fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 26, 2021, 10:43:52 PM |

|

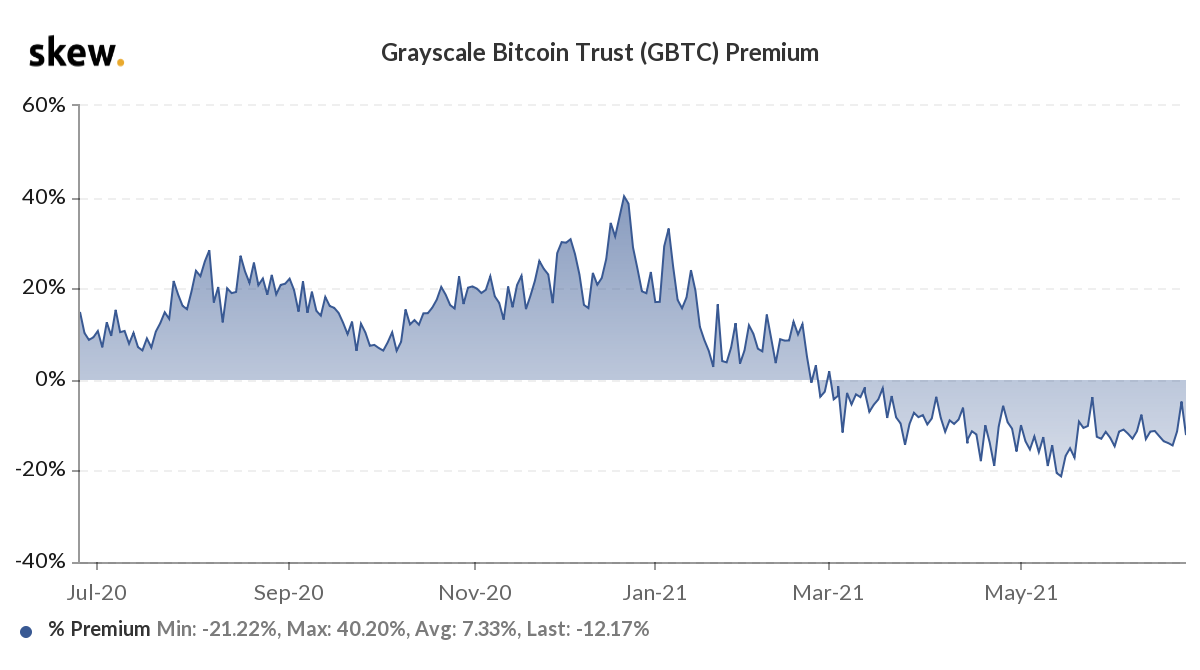

ETF that'll offer up to 15% exposure to BTC through GBTC. Roundabout way of doing things but possible much needed new $$$ for GBTC Well... would I invest in this ETF? Currently Grayscale trades at a 13% discount. This means that the trust is changed into an ETF before 6.5 years (13.5%/2%= 6.5) I am actually buying BTC at a discount. Also, I could buy GBTC shares and sell the future against it, in the most classic cash and carry trade, again locking in the premium + the residual contango curve. The point is, I hardly see what I should invest in an ETF to invest my money in something I can buy on my own, hence making more money. But maybe this is just me and this should be considered a piece of very bullish news. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

