Hey guys, I summarized an article about the divergencies. What is divergenceies, what are the major types of divergiences and how should we use it along with our trading strategy:

SOURCEWhat is Divergence?Divergence occurs when the direction of an asset’s price and the direction of a technical indicator move in opposite directions.

Finding divergence between price and momentum indicators, such as the RSI and MACD, is a useful tool for identifying potential changes in the direction of an asset’s price and is therefore a cornerstone of many trading strategies.

Types of Divergencies?- Bullish Divergence

Types of Divergencies?- Bullish DivergencePrice is printing lower low while the technical indicator shows higher lows. This signalizes a weakening momentum of a downtrend and a reversal to the upside can be expected to follow.

Quick Notes: watching troughs in a downtrend, the indicator moves up first

- Hidden Bullish DivergencePrice is making higher lows while the oscillator makes lower lows. A hidden bullish divergence can signalize that uptrend will continue and can be found at the tail end of a price throwback (retracement down).

Quick Notes: watching troughs in an uptrend drawback, price moves up first

- Bearish DivergencePrice is creating higher highs while the technical indicator shows lower highs. This signalizes that momentum to the upside is weakening and a reversal to the downside can be expected to follow.

Quick Notes: watching peaks in an uptrend, the indicator moves down first

- Hidden Bearish DivergencePrice is making lower highs while the oscillator makes higher highs. A hidden bearish divergence can signalize that downtrend will continue and can be found at the tail end of a price pullback (retracement up).

Quick Notes: watching peaks in a downtrend drawback, price moves down first

Regular divergencies – Provides a reversal signal.They indicate that the trend is strong but its momentum has weakened, providing an early warning of a potential change in direction.

Hidden divergencies – Signals trend continuationThey indicate that the current trend is likely to continue after a pullback, and can be powerful entry triggers when confluence is present.

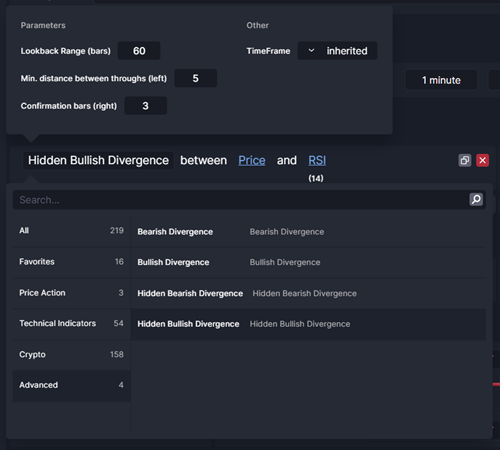

You can find these all 4 divergencies on cleo.finance and compare those divergencies

• Price with an oscillator indicator

• An oscillator indicator with another oscillator indicator

• Price of any asset with the price of any other asset.

And customise the divergencies in terms of 4 different parameters: time frame, lookback range, min. distance between peaks/troughs, and confirmation bars.

ConclusionDivergences can be an important tool for traders to add to their arsenal, but they should be used in a careful and strategic manner. By keeping these things in mind, traders can potentially use divergences to their advantage in making more informed trading decisions.

It is always important to use divergences in conjunction with other forms of technical and fundamental analysis and to approach them with a disciplined and strategic mindset.