Poker Player (OP)

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

|

November 25, 2021, 07:38:06 AM |

|

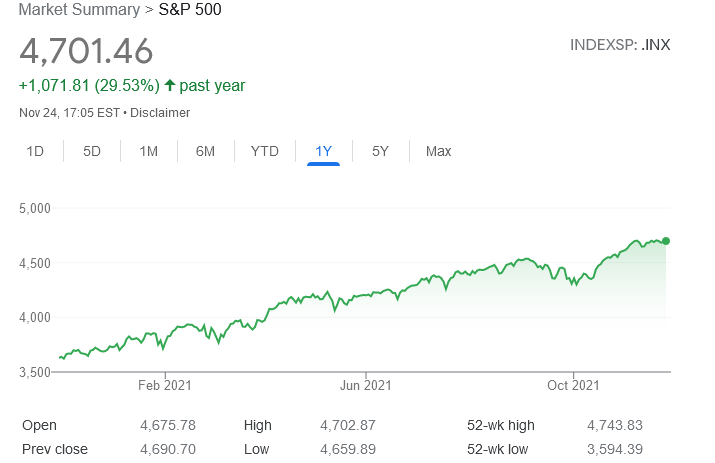

When we think of inflation we usually think of how much food, electricity or gasoline costs. But there is another aspect as well: how much it costs us to buy financial assets. The above chart at first glance may appear to be due to the strong performance of the 500 largest U.S. companies. But this is misleading: I believe it reflects more the effects of massive printing and inflation than how companies are doing. The charts for the stock markets of countries with high inflation are similar: the more currency printing and inflation, the more the stock market rises. That the S&P, which has an average return of about 10% on average has risen 30% in the last year is sobering. Let's think that in November 2020 we were already out of the stock market slump that was the COVID. At the end of the day, anyone like me who has money invested in the S&P 500 can't be too happy about the 30% return because if we discount inflation it comes to almost nothing. |

|

|

|

|

|

|

"Governments are good at cutting off the heads of a centrally

controlled

networks like Napster, but pure P2P networks like Gnutella and Tor seem

to be holding their own." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

Gyfts

Legendary

Offline Offline

Activity: 2758

Merit: 1512

|

|

November 25, 2021, 07:52:36 AM |

|

Inflation and the stock market are not exactly good metrics to compare because it depends on the stock. If you want to see where inflation is, look at prices over all consumer goods year over year, and then look at the general direction of the economy.

If you have a stock that is valuated high because of future projected growth, and that growth doesn't happen because inflation slows the economy and reduces growth of the company/sales, then the value of the stock will eventually come down. Other stocks

On the other hand, if you inject extra money into the economy in the form of stimulus when most people don't need it, a lot of that money ends up going into the stock market which will usually cause a bump in the market, but the effects of inflation are felt much later.

It's a bit difficult to compare.

|

|

|

|

|

|

magneto

|

|

November 25, 2021, 08:23:16 AM |

|

Not really?

The stock market does have some correlation with inflation, but it is not the best inflation proof asset.

Why not just look at the inflation rate instead of trying to proxy it through some other metric? It's not hard to see that inflation is high, way above what central banks are targeting.

|

|

|

|

|

mk4

Legendary

Offline Offline

Activity: 2744

Merit: 3830

Paldo.io 🤖

|

|

November 25, 2021, 08:25:03 AM |

|

I believe it reflects more the effects of massive printing and inflation than how companies are doing.

I mean, that's pretty much it. The federal reserve has been pretty aggressive with the money printing that it might be crazy to hold a huge amount of your wealth accumulating like 0.001% APR or something on your local bank. It simply just makes sense to hold equities and assets in general; the downside of course being that equities are inflated. |

|

|

|

Charles-Tim

Legendary

Offline Offline

Activity: 1526

Merit: 4811

|

|

November 25, 2021, 08:52:09 AM |

|

At the end of the day, anyone like me who has money invested in the S&P 500 can't be too happy about the 30% return because if we discount inflation it comes to almost nothing.

