updating

This is an unofficial business review of Darkcoin and its potential as eCash.

The post will be quite long as I research the coin, its competitors, the landscape for growth, regulatory issues, mass adoption.

The post is subjective. I am an investor in Bitcoin and Darkcoin, and I have mined Darkcoin since March.

I will seek opinion polls on various topics related to Darkcoin and then post the results as part of the business review.

I have not sought permission or coordinated my research or posts with the Darkcoin team. If they use the information, I hope it helps. If they find the information uncomfortable and not helpful I stand to be corrected on any points or they may seek to address some of the issues raised.

The Development of a World First: Cash Over The InternetExecutive SummarySatoshi Nakamoto set out to invent electronic cash, as demonstrated by the title of his Bitcoin

paper:

However, as Bitcoin transactions can be:

* linked together and traced through the

block chain;

* people can be traced to their Bitcoin transactions if they reveal information linking them to their Bitcoin addresses; and

* third parties are able to track Bitcoin spending to IP addresses

..then Bitcoin as it currently stands cannot be considered electronic cash, as cash is not traceable to any individual.

Darkcoin has set out to alter Bitcoin code in order to solve this problem inherent in Bitcoin in order to create cash over the internet: eCash.

The developer of Darkcoin said of the project:

Darkcoin is the first truely decentralized eCash system to ever exist.

For merchants the prospect of eCash should mean more sales. By removing some of the costs and friction that traditional electronic payment systems have, merchants can reduce costs and improve their margins, while allowing customers to pay without having to verify their payment credentials or employ complex security measures for protecting customer financial details - instead they just need to protect their dispatch address.

There are a number of innovations that have gone into creating an eCash version of Bitcoin, but the Darkcoin project has managed to accomplish this goal.

BackgroundeCashDarkcoin is seeking to obfuscate blockchain transaction details using a mixing system that starts from within the wallet. The users therefore do not have to take additional steps to hide their transactions such as using third party tools or to go through the hassle of using different addresses.

As transactions start from within users wallets, the mixing system is decentralised. Several other systems require trusted third parties to carry out the mixing of transactions to hide their origin; these systems typically rely on trust.

Transactions that cannot be tied together turn the coin into eCash: only the two parties to a transaction know the transaction took place. The process replicates real world cash transactions, but digitally over the internet.

The problem eCash solves is traceability. Bitcoin has one feature that is currently both an advantage and a weakness - blockchain transactions can be linked and if the users personal details are revealed, their past, present and future transactions using bitcoin can be linked together. Their anonymity is removed and privacy is also given away.

One of Satoshi's addresses.

Bitcoin blockchain transactions are a benefit to crypto currencies at this point in time as they make it more palatable for regulators to accept Bitcoin.

However, the Chairman of the Bitcoin Foundation said on the issue of privacy and Bitcoin:

User-controlled Privacy

Privacy is extremely hard to come by on the Internet. Bitcoin itself is not very private right now.

Publication of the owner of a single Bitcoin address can yield an incredible amount of personal financial information, information that cannot be put ‘back in the box’ – it will be available forever, encoded into the blockchain. This is the sort of information that law enforcement agencies would typically need to subpoena a bank for; instead right now we offer it to the entire Internet.

We haven’t yet seen significant involvement from consumer privacy agencies at the Foundation, but I believe they will be horrified when they understand just how much private financial data is being broadcast and permanently recorded.

This information directly impacts citizens living under repressive governments. It could cause physical harm to a woman whose finances are controlled by her pimp or her kidnapper. The knowledge of transactions can be combined with violence to limit any human’s fundamental right to transact economically.

It seems therefore critical that we do everything we can to support efforts that enhance this privacy from global inspection. Technological efforts like trustless sharing and ZeroCoin/ZeroCash have potential to improve the privacy guarantees available to those using Bitcoin.

Not everyone will want this kind of privacy to be available. In some jurisdictions, concerns over money laundering are brought up as the reason why such privacy should not be available.

I believe that these concerns are real and valid, and pragmatically, that a balance needs to be struck. We don’t yet know exactly how to balance the risks to different parties; on the one hand direct violence, control of individuals and financial risks borne by citizens with hyper-inflationary money supply are real harms being borne by human beings around the world right now. On the other hand there are real and more generalized harms to society that money laundering enables.

Right now, I believe the most reasonable regulatory approach is to encourage anti-money-laundering and know-your-customer rules that can be implemented at the ‘endpoints’, Bitcoin exchanges or money transmittal businesses. These businesses already have clear regulation and operations rules and understand how to identify money laundering, and what to do about it when they see it.

At the same time, we need to do better protecting those who have no other safe way to transact economically, and the Foundation will be providing support for a variety of proposals as a way to let the broader community engage with them and assess what would be useful.

