|

larry_vw_1955

|

|

March 30, 2023, 02:08:22 AM |

|

Also, it's worth to note that an uncompressed Segwit transaction was always non-standard, it didn't switch from standard to non-standard.

you do have a point there  but there is a distinction though. someone using an uncompressed segwit is not hogging up transactions making other peoples transactions have to pay a higher fee. lets just be honest. about the affects of each. |

|

|

|

|

|

|

|

|

|

|

|

"Your bitcoin is secured in a way that is physically impossible for others to access, no matter for what reason, no matter how good the excuse, no matter a majority of miners, no matter what." -- Greg Maxwell

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

pooya87

Legendary

Offline Offline

Activity: 3444

Merit: 10549

|

|

March 31, 2023, 04:33:13 AM |

|

Also, it's worth to note that an uncompressed Segwit transaction was always non-standard, it didn't switch from standard to non-standard.

you do have a point there  but there is a distinction though. someone using an uncompressed segwit is not hogging up transactions making other peoples transactions have to pay a higher fee. lets just be honest. about the affects of each. His point is that bitcoin core never relayed SegWit transactions using uncompressed keys and miners needed to manually modify the core code to make it happen whereas in Ordinals Attack core is already relaying such transactions so adding the standard rule now wouldn't be as effective. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

larry_vw_1955

|

|

April 01, 2023, 12:36:35 AM |

|

His point is that bitcoin core never relayed SegWit transactions using uncompressed keys and miners needed to manually modify the core code to make it happen whereas in Ordinals Attack core is already relaying such transactions so adding the standard rule now wouldn't be as effective.

it seems to me that in the short term, miners want to maximize their transaction fee income so they want ordinals so they would not be willing to make any changes to the core code themself to filter them out but in the longrun, that might hurt them if people stop using bitcoin as a money transfer method and then all you got left is nft folks that end up moving on to something else leaving the miners without anyone to pay their bills.  |

|

|

|

|

|

|

|

|

zeuner

Member

Offline Offline

Activity: 189

Merit: 16

|

|

April 01, 2023, 03:03:54 PM Merited by JayJuanGee (1) |

|

Bitcoin's voyage away from central authorities and towards decentralization won't succeed if we arbitrarily judge transactions to be "attack" or "non-attack", respectively. The on-chain transaction protocol left plenty of open ends on purpose, so that future innovation is possible. This means that the blockchain will always also contain transactions that some users will find more useful than others.

You are just playing with words and bending the truths. The abuse of the system is not an arbitrary opinion. In fact the Ordinals abusive behavior is pretty clear since it is turning bitcoin (aka a payment system) and its blockchain (aka a ledger to store monetary transactions) into a cloud storage. As abuses go, it doesn't get any clearer than this! As for the protocol, it is left "loose" in some places so that it can be extended but always within the same utility category that Bitcoin is supposed to offer, not to turn Bitcoin into something else like cloud storage! Well, aggressive wording doesn't make your point more true. It may just - together with the fact of the more relevant parts of the posts remaining unanswered - lead to being ignored. Storing data on the blockchain being abusive is an opinion. Even a widespread opinion. But still a mere opinion. I do even agree to some extent, and I am sceptical about "ordinal theory" being a useful concept with respect to NFT storage. I was just saying that the concept may have other, less obvious uses. In the end, the community decides. As long as miners accept the transactions into blocks, and regular users accept the coins mined by these miners, there is something like a consensus, and no one seems to find it bad enough to act. This might of course change. Until then, I suggest to lean back and relax. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

I see BTC as broken but not today more like 2056.

