I finally was able to put my hands on that Bloomberg Report.

Here you have it.

I had to slightly edit it in order to protect my source.

GBTC 27% Discount, Leveraged Play On Spot ETF Approval ETFs, Global Dashboard Bitcoin Misfortune or Opportunity? GBTC Falls to 27% Discount

Contributing Analysts Eric Balchunas (Strategy) (Bloomberg Intelligence) –

The Grayscale Bitcoin Trust (GBTC) may continue to face dwindling demand as its price falls faster than the value of the Bitcoin it holds, expanding its discount to more than 26%. GBTC is unlikely to convert to an ETF in the near term -- a move that would erase the gap -- but the discount offers more affordable Bitcoin exposure. (01/19/22) 1.

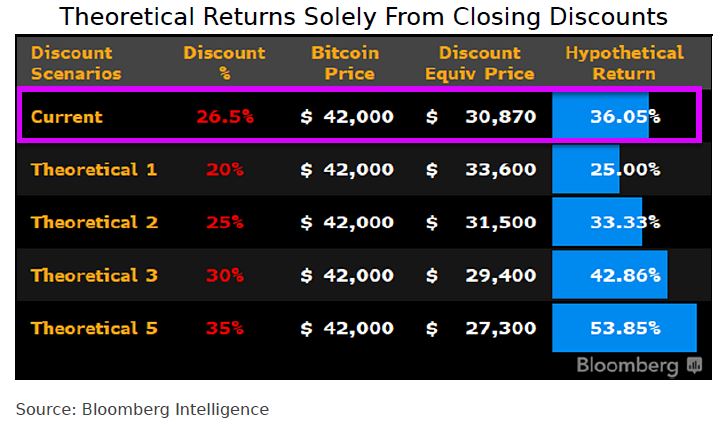

1. Discount Offers Below-Market Bitcoin ExposureGBTC's discount has weighed on shareholders for months but provides Bitcoin exposure at below market prices. GBTC closed trading on Jan. 18 at a 26.5% discount -- equivalent to buying Bitcoin for $30,870 while it's trading around $42,000. That gap will disappear if the SEC allows Grayscale to switch GBTC to an ETF. Yet we expect the SEC to deny Grayscale's conversion application, which has a final decision date of July 6.

The potential compression return would be higher than the discount: Eliminating a 26.5% discount would be analogous to a security appreciating to $100 from $73.50 -- a 36% return. This scenario excludes the risks and price movements of the underlying asset.

(01/19/22)

2. Consistent Discount Hurts Shareholders; Fee a Drag

2. Consistent Discount Hurts Shareholders; Fee a DragContributing Analysts Eric Balchunas (Strategy)

Aside from converting GBTC to an ETF, Grayscale could begin a redemption program or liquidate the fund to unlock the underlying Bitcoin and narrow the steep discount. We don't expect any such move in the next few years, but either is possible if conversion fails. A detriment to holding GBTC long term is the 2% fee. Yet it currently would take more than 15 years for the fee to eat up the potential 36% return from closing the discount.

These scenarios assume Bitcoin's price remains stable, which we believe is unlikely over any time period. (01/19/22)