Peter Vessenes, Chairman of the Board Apr 05 2014,

https://bitcoinfoundation.org/blog/?p=679As far back as 2011, Jeff Garzik, one of the core Bitcoin developers acknowledged that Bitcoin was not anonymous:

In 2011, at the very first Bitcoin conference in New York City, Jeff Garzik, one of the core developers of the Bitcoin software, stood before an audience of about 40 cryptocurrency enthusiasts and told them something that no one in the room wanted to hear. “Sorry,” he declared. “Bitcoins aren’t anonymous. [The currency] is more private and more anonymous than your credit card or PayPal. But it is less private and less anonymous than just face-to-face cash transactions.”

http://sciencefriday.com/blogs/05/14/2014/this-cryptocurrency-could-be-an-answer-to-bitcoin-s-privacy-problems.html?series=33The publication of every bitoin transaction is how it currently secures the network, by making the block chain visible for public inspection. Bitcoin and most alt-coins based on bitcoin are the only financial tools that publish personal financial transactions in this way. If a credit card company did this, people would complain.

Coinsider This! Show 22 - Ask Andreas Antonopoulos - talks about anonymity in general, why its needed and the extent of anonymity in Bitcoin.

https://www.youtube.com/watch?v=s3j5jlB0mmQ&feature=youtu.be&t=1h24m25sDuring his initial development work, Satoshi Nakamoto considered using IP addresses as the means to transmit Bitcoins between parties, but at some point he must have considered the implications of having IP addresses being linked to transactions and therefore creating a historical record of transactions that could be linked back to individuals.

New research has since highlighted that there are methods for tracking Bitcoin transactions by using tools to identify the IP addresses of senders and receivers of Bitcoins.

A research paper published in May 2014, highlighted the approach that could be taken to reveal IP addresses of those using Bitcoin: Deanonymisation of clients in Bitcoin P2P network,

http://arxiv.org/pdf/1405.7418.pdf

http://arxiv.org/pdf/1405.7418.pdfWith research increasingly focused on Bitcoin's lack of anonymity in certain circumstances, in addition to research showing how users IP addresses could be uncovered by using Bitcoin, there is a reasonable assumption that either users could be put off using digital currencies, authorities could try to restrict digital currencies because of potential infringements against privacy laws or a combination of these and other factors.

Bitcoin's exposure to IP scanning is not something new, as noted by Bitcoin's former chief scientist and senior Bitcoin Foundation board member Gavin Anderson, but sophistication in scanning for bitcoin addresses and peoples location and identity is now starting to gather pace.

http://bitcoin.stackexchange.com/questions/193/how-do-i-see-the-ip-address-of-a-bitcoin-transaction

http://bitcoin.stackexchange.com/questions/193/how-do-i-see-the-ip-address-of-a-bitcoin-transactionAs part of its development plan, Darkcoin is seeking to improve on protection measures to make it difficult or impossible to link transactions to IP addresses.

Creating anonymity tools for Bitcoin and using alternatives such as Darkcoin could not only benefit digital currencies, they could actually save digital currencies and allow them to develop into the future.

General Landscape and Market Size for eCash Darkcoin Mission Statement and Vision

Darkcoin Mission Statement and Vision, 28 May 2014

As of 22 April 2014, Darkcoin lacks a mission statement. It also lacks a vision, beyond that of creating an anonymous crypto currency.

My personal view is:

Darkcoin: Mission StatementTo create long term sustainable value for Darkcoin investors, users and supporters.

Darkcoin: Vision StatementTo be the trusted provider and leader of global decentralised eCash for consumers, merchants, businesses, not for profit organsiations and anyone who wishes to maintain private electronic financial transactions.

Darkcoin in the Media*

Medium.com, 18 March 2014

https://medium.com/on-banking/a923facddc3c*

Wired, 5 May 2014

The most technically solid method for protecting the anonymity of bitcoin transactions may be to create a new bitcoin altogether, starting with privacy as a first principle. That’s the approach taken by Darkcoin, an alternative cryptocurrency launched in January.

http://www.wired.com/2014/05/bitcoin-anonymous-projects/*

RT, Boom and Bust, 6 May 2014

https://www.youtube.com/watch?v=rIXCWtgid8Q @ 22 mins 30 seconds

International Business Times, 12 May 2014

http://www.ibtimes.co.uk/cryptocurrency-news-round-dogecoin-twitch-living-bitcoin-darkcoin-rises-1448153CityAM, Darkcoin: The cryptocurrency putting privacy first 12 May 2014

http://www.cityam.com/blog/1399908808/darkcoin-cryptocurrency-putting-privacy-firstCoindesk Advanced Algorithms, 16 May 2014

http://www.coindesk.com/advanced-algorithms-maxcoin-dogecar/Wired: Darkcoin, the Shadowy Cousin of Bitcoin, Is Booming 21 May 2014

http://www.wired.com/2014/05/darkcoin-is-booming/?mbid=social_twitter http://www.coindesk.com/true-anonymity-darkcoin-king-altcoins/

http://www.coindesk.com/true-anonymity-darkcoin-king-altcoins/Keiser Report, 27 May 2014

http://youtu.be/-FXKXH7gvmw?t=9m51sCompetition

http://youtu.be/-FXKXH7gvmw?t=9m51sCompetitionThere are several competitors to Darkcoin.

As at 09 June 2014, a third party survey of the various anonymity coins showed Darkcoin as the current front runner.

https://bitcointalk.org/index.php?topic=568166.msg6188433#msg6188433

https://bitcointalk.org/index.php?topic=568166.msg6188433#msg6188433The OP of this poll, who seems to be a supporter of Anoncoin, has stated his intention to let the survey run indefinitely.

