fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15383

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 08, 2021, 11:25:12 PM

Last edit: May 16, 2023, 12:40:29 AM by fillippone |

|

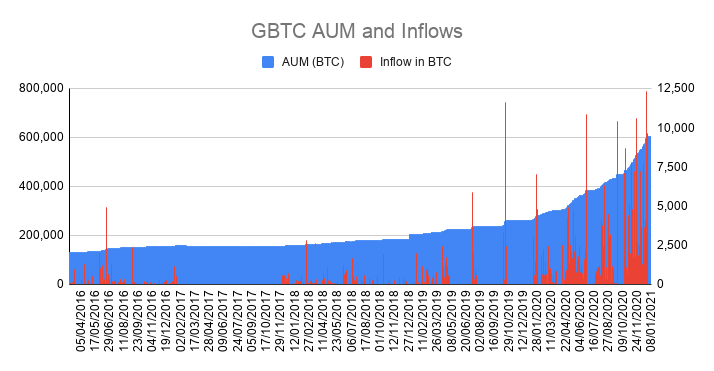

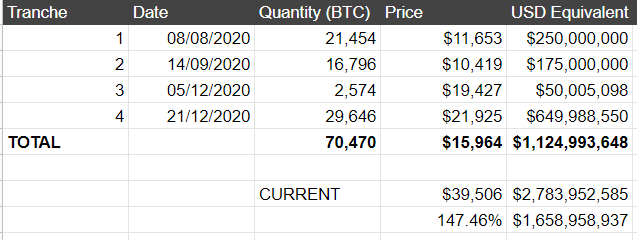

In the past months, I have been a close follower of the institutional adoption of bitcoin from Big players. I am convinced that Bitcoin is a Digital Gold 2.0 and it's #Phase5 narrative is the Ultimate Store of Value. So I have been following Grayscale, Square, Paypal and Microstrategy Gobbling Bitcoins in the past months. |  |  | | GBTC AUM has been growing steadily | Microstrategy buys |

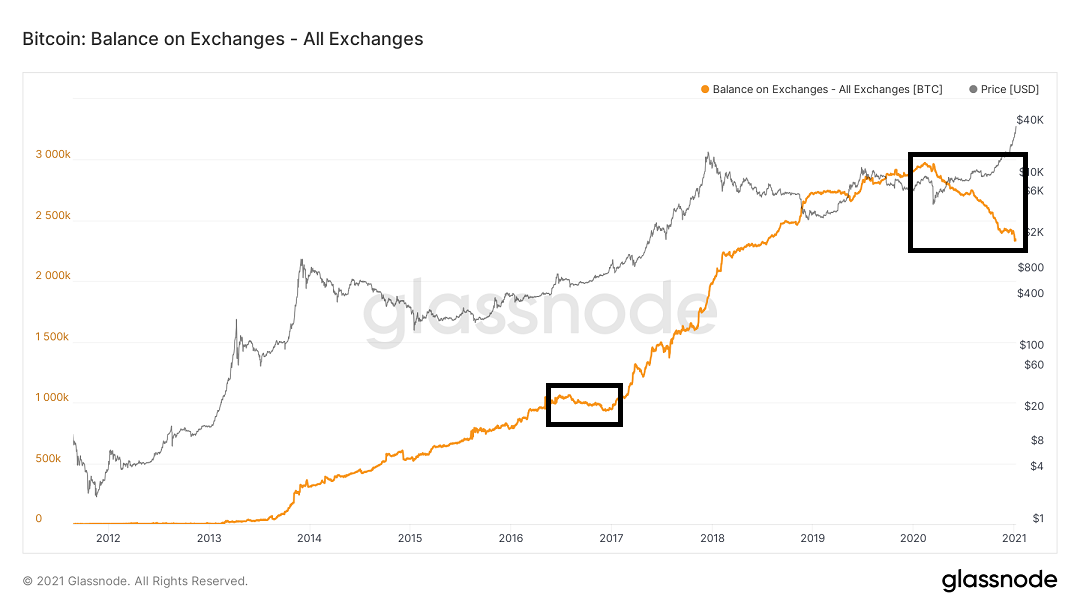

It's undeniable that the continuous, relentless buying has contributed driving the price up. This aggressive buying has been coupled with a constant reduction on the exchanges balance, sign that the coins left at the exchanges, preseudmely for trading purposes, have been draining constantly over the last months: |  | | Exchanges have seen a continuous drainage of funds. It is not a single one, but every exchange had very similar pattern.Source |

