|

teosanru (OP)

|

|

June 24, 2020, 05:47:43 AM

Last edit: June 25, 2020, 06:11:10 PM by teosanru |

|

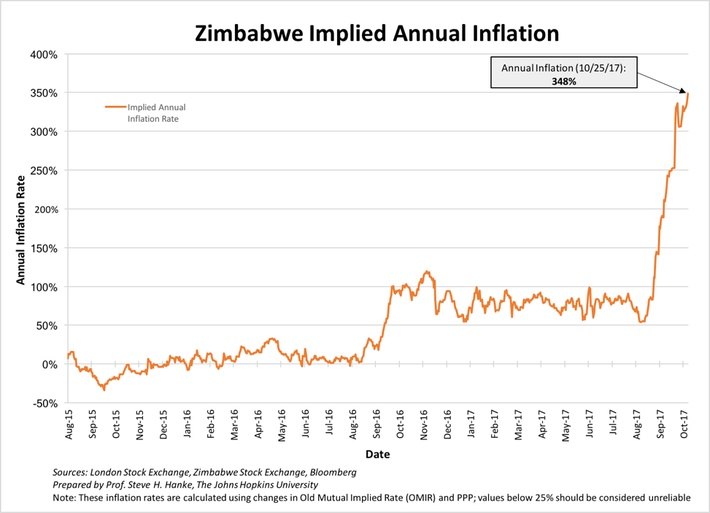

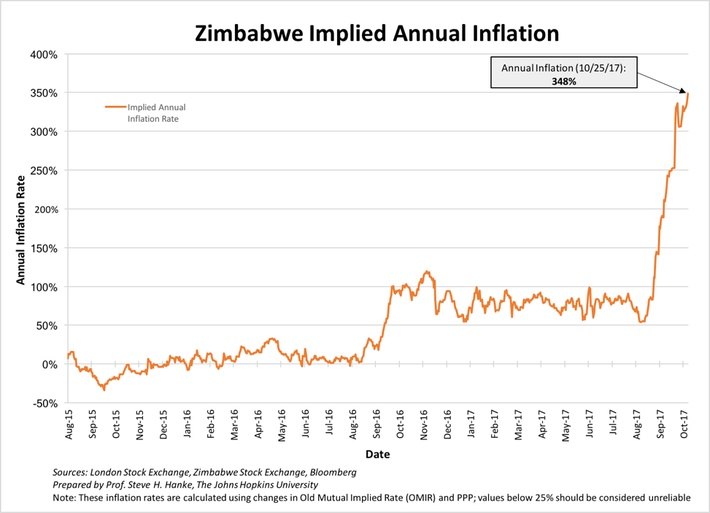

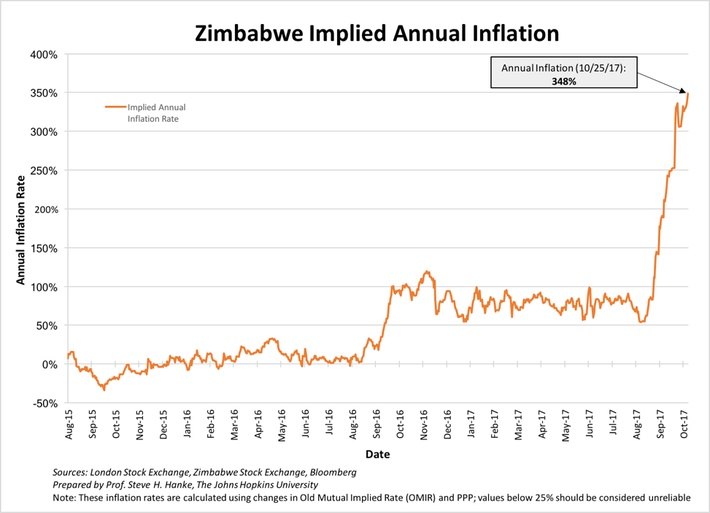

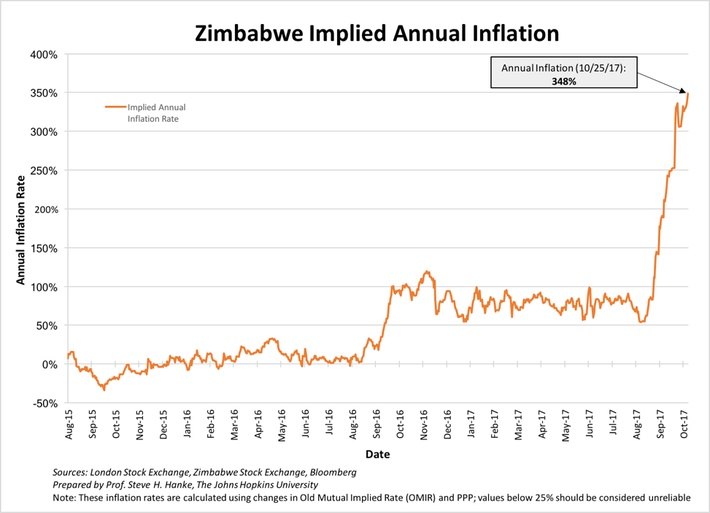

Now that, the whole world is in sort of an Economic Outrage due to Covid, It is worthwhile to note that every Government around the world has announced certain fiscal stimulus to boost up the economy once again. Every country has given aroud a 5-20% Fiscal package. Here is a summary of major countries:  So if we look at this metric we would realize that every country has increased liquidity in hands of people by this much percentage. Now where will this money come from? See considering that there won't be much gains in hands of people and less purchasing due to Covid chances are Tax collections which were expected to Increase Y-O-Y might even go down. Therefore countries would be having just two remaining options: - 1. Deficit Financing: The most obvious answer for every country. For people who don't know what is deficit financing. It's basically printing of money by the Central bank who then gives it as a loan to the Government. But considering that economies around the world already have a deficit financing of average 3-5% Post covid deficit financing rates may go up to 10% therefore Governments might print a whole lot of money than what they expected almost double. This option is more suitable for Stable Economies.

- 2. Approaching the IMF: Now this is a less preferred option as it is an external borrowing which comes with a cost attached to it. Moreover IMF could also be a bit reluctant in relentless lending. But this is a viable option for developing Economies.

So if it's so easy then what's the problem ?The problem is once again what it has already been. Creating money out of thin air devalues money and creates Inflation. Now most of the investors around the world are worried regarding the demon of "INFLATION" . Now it's a well known fact that inflation backed without by any Economic Growth could lead the country into a hyper inflationary stage. So, while the Countries are printing money relentlessly to fight economy distortion chances are few developing economies just run into Hyper-Inflation. We have seen such a case happening with Zimbabwe previously. Here is once again when Bitcoin comes into action. Here is how it looked for Zimbabwe :  Now this is not the only issue second issue is: DEBT TRAP. While most of the developing economy have been liberal in giving loans to individual and businesses. Now when businesses won't be able to pay back the loan. Countries are resorting to restructuring their debt by giving them more Debt. So this could create a situation of a debt Trap pretty similar to one we saw in 2008 only that was more specific to housing