I am still in the middle of catching up with this thread.. but I could not resist to respond to this "holy shit Phil" .. again? I gotta credit you for being persistent (or is it called stubborn) with some of this thinking and attempting to back up why you continue to believe that bitcoin is broken into the future. Maybe this is part of your ongoing flawed thinking?.. Of course, in the past, you were wrong because you did not believe bitcoin was sufficiently valuable so you ongoingly cashed out all of your mined coins for fiat and did not keep side stash of cornz, and now, in recent times (perhaps the last few years), you are finding some value in actually holding some bitcoin (even though you are in love with doggie coin and LTC..like a numbskull.. hahahahaha), but you are discounting BTC's future valuation based on too many speculative points that would have to come true in order for bitcoin to be broken in 2056.. like adaptation, difficulty adjustment, the various ways that adoptions and price can grow with the passage of time. Maybe think about the matter a bit more without locking yourself in so much in regards to things that you do not know and none of us know, no? Or maybe it is is that you are discounting some things that we do know, which is the difficulty adjustment.. but we also have ongoing adoption that is not exactly guaranteed, but there is no real reason to conclude that it is going to stagnate, even if there are various battles along the way.. BTC was built for battles, and there is no real evidence to suggest that BTC is not up to the task of being able to be resilient in the face of current battles and even expected battles. Accordingly, if BTC is currently not broken, and so far the incentives in bitcoin's system have adjusted to continue to allow for (and even facilitate) the many bitcoin networking effects (think of Trace Mayers 7 networking effects as a framework), then why would we either want to presume that the incentives are not going to continue to work in bitcoin and/or that various kinds of developments and adaptations are going to be able to happen in order to tweak to any extent that might be necessary to attempt to realign such incentives if they do not seem to be playing out sufficiently naturally within the system as it continues to grow over the next 33 years-ish? 1st layer and second layer (and probably other layers) play off of each other, but still BTC remains the most valuable in which a lot of value is going to continue to flow, even from places that currently are not in BTC.. which is also going to bring me back to several of my issues in regards to how some of the ordinals/inscription discussion is taking place.. Yeah.. subjectively there is a whole hell of a lot of crap involved with ordinals and inscriptions and even various attempts to commercialize and create scarcity.. (or create the impression of scarcity)... and some smart guys here are proclaiming that ordinals and inscriptions are not intended to be part of bitcoin because they do not fit in the definition of money and blah blah blah that's not what Satoshi intended bitcoin to be money blah blah blah. Bitcoin is not that narrow and has never been that narrow, even if satoshi might have wrongly made certain word choices in regards to peer to peer cash.. and even if he said that, bitcoin is not that narrow, has never been that narrow, and value can be transmitted over it, even if the value is not agreed upon by others not in the transaction and may not even be agreed upon at the time of the transaction. Also, I am thinking that if the whole BTC blockchain.. every single satoshi ends up getting a inscription attached to it, there are probably ways to unattach those inscriptions (or to throw away the inscription part) by doing another transaction that purifies the satoshis contained in the transaction.. if that is what the market ends up facilitating - such as the value of clean satoshis to be higher than those that have inscriptions attached. Muahahahaha... so you're trying to say that in fact the majority of Bitcoin users support ordinals? That's like the funniest stuff I've heard this year.  I don't think there's much sense in this discussion when your opposition is coming up with bozo claims like this... What I'm saying is that you seem to suffer from the same thing a delusion of being the voice of many, and worse than that is manifesting the same commie behavior of judging one who doesn't agree with you as an enemy. The most important thing is, how do you know what the majority wants? Maybe as extrapolating from the views here the majority doesn't like ordinals but they hate censorship more, which for every single individual or bitcoin "user" would be normal behavior. But if you're that sure the majority are against it, why don't you fork it already? Cause all I see here are 4-5 users bitching on a forum about and 200k ordinals being burned already, so who decided this "majority" and who counts the votes of this so called majority? I hope it's not Stalin! If you think the majority supports ordinals, why don't you create a poll on this and we'll see who's the majority?  I'd gladly fork this crap off immediately but unfortunately I'm not a core dev so all I can do is urge people to act responsibly (rarely works).  P.S. And all these 200k ordinals were create by 200k people? Or a dozen of spammers?  It seems to me that the concept of "majority" in bitcoin hardly means anything, so there is a kind of stickiness in which if anyone wants to make a change, there is a need for overwhelming consensus in order to make any such desired change... and there is a need to convince those running nodes to actually update to the version (or feature) that is desired to be included.. So, even mikeywith's (below-referenced) listing of who needs to be convinced seems to leave out an important fact in regards to those running the nodes, might just say.. fuck off, we are not changing.. and they don't even necessarily coordinate or whatever, they just choose not to change from the "sticky" status quo, even if there might be a majority (or even an overwhelming 80% or more majority) or even attempts at domination from several of the members of the groups that mikeywith listed. So who makes the majority or at least, who represents the majority needed to fork BTC to ban Ordinals?

- Mining pools.

- Exchanges.

- Core devs.

- The rich folks who fund Core devs or/and control the media.

