First, the news:

MicroStrategy Adopts Bitcoin as Primary Treasury Reserve AssetTYSONS CORNER, Va.--(BUSINESS WIRE)--MicroStrategy® Incorporated (Nasdaq: MSTR), the largest independent publicly-traded business intelligence company, today announced that it has purchased 21,454 bitcoins at an aggregate purchase price of $250 million, inclusive of fees and expenses. The purchase of Bitcoin cryptocurrency was made pursuant to the two-pronged capital allocation strategy previously announced by the company when it released its second quarter 2020 financial results on July 28, 2020.

Source link:

https://www.businesswire.com/news/home/20200811005331/en/MicroStrategy-Adopts-Bitcoin-Primary-Treasury-Reserve-AssetThis is the main statement:

“Our investment in Bitcoin is part of our new capital allocation strategy, which seeks to maximize long-term value for our shareholders,” said Michael J. Saylor, CEO, MicroStrategy Incorporated. “This investment reflects our belief that Bitcoin, as the world’s most widely-adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash. Since its inception over a decade ago, Bitcoin has emerged as a significant addition to the global financial system, with characteristics that are useful to both individuals and institutions. MicroStrategy has recognized Bitcoin as a legitimate investment asset that can be superior to cash and accordingly has made Bitcoin the principal holding in its treasury reserve strategy.”

Coindesk realunched the news:

MicroStrategy Buys $250M in Bitcoin, Calling the Crypto ‘Superior to Cash’Publicly traded business intelligence firm MicroStrategy purchased 21,454 bitcoin on Tuesday, effectively pouring all $250 million of its planned inflation-hedging funds into the digital currency.

- Disclosing its bitcoin buy alongside an equivalent stock buyback in a Tuesday Securities and Exchange Commission filing, MicroStrategy, a Nasdaq-listed software firm worth over $1.2 billion, said the cryptocurrency provided a "reasonable hedge against inflation" in a press statement shared with CoinDesk.

- “This investment reflects our belief that bitcoin, as the world’s most widely adopted cryptocurrency, is a dependable store of value and an attractive investment asset with more long-term appreciation potential than holding cash," said CEO Michael J. Saylor.

- Saylor cited forces working to weaken fiat currencies – COVID-19, global quantitative easing measures, political and economic uncertainty – but also the technical and qualitative aspects that he said give the bitcoin blockchain strength.

- “We find the global acceptance, brand recognition, ecosystem vitality, network dominance, architectural resilience, technical utility and community ethos of bitcoin to be persuasive evidence of its superiority as an asset class for those seeking a long-term store of value," Saylor said.

- The capital allocation quickly fulfills Saylor's late July promise to shareholders that his company, which he founded in 1989, would buy back $250 million in stock and invest an additional $250 million in gold and bitcoin over the next 12 months. The belief was that these and other "alternative investments" would protect MicroStrategy's dollar-heavy balance sheet.

- It is now clear that half of the $500 million bet turns entirely on bitcoin. MicroStrategy "accordingly has made bitcoin the principal holding in its treasury reserve strategy," Saylor said.

Source link:

https://www.coindesk.com/microstrategy-bitcoin-buy-protects-against-fiat-inflationMy Commentary:

This is so big: A publicly traded firm decided to invest half of his 500 millions excess cash reserves buying bitcoin, deliberately dumping the ever value loser, inflationary, exponentially printed fiat currency, to embrace the superior hard money, digital gold, Bitcoin.

This is so bullish. A new era for Bitcoin in the path of a recognition as a superior Store Of Value.

A few tweet about this:

Gabor Gurbacs

Publicly traded company MicroStrategy adopts #Bitcoin as a treasury reserve asset to hedge against fiat inflation. MicroStrategy allocates $250mm to Bitcoin. This is a big deal and good to see #Bitcoin used as intended: hard money/savings instrument.

https://twitter.com/gaborgurbacs/status/1293153751549784064PlanB

#Phase5

https://twitter.com/100trillionUSD/status/1293174076299673600?s=20Barry Silbert, GrayScale CEO:

https://twitter.com/barrysilbert/status/1293162827478335488?s=20

WSJ reported the news, after a few weeks:

‘Cash Is Trash,’ So Let’s Bet $425 Million on BitcoinMicroStrategy could have gotten rid of its excess cash by paying a big dividend or buying back a ton of stock. Instead, the company made a big digital currency bet.

MicroStrategy’s Mr. Saylor says the primary objective of buying bitcoin isn’t to make the stock go up, but to keep the company’s purchasing power from going down.

Thanks to the Federal Reserve’s immense intervention in the economy, the U.S. monetary supply is soaring—by one measure, up more than 20% this year. Mr. Saylor expects that pace to continue at 10% or 15% annually, not just in the U.S. but globally.

“We realized that cash is trash,” he says, “and we needed either to shrink the capital structure or move our cash into something that is going to float on the flood of liquidity and not sink under the flood of liquidity.”

Second Buy:  https://twitter.com/michael_saylor/status/1305850568531947520?s=20

https://twitter.com/michael_saylor/status/1305850568531947520?s=20

Third Buy:

https://twitter.com/michael_saylor/status/1334990791496884224?s=20

https://twitter.com/michael_saylor/status/1334990791496884224?s=20

Here a brief recap of their holdings: they bought very close to the ATH, still they are 60% in the money!

