as.exchange (OP)

Copper Member

Member

Offline Offline

Activity: 140

Merit: 51

as.exchange

|

|

January 13, 2021, 04:21:30 PM |

|

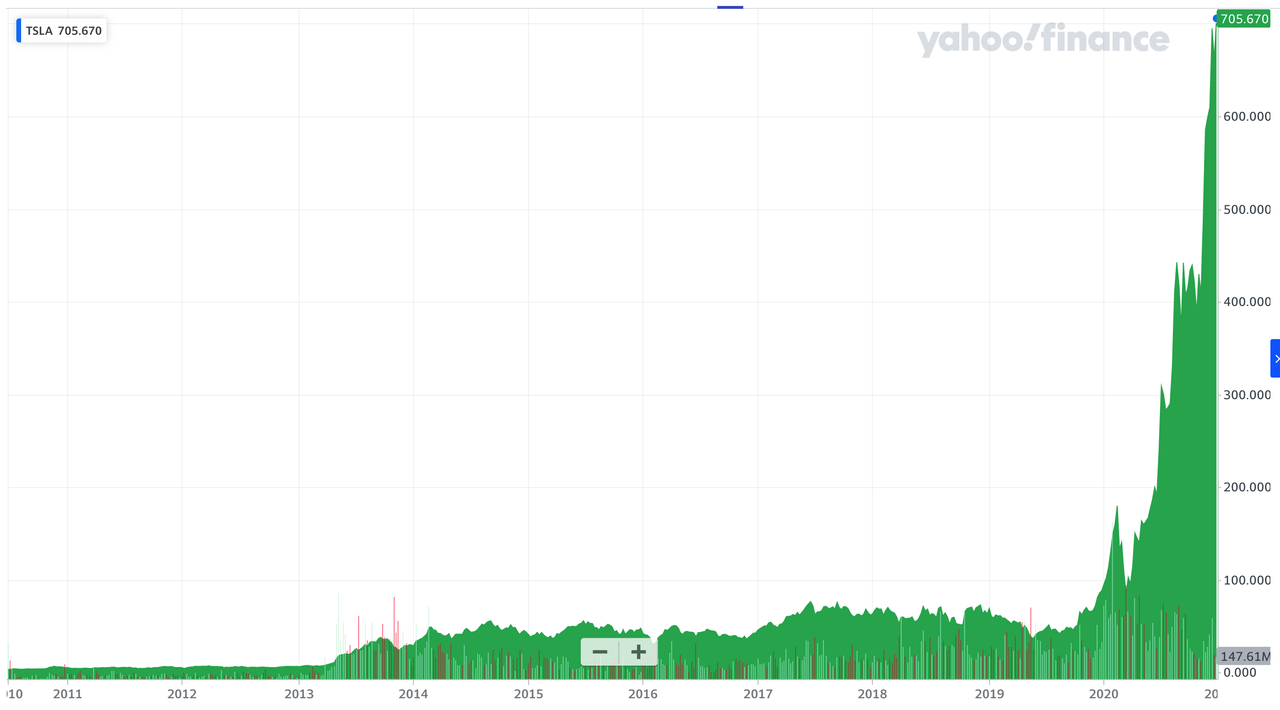

Just wanted to share some thoughts about the recent market developments, and get feedback from the knowledgable BitcoinTalk community. 1920-1930s: we saw an emergence of technical analysis with the books of Richard W. Schabacker (even though the history began long before that in 17th centurty). At those times, if you had ability and resources just to chart data and identify visual patterns - you could make good money (read more here: https://en.wikipedia.org/wiki/Technical_analysis). Effectively it was - see the chart and make investment decision based on the trend.1930-1960s: we saw an emergence of value investing with the first attempts of John Maynard Keynes, but his approach was too high-level (macro-economy) therefore didn't see substantial success before Benjamin Graham started researching and following this approach on a company-wide scale. At those times, if you had ability and resources to analyze fundamental data (balance sheet, income statement, cash flow statement, etc.) and understand good vs. bad patterns - you could make good money (read more here: https://en.wikipedia.org/wiki/Value_investing). Effectively it was - see financial statements, and buy what is undervalued.1960-2010s: we sew an emergence of growth investing with the growing popularity and success of Charlie Munger, Phil Fisher, and of course Warren Buffett. The entire idea was to buy whatever is expected to grow in the future, because it can become the next Google or Facebook. At those times, if you had ability and resources to analyze and predict future potential growth of the company - you could make good money (read more here: https://en.wikipedia.org/wiki/Growth_investing). Effectively it was - even if the company is overvalued or already fairly priced, it's okay to buy-in if there's substantial growth expected.2010-onwards: we are observing an emergence of narrative economy and narrative investing. It is well documented and currently being popularised theory by Robert J. Shiller, where charts don't matter anymore, fundamental data doesn't matter anymore, future growth doesn't matter anymore. All what matters is the narrative (i.e. story) around the particular asset / stock / etc. If it got a good story which is able to spread like a virus, no matter how good or bad the stock/(asset) is - it will deliver substantial returns (read more here: https://www.ft.com/content/5ba0adf6-ec3c-11e9-85f4-d00e5018f061). Effectively it means - if you can identify good story that would be appealing to other prospective investors, and able to invest in that story early enough, you can outperform others.While the idea of narrative economy might sound too new or experimental, the recent market developments, with the stories surrounding such assets as Tesla, Zoom, Bitcoin, BioTech, COVID19 vaccine developers, cannabis stocks, and many others, with the success of such investors as ARK funds, there is clearly some evidence that the world has shifted to narrative-based economy, and neither charts, neither fundamentals, neither growth matters anymore. What do you think about that? P.S. the dates and time ranges above are just for general reference, as some people still falsefully believe that they can use TA to outperform market, or try to make investment decisions based on BS/IS/CFS. Some of the ancient approaches still might work in very specific cases or asset classes, and some people might argue that the investment school of though has changed at other dates, but overall trend and change I personally believe is okay to be marked with those dates. Of course that is by no mean an absolute and only correct idea. |

|

|

|

|

|

|

|

|

In order to achieve higher forum ranks, you need both activity points and merit points.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

Tytanowy Janusz

Legendary

Offline Offline

Activity: 2142

Merit: 1622

|

|

January 14, 2021, 03:53:55 PM |

|

Good read OP. Thats what I observe in last years of my presence on market (regulated stock market and crypto market). Undervalued assets remains undervalud for years, technical indicators are raped one after another. Everything moves in pump/dump like movements. People no longer use math and economy to invest. They use dreams and emotions. I think that evolution of narratives (from undervalued assets, to well priced with good perspective to "yolo, buy the story, give me lambo") is somehow connected to printers doing brrrr and cash surplus, disappearing options to protect it against inflation, increasing amount of retail investors, attracting younger and less experienced investors to the market, 12 years of bull market in US and many more.

|

|

|

|

|

Smartprofit

Legendary

Offline Offline

Activity: 2310

Merit: 1752

|

|

January 14, 2021, 05:06:43 PM |

|

Thank you, thread author! A very interesting and useful topic.