Not all stocks are like that, also better than having fiat that comes down to loss. If I will have to be open minded, there is nothing bad to diversify. But bitcoin and some other cryptocurrencies are most profitable since the last decade till now but there are some successful stocks too. Also the more the adoption, the less the volatility. This is based on what I read. Have you read about gold also, that its price at $678 in 1980 have the buying power of its price of $2,142 in 2020. It's price per Ounce now is $1,795. While gold is seen as a store of value which is truly is.

Gold reached a price of $678 U.S. dollars in 1980, according to a breakdown from Visual Capitalist. Accounting for inflation, based on calculations from Officialdata.org, $678 in 1980 held the same buying power as approximately $2,142 in 2020. The precious metal technically broke its U.S. dollar all-time high this year, hitting $2,075, according to TradingView data. Its 1980 record purchasing power level remains unbroken, however. Since its push to $2,075 in August, gold has retraced in price, sitting near $1,778 per ounce at the time of publication.

|

.

HUGE | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

fiulpro

|

|

November 25, 2021, 10:32:28 AM |

|

I do not think that stock market can be a direct indicator of Inflation, here are certain reasons why :

1. They increase in price undoubtedly during Inflation but the increase is usually much more since people flock to some investments to get a backup when the government won't be able to regulate the economy.

Therefore the change would be much more drastic.

2. Not all stocks are going up, some of them are going down as well and the investors are not being able to earn from them.

3. Inflation does not always have a positive impact, the companies are striving hard to maintain their price thus sometimes they will sell their stocks at a beneficial rate but the companies itself are also being affected by the inflation causing probelms for them as well.

- it can be a indicator but it's not universal-

|

|

|

|

The Sceptical Chymist

Legendary

Offline Offline

Activity: 3318

Merit: 6796

Cashback 15%

|

|

November 25, 2021, 10:39:51 AM |

|

At the end of the day, anyone like me who has money invested in the S&P 500 can't be too happy about the 30% return because if we discount inflation it comes to almost nothing.

Dude, be happy with a 30% return because annual inflation is nowhere near that as far as I know, at least not yet. And while stocks and other investments aren't included in the "basket of goods" that the government uses to measure inflation, you'd better believe the stock market's sky-high prices are indicative of too much money chasing too few investments, which is just another form of inflation. And man, I don't know when this party is going to come to an end, but I've had this feeling for at least a couple of years now that we're overdue for a crash or a major correction--it just never seems to come, and I find that ominous. If I were you, Poker Player, I'd be watching out for warning signs and getting prepared to sell some of your stocks before (or at least shortly after, before prices get really low) that crash comes, because it's coming. It's just a matter of when, not if. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1820

|

|

November 25, 2021, 11:08:45 AM |

|

OP, that IS a very clear sign of high inflation. All that extra money going to stocks, commodities, real estate, AND cryptocurrencies. But it will come down crashing soon, and prepare for the next cycle, OR hyperinflation. The government is spreading a new narrative that “inflation is good”.   |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

Poker Player (OP)

Legendary

Offline Offline

Activity: 1358

Merit: 2011

|

|

November 25, 2021, 11:38:24 AM |

|

Not all stocks are like that, also better than having fiat that comes down to loss.

Dude, be happy with a 30% return because annual inflation is nowhere near that as far as I know, at least not yet.

Yes, I think I've been a bit pessimistic before. Much better than having Fiat, of course, but in real terms the return is quite a bit less than that 30%. You have to think that the CPI index has been manipulated over the years to show what is convenient for governments, so inflation is much higher than what it shows. OP, that IS a very clear sign of high inflation. All that extra money going to stocks, commodities, real estate, AND cryptocurrencies. But it will come down crashing soon, and prepare for the next cycle, OR hyperinflation.

I doubt there will ever be hyperinflation in the US or the EU. Think of it as being defined as a 50% monthly rise in inflation. If I were you, Poker Player, I'd be watching out for warning signs and getting prepared to sell some of your stocks before (or at least shortly after, before prices get really low) that crash comes, because it's coming. It's just a matter of when, not if.

