cryptoboy007 (OP)

Jr. Member

Offline Offline

Activity: 49

Merit: 2

|

|

July 08, 2020, 10:52:02 AM |

|

Over this week I got thinking about the correlation of Bitcoin and the U.S stocks, and the purported claims of Bitcoin being digital gold and therefore a safe-haven. I could only conclude that all these claims contradict the true nature of Bitcoin. Maybe it will be safe to think that those who assume Bitcoin to be safe-haven are only been extreme in their support for the digital asset or attempting to shill their bag. Whichever be the case, Bitcoin is Bitcoin for what it is, a noble digital asset.

On the flip side, the commodities market has a negative correlation with stock. I am beginning to think that a cryptocurrency that tracks the price performance of the top 10 commodities by market cap will best serve as a price hedge against stocks. Just like the S&P 500 is a standalone trading asset that tracks the top 500 U.S stocks, why can't we have such in crypto to track the performance of the top 10 traditional commodities? I am trying so much not to divert the focus from Bitcoin, but look at it, this will give a lot of colors to the crypto trading market.

We will have an asset that doesn't necessarily plunge whenever Bitcoin price tanks, compared to what we are seeing in altcoins that bleed the hell out of them whenever Bitcoin makes a little downward movement.

|

|

|

|

|

|

|

|

|

|

|

|

I HATE TABLES I HATE TABLES I HA(╯°□°)╯︵ ┻━┻ TABLES I HATE TABLES I HATE TABLES

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

fiulpro

|

Over this week I got thinking about the correlation of Bitcoin and the U.S stocks, and the purported claims of Bitcoin being digital gold and therefore a safe-haven. I could only conclude that all these claims contradict the true nature of Bitcoin. Maybe it will be safe to think that those who assume Bitcoin to be safe-haven are only been extreme in their support for the digital asset or attempting to shill their bag. Whichever be the case, Bitcoin is Bitcoin for what it is, a noble digital asset.

On the flip side, the commodities market has a negative correlation with stock. I am beginning to think that a cryptocurrency that tracks the price performance of the top 10 commodities by market cap will best serve as a price hedge against stocks. Just like the S&P 500 is a standalone trading asset that tracks the top 500 U.S stocks, why can't we have such in crypto to track the performance of the top 10 traditional commodities? I am trying so much not to divert the focus from Bitcoin, but look at it, this will give a lot of colors to the crypto trading market.

We will have an asset that doesn't necessarily plunge whenever Bitcoin price tanks, compared to what we are seeing in altcoins that bleed the hell out of them whenever Bitcoin makes a little downward movement.

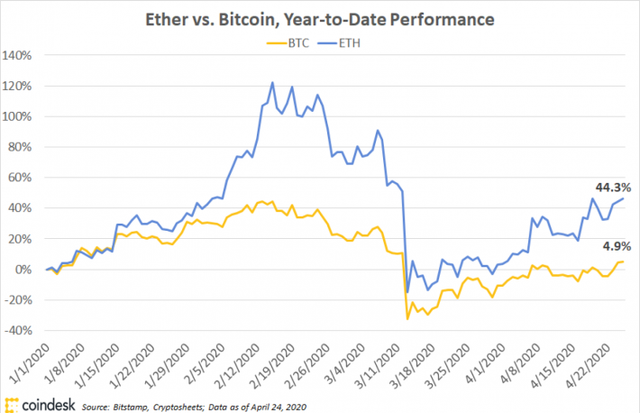

Stocks are centralized and Bitcoins is non centralized investments , even though they might serve the same purpose their correlation is not established with 100% certainty.  This is a graph for back in 2019 , as we can see here , stock , Bitcoins , gold , they are very important but at the same time they don't mirror the movement of each other . ________________________________________________________ BTC and ETH on the other hand are an asset that mirror the movement of each other strongly.  {Images directly taken from google} _________________________________________________________ I do think what you are saying might be a problem , since mixing the centralized market with the non centralized one and that too the commodity market will not only be weird , it would also be unnecessary . I really don't get the whole idea , you might try and maybe represent it more using a graph ? |

|

|

|

joniboini

Legendary

Offline Offline

Activity: 2184

Merit: 1789

|

Graph aside, price movement are an indicator of market sentiment. If an asset is not deemed as a 'safe-haven' or whatever they call it, then the price will move accordingly. In short, if more and more people starts to believe that bitcoin (or any asset) is a good thing to store their wealth, sooner or later the price will follow. It's safe to say that if we don't see that yet, then the market still don't fully trust it even if the potential is there. Time will tell.

|

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

scottt0m

Newbie

Offline Offline

Activity: 10

Merit: 0

|

|

July 08, 2020, 12:36:51 PM |

|

We cannot make a comparison between cryptocurrency market, gold and stocks. Each market has characteristics and standards that differ from the other market and many of these markets have many advantages and disadvantages.

