fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15387

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 26, 2020, 05:23:24 PM

Last edit: October 14, 2020, 09:01:32 AM by fillippone |

|

Fidelity is moving into the Digital Asset Management with a new Fund: Fidelity President Files For New Bitcoin FundFidelity president and head of strategy and planning, Peter Jubber, today filed paperwork with the U.S. Securities and Exchange Commission (SEC) informing the regulator of a new fund dedicated to bitcoin. They adds some detail: The previously unknown Wise Origin Bitcoin Index Fund I, LP was incorporated this year and is being run from the same Boston headquarters where the investing giant manages $8.3 trillion in customer funds. The early documentation provides little in the way of details about the fund, and shows zero investors have currently participated. We do know that the minimum investment to join the pooled investment fund is $100,000, indicating this is likely only for institutional and accredited investors. This is another anedoctical evidence of the new #Phase5 as PlanB has been calling it. Bitcoin as hard money and Store of Value, but also as decorrelated asset (hypotesys under scrutiny) to extract yield without incrreasing portfolio volatility. Bitcoin is gaining traction amongst institutional investors. This is a topic I am focusing a lot lately: Warren Buffet bought “Gold” for the first time. When Bitcoin?MicroStrategy Buys $250M in Bitcoin, Calling the Crypto ‘Superior to Cash’Everything you wanted to know about Grayscale BTC Trust but were afraid to ask!ETC Group to launch bitcoin ETP on Deutsche BoerseAlso there are diverse anedoctical news, who let you understand what is the focus, even in the most bitcoin-advese institutions: Goldman Sachs Is Hiring a New VP of Digital AssetsWhat is striking to me, is how the traditional, legacy exchanges are so lagging behind if the insitutional money is so ready to flow into the Bitcoin ecosystem:

Fidelity <...> published the results of a survey of 800 institutional investors from the U.S. and Europe, finding that 36% of respondents were already invested in digital assets, while 60% said digital assets had a place in their portfolio.

If those are the numbers: where are they buying? On Huobi? I am going to find out. Edit: PlanB tweeted about this news in the most obvious way: #phase5 BREAKING: Fidelity president just filed for a previously unknown bitcoin fund: on.forbes.com/6018GWFbs by @DelRayMan

Fidelity published a series of articles focusing on "Bitcoin Investment Thesis" . |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3318

Merit: 6796

Cashback 15%

|

|

August 26, 2020, 07:36:18 PM |

|

Very cool news. I found this quote to be particularly interesting: A year after becoming one of the earliest institutional supporters of bitcoin in 2017 when Fidelity CEO Abigail Johnson publicly said she’d been mining the asset, the company formalized its interest with the launch of Fidelity Digital Assets. The bolded part caught my attention. Was the CEO of Fidelity really mining bitcoin? Props to her if she was, and if she was doing it before or during 2017 she probably made a lot of money. I have no idea, but you bring up a good point. Bakkt? They're basically an options trading platform, but you can take physical delivery of bitcoin if you want as far as I know. I seriously doubt any institution with deep pockets is using any of the exchanges the rest of us do. Who knows? Maybe some of them have deals worked out with companies like Coinbase and Gemini. If you're going to attempt to find out the answer to that question, I'd be interested to hear what you come up with. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15387

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

August 26, 2020, 07:40:33 PM

Last edit: August 26, 2020, 07:53:55 PM by fillippone |

|

Ah, yes. They like to get their hands dirty: Fidelity CEO Abigail Johnson says the company is mining cryptocurrenciesSome details:

One of Fidelity’s projects is mining bitcoin and ethereum, which Johnson said was started for educational purposes, but now turns a tidy profit. “We set up a small bitcoin and ethereum mining operation…that miraculously now is actually making a lot of money,” she said.

The FT reported that the company had bought its mining hardware from the now-pivoted 21 Inc.

<...>

Johnson, herself is a huge proponent of the digital currency and has mined roughly 200,000 satoshis, according to the FT report.

