HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 09, 2022, 12:08:44 PM |

|

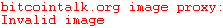

Date : 9th May 2022.Market Update – May 9 – USD dominance rips through every market on FED. Trading Leveraged Products is risky Monday Markets BluesCan the cause sometimes take place after the effect? This is what looks to be the case this week. The USD surged to 2001 and has been bought and fixed income sold on ideas that the Fed had taken a hawkish turn, with investors searching for safety. The hikes will be front-loaded with the next 50 bp hikes discounted for the next two meetings (June and July) and a strong leaning for the same in September (~66%). Yields 10-year is up 1.0 bp at 3.14%. Stock markets are broadly lower, with Japanese markets underperforming and the Nikkei down -2.5%. Tighter Covid lockdowns in Beijing and Shanghai raised pressure on its economy, while China reported faster-than-expected growth in exports for April, while imports were flat. Meanwhile in the market, speculation that President Putin might declare war on Ukraine in order to call up reserves during his speech at “Victory Day” celebrations could further hurt market sentiment. The week ahead is important because it may show the first signs that peak inflation is at hand. * USDIndex above 104.10. * Equities – Nikkei down -2.5%. The ASX closed with a loss of -1.2%, the CSI is currently down -1.4%, while Hong Kong was closed today. USA500 led the way with a drop of 1.1%, while USA100 shed 1.0%. * Yields 10-year is up 1.0 bp at 3.14%, Australia’s long yield also continued to climb and the German 10-year rate is up 0.4 bp at 1.13% this morning. * Oil back to 109, after EU and G7 mull Russian oil imports while Saudi Arabia cut prices for buyers in Asia as China’s lockdowns weigh on demand in the region. * Gold drifted back to 1869 as it looks less attractive from the safety of USD, while elevated yields further weighed on prices. * Bitcoin hammered! Gapped down to33,228. The start of a sharp technical fall ? * FX markets – EURUSD is just over the 1.05 mark, AUD and NZD also struggled against the largely stronger USD. USDJPY climbed above the 131 mark and Cable is at a near 2-year low at currently 1.2259.  Biggest FX Mover @ (06:30 GMT) USOIL (-2.17%) drifted to S1 at 108.15 in the EU open. MAs & Stochastics bearishly crossed, and RSI is at 41 sloping lower. H1 ATR 0.91, Daily ATR 4.43. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

|

|

|

|

|

|

|

Each block is stacked on top of the previous one. Adding another block to the top makes all lower blocks more difficult to remove: there is more "weight" above each block. A transaction in a block 6 blocks deep (6 confirmations) will be very difficult to remove.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 10, 2022, 06:11:52 PM |

|

Date : 10th May 2022.Market Update – May 10 – Stocks Stabilize After Huge Risk-Off Monday. Trading Leveraged Products is risky USD cools from recent highs, Stocks stall their decline after Monday rout (NASDAQ -4.29%), Yields hold at highs with 10-yr over 3.00%. Gold and Oil both slumped as risk-off rattled markets CB tightening and rising inflation fears continuing to spook sentiment. Asian markets weaker (Nikkei -1.00%) and European Futures all weaker.   * * USDIndex tested new at highs at 104.20 yesterday back to 103.60 now. * Equities – USA500 -132 (-3.20%) at 3991, first close below 4k since March 2021. US500FUTS at 4022 now. * Yields moved higher, 10-yr closed at 3.079%, holding key 3.00% level. Trades at 3.054% now * Oil & Gold both had weak & volatile session – USOil tested down to $100.00 before reversing to $102.20 now from opening trades over $109.00. Gold slumped from $1885 zone to $1850 yesterday and struggles at $1860 now. * Bitcoin crashed through $30K struggling with $32K now. * FX markets – EURUSD up from 1.0500 to 1.0560, USDJPY holds over 130.00, at 130.40 and Cable continues to struggle – 1.2260 lows were tested yesterday, back to 1.2325. Overnight Fed’s Kashkari : Reiterates confidence that inflation will return to Fed’s 2.0% target & Fed’s Bostic: 50 bps hike was an aggressive move, Fed can stay at that pace, 75 bps rate hike is low probability. Today – German ZEW, Speeches from Fed’s Williams, Waller, Bostic, Barkin, Kashkari, Mester, ECB’s de Guindos & BoE’s Saunders, Earnings from Bayer, Porsche, Norwegian Cruise Line & Warner Music.  Biggest FX Mover @ (06:30 GMT) USOIL (-2.17%) drifted to S1 at 108.15 in the EU open. MAs & Stochastics bearishly crossed, and RSI is at 41 sloping lower. H1 ATR 0.91, Daily ATR 4.43. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

Head Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 11, 2022, 06:35:26 PM |