It is an alternative for those who do not want to invest in gold or are afraid of stock market in the long run.

Bitcoin has proven to be a better asset to hold for several years than yielding gold and stocks.

Altcoin fail a lot.

|

|

|

|

|

mindrust

Legendary

Offline Offline

Activity: 3248

Merit: 2424

|

We cannot make a comparison between cryptocurrency market, gold and stocks.

Not really. You can compare any financial asset to any other financial asset. You can even compare rice prices to gold prices too if you want to see which one was the smarter and more profitable investment last year. Since crypto, gold and stocks are all financial assets, you can definitely make comparisons between them. I don't know if there is a correlation between crypto and stocks, nobody really can. We can only speculate. Even if there was once, it doesn't mean it was permanent. Maybe gold/crypto pair was correlated for a while because some whales thought crypto was similar to gold but then they changed their mind and started to trade crypto like stocks? That's possible too. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

BrewMaster

Legendary

Offline Offline

Activity: 2114

Merit: 1292

There is trouble abrewing

|

bitcoin doesn't mirror anything least of all US stock market!

it has always been like this, bitcoin is unique and because of that it has never goes with or against movement of another market ever. the false assumption mainly started after the COVID-19 pandemic and only because bitcoin went down while others were also going down. but that is more of a coincidence than a correlation.

that is historically speaking. but also logically, there is absolutely no reason why bitcoin should follow any other market either. of course there are incidents that can affect everything like the pandemic i mentioned and affect every aspects of our lives that includes bitcoin market.

think of it this way, if it rains and both your yard and your neighbors yard get wet you can't say your neighbor's yard is following your yard and should also get wet each time you water your plants! the "rain" was a cause that affected both. other causes such as watering your plants (stock market growth, stock market crashing,...) has no effects on the other yard (ie. bitcoin market).

|

There is a FOMO brewing...

|

|

|

kryptqnick

Legendary

Offline Offline

Activity: 3094

Merit: 1385

Join the world-leading crypto sportsbook NOW!

|

|

July 08, 2020, 02:34:36 PM |

|

Over this week I got thinking about the correlation of Bitcoin and the U.S stocks, and the purported claims of Bitcoin being digital gold and therefore a safe-haven. I could only conclude that all these claims contradict the true nature of Bitcoin. Maybe it will be safe to think that those who assume Bitcoin to be safe-haven are only been extreme in their support for the digital asset or attempting to shill their bag. Whichever be the case, Bitcoin is Bitcoin for what it is, a noble digital asset.

On the flip side, the commodities market has a negative correlation with stock. I am beginning to think that a cryptocurrency that tracks the price performance of the top 10 commodities by market cap will best serve as a price hedge against stocks. Just like the S&P 500 is a standalone trading asset that tracks the top 500 U.S stocks, why can't we have such in crypto to track the performance of the top 10 traditional commodities? I am trying so much not to divert the focus from Bitcoin, but look at it, this will give a lot of colors to the crypto trading market.

We will have an asset that doesn't necessarily plunge whenever Bitcoin price tanks, compared to what we are seeing in altcoins that bleed the hell out of them whenever Bitcoin makes a little downward movement.

Many people who are into Bitcoin don't care if it's a safe haven or not. Long-term investors are interested in high returns, not high stability. Traders care about regular fluctuations, so whether it's safe to hold money in Bitcoin is of no concern to them. More importantly, I agree with BrewMaster and don't think Bitcoin is mirroring the stock price movement. If we look at S&P price chart, the price was steadily albeit slowly increasing from November 2019 till February 2020. Bitcoin, on the other hand, experienced a solid drop in December and was recovering throughout January. While there are some similarities in spring 2020 and December 2018, there's definitely no mirroring. |