Within the wider landscape, Zerocash is a new alt-coin which is yet to be released but has been assessed to be one of the more prominent and serious competitors to Darkcoin.

Led by Professor Matthew Green of Johns Hopkins University, Zerocash will be using Blue Midnight Wish as its hash algorithm and will rely on new anonymity features and proprietary source code that are expected to provide greater anonymity compared to Darkcoin but at the cost of not being fully vetted or tested.

As at 20 May 2014, the Zerocash alt-coin, which is expected to be based around the Bitcoin code base, is scheduled for release towards the end of 2014, according to one of the leader developers, Ian Miers:

The launch of Zerocash also requires a trusted third party to begin the process, but these few seconds to launch the coin has caused some concern as the trusted party could retain an ability to generate coins without being caught. For that reason, Miers and the rest of the team want to take their time on the code and arranging a trusted method for their launch.

A detailed review by one of the Zerocash creators, 27 Feb 2014, highlighted their main reservations with the technical aspects of the project:

http://www.youtube.com/watch?v=l7LSSE0bRRo

http://www.youtube.com/watch?v=l7LSSE0bRRo~9 minutes

Dark Wallet:

Dark Wallet is an online solution which enables bitcoin transactions to be made more anonymous through a plugin. The plugin, according to the developers comments reported in Wired on 29 April 2014, is a CoinJoin mixing service similar to Darkcoin. However, unlike Darkcoin, the mixing is carried out on Bitcoins and so it happens online inside a third party Bitcoin wallet service.

http://www.wired.com/2014/04/dark-wallet/Dark Wallet’s developers admit it’s still at an early stage, and that, like any cryptography project, it will only prove itself and patch its bugs over time. Taaki says, for instance, that the software will eventually combine more than two users’ payments in every CoinJoin transaction, and also integrate the anonymity software Tor to better protect users’ IP addresses. In its current form, Taaki says Dark Wallet protects IPs only by obscuring them behind the server that negotiates CoinJoin transactions, which may still leave users vulnerable to identification by sophisticated traffic analysis. “It’s not foolproof, but it’s a strong tool,” says Taaki. “And it’s going to get better.”

Initially, the team put out some notes on the project development via reddit:

We are building a lightweight bitcoin wallet with a core focus on security and anonimity, using a completely rewritten next-gen implementation of the original bitcoin core.

http://www.reddit.com/r/Bitcoin/comments/1sinh7/hey_rbitcoin_we_are_the_developers_of_the_dark/Shortly following the press releases some early views of Dark Wallet started to appear. On 2 May 2014, security expert Kristov Atlas gave his thoughts:

As the Dark Wallet progresses and more information becomes available, I will revisit this competitor mainly because it will receive a lot of media attention due to the involvement of Cody Wilson. The general feeling in March was:

Dark Wallet is certainly a project worth keeping track of and an option for Bitcoin users. However, malware that can attack browsers is a vulnerability that needs to be watched. It is also facing challenges from ISPs who may be looking to shut down access to DarkWallet.

Looking beyond the immediate anonymity centric competitors, the array of alt-coins that all seek to define themselves as payment tools face an uphill challenge to attract new supporters and retain existing ones. Their inability to compete on a level playing field with a protocol such as Darkcoin which offers anonymous and non-private payment options will likely see a redistribution of investors wealth into the next gen coins with early leaders such as Darkcoin benefiting from an uplift in value.

SWOT AnalysisDarkcoin and eCash payment networks have appealing properties compared to other payment tools, but there are also risks and threats.

Strengths* Decentralised payment protocol

* Anonymity built into the wallet

* Full time developer and dedicated development team

* Use of established, tested and trusted processes

* Anonymity nodes require minimum wallet funds to join the network. Creating a cost barrier to attackers. Nodes can be financially penalised for misbehaving.

* Existing alt-coins attempting to integrate darkcoin's mixing anonymity system risk destabilizing their network. This creates a barrier to entry for established currencies and puts them at a competitive disadvantage

* Merchants focusing on Bitcoin

Weaknesses* Small development team compared to Bitcoin and Litecoin

* Darkcoin long-term identity still being developed

* Branding may create unintended association with illegal use

* Hangover problems from launch in January 2014 with excessive coins minted remains a barrier for some

* Untested regulatory framework

* Development for the small start-up team is sequential and has yet to create a strategy for faster growth and parallel work streams for marketing, payment processor engagement, third party app development. The main focus is technical development.

* Leadership and team structure is still to be established

* As with the majority of alt-coins, their long-term average value is pegged to Bitcoin.

Opportunities* Mainstream adoption as eCash.

* Development of new innovations linked to anonymous transactions such as decentralised anonymous corporations, decentralised market places, use on smartphones as pocket eCash

* Creation of strong anonymity node network which is paid to participate leading to financial incentives for new participants to create nodes for financial gain.

* USA regulators have indicated that anonymity is not a barrier to eCash. Identity checking at fiat entry and exist points is more important to regulators.