|

Date : 11th May 2022.Market Update – May 11 – All About the Inflation Outlook. Trading Leveraged Products is risky USD holds at highs and on standby for US CPI later, Stocks stalled their recent declines, Yields cool a tad as talk of Treasury rout also cools with 10-yr back under 3.00%. Oil paused its 9% slump on EU Oil ban and OPEC talk of capacity issues. Gold under $1850. Asian shares off 2-year lows (Nikkei +0.18%). Chinese Inflation hotter than expected, Biden supports FED actions, more Fed members talk rate hikes, NZ housing market shows signs of cooling. US House of Representatives approves $400bn support package for Ukraine as US intelligence chief talks of Putin preparing for “long war”. * USDIndex remains under 104.00 but holds its bid trading at 103.75 now. * Equities – USA500 +9.81 (0.25%) at 4001.05, US500FUTS at 4015 now. Peloton -8.7% @ $12.70 (ATH was $171), COIN -12.6%, TSLA +1.64%, TWTR -1.64% (Musk would allow TRUMP back). APPLE (+1.61%) retired the iPod after 21 years. * Yields cooled -10-yr closed at 2.993%, below key 3.00% level. Trades down over 1.5% today at 2.98%. Oil & Gold both had weak & volatile sessions – USOil tested down to $98.00 before reversing to $102.20 Gold slumped from $1865 to $1830 earlier and struggles at $1845 now. No safe-haven bid. * Bitcoin languishes at $31K now, over 50% down from ATH and -35% YTD * FX markets – EURUSD up from 1.0500 to 1.0545, USDJPY holds over 130.00, at 130.25 and Cable continues to struggle at 1.2335. AUD outperformed in Asia. Overnight – CHINA CPI & PPI hotter than expected, (2.1% vs 1.5% & 8.0% vs 7.8%) respectively. JPY leading Indicators better than expected & German M/M CPI in-line at 0.8%. ECB’s Müller: Appropriate to raise rates into positive territory by year-end. Fed’s Waller & Mester more hawkish. (Mester talked of going beyond neutral) Today – US CPI, Speeches from Fed’s Bostic, ECB’s Lagarde, Schnabel, Elderson, de Cos, Centeno, Vasle & Muller. Earnings from Ubisoft, Siemens Energy, Poste Italiane, E.ON, Continental, ITV, Compass & Beyond Meat.  Biggest FX Mover @ (06:30 GMT) AUDUSD (+0.42%) Rallied from lows at 0.6910 yesterday to 0.6970 now, next resistance 0.6980 and 0.7000 today. MAs aligning higher, MACD signal line & histogram moving higher & testing 0 line, RSI 56 & rising, H1 ATR 0.0016, Daily ATR 0.011. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

Head Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 12, 2022, 06:20:19 PM |

|

Date : 12th May 2022.Market Update – May 12 – Tech Trounced as Inflation Possibly Peaks. Trading Leveraged Products is risky USD rallies to new highs following much volatility after US CPI data for April was lower than March but higher than expected, rekindling concern that aggressive central bank action will weigh on growth. Stocks sharply into the red, Yields spiked sharply higher as talk of Treasury rout also cools with 10-yr back under 3.00%. Oil jumped after Russia sanctioned 31 companies & on recession fears. Gold slightly up, but holds below $1860. Bitcoin tumbled to new 16-month low. UK economy shrinks in March, grows 0.8% in Q1. Nomura estimated this week that 41 Chinese cities are in full or partial lockdowns, making up 30% of the country’s GDP. Reuters: “Property developer Sunac China missed a bond interest payment and will miss more as China’s real estate sector remains in the grip of a credit crunch.” New Zealand inflation survey steady. * USDIndex spiked to 104.20 & holds its bid trading at 104 now. * Equities – USA500 slid below the 4000 level before bouncing back, into the green with the USA30. But all of the indexes crashed into the close, paced by the USA100’s -3.18% plunge. Nikkei dropped 1.8%, the ASX also -1.8%. * Yields had jumped to 2.839% and 3.07%, respectively, in the immediate aftermath of the data. 10-year rate closed 6.5 bps lower at 2.920%, with the 2-year up 3 bps to 2.64%. * Oil breached $106.23 before reversing to $103.46 (PP of the day). * Bitcoin fire-sale of risky assets as rate hikes gather steam, fell 7% to $26,673. * FX markets – EURUSD down to 1.0489, USDJPY drifted further on EU open to 129.25, & Cable retests 1.2210. AUD & NZD at 2 year lows. Today – US PPI & Initial Claims, Speeches from BOC Gravelle.  Biggest FX Mover @ (06:30 GMT) ETHUSD (-12.47%) Down to June 2021 low, at 1787. MAs aligning lower, MACD signal line & histogram extend lower, RSI 27 OS, H1 ATR 90.59, Daily ATR 236.65. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 13, 2022, 05:49:02 PM |

|

Date : 13th May 2022.Market Update – May 13 – USD dominates, Stocks lick their wounds. Trading Leveraged Products is risky USD holds at highs following hot CPI & PPI data but with signs the peak may have been reached. Stocks stalled their recent declines, closing flat in the US and bouncing in Asian markets (Nikkei +2.6%), Yields climbed as risk appetite improved, Fed Chair Powell still flagged half-percentage point interest rate increases at the next two policy meetings, adding that the Fed is “prepared to do more!” and that stable prices are the “bedrock” of the economy but it will cause “some pain”. Oil continued to rally on supply concerns whilst Gold dipped to within $10 of $1800. Kuroda maintains dovish guidance even as Inflation moves higher, Russia threatens “technical retaliation” as Finland seeks NATO membership, Sweden to follow? Putin “humiliating himself on the world stage” – UK Foreign Sec. Truss. * USDIndex rallied to within 5 ticks of 105.00 and remains at 20-year highs at 104.75 up from 103.60 last Friday. * Equities – USA500 -5.10 (0.25%) at 3930, US500FUTS at 3955 now. COIN +8.9%, TSLA -0.82%, (Musk would not back TRUMP in 2024). APPLE -2.69%, GM -4.59%. * Yields rallied, 10-yr closed at 2.817%, significantly below key 3.00% level. Trades up at 2.89% * Oil & Gold both had weak & volatile sessions – USOil rallied to test $108.00 earlier today from $98.00 on Wednesday. Gold slump continued with a test of $1810 on open today from highs this week at $1885, struggles at $1822 now. No safe-haven bid. * Bitcoin languishes at $30K now, but up from $26.5k. 6th consecutive week lower. * FX markets – EURUSD up from 1.0355 to 1.0400, parity calls rising. USDJPY dived from 130.00, to 127.50 yesterday now back to 128.70 and Cable continues to struggle at 1.2335. AUD again outperformed in Asia. Overnight – JPY Money Supply better than expected & French M/M CPI in-line at 0.4%. Today – US Export/Imports Prices, UoM (Prelim.) data, Speeches from ECB’s Schnabel, de Guindos & Fed’s Kashkari.  Biggest FX Mover @ (06:30 GMT) AUDJPY (+0.74%) Rallied from lows at 87.30 yesterday as risk appetite raised it’s head to 89.00 ( and next resistance) earlier. Now back to 88.55. MAs aligning higher, MACD signal line & histogram moving higher & testing 0 line, RSI 48 & rising, H1 ATR 0.346, Daily ATR 1.67. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 23, 2022, 04:55:29 PM |