|

|

|

Darker45

Legendary

Offline Offline

Activity: 2576

Merit: 1857

🙏🏼Padayon...🙏

|

The claim that Bitcoin is a safe-haven is almost as dubious as the claim that Bitcoin's price movement is in direct correlation to the US stock market's movement. However, if Bitcoin's non-correlation to the S&P 500 is proven true, then it could indeed be treated as a safe option whenever the general sentiment of the traditional market is bearish. At the very least, shifting to Bitcoin could provide you an opposite result. There may be times when the movements of both markets are parallel but these movements are temporary and do not form a pattern, especially in a relatively longer period of time. Which means to say that Bitcoin could indeed be an independent market. Here's a Forbes article written a few months ago on Bitcoin being more or less an independent market. “Bitcoin is definitely a non-correlated asset,” Pompliano told CNBC in a December 2018 interview. “If you look at the correlation between the digital asset and the S&P 500 over the last 180 days, it’s at zero,” he noted. “If you look at it compared to the dollar index, it’s near zero,” he added.

As of a January 2020 interview with Cointelegraph, Pompliano said his position on the matter had not changed. “The most important part of bitcoin, when it comes to the global hedge, is the fact that it’s a non-correlated asset — meaning that, as stocks go up or down, bitcoin doesn’t have correlation to that,” he told the media outlet. |

|

|

|

20kevin20

Legendary

Offline Offline

Activity: 1134

Merit: 1597

|

This has been under debate ever since Bitcoin's existence.

Just give it time and it'll tell you 100% whether it's a safe haven asset or not. It truly and completely depends on you as a Bitcoin holder whether you consider it yourself one or not as well. One of the ways we influence price is through buying & selling, right?

If enough people considered it's the perfect safe haven asset, they'd make moves on the market accordingly and Bitcoin would then become a trusted financial asset for difficult times. If enough people think the opposite, it'd not be a safe haven. In time, things will be decided. When hard times come, it's much easier and safer to sell your Bitcoins and buy Gold if you want stability and a 100% safe haven asset. Bitcoin is still a question mark and it's too big of a mark not to be worried in difficult times about its potential and future.

Then you have regulations, which vary widely from one country to another and is under constant change. Gold has a VERY long history of regulations and chances are less to be surprised (negatively) by some new Gold regulations vs by some crypto ones. And then consider volatility - during a difficult time such as a pandemic, what would you rather do:

1. Sell your entire stocks portfolio and buy Gold

2. Sell your entire stocks portfolio and buy Bitcoin

3. Sell your entire stocks portfolio and buy 1/2 Gold, 1/2 Bitcoin

I think I can assure you that no. 1 would be the dominating answer. During such times you want to hold a portfolio that's today valued at $100k and will be $90-110k in the distant future as well, not one that is worth $100k today and might be worth $15k next month.

|

|

|

|

|

|

concept2

|

|

July 08, 2020, 03:26:36 PM |

|

Its really silly to compare a centralized market with a decentralized market. Moreover, every asset is a unique variable to the market and anyone in this world is a unique person who can choose whichever kind of investment. And any kind of investment has a chance to give the profit to you. Since the development in technologies and internet, everyone right now have a chance to interact with any kind of trading, brokers and stocks. Why would people put their money in bitcoin if they see a more potential stock which can give them a great amount of money in a short time ? They will quickly withdraw their money, deposit it to a stock market and buy some shares with a few buttons

|

|

|

|

|

cryptoboy007 (OP)

Jr. Member

Offline Offline

Activity: 49

Merit: 2

|

|

July 08, 2020, 07:12:15 PM |

|

Graph aside, price movement are an indicator of market sentiment. If an asset is not deemed as a 'safe-haven' or whatever they call it, then the price will move accordingly. In short, if more and more people starts to believe that bitcoin (or any asset) is a good thing to store their wealth, sooner or later the price will follow. It's safe to say that if we don't see that yet, then the market still don't fully trust it even if the potential is there. Time will tell.

Intelligent comment tbh. This further proves that Bitcoin is more of a speculative risk asset than being a safe-haven. On the flip side, gold has stood the test of time and has a proven use-case and high demand across industries which makes people value it year in, year out. |

|

|

|

|

|

pixie85

|

|

July 08, 2020, 07:55:20 PM |

|

It isn't a sfe haven as long as both Bitcoin and stocks are mainly bought and measured in USD value. We could see that when Trump closed borders in fear of covid both stocks and cryptocurrencies decreased in price and Bitcoin still did well compared to stocks.

Bitcoin stopped by itself and stocks had to be stopped by a Wall Street trading pause.

|

|

|

|

|

|

jostorres

|

|

July 08, 2020, 08:31:25 PM |

|

I think all those things are quite unnecessary. Assets can't be a safe haven all the time. There are times that cash can be a better option as a safe haven, and sometimes gold is a good option to go with. There are times you will check and a particular asset will be doing fine while the majority in the market are falling. You can decide to buy that particular asset so you will be able to save your money and not lose it.