sector. Now this would be more devastating as Small businesses and unorganized sector is backbone for developing countries. Now once again people would realize how easily the Debt Trap can fall like a house of cards. Interesting point to note here is China. China has been very aggressive in providing debt to various countries around the world and due to Covid most of the countries now might not be able to repay China. Moreover, External borrowing from some other Country like US would also not be possible due to stressed conditions in almost every country. Here is a map about how much debt does every country has to China :  Now here chances are that countries might have to lease out their territory to China as a repayment of these borrowings. People around the world will realize that how easy it is for an economy to crash. I think these issues are already what Bitcoin is striving to fight with but in current times they seem to be more deadly. Bitcoin is providing a practical solution for it at-least as a stable alternative to Fiat. |

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

so98nn

|

|

June 25, 2020, 02:55:12 AM |

|

where will this money come from? What I understand from the government decisions made into last stimulus package the was actually bought from the bank of reserves (respective country has different names) where they keep portion of money in safe deposits all the time. This is why it's called as reserve bank. They use this money in the same situation as we are in "the emergency". This helps push ahead the economic conditions of country and try to stabilise it. However each country has limited supply and surely this cause the second problem here as stated in your post and that :- Inflation developing economies just run into Hyper-Inflation. Yes inflation in developing countries could be worst since government can not feed all the people, large population and illiteracy rate is always high in these country which leads to poor management as whole. Businesses are ran by wealthy and employment goes to educated. Again the question arise for illiterate population and they become unsecured in terms of buying even food, consumable and daily needs. a debt Trap pretty similar to one we saw in 2008 And when businesses suffer, people are suffered too. They have loans, EMI's for houses, cars and what not. They need to take more and there they trap. Yes this is the case scenario here but it won't help adoption of bitcoin since this there is no relationship between the two at all. All these three are real problems and unfortunately bitcoin is not the solution. |

|

|

|

|

mu_enrico

Copper Member

Legendary

Offline Offline

Activity: 2296

Merit: 2133

Slots Enthusiast & Expert

|

|

June 25, 2020, 03:22:23 AM |

|

Global adoption is possible, no adoption is also possible. The future is full of uncertainty.