|

Date : 23rd May 2022.Market Update – May 23 – USD Dips, Stocks Pressured, Futures Higher. Trading Leveraged Products is risky USD slipped again, Stocks had a torrid day on Friday, but recovered in final hour, Bear market talk dominated weekend press. Asian markets rose, and US Futures up 1.6% after improvements in Shanghai covid news as isolation times were reduced, but record cases in Beijing. Biden in Tokyo, offered olive branch to Kim, says US recession “not inevitable” and is willing to us force to defend Taiwan. AUD & NZD rally on new Aussie PM. * USDIndex down to 12-day low at 102.6 and 5th down day of last seven. * Equities – USA500 0.57 (0.005%) at 3901, US500FUTS at 3952 now. * Yields down 10-yr closed at 2.788%, now up at 2.79% Oil & Gold both had positive sessions – USOil rallied to test $110.00 earlier today from $103.50 on Thursday. Gold holds $1850 today from lows at $1788 last week. * Bitcoin rotates through $30K – Lagarde says crypto assets are ‘worth nothing.’ * FX markets – EURUSD up from 1.0355 to 1.0600, parity calls falling. USDJPY under 128.00, and Cable back to 1.2570. AUD again outperformed in Asia. Overnight – GBP House Prices hotter than expected & RBA’s Kent says the Bank’s estimate of the neutral rate is 2 to 3%. Today – German Ifo Survey, Speeches from BOE’s Bailey ECB’s Villeroy & Fed’s Bostic.  Biggest FX Mover @ (06:30 GMT) AUDUSD (+1.20%) Rallied from lows at 0.7000 on Friday to 0.7125 today, following new labor PM’s election. MAs aligning higher, MACD signal line & histogram moving higher line, RSI 70, OB & rising, H1 ATR 0.0020, Daily ATR 0.0111. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 24, 2022, 09:28:00 AM |

|

Date : 24th May 2022.Market Update – May 24 – Bear Market Rally? Trading Leveraged Products is risky USD slipped again (USDIndex down a whole big number), Stocks rallied as Euro moved higher on rate hike expectations, Asian markets fell (Nikkei -0.97%) after Snap’s profit warning and US Futures are lower. Shanghai & Beijing tightening Covid rules, Biden no change to Taiwan policy, Ukraine is a global issue prodding neutral countries. Zelenskiy says he would meet with Putin to end the war. * USDIndex down to 102.00 and 6th down day of last eight. * Equities – USA500 72 (1.86%) at 3973, US500FUTS at 3914 now. * Yields down, 10-yr closed at 2.83%, now up 2.87% * Oil & Gold both had negative sessions – USOil down to test $108.75 Gold holds $1850 today, down from 1864. * Bitcoin rotates through $30K – but under today at 29.8k. * FX markets – EURUSD up to test 1.0700, parity calls falling. USDJPY under 128.00, at 127.55, Cable up to 1.2580. AUD under performed in Asia. Overnight – JPY & AUD PMIs miss, NZD retail sales miss and hotter JPY Tokyo CPI all weighed. Eurozone PMIs disappointed. The German composite PMI unexpectedly improved, but that wasn’t enough to lift the overall Eurozone numbers. The S&P Global Composite PMI dropped to 54.9 from 55.8, with both manufacturing and services readings coming in weaker than anticipated and flagging a renewed deceleration in the pace of expansion. The recovery continues, but at a slower pace and with the balance of risks still tilted to the downside, thanks to the threat of cut off gas deliveries from Russia. Today – EZ, UK & US Flash PMIs, US ISM Semi-annual Economic Forecast, Speeches from Fed’s Powell, ECB’s Lagarde & Villeroy.  Biggest FX Mover @ (06:30 GMT) NZDJPY (-1.20%) Drifted to 81.79 from 82.80 highs. MAs aligning lower, MACD histogram turned negative however signal line remains above 0, RSI 29, OS & falling, H1 ATR 0.00208, Daily ATR 0.01413. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 25, 2022, 06:02:41 PM |

|

Date : 25th May 2022.Market Update – May 25 – Stocks Volatile, USD Stable, NZD Surges. Trading Leveraged Products is risky USD slipped again, but is stable today (USDIndex 102.00), weak global PMI data & US data missed and Powell adding to rate hike expectations meant Stocks had another volatile session (SNAP lost -43%, and other big tech stocks hit NASDAQ -2.35%) Yields down as treasuries firmed. Asian markets mixed (Nikkei -0.26%) RBNZ raised by 50bps & Gov. Orr had more hawkish outlook than expected (rates to 4%?) NZD surged. NK tested a range of missiles as Biden left Asia, Zelenskiy says Donbas situation critical. * USDIndex down to 101.64 yesterday back to 102.00 * Equities – USA500 -32 (0.81%) at 3941, US500FUTS at 3962 now. Snap lead some huge declines. Yields down, 10-yr closed at 2.76%, now 2.77% * Oil & Gold both had positive sessions – USOil back up to test $111 Gold holds $1860 today, down from $1870. * Bitcoin rotates through $30K – but under today at $29.8k. * FX markets – EURUSD up to test 1.0750, holds 1.0700, USDJPY down to 127.00, Cable up to 1.2540. NZD off 5-week low at 0.6515 Overnight – Hawkish RBNZ, German Gfk missed, French Consumer Confidence missed. Today US Durable Goods, FOMC Minutes, ECB Financial Stability Review, Speeches from ECB’s Lagarde, Lane, Panetta, Fed’s Brainard. Today – US Durable Goods, FOMC Minutes, ECB Financial Stability Review, Speeches from ECB’s Lagarde, Lane, Panetta, Fed’s Brainard.  Biggest FX Mover @ (06:30 GMT) EURNZD (-1.02%) Tanked from 1.6650 to 1.6425 on Hawkish RBNZ. MAs aligning lower, MACD histogram turned negative crashing signal line RSI 29, OS & falling, H1 ATR 0.0043, Daily ATR 0.01413. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 26, 2022, 08:53:47 AM |