So in this case of cryptocurrency/bitcoin, I don't think it's necessary creating what you have referred to as S&P 500. Cryptocurrency is different, and it doesn't correlate with stocks just as you have said, sometimes when it does it's just a coincidence. They don't correlate in any way, neither does it correlate with gold. The only thing bitcoin correlates with its same cryptocurrencies such as Ethereum.

|

| | .

.Duelbits│SPORTS. | | | ▄▄▄███████▄▄▄

▄▄█████████████████▄▄

▄███████████████████████▄

███████████████████████████

█████████████████████████████

███████████████████████████████

███████████████████████████████

███████████████████████████████

█████████████████████████████

███████████████████████████

▀████████████████████████

▀▀███████████████████

██████████████████████████████ | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | ███▄██▄███▄█▄▄▄▄██▄▄▄██

███▄██▀▄█▄▀███▄██████▄█

█▀███▀██▀████▀████▀▀▀██

██▀ ▀██████████████████

███▄███████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

▀█████████████████████▀

▀▀███████████████▀▀

▀▀▀▀█▀▀▀▀ | | OFFICIAL EUROPEAN

BETTING PARTNER OF

ASTON VILLA FC | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | 10% CASHBACK

100% MULTICHARGER | │ | | │ |

|

|

|

dothebeats

Legendary

Offline Offline

Activity: 3640

Merit: 1352

Cashback 15%

|

|

July 08, 2020, 08:35:26 PM |

|

I'm pretty sure they are just mere coincidence, as it is not only people invested in US stocks are in the bitcoin market, and not even the majority of huge bitcoin movements came from the West itself. Anyway, you have a point that people may just be shilling their bags by stating that bitcoin is a safe-haven, as we obviously have seen some massive crashes of bitcoin where it is least expected and where people believe that it is still capable of making a push. It is too early to claim that bitcoin is a safe-haven, at is still susceptible to heavy market swings and flash crashes, and it is also difficult to tell that it's not given that it sometimes move in a different direction when some traditional assets are falling down, just like what we saw these past few months.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

hatshepsut93

Legendary

Offline Offline

Activity: 2968

Merit: 2145

|

Bitcoin is not and never was a safe haven, a safe haven is something that has very high chance of preserving its value during a crisis, or at worst only loses at little bit of value. Bitcoin goes randomly up or down by a few percents almost every day, and it swing by tens of percents many times per year. This already disqualifies it from being a safe haven, just like no one ever considers penny stocks to be a saf haven, but now that Bitcoin followed stocks at the beginning of the covid-19 crisis, investors have even less reasons to view it as a safe haven. It might take decades before Bitcoin will start showing these properties.

|

|

|

|

|

DoublerHunter

|

|

July 08, 2020, 10:25:43 PM |

|

Bitcoin is not and never was a safe haven, a safe haven is something that has very high chance of preserving its value during a crisis, or at worst only loses at little bit of value. Bitcoin goes randomly up or down by a few percents almost every day, and it swing by tens of percents many times per year. This already disqualifies it from being a safe haven, just like no one ever considers penny stocks to be a saf haven, but now that Bitcoin followed stocks at the beginning of the covid-19 crisis, investors have even less reasons to view it as a safe haven. It might take decades before Bitcoin will start showing these properties.

^ Definitely right, this is not safe haven as investment purposes but when it comes safety purposes against thieves, bitcoin probably consider as a safe haven. At the price stability, bitcoin will not consider as a safe haven and bitcoin do not have any mirror in any form of investment because this has its own demand and supply which makes becomes a valuable asset or currency. So, I don't see any correlation of bitcoin price movement even when pandemic hits the world bitcoin price remain calm. |

|

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3013

Welt Am Draht

|

|

July 08, 2020, 10:40:21 PM |

|

We cannot make a comparison between cryptocurrency market, gold and stocks.

All markets are filled with people. Most of them are filled with the same people. It stands to reason that their behaviour will be pretty consistent across all of them. Anyone who says it's a safe haven is a silly sausage. It's still deep in the wild bet phase. |

|

|

|

|

|

goaldigger

|

|

July 08, 2020, 11:11:30 PM |

|

We cannot make a comparison between cryptocurrency market, gold and stocks.