I first learned about promising altcoins in 2017. I asked myself the question - which altcoin should I invest in? In my opinion, the main criterion for a good investment object is the developer's ambitions. A developer's ambitions are the stories they tell. Storytelling is very important in the crypto industry.

In June 2017, I loved the story told by Dan Larimer. These were stories about the killer Ethereum, about the first blockchain operating system, about global corporations that would seek to buy EOS cryptocurrency for themselves. It was a beautiful story.

Dan Larimer wrote in one of his articles that EOS will cost $ 30. At the same time, this cryptocurrency could be bought for 0.6 - 0.8 dollars. EOS's price never hit $ 30. However, in May 2018, she bet $ 21. At this price, I sold my coins.

When the mainnet launched, telling beautiful stories became more difficult and the price of EOS plummeted ...

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

HeRetiK

Legendary

Offline Offline

Activity: 2898

Merit: 2066

Cashback 15%

|

|

January 14, 2021, 10:52:59 PM |

|

I think the description of the historical eras hit the nail pretty much on the head, but with the 2010s onwards I'm not so sure.

While the label "narrative economy" (or rather "narrative investing") does make sense, generally speaking, I would not see it as part of economic evolution but rather as a short phase that usually precedes a bubble. Take the dotcom bubble for example. Sure, it may have started as an example of growth investing, but it ended up as investors telling themselves fantastic stories about the companies they are investing in. Or if you look further back in history, the South Sea bubble. Investors telling themselves fantastic stories about unimaginable riches across the pond. Even outside of bubbles you often see a bit of a narrative factor at play. That's why exciting stocks mostly come at a bit of a premium, regardless of growth potential.

Now I'm not saying that narrative investing had its play in every bubble -- both the US and Japanese housing crises had mostly other root causes -- but once investors turn to narratives rather than facts, by definition they are decoupling from reality. And while that may work for a little while, it's rarely a good sign.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

as.exchange (OP)

Copper Member

Member

Offline Offline

Activity: 140

Merit: 51

as.exchange

|

|

January 15, 2021, 07:22:37 AM |

|

Thank you guys for your kind comments and for your valuable opinions! Good read OP. Thats what I observe in last years of my presence on market (regulated stock market and crypto market). Undervalued assets remains undervalud for years, technical indicators are raped one after another. Everything moves in pump/dump like movements. People no longer use math and economy to invest. They use dreams and emotions. I think that evolution of narratives (from undervalued assets, to well priced with good perspective to "yolo, buy the story, give me lambo") is somehow connected to printers doing brrrr and cash surplus, disappearing options to protect it against inflation, increasing amount of retail investors, attracting younger and less experienced investors to the market, 12 years of bull market in US and many more.

You are absolutely right. That's actually what I observed too while working for activist investment fund where they try to find undervalued assets (thus there's possible upside when market realizes the asset value) + try to create value for the company themselves. Yet, over the many years, if the company doesn't become popular (i.e. like Tesla and those) - no matter how good or strong its fundamentals - it will remain undervalued for decades. If you check the performance of other activist funds - they also start to struggle to earn decent returns, and I assume it's for the same reason. I think you summarized the main drivers behind that transition pretty well about expansionary monetary policy, retail investors, etc. As a good evidence of that is also the sad story about the trader of Robinhood who got a negative $730,000 balance and decided to end his life. Before at least it were professional Wall Street professionals committing suicides  but now it's regular people who didn't know what and what for they trade. Thank you, thread author! A very interesting and useful topic.

I first learned about promising altcoins in 2017. I asked myself the question - which altcoin should I invest in? In my opinion, the main criterion for a good investment object is the developer's ambitions. A developer's ambitions are the stories they tell. Storytelling is very important in the crypto industry.

In June 2017, I loved the story told by Dan Larimer. These were stories about the killer Ethereum, about the first blockchain operating system, about global corporations that would seek to buy EOS cryptocurrency for themselves. It was a beautiful story.

Dan Larimer wrote in one of his articles that EOS will cost $ 30. At the same time, this cryptocurrency could be bought for 0.6 - 0.8 dollars. EOS's price never hit $ 30. However, in May 2018, she bet $ 21. At this price, I sold my coins.

When the mainnet launched, telling beautiful stories became more difficult and the price of EOS plummeted ...

It's "sad but true" that you mentioned that "Storytelling is very important in the crypto industry". Way too many people rely entirely on stories, and due to that lose their money (to the ones who exploit those stories {either project teams, either early investors ("greater fool theory": https://en.wikipedia.org/wiki/Greater_fool_theory)}). I agree with your opinion, except for one part only that "the main criterion for a good investment object is the developer's ambitions". Sorry, but I think this is wrong. I personally might have ambition to overtake NYSE & NASDAQ, but I might be completely ignorant and have no idea how business works. Then you are in a bad investment. But I see how other people followed the same logic, and this is what always made me smile - when literally a bunch of kids or recent grads without work experience or obvious scams / ICO-"prostitutes" (a term in Russian for people who sell their faces to different projects just to add "recognized" team members) claim that they gonna make the next CME in derivatives, or HSBC but on blockchain, or something else. From my personal perspective - of course ambition is a great thing, and if you don't have one - you shouldn't be doing own project / company / startup (as they say "The soldier who doesn't dream to be a general is a bad soldier"). But the ambitions should be reasonable. Like if some kid from Ukraine says he is gonna do next Facebook on blockchain - I definitely will turn down such project; if Elon Musk says he is gonna do next Facebook - I believe, because he has resources, money and experience; if the kid from Europe says he is gonna do some ad-on for Facebook or improve some minor area - that sounds more reasonable and doable. As for EOS, I also invested there before, when I was engaged in investments, but luckily I bought at around $1-1.5 back in 2017, but I liquidated all of it in April, and the rest of crypto portfolio together with BTC in the end of 2018, so I can't complain about returns  but as I mentioned - my opinion is that if you are able to predict the development of narrative and how it will be perceived, or can exploit it - you might be well positioned in current investment area, otherwise, it's not very good idea to base investment decision entirely on promises or ambitions (especially dev teams' cuz they are not businessmen, they are just tech guys, and developing a narrative or good and stable business requires a different skillset). I think the description of the historical eras hit the nail pretty much on the head, but with the 2010s onwards I'm not so sure.

While the label "narrative economy" (or rather "narrative investing") does make sense, generally speaking, I would not see it as part of economic evolution but rather as a short phase that usually precedes a bubble. Take the dotcom bubble for example. Sure, it may have started as an example of growth investing, but it ended up as investors telling themselves fantastic stories about the companies they are investing in. Or if you look further back in history, the South Sea bubble. Investors telling themselves fantastic stories about unimaginable riches across the pond. Even outside of bubbles you often see a bit of a narrative factor at play. That's why exciting stocks mostly come at a bit of a premium, regardless of growth potential.