|

Date : 26th May 2022.Market Update – May 26 – FOMC 100bp by July, USD Stable. Trading Leveraged Products is risky USD stable today (USDIndex holds 102.00) following FOMC minutes that showed agreement by “most participants” that 50 bp hikes in June & July would “likely be appropriate”, Stocks had a positive session (NASDAQ +1.50%) and Yields ticked up as treasuries slipped. Asian markets mixed (Nikkei -0.27%) Shanghai reopening gradually (Port is 95% operational & schools from June 6). * USDIndex rotates at 102.00 *Equities – USA500 +37 (0.95%) at 3978, US500FUTS at 3967 now. NVDA +5% at close but lowered outlook following Earnings announcement, -6.82% after hours. Yields 10-year yield edged up to 2.781% and the policy-sensitive two-year yield was flat at 2.502%. *Oil & Gold had mixed sessions – USOil steady after a cautious rally this week back up to $110, Gold is weaker – broke below $1850, down to $1846. *Bitcoin rotates under $30K – at $29.6k, having touched $28.6k yesterday. *FX markets – EURUSD up to test 1.0670, breach of 1.0700 limited, USDJPY back over 127.00, at 127.25 Cable up to 1.2550. Overnight – RBNZ Orr – will move on rates quickly, JPY PPI beats at 1.7% vs 1.5%, World Bank says Russian invasion of Ukraine could cause “global recession”. Today Today – US GDP (2nd), US IJC, Canadian Retail Sales, UK Chancellor Sunak, Fed’s Brainard. Earnings from Alibaba, Baidu. Ascension Day holidays – Germany, France, Switzerland, Denmark, Sweden, & Norway all closed.  Biggest FX Mover @ (06:30 GMT) EURNZD (-1.02%) Tanked from 1.6650 to 1.6425 on Hawkish RBNZ. MAs aligning lower, MACD histogram turned negative crashing signal line RSI 29, OS & falling, H1 ATR 0.0043, Daily ATR 0.01413. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 27, 2022, 05:24:34 PM |

|

Date : 27th May 2022.Market Update – May 27 – USD 1-month low, Stocks Rally, Yields Ease. Trading Leveraged Products is risky USD sinks to 1-month low (USDIndex 101.43) as CB easing pressures absorbed, despite GDP slipping to -1.5% from -1.3% & Pending Home sales at -3.9% from -1.6%. Stocks had a very strong day on weaker USD (NASDAQ +2.68%) and Yields slipped. Asian markets followed US lead (Nikkei +0.66%, Hang Seng +2.07%) and European FUTS are higher. BOJ’s Kuroda & PM Kishida, talk up YEN and want it stabilized, see core CPI at 2% for next 12-months. * USDIndex sinks further to 4-week lows trades at 101.55. (-1.5% this week, after -1.37% last week) * Equities – USA500 +79 (1.99%) at 4057, US500FUTS at 4050 now. Discount Retailers lead markets higher on good Earnings – Dollar Tree +21.87%, Macy’s +19%, Dollar General +13% TSLA +7% NVDA +5% * Yields 10-year yield edged lower to 2.75% at close and trades at 2.76% now. * Oil & Gold had mixed sessions – USOil rallied after a cautious week back to test over $114, trades at $13.70 now, Gold is holding over $1850 at $1854. * Bitcoin continues to weaken under $30K at $28.6k, having touched $27.9k yesterday. * FX markets – EURUSD up to test 1.0750, breaching 1.0700 again, USDJPY capped under 127.00, having tested 126.50 Cable to 1.2625, from 1.2540 yesterday. Overnight – JPY – Tokyo Core CPI in line, (1.9%) AUD Retail Sales in line (0.9%) Today US PCE Price Index, Personal Income & Consumption, Speech from ECB’s Lane.  Biggest FX Mover @ (06:30 GMT) NZDUSD (+0.51%) gave up yesterday’s declines to 0.6450 and retook 0.6500 today, trades at 0.6512 (16-day high). MAs aligning higher, MACD histogram positive & holds 0 line, RSI 65 & rising, H1 ATR 0.0010, Daily ATR 0.0077. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 30, 2022, 10:05:52 AM |

|

Date : 30th May 2022.Market Update – May 30 – Month-end Rebalancing. Trading Leveraged Products is risky Risk appetite continued to surge with Wall Street closing sharply higher on Friday ahead of the long Memorial Day weekend. Worries that an aggressive FOMC policy posture with officials intent on destroying growth to curb inflation have been dissipating. USD down from Friday’s highs (USDIndex 101.39) as Fed bets ease. Today, Stocks had a very strong start to the day as concern over aggressive tightening in the US and China’s virus lockdowns eased somewhat. (NASDAQ +1.4%, Nikkei +2.2%). Shanghai said on Sunday “unreasonable” curbs on businesses will be removed from June 1, while Beijing reopened parts of its public transport as well as some malls. US markets will remain closed for a holiday today, but across the Eurozone Yields are rising as confidence improves and the German 10-year has lifted 4.7 bp to 1.00% in early trade. The Swedish economy contracted -0.8% q/q in Q1, a much weaker than expected result. Spanish HICP inflation hit 8.5% in May, and German import price inflation came in at 31.7% in April readings, up from 31.2% y/y. * USDIndex extends declines and trades at 101.39. Chair Powell confirming that a 75 bp hike is not on the table for now has helped stabilize investor sentiment and encourage bargain hunters. * Equities – Nikkei up 1.8% at 27,263.37, a level not seen since April 21, Topix was up 1.59% at 1,916.88. Shares of shipping firms such as ISHIP.T fell 4.3 which was the worst performer. GER40 and UK100 are up 0.9% and 0.4%. * Yields – German 10-year has lifted 4.7 bp to 1.00% in early trade. * Oil & Gold up – USOil rallied to $115.80, and Gold retested the $1863 barrier, holding over $1850 at $1854. Markets waited to see if the European Union would reach an agreement on banning Russian oil ahead of a meeting on a sixth package of sanctions against Moscow for its invasion of Ukraine. * Bitcoin holds on the back foot – below 31K. * FX markets – EURUSD up to test 1.0770, USDJPY retests up to 127.34, Cable pull back to 1.2634 from 1.2656 this morning. Today German HICP, Fed’s Waller speech, New Zealand building permits and Japanese labor data and retail trade.  Biggest FX Mover @ (08:00 GMT) CADCHF (+0.39%) jumped to 0.7550 on EU open, and retook a place above the 50-day SMA. In the 1-hour chart, MAs aligning higher, MACD histogram positive & holds 0 line, RSI 64 & rising, H1 ATR 0.00099, Daily ATR 0.00747. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Andria Pichidi

