|

Theones

|

|

July 05, 2022, 12:05:42 AM |

|

In real economy analysis somehow you see the injection of new money into the system as a factor that increases development and that pushes up the value of estates if the injected money is used for infrastructure and capital projects. Such money that is injected is either printed or borrowed, it is just like an evil that can't be avoided likewise capital projects. Take away capital projects then real estate will have no value. Borrowing and printing of money will be done but if used well then inflation will be controlled.

Who are those that injects this money into the system? Who borrows and from whom do they borrow? Who prints fiat? Who sets budget to deficit or surplus and then sell money or buy money to maintain the acclaimed balance? Who controls or decides that it is OK to not print more fiat? Who detects when to print more fiat? Then, after printing these fiat, who hoards them at the expense of the poor? Who are the real real estate investors. The answer circles around the government and the politicians. They own the system, they control it and milk from it also. They designed it to remain relevant to them and make us believe they have our interest at heart. They shouldn't bother, bitcoin is coming with full force to shame them all. The only solution to this is financial freedom. Try to earn as much as you can - dont gamble if you think you will lose money. And try to invest where you get good return - dont look up to anyone for the help. |

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

yhiaali3

Legendary

Offline Offline

Activity: 1666

Merit: 1838

#SWGT CERTIK Audited

|

|

July 05, 2022, 01:52:46 AM |

|

Yes, things have become easier to understand now, the government prints more money, the value of money decreases, inflation increases, the government stops printing, spending and debt difficulties arise, and the need for new resources arises. This is a real economic cycle that needs a radical solution to get out of it. The problems of the economy are very complex and it is not possible to come up with an easy solution because everything is linked to each other, but is it possible that Bitcoin is the solution? Bitcoin is a very good solution to the problem of fiat currency inflation and maintaining its value, but it is not a solution to other economic problems resulting from lack of resources and high fuel prices as a result of high global demand.

|

|

|

|

|

Hamphser

|

|

July 05, 2022, 10:40:02 PM |

|

In real economy analysis somehow you see the injection of new money into the system as a factor that increases development and that pushes up the value of estates if the injected money is used for infrastructure and capital projects. Such money that is injected is either printed or borrowed, it is just like an evil that can't be avoided likewise capital projects. Take away capital projects then real estate will have no value. Borrowing and printing of money will be done but if used well then inflation will be controlled.

Who are those that injects this money into the system? Who borrows and from whom do they borrow? Who prints fiat? Who sets budget to deficit or surplus and then sell money or buy money to maintain the acclaimed balance? Who controls or decides that it is OK to not print more fiat? Who detects when to print more fiat? Then, after printing these fiat, who hoards them at the expense of the poor? Who are the real real estate investors. The answer circles around the government and the politicians. They own the system, they control it and milk from it also. They designed it to remain relevant to them and make us believe they have our interest at heart. They shouldn't bother, bitcoin is coming with full force to shame them all. The only solution to this is financial freedom. Try to earn as much as you can - dont gamble if you think you will lose money. And try to invest where you get good return - dont look up to anyone for the help. Not really that bad to call for some help or to snip out some ideas from others basing on their real experiences but you wont really be able to copy it 100% considering that there are still factors which could affect the entire outcome even if you do tend to follow or do the same steps which does basically means that it is really depending on you whether you would really be that serious on achieving your goals through your own hard work and analysis and not all does have the same level of patience and perseverance on dealing up with something. We do almost have on the same target or prospects in life which is to have financial freedom and that means having various sources of income and investment which would make yourself financially sustainable and capable. |

| │ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███▀▀▀█████████████████

███▄▄▄█████████████████

███████████████████████

███████████████████████

███████████████████████

█████████████████████

███████████████████

███████████████

████████████████████████ | ███████████████████████████

███████████████████████████

███████████████████████████

█████████▀▀██▀██▀▀█████████

█████████████▄█████████████

████████▄█████████▄████████

█████████████▄█████████████

█████████████▄█▄███████████

██████████▀▀█████████████

██████████▀█▀██████████

▀███████████████████▀

▀███████████████▀

█████████████████████████ | | | O F F I C I A L P A R T N E R S

▬▬▬▬▬▬▬▬▬▬

ASTON VILLA FC

BURNLEY FC | │ | | │ | | BK8? | | | █▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄ | .