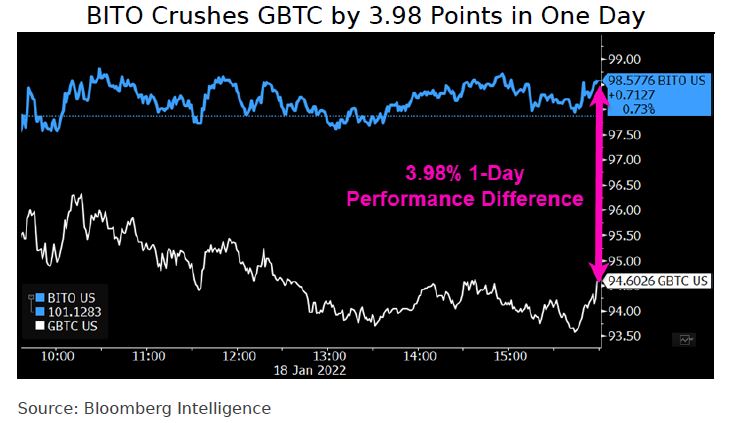

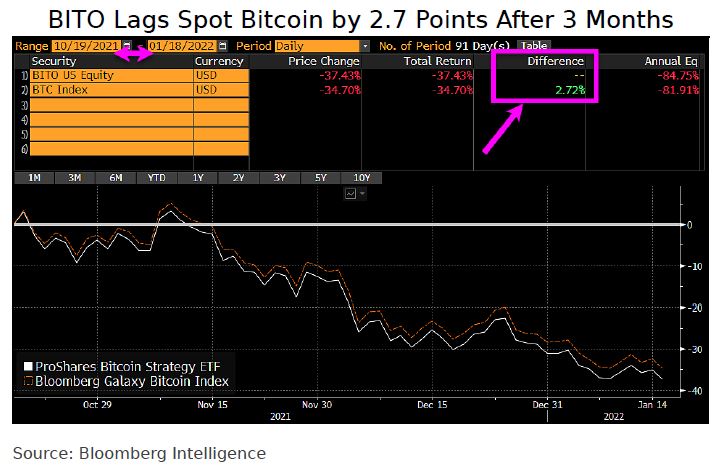

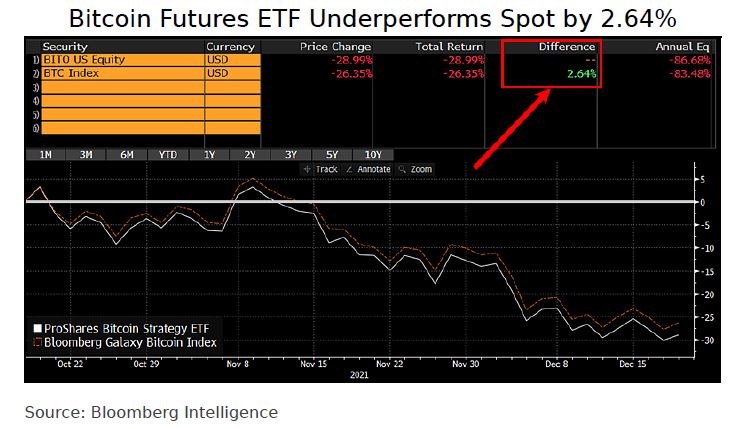

3. Futures Are More Correlated Than GBTC

3. Futures Are More Correlated Than GBTCThe ProShares Bitcoin Strategy ETF (BITO) isn't a particularly efficient vehicle for long-term Bitcoin exposure due to the costs associated with rolling Bitcoin futures. The ETF trails spot Bitcoin by 2.72 percentage points after three months of trading. A linear extrapolation would leave BITO underperforming by almost 11 points in its first year. Yet futures still offer tighter tracking of Bitcoin than GBTC shares. On Jan. 18, BITO outperformed GBTC by 4 percentage points. (01/19/22)

4.Spot Bitcoin ETF Would Offer Better Tracking

4.Spot Bitcoin ETF Would Offer Better TrackingThe growth of alternative Bitcoin products worldwide, particularly in Canada, helped to curb demand for GBTC shares in early 2021, leading to the persistent discount. This lack of demand worsened after the launch of U.S. Bitcoin futures ETFs such as BITO in October. Though neither product is particularly efficient for accessing Bitcoin exposure over the long term, each has pros and cons. BITO is highly correlated to Bitcoin in the near term, while GBTC has almost leveraged return potential if the SEC approves a spot Bitcoin ETF. Yet approval isn't guaranteed anytime soon, and nothing is stopping the discount from widening in the meantime.