With such drainage from exchange's wallets, it's easy to guess Excahgne's books have bee quite empty too, offering little resistance to the wall fo buyers, hence driving the price up. Exchanges have another problem sourcing bitcoins: apparently, miners have not been selling a lot of bitcoin, lately:  Source SourceThey have been selling roughly 500 daily BTC, against the daily 900 mined Bitcoins. This means they could hold 400 daily BTC or 45% of the total supply. Of course, miners are probably selling also OTC to people interested (for various reasons..) to newly mined BTC, or they could also have been selling to institutions like Grayscale, but surely the percentage flowing into exchanges has dropped significantly. So we had a nice price action, with price constantly rising and an average of 1,000 USD per day, erasing with incredible ease any momentarily dip. This was so different from the tiny pump of 2013, or the irrational excess of 2017: in this run, the market followed quite closely the Stock to Flow model prediction: |  | | Stock to Flow Multiplier. Values grether than unity means market price is above the model price, whilst values smaller than unity means value is above the current market price. Please note that the model is conservative: can overshoot only the twice of current market model, while can be overshoot 4 or 5 times by market prices during peaks. |

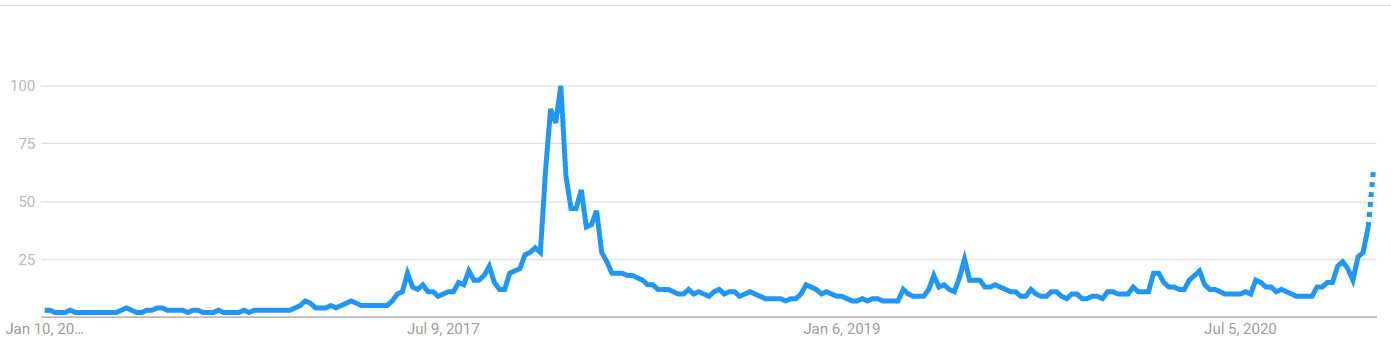

We see that while in 2017 the market was irrational with a quote more than 3 times the model price forecasted, now he excess is only 30% of the model price. This means the rise has been extremely organic and "well behaved". All this make me think about a deep-pocketed, cold-hearted institutional driven price action: no sign of retail-driven FOMO: |  |  | | Search Interest for Bitcoin is still a fraction of what it was in 2017 | Searches are well spread all over the world, without any particular spot |