Now I'm not saying that narrative investing had its play in every bubble -- both the US and Japanese housing crises had mostly other root causes -- but once investors turn to narratives rather than facts, by definition they are decoupling from reality. And while that may work for a little while, it's rarely a good sign.

I was thinking about the same examples actually with the dotcom & South Sea  yes, you are absolutely right that at those periods the reason for crashes was ultimately the narrative-based logic, but those were isolated examples within specific niches / companies / markets. But nowadays, in the past decade or so, it appears to me that this is very persistent and is now the only way to make alpha in the market. Thus, can't we mark it as investment/economic paradigm shift? As I mentioned above about my previous work experience (+ other value/growth/activist/etc. funds), and as mentioned change of global factors by Tytanowy Janusz above, it appears that this is the strategy for now. I know that dotcom, US/Japanese/(now Chinese?) real estate markets started growing for a good reason, but ended up in the "narrative" area with the known results, but now this narrative-based logic appears to be literally in every area - from the American large caps, to Chinese small caps, Russian mid caps, cryptos, PE/VC, seed startups, DeFis, fixed-income, new tech, ... you can continue the list. Whoever is not part of the fancy "next great X" or "will change the world in Y" - is losing, whoever is in - is earning. And I believe the greatest evidence that it's not just a small market hype or craziness, but the "new normal" is again it's prolonged history of it for over a decade. Now is the only time when everyone around expects market(s) to crash, but it doesn't, while before everyone expected market to go on raising, and it eventually crashed. Not sure who said that, but I read ones that "if everyone expects a certain thing to happen - it will not happen, when everyone isn't expecting that to happen - it eventually will", and this thing is again the market crash, which people predicted in 2010, 2012, 2013, 2014, 2015, 16, 17, 18, 19, 20, and now 21... Yet, all markets which are part of the great narrative continue to hit ATHs, and the short sellers (of Tesla, Bitcoin, Zoom, cannabis stocks, tech, solar energy, ESG, real estate EFTs, etc.) keep losing. |

|

|

|

Tytanowy Janusz

Legendary

Offline Offline

Activity: 2142

Merit: 1622

|

|

January 15, 2021, 08:14:21 AM |

|

One more think caught my attention: Effectively it means - if you can identify good story that would be appealing to other prospective investors, and able to invest in that story early enough, you can outperform others.

Doesn't it change the investing into "gambling on Ponzi scheme"? You don't earn from profit that undervalued asset generates and share with investors (old era investing), you earn only if more and more investors believed in the story you spot before them. |

|

|

|

|

Betwrong

Legendary

Offline Offline

Activity: 3248

Merit: 2135

It's underdogs who win in the end

|

|

January 15, 2021, 09:01:34 AM |

|

One more think caught my attention: Effectively it means - if you can identify good story that would be appealing to other prospective investors, and able to invest in that story early enough, you can outperform others.

Doesn't it change the investing into "gambling on Ponzi scheme"? You don't earn from profit that undervalued asset generates and share with investors (old era investing), you earn only if more and more investors believed in the story you spot before them. Although it does look like a Ponzi scheme, I think this is the current reality: no matter how good your asset can be you are going lose the competition to those who attracted more investors. So, apart from being a good project, attracting investors is very important. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

Smartprofit

Legendary

Offline Offline

Activity: 2310

Merit: 1752

|

|

January 15, 2021, 09:15:09 AM |

|

One more think caught my attention: Effectively it means - if you can identify good story that would be appealing to other prospective investors, and able to invest in that story early enough, you can outperform others.

Doesn't it change the investing into "gambling on Ponzi scheme"? You don't earn from profit that undervalued asset generates and share with investors (old era investing), you earn only if more and more investors believed in the story you spot before them. In my opinion, everything here is much more complicated and at the same time more interesting. Nowadays virtual reality has gained great importance in our world. At the same time, the development of technology has advanced significantly. Engineers can solve any technical problem. Programmers can write any program. However, terms of reference are required for both engineers and programmers. This technical assignment (at the architecture level) is an interesting story. The Bible said, "In the beginning was the word." Thus, we see a logical sequence. Interesting story - Terms of reference - Program code - Final Product. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

HeRetiK

Legendary

Offline Offline

Activity: 2898

Merit: 2066

Cashback 15%

|

|

January 15, 2021, 09:42:44 AM |

|

I was thinking about the same examples actually with the dotcom & South Sea  yes, you are absolutely right that at those periods the reason for crashes was ultimately the narrative-based logic, but those were isolated examples within specific niches / companies / markets. But nowadays, in the past decade or so, it appears to me that this is very persistent and is now the only way to make alpha in the market. Thus, can't we mark it as investment/economic paradigm shift? As I mentioned above about my previous work experience (+ other value/growth/activist/etc. funds), and as mentioned change of global factors by Tytanowy Janusz above, it appears that this is the strategy for now. I know that dotcom, US/Japanese/(now Chinese?) real estate markets started growing for a good reason, but ended up in the "narrative" area with the known results, but now this narrative-based logic appears to be literally in every area - from the American large caps, to Chinese small caps, Russian mid caps, cryptos, PE/VC, seed startups, DeFis, fixed-income, new tech, ... you can continue the list. Whoever is not part of the fancy "next great X" or "will change the world in Y" - is losing, whoever is in - is earning. And I believe the greatest evidence that it's not just a small market hype or craziness, but the "new normal" is again it's prolonged history of it for over a decade. Now is the only time when everyone around expects market(s) to crash, but it doesn't, while before everyone expected market to go on raising, and it eventually crashed. Not sure who said that, but I read ones that "if everyone expects a certain thing to happen - it will not happen, when everyone isn't expecting that to happen - it eventually will", and this thing is again the market crash, which people predicted in 2010, 2012, 2013, 2014, 2015, 16, 17, 18, 19, 20, and now 21... Yet, all markets which are part of the great narrative continue to hit ATHs, and the short sellers (of Tesla, Bitcoin, Zoom, cannabis stocks, tech, solar energy, ESG, real estate EFTs, etc.) keep losing. "Isolated examples" that crashed whole markets though! Also the examples you mentioned as narrative investment cases are pretty niche as well  Honestly I think the main driver behind this extended bull market is a lack of alternatives for any aspiring investor. There's just nowhere to put your cash in except for stocks, crypto and maybe real estate. A decade ago the cautious investor could flee into bonds. They might have made less profit, but it would still have been profit. These days that's a losing proposition and there's nowhere to go but to charge forward. Essentially monetary policies have herded cash into arguably ever more overvalued assets -- which of course kinda loses its meaning once everything is overvalued. I get that narrative investing can be highly profitable, but it's simply not sustainable, not if it's the only factor. And while investors seem to be more likely to "buy the dip" these days, as we've seen in March 2020, it will come down eventually. Regardless of that not being invested seems to remain a losing proposition -- After all "the markets can remain irrational longer than you can remain solvent". |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

as.exchange (OP)

Copper Member

Member

Offline Offline

Activity: 140

Merit: 51

as.exchange

|

One more think caught my attention: Effectively it means - if you can identify good story that would be appealing to other prospective investors, and able to invest in that story early enough, you can outperform others.