All markets are filled with people. Most of them are filled with the same people. It stands to reason that their behaviour will be pretty consistent across all of them. Anyone who says it's a safe haven is a silly sausage. It's still deep in the wild bet phase. We all have the same rules to follow, in trading or by way of investing, is just that the news and the current performance of a market makes the difference. If we’re going to treat bitcoin as the safe haven then so be it, its your choice to believe on that but as I can see on the charts and other markets, bitcoin is still depending on stock trend and economic situation, no proven theory as the safe haven at all. |

| │ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███▀▀▀█████████████████

███▄▄▄█████████████████

███████████████████████

███████████████████████

███████████████████████

█████████████████████

███████████████████

███████████████

████████████████████████ | ███████████████████████████

███████████████████████████

███████████████████████████

█████████▀▀██▀██▀▀█████████

█████████████▄█████████████

████████▄█████████▄████████

█████████████▄█████████████

█████████████▄█▄███████████

██████████▀▀█████████████

██████████▀█▀██████████

▀███████████████████▀

▀███████████████▀

█████████████████████████ | | | O F F I C I A L P A R T N E R S

▬▬▬▬▬▬▬▬▬▬

ASTON VILLA FC

BURNLEY FC | │ | | │ | | BK8? | | | █▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄ | .

PLAY NOW | ▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄█ |

|

|

|

famososMuertos

Legendary

Offline Offline

Activity: 1736

Merit: 2731

LE ☮︎ Halving es la purga

|

|

July 08, 2020, 11:40:48 PM |

|

There is a tendency to make comparisons and then try to adapt, it is something very similar to the flag that some followers of bitcoin carry for adoption, in the sense that the old establishment adopts and consequently accepts bitcoin.

In reality, bitcoin is an innovative system that "aims" at a change not only in economic terms, but also in behavior on the part of users and traditional institutions, represented in private banking and in governments that dictate rules based on protection. and benefit of private institutions.

Bitcoin must be able to create its own standards, being the benchmark of the crypto world is its first "bureaucratic" function, what it is doing, the other currencies that exist are based on the bitcoin standard, its price, volume, number of users and the main thing is the genesis of what exists.

If the above works, it is the main thing, the other standards that arise depend on your ability to pay to generate influence and then start creating indices according to the market where have the most influence, but that is far from happening in the short term.

|

|

|

|

LogitechMouse

Legendary

Offline Offline

Activity: 2422

Merit: 1036

Chancellor on brink of second bailout for banks

|

|

July 09, 2020, 12:09:06 AM |

|

Many are saying that Bitcoin is mirroring the price movement of Stock Market and at the same time Bitcoin is a safe haven.

We know already that the price of Bitcoin is driven by its investors. If there is a bad news that is happening that may affect the price of it then it will plummet. Within the past months we saw Bitcoin and at the same time US stocks go down because of the pandemic but after that, Bitcoin went up higher compare to Stocks. This is just a proof that it isn't mirroring the price movement of Stocks because if it is then Bitcoin's price mustn't be at the $9k level right now.

Its just a mere coincidence for me since we know Bitcoin is a decentralized asset/currency.

|

|

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3332

Merit: 6809

Cashback 15%

|

|

July 09, 2020, 12:21:50 AM |

|

If you start giving people free money and or lend it to them at extremely low interest rates, and you'll start seeing asset classes correlate in their movements, regardless of what they are. That's my layman's opinion about what OP's brought up here. I don't think gold and bitcoin have a strong, long-term connection. What that graph shows is a short-term correlation of two assets caused by macroeconomic conditions (as far as I can tell).

Bitcoin is certainly NOT a safe-haven asset. Gold? I guess it's as safe as any speculative asset can be, though there's still no guarantee that it's going to preserve any given person's wealth, as it depends on what price you got in at. Anyway, that's a debate which has been done to death IMO.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

The Cryptovator

Legendary

Offline Offline

Activity: 2240

Merit: 2172

Need PR/CMC & CG? TG @The_Cryptovator

|

|

July 09, 2020, 12:25:21 AM |

|

Honestly Bitcoin itself doesn't have enough power to follow any trends. Its totally depends on investors & community since its backed by them. So if you notice some similarities on stock market chart and bitcoin chart it's just a coincidence IMO. I believe investors aren't limited to any single platform like bitcoin or stock markets. So probably when you notice similarities then likely it's a investors influence. For example when stock market went down then an investor become panic, perhaps same investors invested on bitcoin as well, so this investor would sell his bitcoin as well due to panic. That's how sometimes stock market & bitcoin market pattern would be same. This theory applicable when orttern become same during bump as well. Note; Those users replying on main (full) thread then they shouldn't quote full thread. For example here is some users quoted full thread even on first reply. It will discourage readers to read your post. If you want to reply on a specific sentence then its fine to quote only that part instead of quote full thread. |