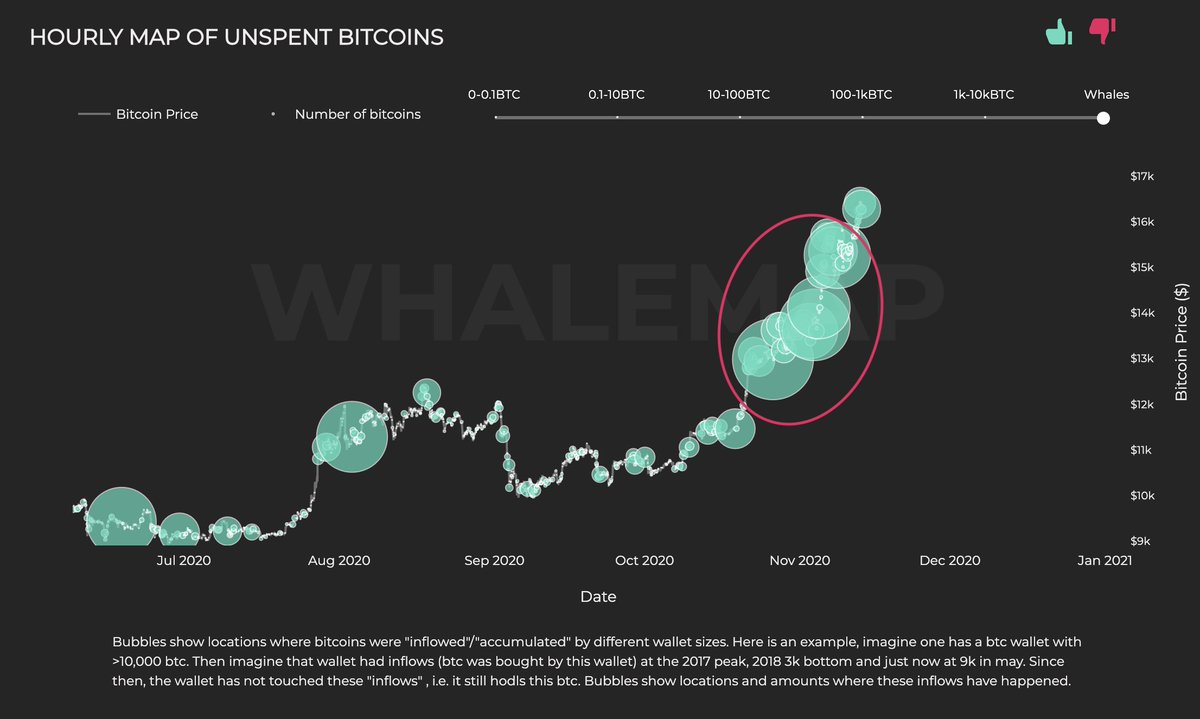

https://pbs.twimg.com/media/EmtgVkuXcAIuX_O.jpg |  | | Chain Analysis by Whale Map shows a consistent Whale activity in the first leg run | | |

All good then? Well.... not exactly, if we dig a little bit under the surface of the things, we might discover something interesting. First of all, Grayscale closed their investments on Christmas Eve, they haven't been buying a single BTC since Dec 24th, when the price was 23,000 USD.  Second I see that exchange volumes have been pretty consistent during both weekdays and weekends during the last weeks:  This is a sign that maybe a good chunk of those buys have been made by retail, who typically operate also during the weekend. Another hint is given by the iBit volumes, which are mainly driven by PayPal Buys: those have been considerably rising over the last few weeks.  What I mean is that: is it possible that the last leg in this rally hasn't been fueled entirely by the institutional, as the main narrative tends to convince us, but also there is a consistent inflow from retailers, which, without FOMOing, have definitely contributed to the rise in price in the last, say 70% leg up from 25K to 42K. Useful Thread: Everything you wanted to know about Grayscale BTC Trust but were afraid to ask!PayPal to allow cryptocurrency buying, selling and shopping on its networkMicroStrategy Buys $250M in Bitcoin, Calling the Crypto ‘Superior to Cash’Stock-to-Flow Model: Modeling Bitcoin's Value with Scarcity |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

HeRetiK

Legendary

Offline Offline

Activity: 2912

Merit: 2079

Cashback 15%

|

|

January 09, 2021, 12:02:05 AM |

|

What I mean is that: is it possible that the last leg in this rally hasn't been fueled entirely by the institutional, as the main narrative tends to convince us, but also there is a consistent inflow from retailers, which, without FOMOing, have definitely contributed to the rise in price in the last, say 70% leg up from 25K to 42K.

Very interesting analysis which makes a lot of sense to me. I do believe that without instituational investors having created a solid foundation for the 10k - 15k price range our ride after breaking 20k would have been way bumpier though. We see that while in 2017 the market was irrational with a quote more than 3 times the model price forecasted, now he excess is only 30% of the model price.

This means the rise has been extremely organic and "well behaved".