I had some stocks that I have already sold. Now I only have the S&P 500 left, and I don't care if there is a crash because I do DCA, and Bitcoin, which I do the same. |

|

|

|

stompix

Legendary

Offline Offline

Activity: 2870

Merit: 6267

Blackjack.fun

|

|

November 25, 2021, 11:58:42 AM

Last edit: June 12, 2023, 08:36:50 PM by stompix |

|

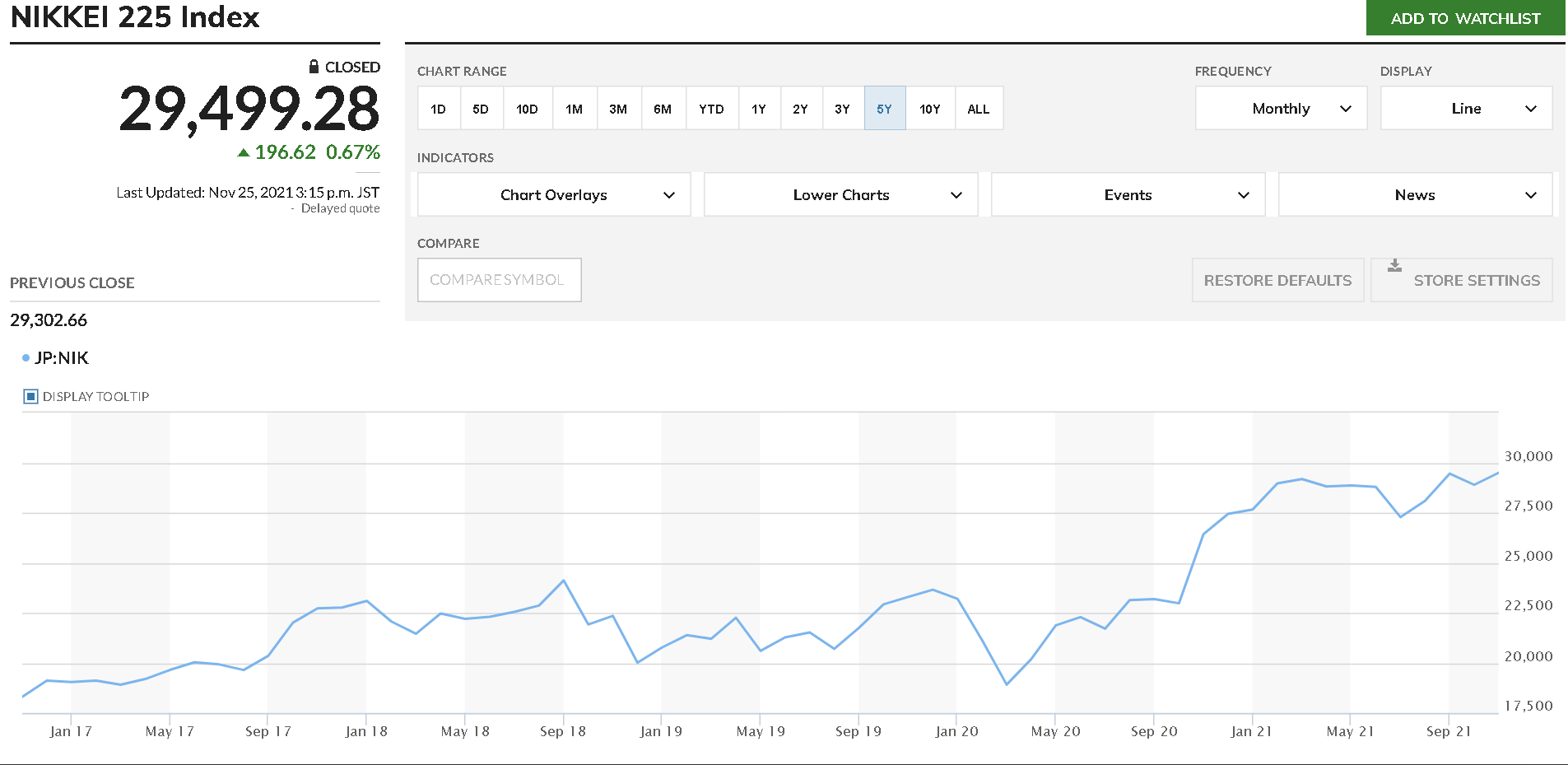

You can't really blame inflation for that. When you think one thing is caused by that you should look at others to see if they match, let's check a country which experiened deflation, Japan:  Then something else must also be happening, DJI is 19,86 % while NDAQ is 60%, so the growth is triggered clearly by some industries, and not all of them. OP, that IS a very clear sign of high inflation. All that extra money going to stocks, commodities, real estate, AND cryptocurrencies. But it will come down crashing soon, and prepare for the next cycle, OR hyperinflation. Hyperinflation in the US? I don't understand why you're happy about this, trust me even if your coins will be worth 1 billion and you could buy everything you wanted you wouldn't want to live in such a period. Unless you enjoy seeing people suffering. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1820