* As anonymous eCash, Darkcoin has the ability to free float its price and detach from Bitcoin if its anonymity feature is recognised by third parties and merchants as a valuable privacy tool beyond that of Bitcoin and Litecoin

* Adoption by larger exchanges will be determined by volume. The anonymity features of Darkcoin make high volume use more likely at an earlier stage than most other forms of crypto currency.

* Based on Bitcoin code, Darkcoin could beat very strong competition by being easier to integrate into existing systems that have already introduced Bitcoin or Litecoin

Threats* Darkcoin technology is or will be open source. Clones can therefore spend more of their time focusing on marketing and eating into Darkcoin market share.

* Excessively used by bad actors for illegal purposes may create negative brand association over the medium term which may put off consumer focused merchants

* Launch of new anonymity protocols which offer better anonymity features

* Development team remains small and unable to scale the project

* Early success causing distractions and loss of focus for core team from technical and project development

* Development of Bitcoin sidechains which, when eventually made available, could link anonymity features to bitcoin transactions

Development Team & ExpertiseEvan Duffield is the senior developer of Darkcoin. He works on the project full time.

He has written a personal statement about the project, its creation and teething problems

https://www.darkcointalk.org/threads/the-birth-of-darkcoin.162/The developer of Darkcoin said of the project:

Darkcoin is the first truely decentralized eCash system to ever exist.

There is also a growing support network of around 20 people that are helping to develop around the core team. From running the darkcointalk.org forum, to marketing support, technical testing, running mining pools, to support for merchants and third party processors.

Technical features mapped against the competitive landscapeThe original concept that lead Evan Duffield down the road to creating Darkcoin was first raised by Bitcoin developer GMaxwell:

Bitcoin is often promoted as a tool for privacy but the only privacy that exists in Bitcoin comes from pseudonymous addresses which are fragile and easily compromised through reuse, "taint" analysis, tracking payments, IP address monitoring nodes, web-spidering, and many other mechanisms. Once broken this privacy is difficult and sometimes costly to recover.Traditional banking provides a fair amount of privacy by default. Your inlaws don't see that you're buying birth control that deprives them of grand children, your employer doesn't learn about the non-profits you support with money from your paycheck, and thieves don't see your latest purchases or how wealthy you are to help them target and scam you. Poor privacy in Bitcoin can be a major practical disadvantage for both individuals and businesses.

Even when a user ends address reuse by switching to

BIP 32 address chains, they still have privacy loss from their old coins and the joining of past payments when they make larger transactions.

Privacy errors can also create externalized costs: You might have good practices but when you trade with people who don't (say ones using "green addresses") you and everyone you trade with loses some privacy. A loss of privacy also presents a grave systemic risk for Bitcoin: If degraded privacy allows people to assemble centralized lists of good and bad coins you may find Bitcoin's fungibility destroyed when your honestly accepted coin is later not honored by others, and its decentralization along with it when people feel forced to enforce popular blacklists on their own coin.

As I write this people with unknown motivations are raining down tiny little payments on old addresses, presumably in an effort to get wallets to consume them and create evidence of common address ownership.

I think this must be improved, urgently.

This message describes a transaction style Bitcoin users can use to dramatically improve their privacy which I've been calling

CoinJoin. It involves no changes to the Bitcoin protocol and has already seen some very limited use spanning back a couple of years now but it seems to not be widely understood.

I first publicly described this transaction style in a whimsically-named thread— "

I taint rich!"— where I focused on a specific side effect of these transactions, with an expectation that people would see the rest of the implications on their own.

Explicit beats implicit, and even people who understand the idea have had some questions which could use answering. Thus this post.

The idea is very simple, first some quick background:

A Bitcoin transaction consumes one or more inputs and creates one or more outputs with specified values.

Each input is an output from a past transaction. For each input there is a distinct signature (scriptsig) which is created in accordance with the rules specified in the past-output that it is consuming (scriptpubkey).

https://bitcointalk.org/index.php?topic=279249.msg2983902#msg2983902Improvements over this mixing solution are due to include the following features:

DarkSend+

Over the last week or two, Darksend+ has made some significant advances. We’re happy to say that we’re closing in on a finished product.

We've opted to employ a strategy for Darksend+ that is slightly different than the one we outlined in our last update. This new strategy has several advantages, and we think it is a significant improvement over the previous iteration in terms of both privacy and efficiency. The Darkcoin client will now store pre-mixed, denominated Darkcoins in the user’s wallet, to be used instantly at any time the user desires. The mixing and denomination process is seamless, automatic, and requires no intervention on the part of the user. The 10 DRK limit previously in place with Darksend v1 will be permanently removed. With RC4, the amount that users can send via Darksend+ is limited only by the available balance in their wallet.

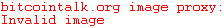

Here's how it works:

Every 10 blocks, user clients network-wide will send any unmixed, traceable Darkcoins in their possession through an anonymization phase. In this phase, Masternodes are used in chained succession to mix the coins they receive from the network and break them down into homogenous denominations. After being processed by a minimum of 2 Masternodes, the coins are either sent to the next Masternode in the chain or back to the user’s wallet at randomly generated change addresses.

