??

How Come?

|

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3696

Merit: 10143

Self-Custody is a right. Say no to"Non-custodial"

|

|

February 16, 2021, 01:56:26 AM Merited by fillippone (2) |

|

Stop cheering

There is no proof grayscale is really invest anything.

They can Say or show their fake proofs.

I Don't belive it if I Don't see it with my own eyes.

And Where They get so much coins? If they are real?

We live in the World of lias...

Everything is fake Women's tits are fake I dont belive If I Don't see it.

In this world Can't belive anyone.

All of sudden Where this gravescale coming from?

The owners Back ground is unknown

The company just pop up from nowhere..

The website Looking shiet I done websites I make Ten times Better.

They Got so much money but website poor Looking??

How Come?

Not really worth a response, but just contemplating such extremes of zero reserves would be almost impossible to achieve, but even something like less than 40% reserves would be quite difficult to juggle for 7-8 years.. even if escalating like Bernie Maddoff... and even less than 75% would be quite the ballsy move for any entity to attempt with an asset like bitcoin, but hey I doubt we could proclaim with 100% certainty that Grayscale has 100% of the reserves that they claim at all times.., but then risky to try to get away with fractional reserves, too.. the higher the fractional reserves, the more difficult to actually prevent getting caught. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15381

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 16, 2021, 11:46:49 AM |

|

Wondering how traditional finance can use GBTC to boost their results? ARK Invest Boosted Its GBTC Holdings by 2.14M Shares in Q4Cathie Wood’s ARK Investment Management increased its holdings of the Grayscale Bitcoin Investment Trust (GBTC) by 2.14 million shares in the fourth quarter of 2020, bringing its holdings of the market-leading institutional bitcoin investment vehicle to 7.31 million shares.

Ark investment is now long almost 350 USD miso in GBTC. I don’t know how ARK investors feel in paying 2%, or 7 millions, to Grayscale just to hold their coins. Looks like a bad deal to me. If MicroStrategy and Tesla hold bitcoin directly, I can’t see any reason why an investment fund cannot do the same. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5625

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

February 16, 2021, 12:04:33 PM Merited by fillippone (2) |

|

If MicroStrategy and Tesla hold bitcoin directly, I can’t see any reason why an investment fund cannot do the same.

When you say it directly, I believe you don't think they keep their BTC in non-custodial wallets - because at least as far as MS is concerned they did all their purchases through Coinbase, and I believe Tesla did the same. If their BTC is in Coinbase Custody cold wallets, I believe that way of storing comes at a price - but it's probably less than what Grayscale charges. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15381

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 16, 2021, 12:09:22 PM

Last edit: February 16, 2021, 04:04:39 PM by fillippone |

|

If MicroStrategy and Tesla hold bitcoin directly, I can’t see any reason why an investment fund cannot do the same.

When you say it directly, I believe you don't think they keep their BTC in non-custodial wallets - because at least as far as MS is concerned they did all their purchases through Coinbase, and I believe Tesla did the same. If their BTC is in Coinbase Custody cold wallets, I believe that way of storing comes at a price - but it's probably less than what Grayscale charges. Exactly, they probably hold bitcoin on Coinbase Custody. I know that they bought trough Coinbase, but I didn’t remember reading anything about their storage solution. What I meant is that they own Bitcoins (even if they don’t own the private keys of their bitcoin they legally own those coins via a legally binding contract between them and Coinbase) and not some kind of “securitised bitcoin” like a GBTC share. Edit:corrected funny typos. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5625

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

February 16, 2021, 02:11:39 PM |

|

Speaking of fees I checked out Coinbase Custody and it states the following : Implementation fee

$0 – $10,000 depending on use-case Custody fee

50 bps annualized

Minimum balance $500,000 I have to admit I didn’t know what bps meant, so I had to seek help on Investopedia - Basis Points (BPS), and according to the table 50 bps would be 0.5%. If I calculate correctly, this would mean that Tesla will pay 0.5% to $1.5 billion - or $7.5 million per year + max $10 000 for implementation fee. Of course, assuming that they really use CC - and that I'm right with my calculation. I agree that MS and Tesla are in a better position when it comes to the way they stored their BTC, but if they asked you or me what we think about it, the answer would be unique and very clear - "not your keys, not your coins." |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

thecodebear

|

|

February 16, 2021, 03:45:31 PM Merited by fillippone (1) |

|

If MicroStrategy and Tesla hold bitcoin directly, I can’t see any reason why an investment fund cannot do the same.

When you say it directly, I believe you don't think they keep their BTC in non-custodial wallets - because at least as far as MS is concerned they did all their purchases through Coinbase, and I believe Tesla did the same. If their BTC is in Coinbase Custody cold wallets, I believe that way of storing comes at a price - but it's probably less than what Grayscale charges. Exactly, they probably hold bitcoin on Coinbase Custody. I know that they bought trough Coinbase, but I didn’t remember reading anything about their storage solution. What I meant is that they own Bitcoins (even if they don’t own the private Jews of their bitcoin they legally own those coins via a legally binding contract between them and Coinbase) and not some kind of “securitised bitcoin” like a GBTC share.  ...."keys" i hope haha |

|

|

|

|

hugeblack

Legendary

Offline Offline

Activity: 2492

Merit: 3594

Buy/Sell crypto at BestChange

|

|

February 17, 2021, 03:14:54 PM

Last edit: February 17, 2021, 03:36:05 PM by hugeblack |

|

Hello @fillippone your spreadsheet outdated. Last update 09/02/2021 Total Holding 649,993 ~ According to https://www.bybt.com/Grayscale GBTC Total Holding is 653.73K BTC Thanks for this topic. I saw it a while ago, but I did not read. Today I was wondering whether they are still buying despite the big change in price.

Edit: It worked fine, maybe it was the bug on my part    |

|

|

|

fillippone (OP)

Legendary

Online Online

Activity: 2142

Merit: 15381

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

February 17, 2021, 03:27:01 PM |

|

Hello @fillippone your spreadsheet outdated. Last update 09/02/2021 Total Holding 649,993 ~ According to https://www.bybt.com/Grayscale GBTC Total Holding is 653.73K BTC Thanks for this topic. I saw it a while ago, but I did not read. Today I was wondering whether they are still buying despite the big change in price. Strange, I just checked on the spreadsheet and everything is working fine, with values aligned to bybt.com. I don’t exactly know how Google sync works across multiple files (this spreadsheet is fed via a service spreadsheet, but maybe it’s just a temporary delay in updating the values. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|