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

May 31, 2022, 09:16:19 PM |

|

Date : 31st May 2022.Market Update – May 31. Trading Leveraged Products is risky Stock markets traded mixed. Overnight Chinese data showed a slowdown in the pace of contraction in the manufacturing sector. Beijing’s new policy support, which includes cash handouts for hiring graduates and support for internet companies’ offshore listings, supported the sentiment a bit. In the rest of the world though, inflation jitters returned and yields spiked, with Australia’s 10-year up 8.5 bp and the German Bund yield lifting 1.0 bp to 1.06%. US Dollar stabilized as Treasury yields spiked. European open: Swiss economy stronger than expected at the start of the year. Official GDP numbers beat expectations and showed a quarterly growth rate of 0.5% q/q up from 0.3% q/q in Q4 last year. Services were still held back at the start of the quarter by virus restrictions, and the impact of Russia’s invasion of Ukraine won’t show in these numbers yet. SNB head Jordan warned that the fallout from the war and sanctions against Russia could mean stagflation risks globally, but still, with these numbers, the SNB’s negative interest rate environment will also be challenged. * USDIndex recovered slightly to 101.79. * Equities – Nikkei and ASX meanwhile closed with losses of -0.3% and -1.0% respectively as inflation jitters returned and yields spiked. GER40 and UK100 up 0.9% and 0.4%. * Yields – US 10-year rate has jumped 9.4 bp to 2.83% as markets return from yesterday’s holiday. * Oil – USOil spiked to $119.20 per barrel as demand expectations pick up and EU leaders agreed a partial ban on Russian oil. * Bitcoin extended gains above 20-day SMA for the first time since April 7. * FX markets – USDJPY lifted to 127.33, EURUSD down to 1.0734, Cable below the 1.26 mark. Today GDP from Switzerland and Canada for Q1, German unemployment, Eurozone HICP. US housing index, Chicago index and Consumer Confidence. The Biden-Powell meeting is also on tap.  Biggest FX Mover @ (08:00 GMT) EURUSD (-0.39%) declined to 1.0730 due to USD strength. MAs aligning lower, MACD histogram zeroed, RSI 35 & falling, H1 ATR 0.00117, Daily ATR 0.00942. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Andria Pichidi

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 01, 2022, 06:10:04 PM |

|

Date : 1st June 2022.Market Update – June 01 – European stocks advance despite data. Trading Leveraged Products is risky Wall Street was generally lower, but off its worst levels. Bond and stock bears returned refreshed from the Memorial Day holiday and got right to work, pushing Treasury yields higher and Wall Street lower. Treasuries underperformed globally after comments from Fed Governor Waller on Monday where he supported several more 50 bp rate hikes to curb inflation. Additionally, record high Eurozone inflation and hawkish ECB speak from Villeroy and Visco added to the concerns over central bank tightening. US data were mixed with ongoing record strength in home prices but worsening in consumer sentiment. Today, European stock futures are advancing as Bunds move higher at the open, despite the plunge in German retail sales data at the start of the session, which flagged the impact of rising inflation on consumption trends. Overnight: President Biden stressed he would not interfere with the Fed’s independence, in comments after meeting with Chair Powell and Treasury Secretary Yellen. Biden said his plan to address inflation “starts with a simple proposition, respect the Fed’s independence.” He also said Powell has noted he has a “laser focus on addressing inflation.” So as expected this was largely a photo op for the president as he tried to assure that he and Chair Powell are addressing inflation. * USDIndex at 101.97, after 102.17 highs. The buck found renewed strength after comments from Fed Governor Waller who said on Monday, he favored several more half point rate hikes until the inflation rate is brought back toward the 2% target. * Equities – The USA30 and USA500 closed down -0.67% and -0.63%, respectively, while the USA100 fell -0.41%. DAX and FTSE 100 futures are posting gains of 0.43% and 0.36%. * Yields – 10-year rate spiked 13 bps to a high of 2.88%, and the 2-year climbed 10 bps to test 2.58%. * Oil – USOil drifted to 114.05 from 120.45. Oil prices rallied on the economic hopes and news the EU would ban some Russian imports, but then collapsed into the close on reports OPEC+ was considering exempting Russia from production quotas, thus opening the door for increased output from the likes of Saudi and UAE. * Bitcoin steady at 31,550. * FX markets – USDJPY spiked to 129.35, with EURUSD at 1.0716, and GBPUSD has dropped below 1.2600, although Sterling is nudging higher against the EUR. Today Eurozone unemployment rate, ECB Lagarde speech, ISM Manufacturing Index & PMI, BOC Rate Decision and Statement and lots of Fed speeches.  Biggest FX Mover @ (08:00 GMT) XAUUSD (-0.70%) broke the 20- and 200-day SMA. Intraday MAs flattened, MACD histogram & signal line well below 0, RSI 34 but flattening, H1 ATR 3.16, Daily ATR 21.92. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Andria Pichidi