Depending on the desired depth of security and privacy, users may select between 2 and 8 “hops” to successive Masternodes before their coins are sent back to the client. Hops are made every 10 blocks, so anonymization at a depth of 2 hops will take 10*2*2.5=50 minutes, 3 hops 10*3*2.5=75 minutes, and so on. The desired mixing depth can be selected in the client GUI.

At the end of the anonymization phase, the user’s coins are returned to their client at randomly generated change addresses. When the user wishes to make a transaction, the client forwards the intended amount from these anonymous change addresses directly to the intended receiver’s address. There is no direct involvement of of Masternodes in the final person-to-person transaction.

Proof of payment will work as it always has: a user can see the send transaction with the receiver’s address in their own wallet, and the blockchain will show that the receiver’s address received an input in the corresponding amount.

PLUS

...

Darkcoin suffers from a bad methodology to achieve anonymity and it's put everything into this one basket.

Sorry to hear you lost faith in the project. Also, sorry you're going to be getting out at a horrible time (right before I announce I have EVERYTHING figured out to make Darkcoin mainstream?).

Over the past couple of days, I've made huge leaps in the Darksend technology. In fact, RC4 will be the final solution to Darkcoin's anonymity. The client will automatically look at all of your funds and it will be able to tell which funds are not anonymized, if it finds non-anonymous outputs it will run them through a darksend with other clients. After that process, users can send without Darksend using the anonymous outputs for instant transactions without waiting for other nodes (with no upper limit on transaction sizes).

The other thing you're missing is that there is a reason I forked Bitcoin. Adoption for Darkcoin will be MUCH faster and easier for vendors, because all of the APIs are the same.

Expect more news in a few days. I have lots of work to do, but soon we can start testing all of this new functionality.

These nodes handle the mixing through random selection -

They are responsible for being the authority of what goes into the joined transaction each session.

eduffield, 21 February 2014

https://bitcointalk.org/index.php?topic=421615.msg5282966#msg5282966* I2P:

I'm implementing I2P into the masternodes. We're going to have our own private network just for DarkSend.

eduffield, 10 May 2014.

https://bitcointalk.org/index.php?topic=421615.msg6643662#msg6643662While ring signatures present their own compatibility problems with the core DarkSend and Master Node network, the lead developer has consider the issues:

Ring Signatures, RC3 Progress Report 22 May 2014

I've had some substantial progress on DarkSend and have figured out how to make our existing system as secure as ring signatures. Vastly improved security, no bloat (from the ring signatures) and without actually having to trust new cryptography (it hasn't been extensively tested like what DarkSend uses) . So I think it'll give us a HUGE advantage in the coming months. More to come soon, I'm going to start implementing this tomorrow.

https://bitcointalk.org/index.php?topic=421615.msg6864666#msg6864666*IP obfuscation 12 May 2014

https://bitcointalk.org/index.php?topic=421615.msg6694377#msg6694377Developing anonymity tools for Bitcoin has proven to be difficult without creating third party tools or new digital currencies such as Darkcoin. But efforts to create an easy to use system are ongoing, despite some reservations from those that believe Bitcoins transparency is the key to its acceptance by Governments.

http://eprint.iacr.org/2014/077.pdfTBC

Target MarketsThe Bank of England has prepared a detailed report on the prospects of digital payments.

http://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q3digitalcurrenciesbitcoin1.pdfhttp://www.bankofengland.co.uk/publications/Documents/quarterlybulletin/2014/qb14q3digitalcurrenciesbitcoin2.pdfAs at 2014, the demographics for crypto currency remain heavily weighted towards early technology adopters.

BTC China, one of the worlds largest Bitcoin and Litecoin exchanges, carried out a survey of its users in 2013. The demographics of its users were:

Globally, this map of those posting about bitcoin on Twitter highlights the main hot spots for crypto currencies:

Exchanges are also a good indicator of global spread of transaction volume. However, the lack of an exchange in the USA hides the true volume of trade in the US.

China, America and Europe are currently seen as the main global trading hubs for crypto currencies.

Distribution Channels, Customer Acquisition Strategy and Payment Processor networkBitcoin is at the point where its market leading position could become unassailable. However, while it has global brand recognition lack of mainstream merchant adoption remains its barrier to breaking away from any potential competition.

Those who use Bitcoin for nefarious reasons will be aware of the anonymity risks and so its use for underground activities will diminish. At the other extreme, Bill Gates and Bitcoin investor Richard Branson have both publicly announced that they do not believe Bitcoin will be the market leader in the future because it offers too much privacy.

It may not be the perfect global currency of the future yet, but it’s the pioneer of a global currency

http://bitcoinmagazine.com/12510/sir-richard-branson-wants-a-transparent-cryptocurrency-but-will-customers/Bitcoin is in a strong leadership position because of its first mover advantage, the significant and passionate following it has and because of the substantial business investments that people have made to profit from Bitcoin.

However, Bitcoin sits in a difficult middle ground and it has many competing interests pulling it in different directions. This causes some growth uncertainties and opens the door to an alt-coin to grow and fill some of the demand in the various areas that hold Bitcoin back.

Regulatory uncertainty, lack of merchant adoption, high volume trading and lack of convenient consumer payment processes at points of sale remain barriers to mass consumer adoption for bitcoin. These hurdles are faced by all crypto currencies.