[...] It's roughly what's happening, I guess. Miners follow profit, but there is concern on whether short-term profit is greater than long-term, or if excessive fee rate is more desirable in the end. I can guess the miners don't care a lot about the long-term, but a mining expert can give us some better insight. Many of us likely realize that miners are not a monolith, either. They may have quite a few similar factors that motivate them in terms of trying to reduce their costs and to increase their hashpower, but as you seem to be suggesting BlackHatCoiner, there also is going to be variation in terms of how they set up their business (partnerships, consumption of energy consideration, equipment, personnel, even variation in kinds of coins that they mine or other ways that they might generate capital in terms of other operations that they might have or even if they might produce their own power or make their own equipment), the extent to which they choose to hold BTC (as part of their business treasury), the extent to which they use debt and perhaps several other matters, not necessarily excluding political/ideological considerations that they might include into their business practices. Am i an expert no. but i do know what is good for me to do.

Hahahahahaha Good one.

I am not even saying that I don't believe you.(By the way, I am reading this thread in the order that the posts are made, and it may take me a bit more time to catch up to responding to anyone who might respond to any parts of this post of mine..and I also recognize that some of my points may well have already been addressed.. and so if I need to respond again or to acknowledge that, then I will decide whether to do so when I come across such potentially responsive posts.. not that I claim to understand everything that is posted). |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

April 02, 2023, 07:01:14 PM |

|

I felt like I needed to start a new post. My last one was starting to get a wee bit long-ish.. and then I am adding this new responsive content... and with this, I am caught up to all the thread contents (yeah!!!!).. not that I understood much of anything that I read herein... hahahaha That's merely an opinion,

And that's your opinion because what I said is a fact. but technically it's wrong because an "exploit" in computing is an actual attack that takes advantage of a vulnerability in a computing system. Ordinals is neither an attack, nor Taproot has a vulnerability. Newbies are reading our posts, let's not spread misinformation.

There is no vulnerability in Taproot, there is an exploit in implementation of Taproot that is in bitcoin core. The core devs either didn't foresee this attack vector or they saw it and didn't care enough to prevent it just like they'd prevented similar attack vectors in the past through standard rules.today I tried to transfer around $70-80 and had to pay for it around $1.30 in fees

You should always report transaction fees in terms of "amount per size" instead of raw values and definitely never in dollar terms for it to be a clear and understandable value. For example right now the fee rate is between 17 to 20 sat/vbyte. if you compare that price for non-blockchain money transfer services like western union then i'm sure $1.30 is not outrageous for sending $70.

The problem is not with the fee amount, the problem is with the reason for the high amount. Just like 2017, it doesn't sit well with users to pay a high fee just because someone is maliciously spamming the chain. To the extent that I follow these various arguments, for sure, I am seeing a kind of thread in which some members, including you pooya87, consider ordinals/inscriptions as a kind of "attack on bitcoin" because there was an "exploitation" of a vulnerable area in which such "fun" could be slipped into bitcoin, and surely I am having difficulties understanding and appreciating such characterization as these ordinals/inscriptions as attacks, including that you are suggesting that it is "similar to 2017's attack," and truly I do consider the late 2017/early 2018 as a spam attack because the ONLY purpose seemed to be to clog the bitcoin blockchain to make some various shitcoins to look better and to continue to propagate shitcoin talking points, even if we cannot really be sure exactly who was funding the late 2017/early 2018 spam attack, but there was likely little to no economic purpose beyond pumping their own crap and to make bitcoin look bad, but at some point even that ongoing spam attack seemed to have had not really been working in terms of how much it was costing to continue to carry out. Sure, there might be some folks who might be using ordinals/inscriptions as a way to "attack bitcoin," but really I have my doubts. To me, it just seems to be a use case in which many members do not really agree or see any value in it, and even though historically, I have not participated in shitcoins, NFTs, or even astrology or numerology, I can appreciate that people can do whatever the fuck they want... even if it is not valuable, and if they want to put their dickbutt farting monkey on the chain and they are willing to pay for it, then so be it.. let them bid for the space, and clog however with their various uses of the blockchain.. The market is likely to sort it out... and sure every piece of crap from the various shitcoins, may well end up getting pegged in one way or another to bitcoins 2.1 quadrillion satoshis that had been "clean" prior to this infiltration.. and then now, little by little they are getting crap attached to them, so in the future, when I go to spend a few of my satoshis, then I will find out that I had a dickbuttfarting monkey attached to one of them, and is it more/less valuable/fungable? Did I get tricked into taking something? I doubt that it is more or less valuable than the satoshis, and whatever value that is attached to the thing that is attached would be a side valuation. I don't know if I will have to send those satoshis through an expunger/purger prior to being able to use them.. We can cross that bridge when we get there.. if we get there and if it matters, but personally, I still do not consider this attaching of other information to satoshis and putting them in order (with labels) to be an attack on bitcoin... Maybe I am missing something? The fees will sort themselves out too.. They seem to go up and they go down and over the years, the fees are somewhat of a moving target and it seems to be a good thing that there are more and more fee demands, and surely there may also continue to be alternatives that are developed to lessen fees.. of course, we have lightning network, but we are still ONLY a bit more than 14 years into bitcoin having had gone live and lightning network only went live (on a seemingly expedited basis in response to the then spam attacks that had been referenced) in early 2018. I also don't claim to be any kind of expert in regards to spending options, but the assertion that $1.30 fees to send $70 transaction seems to be a choice, and if it is the ONLY option, then that is the price that needs to be paid. Of course, we likely should realize that on chain is priced by weight and lightning network is priced by amount sent.. so coin control can help in which that $1.30 might be the same to send $5 or to send $5 billion.... and of course, it makes a difference if we are sending coins in a known parties situation (or to oneself) versus in various scenarios between strangers that might take place, and some of those relations will be more/less trusted than others. But it is ok with those same people if the bitcoin fee is high for some other reason like mass adoption?