PLAY NOW | ▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄█ |

|

|

|

Hydrogen

Legendary

Offline Offline

Activity: 2562

Merit: 1441

|

|

July 05, 2022, 11:35:08 PM |

|

prices going lower. One solution to diminishing prices that I like. Is an increase of production. Whatever scarcity and inflation can produce, an overabundance might overturn. Scaling up production can also decrease production costs. Corporate profit margins in sectors like oil have done well for themselves. Now we can encourage an expansion of production. Or find alternate means. Perhaps biodiesel can make a comeback. Or ethanol production can be expanded. There are youtube clips of people making their own biodiesel and ethanol. The technology may be viable and openly accessible on an entry level scale. Rampant consumerism we have all seen and lived through. Credit and installment buying. Amazon free shipping. Social media ads targeting text message and microphone keywords. Now is a time for rampant productionism. |

|

|

|

|

Darker45

Legendary

Offline Offline

Activity: 2548

Merit: 1852

🙏🏼Padayon...🙏

|

|

July 06, 2022, 02:03:39 AM |

|

It was an urgent measure to print more money during the height of the pandemic. Hard times demand hard decisions. Something had to be done to keep the economy afloat with all the lockdowns, quarantines, closed businesses. The pandemic crippled employment, supply chains, and the entire business sector.

But now that the economy is on the road to recovery, measures had to be done to deflate the circulating supply of money. Interest rates had to be increased. The devaluation of money had to be addressed. Fiat has to recover its purchasing power.

|

|

|

|

Minecache

Legendary

Offline Offline

Activity: 2170

Merit: 1024

Vave.com - Crypto Casino

|

|

July 06, 2022, 03:19:19 AM |

|

Yes, things have become easier to understand now, the government prints more money, the value of money decreases, inflation increases, the government stops printing, spending and debt difficulties arise, and the need for new resources arises. This is a real economic cycle that needs a radical solution to get out of it. The problems of the economy are very complex and it is not possible to come up with an easy solution because everything is linked to each other, but is it possible that Bitcoin is the solution? Bitcoin is a very good solution to the problem of fiat currency inflation and maintaining its value, but it is not a solution to other economic problems resulting from lack of resources and high fuel prices as a result of high global demand.

While bitcoin can be seen as a solution to fight inflation due to its fixed supply, it is not the right now to call bitcoin a suitable asset class for reducing inflation. Bitcoin's volatility makes it a high-risk asset, so bitcoin would not be suitable as a de-inflationary asset in the current inflationary era. If you can hold bitcoin for as long as 5 years to 10 years then bitcoin can be a very effective deflationary asset because over time bitcoin will have a new ATH and the price will go very high and fiat is dying. |

|

|

|

|

Anonylz

|

|

July 06, 2022, 04:14:18 AM |

|

and the whole story began when every country started giving away stimulus packages and to full fill everyone’s need they required to print more money than ever before. However they forgot one thing, peeps were loosing their jobs, companies were not doing well, supply chain stopped so as to inward of money and taxes thereafter. Central banks required to print even more money but it was above the income of government through taxes and businesses. So it was but obvious to have higher costs and in short followed inflation.

If they didn't print new money to support the stimulus package idea where wouod they have gotten the money to address that situation as it raises! The money has to come somehow. The real issue now is making supply meet up with demand. Since the pandemic the economy is struggling and supply chain is behind. Printing more money into the system won't solve the inflation problem except those monies are directed to improve the supply chain radically. |

| .

SECONDLIVE | | | │ | | | | | | │ | | | | ▄▄███████▄▄▄

▄▄████████████████▄▄

██████████████████████▄

████████▀▀▀██████████████

███████▌ ▀█████████████

████████▀ ▀▀▄▄██▀▀▀██████████

███████ ▀████████

███████▄ ████████

████████▄▄ ▄████████

███████████▄▄▄▄██████████

▀█████████████████████▀

▀████████████████▀▀

██████████████████████ |

|

|

|

|

South Park

|

|

July 06, 2022, 04:45:02 AM |

|

and the whole story began when every country started giving away stimulus packages and to full fill everyone’s need they required to print more money than ever before. However they forgot one thing, peeps were loosing their jobs, companies were not doing well, supply chain stopped so as to inward of money and taxes thereafter. Central banks required to print even more money but it was above the income of government through taxes and businesses. So it was but obvious to have higher costs and in short followed inflation.