But why the narrative always, hyperinflation, crisis, doomsday, and then adoption, while it is not mutually exclusive? You can have global Bitcoin adoption without any of that stuff. And you can have no adoption after those events occur.

|

| │ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███▀▀▀█████████████████

███▄▄▄█████████████████

███████████████████████

███████████████████████

███████████████████████

█████████████████████

███████████████████

███████████████

████████████████████████ | ███████████████████████████

███████████████████████████

███████████████████████████

█████████▀▀██▀██▀▀█████████

█████████████▄█████████████

████████▄█████████▄████████

█████████████▄█████████████

█████████████▄█▄███████████

██████████▀▀█████████████

██████████▀█▀██████████

▀███████████████████▀

▀███████████████▀

█████████████████████████ | | | O F F I C I A L P A R T N E R S

▬▬▬▬▬▬▬▬▬▬

ASTON VILLA FC

BURNLEY FC | | | BK8? | | | .

..PLAY NOW.. |

|

|

|

Upgrade00

Legendary

Offline Offline

Activity: 2016

Merit: 2168

Professional Community manager

|

|

June 25, 2020, 04:43:02 AM |

|

I think these issues are already what Bitcoin is striving to fight with but in current times they seem to be more deadly. Bitcoin is providing a practical solution for it at-least as a stable alternative to Fiat.

Bitcoin was created during the aftermath of the 2008 recession and many assumed it was meant to correct the failures of the banking sector and salvage the economy, these however is not stated anywhere in the white paper. I don't think Bitcoin was created to prevent the collapse of global economies or to thrive in crisis. It's a trustless peer-to-peer payment option that gives the public an alternative. It may or may not be the solution to a global crisis. Pros and cons; • Bitcoin can be used to prevent inflation caused by debit financing due to its limited supply, but if more people held due to less spending there'll be more demand than supply and could lead to deflation. • On the debt issue, Bitcoin can only be used to finance debts if it became globally accepted and it would function like any financial tool in this regards. It wouldn't prevent debtors from losing part of their territory if they can not repay their loans. • It can be used as a hedge fund for those who want to escape the uncertainty of their local currency. How Bitcoin would function in the future either as a staple currency or an alternative to fiat is yet to be seen and with time and adoption it would mature into the currency of the future |

|

|

|

|

Wexnident

|

|

June 25, 2020, 04:44:15 AM |

|

I don't really see how Bitcoin is supposed to be related to these. I mean, the said events by OP doesn't necessarily put Bitcoin above fiat nor does it put Bitcoin as something that should be used instead of fiat. It more like presents the problems that the government is currently facing with regards to the economy, specifically talking about the inflation problems that may occur if they keep printing out money after money. Besides, the problem stays the same, Bitcoin isn't that well known, maybe even >1% actually even see Bitcoin as a currency. The majority see Bitcoin as an investment of sorts, and as such, adoption post-Covid? Maybe even after another decade, adoption wouldn't be seen as possible.

|

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

|

fiulpro

|

|

June 25, 2020, 06:41:44 PM |

|

Now that, the whole world is in sort of an Economic Outrage due to Covid, It is worthwhile to note that every Government around the world has announced certain fiscal stimulus to boost up the economy once again. Every country has given aroud a 5-20% Fiscal package. Here is a summary of major countries:  So if we look at this metric we would realize that every country has increased liquidity in hands of people by this much percentage. Now where will this money come from? See considering that there won't be much gains in hands of people and less purchasing due to Covid chances are Tax collections which were expected to Increase Y-O-Y might even go down. Therefore countries would be having just two remaining options: - 1. Deficit Financing: The most obvious answer for every country. For people who don't know what is deficit financing. It's basically printing of money by the Central bank who then gives it as a loan to the Government. But considering that economies around the world already have a deficit financing of average 3-5% Post covid deficit financing rates may go up to 10% therefore Governments might print a whole lot of money than what they expected almost double. This option is more suitable for Stable Economies.

- 2. Approaching the IMF: Now this is a less preferred option as it is an external borrowing which comes with a cost attached to it. Moreover IMF could also be a bit reluctant in relentless lending. But this is a viable option for developing Economies.