She mined herself 0,002 BTC. She is now amongst the people that immediately recognised the value of Bitcoin. Not like the writer of this post who needed several years to get into the rabbit hole. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

bitbollo

Legendary

Offline Offline

Activity: 3234

Merit: 3475

Nec Recisa Recedit

|

|

August 27, 2020, 09:25:44 AM |

|

Thank you @fillippone for sharing this news. I think this is what we need for our environment & community. BTC is not anymore just a "fancy" "nerd" money or just a speculation, but something that It's going to assume a strong value also in real world, and against all bets also in financial environment. It was some years ago that Overstock started to accept bitcoin as form of payment, and now look where we are, it's just amazing! [it's always cool to see that also a CEO has mined bitcoin some years ago  ] |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5628

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

August 27, 2020, 10:41:28 AM |

|

It seems that only positive news has been coming lately, and when we read words like "Bitcoin fund, Fidelity, $8.3 trillion" in the same sentence, then in combination with everything else we can conclude that there is a lot of interest in investing in Bitcoin. I remember Fidelity popping up in the media about 3 years ago when it allowed its clients to gain insight into their crypto holdings on the Fidelity site through Coinbase. Fidelity Investments Inc has started allowing clients to use its website to view their holdings of bitcoin and other cryptocurrencies held through digital wallet provider Coinbase. Through the experiment, the company said it aims to learn more about digital currencies. It is also significant that the company then admitted that it wanted to learn more about digital currencies, which after three years resulted in the establishment of the Bitcoin fund. If we look at the moves of some other companies listed in the OP, and the moves of banks in the EU (Germany) or recently in the USA, can we say that 2017 was a year in which large institutions like Fidelity began to take Bitcoin more seriously, but it took them several years to decide on more serious moves? fillippone , what do you think about the amount of money that could enter Bitcoin through Fidelity? Given all the huge trillions of dollars that their clients have with them, can we say that between 3-5% would be a realistic figure or is it an exaggeration? |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

Upgrade00

Legendary

Offline Offline

Activity: 2016

Merit: 2170

Professional Community manager

|

|

August 27, 2020, 01:09:58 PM |

|

can we say that 2017 was a year in which large institutions like Fidelity began to take Bitcoin more seriously, but it took them several years to decide on more serious moves?

You could sum it up that way. Introducing a fund would mean exposing it to their investors and they would need to do a lot of research on it as well as work out the technical and legal procedures inorder to arrive at the finished product. During that time they and their investors could have personally been heavily invested in bitcoin. @fillipone, this is another bullish news and when you put it together the way you have, it shows a pattern of interest from the institutional sector, a few years ago, institutional money coming into Bitcoin was only discussed as a possibility. Bull run imminent? |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15387

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 05, 2020, 09:20:48 AM |

|

An interesting series of tweets by Willy Woo, regarding the BitMex hack.

Fundamentally the market is scared for all the wrong reasons.

MEX did NOT get hacked. No traders will lose coins.

Futures exchanges will clean up their practices.

We'll see less volatility, less scam-wicking, more spot volumes, more organic moves, more institutional money.

https://twitter.com/woonomic/status/1311941304532627456?s=21On the last point: The CFTC just announced they are turning the volume down on unregulated derivative exchanges and their dominance on price.

BTC is going to pop.

https://twitter.com/woonomic/status/1311941309007970306?s=21And lastly, coming in topic:

CFTC is wrecking BitMEX for wrecking Bitcoiners. It's a necessary clean up step before an ETF can be approved. This is one of those "the herd is coming" events

They even explicitly wrote it in the official press release: Of course, cleaning the trading environment from illicit practices get Bitcoin Trading more reliable, safe for investors and more compliant with the US domestic rules. I think that would be a massive step in the direction of the removal of the conditions didn’t allow for an ETF approval. They are basically paving the way for Fidelity. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5628

