casperBGD (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 1151

Nil Satis Nisi Optimum

|

|

January 12, 2021, 01:45:53 PM

Last edit: February 08, 2021, 02:32:08 PM by casperBGD |

|

I am creating this topic to track all institutional investments in Bitcoin up to this point and beyond, there were a massive investments in 2020, and this probably propelled BTC into new highs, reaching ATH above $40k USD. The list will consist from the investment groups and funds that published their involvement and total funds with them, without Grayscale, since that is a custodian for a large number of individual investors, which is arguably the biggest BTC holder at the moment with above 600k BTC at the moment, according to their website https://grayscale.co/bitcoin-trust/May 2020 - Paul Tudor Jones BVI Fund invested small part of their portfolio (there is no disclosure how much) into BTC, as a hedge from "The Great Monetary Inflation", and Tudor explained that BTC remains him on Gold, when he started investing business in 1976 https://www.cnbc.com/2020/05/11/paul-tudor-jones-calls-bitcoin-a-great-speculation-says-he-has-almost-2percent-of-his-assets-in-it.htmlAugust 2020 - Microstrategy  Microstrategy bought 21.454 BTC for $250 million, as their CEO Michael Saylor changed his mind regarding BTC, and became a Bitcoin maximalist, they added to the holdings two times, first buying for $175 million more BTC and then issuing convertible senior notes to purchase more BTC, for $650 million, with their final position amounts almost $1.1 billion USD spent and 70.470 BTC bought, which is above $2.5 billion at the moment https://www.microstrategy.com/en/company/company-videos/microstrategy-announces-over-1b-in-total-bitcoin-purchases-in-2020https://news.bitcoin.com/microstrategy-buys-29646-more-bitcoins-holds-over-1-billion-btc/https://www.coindesk.com/microstrategy-buys-more-bitcoinOctober 2020 - Square Square announced as well that they will buy BTC for their treasury and bought 4.709 BTC for $50 million https://squareup.com/us/en/press/2020-bitcoin-investmentNovember 2020 - Stanley DruckenmillerStanley had an interview on CNBC and proclaimed that he own more gold than BTC, but that he thinks that "if the gold bet works, the bitcoin bet will probably work better" https://www.coindesk.com/druckenmiller-invests-bitcoinNovember 2020 - PayPal PayPal announced in November that their users in US can buy BTC, among other three cryptocurrencies directly through-out their account, and, according to cryptoslate portal, they have bought BTC in amount of 70% newly minted BTC in November, through Ibit provider https://www.reuters.com/article/paypal-cryptocurrency/update-1-paypal-to-open-up-network-to-cryptocurrencies-idUSL1N2HC0PLhttps://cryptoslate.com/bitcoin-shortage-paypal-bought-70-of-all-mined-btc-last-month/December 2020 - MassMutual MassMutual, an insurance firm, first one of the kind, announced that they bought $100 million BTC for their general investment account. It is a small part of their portfolio, but first step into BTC world from one insurance firm https://www.investopedia.com/decoding-insurance-giant-massmutuals-bitcoin-investment-5092586December 2020 - Ruffer Investment On December 16, Ruffer Investment, UK based investment management fund bought $744 million into Bitcoin, indicating that they are hedging their much larger gold position edit: 20210203 - their position is cut-down on half in BTC, same USD value, after having great gains during Januaryhttps://www.coindesk.com/ruffer-confirms-744m-bitcoin-investmentDecember 2020 - One River One River announced that they bought over $600 million into BTC, and that they are planning to build up their position to $1 billion in near future, buying both BTC and ETH https://news.bitcoin.com/1-billion-bitcoin-ether-one-river-hedge-fund-increase-holdings-600-million/https://www.coindesk.com/one-river-digital-alan-howard-crypto-fundDisclaimer: this is not an investment advise, just information list 20210114 - PayPal purchase added 20210203 - Ruffer sale activity added 20210208 - Tesla announced 1,5 billion USD holdings |

|

|

|

|

|

|

|

|

|

You can see the statistics of your reports to moderators on the "Report to moderator" pages.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

|

|

magneto

|

|

January 12, 2021, 10:12:46 PM |

|

There was actually a lot of institutional money behind the past rallies as well, but it's different this time in that institutions are actually actively seeking to hold BTC in their proprietary trust as opposed to taking advantage of short term price fluctuations.