"Governments are good at cutting off the heads of a centrally

controlled

networks like Napster, but pure P2P networks like Gnutella and Tor seem

to be holding their own." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

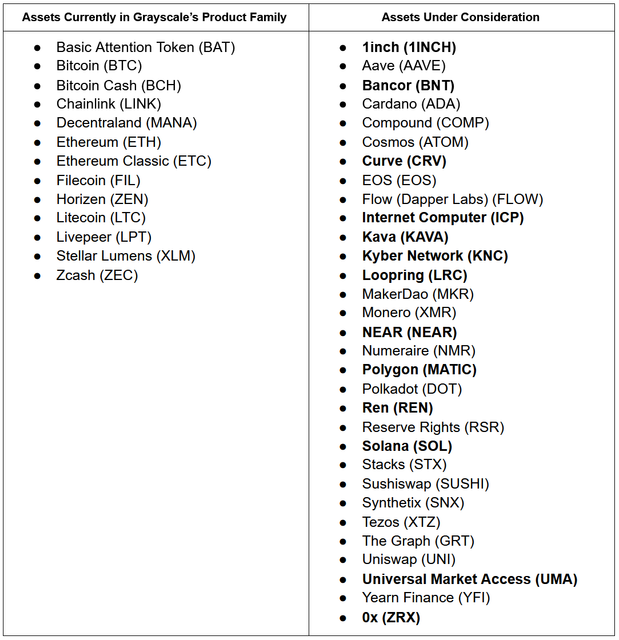

Grayscale Investments has added 13 additional assets to the list, on the basis of which it can offer new investment trusts to its clients in the future. These included: 1inch( 1INCH), Bancor (BNT), Curve (CRV), Internet Computer (ICP), Kava (KAVA), Kyber Network (KNC), Loopring (LRC), NEAR (NEAR), Polygon (MATIC), Ren (REN), Solana (SOL), Universal Market Access (UMA), and 0x (ZRX). https://twitter.com/Grayscale/status/1405616083105718273The company promised to periodically update the list. https://grayscaleinvest.medium.com/update-grayscale-investments-exploring-additional-assets-e4e80da683bb |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 18, 2021, 10:40:53 AM Merited by JayJuanGee (1) |

|

Grayscale Investments has added 13 additional assets to the list, on the basis of which it can offer new investment trusts to its clients in the future.

I struggle for the rationale to invest in those shut coins, let alone on the rationale about investing in those shitcoins via Grayscale! But apparently I am missing something,as otherwise Grayscale wouldn’t expose themselves to such a “risk”. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

hugeblack

Legendary

Offline Offline

Activity: 2492

Merit: 3596

Buy/Sell crypto at BestChange

|

|

June 18, 2021, 01:19:00 PM Merited by JayJuanGee (1) |

|

I struggle for the rationale to invest in those shut coins, let alone on the rationale about investing in those shitcoins via Grayscale! But apparently I am missing something,as otherwise Grayscale wouldn’t expose themselves to such a “risk”.

I started a few weeks ago to find a logic that may be similar, although it is strange. I am not familiar with all the details of the projects, but LRC/REN/SOL are one of projects that I invested in. The reason is that the Ethereum network would be ideal if the fees were lower, so the support for decentralized platforms would be good. If Uniswap platform failed to provide idealized integration, these options would go up a lot. I'm still not convinced of the feasibility of investing in 1inch but $CRV $KNC $LRC $REN $SOL $ZRX seems like a reasonable option. The confusing thing is their lack of support for ADA especially with parallel blockchain concepts. ICP & UMA are weird points on that list that I don't have an explanation for is. |

|

|

|

zasad@

Legendary

Offline Offline

Activity: 1736

Merit: 4269

|

|

June 21, 2021, 10:47:33 PM |

|

https://grayscaleinvest.medium.com/update-grayscale-investments-exploring-additional-assets-e4e80da683bbUpdate: Grayscale Investments Exploring Additional Assets  "* New entrants as of June 17, 2021 are in bold above. As a reminder, not every asset under consideration will be turned into one of our investment products. The process of creating an investment product similar to the ones we already offer is a complex, multifaceted process. It requires significant review and consideration and is subject to substantial internal controls, sufficiently secure custody arrangements, and regulatory considerations."

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 22, 2021, 06:07:07 AM |

|

<...>

Daltonik reported the news a few post above, my friend. I must admit that the list is quite impressive. I barely know the majority of those shitcoins, and I still struggle what is the logical path of someone willing to buy a (presumedly overpriced) Grayscale version of it. The Grayscale rationale, however, is pretty clear. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 23, 2021, 10:10:35 AM |

|

Buying Grayscale shares, selling the BTC future. Nice way of cashing in the NAV premium discount, without worrying too much about BTC price. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

June 24, 2021, 12:02:12 PM

Last edit: May 15, 2023, 11:35:54 PM by fillippone |

|

JPM published a report that Coindesk analysed, publishing this article: Grayscale ‘Unlockings’ Poses Downside Risk to Bitcoin Price, JPMorgan Says While some observers say bitcoin (BTC, -0.19%) has bottomed out, analysts at JPMorgan remain bearish, identifying the impending unlocking of shares in the Grayscale Bitcoin Trust (GBTC) purchased in January as a source of downside risk to the cryptocurrency.

I will try to put my hands on this in order to know more. Edit:just realised @Daltonik beat me again on the news. I blame my hectic RL preventing me to check notifications. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 01, 2021, 08:12:10 PM |

|

Something that makes you realise we are still early on the cycle. Morgan Stanley Buys Over 28,000 Shares of Grayscale Bitcoin TrustMegabank Morgan Stanley has purchased 28,289 shares of Grayscale Bitcoin Trust through its Europe Opportunity Fund, according to a U.S. Securities and Exchange Commission filing.