Litecoin has attempted to play on Bitcoins investor following by suggesting that Bitcoin is gold which should be held as an investment, while Litecoin is silver which is more easily suited to everyday transactions. The message being that Litecoin is the natural choice as an everyday payment protocol.

The unique selling proposition of Darkcoin is the ability to turn crypto currency transactions into virtual cash transactions. Lack of anonymity within Litecoin, along with uncertainty brought about by new mining hardware which threatens to create pockets of centralization and threats of 51% attacks, leave Litecoin vulnerable to a new competitor such as Darkcoin.

While new merchants such as Overstock have drawn attention to the transactional benefits of using Bitcoin and crypto currencies as payment tools, much of the use for Bitcoin has been limited to activities that, helpfully, the Bitcoin blockchain allows people to follow.

A Fistful of Bitcoins: Characterizing Payments Among Men with No Names, Meiklejohn et al, 2013

From this study, which uses historical data which may lose its relevance in many cases, some of the noticeable indicators of transactions conducted were:

* Gambling - I have put together a more detailed overview of gaming

here >* Exchanges

* SilkRoad type services

By mapping unique Bitcoin change addresses, the researchers were able to break down their cluster of around 5.5m distinct clusters of public keys to 3,384,179 clusters. Then, after combining the fruits of their open source research and “tagging,” the researchers positively identified 2,197 of the clusters, linked to over 1.8 million BitCoin addresses.

“I think whatever anonymity that’s been enjoyed on the network to date has been the result of the relatively low volume of transactions and actors on the network,” Potter wrote. “Now that’s its growing exponentially, that anonymity will start disappearing, in my opinion.”

https://securityledger.com/2013/12/bitcoins-anonymity-more-theory-than-practice/While regulators focus on establishing rules that they feel comfortable with, the opportunities for crypto currency use over the short to medium-term remains around those areas of trade that court anonymity the most, taking into account the existing demographic of crypto coin users:

*

Porn - Those that are thinking of using Bitcoin to pay for porn, the driving factor for internet adoption and innovation since the late 1990s, will be concerned when the media begin to talk about the lack of privacy and anonymity that bitcoin has. Anonymity payment tools are more suited to porn use than Bitcoin.

*

Sex Workers - Those looking to legally pay for sex and companionship would potentially welcome a privacy centric electronic payment method enabling them to keep transactions off credit cards and off the radar of any spouses. In addition, sex workers and porn stars are increasingly being denied banking facilities for unexplained reasons and because of this denial of access to the banking system payment tools such as Darkcoin assist both the customer and the vendor.

*

Legal Fire Arms - As it is legal to pay for licensed firearms with cash with accompanying ID, using eCash could be even more convenient, including the ability to enable advance payments and deposits to be paid and large transactions to be conducted without the accompanying personal risks of carrying physical cash.

*

Tax Avoidance Subject to seeking professional assistance, there could be benefits from using Darkcoin to avoid any unnecessary tax payments. However, careful tax planning is required to ensure that tax avoidance, which is legal, does not unwittingly lead to tax evasion which is generally illegal. For example, redeeming value to fiat in a tax free country or jurisdiction is a planning option that is open to some who can transfer their material place of residence to benefit from tax exempt status.

*

Oppression As pointed out by the Bitcoin Foundation Chairman, using privacy tools can be of value to those living in controlled States or under oppressive financial circumstances.

*

Drugs Soft drugs such as marijuana are not universally banned or illegal in every country or jurisdiction. With vendors having difficulties with securing bank accounts and having to deal in cash, eCash offers a more secure middle ground option for vendors and a safe way for purchasers to buy legal drugs without fear of being stigmatized. Where it is legal to do so, eCash may also enable internet and mail orders for those merchants that cannot access banking facilities where banks withhold services without proper justification.

While there is a desire to move into ordinary financial transactions, the initial adoption phase will likely involve some or all of these sectors. The transition to mainstream eCash needs to be weighed up with pragmatic short-term cash flow and brand building needs in mind.

*

Beating corruption Charitable giving is made significantly easier with digital currencies. Projects all around the world can be easily supported with just a few clicks. Governments too may find that sending digital cash aide direct to the source needing funding might be easier and less prone to skimming by corrupt administrators. Using technology such as Darkcoin, such charity or government assistance would be untraceable and would avoid putting local people at risk of reprisals from corrupt officials missing out on their skim.

Regulatory IssuesAs it currently stands, crypto currencies are understood to exist by regulators all around the world. Their main focus of attention at present is to use Bitcoin as part of their narrative to describe crypto currency in general.

Commenting on anonymity within crypto currencies, Jennifer Shasky Calvery, Director, Financial Crimes Enforcement Network, United States Department of the Treasury, confirms that financial privacy is a real and important aspect of all financial transactions.

The view on regulation is currently being considered in a similar light to Bitcoin. The Bank Secrecy Act and existing AML policies towards digital currency will still apply. In general, moving in and out of fiat requires the use of regulated entities.

Non disclosure of financial transactions on a blockchain ledger is not a reason to stop anonymity tools such as Darkcoin.

https://www.youtube.com/watch?v=M7bbDpwlTws&feature=youtu.be&t=11m48s~12mins

Marketing and BrandingTBC

Marketing and branding follows a review of demographics, target markets.