And you can see this from the fact that exchange balances are actually decreasing at a rapid rate despite the rally.

Institutions aren't as interested in speculating this time round. The likes of Ray Dalio have said that the current world order is very fragile, and BTC has now grown to be seen as a hedge against that as a long term asset.

|

|

|

|

|

|

TheGreatPython

|

|

January 13, 2021, 01:39:57 PM |

|

Apart from that of Square and Microstrategy, I am just getting to know about the other institutions you have mentioned here; Tudor, Ruffer, Mass Mutual, and One River are still new to me. I have seen someone create a list like this and I don’t remember seeing them mention any of these ones that you have mentioned, so that shows that there are more to this.

I think you should do more research, there are still a lot of other companies that are investing in Bitcoin this year. Although I’ve never really liked the idea of these institutions because I prefer that Bitcoin is being by more individuals than institutions holding it in buck.

|

|

|

|

aoluain

Legendary

Offline Offline

Activity: 2240

Merit: 1250

|

|

January 13, 2021, 03:59:57 PM |

|

Interesting info even though it is listed elsewhere as exstasie posted.

Might be worth listing The Winklevoss Twins.

Also it would be nice to see those custodial investors seperately like

Grayscale as you noted and also Fidelity Investments, I'm sure there

are more, PayPal and Revolut perhaps.

|

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

sana54210

Legendary

Offline Offline

Activity: 3178

Merit: 1128

|

|

January 13, 2021, 05:12:08 PM |

|

There was actually a lot of institutional money behind the past rallies as well, but it's different this time in that institutions are actually actively seeking to hold BTC in their proprietary trust as opposed to taking advantage of short term price fluctuations.

And you can see this from the fact that exchange balances are actually decreasing at a rapid rate despite the rally.

Institutions aren't as interested in speculating this time round. The likes of Ray Dalio have said that the current world order is very fragile, and BTC has now grown to be seen as a hedge against that as a long term asset.

The holding is the biggest change, because in the end we are talking about corporations that want to keep bitcoin and not sell theirs, that is a huge change from what we had in the years before, people bought bitcoin in bulk before as well but they ended up selling theirs very quickly when there was profit, we are talking about tens of thousands of bitcoins all bought to increase the price but decreased when all of them ended up selling bitcoin as well. So, year was a lot different because we are talking about over half a million bitcoins all bought and not being sold on the market right now, don't know if grayscale will ever end up selling their coins, the more they hold it and the longer they hold it, the more money they will make, it is all about patience and who would be more patient than someone who has tens of billions of dollars. |

|

|

|

|

casperBGD (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 1151

Nil Satis Nisi Optimum

|

|

January 13, 2021, 07:13:15 PM |

|

Interesting info even though it is listed elsewhere as exstasie posted.

Might be worth listing The Winklevoss Twins.

Also it would be nice to see those custodial investors seperately like

Grayscale as you noted and also Fidelity Investments, I'm sure there

are more, PayPal and Revolut perhaps.

yeah, I saw that there is several listings that comprise Institutional investors, but wanted to put a list that has recent inputs (from 2020) that probably influenced this spike in price Winklevoss Twins are large investors, but I did not saw their recent investments, could you provide any link on that PayPal is having good inputs as well, will try to figure out how much they bought since adoption, and put it into this list, thanks for comment |

|

|

|

|

Coyster

Legendary

Offline Offline

Activity: 2002

Merit: 1235

Cashback 15%

|

|

January 13, 2021, 08:03:00 PM |

|

Although I’ve never really liked the idea of these institutions because I prefer that Bitcoin is being by more individuals than institutions holding it in buck.