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

October 05, 2020, 01:58:03 PM Merited by fillippone (2) |

|

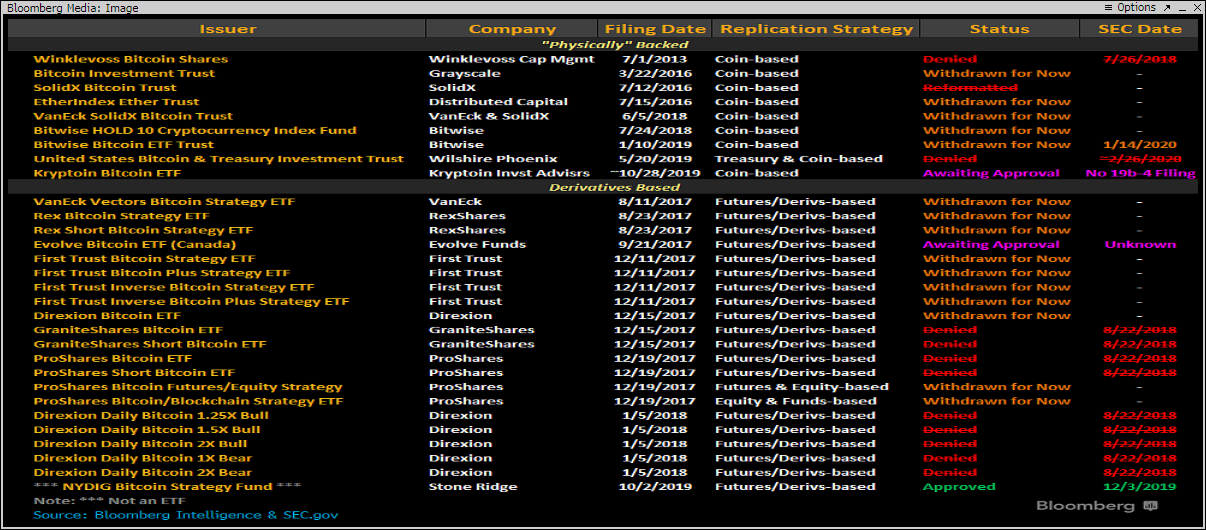

fillippone, the fund for which the request was initiated by Fidelity is not ETF if I understood correctly from OP? This latest BitMEX news and comments from the CFTC should then be on the trail of some future ETF that we know has been of interest to a number of different companies in the past.

If things have to start cleaning up from somewhere, then BitMEX is a great start - but I wonder if the crypto market can be regulated to the extent that it meets the SEC criteria for the BTC ETF? As far as I know there is not a single active ETF request since the SEC rejected the last one in February this year (Wilshire Phoenix).

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

stompix

Legendary

Offline Offline

Activity: 2870

Merit: 6267

Blackjack.fun

|

|

October 05, 2020, 02:32:35 PM |

|

Ah, yes. They like to get their hands dirty: The FT reported that the company had bought its mining hardware from the now-pivoted 21 Inc.

21 Inc, this brings back memories, are they still in business? The article is from 2017....remember something about a rebranding or something but I don't think they have launched any new mining gear .. But about the cleaning, I'm not that optimistic about it, yeah, sounds good, everything will be legal, regulated no more face volume and insider trading, but this doesn't happen even in the already heavily regulated environment, it will take a lot for cryptos, and a lot of people will stick to those shady exchanges, those even worse than bitmex. Not everyone sees regulation and more rules as something good. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15387

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 05, 2020, 04:36:37 PM

Last edit: May 16, 2023, 01:18:07 AM by fillippone |

|

fillippone, the fund for which the request was initiated by Fidelity is not ETF if I understood correctly from OP? This latest BitMEX news and comments from the CFTC should then be on the trail of some future ETF that we know has been of interest to a number of different companies in the past.

If things have to start cleaning up from somewhere, then BitMEX is a great start - but I wonder if the crypto market can be regulated to the extent that it meets the SEC criteria for the BTC ETF? As far as I know there is not a single active ETF request since the SEC rejected the last one in February this year (Wilshire Phoenix).

Correct. The fund in OP is not an ETF, as the “ET” part of the ETF[/ETF] acronym refers to retail investors.

This kind on investors are tricky, because the need a bigger protection by law, as they need to be tutored given their contractual weakness. On the contrary institutional investors, able to drop investments in minimum chunks of 100K, are basically free to to what they want with their money.