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 02, 2022, 09:42:07 AM |

|

Date : 2nd June 2022.Market Update – June 2 – USD Ticks Higher, Stocks Slip Yields Firmer. Trading Leveraged Products is risky USD moved higher (USDIndex 102.43) Stocks had a weak US session (NASDAQ -0.72%) and Yields rallied to 2.931%. Asian markets followed US lower (Nikkei -0.16%, Hang Seng -1.10%) with China closed today. European FUTS are lower (Italy, Spain & France closed & UK closed until Monday). Central bank outlooks and China’s virus lockdowns remain in focus (Shanghai open but zero policy still in place) amid concern that aggressive monetary policy tightening will weigh on growth outlook. BOC increased rates by 50bp & Bullard remained very hawkish, both expected. Oil prices bounced ahead of OPEC+ today – Saudi Arabia ready to boost output should Russian production fall. * USDIndex rallied to 102.72 from 101.28 & one-month lows on Monday. Back to 102.40 now. * Equities – USA500 -31 (-0.75%) at 4101, US500FUTS at 4100 now. Walmart & Meta -2.49% (Sheryl Sandberg to leave Meta after 14 yrs as COO) * Yields 10-year yield higher (2.931% at close), trades at 2.91% now. Oil & Gold had mixed sessions – USOil sank to $111.60 before correcting to $113 now following SA news ahead of OPEC+ meeting, Gold rallied over $1850 to $1852 from $1830 yesterday. * Bitcoin slipped back under $30K after 3-day move north. Trades at $29.8K now. * FX markets – EURUSD down under 1.0700 again to 1.0670, USDJPY breaks over 130.00, Cable trades at 1.2500, from 1.2450 yesterday. Overnight – AUD Trade Balance significantly better than expected. Today ADP Employment, Weekly Claims, Weekly Oil Inventories, OPEC+ Meeting, Speeches from Mester & NY Fed’s Logan.  Biggest FX Mover @ (06:30 GMT) USDCHF (-0.54%) A surprise spike in Swiss CPI puts pressure on SNB to act. Pair dived from 0.9640 to 0.9575. MAs aligning lower, MACD histogram negative & breaks 0 line, RSI 35 & falling, H1 ATR 0.0013, Daily ATR 0.0070. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

Head HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 03, 2022, 08:32:10 PM |

|

Date : 3rd June 2022.Market Update – June 3 – Wild Swings Continued. Trading Leveraged Products is risky Trading is rather directionless this morning in the lead up to the jobs data. USD moved lower (USDIndex 101.70). Stocks extended gains overnight (NASDAQ +2.69%) and Treasuries bounced from red to green and back again. Asian markets managed pretty broad gains, with tech stocks still outperforming after they led yesterday’s rally on Wall Street (Nikkei +1.2%, ASX +0.9%) with China & HK closed today. European FUTS are lower (Italy, Spain & France closed & UK closed until Monday). Treasury announced a $96 bln package of coupon auctions for next week. Yesterday’s data showed strength in jobless claims and weakness in ADP private payrolls and factory orders. * USDIndex pulled back to 101.70, reverting all the gains from Wednesday. * Equities – USA500 (+1.84%) at 4189, while the USA30 was 1.33% firmer. The GER40 future is up 0.8% while US futures are looking more cautious as key US payroll numbers come into view. * Yields 10-year rate was up 0.5 bps to 2.91%, with the 2-year 0.2 bps lower at 2.64%. * Oil – USOil spiked to $116.27 before correcting to $114.60 now, following the bullish EIA inventory report that overshadowed the boost in production announced by OPEC+ in July and August, only to tumble on reports OPEC+ was considering excluding Russia from production quotas which suggested increased output from Saudi and the UAE to make up for the loss. * Gold rallied to $1874. * Bitcoin back above $30k. * FX markets – USDIndex is slightly lower, EURUSD managed to move up to 1.0755, USDJPY is still holding close to 130.00, Cable is at 1.2574. NOTE: NFP is unlikely to make any difference in terms of the Fed – but the labor market into Q3 will be an important determinant for the FOMC. Meanwhile, the markets continue to vacillate on risk-on, risk-off flows, and waver on inflation/growth uncertainties, as well as the outlook for the responses from key central banks, while volatility in energy and the ongoing distortions from supply chains also continue to impact. Today EU Retail Sales, US NFP, ISM Services PMI and Speech from Biden.  Biggest FX Mover @ (06:30 GMT) Cocoa (-1.55%) dipped to 50-period SMA at 2470 from 2537. MAs aligning lower, MACD lines decline but hold above 0, RSI 46 but pointing higher, H1 ATR 19.07, Daily ATR 51.92. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Andria Pichidi

HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 06, 2022, 09:53:07 AM |

|

Date : 6th June 2022.Market Update – June 6 – USD & Stocks steady inflation worries still loom. Trading Leveraged Products is risky USD remained steady (USDIndex 102.10) Stocks recover a tad from Friday’s post NFP sell off (NASDAQ -2.47%) and Yields also hold onto gains (2.957%). Asian markets mixed in thin trading today (AUD & NZD closed along with many EZ countries). Central bank outlooks, China’s virus lockdowns and inflation data remain in focus – NFP showed a tight jobs market and Earnings holding up, so FED may need to act again in September, Saudi Arabia has increased oil prices & US will allow two companies to import Venezuelan oil into Europe. Musk predicted a gloomy US economy (following Dimon’s comments) and suggested TESLA needed to shrink its workforce by 10% (only to then withdraw the comment), US to pause, for 24mths, tariffs on Solar Panel imports, Kuroda “Japan will not tighten monetary policy”. * USDIndex rallied to 102.25, back to 102.00 now. * Equities – USA500 -68 (–1.63%) at 4108, US500FUTS at 4131 now. Worries about a more aggressive FEd during the Autumn weighed on stocks. * Yields 10-year yield higher (2.957% at close), trades at 2.950% now. * Oil & Gold had mixed sessions – USOil rallied to $120.86 following Saudi news before slipping under $120, Gold sank from over $1874 on Friday to $1852 now. * Bitcoin rallied from under $30K on Friday to trade at $31.2K now. * FX markets – EURUSD under 1.0725 again, USDJPY tested 131.00 brand holds 130.50, Cable trades over 1.2500, a no confidence vote in PM Johnson will take place later today by his own elected MPs. Overnight CNY Caixin Services PMI missed significantly 41.4 vs. 46.1. Today A light calendar with Holiday Closures in many parts of Europe and no econ. news scheduled for NA session. All eyes on RBA, ECB & US CPI data later this week.  Biggest FX Mover @ (06:30 GMT) GBPAUD (-0.44%). Rallies from sub 1.7300 on Friday to 1.7400 today following Johnson news. MAs aligning higher, MACD histogram positive & breaks 0 line, RSI 65 & rising, H1 ATR 0.0024, Daily ATR 0.0050. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