So if it's so easy then what's the problem ?The problem is once again what it has already been. Creating money out of thin air devalues money and creates Inflation. Now most of the investors around the world are worried regarding the demon of "INFLATION" . Now it's a well known fact that inflation backed without by any Economic Growth could lead the country into a hyper inflationary stage. So, while the Countries are printing money relentlessly to fight economy distortion chances are few developing economies just run into Hyper-Inflation. We have seen such a case happening with Zimbabwe previously. Here is once again when Bitcoin comes into action. Here is how it looked for Zimbabwe :  Now this is not the only issue second issue is: DEBT TRAP. While most of the developing economy have been liberal in giving loans to individual and businesses. Now when businesses won't be able to pay back the loan. Countries are resorting to restructuring their debt by giving them more Debt. So this could create a situation of a debt Trap pretty similar to one we saw in 2008 only that was more specific to housing sector. Now this would be more devastating as Small businesses and unorganized sector is backbone for developing countries. Now once again people would realize how easily the Debt Trap can fall like a house of cards. Interesting point to note here is China. China has been very aggressive in providing debt to various countries around the world and due to Covid most of the countries now might not be able to repay China. Moreover, External borrowing from some other Country like US would also not be possible due to stressed conditions in almost every country. Here is a map about how much debt does every country has to China :  Now here chances are that countries might have to lease out their territory to China as a repayment of these borrowings. People around the world will realize that how easy it is for an economy to crash. I think these issues are already what Bitcoin is striving to fight with but in current times they seem to be more deadly. Bitcoin is providing a practical solution for it at-least as a stable alternative to Fiat. Is the Global adaptation of Bitcoins post COVID-19 possible : Yes Are the governments gonna let it go like this: No The governments all around the world are feeling threatened by the power of Bitcoins and other cryptocurrencies . The politicians and the government are making not so good comments about the same . Even though they are not able to provide jobs for the community and cryptocurrencies are doing much better in this regards. People are now understanding a fact * The financial and political system is too fragile to handle any ups and downs* , Therefore it is completely reasonable too look for alternatives. Now the government knows what Bitcoins can do , until and unless they do want to handle another round of protests all around the world related to Cryptocurrencies they do need to leave it alone . Most countries are a Democracy , that means people does have a say in what the government does , of they do not follow through it would just mean that the government is unfortunately not fit for functioning efficiently over the years , therefore if we demand sternly , I do think we would be able to make a change . The only way we can see adoption of Bitcoins is by making sure we ask for it , educate people about it , learn more about the possibilities it can provide . |

|

|

|

meto012

Newbie

Offline Offline

Activity: 29

Merit: 0

|

|

June 25, 2020, 08:08:34 PM |

|

I don't really see how Bitcoin is supposed to be related to these. I mean, the said events by OP doesn't necessarily put Bitcoin above fiat nor does it put Bitcoin as something that should be used instead of fiat. It more like presents the problems that the government is currently facing with regards to the economy, specifically talking about the inflation problems that may occur if they keep printing out money after money. Besides, the problem stays the same, Bitcoin isn't that well known, maybe even >1% actually even see Bitcoin as a currency. The majority see Bitcoin as an investment of sorts, and as such, adoption post-Covid? Maybe even after another decade, adoption wouldn't be seen as possible.

Thats a misconception actually. Bitcoin could be a currency a decade earlier when transaction time and fees were way way lower than they are now. So fast forward one decade later Bitcoin will be even bulkier and heavier and won't be used as a currency for sure. We should bet on some alts with possibility to handle this role, like ETH XMR TXZ and others, those are my personal favorites |

|

|

|

|

electronicash

Legendary

Offline Offline

Activity: 3066

Merit: 1049

Eloncoin.org - Mars, here we come!

|

|

June 25, 2020, 09:11:19 PM |

|

post covid when we know going out is safer. no businesses will likely accept BTC especially if they dont know about it right now. all they'd rather want today are subsidies from government. an assurance that we and our kids dont die in hunger in the coming months.

there is no room for bitcoin adoption today. there are still payment method apart from cryptocurrency which governments will approved. bitcoin isn't on their list.

|

▄▄████████▄▄

▄▄████████████████▄▄

▄██████████████████████▄

▄█████████████████████████▄

▄███████████████████████████▄

| ███████████████████▄████▄

█████████████████▄███████

████████████████▄███████▀

██████████▄▄███▄██████▀

████████▄████▄█████▀▀

██████▄██████████▀

███▄▄████████████▄

██▄███████████████

░▄██████████████▀

▄█████████████▀

█████████████

███████████▀

███████▀▀ | | | .

| | ▄▄███████▄▄

▄███████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀███████▀▀ | .

ElonCoin.org | │ | | .

| │ | ████████▄▄███████▄▄

███████▄████████████▌

██████▐██▀███████▀▀██

███████████████████▐█▌

████▄▄▄▄▄▄▄▄▄▄██▄▄▄▄▄

███▀░▐███▀▄█▄█▀▀█▄█▄▀

██████████████▄██████▌

█████▐██▄██████▄████▐

█████████▀░▄▄▄▄▄

███████▄█▄░▀█▄▄░▀

███▄██▄▀███▄█████▄▀

▄██████▄▀███████▀

████████▄▀████▀█████▄▄ | .