However, it is likely that Darkcoin will require a strategy for rebranding and market positioning once it becomes an established payment network with the ability to rotate into high volume mass market retail merchant use.

Innovation and Product DevelopmentAnonymity featuresThe whitepaper for Darkcoin

http://www.darkcoin.io/downloads/DarkcoinWhitepaper.pdfThe whitepaper for Zerocash is due to be published on 18 May 2014

Since moving out of Beta in April 2014, Darkcoin development has started to transition to final release through a series of release candidates (RC1, RC2 at 1 May 2014), with the aim of going live after final testing and code vetting in May and June. The developers provided this summary on progress towards final release:

Here's the new schedule for development:

- RC2 (masternode payments, DGW3) : May 14th

- RC3 (1000 DRK limit and denominated change) :

May 21st 14 June

- After this, I'll find someone to vet the code and open source.

- RC4 (Bugs, security issues) new anonymity features, secret additions: end of July 2014

- Testing, RC5

- Kristov Atlas code and anon review

- ~RC5 opensource

General developmentWhile working on Darkcoin, Evan created a number of new innovations. These are now starting to be used by other coins.

As at May 14, 2014, this is a list of the the coins that are using Darkcoin innovations.

* Badgercoin - x11

* Bulgarian Crypto Coin (BGC) - x11

* CATicoin - x11

* CryptoPowers Coin - x11 and DGW

* ConspiracyCoin - x11

* Colorcoin - x11

* Edgecoin - x11

* Einsteinium Emc2 - looking to switch from Scrypt to x11

* ElectronicYen - x11

* Electronic LIRA - x11 and DGW

* Emirates Coin - x11

* EuropeCoin - x11

* GiveCoin - x11

* Global Denomination - x11

* Groestlcoin - DGW

* H20Coin - DGW

* HackCoin - x11 (PoW/PoS)

* HashCoin - X11 and DGW

* HighFiveCoin - x11 and users voted to add DGW

* Hirocoin - x11

* Frycoin - added DGW to fix problems with KGW

* Juggalocoin - x11

* Lamacoin LAMA lamaco.in - x11

* Limecoin - x11 and DGW

* Libertycoin - x11 PoS

* Logicoin X11 and DGW

* MaruCoin - DGW

* Muniti - x11

* Our Coin - x11 (Pow/PoS)

* PinkCoin - x11

* Nyancoin - switching algo to x11

* Quebecoin - x11 and DGW

* RAP(e)COIN - DGW

* Rotocoin - DGW

* SummerCoin - x11 (after vote on others)

* TwilightCoin - x11 and DGW

* VirtualCoin - x11

* WILDWESTCOIN - x11 PoS

X11By May 2014 the list was getting pretty big and new coins were being launched too regularly to keep an updated list.

Coins are using X11 hasing algo because it provides CPU and GPU support, with far less power requirements and GPUs run much cooler.

With the chained hashing, high end CPUs give an average return similar to that of GPUs. Another side effect of the algorithm is GPUs run at about 30% less wattage than scrypt and 30-50% cooler.

Darkcoin Gravity Wave (DGW)DGW adjusts the difficulty. It was created to fix problems found in KGW.

The founder of QuebecCoin uses it because:

DGW is currently the best difficulty adjustment algorithm available. It fixes the KGW timewarp exploit and allows a very accurate difficulty adjustment. X11 multipools will soon be a reality and hashrate manipulation will be easily prevented with DGW. Once again, there's simply no alternative if you want the best.

DarkSendDarkSend is an e-cash tool to make transactions anonymous. The process begins within the wallet and therefore it is a decentralized solution to leaving breadcrumbs of spending on a block chain.

Third party developers using DarkcoinUntil Darkcoin has its final release, there will be few projects that will seek to leverage off its anonymity features. Two notable projects that have indicated their use of Darkcoin are:

* DarkRoad - launched on March 3, 2014, Darkroad is set to accept Bitcoin, Darkcoin and Anoncoin.

* Dark Stock Exchange - Decentralised anonymous corporation stock market - a project that is in its early stages of development is seeking to provide a decentralised market place for shareholders of anonymous corporations to buy and sell their stocks and shares.

* Decentralised p2p auctions and market place - a concept that has been discussed, but there are no indications that development has started

One of the features of Darkcoin that may end up being a significant competitive advantage is that its base code originates from Bitcoin. While there are heavy modifications, there is likely to be enough to make it feasible for third party Bitcoin developers, merchants, payment processors, ATMs and vendors to add Darkcoin alongside any Bitcoin offering.

Provided Darkcoin can delivery sufficient anonymity to make payments fungible or as close to cash as possible, competitors that may offer stronger privacy technology may find their protocols are to difficult to adopt by systems that have focused on Bitcoin. Compatibility with Bticoin code that makes it easier to work with might be the underlying feature of Darkcoin that is yet to be realised.

Cash flow and ValuationA survey on the potential market cap of Darkcoin at the end of 2014 showed a high degree of confidence that the price would increase from the ~$6m at 1 May 2014 to a range between $100m - $500m.