Doesn't it change the investing into "gambling on Ponzi scheme"? You don't earn from profit that undervalued asset generates and share with investors (old era investing), you earn only if more and more investors believed in the story you spot before them. From my view it doesn't necessarily make investing "gambling on Ponzi scheme". While yes, certainly it makes (potentially) unfavourable asset overvalued, there are two additional factors to consider: 1) Greater fool theory (https://en.wikipedia.org/wiki/Greater_fool_theory): it means people buy/invest based on the narrative that either the "next fool will buy it from me later" or "the narrative keeps spreading like a virus, and with greater penetration I can sell to others". With the whole concept of investment or trading, I believe that is applicable not only to narrative economy but even to TA/value/growth/etc. investing. In the end we all buy with the hope of being able to be able to sell to someone later at higher price. That buyer might be buying from us due to: 1) s/he is fool, 2) has more information than us and expects to earn more, 3) various investment strategies and investment horizons (maybe I want to invest only until end of 2020 and then retire and liquidate all holdings, but the buyer just starts investing in the end of 2020 so my asset is a perfect fit for h/im/er), or due to 4) different kinds of mismatches (liquidity, duration, rate, return, etc. mismatches (maybe I need money right now so I have to sell, but someone is able to buy it now). From this perspective, while most of the people might be selling because they think the buyer is a fool, it doesn't actually mean that we are playing ponzi or gamble. 2) Minsky moment (https://en.wikipedia.org/wiki/Minsky_moment): " In economics, a Minsky moment is the moment when reality catches up with an overly-optimistic financial sector, leading to collapsing prices." - the green colored part is what I try to explain, but the rest is just FYI about what the original term means. So for example imagine a bad company X which somehow got a way to manage and promote it's narrative and spread it like a virus. If the company is publicly traded, their stock price will shoot, leading to lower cost of capital (WACC: https://en.wikipedia.org/wiki/Weighted_average_cost_of_capital), as a result of lower WACC, stock price will continue to increase. With that, banks will be more willing to lend them at lower rates and/or use those stocks as collateral. So the company can borrow cheap money if they have too. As a result, with more capital in hand, they can hire top people (ex.Google, Goldman Sachs, etc.) who could fix the product/service and operations and make it a really good company eventually. So like that "overly-optimistic financial sector" based on a good, yet untruthful narrative, made actually a good company in the end when the reality caught up with the market perception. So based on the above two, I believe narrative economy certainly has some component of gambling and/or Ponzi (like any other regular investment/trading/speculation), but is not entirely that bad. Just another way, not better or worse than others, I think. Although it does look like a Ponzi scheme, I think this is the current reality: no matter how good your asset can be you are going lose the competition to those who attracted more investors. So, apart from being a good project, attracting investors is very important.

Yes, that's my point. Not necessarily investors though, as it can be just supporters/promoters/media/etc., but all of that will eventually translate into investors. Like if everyone in the world starts saying you must invest in X ICO and repeat it every day, even Warren Buffet will do so eventually when every single person (including his wife, kids, drivers, shop sellets, etc.) says so. In my opinion, everything here is much more complicated and at the same time more interesting.

Nowadays virtual reality has gained great importance in our world. At the same time, the development of technology has advanced significantly.

Engineers can solve any technical problem. Programmers can write any program.

However, terms of reference are required for both engineers and programmers. This technical assignment (at the architecture level) is an interesting story.

The Bible said, "In the beginning was the word."

Thus, we see a logical sequence. Interesting story - Terms of reference - Program code - Final Product.

I am not entirely sure, but I believe you refer to the 2nd part of my above comment about partial Minsky Moment? And I like your reasoning on this, I believe you are correct and it fits well the new narrative economy theory, as following that way even a bad/inexistent/failing/yet-to-be-developed product/company/service/project has a potential to be great. But only if the team is good and strong and understand what it understand, and understand what they don't understand (reference to my earlier comments when I said that some of the kids doing DeFi or startups are very funny when they think they with a team of 3-5 or even 20 people can build the next Google or international bank  ) |

|

|

|

|

jacafbiz

|

|

January 15, 2021, 10:12:32 AM |

|

I believe Value investing is the best and will never fail any analyst if done right though mostly for long term investors. Everything is also about narrative, if you can sell your project well to investors and they believe your story fine but its only work short time for project not creating any value, the story behind Bitcoin is true and people bought into it but apart from this narrative it has proven over and over again that it is a good Store or Value, I bought my first BTC at $420, it has done 100X since then unlike most of these 2017 ICOs that promised to change the world but have nothing to back it up

|

| .SUGAR. | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | ███████████████████████████

███████████████████████████

██████ ██████

██████ ▄████▀ ██████

██████▄▄▄███▀ ▄█ ██████

██████████▀ ▄███ ██████

████████▀ ▄█████▄▄▄██████

██████▀ ▄███████▀▀▀██████

██████ ▀▀▀▀▀▀▀▀▀ ██████

██████ ██████

███████████████████████████

███████████████████████████ | .

Backed By

ZetaChain | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | |

|

|

|

as.exchange (OP)