It's also possible that the SEC will never approve GBTC's conversion to an ETF. (01/19/22)

5.Lower Fee Could Limit Exodus and Discounts

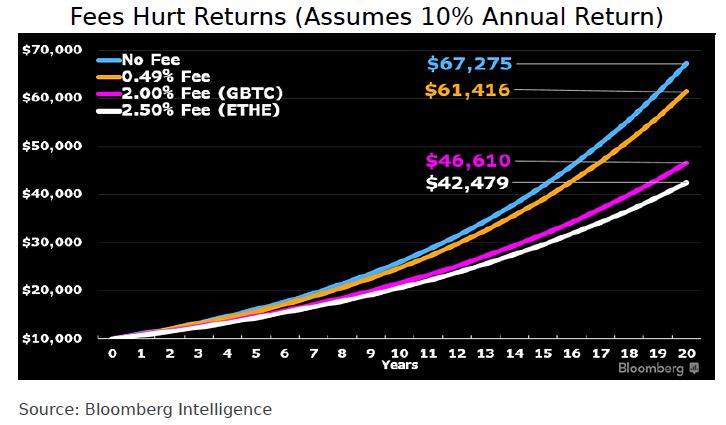

5.Lower Fee Could Limit Exodus and DiscountsGrayscale may have to reduce GBTC's fees to remain competitive. Shrinking demand for GBTC's shares -- and its expanding discount -- stem partly from the proliferation of alternative ways to access Bitcoin, with many offered at far lower cost. We expect the discount to linger, especially after the October launch of U.S. Bitcoin futures ETFs that undercut GBTC's 2% expense ratio by more than half. BITO and BTF charge fees of 0.95% and VanEck's XBTF costs just 0.65%.

Higher fees can dramatically erode returns, as illustrated by the hypothetical growth of $10,000 at 10% annually for 20 years. Without fees, the portfolio would reach $67,275. At an annual fee of 0.49%, that total drops almost $6,000 to $61,416. Increasing the fee to 2%, like GBTC's, cuts the value vs. the free portfolio by almost one-third, to $46,610.

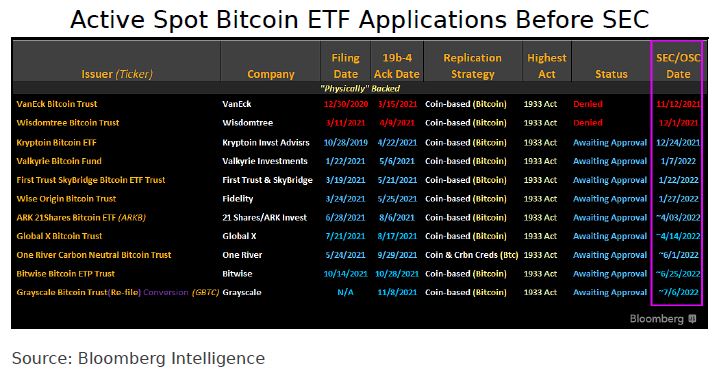

The SEC's October approval of Bitcoin futures ETFs may have forced the agency into a greater likelihood of consenting to spot-based variants in 2022, ending years of rejection. Decision documents on Teucrium and Valkyrie spot Bitcoin ETF filings under arduous SEC 19b-4 review, no matter the view, are likely to expose the agency to rulemaking violations and improve arguments for such funds. Regulators disagree with filers that there's little difference between the ETF types.

6. Two ETF Reviews Could Force SEC Hand in 2022SEC 19b-4 reviews for Teucrium and Valkyrie Bitcoin futures ETFs, filed under the Securities Act of 1933 and marked in our exhibit, weren't on anyone's radar. Recent "1940 Act" Bitcoin futures and spot Bitcoin ETF filings have been the focus, but that's likely to change. Teucrium's April 8, 2022, decision deadline will be the SEC's first 19b-4 response to a futures ETF filing since it approved funds in October. The SEC's view of Bitcoin futures markets in previous responses indicates it would deny the two proposed futures ETFs, but that's unlikely now, as rejections could open the agency to Administrative Procedure Act (APA) violations on rulemaking.