I don't know who these people are but they are just as wrong. In fact all the efforts in the past 7-8 years put into developing SegWit, second layer and even Taproot (introduction of Schnorr signature algorithm) has been to improve bitcoin scaling and its capability to handle a lot more transactions as the adoption increases. One of the results of these efforts is keeping fees low.You sound like Roger Ver with a nonsense talking-point like that..whining because you cannot buy coffee onchain anymore... It sounds something like this: "there have been so many efforts and history and legacy to keep fees low by a lot of parties, and some dickbutt monkey farters come in and ruin it for the rest of us. We could fix this.. blah blah blah." (nothing personal but still.. hahahahaha). But using that concept to push for more content being put on-chain seems counterintuitive in presence of all the progress made to reduce the burden on the chain.

Bottom line is no matter how a small group of people swing this, Ordinals is an exploit since it is using it in a way that is should not be used, ergo it is categorized as an attack on bitcoin. Bitcoin's voyage away from central authorities and towards decentralization won't succeed if we arbitrarily judge transactions to be "attack" or "non-attack", respectively. The on-chain transaction protocol left plenty of open ends on purpose, so that future innovation is possible. This means that the blockchain will always also contain transactions that some users will find more useful than others. Whoaza!!!! zeuner said this part better than me... .. I will just add that there can be some value in pretty fucking stupid-shit, and I doubt that it is the place for developers to try to figure that out in order to change the code in terms of what they consider to be more valuable or not.... and yeah there would be choices to run such software or not.. and hardforks do not come easy, either.. right? Another thing is that node operators (or even miners) may also be pressured to either not route certain transactions or to be pressured into not carrying/storing certain content, and as a node operator (or a miner), I could give less than two shits about the contents contained therein (I am not proclaiming to be a miner... and barely know anything about being a node operator at this point.. but I am planning to at least increase some of my dabblings and knowledge in that direction.. since it seems to becoming easier and easier to run nodes.. and potentially powerful nodes, too.. and it seems to be becoming more and more important to perhaps have some nodes.. including maybe getting involved in nostr too.. )... .. and then someone points it out and says, "hey, look... you have blah blah blah blah content on your node (or what you had been mining)" I give few shits about the content.. and continue to run (or mine)... which surely is likely to become the prevailing way forward in terms of being content neutral... Some will choose to get distracted into baloney concerns about which information is valuable and which is not and to prune or purge or not to carry/route certain content.. and it seems to me that they will likely be disadvantaged for such choices to get worried or worked up in judging the value of content. Guys, enough of this shitcoin talk here in this thread. There's a nice altcoin forum part where you can share opinions on your beloved shitcoins and discuss all the news, including NFTs on your blockchain etc. This thread is for Bitcoin and ordinals.  I usually would agree with any proclamation to eliminate shitcoin talk, but in this case (thread), the discussion is about technical implementations on bitcoin and even some members believing that shitcoins are coming to bitcoin through the adoption/use of ordinals/inscriptions. It seems relevant to figure the boundaries.... and options and also one of the cardinal sins in regards to discussing shitcoins in bitcoin threads is that there is a slippery-slope tendency to either pump the shitcoins or to denigrate bitcoin, and I don't see that either pumping of shitcoins or denigration of bitcoin is taking place merely by engaging in compare contrast of ordinal/inscription practices on other coins. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