"I could either watch it

happen or be a part of it"

▬▬▬▬▬ |

|

|

|

|

teosanru (OP)

|

|

June 26, 2020, 04:40:27 AM |

|

where will this money come from? What I understand from the government decisions made into last stimulus package the was actually bought from the bank of reserves (respective country has different names) where they keep portion of money in safe deposits all the time. This is why it's called as reserve bank. They use this money in the same situation as we are in "the emergency". This helps push ahead the economic conditions of country and try to stabilise it. However each country has limited supply and surely this cause the second problem here as stated in your post and that :- Inflation No there is no such case in last 70 years of what you are talking about. No central Bank keeps any reserves today. All they keep is different types of financing options for government. Central Banks either finances the government using deficit financing or just provides them with some dividend. By whatever name called it's not out of any fixed asset reserves. a debt Trap pretty similar to one we saw in 2008 And when businesses suffer, people are suffered too. They have loans, EMI's for houses, cars and what not. They need to take more and there they trap. Yes this is the case scenario here but it won't help adoption of bitcoin since this there is no relationship between the two at all. All these three are real problems and unfortunately bitcoin is not the solution. Bitcoin in it's current form might not be the available solution but this mounting debt trap can only be solved using any asset backed currency. Global adoption is possible, no adoption is also possible. The future is full of uncertainty.

But why the narrative always, hyperinflation, crisis, doomsday, and then adoption, while it is not mutually exclusive? You can have global Bitcoin adoption without any of that stuff. And you can have no adoption after those events occur.

It's because if you see the past revolutions have never come during normalcy. For instance if you even see the introduction of Fiat Currency. The world war II was the reason why governments shifted from Gold Pegged currency to US Dollar pegged currency which would be pegged further to gold. But post that President Nixon couldn't find the solution to maintain gold prices and that ended this system also and system got converted to Fiat. Why would you think any government would allow use of bitcoin in normalcy? They can pretty easily ban it China has showed the world how to do it properly. I think these issues are already what Bitcoin is striving to fight with but in current times they seem to be more deadly. Bitcoin is providing a practical solution for it at-least as a stable alternative to Fiat.

Bitcoin was created during the aftermath of the 2008 recession and many assumed it was meant to correct the failures of the banking sector and salvage the economy, these however is not stated anywhere in the white paper. I don't think Bitcoin was created to prevent the collapse of global economies or to thrive in crisis. It's a trustless peer-to-peer payment option that gives the public an alternative. It may or may not be the solution to a global crisis. Pros and cons; • Bitcoin can be used to prevent inflation caused by debit financing due to its limited supply, but if more people held due to less spending there'll be more demand than supply and could lead to deflation. • On the debt issue, Bitcoin can only be used to finance debts if it became globally accepted and it would function like any financial tool in this regards. It wouldn't prevent debtors from losing part of their territory if they can not repay their loans. • It can be used as a hedge fund for those who want to escape the uncertainty of their local currency. How Bitcoin would function in the future either as a staple currency or an alternative to fiat is yet to be seen and with time and adoption it would mature into the currency of the future Even I myself created a post that Bitcoin might be aftermath of 2008 crisis. Most people seem not to agree with me. Nevertheless. I still think that could have been a reason. But yes you are right as I say in the current form it's pretty difficult to imagine how Bitcoin can be adjusted into the complete market scenario. |

|

|

|

|

|

Latviand

|

|

June 26, 2020, 07:59:59 AM |

|

Global adoption is possible, no adoption is also possible. The future is full of uncertainty.

But why the narrative always, hyperinflation, crisis, doomsday, and then adoption, while it is not mutually exclusive? You can have global Bitcoin adoption without any of that stuff. And you can have no adoption after those events occur.

Probably yes, there are people right now who are engaging in the use of bitcoin as they are staying at their home. There are also people who are using bitcoin in their transaction because it is contact less and easy to send with the use of technology and connections. The only problem in bitcoin is that it is very volatile in the market. But people need to deal with that if they are willing to use bitcoin as their assets. I heard about those Australian post office who already accept bitcoin and I'm hoping for more adoption after or during this Covid-19 pandemic. Nothing is impossible if we really want to earn a huge profits and grow in life. We can also help and contribute to the global adoption of bitcoin just by using it. |

|

|

|

|

|

TheGreatPython

|

|

June 26, 2020, 03:04:36 PM |

|

--snipped

Bitcoin might be a good option if the price will go up during these times. Although cryptocurrency, especially BTC, are the major thing for me now, I am not just stopping with it. I am also looking into other assets as well. And I was seeing a news on Cointelegraph today that an allocation from institutions could be driving the market price to $50,000. So, Bitcoin is a really good asset to gold now. developing economies just run into Hyper-Inflation. Yes inflation in developing countries could be worst since government can not feed all the people, large population and illiteracy rate is always high in these country which leads to poor management as whole. Businesses are ran by wealthy and employment goes to educated. Again the question arise for illiterate population and they become unsecured in terms of buying even food, consumable and daily needs. Even the educated ones in developing countries hardly gets any job, because they are always biased. And just like you have said, companies are owned by the rich and jobs are usually gotten through the connections. Those that are educated but from poor families finds it difficult to get any job. As for those children from rich families, it’s always just a piece of cake. |

|

|

|

Alert31

Member

Offline Offline

Activity: 1041

Merit: 25

Trident Protocol | Simple «buy-hold-earn» system!