If they didn't print new money to support the stimulus package idea where wouod they have gotten the money to address that situation as it raises! The money has to come somehow. The real issue now is making supply meet up with demand. Since the pandemic the economy is struggling and supply chain is behind. Printing more money into the system won't solve the inflation problem except those monies are directed to improve the supply chain radically. Yes, it is impossible to solve a crisis caused by printing too much money too fast by printing even more money, at this point people are realizing the economies of the world are in real trouble and it does not help that a war started out of nowhere, and now Europe is facing huge problems to the point the euro is about to reach dollar parity not long from now, so while I hope the economy somehow stabilizes itself I am not sure this will happen at all. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

gunhell16

|

|

July 06, 2022, 09:57:08 AM |

|

Its easy yes now the prices are up but if central banks and fed dont start printing MONEY again then all will fall down.

All those real estate unreal prices are so high only becouse big money been printed this was holding as the legs of the high prices but if they dont print asap all will fall also people need cash to pay their fuel energy and food prices those who got extra real estate some extra cars in family or gold stocks or crypto to get cash off course you sell some asssets but whos gona buy ? Off course prices going lower.

Long story short current economy is on the massive ammount of printed money it was holding all this up but now central banks dont print anymore and rate hikes so if we dont hear the news they will step in and print then we all know what happens.

I'm not really sure, if I understand it correctly. Based on my assessment, for what is happening now in the entire world, almost all countries are facing inflation problems, where majority of the commodities are getting increased, especially the war between Russia ang Ukraine the gasoline was also increase particularly in the asian country, and a lot of the citizens are affected by this inflation as well. So, the economy of each country now are affected by this circumstances, where the government can't able to stop, that is why from time to time they've been thinking a solutions for this matter also. |

|

|

|

|

boyptc

|

|

July 06, 2022, 06:16:06 PM |

|

I do not think that everyone will afford the effect of printing more money by the FED. As you can see, despite the recovery, there goes the high inflation due to the issue of the war.

And if another printing happens, this adds up to the current percentage that every country that's affected by the war like the shortage of food through wheat and even with oil.

|

|

|

|

|

Theones

|

|

July 07, 2022, 07:25:59 PM |

|

I do not think that everyone will afford the effect of printing more money by the FED. As you can see, despite the recovery, there goes the high inflation due to the issue of the war.

And if another printing happens, this adds up to the current percentage that every country that's affected by the war like the shortage of food through wheat and even with oil.

that is correct printing money is not always a choice and what is going behind the closed door and who controls the power game - noone knows and no-one can guess. But what we can control is our financial freedom so that we are happy and contented and live like a king. |

|

|

|

|

fullhdpixel

|

|

July 09, 2022, 12:25:29 PM |

|

Its easy yes now the prices are up but if central banks and fed dont start printing MONEY again then all will fall down.

All those real estate unreal prices are so high only becouse big money been printed this was holding as the legs of the high prices but if they dont print asap all will fall also people need cash to pay their fuel energy and food prices those who got extra real estate some extra cars in family or gold stocks or crypto to get cash off course you sell some asssets but whos gona buy ? Off course prices going lower.

Long story short current economy is on the massive ammount of printed money it was holding all this up but now central banks dont print anymore and rate hikes so if we dont hear the news they will step in and print then we all know what happens.