kano

Legendary

Offline Offline

Activity: 4494

Merit: 1808

Linux since 1997 RedHat 4

|

|

April 03, 2023, 12:45:22 AM Merited by JayJuanGee (1) |

|

...

Ordinals as we speak hold a steady income in case there is an empty mempool.

...

Not at all. If the mempool is empty then the fees with NFTs will be crap for full 4M blocks. You can already see this in the blockchain of blocks with low fees containing NFTs. NFTs don't have to pay better than the highest fee txn in a block, they just need to produce a fee just higher than the txns they displace. But if they aren't displacing txns, then they can effectively be zero fee. Blocks don't have to have any transactions in them except the coinbase. If no transactions are available, then you get what's commonly called an empty block. Aside: however, the empty blocks you see every so often are caused by all the large pools not verifying transactions. True empty blocks due to lack of transactions are exceptionally rare. |

|

|

|

mikeywith

Legendary

Offline Offline

Activity: 2226

Merit: 6367

be constructive or S.T.F.U

|

|

April 03, 2023, 02:35:41 AM

Last edit: April 03, 2023, 03:47:49 AM by mikeywith Merited by JayJuanGee (1) |

|

So, even mikeywith's (below-referenced) listing of who needs to be convinced seems to leave out an important fact in regards to those running the nodes

You are correct, I missed a dozen of them in the list, payment gateways, wallets, and whatnot, some people seem to think that a change in bitcoin can and must happen just because they wrote about it, look at all the changes we had in the past couple years, taproot was proposed around 2019 IIRC, took a lot of lobbying, emails, debates, and testing for it to come to existence, now some folks want to go back and do another change which they call a "fix" and they expect to happen tomorrow and all they do is write about it in this topic where 99% of those who have the means to do it don't even know about the existence of this topic. NFTs don't have to pay better than the highest fee txn in a block, they just need to produce a fee just higher than the txns they displace. But if they aren't displacing txns, then they can effectively be zero fee.

NFTs raise demand on block space, anything that raises demand increases the price of that said service, if everyone is paying 1 sat and blocks are full, someone will pay 2 sat, it's either an NFT transactions or a normal transaction, it doesn't matter, the number/size of the transactions is all that matters. Block fees are the highest they have ever been since July 2021, it's all because of those useless NFTs, wether that's a good or a bad thing the fact is, as a pool operator and a miner you will extract more "value" with NFTs on the blockchain than without. |

|

|

|

fillippone

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

April 03, 2023, 08:17:29 AM

Last edit: May 15, 2023, 10:08:55 AM by fillippone |

|

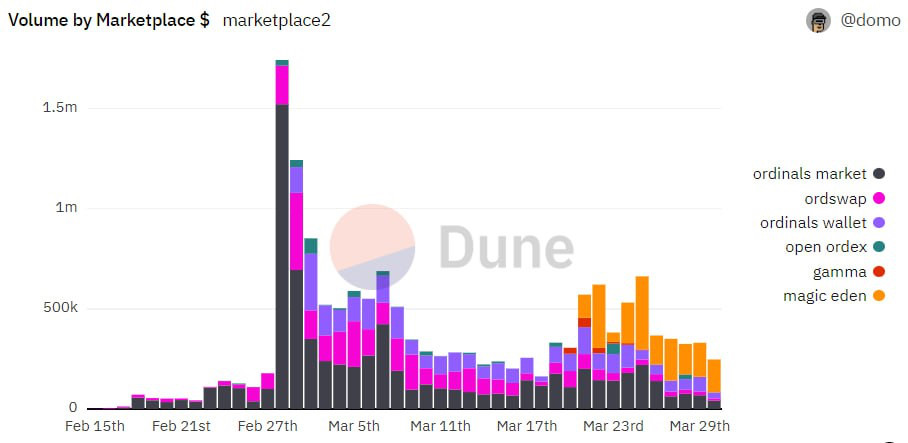

Sorry guys a few days have passed since the release of this article, but I think no one reported it here. Which is the most common ordinals marketplace?  According to this graph and the following article, this “New Eden” marketplace seems the most liquid nowadays Magic Eden’s New Bitcoin NFT Marketplace Dominates Ordinals Market