Conversely, if it approves, the SEC will have to thread a tight needle stating why CME Bitcoin futures markets aren't of significant size but are good enough for ETFs. (12/23/21)

7. Grayscale APA Argument to Gain Strength Either Way

7. Grayscale APA Argument to Gain Strength Either Way The SEC's approval of Bitcoin futures ETFs likely created an opening for issuers seeking to launch spot-oriented funds in 2022. Filers' positions are likely to be strengthened after SEC decisions on the two Bitcoin futures ETFs in 19b-4 review. As part of its 19b-4 filing to convert Grayscale Bitcoin Trust (GBTC) to an ETF, Grayscale and its lawyer Davis Polk say the SEC's stance -- favoring investment in Bitcoin futures rather than the underlying asset -- violates the APA, which requires federal agencies to treat similar situations alike, absent a rational basis for differing assessments. Grayscale's assertion that the SEC's position appears inconsistent has merit, but it's unclear whether the agency will consider that argument in its 19b-4 decisions expected in 2Q.

8. Spot Bitcoin ETF Issuers Have Ammo If SEC Denies

8. Spot Bitcoin ETF Issuers Have Ammo If SEC Denies A denial of Bitcoin futures ETFs under the 1933 act, we believe, would strengthen calls of APA violations in the SEC's handling of spot-based fund variants. To allow one product to market that's nearly identical to another, solely because it doesn't go through the same regulatory approval process, would qualify. The agency is expected to treat like situations consistently, and there seems to be little rational basis for a differing assessment of spot Bitcoin ETFs.

The reason these ETFs can file under either act centers on U.S. law that allows a fund to classify Treasuries as a security or not. If classified as a security, a Bitcoin futures ETF can apply to list under the 1940 act since Treasuries are the collateral. ETFs approved under the 1940 act no longer go through the 19b-4 process. (12/23/21)

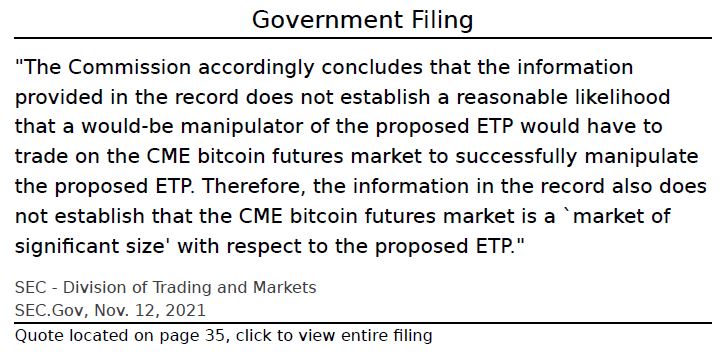

9. Filers' Arguments for SEC Approval Also Valid

9. Filers' Arguments for SEC Approval Also ValidCboe and VanEck's 19b-4 applications argued the Bitcoin futures market is "meaningfully large" and regulated by the Commodity Futures Trading Commission, satisfying SEC surveillance criteria. Most spot Bitcoin 19b-4 filings claim similar. SEC letters don't align with this notion, saying actors could manipulate the spot Bitcoin market without trading CME futures or affecting them. This position is inconsistent with its prior approval of Bitcoin futures ETFs outside the 19b-4 process, given that the spot and futures markets are intertwined; manipulating spot prices would, in turn, affect futures. In addition, most spot Bitcoin ETFs would use a pricing methodology extremely similar to CME's calculation.