|

|

|

|

Shasha80

|

|

July 09, 2020, 12:52:04 AM |

|

Actually Bitcoin cannot be said of safe-haven, because investing in Bitcoin is very risky with its volatile prices. And since Bitcoin was not

created as an initial asset, Satoshi Nakamoto wanted Bitcoin to be payment as if it were fiat. In my opinion, the movement of Bitcoin is not

like US Stock, although it looks the same as just a coincidence and happens in the short term. Then for now Gold is more worthy of being

called a safe-haven.

|

| | | | | BIGGEST AND MOST

TRUSTED FULLY LICENSED

CRYPTO CASINO | | | | ▄▄▄▄█▄█▄▄▄▄

▄█████████████▄

███▀▀███████▀▀███

█▀ ▀█▀ ▀█

█████████████████████

█████████████████████

█████████████████████

███████████████████

███████████████████

█████████████████

███████████████

███████████

▀▀███▀▀ | █▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀█

█ ▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ █

█ █ ▄ ███ ███ █

█▀▄▀█ ▄███▄ █ ███ ██▀▄▀█

█▀ ▀██▀█▀█▀██████ ██▀ ▀█

█ ▄▀▄▀▄███ ██ █ █

█ █▄█ ██ ██ █ █

█ ██ ██ ███ █

█ █ ██ ██ █

▀▄ ▀▄██ ▄▀ ▄▀

▀▄ ▀█▀ ▄▀

▀▄ ▄▀

▀▀▄▀▀ | ▀▄ ▄▀▄ ▄▀

█▄ ▀█▄▄▀▄▄█▀ ▄█

▀█▀███▀███▀█▀

▄█████████████▄

█████████████████

███████████████████

█████████████████████

█████████████████████

▀███████████████████▀

▀█████████████████▀

▀███████████████▀

▀███████████▀

▀▀▀█▀▀▀ | | SPANISH CLUBS

OFFICIAL ASIAN

BETTING PARTNER | │ | ACCEPT

MULTIPLE

CURRENCIES | │ | .

JOIN US | │ |

|

|

|

ChiBitCTy

Legendary

Offline Offline

Activity: 2254

Merit: 3003

|

|

July 09, 2020, 02:25:18 AM |

|

It is true that bitcoin has certainly seemed to mirror the stock markets ups and downs quite a bit over the past several months. That doesn't necessarily mean it's 100% mirroring the stock market nor if it would continue to mirror it in an extended crash. I think at some point it would stop correlating.

|

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

cryptoboy007 (OP)

Jr. Member

Offline Offline

Activity: 49

Merit: 2

|

|

July 09, 2020, 09:47:57 PM |

|

Actually Bitcoin cannot be said of safe-haven, because investing in Bitcoin is very risky with its volatile prices. And since Bitcoin was not

created as an initial asset, Satoshi Nakamoto wanted Bitcoin to be payment as if it were fiat. In my opinion, the movement of Bitcoin is not

like US Stock, although it looks the same as just a coincidence and happens in the short term. Then for now Gold is more worthy of being

called a safe-haven.

Then it looks like analysts that are positioning Bitcoin as a safe haven asset are also getting it wrong. I don't understand why everyone is saying Bitcoin isn't correlated with the S&P 500. Take a look at this piece, Bitcoin’s Price Correlation With S&P 500 Hits Record Highs. |

|

|

|

|

kawetsriyanto

Legendary

Offline Offline

Activity: 2226

Merit: 1086

Free Bitcoins Every Hour!

|

|

July 09, 2020, 11:47:32 PM |

|

In this case, is there any relation to the length of time for an investment to become a safe-haven asset? Because basically, Bitcoin is decentralized. price is very determined by the market. We cannot control the price. In this case, if the investment is done in the short term, there is a possibility that the price will suddenly change drastically. and we might actually experience a loss. however, if used for long-term investment, the value of BTC will continue to rise until it reaches ATH again within a period of several years.

|

|

|

|

|

Savemore

|

|

July 10, 2020, 02:48:32 AM |

|

It is really a big mistake if you will treat bitcoin as a safe haven asset because at the first-place bitcoin is so volatile and it already broken one of the characteristics of being a safe haven where its price is stable. There is also no correlation between the price of the bitcoin and the U.S. stocks. IF you will observe the price of the bitcoin today, it is going sideways why some of the U.S. indices are in uptrend and making all time high and 52 weeks highs.

|

|

|

|

|

|

Fundamentals Of

|

|

July 10, 2020, 03:20:01 AM |

|

There are two false assumptions here:

One, that Bitcoin is a safe-haven.