During which period? The early / mid bull market of 2017 was also fairly "well behaved" once we stabilized above the old ATH, except for a few weird skirmishes with Bitcoin Cash during the late summer. It was only after we broke 10k in December that the market went completely bonkers. I guess what I'm trying to say is: The rise has been extremely organic for now. Don't get me wrong, the current steadiness of growth bodes very well, but FOMO will kick in eventually. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Tytanowy Janusz

Legendary

Offline Offline

Activity: 2142

Merit: 1622

|

|

January 10, 2021, 01:14:19 PM |

|

Another point that could indicate the purchases of large investors are very low bitcoin transaction fees. New ATH almost every day and fees stays at 5-20 sat/vbyte for next block transfer. If retail small investors would be buying btc now we would see many small transactions and congested network.

Fun fact. In my city there is notorious lack of cash in bitomats. Yesterday one ATM went from full to empty in 2 hours. Looks like retail investors are dumping bitcoin currently not buying.

|

|

|

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3318

Merit: 6796

Cashback 15%

|

|

January 10, 2021, 01:29:34 PM |

|

They have been selling roughly 500 daily BTC, against the daily 900 mined Bitcoins. This means they could hold 400 daily BTC or 45% of the total supply.

Of course, miners are probably selling also OTC to people interested (for various reasons..) to newly mined BTC, or they could also have been selling to institutions like Grayscale, but surely the percentage flowing into exchanges has dropped significantly.

Yeah, somehow I have a feeling miners aren't exactly holding onto that many of their mined coins--true, some of them could be very bullish on bitcoin and could be waiting for an even higher price to sell at, but these big mining farms are businesses. They're not really in business to gamble on bitcoin's price like that (that's my guess anyway). I would imagine that at least some of the coins that the big institutional investors are buying are coming from the miners in off-exchange deals. In fact I thought I'd heard something about just that a while back. Anyway, I've been very interested in all of this deep-pocket, big-company bitcoin buying as well, though I haven't been paying attention to it in as much detail as you OP--so I thank you for the info you put into this thread. It's definitely a seller's market right now because of all the big-boy buying. I watched a Youtube video with the CEO of MicroStrategy last night, and man is he bullish on bitcoin. Hopefully the market doesn't crash, because his company would take one hell of a hit on its books if that happened. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Husires

Legendary

Offline Offline

Activity: 1582

Merit: 1284

|

|

January 10, 2021, 02:03:56 PM |

|

The coming days will answer your question. we have not witnessed real corrections since we broke the $ 20,000, which is a matter of confusion.

I don't think there is enough money to keep demand high and the price increases.

The positive point is the stability of the price, not as it happened in the year 2017, where the collapse was rapid, which means that we may reach a real evaluation point at 30,000 + or _ within a short period of time, and we may find levels of $ 70,000 in the future.

Does you know why Grayscale stop buying bitcoin?

|

|

|

|

HeRetiK

Legendary

Offline Offline

Activity: 2912

Merit: 2079

Cashback 15%

|

|

January 10, 2021, 04:27:12 PM |

|

Does you know why Grayscale stop buying bitcoin?

Because of the holidays, presumably? Unlike us retail-coiners, businesses have business hours  More interesting would be at which point they continue investing, assuming they haven't done so already. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

fiulpro

|

|

January 10, 2021, 05:01:14 PM Merited by fillippone (2) |

|

Does you know why Grayscale stop buying bitcoin?

Because of the holidays, presumably? Unlike us retail-coiners, businesses have business hours  More interesting would be at which point they continue investing, assuming they haven't done so already. They are just waiting for the price to go down so that they can buy at a better price and then sell them at a higher rate to make profit. The coming days will answer your question. we have not witnessed real corrections since we broke the $ 20,000, which is a matter of confusion.

I don't think there is enough money to keep demand high and the price increases.

The positive point is the stability of the price, not as it happened in the year 2017, where the collapse was rapid, which means that we may reach a real evaluation point at 30,000 + or _ within a short period of time, and we may find levels of $ 70,000 in the future.

Does you know why Grayscale stop buying bitcoin?