To approve a CME Bitcoin futures ETF under the 19b-4 process would theoretically invalidate many of the SEC's arguments. (12/23/21)

10. Diverging Views Specific to 19b-4 Process

10. Diverging Views Specific to 19b-4 Process Regulatory and legal technicalities underlie 7-8 years of SEC denials of spot Bitcoin ETF applicants, though we believe a reversal may occur in 2022. The agency believed approving them would subject Bitcoin to manipulation and a lack of surveillance, but has since given consent to futures oriented funds despite similar risks. Unlike the proposed spot-market funds, the approved Bitcoin ETFs fall under the 1940 act, exempt from the 19b-4 process, which puts the onus on the applicant to allay the concerns of the SEC Division of Trading and Markets.

Our argument from November that Bitcoin futures ETFs likely would have been rejected had they gone through the 19b-4 process is intact. The April decision deadline on the two 19b-4 applicants will force the SEC to make a move. (12/23/21)

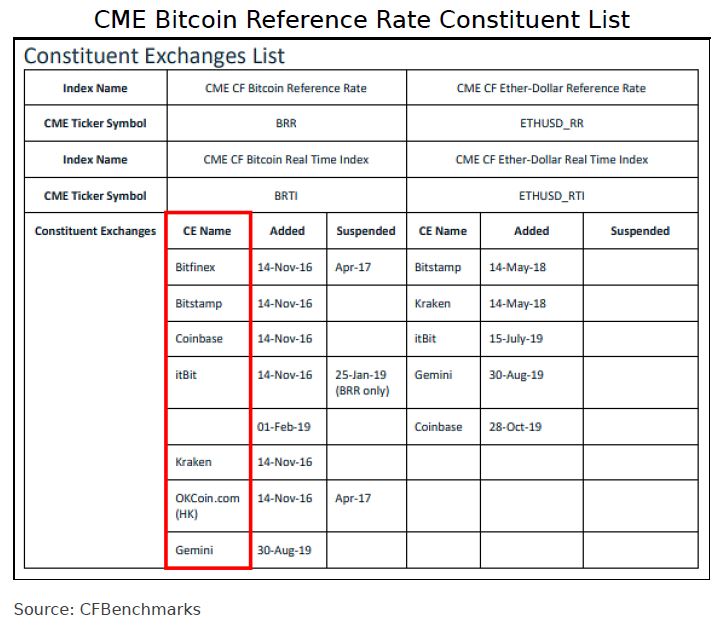

11. CME Bitcoin Price Calculated by Aggregate of Spot Exchanges

11. CME Bitcoin Price Calculated by Aggregate of Spot Exchanges The Bitcoin Reference Rate used to determine the value of CME Bitcoin futures is a calculation of the prices from five spot exchanges for the crypto -- the very venues and markets the SEC deems prone to fraud and market manipulation. The proposed spot Bitcoin ETFs would be tied to similar aggregated valuation methodologies from diverse exchanges to prevent erroneous data or manipulation to affect pricing assessments. (12/23/21)

Grayscale Letter Could Morph Into Court Win for Bitcoin Spot ETF

Contributing Analysts Elliott Z Stein (Litigation)

A letter to the SEC from lawyers for Grayscale sets the table for what we think may be a successful lawsuit in favor of approving Bitcoin spot ETFs, a product the agency has rejected. The letter includes compelling arguments for why SEC reasoning is inconsistent. Such a suit can't come until the agency rejects an application, which for Grayscale might not be until July. (12/21/21)

12. Lawsuit Against SEC Could Succeed Contributing Analysts Elliott Z Stein (Litigation)

A lawsuit against the SEC for rejecting a Bitcoin spot ETF while allowing Bitcoin futures ETFs could succeed if filed, though it would be close because the agency gets court deference, we believe. As articulated in a Nov. 29 letter by lawyers for Grayscale, the SEC's disparate treatment of the two products is fodder for an Administrative Procedures Act (APA) violation. We think it's inconsistent and illogical (or arbitrary and capricious using the statute's language) for the SEC to say no adequate surveillance-sharing agreement can exist for a Bitcoin spot ETF when Bitcoin futures ETFs can be exempted from the same 19b-4 approval process on the presumption that derivatives based securities have adequate surveillance programs.