Two, that Bitcoin is mirroring the US stocks in terms of price.

Better check the basics and both of their figures once again. They will argue against the above-mentioned assumptions.

|

|

|

|

|

cryptoboy007 (OP)

Jr. Member

Offline Offline

Activity: 49

Merit: 2

|

|

July 11, 2020, 05:52:06 PM |

|

I think all those things are quite unnecessary. Assets can't be a safe haven all the time. There are times that cash can be a better option as a safe haven, and sometimes gold is a good option to go with. There are times you will check and a particular asset will be doing fine while the majority in the market are falling. You can decide to buy that particular asset so you will be able to save your money and not lose it.

So in this case of cryptocurrency/bitcoin, I don't think it's necessary creating what you have referred to as S&P 500. Cryptocurrency is different, and it doesn't correlate with stocks just as you have said, sometimes when it does it's just a coincidence. They don't correlate in any way, neither does it correlate with gold. The only thing bitcoin correlates with its same cryptocurrencies such as Ethereum.

I think it's very necessary you understand the point from which I'm heading from, cryptocurrency fundamentals is quite different from stocks. But it clearly looks like the market sentiment is beginning to mirror each other. |

|

|

|

|

lumeire

Legendary

Offline Offline

Activity: 1848

Merit: 1009

Next-Gen Trade Racing Metaverse

|

|

July 11, 2020, 07:06:53 PM |

|

I think all those things are quite unnecessary. Assets can't be a safe haven all the time. There are times that cash can be a better option as a safe haven, and sometimes gold is a good option to go with. There are times you will check and a particular asset will be doing fine while the majority in the market are falling. You can decide to buy that particular asset so you will be able to save your money and not lose it.

So in this case of cryptocurrency/bitcoin, I don't think it's necessary creating what you have referred to as S&P 500. Cryptocurrency is different, and it doesn't correlate with stocks just as you have said, sometimes when it does it's just a coincidence. They don't correlate in any way, neither does it correlate with gold. The only thing bitcoin correlates with its same cryptocurrencies such as Ethereum.

I think it's very necessary you understand the point from which I'm heading from, cryptocurrency fundamentals is quite different from stocks. But it clearly looks like the market sentiment is beginning to mirror each other. There can be times when they mirror each other but in reality they are completely different from each other and bitcoin don't follow The stock market. In the past also there used to be a reverse trend between these two, when the stock market used to fall bitcoin rose in price and when former rose the latter fell, this is just a speculations all the time, the market sentiments changes and a lot of factors make the Price rise or fall we can only try and find these relations and still bitcoins will be unpredictable. |

|

|

|

cryptoboy007 (OP)

Jr. Member

Offline Offline

Activity: 49

Merit: 2

|

|

July 12, 2020, 10:24:57 AM |

|

It is really a big mistake if you will treat bitcoin as a safe haven asset because at the first-place bitcoin is so volatile and it already broken one of the characteristics of being a safe haven where its price is stable. There is also no correlation between the price of the bitcoin and the U.S. stocks. IF you will observe the price of the bitcoin today, it is going sideways why some of the U.S. indices are in uptrend and making all time high and 52 weeks highs.

I think Bitcoin decoupled its correlation with the US stock just before the halving, the halving effect on the price of the asset. Check last year and the first quarter of 2020, both assets were correlative. |

|

|

|

|

|

davis196

|

|

July 12, 2020, 11:09:34 AM |

|

A "safe heaven" is a financial asset that is considered stable and not risky.Gold is the only safe heaven asset,because the demand for gold will last forever and people will always consider gold as something valuable.

Bitcoin is not a safe heaven NOW,because the BTC market price is too volatile and such investment into bTC is too risky.