Magic Eden opened the door to trading inscriptions just over a week ago, on March 21, and has grown to represent a majority of Ordinals trading volume across various marketplaces that support them as of yesterday

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

pooya87

Legendary

Offline Offline

Activity: 3444

Merit: 10549

|

|

April 03, 2023, 02:08:37 PM |

|

even if it is not valuable, and if they want to put their dickbutt farting monkey on the chain and they are willing to pay for it, then so be it.. let them bid for the space, and clog however with their various uses of the blockchain.

Well that's the problem. Bitcoin is not a decentralized cloud storage service. It never was and it should not be in the future either. And why do you say "dickbutt farting monkey"? I'd say "cure for cancer". It still is abuse of the system because once again bitcoin is not a cloud storage service... The market is likely to sort it out.

The fees will sort themselves out too.

That's what I don't see happening that easily. You see, there is incentive to create this type of nonsense. People could sell 500 satoshis for a million dollar (and even launder money that way). That means the market is a lot more complicated than thinking some idiots are selling monkey pics that would die off in a couple of weeks. Here is another way of looking at The Ordinals Shenanigan which is using another way for it which is using a side-chain. Let me put it this way: On one hand- They claim they want to create "NFT" on Bitcoin but they can't and aren't. - The bitcoin smart contracts are very limited (for good reasons too) and it is nearly impossible to make a significant change to the protocol adding new OP codes to allow them (this was discussed many years ago and rejected and led to creation of Ethereum). - You want to be able to transfer the ownership of a "token" or whatever junk you insert in the blockchain which is not possible in Bitcoin since you can't create a token in first place or transfer the ownership of the content you injected into the chain! - Bitcoin transactions can be expensive which is not desirable for the "token market" - The blocks are also limited to disallow spam and the current Ordinals shenanigan is already angering a lot of people On another hand- By using a side-chain you will not have ANY of those limitations, it will literary open up a world of possibilities since it is 100% flexible to what the new protocol needs - The smart contracts in a side-chain could be as complex as you want and need by having all kinds of new OP codes and even an entirely new script language - You can create any kind of token on a side-chain without limitation - Everything you create there can be pegged to bitcoin and benefiting from its high security. - You won't have any issue with transferring ownership of these tokens - You won't store that junk (or even cure for cancer  ) in a ledger that is meant for financial transfers (ie. bitcoin blockchain) anymore - You won't create fee spikes in bitcoin hence you won't have to pay a lot of money to transfer those tokens yourself either. The fees on the side-chain can be kept low too. - You won't anger a lot of bitcoin users. But of course those insisting that Ordinals is "valuable" don't want to hear any of that, instead they want to continue insisting on the persistent spam of the main chain! Ergo I continue insisting that this is a malicious attack. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

philipma1957

Legendary

Offline Offline

Activity: 4116

Merit: 7851

'The right to privacy matters'

|

|

April 03, 2023, 03:05:39 PM |

|

...

Ordinals as we speak hold a steady income in case there is an empty mempool.

...

Not at all. If the mempool is empty then the fees with NFTs will be crap for full 4M blocks. You can already see this in the blockchain of blocks with low fees containing NFTs. NFTs don't have to pay better than the highest fee txn in a block, they just need to produce a fee just higher than the txns they displace. But if they aren't displacing txns, then they can effectively be zero fee. Blocks don't have to have any transactions in them except the coinbase. If no transactions are available, then you get what's commonly called an empty block. Aside: however, the empty blocks you see every so often are caused by all the large pools not verifying transactions. True empty blocks due to lack of transactions are exceptionally rare. So by this logic all exchanges that do off chain trades are an attack on BTC. For instance. I have 1 btc at coinbase I buy 10000 doge for 80 bucks. If it was done on chain there would be a tx on the btc chain convert to cash and then a tx on the Doge chain. Coinbase does not do it that way. This means no-one should use or have anything on an exchange because they lower fees on all internal transactions by doing them off book. I can be pretty sure that coinbase does millions of internal trades off the chains so they ruin the fees. in fact all exchanges do internal off chain trades. This is certainly far worse than ordinals and NFTs Back to BTC reward and fee structure. if it is 2056 and block rewards are 0.012207xx fees are 0.877 total 1 btc a block BTC price needs to be 6.3 times todays price or 168,000 a coin. difficulty doubles efficiency doubles. The power use is the same the gear value is in this case presented around 4 billion 20.5 coins x 168000 a coin means 3.24 trillion value protected by only 4 billion and fees are not terrible as a 6 sat fee per byte is about 0.000017 or $2.85 so in theory you could pay as low as 1/6 of that or 47 cents So a quick look seems not so bad.. except for today 4-5 billion in mining gear protects 540 billion in value