Copper Member

Member

Offline Offline

Activity: 140

Merit: 51

as.exchange

|

|

January 15, 2021, 10:13:02 AM |

|

"Isolated examples" that crashed whole markets though! Also the examples you mentioned as narrative investment cases are pretty niche as well  Honestly I think the main driver behind this extended bull market is a lack of alternatives for any aspiring investor. There's just nowhere to put your cash in except for stocks, crypto and maybe real estate. A decade ago the cautious investor could flee into bonds. They might have made less profit, but it would still have been profit. These days that's a losing proposition and there's nowhere to go but to charge forward. Essentially monetary policies have herded cash into arguably ever more overvalued assets -- which of course kinda loses its meaning once everything is overvalued. I get that narrative investing can be highly profitable, but it's simply not sustainable, not if it's the only factor. And while investors seem to be more likely to "buy the dip" these days, as we've seen in March 2020, it will come down eventually. Regardless of that not being invested seems to remain a losing proposition -- After all "the markets can remain irrational longer than you can remain solvent". Yes, you are right that those examples crashed the entire markets (same with Bernie Madoff and LTCM)  But what I meant as isolated examples is that at that time okay there could be 1-2-3-5-n overhyped narrative-based overvalued stories which negatively affected markets. But now we see a great number of those all together. And the examples I gave are just among the most obvious ones, yet there are many others less obvious which I didn't mention (for example: gave investment (I know that sounds crazy  ) - is a big thing in China, due to limited space available, and continuous appreciation of space for keeping the urn for ashes; luxury goods secondary market - some of the luxury bags/snickers/clothes double in price within days (and the trend persists for long time) once they are released by big brands; and there are other examples if we think of). Thus my point is that now virtually everything is either following a narrative based logic, or simply failing. And for luck alternatives, honestly I don't really know. From one side we have all these things which we never had before - from grave investing and Amazon shops to complex financial products, derivatives and cryptos. Investment opportunities are countless (you could even just go down the street and ask for equity stake some local bakery or coffee shop). Yet, as you correctly mentioned - with these prices and overall market fuelled by insane printing (yet it's arguable if that's good or bad, as without that we all could be bankrupt by now). Loved the quote "the markets can remain irrational longer than you can remain solvent" - it's one of my favourite ones. As for narrative investing being not sustainable, well certainly it's not. Same with value or growth investing. Nobody can guarantee that the startup I invested will really become the next Uber or Google. Same as nobody can guarantee that if I buy a factory for less than it's NAV, it will eventually match with its NAV. Isn't that a definition of investing and trading, irrespective of which strategy or logic we follow?  |

|

|

|

as.exchange (OP)

Copper Member

Member

Offline Offline

Activity: 140

Merit: 51

as.exchange

|

|

January 15, 2021, 10:20:03 AM |

|

I believe Value investing is the best and will never fail any analyst if done right though mostly for long term investors. Everything is also about narrative, if you can sell your project well to investors and they believe your story fine but its only work short time for project not creating any value, the story behind Bitcoin is true and people bought into it but apart from this narrative it has proven over and over again that it is a good Store or Value, I bought my first BTC at $420, it has done 100X since then unlike most of these 2017 ICOs that promised to change the world but have nothing to back it up

Value investing vs. any other style I think is more of a personal preference and beliefs. But you might want to look at the top funds' performance that follow value investing strategy (here: https://money.usnews.com/funds/search?category=large-value, and here: https://www.moneycontrol.com/mutual-funds/performance-tracker/annual-returns/value-fund.html). Similar patterns would be for growth, and usually worse patterns for TA-based (yet in professional finance that's not TA-based, but arbitrage funds or quantitative funds or high-frequency trading firms). As for Bitcoin, well only the history will show what it was and what it is. When we look at current events, we are always biased, but such things are better analyzed in retrospective historical way, once we have more data, free of short-term biases (narratives?  ) and can make well informed and comprehensive analytical decisions. |

|

|

|

|

Mauser

|

|

January 15, 2021, 12:38:46 PM |

|

This is a great summary of investment strategies over the last 100 years. We can see a change in investors sentiment and what kind of financial tools they use for making decisions. Even though people already focused on trends in the 20s I think its still a major tool in today's world. Relying on chart analysis is still the bread and butter of many financial advisors in today's world. There are quite a few trading systems out there which have very fast access to the exchange and use intra day data of stocks to make a good profit.

|

|

|

|

as.exchange (OP)

Copper Member

Member

Offline Offline

Activity: 140

Merit: 51

as.exchange

|

|

January 15, 2021, 04:55:56 PM |

|

This is a great summary of investment strategies over the last 100 years. We can see a change in investors sentiment and what kind of financial tools they use for making decisions. Even though people already focused on trends in the 20s I think its still a major tool in today's world. Relying on chart analysis is still the bread and butter of many financial advisors in today's world. There are quite a few trading systems out there which have very fast access to the exchange and use intra day data of stocks to make a good profit.

Thank you for your kind comment. Actually that's something I recently noticed too (after writing the post and reading it again) that as we move along to the current era/times investors are less and less numbers-driven, with one extreme being TAs who rely entirely on numbers/charts, value and growth being in the middle as those metrics can be interpreted differently (even EBITDA, EV, Equity, etc. can be calculated differently depending on which accounting standards and which logic you chose to use), and narrative-investing being another extreme and we can say numbers-agnostic. And yes, some funds still do use TA and trading data to make investment decisions, but those are mainly either arbitrage funds (thus yearn stable but super low returns), and others being high-frequency trading firms with the direct links to the exchange to get the data first in the world so they could legally "front-run" the market. But they are not that profitable usually too. But at least they don't have human error factor in  |

|

|

|

jaysabi

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

January 15, 2021, 10:57:31 PM |

|

Just wanted to share some thoughts about the recent market developments, and get feedback from the knowledgable BitcoinTalk community. 1920-1930s: we saw an emergence of technical analysis with the books of Richard W. Schabacker (even though the history began long before that in 17th centurty). At those times, if you had ability and resources just to chart data and identify visual patterns - you could make good money (read more here: https://en.wikipedia.org/wiki/Technical_analysis). Effectively it was - see the chart and make investment decision based on the trend.1930-1960s: we saw an emergence of value investing with the first attempts of John Maynard Keynes, but his approach was too high-level (macro-economy) therefore didn't see substantial success before Benjamin Graham started researching and following this approach on a company-wide scale. At those times, if you had ability and resources to analyze fundamental data (balance sheet, income statement, cash flow statement, etc.) and understand good vs. bad patterns - you could make good money (read more here: https://en.wikipedia.org/wiki/Value_investing). Effectively it was - see financial statements, and buy what is undervalued.1960-2010s: we sew an emergence of growth investing with the growing popularity and success of Charlie Munger, Phil Fisher, and of course Warren Buffett. The entire idea was to buy whatever is expected to grow in the future, because it can become the next Google or Facebook. At those times, if you had ability and resources to analyze and predict future potential growth of the company - you could make good money (read more here: https://en.wikipedia.org/wiki/Growth_investing). Effectively it was - even if the company is overvalued or already fairly priced, it's okay to buy-in if there's substantial growth expected.2010-onwards: we are observing an emergence of narrative economy and narrative investing. It is well documented and currently being popularised theory by Robert J. Shiller, where charts don't matter anymore, fundamental data doesn't matter anymore, future growth doesn't matter anymore. All what matters is the narrative (i.e. story) around the particular asset / stock / etc. If it got a good story which is able to spread like a virus, no matter how good or bad the stock/(asset) is - it will deliver substantial returns (read more here: https://www.ft.com/content/5ba0adf6-ec3c-11e9-85f4-d00e5018f061). Effectively it means - if you can identify good story that would be appealing to other prospective investors, and able to invest in that story early enough, you can outperform others.While the idea of narrative economy might sound too new or experimental, the recent market developments, with the stories surrounding such assets as Tesla, Zoom, Bitcoin, BioTech, COVID19 vaccine developers, cannabis stocks, and many others, with the success of such investors as ARK funds, there is clearly some evidence that the world has shifted to narrative-based economy, and neither charts, neither fundamentals, neither growth matters anymore. What do you think about that? P.S. the dates and time ranges above are just for general reference, as some people still falsefully believe that they can use TA to outperform market, or try to make investment decisions based on BS/IS/CFS. Some of the ancient approaches still might work in very specific cases or asset classes, and some people might argue that the investment school of though has changed at other dates, but overall trend and change I personally believe is okay to be marked with those dates. Of course that is by no mean an absolute and only correct idea.Lol, Charlie Munger and Warren Buffet are two of the greatest value investors in history. What on earth would make you identify them as growth investors? Growth and value investing are completely antithetical to each other. As for narrative investing, I don't agree. Eventually, fundamentals of the underlying business matters. The best example of this is Tesla. Tesla won't keep trading at this valuation indefinitely, no matter the narrative around it. Eventually, it's going to have to turn mega-insane profits to justify this valuation. Ironically, bitcoin is only valuable because of narrative investing. |