I don't mind if Bitcoin is used more by individuals or institutions, imo, that's the reason i have a proclivity to Bitcoin, I'm talking about the control, freedom of use by whatever or whoever party chooses to use it. This corporations adopting Bitcoin is definitely good for the network, not just in the price movement, but also for adoption. Having said that, Bitcoiners are prolly worried if this institutions sell off their Bitcoins, what's going to become of the price, but imo, it's not something to sweat over, there could be a plunge if that's to happen, but there have been many in the past, plus it's not possible for them all to pull out of the network at the same period in time; so Bitcoin would still find it's feet even if that happens. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Kakmakr

Legendary

Offline Offline

Activity: 3430

Merit: 1957

Leading Crypto Sports Betting & Casino Platform

|

|

January 13, 2021, 08:06:31 PM |

|

I do not see "PayPal" on your list and I should think that they should be on top of the list....seeing that they are the trigger for most of these companies to start buying Bitcoin. One of the first large companies to buy Bitcoin was Overstock under Patrick Byrne and they set the example for many other large companies to buy bitcoins.  PayPal will soon be the company with the most bitcoins, even if the ownership is tracked on their own internal ledger system. (The trading is not done on the Blockchain)  |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

casperBGD (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 1151

Nil Satis Nisi Optimum

|

|

January 13, 2021, 09:01:03 PM

Last edit: January 14, 2021, 08:56:03 AM by casperBGD |

|

I do not see "PayPal" on your list and I should think that they should be on top of the list....seeing that they are the trigger for most of these companies to start buying Bitcoin. One of the first large companies to buy Bitcoin was Overstock under Patrick Byrne and they set the example for many other large companies to buy bitcoins.  could you provide some links for Overstock and PayPal holdings, and I will put them into the list, it is hard to find what amounts they have actually bought, but nevertheless, will add PayPal into the list, their move was really important for the industry, and other followed examples set by MicroStrategy and PayPal edit: added PayPal to the list |

|

|

|

|

zanezane

Full Member

Offline Offline

Activity: 868

Merit: 150

★Bitvest.io★ Play Plinko or Invest!

|

|

January 14, 2021, 03:41:41 AM |

|

There was actually a lot of institutional money behind the past rallies as well, but it's different this time in that institutions are actually actively seeking to hold BTC in their proprietary trust as opposed to taking advantage of short term price fluctuations.

And you can see this from the fact that exchange balances are actually decreasing at a rapid rate despite the rally.

Institutions aren't as interested in speculating this time round. The likes of Ray Dalio have said that the current world order is very fragile, and BTC has now grown to be seen as a hedge against that as a long term asset.

That must be the reason that institutional investors become the talk of the town, they become a more proactive players in the bitcoin market. The balances getting lower is a pretty scary prospect for individuals that invest in bitcoin because they will be the first to be affected by a price dump or a hiccup that can cause panic amongst the bitcoin population. The good thing about this is that institutional investors as @magneto said is not interested in speculation but a long term hodl is a good indicator of price hike which I hope that it will be the case. |

|

|

|

casperBGD (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 1151

Nil Satis Nisi Optimum

|

|

January 14, 2021, 08:47:00 AM |

|

~snip

The good thing about this is that institutional investors as @magneto said is not interested in speculation but a long term hodl is a good indicator of price hike which I hope that it will be the case.

yeah, exactly it seems that institutional investors are here to stay, and would not go out for short-term profit, which is certainly obtained by some of them (MicroStrategy earned from BTC more than their previous market capitalization on NASDAQ) they are looking to buy and HODL as a hedge, same as Gold, and that is a strategic decision, not for a profit, especially from MassMutual, for example, whereas their profit would be small in comparison to their complete assets as well, institutional investors do have to have regulated practice, and cannot buy and sell occasionally, they have some boards to consult first, and they will probably stay for a long time here |

|

|

|

|

aoluain

Legendary

Offline Offline

Activity: 2240

Merit: 1250

|

|

January 14, 2021, 10:47:05 AM |

|

Interesting info even though it is listed elsewhere as exstasie posted.