So yes, I might have put the whole thing a little bit further.

So yes, they are starting to clean the markets, because they know that eventually they will have to approve a Bitcoin ETF, as the demand is too strong, and the money to be made is too big, above all for the exchanges and all the other zero risk actors (government, ETF issuer, etc.)

As far as I know, a lot of ETF requests have been already been rejected or put on hold:

This doesn’t mean they can fix the requests and resubmit them again.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

RealMalatesta

Legendary

Offline Offline

Activity: 2338

Merit: 1124

|

|

October 07, 2020, 12:51:44 PM |

|

I am sure that they are going to get involved but for this one they are not going to be doing it right away and they are probably not going to do it too big neither. I mean obviously all wall street companies without a doubt will get in, there will be no company that will stay away, obviously they are going to miss a ton of profit if they insist on bitcoin bad narrative so they will all get in. However when they get in and how they get in changes too much.

If they get in big and quickly but do it on OTC that will not change the price, if they get in very slowly in long period of time they are not going to affect the price, so all in all we need them to get in quickly and on the market as well which they will not do neither as well, so it is not going to change much in crypto.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15387

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 08, 2020, 11:00:24 AM |

|

I think Fidelity is focused on deploying every available tool to pave the way for institutional bitcoin adoption. On a separate news, for example, they lead an effort to promote a tool to simplify KYC/AML for bitcoin gateways. Group Backed by ING Bank, Fidelity and Standard Chartered Releases Crypto AML Tools

The Travel Rule Protocol (TRP), a working group favored by banks and traditional financial institutions and focused on bringing crypto in line with global anti-money laundering (AML) standards, has released the first version of its API.

Announced Thursday, the 25-member TRP working group, which includes Standard Chartered, ING Bank and Fidelity Digital Assets, has published the TRP API version 1.0.0.

The product aims to offer a straightforward way for firms to swap identification data about the originators and beneficiaries of crypto transactions, as per the requirements of global AML watchdog the Financial Action Task Force (FATF).

You might not like that, I don’t, but having a sort of “walled garden” where “clean bitcoin” can be traded, is a fundamental condition for regulators to approve a Bitcoin ETF |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

jaysabi

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

October 08, 2020, 11:30:22 PM Merited by fillippone (2) |

|

fillippone, the fund for which the request was initiated by Fidelity is not ETF if I understood correctly from OP? This latest BitMEX news and comments from the CFTC should then be on the trail of some future ETF that we know has been of interest to a number of different companies in the past.

If things have to start cleaning up from somewhere, then BitMEX is a great start - but I wonder if the crypto market can be regulated to the extent that it meets the SEC criteria for the BTC ETF? As far as I know there is not a single active ETF request since the SEC rejected the last one in February this year (Wilshire Phoenix).

This is just a private fund, which means it will be targeting at a minimum accredited investors. Fidelity filed the Form D on 8/26 prior to any sales, so they won't have to disclose any sales figures for this fund until 8/26/2021, which is a shame because I'd be interested to see what kind of interest they're getting. They could opt to publish an amendment prior to that if they wanted to update the sales figures prior to that, which some issuers do as a sign of interest in their fund, but I wouldn't count on that. |

|

|

|

cryptoboss2020

Member

Offline Offline

Activity: 322

Merit: 14

|

|

October 08, 2020, 11:36:10 PM |

|

fidelity is usa investment company?

are they investing hedge funds big investors money? private indviduals ? or just usa pensions funds? tax payers money? wich one they do ?

|

|

|

|

|

Febo

Legendary

Offline Offline

Activity: 2730

Merit: 1288

|

|

October 09, 2020, 02:40:13 PM |

|

fidelity is usa investment company?

are they investing hedge funds big investors money? private indviduals ? or just usa pensions funds? tax payers money? wich one they do ?