|

|

|

Tytanowy Janusz

Legendary

Offline Offline

Activity: 2142

Merit: 1622

|

|

January 16, 2021, 10:47:47 AM Merited by as.exchange (3) |

|

As for narrative investing, I don't agree. Eventually, fundamentals of the underlying business matters. The best example of this is Tesla. Tesla won't keep trading at this valuation indefinitely, no matter the narrative around it. Eventually, it's going to have to turn mega-insane profits to justify this valuation.

I love it when people put forward theses and justify them with 1 extreme case. I could say that it always rains in my city, because a moment ago I looked out the window and it was raining. The fact is that popular assets (not only tesla) had p/e around 50 and were overvalued, and should dump to around p/e=20 (average for nasdaq is 30 - and nasdaq is overvalued too), but after 5 years has p/e around 500. (f.e nvidia, netflix), and in another 5 years can have 5000. You know why? Because we broke off the foundations not 2-5 months ago (tesla) but 8-10 years ago on every popular asset, because ... for 10 years the foundations do not play a role, because ... "2010-onwards" we deal with "narrative investing" exactly like described it by the OP. Dump, you are talking about, will come with the emergence of a new narrative. But whether it will be in 2021 or 2030 is not known. |

|

|

|

|

as.exchange (OP)

Copper Member

Member

Offline Offline

Activity: 140

Merit: 51

as.exchange

|

|

January 16, 2021, 04:48:13 PM |

|

Lol, Charlie Munger and Warren Buffet are two of the greatest value investors in history. What on earth would make you identify them as growth investors? Growth and value investing are completely antithetical to each other.

As for narrative investing, I don't agree. Eventually, fundamentals of the underlying business matters. The best example of this is Tesla. Tesla won't keep trading at this valuation indefinitely, no matter the narrative around it. Eventually, it's going to have to turn mega-insane profits to justify this valuation.

Ironically, bitcoin is only valuable because of narrative investing.