|

|

November 25, 2021, 12:25:20 PM |

|

OP, that IS a very clear sign of high inflation. All that extra money going to stocks, commodities, real estate, AND cryptocurrencies. But it will come down crashing soon, and prepare for the next cycle, OR hyperinflation.

I doubt there will ever be hyperinflation in the US or the EU. Think of it as being defined as a 50% monthly rise in inflation. The probability of hyperinflation is very low, yes, but it’s always better to have a back up/fall back if the Fed and the government loses its control over economic/financial system because of all their BRRR-money-printing.  |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

kryptqnick

Legendary

Offline Offline

Activity: 3080

Merit: 1384

Join the world-leading crypto sportsbook NOW!

|

|

November 25, 2021, 12:40:40 PM |

|

From what I've read, it seems that it's not so simple. For example, an excerpt from here: stocks react much more negatively to inflation when the economy is contracting or in a recession than when inflation happens as the economy is expanding.

This makes sense. When the economy is contracting, profits and revenues are usually declining even without inflationary concerns. When the economy is booming, profits are higher (as they are now) and the economy may be able to withstand higher inflation.

So it's not only about the fact of inflation but also about the circumstances of it. I've seen a similar thought in other articles as well, and sometimes stock can hold up against inflation, as long as the overall economic situation is good. And while some rise might be attributed to growing inflation, it might also just be that there's more demand for these stocks and people are more willing to buy them, so the price is going up. Also, I don't realize why we need signs of inflation by analyzing the stock prices if the inflation rate is not something kept secret, right? According to Guardian, According to CPI numbers released in mid-November, prices in the US rose 6.2% in October compared with where prices were the same time last year. US core inflation, which does not include goods like energy and food whose supply is susceptible to external events, was 4.6% in October, its highest since 1991.

So it is true that the inflation is on the rise, and it is true that the stock price is up, but it doesn't mean the two are causally related and, if so, to what extent. |

|

|

|

buwaytress

Legendary

Offline Offline

Activity: 2786

Merit: 3437

Join the world-leading crypto sportsbook NOW!

|

|

November 25, 2021, 01:31:25 PM |

|

I believe it reflects more the effects of massive printing and inflation than how companies are doing.

One of the first money things I learnt about in school actually. Now I'm just putting it as I remember, and how the basics went, but we had in our country a period where the Japanese occupied and printed their own local money. But they kept printing more and more of it to give out to locals and try to quickly establish a new cash economy (they had to displace at least 2 systems that pre-existed). Goods soared in price, and the scenes we're seeing now in some parts of Africa, the Middle East, and South America, where people are buying food with wheelbarrows of money, that's what my grandparents said happen. And those businesses and people who bet on the Japanese staying for good, well, they lost a lot, while actually holding a lot of cash, when hyperinflation hit the roof. Those who preferred to hang on to old currency, or gold, waited out the occupation and made it out alive. It does make me wonder now what happened to stocks  Anyway, they were so numerous you can still buy these notes in mint condition in tourist shops and flea markets. We call them banana money (as they printed bananas on the notes haha). They were used in basic school to teach us about inflation. That said, there are countries still betting on the dollar... and with euroskeptics getting stronger and the global south scattering their fortunes and still opting for dollarisation, I doubt anything catastrophic happens to the dollar in our lifetimes. |

|

|

|

jackg

Copper Member

Legendary

Offline Offline

Activity: 2856

Merit: 3071

https://bit.ly/387FXHi lightning theory

|

|

November 25, 2021, 02:16:37 PM |

|

The stock markets in each country are often effected by both domestic markets and international ones. There's lots of international interest in growth stocks in places like the US, and interest in dividend stocks internationally in places like the UK and Germany.