|

|

June 26, 2020, 03:28:18 PM |

|

Now that, the whole world is in sort of an Economic Outrage due to Covid, It is worthwhile to note that every Government around the world has announced certain fiscal stimulus to boost up the economy once again. Every country has given aroud a 5-20% Fiscal package. Here is a summary of major countries:  So if we look at this metric we would realize that every country has increased liquidity in hands of people by this much percentage. Now where will this money come from? See considering that there won't be much gains in hands of people and less purchasing due to Covid chances are Tax collections which were expected to Increase Y-O-Y might even go down. Therefore countries would be having just two remaining options: - 1. Deficit Financing: The most obvious answer for every country. For people who don't know what is deficit financing. It's basically printing of money by the Central bank who then gives it as a loan to the Government. But considering that economies around the world already have a deficit financing of average 3-5% Post covid deficit financing rates may go up to 10% therefore Governments might print a whole lot of money than what they expected almost double. This option is more suitable for Stable Economies.

- 2. Approaching the IMF: Now this is a less preferred option as it is an external borrowing which comes with a cost attached to it. Moreover IMF could also be a bit reluctant in relentless lending. But this is a viable option for developing Economies.

So if it's so easy then what's the problem ?The problem is once again what it has already been. Creating money out of thin air devalues money and creates Inflation. Now most of the investors around the world are worried regarding the demon of "INFLATION" . Now it's a well known fact that inflation backed without by any Economic Growth could lead the country into a hyper inflationary stage. So, while the Countries are printing money relentlessly to fight economy distortion chances are few developing economies just run into Hyper-Inflation. We have seen such a case happening with Zimbabwe previously. Here is once again when Bitcoin comes into action. Here is how it looked for Zimbabwe :  Now this is not the only issue second issue is: DEBT TRAP. While most of the developing economy have been liberal in giving loans to individual and businesses. Now when businesses won't be able to pay back the loan. Countries are resorting to restructuring their debt by giving them more Debt. So this could create a situation of a debt Trap pretty similar to one we saw in 2008 only that was more specific to housing sector. Now this would be more devastating as Small businesses and unorganized sector is backbone for developing countries. Now once again people would realize how easily the Debt Trap can fall like a house of cards. Interesting point to note here is China. China has been very aggressive in providing debt to various countries around the world and due to Covid most of the countries now might not be able to repay China. Moreover, External borrowing from some other Country like US would also not be possible due to stressed conditions in almost every country. Here is a map about how much debt does every country has to China :  Now here chances are that countries might have to lease out their territory to China as a repayment of these borrowings. People around the world will realize that how easy it is for an economy to crash. I think these issues are already what Bitcoin is striving to fight with but in current times they seem to be more deadly. Bitcoin is providing a practical solution for it at-least as a stable alternative to Fiat. It is be possible for the global adoption of bitcoin post covid 19. But the government is the main problem. Most of the country is democratic in which people have the rights to say something or to ask the government for what they want to know or to happen ,but in overall the government will decide. At this pandemic situation ,most of the people lost their job and the unemployment keep on increasing as the goes by. Bitcoin could help the people have work in crypto if there will be a proper education regarding the cryptocurrency.It could be an alternative solution for every countries economic and unemployment problem. But we can't avoid the fact that bitcoin is like a flame for the government that they will be burn if they will touch it. Adoption of bitcoin at the middle of pandemic will only visible if government accept it and allowing people to learn,to educate and to use it like a traditional fiat money. |

|

|

|

|

Twentyonepaylots

|

|

June 26, 2020, 04:00:18 PM |

|

post covid when we know going out is safer. no businesses will likely accept BTC especially if they dont know about it right now. all they'd rather want today are subsidies from government. an assurance that we and our kids dont die in hunger in the coming months.

Yeah I think that the most possible answer for post-covid situation is the CBDC that plenty of countries are testing, as we move on to the pandemic ( I hope for it asap ) we are still not sure if the virus will or will not comeback so as we say we are going to a new normal where we'll get rid of the paper money probably to avoid the spread again. As I see from the news, countries like USA, Spain and China isn't really going for cryptocurrency. But don't be sad. there is no room for bitcoin adoption today. there are still payment method apart from cryptocurrency which governments will approved. bitcoin isn't on their list.