At minimum, the SEC’s failure to grapple with that inconsistency could be an APA violation. (12/21/21)

13. A Grayscale Lawsuit Might Not Come Until JulyContributing Analysts Elliott Z Stein (Litigation)

Grayscale can't sue the SEC until the agency denies the application for a Bitcoin spot ETF and the rejection order is filed in the federal register, which might not happen until July. NYSE Arca likely also has standing to sue as the exchange that filed the relevant application. The SEC generally has 45 days to approve or reject such applications but can extend that process up to 240 days. Publication in the register generally happens within days of the SEC order. Once a lawsuit is filed, it could take more than a year to resolve.

Other sponsors of rejected Bitcoin spot ETFs -- namely VanEck and WisdomTree -- already have standing to sue, but we haven't seen any indication that they will. (12/21/21)

14. Venue Options for Grayscale Not Ideal

14. Venue Options for Grayscale Not IdealContributing Analysts Elliott Z Stein (Litigation)

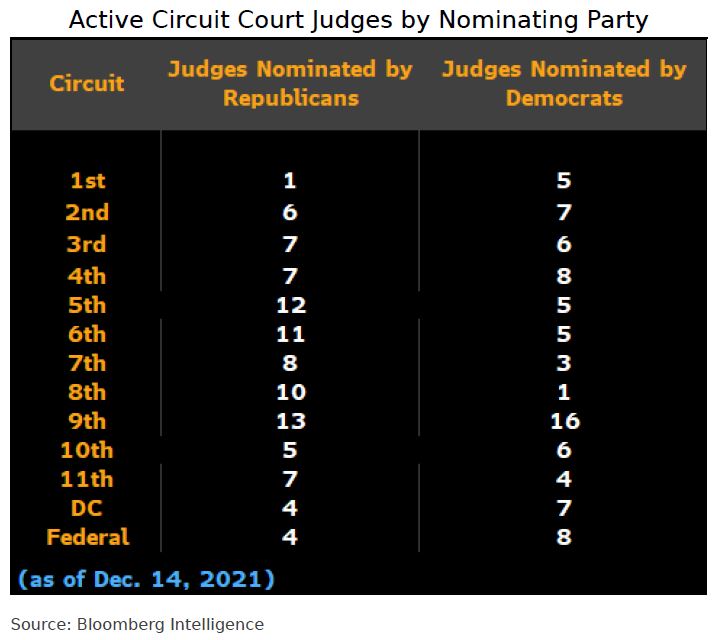

If Grayscale were to sue, its options for court venues would be limited and suboptimal. The Exchange Act (15 U.S. Code 78y) permits such lawsuits to be filed in federal appeals court in either Washington, D.C., or the petitioner's principal place of business, which for Grayscale is New York. Each court has a majority of judges appointed by Democratic presidents. Those judges are generally more deferential to agency action than their Republican-appointed colleagues, though that's a broad generalisation that doesn't always hold.

More favourable venues for Grayscale or another petitioner would be the Fifth Circuit federal appeals court (covering Louisiana, Mississippi and Texas) or the Eighth Circuit (covering Arkansas, the Dakotas, Iowa, Minnesota, Missouri and Nebraska). (12/21/21)

15. Potential Downside Risks of a Lawsuit

15. Potential Downside Risks of a LawsuitContributing Analysts Elliott Z Stein (Litigation)

Suing the SEC isn't without risks. First, there's the possibility of antagonising your regulator. A second potential downside is that, in response to a court finding an APA violation, the SEC doesn't approve a Bitcoin spot ETF and instead mandates that Bitcoin futures ETFs also go through the 19b-4 approval process as the spot funds must. That outcome would treat Bitcoin spot and futures ETFs similarly, but not in the way proponents of the former envision. We think that outcome is unlikely since it could effectively unwind the glide path to Bitcoin futures ETF approval that the SEC has already blessed, yet it can't be completely ruled out. (12/21/21)