It is a new found. So they plan to get fresh investors or relocate founds of existing investors. The previously unknown Wise Origin Bitcoin Index Fund I, LP was incorporated this year. The early documentation provides little in the way of details about the fund, and shows that zero investors have currently participated. We do know that the minimum investment to join the pooled investment fund is $100,000, indicating this is likely only for institutional and accredited investors. |

|

|

|

|

Harriti

Sr. Member

Offline Offline

Activity: 756

Merit: 256

HEX: Longer pays better

|

|

October 09, 2020, 03:15:00 PM |

|

Fidelity is moving into the Digital Asset Management with a new Fund: Fidelity President Files For New Bitcoin FundFidelity president and head of strategy and planning, Peter Jubber, today filed paperwork with the U.S. Securities and Exchange Commission (SEC) informing the regulator of a new fund dedicated to bitcoin. This has a huge effect on our crypto market. we have more large investment funds participating and that will make the volume of the crypto market bigger and bigger. This will also motivate potential projects to proliferate, and our market will also be more diverse and functional. ** My other thing is that 1 day ago, Financial Investment Fund Square bought $ 50 million worth of bitcoin into their wallet! I'm feeling 2021 will be a great year for the crypto market. What do you think? |

████████████████████

██████████████████████

████████████████████████

██████████████████████████

████████████████████████████

████ ▀██████████

████ ██████████████ ██████████

████ ████████████████ ██████████▄

████ ██████████████████ █████████▀

██ ████████████████████ ███████

███ █████████ █████

███ ███████ ███████ █████

█████████ █████ █████

███████████ ███ █████

█████████ ███ █████

███████ ███ █████ | | |

●

●

●

●

●

●

●

| | | |

●

●

●

●

●

●

●

| |

Powered by,

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15387

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 10, 2020, 07:07:10 AM |

|

<...>

This has a huge effect on our crypto market. we have more large investment funds participating and that will make the volume of the crypto market bigger and bigger.

This will also motivate potential projects to proliferate, and our market will also be more diverse and functional.

** My other thing is that 1 day ago, Financial Investment Fund Square bought $ 50 million worth of bitcoin into their wallet!

I'm feeling 2021 will be a great year for the crypto market. What do you think?

We are discussing this news on another thread: Square invests 50 million USD in BTC: instrument of economic empowermentUndoubtedly a nice turning point. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

BTCappu

Member

Offline Offline

Activity: 516

Merit: 38

|

|

October 12, 2020, 08:17:42 AM Merited by fillippone (2) |

|

Lol I wouldn’t say such an institution as big as that and also in the US will be making use of Huobi. If they are to be making use of any of the Exchanges we know it’s probably going to be Coinbase or Bakkt. Why I said Coinbase is because Coinbase is a regulated cryptocurrency exchange and is also like one of the biggest exchanges in the world (if not the biggest), and also in the US. Then as for Bakkt, we all already know that is the purpose it was created for, I wouldn’t be surprised if that’s what they are using. |

|

|

|

proTECH77

Member

Offline Offline

Activity: 1120

Merit: 30

Bisq Market Day - March 20th 2023

|

|

October 12, 2020, 10:09:54 AM |

|

This is a welcome development to all fidelity bitcon users to have more bitcoin to grow their business in the market place. Since many people has found it difficult to get new bitcoin fund to invest and improve their businesses, I think this is an opportunity for those that saw the news concerning fidelity bank that need more bitcoin fund for their customers to improve their businesses.

This new bitcoin fund it will help some of the citizens to grow their businesses in the country. Many investors will like to have interest on this new bitcoin fund to use it to make more profit.

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15387

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 12, 2020, 10:17:51 AM |

|

Lol I wouldn’t say such an institution as big as that and also in the US will be making use of Huobi. If they are to be making use of any of the Exchanges we know it’s probably going to be Coinbase or Bakkt. Why I said Coinbase is because Coinbase is a regulated cryptocurrency exchange and is also like one of the biggest exchanges in the world (if not the biggest), and also in the US. Then as for Bakkt, we all already know that is the purpose it was created for, I wouldn’t be surprised if that’s what they are using. Of course there was sarcasm in the above statement of mine. Any institution willing to have a chance to pass any even more remotely bland KYC/AML requirement will have to head to well regulated, legacy exchange. I think the recent action against BitMex is going to reinforce that, shifting the weight toward more traditional, law-abiding, exchanges. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|