However, things like REITs will obviously have an impact on inflation as they can send up the cost of living.

|

|

|

|

|

Zanab247

Full Member

Offline Offline

Activity: 1176

Merit: 118

★Bitvest.io★ Play Plinko or Invest!

|

|

November 25, 2021, 02:47:57 PM |

|

Many countries are still struggling to reduce inflation in their country since we escape from pandemic few years ago. Now that the price of a commodities is about to go up because the government refuse to print more money to prevent inflation from the country. Many investors are finding it difficult to make a good profit from their investment because of the way the price of market is developing some negative challenges in the market.

Many companies are preparing to close down production unit first week of December which will cause so much inflation in the country. Many products price will definitely increase to cause hardship in the country like the one citizens experienced during the covid-19, that takes place good one year and some months in the country.

|

|

|

|

pancakebirb

Jr. Member

Offline Offline

Activity: 115

Merit: 1

|

|

November 25, 2021, 03:28:30 PM |

|

At the end of the day, anyone like me who has money invested in the S&P 500 can't be too happy about the 30% return because if we discount inflation it comes to almost nothing.

https://postimg.cc/c6rFTWX0 |

|

|

|

|

el kaka22

Legendary

Offline Offline

Activity: 3500

Merit: 1162

www.Crypto.Games: Multiple coins, multiple games

|

|

November 25, 2021, 08:16:02 PM |

|

This is both good but also very bad at the same time. It is bad because it shows that inflation has cost the nation a lot and we are going to pay a lot more for everything we buy, even though we look like we got "richer" in reality our money stayed the same so there is really nothing that helps us in this regard.

However, it is good because we may not have any money to invest at all and it would mean that we wouldn't be able to invest and we would be missing out on this. Imagine yourself being one of the people who are out of work because of the nationwide strikes and now you need to spend the money you have in your bank account, or maybe not even have anything in your bank account, that is the worst situation you could be in at that moment. This is why even though inflation is bad, at least having enough money to take advantage of this increase in stocks is good for all of us who invested into it.

|

|

|

|

|

Jaycee99

|

|

November 25, 2021, 08:43:04 PM |

|

From My own point of view of inflation, it is sometimes a correction and real inflation.

Like When I saw the bitcoin value is 51k I stop and thought there I will sell my bitcoin

Sadly it turned out a sad story it was too early to pull it out.

The best way here is really study the movements to help you with trading or stock trading

to simply put an answer to your question sometimes it is not a clear sign.

|

|

|

|

|

Hydrogen

Legendary

Offline Offline

Activity: 2562

Merit: 1441

|

|

November 25, 2021, 11:32:25 PM |

|

One key aspect to understanding markets and the economy is breaking down traders of assets by demographic. And recognizing how much of an influence each demographic can exert in terms of their liquidity.

We can see markets rise and fall. But not many know the liquidity of which demographic is responsible for price trends. Fewer still can identify motives which lie behind trades. This was proven during gamestop and dogecoin pumps. Where the majority struggled and failed to identify where the likely liquidity behind said pumps came from.

There are historical precedents to draw upon from past eras of inflation. Similar trends were observed post 2008 economic crisis. As well as the initial phase of COVID. Eras where stock market trends failed to make much sense to investors who have followed market trends for many years.

|

|

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1820

|

|

November 27, 2021, 10:56:54 AM |

|

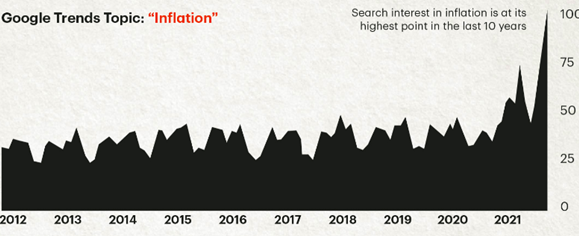

Awareness to inflation is rising could be another clear sign that it’s starting to be more noticeable than normal. There’s data showing that prices of second hand cars are surging in their ATH, which is something never observed before.  I believe their next search phrase will be “inflation hedge”. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|