Head HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 07, 2022, 04:32:58 PM |

|

Date : 7th June 2022.Market Update – June 7 – RBA Surprises, Yields Rocket, Yen Dives. Trading Leveraged Products is risky USD moved higher (USDIndex 102.78), Stocks also higher into close (NASDAQ 0.40%) but Futures rocked (-0.60%) by a surprise 50 bps hike from the RBA (25-40 bp expected) and noises that there will be more to come. Yields rallied (US 10yr over 3.00%), Asian markets have mostly slipped, (Nikkei +0.10%) and YEN has tanked (USDJPY at new 20-year high). UK PM Johnson survives no confidence vote (211 vs 118) 41.2% of his own MPs want him out UK Gilts rally GBP sinks. Oil slips but holds on to gains, Gold pressured by rising yields. * USDIndex rallied to 102.82 ahead of ECB on Thursday & US CPI on Friday. * Equities – USA500 -12 (-0.31%) at 4121, US500FUTS at 4096 now. More worries, following aggressive RBA, TWTR -1.5% after MUSK suggested he could walk away from the deal, AMZN +2% after 20 for 1 stock split. DIDI +23% & BABA +6%, Chinese regulators are reported to have concluded DIDI investigation. * Yields 10-year yield higher (2.987% at close), trades at 3.064% now. * Oil & Gold had weaker sessions – USOil slipped from $120.00 handle to $119.36, Gold sank as Yields rallied from over $1858 to $1840 now. * Bitcoin rally over $30K was short lived, from $31.8K yesterday to trade at $29.4K now. * FX markets – EURUSD at 1.0680, under 1.0700 again, USDJPY tested 133.00 zone and holds 132.60, Cable trades down at 1.2430,following political upheaval in UK. Overnight Mixed data from Japan, Weak UK Housing data and German factory orders missed significantly (-2.7% vs -0.4%). Today UK Composite/Services PMI (Final), Canadian Trade Balance.  Biggest FX Mover @ (06:30 GMT) USDJPY (+0.67%). Rallies to new 20-yr highs and within a smidge of 133.00 from sub 130.00 on Friday. Next key resistance 134.00 form the Weekly Chart. MAs aligning higher, MACD histogram positive, RSI 77, OB & rising, H1 ATR 0.233, Daily ATR 1.18. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

Head HF Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 08, 2022, 05:52:21 PM |

|

Date : 8th June 2022.Market Update – June 8 – Wait & See Mode Ahead of US Inflation. Trading Leveraged Products is risky USD moved lower at close but is currently retaking the 102.50 level. Stocks also higher into close (NASDAQ over 1%) on retailers and energy stocks, Yields cooled (10yr below 3%), Oil rallied over 1% to 13-week high on tight supply from private inventories. Yellen persistent high inflation “Unacceptable”. Demand for the safety of Treasuries picked up after the World Bank slashed its global growth forecast by nearly a third to 2.9% for 2022, warning that Russia’s invasion of Ukraine has compounded the damage from the COVID-19 pandemic, and many countries now face recession. In Asia, a rally in Chinese tech stocks that followed a batch of game approvals helped to keep stock market sentiment supported overnight, and the Hang Seng has gained nearly 2% so far. The CSI 300 is up 0.4%, while ASX and Nikkei lifted 0.4% and 1.0% respectively. Overnight – JPY GDP beat (-0.1% vs. -0.3%) & Economic Watchers Sentiment better (54.0 vs 51.9), CHF Unemployment in line (2.2%) but German Industrial Production missed significantly (0.7% vs 1.3%). * USDIndex dipped to 102.24 after Target Corp warned about excess inventory and said it would cut prices, offering some relief to those who think inflation may be peaking. * Equities – CSI 300 is up 0.4%, while ASX and Nikkei lifted 0.4% and 1.0% respectively. GER40 and UK100 futures are posting gains of 0.3% and 0.2% respectively. * Yields 10-year yield below the 3% mark helped extend the drop in yields. * USOIL spiked to $120.35 – low oil inventories, Goldman Sacks – “we now forecast that Brent prices will need to average $135/bbl in 2H22-1H23 (up $10/bbl vs. prior forecast) for inventories to finally normalize by late 2023, the binding constraint to prices in our view. This represents summer retail prices reaching levels normally associated with $160/bbl crude prices”. The CEO of global commodities trader Trafigura said oil prices could soon hit $150 a barrel and go higher this year, with demand destruction likely by the end of the year. * Bitcoin down to $30320 area now. * FX markets – USD is continuing its ascent and USDJPY is above 133.53. EURUSD is slightly below 1.07 and Cable is at 1.2560. Today EU GDP and Employment change, US Wholesale Inventories and EIA Crude Oil Stocks change.  Biggest FX Mover @ (06:30 GMT) Sugar (-3%). Dipped below 20- and 50-day SMA. Next key support at 18.60 from the Weekly Chart. H1 MAs aligning lower, MACD histogram sharply down, RSI 24, OS & declining, H1 ATR 0.12, Daily ATR 0.38. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 09, 2022, 10:07:46 PM |