Taking account of the voting of the hardened supporters who consider a valuation of over $1bn by the end of the year, and the votes at the other end of the scale, the general consensus falls around $250m. Using an estimate of 4.8m for the number of coins that will be in circulation by the end of the year, the price target for each coin is ~$45 to $55.

The supply of coins, the minting of new coins and the future distribution has been adjusted since the coins launch, with a greater emphasis on scarcity and removal of inflationary pressures from the release of new coins each year.

After a vote, the developers changed the amount of coins that were due to go out into circulation

https://bitcointalk.org/index.php?topic=421615.msg5823918#msg5823918The new supply lost an annual 1m new coins inflation amount, and instead went down to a range of ~15m to 23m through an annual reduction rate of 7%.

Darkcoin has done something really impressive by making a coin distribution strategy that no other cryptocurrency can claim to have implemented. It ultimately does have a limited supply. New coin generation (and inflation) will gradually taper off over time at a stable rate of 7% annually. Compare this to the much sharper 50% drops every 4 years in bitcoin.

Additionally, the darkcoin block reward still adjusts on a block-to-block basis due to difficulty. Maximum:25, minimum 5. If the network hashpower is too low, the payout increases as an incentive. In the long term, it is incredibly likely that added network power will simply reduce the reward rate to 5 DRK per block. This results in the projected total number of coins reaching approximately 22 million over the time frame shown - slightly more or less depending on how quickly hash power is added.

work in progress - TBC

Infrastructure and CostsFor Darkcoin, the development of anonymity is based around the block chain. Transactions will be mixed to avoid leaving a trail on the block chain that is traceable.

As the project is a decentralised eCash system, there are few project costs to the development team. The infrastructure costs to run Darkcoin is transferred to the miners who carry out validation on transactions and are rewarded through the random issue of new minted coins which are released every 2.5 minutes.

Master NodesAs part of this development, Darkcoin has created a mixing system that goes through 'Master Nodes' in a random selection process.

In order to prevent anyone from setting up a complex network of Master Nodes in order to bring down the anonymity layers and overall anonymity network, Master Nodes require to be linked to a wallet with 1,000 DRK coins. This creates an economic barrier to participation. To encourage a network of Master Nodes to be established on a decentralised basis, Master Nodes are given a % network fee from the solving of blocks. Master Nodes effectively become a proof of stake or proof of service type system where Master Nodes are financially rewarded by the miners.

The intention is to create an arms race, similar to the arms race for mining, for owning Master Nodes. The numbers and financial rewards will therefore be linked to the growth of the network and the growth of the value of Darkcoin.

So I propose the following solution, each block the last master node will receive 10% of the mining reward (in addition to the reward given to the miner). So for example, if the mining reward was 19DRK the last master node will automatically receive 1.9DRK.

This also has some really great side effects:

- It creates a completely new type of investor that buys DRK and holds it (where as miners create dark coin and sell it for the most part)

- It adds a ton of full nodes to the network

- It creates demand and scarcity, which should provide a nice return for our investors

Also, these payments are completely secure. New blocks with the dividend payment made out to the incorrect master node will be rejected (the whole network knows who won the election).

At the present moment we have a chicken and egg problem. We need master nodes to support darksend and we don't want to go live with 1 or 2 master nodes. To solve this we will implement the election code into the main client, along with the payments to master nodes while DarkSend is still beta.

What type of return will you see?

- If there’s 1 capable master node, you’ll receive all payments 576*(AverageReward/10) per day

Capable Nodes, Daily Reward

1, 1094DRK

2, 547DKR

5, 218DRK

10, 109DRK

20, 54DRK

50, 21DRK

100, 11DRK

As you can see, we’ll quickly reach equilibrium with the price and at the same time this will create buying pressure raising the price more and causing the network to become increasingly secure.

Distribution of users - The Darkcoin Rich List

if you take a closer look at the top 300 wallets, you get an interesting picture of the distribution:

http://bitinfocharts.com/top-100-richest-darkcoin-addresses-1.html

http://bitinfocharts.com/top-100-richest-darkcoin-addresses-1.htmlOf all the wallets created in:

*Jan-14: 146,000 DRK

*Feb-14: 175,000 DRK

*Mar-14: 315,300 DRK

*Apr-14: 524,200 DRK

*May-14: 522,500 DRK

*Jun-14: 332,900 DRK

*JUL-14: 96,300 DRK

*Aug-14:713,855 DRK

*Sep-14: 125,624 DRK

Total: 2.94m DRK [~63%]

Large investors started entering the market place to buy DRK between April and May. This saw a significant peak in market activity.

During August the overall crypto market declined and alts suffered significantly. Large investors used this opportunity to buy up Darkcoins as smaller investors moved to BTC.

Overall, the initial distribution from launch in January 2014 has seen most of the early miners exit and they have been replaced by a number of investors that have purchased their holdings primarily via Mintpal and Cryptsy.

-----------------------------------------------------

work in progress.....

NBThis thread is not an invitation to treat. Nor is it any form of investment advice.

Any incentives to keep going, keep updating this thread and a sign of helpfulness are welcome: Xtq2TgBYQiSfBLzE82inSpzNkZnkc71hZQ