Might be worth listing The Winklevoss Twins.

Also it would be nice to see those custodial investors seperately like

Grayscale as you noted and also Fidelity Investments, I'm sure there

are more, PayPal and Revolut perhaps.

yeah, I saw that there is several listings that comprise Institutional investors, but wanted to put a list that has recent inputs (from 2020) that probably influenced this spike in price Winklevoss Twins are large investors, but I did not saw their recent investments, could you provide any link on that PayPal is having good inputs as well, will try to figure out how much they bought since adoption, and put it into this list, thanks for comment Ah ok I see that you are focusing on recent inputs, im not aware either of the Winklevoss Twins expanding their Bitcoin holdings. Publically listed companies have a process to go through before they can make an official announcement so some of the news we hear is related to Bitcoin aquisitions from December and November. This article announces Guggenheim wants to get in on the action, should be worth keeping an eye on, although news will break and we wont miss it. Guggenheim Funds Trust filed an amendment with the U.S. Securities and Exchange Commission

to allow its $5 billion Macro Opportunities Fund gain exposure to bitcoin by investing up to 10% of the

fund’s net asset value in the Grayscale Bitcoin Trust (GBTC). |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

fillippone

Legendary

Online Online

Activity: 2142

Merit: 15349

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 14, 2021, 01:20:26 PM |

|

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

cryptomaniac_xxx

|

|

January 15, 2021, 09:07:37 AM |

|

^^ Yeah, hot topic as bitcoin's narrative has completely made a U-turn. No longer just an assets that we can trade in an exchange, but this huge companies are using it to hedge or as reserved assets now, pushing the price to a level that we have conquered. And it's just the beginning, there could be more just waiting for the perfect timing to join in the next 3-6 months.

|

|

|

|

fillippone

Legendary

Online Online

Activity: 2142

Merit: 15349

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 15, 2021, 09:42:53 AM

Last edit: May 16, 2023, 12:38:17 AM by fillippone |

|

^^ Yeah, hot topic as bitcoin's narrative has completely made a U-turn. No longer just an assets that we can trade in an exchange, but this huge companies are using it to hedge or as reserved assets now, pushing the price to a level that we have conquered. And it's just the beginning, there could be more just waiting for the perfect timing to join in the next 3-6 months.