Indeed. We cannot push for it now just because there is a pandemic, I know cryptocurrencies are made for this situation but so are the other digital payment. Having it with crypto is a great move, but there is just greater for now. |

|

|

|

|

|

teosanru (OP)

|

|

June 27, 2020, 05:16:51 AM |

|

--snipped

Bitcoin might be a good option if the price will go up during these times. Although cryptocurrency, especially BTC, are the major thing for me now, I am not just stopping with it. I am also looking into other assets as well. And I was seeing a news on Cointelegraph today that an allocation from institutions could be driving the market price to $50,000. So, Bitcoin is a really good asset to gold now. Speaking of gold it's price too has risen tremendously during the covid lockdown people might be looking towards it as a safe heaven investment. But cointelegraph has been doing a lot of speculations which generally never turn ino reality. developing economies just run into Hyper-Inflation. Yes inflation in developing countries could be worst since government can not feed all the people, large population and illiteracy rate is always high in these country which leads to poor management as whole. Businesses are ran by wealthy and employment goes to educated. Again the question arise for illiterate population and they become unsecured in terms of buying even food, consumable and daily needs. Even the educated ones in developing countries hardly gets any job, because they are always biased. And just like you have said, companies are owned by the rich and jobs are usually gotten through the connections. Those that are educated but from poor families finds it difficult to get any job. As for those children from rich families, it’s always just a piece of cake. This is a bit out of context but let me tell you this isn't because of rich and poor it's because of useless education system. In my country the so called educated graduates don't have a bit of practical knowledge regarding their subjects. Forget practical they struggle even answering plain questions regarding their subjects. These generalized system of education leaves them with no developed skills which they can harness to get jobs. This is the real problem. Now that, the whole world is in sort of an Economic Outrage due to Covid, It is worthwhile to note that every Government around the world has announced certain fiscal stimulus to boost up the economy once again. Every country has given aroud a 5-20% Fiscal package. Here is a summary of major countries:  So if we look at this metric we would realize that every country has increased liquidity in hands of people by this much percentage. Now where will this money come from? See considering that there won't be much gains in hands of people and less purchasing due to Covid chances are Tax collections which were expected to Increase Y-O-Y might even go down. Therefore countries would be having just two remaining options: - 1. Deficit Financing: The most obvious answer for every country. For people who don't know what is deficit financing. It's basically printing of money by the Central bank who then gives it as a loan to the Government. But considering that economies around the world already have a deficit financing of average 3-5% Post covid deficit financing rates may go up to 10% therefore Governments might print a whole lot of money than what they expected almost double. This option is more suitable for Stable Economies.

- 2. Approaching the IMF: Now this is a less preferred option as it is an external borrowing which comes with a cost attached to it. Moreover IMF could also be a bit reluctant in relentless lending. But this is a viable option for developing Economies.

So if it's so easy then what's the problem ?The problem is once again what it has already been. Creating money out of thin air devalues money and creates Inflation. Now most of the investors around the world are worried regarding the demon of "INFLATION" . Now it's a well known fact that inflation backed without by any Economic Growth could lead the country into a hyper inflationary stage. So, while the Countries are printing money relentlessly to fight economy distortion chances are few developing economies just run into Hyper-Inflation. We have seen such a case happening with Zimbabwe previously. Here is once again when Bitcoin comes into action. Here is how it looked for Zimbabwe :  Now this is not the only issue second issue is: DEBT TRAP. While most of the developing economy have been liberal in giving loans to individual and businesses. Now when businesses won't be able to pay back the loan. Countries are resorting to restructuring their debt by giving them more Debt. So this could create a situation of a debt Trap pretty similar to one we saw in 2008 only that was more specific to housing sector. Now this would be more devastating as Small businesses and unorganized sector is backbone for developing countries. Now once again people would realize how easily the Debt Trap can fall like a house of cards. Interesting point to note here is China. China has been very aggressive in providing debt to various countries around the world and due to Covid most of the countries now might not be able to repay China. Moreover, External borrowing from some other Country like US would also not be possible due to stressed conditions in almost every country. Here is a map about how much debt does every country has to China :  Now here chances are that countries might have to lease out their territory to China as a repayment of these borrowings. People around the world will realize that how easy it is for an economy to crash. I think these issues are already what Bitcoin is striving to fight with but in current times they seem to be more deadly. Bitcoin is providing a practical solution for it at-least as a stable alternative to Fiat. It is be possible for the global adoption of bitcoin post covid 19. But the government is the main problem. Most of the country is democratic in which people have the rights to say something or to ask the government for what they want to know or to happen ,but in overall the government will decide. At this pandemic situation ,most of the people lost their job and the unemployment keep on increasing as the goes by. Bitcoin could help the people have work in crypto if there will be a proper education regarding the cryptocurrency.It could be an alternative solution for every countries economic and unemployment problem. But we can't avoid the fact that bitcoin is like a flame for the government that they will be burn if they will touch it. Adoption of bitcoin at the middle of pandemic will only visible if government accept it and allowing people to learn,to educate and to use it like a traditional fiat money. This was the prime.reason why I said that a few countries economy needs to burst for bitcoin adoption to take place but once again I doubt how can bitcoin be used in it's current condition. |