[LINK]

[LINK]

A few words about Micheal Saylor.

Micheal Saylor himself has been interviewed by Antony Pompliano in his Podcast:

The Pomp Podcast #385: Michael Saylor On Buying Bitcoin With His Balance SheetYoutube Version:

The Pomp Podcast #385: Michael Saylor On Buying Bitcoin With His Balance Sheet

This is an episode of The Pomp Podcast with host Anthony "Pomp" Pompliano and guest, Michael Saylor, an entrepreneur and business executive, who co-founded and leads MicroStrategy, a company which provides business intelligence, mobile software, and cloud-based services. He has become well known in the Bitcoin community for using the company's ibalance sheet to purchase more than $400 million of Bitcoin.

In this conversation, we discuss how Michael built MicroStrategy, what his $500 million dilemma earlier this year was, and why he choose to put more than $400 million into Bitcoin with the company's balance sheet.

Also thanks to @lucius, a nice article from Bloomberg, detailing a few interesting bits.

Firstly: Saylor is not a bitcoin zealot:

CEO Says Bitcoin Is Safer After Moving Firm’s Cash to CryptoEven so, Saylor said he’s not a crypto diehard. If bond yields jump, for instance, he said he won’t hesitate to dump the cryptocurrency, though he has no immediate plans to sell.

“We can liquidate it any day of the week, any hour of the day,”Saylor said. “If I needed to liquidate $200 million of Bitcoin, I believe I could do it on a Saturday. If I took a haircut, I believe it would be 2%.”

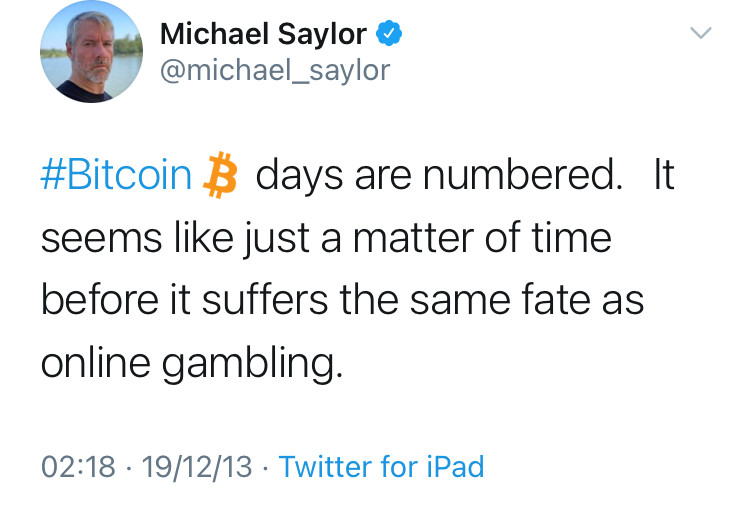

Well, we knew that, as for sure he elaborated some thought from 2013:

Another important bit of information, I was already aware of is settlement with the SEC:

This isn’t the first time Saylor has garnered headlines. He lost billions in personal wealth after the shares tumbled when the company was accused by the U.S. Securities and Exchange Commission of overstating results. Saylor reached a settlement in 2000 without admitting or denying guilt.

More information

here.

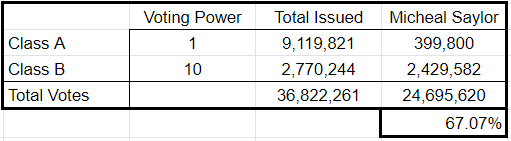

Micheal Saylor owns 67% of voting rights of MicroStrategy. Just remember that. When he says MicroStrategy decided to" he's actually saying "I decided to".

From their SEC Filing:

Because of the rights of our two classes of common stock, and because we are controlled by our existing holders of class B common stock, these stockholders could transfer control of MicroStrategy to a third party without the approval of our Board of Directors or our other stockholders, prevent a third party from acquiring MicroStrategy, or limit your ability to influence corporate matters

We have two classes of common stock: class A common stock and class B common stock. Holders of our class A common stock generally have the same rights as holders of our class B common stock, except that holders of class A common stock have one vote per share while holders of class B common stock have ten votes per share. As of February 2, 2009, holders of our class B common stock owned 2,770,244 shares of class B common stock, or 75.2% of the total voting power. Michael J. Saylor, our Chairman, President and Chief Executive Officer, beneficially owned 399,800 shares of class A common stock and 2,429,582 shares of class B common stock, or 67.1% of the total voting power, as of February 2, 2009. Accordingly, Mr. Saylor is able to control MicroStrategy through his ability to determine the outcome of elections of our directors, amend our certificate of incorporation and by-laws and take other actions requiring the vote or consent of stockholders, including mergers, going-private transactions and other extraordinary transactions and their terms.

Source:

https://ir.microstrategy.com/node/17726/htmlRecapping with a simple image:

Saylor controls 67.1% of the voting capital of the company. Hence he can dictate everything in the company.

Of course this can be viewed as a call to stability and focus on business, as they stated in some interviews, but this is actually relevant information not to be ignored while reading the statements in the first paragraph.

Also worth Noticing Salyor himself owns many bitcoins.

https://twitter.com/michael_saylor/status/1321422012380753921?s=20

https://twitter.com/michael_saylor/status/1321422012380753921?s=20Again, the point he informed the managers, is laughable.