and in 2056 the same 4-5 billion in mining gear protects 3.24 trillion in value.The fail I see is right there for 2056 0.012207 in rewards needs 0.877 in fees for us to simply thread water.and so far every move I see does not support that much in fees. so no mining growth and not enough protection for a 3.24 trillion cap. |

|

|

|

kano

Legendary

Offline Offline

Activity: 4494

Merit: 1808

Linux since 1997 RedHat 4

|

|

April 03, 2023, 10:49:08 PM

Last edit: April 03, 2023, 11:12:29 PM by kano |

|

So by this logic all exchanges that do off chain trades are an attack on BTC.

The attack is obvious as I already explained, and nothing to do with off chain. It reduces the number BTC transfers fitting in each block, leading to mempool bloat, and also increased blockchain storage cost. Effect is people going to scamcoins ... as has already happened due to block size limits over the years. Aside: mining power has no effect on price. This is blatantly obvious with the fact that with massive continuous growth in mining, the price dropped from the ATH of approx $65k (about 160EH) to the current less than $30k (about 335EH) |

|

|

|

|

sha420hashcollision

|

|

April 03, 2023, 11:36:39 PM Merited by cryptosize (1) |

|

So by this logic all exchanges that do off chain trades are an attack on BTC.

The attack is obvious as I already explained, and nothing to do with off chain. It reduces the number BTC transfers fitting in each block, leading to mempool bloat, and also increased blockchain storage cost. Effect is people going to scamcoins ... as has already happened due to block size limits over the years. Aside: mining power has no effect on price. This is blatantly obvious with the fact that with massive continuous growth in mining, the price dropped from the ATH of approx $65k (about 160EH) to the current less than $30k (about 335EH) In my opinion it is not that mining power has NO effect on the price, it is more that the correlation between mining power and price has become heavily out of parity in favor of miner speculation and not network security based on hashrate robustness. There needs to be a consolidation of large miners who lose profit before this parity can come back into view and even the latest crash did not pull most of the largest miners out of profit which is honestly amazing. (I know there were huge losses to several miners but the hashrate has gone upwards since representing an overall resilience to the market effect.) Also the decentralization of pools seems to be a major factor in this parity, if pool decentralization was even synthetically improved (ie through large operations mindfully spreading out hashrate) I believe this would reintroduce a parity between mining hash power and long term price action / mempool fee activity which is whats relevant here I suppose. |

|

|

|

|

|

larry_vw_1955

|

|

April 04, 2023, 11:48:02 PM |

|

Currently there is a boom of NFT on BTC Chain and it's super hyped and I think that it's Minting fee will also be higher than Ethereum chain. So I want to say that These Bitcoin based NFT could be a game changer for the industry. I have high hopes to it.

But isn't that kind of contradictory to say that fees will be higher than ethereum but you still have high hopes for it? maybe you meant to say lower fees than ethereum but i'm not even sure that's the case.  |

|

|

|

|

|

sha420hashcollision

|

|

April 05, 2023, 02:04:48 AM |

|

Currently there is a boom of NFT on BTC Chain and it's super hyped and I think that it's Minting fee will also be higher than Ethereum chain. So I want to say that These Bitcoin based NFT could be a game changer for the industry. I have high hopes to it.