The correction might not happen , we didn't think about 40k did we ? But it did happen so I believe we won't have such an aggressive correction since the media is flowing with the 100k margin and people are panic buying. As long as the people hold and the investors continue to pool in it we will have no problem maintaining the stability during the pandemic. I think the aggressive buying is due to : Government being foolish, giving excessive stimulus , riots , bad handling of covid cases etc ...they just presumed that soon enough we will have a very bad situation in all the countries and they at least need a stable thing like bitcoins. Even if it's Volatile the government cannot harm much now. They are just keeping their companies safe and trying to make sure they don't lag behind. |

|

|

|

Poker Player

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

|

January 10, 2021, 05:05:41 PM |

|

We see that while in 2017 the market was irrational with a quote more than 3 times the model price forecasted, now he excess is only 30% of the model price.

This means the rise has been extremely organic and "well behaved".

All this make me think about a deep-pocketed, cold-hearted institutional driven price action: no sign of retail-driven FOMO:

I suppose you are referring to Stock-to-Flow Model. Just a (probably dumb) question: does it predict a S-curve adoption? Because it doesn't seem to me and I've been seeing that concept mentioned a lot lately. What I mean is that: is it possible that the last leg in this rally hasn't been fueled entirely by the institutional, as the main narrative tends to convince us, but also there is a consistent inflow from retailers, which, without FOMOing, have definitely contributed to the rise in price in the last, say 70% leg up from 25K to 42K.

I believe it is quite likely. Searches show there is no FOMO but it's on the way. Also, in countries with very high inflation like Argentina, Venezuela or Turkey they are at an ATH I watched a Youtube video with the CEO of MicroStrategy last night, and man is he bullish on bitcoin. Hopefully the market doesn't crash, because his company would take one hell of a hit on its books if that happened.

Yes, look at how bullish he is: Michael Saylor goes nuts: he predicts a $15 million Bitcoin price. |

|

|

|

Smartprofit

Legendary

Offline Offline

Activity: 2324

Merit: 1759

|

|

January 10, 2021, 09:00:16 PM |

|

In my opinion, in the future we will see bitcoin at $ 50,000 and $ 100,000, however, there will now be a price correction in the market.

Organizations that bought bitcoin for between $ 19,000 and $ 20,000 most likely sold it for between $ 40,000 and $ 41,000 (to lock in their profits).

I currently expect the price to drop to $ 20,000. The US political crisis is probably over. This is another reason for the fall in the price of bitcoin.

$ 40,000 is a very high price for Bitcoin. Further price increases are not organic growth.

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

hatshepsut93

Legendary

Offline Offline

Activity: 2954

Merit: 2145

|

|

January 10, 2021, 09:51:41 PM |

|

So, institutional investors could have dumped their coins in retails for up to x4 profit, but didn't? This is good to know. Also, I'm a bit surprised that retail investors joined the really so quickly, I thought they would do it much later, although it makes sense, because it looks like this time the media is covering Bitcoin's rally much more eagerly than before. I read some general economic news sites, and they report Bitcoin news a few times per day, especially if there's a lot of price action.

|

|

|

|

HeRetiK

Legendary

Offline Offline

Activity: 2912

Merit: 2079

Cashback 15%

|

|

January 10, 2021, 10:12:23 PM Merited by fillippone (2) |

|

So, institutional investors could have dumped their coins in retails for up to x4 profit, but didn't? This is good to know. I believe most institutional investors are in it for long term gains, rather than swing trading, so it's not all that surprising that they didn't lock in their profits yet. It will be interesting to see what happens once the market gets really crazy though, ie. whether they weather the storm or shed some coins to alleviate the subsequent crash and crypto-winter. Also, I'm a bit surprised that retail investors joined the really so quickly, I thought they would do it much later, although it makes sense, because it looks like this time the media is covering Bitcoin's rally much more eagerly than before. I read some general economic news sites, and they report Bitcoin news a few times per day, especially if there's a lot of price action.

Yeah, I've been noticing the same thing. Lots of small but steady mainstream coverage. Usually that only happened a few months after an ATH was breached, towards the end of the bull market. Now it's more present. Seems like people are keeping a closer eye on Bitcoin these days. Presumably they finally caught on that Bitcoin only comes back stronger after each "death". |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Silberman

Legendary

Offline Offline

Activity: 2492

Merit: 1327

|

|

January 10, 2021, 11:43:42 PM Merited by fillippone (2) |

|

We see that while in 2017 the market was irrational with a quote more than 3 times the model price forecasted, now he excess is only 30% of the model price.