I'm not really sure, if I understand it correctly. Based on my assessment, for what is happening now in the entire world, almost all countries are facing inflation problems, where majority of the commodities are getting increased, especially the war between Russia ang Ukraine the gasoline was also increase particularly in the asian country, and a lot of the citizens are affected by this inflation as well. So, the economy of each country now are affected by this circumstances, where the government can't able to stop, that is why from time to time they've been thinking a solutions for this matter also. Inflation "was" a problem and it is still a problem, but on top of that now we are facing recession to stop inflation as well. We will have less and less inflation, the prices will probably stay at this level for a long time, and then we are going to end up with recession instead. What does that mean? If the money is withdrawn from the markets, and there are less jobs available, less money available, and less income going around, everyone will live a worse life, and won't be able to earn enough to survive. This is why recession is even worse situation we are in right now. Hopefully it will all get fixed soon and we will be doing much better. |

|

|

|

|

Theones

|

|

July 11, 2022, 03:30:09 PM |

|

Inflation "was" a problem and it is still a problem, but on top of that now we are facing recession to stop inflation as well. We will have less and less inflation, the prices will probably stay at this level for a long time, and then we are going to end up with recession instead.

What does that mean? If the money is withdrawn from the markets, and there are less jobs available, less money available, and less income going around, everyone will live a worse life, and won't be able to earn enough to survive. This is why recession is even worse situation we are in right now. Hopefully it will all get fixed soon and we will be doing much better.

That is correct - the country I live in - is experiencing highest rate of inflation in past 50 years. The poor segment of the society is most affected by - but having said that the rich people are also not much comfortable with their finances. |

|

|

|

ChrisPop

Legendary

Offline Offline

Activity: 2310

Merit: 1033

Not your Keys, Not your Bitcoins

|

|

July 11, 2022, 07:38:47 PM |

|

One solution to diminishing prices that I like.

Is an increase of production.

Whatever scarcity and inflation can produce, an overabundance might overturn. Scaling up production can also decrease production costs. Corporate profit margins in sectors like oil have done well for themselves. Now we can encourage an expansion of production. Or find alternate means. Perhaps biodiesel can make a comeback. Or ethanol production can be expanded. There are youtube clips of people making their own biodiesel and ethanol. The technology may be viable and openly accessible on an entry level scale.

Rampant consumerism we have all seen and lived through. Credit and installment buying. Amazon free shipping. Social media ads targeting text message and microphone keywords.

Now is a time for rampant productionism.

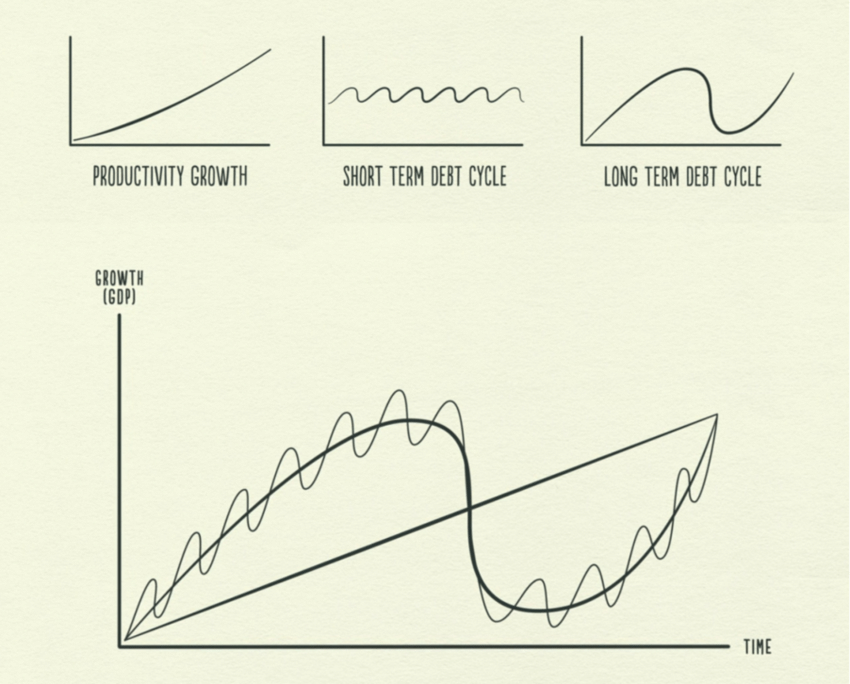

Easy to say, but hard to implement. Productivity raises in a linear fashion, while economic cycles are much faster/violent.  Source: Ray Dalio debt curve Source: Ray Dalio debt curveUnder the current financial system all we can do is to hope that the state will apply the correct monetary and fiscal policies while we reduce the credit in the economy. |

|

|

|

|

|