But isn't that kind of contradictory to say that fees will be higher than ethereum but you still have high hopes for it? maybe you meant to say lower fees than ethereum but i'm not even sure that's the case.  ordinals are not NFTs on bitcoin they are a completely auxiliary protocol that uses Bitcoin as an expensive peer to peer layer theres no support for it in bitcoin core. A Bitcoin NFT would likely be supported by core if such a thing really ever existed and I would not count on any being in the base layer. |

|

|

|

|

|

larry_vw_1955

|

|

April 06, 2023, 01:45:28 AM |

|

ordinals are not NFTs on bitcoin they are a completely auxiliary protocol that uses Bitcoin as an expensive peer to peer layer theres no support for it in bitcoin core. A Bitcoin NFT would likely be supported by core if such a thing really ever existed and I would not count on any being in the base layer.

well all get that but he said that minting fees would be higher on bitcoin. so if that was the case why would bitcoin "NFTs" represent a "game changer" as he put it? who wants to pay MORE? |

|

|

|

|

|

sha420hashcollision

|

|

April 06, 2023, 05:13:02 PM |

|

ordinals are not NFTs on bitcoin they are a completely auxiliary protocol that uses Bitcoin as an expensive peer to peer layer theres no support for it in bitcoin core. A Bitcoin NFT would likely be supported by core if such a thing really ever existed and I would not count on any being in the base layer.

well all get that but he said that minting fees would be higher on bitcoin. so if that was the case why would bitcoin "NFTs" represent a "game changer" as he put it? who wants to pay MORE? IDK what he is trying to say, but in my personal opinion ordinals and anything else that is not optimized expensive and useless is of no value whether or not one considers it an NFT. |

|

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

April 06, 2023, 05:39:38 PM |

|

ordinals are not NFTs on bitcoin they are a completely auxiliary protocol that uses Bitcoin as an expensive peer to peer layer theres no support for it in bitcoin core. A Bitcoin NFT would likely be supported by core if such a thing really ever existed and I would not count on any being in the base layer.

well all get that but he said that minting fees would be higher on bitcoin. so if that was the case why would bitcoin "NFTs" represent a "game changer" as he put it? who wants to pay MORE? IDK what he is trying to say, but in my personal opinion ordinals and anything else that is not optimized expensive and useless is of no value whether or not one considers it an NFT. Does it even matter what these various things related to ordinals/inscriptions are called, except to try to make sure that we are understanding what we are talking about when we provide a reference. Forgive me if some of my technical explanations are lacking, yet let's say for example that ordinals are assigning numbers to each and every satoshi, and there is some level of marketing to attempt to claim that some of the assigned numbers have higher values than others based on some kind of a historical reference to that satoshi or that group of satoshis, and so the software that particularizes the ability to assign numbers to each of those satoshis, then allows the astrology-like valuations of some of the satoshis to the extent that anyone might buy into such a framework that this satoshi is more valuable than that satoshi because of its number or some aspect of its history and the assignment of the number(and the software that allows the ability of continuously track the movement of the satoshi's based on their numbers) provides those abilities to even proclaim that each and every satoshi has a unique number and some of those are "more special" than others so long as others are willing to agree to that higher valuation... so then certain satoshis will have their value as a satoshi, but also will potentially have value based on their framework.. but that would not necessarily stop anyone from only valuing the satoshis based on their mere (and base) satoshi value without recognizing their number/history. The creation of a system to number each satoshi, then seems to allow for the attachment of inscriptions to each satoshi and then to follow it around or to keep the inscription assigned to the certain satoshis that have been assigned/associated with the inscription(s). We can choose to ignore it or we can choose to assign higher or lower value to such satoshis.. and maybe like I mentioned further, there could be ways to purge the satoshis from their earlier attached inscriptions in order to free them from their earlier attached inscriptions.. or would that merely be a fiction because let's say for example that on March 23, 2023 an inscription is attached to satoshi number 1,092,367,439,881, but then July 18, 2027 I receive that satoshi, and I realize that it has an inscription assigned to it, and I don't agree with that inscription, so I want to purge that inscription from that particular satoshi. If I purge the satoshi on that same date that I received it, the satoshi still would have a history of having had been attached to the inscription between March 23, 2023 and July 18, 2027, no? Since the bitcoin blockchain is permanent, maybe I only purge the satoshi of its inscription from the date that I do so rather than being able to remove any history from it, and maybe there would be a cost to purge some information from some satoshi's even if that would potentially be a valid way of attempting to re-evaluate some value that had historically been attached to some satoshis? I concede that I might have devolved into babbling... what else is new? |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

|