This means the rise has been extremely organic and "well behaved".

During which period? The early / mid bull market of 2017 was also fairly "well behaved" once we stabilized above the old ATH, except for a few weird skirmishes with Bitcoin Cash during the late summer. It was only after we broke 10k in December that the market went completely bonkers. I guess what I'm trying to say is: The rise has been extremely organic for now. Don't get me wrong, the current steadiness of growth bodes very well, but FOMO will kick in eventually. FOMO is incoming there is no doubt in my mind about it, even if the research from the OP seems to suggest that retail investors were the responsible for the last growth I still do not think this is the FOMO we all know, to me this are just speculators coming late to the party, once FOMO comes I will not be surprised if we see the prices that people have been dreaming for years, at minimum I think 100k will be touched and quite honestly the price could go much higher than that. |

|

|

|

|

Darker45

Legendary

Offline Offline

Activity: 2562

Merit: 1854

🙏🏼Padayon...🙏

|

|

January 11, 2021, 01:30:46 AM |

|

but the biggest influence on the bitcoin market today are large investors because they must buy in large quantities, so that it will reduce the supply of bitcoin and increase trading volume which will make the price even higher. it might hit $ 50k if the trend continues this way.

Apparently, but this influence is not just on the price but also on the people, the retail people that's what I mean. MicroStrategy buying thousands of Bitcoin may cause the supply to decrease as well as the price to increase. This will somehow signal retail investors of a bull run and many of them will probably jump in. And as stated in the OP, there is a possibility that the most recent part of the rally was actually brought about by retail investors who are mostly operating during the weekends. Well, we cannot be 100% certain of this but there are signs of it. And this is great for the market and all of us. If there is strong buying from both institutional investors and retail investors, there'd be no other beneficiary but Bitcoin itself and those who own some. |

|

|

|

zanezane

Full Member

Offline Offline

Activity: 868

Merit: 150

★Bitvest.io★ Play Plinko or Invest!

|

|

January 11, 2021, 03:29:24 AM |

|

but the biggest influence on the bitcoin market today are large investors because they must buy in large quantities, so that it will reduce the supply of bitcoin and increase trading volume which will make the price even higher. it might hit $ 50k if the trend continues this way.

There has been a drop in the market but knowing these companies buying large amounts of bitcoin, I think that a bounce back is possible and a 50k mark is possible, anything beyond that is still a little bit impossible. |

|

|

|

Smartprofit

Legendary

Offline Offline

Activity: 2324

Merit: 1759

|

|

January 11, 2021, 11:31:59 AM |

|

but the biggest influence on the bitcoin market today are large investors because they must buy in large quantities, so that it will reduce the supply of bitcoin and increase trading volume which will make the price even higher. it might hit $ 50k if the trend continues this way.

There has been a drop in the market but knowing these companies buying large amounts of bitcoin, I think that a bounce back is possible and a 50k mark is possible, anything beyond that is still a little bit impossible. I think the drop in the bitcoin price was due to sales by institutional investors who bought in 2020 at $ 9,000, $ 12,000 and 19,000 and sold now at $ 40,000 - $ 41,000. At the same time, retail investors continue to hold bitcoins. That is why the collapse of the Bitcoin price did not happen. Institutional investors are waiting for the Bitcoin price (retail buyers will start selling Bitcoin) to fall to continue shopping. This is my version. This version may be wrong. If it is possible to confirm or deny it, it would be useful information. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

TheUltraElite

Legendary

Offline Offline

Activity: 2856

Merit: 1218

Call your grandparents and tell them you love them

|

|

January 11, 2021, 01:16:49 PM

Last edit: January 11, 2021, 01:34:10 PM by TheUltraElite |

|

but the biggest influence on the bitcoin market today are large investors because they must buy in large quantities, so that it will reduce the supply of bitcoin and increase trading volume which will make the price even higher. it might hit $ 50k if the trend continues this way.