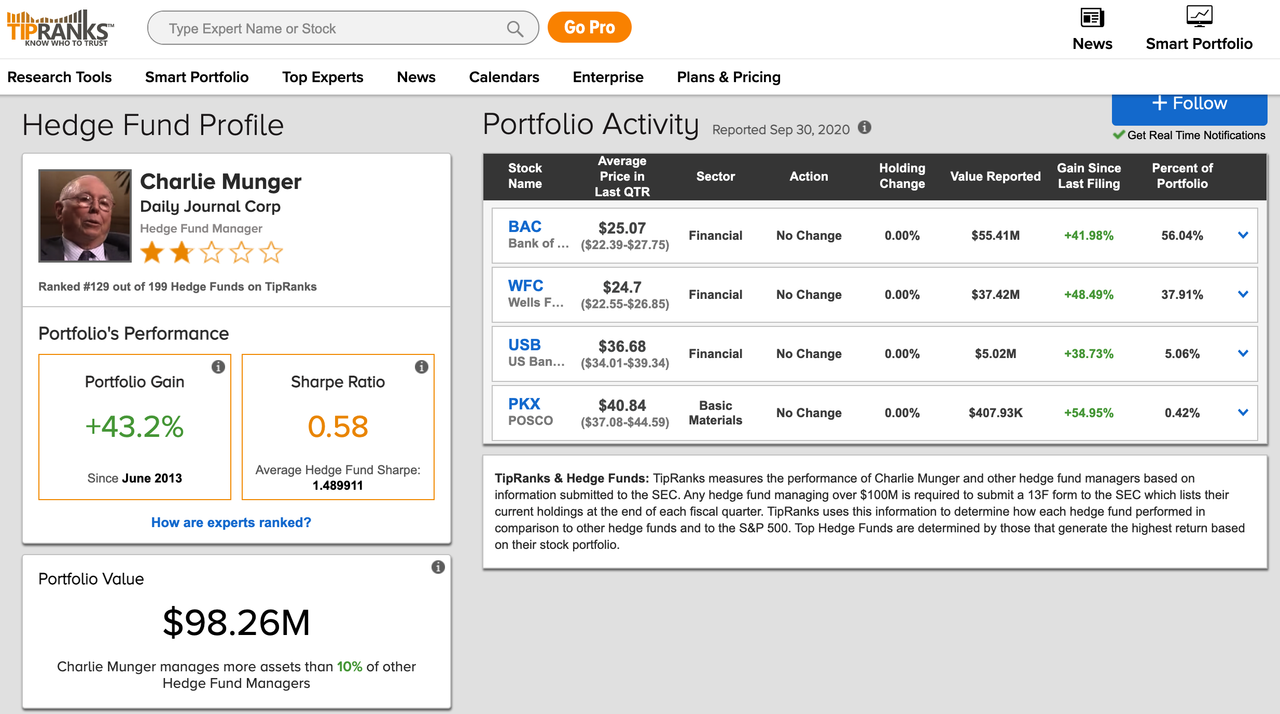

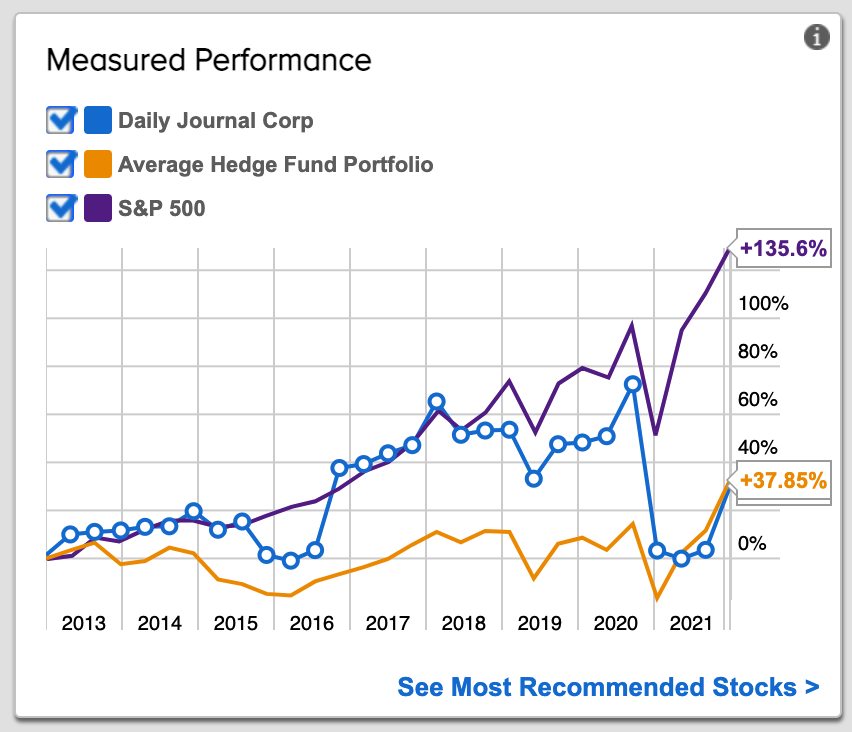

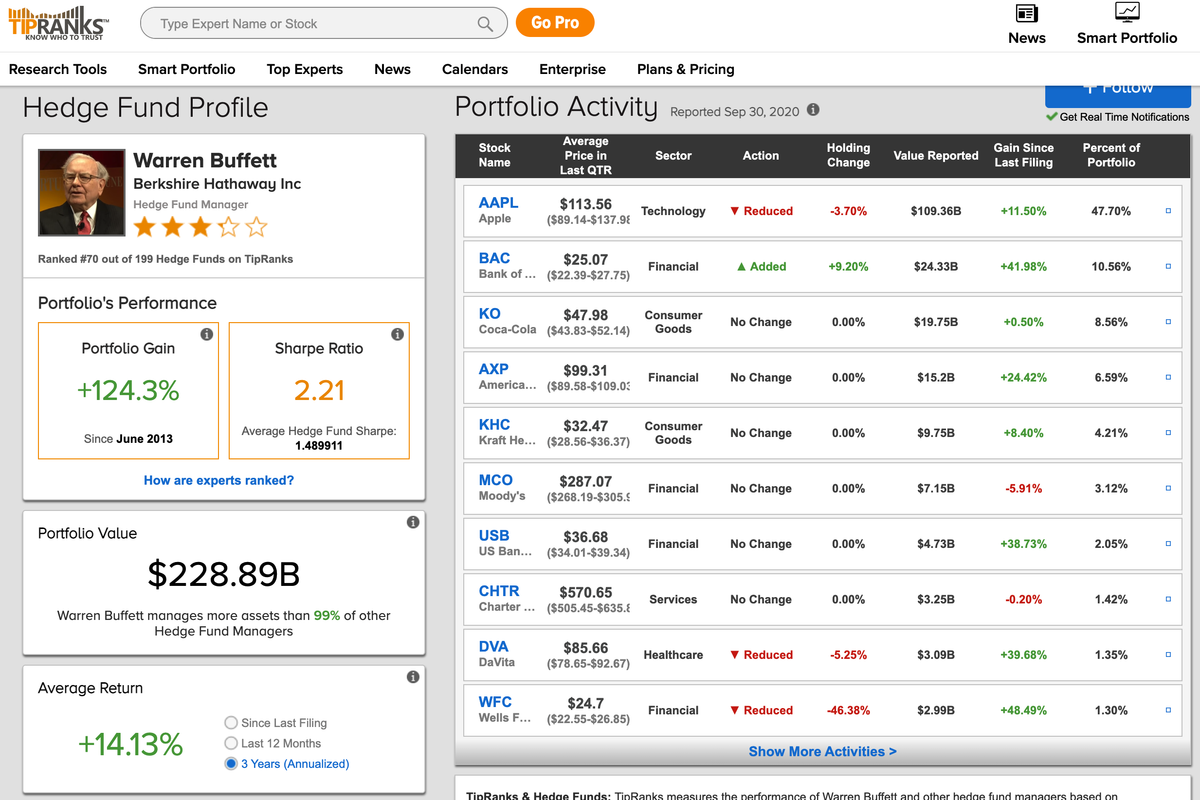

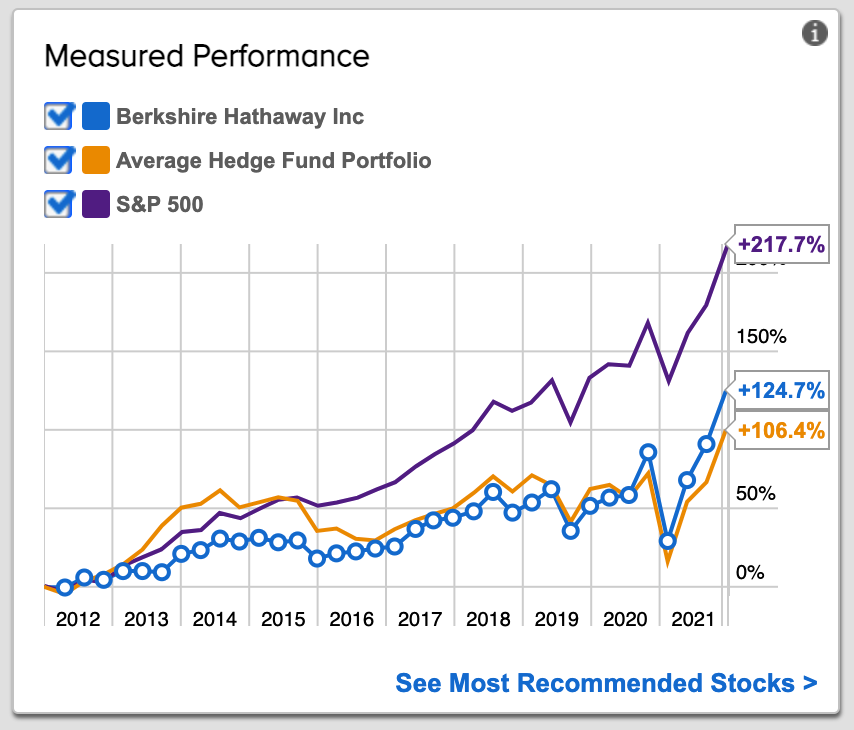

Okay, here we go: Charlie Munger   Warren Buffet Warren Buffet   Bitcoin Bitcoin  Tesla Tesla Do I need to provide more comments or arguments about who is the greatest investor? While Charlie Munger and Warren Buffet surely WERE the best investors of THEIR times, for now, I am not so sure they still remain so. We must recognize when the times and leaders and "greatest investor" title changes. Otherwise it's like observing Bitcoin, but still calling U.S. Dollar the greatest currency in the world. Well, I believe just a simple data of Charlie Munger vs Warren Buffet vs Bitcoin vs Tesla show my entire answer and argument, so I don't need to add more to that. As for why identiffying the aforementioned two as growth investors, you can take a look at their portfolios and latest investments. Some of their assets show clear "growth-investor"-like patterns, while they don't publicly disclose that. Irrespective of that - what people say in public is not always what they actually have in mind. And about Tesla, I gave a comprehensive explanation above why even if Tesla fails to deliver solid revenue in the near future, their narrative-driven market cap can turn the company and force it into a great business eventually. That's not something good or bad, that's just what it is. Using your own argument about "won't keep trading at this valuation indefinitely, no matter the narrative around it. Eventually, it's going to have to turn mega-insane profits to justify this valuation." - what would you say about Bitcoin in such context then? I love it when people put forward theses and justify them with 1 extreme case. I could say that it always rains in my city, because a moment ago I looked out the window and it was raining.