The important thing is that Bitcoin MIGHT become a safe heaven asset in the future,as Bitcoin adoption grows faster across the globe.

|

|

|

|

larus

Jr. Member

Offline Offline

Activity: 236

Merit: 1

|

|

July 12, 2020, 12:00:05 PM |

|

Bitcoin is not safe haven, thats simple answer. With price flactuation like in last year how it could be safe?

|

|

|

|

|

Sanugarid

Full Member

Offline Offline

Activity: 1442

Merit: 153

★Bitvest.io★ Play Plinko or Invest!

|

|

July 12, 2020, 02:35:23 PM |

|

There are two false assumptions here:

One, that Bitcoin is a safe-haven.

I don't how other people calling it safe-haven, is it because it already stayed in a tight price range? If that is the case then we there should be things to be considered as safe haven, not just bitcoin but also things that are unstable in prices. There are already lot of thread that talks about bitcoin as safe haven, I guess we should all look into a single thread coz there must be the answer there. I bet we all know, aren't we? Two, that Bitcoin is mirroring the US stocks in terms of price.

A simple graph between crypto market and stock market would speak a lot. No need to prove such things. Better check the basics and both of their figures once again. They will argue against the above-mentioned assumptions.

A simple research would save us a lot of time, so please do it next time. |

|

|

|

|

DougM

|

|

July 12, 2020, 04:55:41 PM |

|

I think Bitcoin decoupled its correlation with the US stock just before the halving, the halving effect on the price of the asset. Check last year and the first quarter of 2020, both assets were correlative.

Interesting thread! I had wondered/worried about the BTC/Stock market correlation myself. IMHO the financial markets had a majorcrash in response to the worldwide COVID crisis and unfortunately BTC followed along for the ride. I was hoping that BTC would have stayed the course or even increased in value as money flowed out of the stock market seeking alternative investments that are less impacted by world economy crashing. However, that was not the case. Following the crash both BTC and the stock market recovered as panic was replaced by hope/optimism and the stock market has recovered considerably. If you compare stock market since March to today it is hard to argue that there is some consistency in movements. However, 'correlation is not always causation' and as pointed out earlier by ETFbitcoin it could just be coincidence. This is also a very short time period. I personally believe the stock market has not fully priced in the long term impact of the COVID crisis and I expect to see another drop sometime this fall. I am hoping, this time, that BTC does not follow suit. Time will tell I guess...  Here is yet another Forbes article in May on this topic suggesting the stock market/BTC are trending in tandem since March timeframe: Bitcoin And Stocks’ Correlation Reveal A Secret. I do not buy in on the authors suggestion that BTC is a leading indicator for stocks, but he makes some other points worth considering. |

|

|

|

|

|

DevilSlayer

|

|

July 13, 2020, 01:07:02 AM |

|

There are two false assumptions here:

One, that Bitcoin is a safe-haven.

I don't how other people calling it safe-haven, is it because it already stayed in a tight price range? If that is the case then we there should be things to be considered as safe haven, not just bitcoin but also things that are unstable in prices. There are already lot of thread that talks about bitcoin as safe haven, I guess we should all look into a single thread coz there must be the answer there. I bet we all know, aren't we? Two, that Bitcoin is mirroring the US stocks in terms of price.

A simple graph between crypto market and stock market would speak a lot. No need to prove such things. Better check the basics and both of their figures once again. They will argue against the above-mentioned assumptions.

A simple research would save us a lot of time, so please do it next time. It is still a misconception if you treat bitcoin as a safe have investment, even though we are now in information age; it doesn't mean that the information available all over the internet is true and legit. If you will consider bitcoin as safe haven, be ready because it is so volatile. For those who do not know what it is, it is simply means that the investments have low risk and there is a high probability of winning. I like to agree to you in terms of graph between crypto and stock market, it is true that there is no correlation between both market and we should not compare it because it is both different market. If you see that there is an article saying that the price of the bitcoin is really mirroring the stock market. Be careful because what he just say is not true and it can affect your decisions. |

|

|

|

|

conhela

Jr. Member

Offline Offline

Activity: 41

Merit: 4

|

|

July 13, 2020, 01:50:06 AM |

|

Graph aside, price movement are an indicator of market sentiment. If an asset is not deemed as a 'safe-haven' or whatever they call it, then the price will move accordingly. In short, if more and more people starts to believe that bitcoin (or any asset) is a good thing to store their wealth, sooner or later the price will follow. It's safe to say that if we don't see that yet, then the market still don't fully trust it even if the potential is there. Time will tell.

Isn't that one of the biggest gripes with crypto? That only time can tell many of the benefits touted over and over online? Not being critical of it, I agree though that the fact that current bitcoin price mirroring the stock market is mimicking people's sentiment rather than the US stock rate. |

|

|

|

|

|