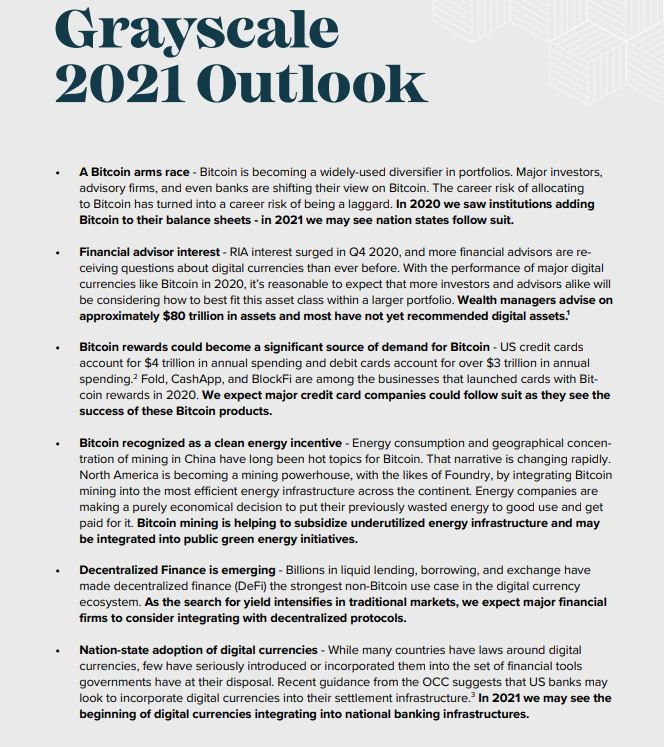

Indeed, interesting times ahead. As you know Grayscale yesterday resumed buying bitcoins. They also published their 2020 Q4 investment report, amongst their impressive report, there is a very interesting piece of information: their view on the future of Bitcoin in 2021 Really interesting to read is the vision of Greyscale for 2021: What's next?  Todays institutions are flocking to bitcoin, tomorrow States will. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

jacafbiz

|

|

January 15, 2021, 09:49:39 AM |

|

The good thing about the Institutional investors buying Bitcoin is that they are long term investors unlike retail investors that looked at the screen every time. There is plus and minus of everything but the positive here is more than the negative.

|

| .SUGAR. | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | ███████████████████████████

███████████████████████████

██████ ██████

██████ ▄████▀ ██████

██████▄▄▄███▀ ▄█ ██████

██████████▀ ▄███ ██████

████████▀ ▄█████▄▄▄██████

██████▀ ▄███████▀▀▀██████

██████ ▀▀▀▀▀▀▀▀▀ ██████

██████ ██████

███████████████████████████

███████████████████████████ | .

Backed By

ZetaChain | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | |

|

|

|

casperBGD (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 1151

Nil Satis Nisi Optimum

|

|

January 15, 2021, 12:43:38 PM |

|

~snip

Todays institutions are flocking to bitcoin, tomorrow States will.

indeed, already happening with Iran and Pakistan, that are in the process, Iran is subsidizing mining equipment for large farms, in a pursue to avoid sanctions on their banking system and one province in Pakistan is establishing their own mining farm (as to my knowledge, first state (province) owned Bitcoin mining farm) https://decrypt.co/53918/pakistan-is-now-using-government-funds-to-mine-bitcoinseems that West countries will follow the process, it is inevitable |

|

|

|

|

|

crzy

|

|

January 15, 2021, 01:27:04 PM |

|

The whole market had changed completely compared to the recent bull-market due to the number of institutions getting involved in the market. In time more and more institutions and even companies will start getting into crypto which will be beneficial to those early adopters.

Very unfortunate for a small time investors since Bitcoin will finally take over by those companies and will continue to manipulate the market. Well, the real idea of this one is to give access to those who don’t have bank accounts before but I think we grow a lot over the past decade and yeah, we must embrace this one. If you still don’t have Bitcoin better to grab some now before its too late, hopefully those whales will not dump Bitcoin on a one time big time. |

|

|

|

|

Twinkledoe

Full Member

Offline Offline

Activity: 1904

Merit: 138

★Bitvest.io★ Play Plinko or Invest!

|

|

January 16, 2021, 04:27:11 AM |

|

The whole market had changed completely compared to the recent bull-market due to the number of institutions getting involved in the market. In time more and more institutions and even companies will start getting into crypto which will be beneficial to those early adopters.

Very unfortunate for a small time investors since Bitcoin will finally take over by those companies and will continue to manipulate the market. Well, the real idea of this one is to give access to those who don’t have bank accounts before but I think we grow a lot over the past decade and yeah, we must embrace this one. If you still don’t have Bitcoin better to grab some now before its too late, hopefully those whales will not dump Bitcoin on a one time big time. Small time crypto users can still own some satoshis. Everyone is welcome to invest or hold bitcoin. That is the beauty of crypto. No one is labeled to be poor or rich. Names are not mentioned. Usually, just a group of people, like whales or entities like institutions. But you will not hear or read that this individual (with name) is the top bitcoin holder. |

|

|

|

|

|