|

Date : 9th June 2022.Market Update – June 9 – European Futures Down Ahead of ECB. Trading Leveraged Products is risky USDIndex steady at 102.50 but overall USD on bid. Stocks traded mostly lower, with China bourses hit by news suggesting that virus restrictions in part of Shanghai are already being tightened again amid a rise in case numbers, shortly after Covid lockdowns were lifted. Shanghai will lock down the Minhang district on Saturday morning for mass COVID-19 testing, according to Bloomberg. Hang Seng -0.9%, US stocks closed down over 1% (INTEL -5.28%), Yields back up (10-yr over 3% again), JPY pressured, Brent & WTI rose over 2.5% on tight supply and China opening up. Yellen says some China tariffs still warranted. Bonds are under pressure, with a 6 bp jump in Australia leading the way overnight. Overnight – China trade surplus widened as exports rebound. * USDIndex dipped to 102.24. * Equities – Hang Seng and CSI300 are currently down -0.9% and -0.8% respectively. JPN225 moved sideways, but the ASX lost 1.5%. GER40 and UK100 are both down -0.6% and US futures are also in the red. USA500 finished off -1.08%, while the USA30 was off -0.81% and the USA100 was -0.73% lower. * Intel rethinks near-term spending plans amid economic uncertainty – freezes some hiring. * Yields 10-year rose over 6 bps to test 3.045%. The 2-year was 4 bps higher at 2.77%. The 10-year Bund yield is up 0.4 bp at 1.35%. * USOIL up to $123.13 after stronger-than-expected Chinese exports in May, but found a ceiling amid new Shanghai lockdown restrictions. Gold weaker again below 1850. * NATGAS futures jump 25% this morning on US LNG outage. * FX markets – Yen found some support in the near term. USDJPY is above 133.90. EURUSD found some buyers ahead of the ECB meeting, leaving EURUSD at 1.0712, while Cable dropped to 1.2516 and Sterling also declined against the EUR. Turkish lira slid to beyond 17.2. Today ECB Rate Decision and Statement and US jobless claims. ECB Preview: Markets are eagerly awaiting today’s press conference. Rate settings are expected to be held steady for now, and while there are some members who see the urgency to act sooner rather than later as inflation goes through the roof, the ECB’s timetable for the phasing out of stimulus effectively excludes a move on rates this week. Net asset purchases need to end first and Lagarde is expected to confirm that this will happen early in July, which would pave the way for a rate hike in July. Lagarde has already mapped out two moves in July and September and the basic scenario is for “gradual” 25 bp steps, although the discussion on a bolder kick off with a 50 bp boost in July has already started. We suspect that Lagarde will stick with a focus on “gradualism” for now. But she will not rule out a 50 bp step as the need to maintain credibility and assert the Bank’s commitment to price stability and the 2% inflation target seem increasingly urgent.  Biggest Mover @ (06:30 GMT) Platinum (-1.92%). Next key support at 970.00. H1 MAs aligning lower, MACD histogram sharply down, RSI 28, OS & declining, H1 ATR 3.91, Daily ATR 24.51. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Andria Pichidi

Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 10, 2022, 04:15:55 PM |

|

Date : 10th June 2022.Market Update – June 10 – Stocks Tank & Yields Rise ahead of US CPI. Trading Leveraged Products is risky USD moved higher (USDIndex 103.10), Stocks TANKED into close (NASDAQ -2.75%, Dow -600 pts & S&P close to -100 pts) Futures steady. ECB cut growth and raised inflation forecasts, confirmed end of PEPP and 25bp rate hike in July (some wanted 50bp) & 25bp in Sept. (the caution weighed on EUR). Yields rallied (US 5yr & 10yr back over 3.00%, 2yr at 2.84%), Asian markets have mostly slipped, (Nikkei -1.49%). Yellen inflation a serious problem “what I am focused on”. Goldmans & Deutsche now expect 2 x 50bp hikes from ECB in Sept & Oct and RTS poll sees the same from FED (bring it to 4 x 50bp hikes). Oil slips but holds on to gains, Gold remains pressured by rising yields. NZD bid overnight.  * * USDIndex rallied to 103.33 apost ECB and ahead of US CPI today. * Equities – USA500 -98 (-2.38%) at 4017, US500FUTS at 4025 now. AMZN –4% BABA +-8.13%, NFLX -4.96%, APPL -3.60% GOOGL -2%, MRNA -9.76% * Yields 10-year yield higher (3.064% at close), trades at 3.055% now. * Oil & Gold had weaker sessions – USOil slipped but holds over $120.00 handle, Gold sank as Yields rallied from over $1855 to $1845 now. * Bitcoin continues to pivot around $30K. * FX markets – EURUSD down at 1.0630, from a spike to 1.0770, USDJPY tested 134.50 zone (24-yr high) and holds 134.00, Cable trades down at 1.2500, from 1.2550. Overnight – PPI in Japan missed (9.1% vs 9.9%) but remains high, China CPI missed (2.1% vs 2.2%) & PPI in line 6.4% & down from 8% last month (Shanghai lockdowns) Today US CPI, Canadian Jobs Report, US University of Michigan (Prelim.) & Speech from ECB’s Lagarde.  Biggest FX Mover Biggest FX Mover @ (06:30 GMT) NZDUSD (+0.54%). Moves higher from 0.6380 to 0.6420, as NZD gets a bid in the Asian session. Next key resistance 0.6450. MAs aligning higher, MACD histogram negative but turning higher, RSI 54 & rising, H1 ATR 0.0011, Daily ATR 0.0068. Always trade with strict risk management. Your capital is the single most important aspect of your trading business.Please note that times displayed based on local time zone and are from time of writing this report.Click HERE to access the full HotForex Economic calendar. Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! Click HERE to READ more Market news.

Stuart Cowell

Head Market Analyst

HFMarkets

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

|

|

|

|

|

HFblogNews (OP)

Jr. Member

Offline Offline

Activity: 1139

Merit: 1

|

|

June 14, 2022, 09:21:51 AM |

|