Of course, we welcome this tiny investment, around one million dollars. Also being the shares at discount vs NAV, it's a rational move to buy those like it were a discount bitcoin. Maybe MS also sold futures against it to lock a (tiny) cash and carry trade. Whatever it works to get Wall Street banks comfortable with Bitcoin is good in my opinion. Just to clarify: it's not Bitcoin needs Wall Street to survive. It's the other way round: Wall Street needs bitcoin to survive. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

July 03, 2021, 06:08:56 AM Merited by fillippone (2) |

|

Grayscale Investments has included the Cardano cryptocurrency (ADA) as a component of the Digital Large Cap Fund. The company clarified that the proceeds from the sale of some components of the trust were used to purchase ADA. As of July 2, 2021, the share of the asset was 4.26%. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 09, 2021, 07:21:32 PM Merited by JayJuanGee (2) |

|

Finally a comment with some grain of salt. As everyone knows, and as our spreadsheet has been signalling, in the coming weeks there will be significant GBTC shares unlocks. Investors buying GBTC in the primary market have a lockout period of 6 months, after this term, they are free to transfer those shares freely. Well, GBTC had a very significant inflow six months ago, and now those shares are going to be freed from their sell ban. This, coupled with a negative GBTC premium has rang some bell in someone head. I suspect the impact on BTC will be negligible, and also I think the impact on the very same GBTC share will be also small. QPC Capital explains why in this nice medium post: Market Update: 8 July 2021

The upcoming unlocks are for institutional holders who subscribed directly to GBTC 6 months ago — and this batch consists of all the new Q1/2021 positions, largely ARK’s last tranche (Chart 3).

To state clearly — We dont expect these unlocks on its own to have significant impact on the overall market outside of GBTC itself.

These are the two main reasons why we conclude little will be happening: 7. GBTC was essentially a “long-end of the BTC curve” play, where one could subscribe with physical BTC at par value and capture the GBTC price premium after the lock-up period. A tonne of leverage was used to maximise profits on this premium of the ‘terminal forward’:

<...>

ii. Borrow USD to make a double spread by buying physical BTC and short the perpetual swaps or futures (earn 1st spread), then use the physical BTC purchased to subscribe to GBTC to earn the premium after 6 months (earn 2nd spread).

<...>

15. Converting to an ETF would be the most obvious future solution, but thats entirely out of their hands, and into the still-skeptical hands of the SEC. An ETF structure with more frequent & accessible subscription/redemptions would certainly result in their share price trading much closer to par.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

Daltonik

Legendary

Offline Offline

Activity: 2520

Merit: 1490

|

|

July 15, 2021, 06:23:37 AM |

|

A little bit about the "conspiracy theory" and the related one of the shareholders of the Grayscale BlockFi fund and how ultimately loans in bitcoins can affect the value of cryptocurrencies, according to Jarvis Labs. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

July 15, 2021, 01:38:05 PM |

|

<...>

Very interesting. But I guess the history is a little bit more complicated than that. If I had been Blockfi I would have: - Taken BTC from clients

- Buy GBTC shares in kind with client BTC

- Open a short position on GBTC shares

After six months: - Close the short position on GBTC shares buying back the shares

- Sell GBTC shares on the open market

Now, this is a delta neutral strategy that allows me to cash in the premium at the inception of the trade. Delta neutral means that this strategy payoff is not impacted by the directionality in the market. The strategy is aimed at capturing the premium, not the bitcoin appreciation. So I guess this is the BlockFi playbook, not just the buy and hodl. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15386

Fully fledged Merit Cycler - Golden Feather 22-23

|

Catching up with an old news. This is an interesting development. Something we actually have always seen as the most probable trajectory for GBTC. Grayscale Wants to Turn Its Bitcoin Trust into an ETF

Grayscale, the US investment firm responsible for a mammoth $38.8 billion closed-end Bitcoin trust, has its sights trained on converting the fund into a Bitcoin Exchange-Traded Fund as soon as possible.

"We are 100% committed to converting GBTC into an ETF," said the firm in an announcement today, adding, "The timing will be driven by the regulatory

Also a number of trades, as for example buying cheap GBTC shares waiting for conversion, are also looking at this event as that would immediately impress the premium to 0%. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|