|

|

|

|

|

davis196

|

|

June 27, 2020, 06:22:21 AM |

|

I get your point,but this still doesn't prove that Bitcoin is going to be globally adopted.

Do you really think that the global "debt trap" problem is going to be solved by the governments adopting Bitcoin and dumping their national currencies?I don't think so.Bitcoin being adopted as a global currency means that governments will lose control over their monetary power.No government in the world would want to lose a part of it's power and authority.

|

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3008

Welt Am Draht

|

|

June 27, 2020, 09:36:04 AM |

|

The biggest development standing in Bitcoin's way to progress is stock markets becoming like shitcoins. Most people enter BTC to make more dollars, they don't give a toss about its qualities but hopefully down the line its true virtues dawn on them.

With new apps like Robinhood and governments signalling willingness to do anything to keep things buoyant people will go straight there.

|

|

|

|

|

|

Haunebu

|

|

June 27, 2020, 11:23:51 AM |

|

Global adoption of BTC is only possible when the people who invest in BTC treat it primarily as a payment currency and investment asset secondarily.

Conditions like government approval, economic issues, natural disasters etc will definitely not have a major affect in this case and history has taught us that much.

COVID has helped make digital payment methods more popular though when compared to physical FIAT. However, it has had low impact on the crypto world clearly which is why global adoption here is clearly out of the question.

It's been more than a decade since BTC and crypto were introduced into this world and I feel like many more decades need to pass for global adoption of BTC to actually become a reality.

|

|

|

|

FanEagle

Legendary

Offline Offline

Activity: 2842

Merit: 1113

Leading Crypto Sports Betting & Casino Platform

|

|

June 27, 2020, 04:40:14 PM |

|

We actually do have data on how much money does USA owe to China and it is around 2.1 trillion dollars. I used to say that it was a huge amount because lets face it 2.1 trillion is a big big amount and their total debt was 20 trillion dollars so around 10% of all their debt was to China.

However they recently printed out 4 trillion dollars for relief which means there is really not that much of a trouble for them to pay something like that. Also there is no reason to actually lease your land to china or whatever, you give treasury bonds that worths that much and they will be able to collect it when the time comes, or they could sell it to willing buyers as well who usually buy for cheaper. Business model of China is not really sustainable but they don't know what to do and how to do it better so all they get is worthless bonds when countries can't pay.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

Sanugarid

Full Member

Offline Offline

Activity: 1442

Merit: 153

★Bitvest.io★ Play Plinko or Invest!

|

|

June 27, 2020, 06:28:40 PM |

|

Global adoption of BTC is only possible when the people who invest in BTC treat it primarily as a payment currency and investment asset secondarily.

But this is not the case for us, people, now with bitcoin. As you can see, the price is quite stable in $9K to $10K range, it is just sitting around that price point and that means, the buying and selling is constant, the trading is wild. And the resistance? the holders who want to do a long term investment on bitcoin which I can conclude that people want bitcoin as a form of investment rather than a daily driver currency. Conditions like government approval, economic issues, natural disasters etc will definitely not have a major affect in this case and history has taught us that much.

We only deal with the positivity towards bitcoin because we haven't had that problems yet, if we come to adopt bitcoin then we will surely encounter its problem too. It's been more than a decade since BTC and crypto were introduced into this world and I feel like many more decades need to pass for global adoption of BTC to actually become a reality.

A decade is still a short amount of time for technology like this, you see how services provider being hacked and stolen, that only means that the security is still got a huge room for improvement. |

|

|

|

Febo

Legendary

Offline Offline

Activity: 2730

Merit: 1288

|

|

June 27, 2020, 07:08:57 PM |

|

Is global adoption of Bitcoin possible post-Covid?

Global adoption of Bitcoin would increase no matter if covid-19 would happen or not. All this printing money to give to people and companies will once make it faster. We see that the global number of new daily cases is increasing. So much more printing will be needed. Vaccine will not be widely available before winter. |

|

|

|

|

|