The fact is that popular assets (not only tesla) had p/e around 50 and were overvalued, and should dump to around p/e=20 (average for nasdaq is 30 - and nasdaq is overvalued too), but after 5 years has p/e around 500. (f.e nvidia, netflix), and in another 5 years can have 5000. You know why? Because we broke off the foundations not 2-5 months ago (tesla) but 8-10 years ago on every popular asset, because ... for 10 years the foundations do not play a role, because ... "2010-onwards" we deal with "narrative investing" exactly like described it by the OP. Dump, you are talking about, will come with the emergence of a new narrative. But whether it will be in 2021 or 2030 is not known.

I really agree with you in regard to how people tend to generalize one thing to everything else. Just an additional point to your comment is that if for example, the previous commenter would take a loot at Chinese BioTech P/Es or HighTech P/Es or some very popular companies (premium alcohol, social media, content production, new media, KOL factories) P/E of 1,000-1,500 would be very very normal. Nobody will be concerned that such stock is "overvalued". It's just the way it should be because it's the top narrative now, everyone wants it, and "tomorrow will be more expensive than today as more people will get to know it". And I personally don't know what new paradigm will come next, but I for sure don't foresee the current one changing in the nearest future - nobody is going to care about fundamentals anymore. |

|

|

|

jaysabi

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

January 17, 2021, 06:39:36 AM |

|

As for narrative investing, I don't agree. Eventually, fundamentals of the underlying business matters. The best example of this is Tesla. Tesla won't keep trading at this valuation indefinitely, no matter the narrative around it. Eventually, it's going to have to turn mega-insane profits to justify this valuation.

I love it when people put forward theses and justify them with 1 extreme case. I could say that it always rains in my city, because a moment ago I looked out the window and it was raining. The fact is that popular assets (not only tesla) had p/e around 50 and were overvalued, and should dump to around p/e=20 (average for nasdaq is 30 - and nasdaq is overvalued too), but after 5 years has p/e around 500. (f.e nvidia, netflix), and in another 5 years can have 5000. You know why? Because we broke off the foundations not 2-5 months ago (tesla) but 8-10 years ago on every popular asset, because ... for 10 years the foundations do not play a role, because ... "2010-onwards" we deal with "narrative investing" exactly like described it by the OP. Dump, you are talking about, will come with the emergence of a new narrative. But whether it will be in 2021 or 2030 is not known. P/E ratio is only useful when comparing like companies. You can't compare high growth tech stocks like NVIDIA or Netflix to an entire index and generally conclude they're overvalued because the NASDAQ is such a broader base, and growth stocks are so speculative in general. But one thing remains universal, the moment the growth that was anticipated slows, the prices crash, no matter what the narrative is. Because eventually, it all comes back to fundamentals and profitability. |

|

|

|

jaysabi

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

January 17, 2021, 07:10:46 AM |

|

Lol, Charlie Munger and Warren Buffet are two of the greatest value investors in history. What on earth would make you identify them as growth investors? Growth and value investing are completely antithetical to each other.

As for narrative investing, I don't agree. Eventually, fundamentals of the underlying business matters. The best example of this is Tesla. Tesla won't keep trading at this valuation indefinitely, no matter the narrative around it. Eventually, it's going to have to turn mega-insane profits to justify this valuation.

Ironically, bitcoin is only valuable because of narrative investing.

Okay, here we go: Do I need to provide more comments or arguments about who is the greatest investor? While Charlie Munger and Warren Buffet surely WERE the best investors of THEIR times, for now, I am not so sure they still remain so. We must recognize when the times and leaders and "greatest investor" title changes. Otherwise it's like observing Bitcoin, but still calling U.S. Dollar the greatest currency in the world. Well, I believe just a simple data of Charlie Munger vs Warren Buffet vs Bitcoin vs Tesla show my entire answer and argument, so I don't need to add more to that. As for why identiffying the aforementioned two as growth investors, you can take a look at their portfolios and latest investments. Some of their assets show clear "growth-investor"-like patterns, while they don't publicly disclose that. Irrespective of that - what people say in public is not always what they actually have in mind. And about Tesla, I gave a comprehensive explanation above why even if Tesla fails to deliver solid revenue in the near future, their narrative-driven market cap can turn the company and force it into a great business eventually. That's not something good or bad, that's just what it is. Using your own argument about "won't keep trading at this valuation indefinitely, no matter the narrative around it. Eventually, it's going to have to turn mega-insane profits to justify this valuation." - what would you say about Bitcoin in such context then? I'm just trying to understand why you think Munger and Buffet are growth investors. Your posts though lead me to believe you may not know the difference between value investing and growth investing, or else you just don't know much about Munger or Buffet as neither would be described as growth investors by themselves or anyone who knows anything about stock investing. Buffet's biography on wikipedia attests to this: "He went on to graduate from Columbia Business School, where he molded his investment philosophy around the concept of value investing pioneered by Benjamin Graham... He is noted for his adherence to value investing, and his personal frugality despite his immense wealth." A better example might be reading Buffet's own words though. You can read all of Berkshire's annual letters to shareholders on their website. In fact, if you start at the most recent and work your way backwards, you'll see they start nearly every letter with a discussion of "intrinsic value." It is universally at the top of every letter because intrinsic value is what Buffet and Munger care about because they're value investors to the core. Look for yourself: https://www.berkshirehathaway.com/letters/letters.htmlAs for Bitcoin in the above context, I wouldn't say anything about it because it's not applicable. Bitcoin doesn't produce income, so it can't be valued on fundamentals because there are no fundamentals. It's purely a speculative asset and as I stated, the ultimate example of narrative investing. Telsa, however, as much as the price is driven by speculation, will eventually have to produce profits to justify its valuation. If growth slows before turning big profits, the price will crash. Bitcoin and Tesla exist in two different universes, they aren't subject to the same rules. |

|

|

|

|