Apart from Gr ayscale (<sorry typo there) at lot of other groups may have taken part in this pump too. You might never know it or get an idea much later in future when it is no longer needed. What people still need to know is that such cycles will happen and it is a part of the money making game of trading. In case someone is new to this, they might be FOMOed in, heck even experienced traders get FOMOed at times. However 50k USD might not be reached in this cycle. See the downtrend started yesterday and now price is back to 34k and hoping to see this level holds. These levels were newly touched so I dont expect much support levels at these prices, on the contrary to what other bullish investors might think. Hence I feel the price will fall a lot more probably stop at the levels of 20k-25k USD. Even though I am a bull, I am not stubborn but sensible enough in such cases. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3220

Merit: 5625

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

January 11, 2021, 01:30:42 PM Merited by fillippone (2) |

|

With such drainage from exchange's wallets, it's easy to guess Excahgne's books have bee quite empty too, offering little resistance to the wall fo buyers, hence driving the price up.

Exchanges have another problem sourcing bitcoins: apparently, miners have not been selling a lot of bitcoin, lately

A few months ago, there was news that Chinese miners are having big problems selling BTC via OTC because the Chinese authorities have decided to regulate that part of the crypto trade as well. If there really is truth in that, then that might explain why fewer and fewer new coins are coming to market given how strong Chinese miners are in that regard. https://www.nasdaq.com/articles/chinas-crypto-miners-struggle-to-pay-power-bills-as-regulators-clamp-down-on-otc-desksFirst of all, Grayscale closed their investments on Christmas Eve, they haven't been buying a single BTC since Dec 24th, when the price was 23,000 USD.

Given how much Grayscale has been buying BTC for the past few months, can we conclude that their current absence in this segment just results in one such dip? Has some perhaps interpreted this in a way that big players might be out of the game or getting ready to make a profit? What I mean is that: is it possible that the last leg in this rally hasn't been fueled entirely by the institutional, as the main narrative tends to convince us, but also there is a consistent inflow from retailers, which, without FOMOing, have definitely contributed to the rise in price in the last, say 70% leg up from 25K to 42K.

I personally think that this is probably one of the options that should not be ignored, but what may make it less likely is the timing - people usually do not invest money in such things during the holidays, and even less after spending money on gifts and on New Year's Eve. But this year is different in that regard as well, so there may be truth retail are being a part of the last rally - especially since the mainstream media took a good bite out of the story that only the sky is the limit and that this time the whole thing is different than it was in the case of 2017.

Apart from Greyscale at lot of other groups may have taken part in this pump too.

I don't know why, but even some media outlets keep writing Grayscale wrong... However 50k USD might not be reached in this cycle. See the downtrend started yesterday and now price is back to 34k and hoping to see this level holds.

One little retreat and people immediately start to be pessimistic, as if similar things haven’t been happening for years. I wonder what will happen if we go below $20k, Bitcoin dead again  |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

bosede1

Member

Offline Offline

Activity: 714

Merit: 16

|

|

January 11, 2021, 03:14:28 PM |

|

This analysis is great and I got to know a quite lot of things about it. Seeing the number of big investors into Bitcoin now I also have a thought that the last rally leg will be brought by retailers

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2142

Merit: 15383

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 12, 2021, 12:57:35 PM |

|

One little retreat and people immediately start to be pessimistic, as if similar things haven’t been happening for years. I wonder what will happen if we go below $20k, Bitcoin dead again  Which retreat? Ah, yeah, I just noticed it: This is the "dump" you've all been freaking out about in the last few hours... LOL @100trillionUSD #s2f #bitcoin  As long as BTC doesn't cross the 50% of S2F value (around 13,500 now and rising fast) or the 200 weeks MA (around 8,200 now and rising fast), you shouldn't have to be concerned and see it only as a possibility to stack more sats. Also, as detailed in OP, a certain rotation of buyers seems healthy for the uptrend. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

crwth

Copper Member

Legendary

Offline Offline

Activity: 2744

Merit: 1250

Try Gunbot for a month go to -> https://gunbot.ph

|

|

January 12, 2021, 01:05:24 PM |

|

What can be extracted from this is that as more and more retailers adapt to this, without FOMOing, we could stay in this 25k to 45k range for a long time. That's what I think could happen, especially as seen in the current events and happenings. As long as miners and HODLers don't sell their BTC, it will definitely drive up the price even more. That's if the demand is still there. Spot on analysis.  Can you also check on data with regards to the cause of dumping? Maybe after analyzing the data about it, we could foresee when it will go down, or something to that sense. |

|

|

|

|