CryptInvest

Legendary

Offline Offline

Activity: 2156

Merit: 1132

|

|

July 06, 2014, 11:19:37 PM |

|

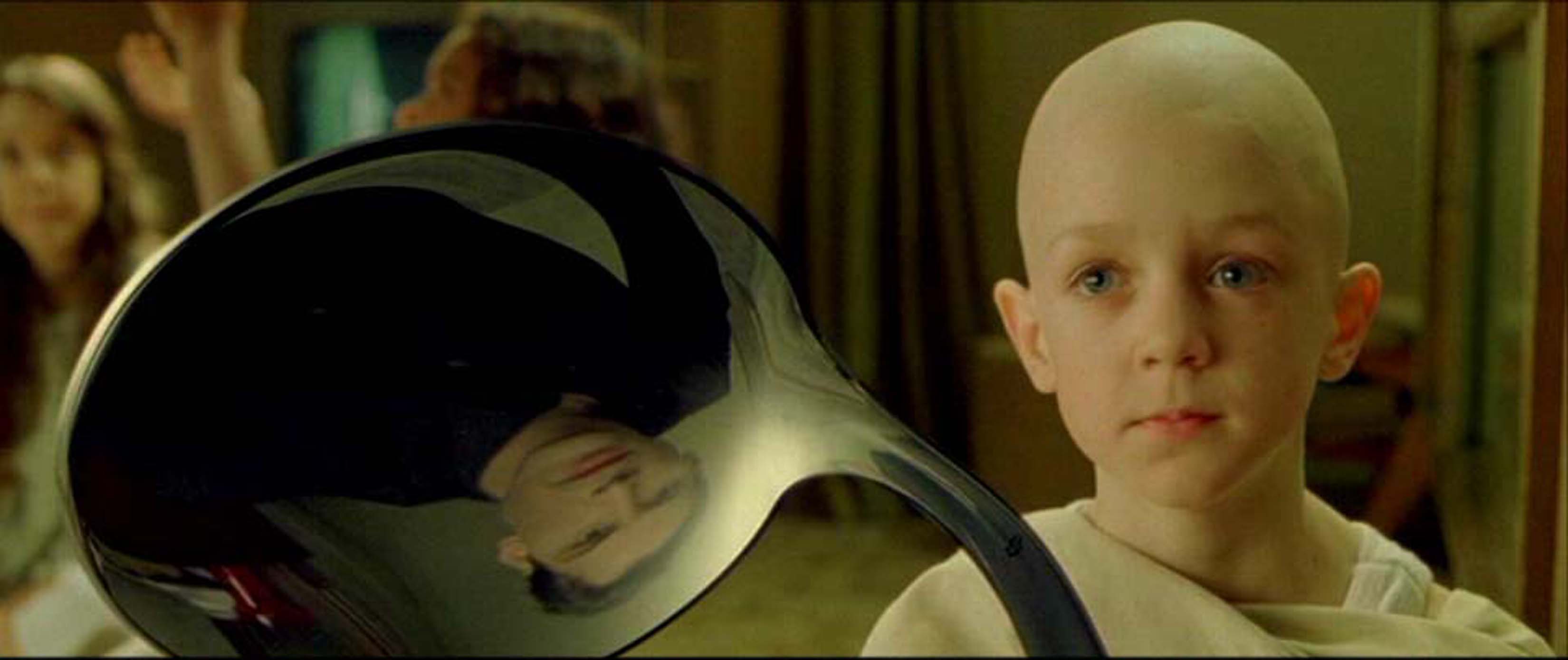

Time will tell. I Want to Believe  |

|

|

|

|

|

|

|

|

|

Even in the event that an attacker gains more than 50% of the network's

computational power, only transactions sent by the attacker could be

reversed or double-spent. The network would not be destroyed.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

sukamasoto

Legendary

Offline Offline

Activity: 1148

Merit: 1006

Black Panther

|

|

July 07, 2014, 08:58:44 AM |

|

I don't think bitcoin will ever reach 1 million dollars in the future, it can reach perhaps 100000$ but I don't see how it can go higher.

if so I will try not to sell my bitcoin now  |

|

|

|

greaterfool

Newbie

Offline Offline

Activity: 24

Merit: 0

|

|

July 08, 2014, 05:15:02 AM |

|

I think 50 to 100k is possible in the far away future if a lot of things come together

1m is just a ridiculous number, far too abstract almost

Just because it seems "ridiculous" does not mean it isn't possible.  Many people thought $1000 a coin was a ridiculous price and it would never get there. Why don't you look at it this way. Once all the BTC is mined there will be 21,000,000 BTC in circulation. If one BTC is worth $1 then the market cap of bitcoin would be $21 million If one BTC is worth $100 then the market cap of bitcoin would be $2.1 Billion If one BTC is worth $1,000 then the market cap of bitcoin would be $210 Billion If one BTC is worth $100,000 then the market cap of bitcoin would be $21 trillion If one BTC is worth $1,000,000 then the market cap of bitcoin would be $210 Trillion. As of 2012 the GDP of the US was ~15 trillion dollars and the GDP of the world was ~46 Trillion Does it still seem plausible for bitcoin to reach $1,000,000? Here's an idea, bear with me: This wikipedia article claims that the world GDP is ~85 trillion as of 2012: http://en.wikipedia.org/wiki/Gross_world_productAssuming that number is accurate - what if there's only 2.1 million coins available instead of 21 million? E.g. because most people will hold for very long periods of time, it's entirely possible that most of the value is concentrated in the number of coins being used for economic activity. Let's say only 10% of coins are "in play". Divide those 2.1 million by 1 billion people (smartphone users would be a good example) that have a need to use BTC for economic activity, and you have something like each person on average gets .0128 BTC. If BTC are 1 MM USD, then each person on average is responsible for 12,800 dollars of economic activity in BTC, with a market cap of 12.8 trillion USD. (Compared to the previous numbers 2.1 million coins available reduces this by a factor of 10x and the updated GDP halves it - with your numbers it's more like each person needs to be responsible for 250K of economic activity in BTC). This implies that the long term holders of bitcoin - people in the top 1% of ownership - will have a heavy incentive to cash out REALLY slowly (slow enough to maintain a nash equilibrium between new USDs going into BTC and their BTC cashing out to USD) - but they may not be able to coordinate well enough to maintain an equilibrium, causing a crash as the market gets flooded with BTC the first time someone cashes out hard and supply increases. I think BTC can easily hit 1 million USD assuming it becomes 'the paypal of smartphones', and as long as finance + tech sector maintains interest in it - a broad base of users who small amounts of value, and a large group of whales in semi-collusion or at least who recognize their own self interest and won't crash the system for a while. The question is, can it stay at 1 MM USD for even more than a single femtosecond, and who's going to be making money off of the short trades and the exchange vig?  The difference between |

|

|

|

|

|

Bogleg

|

|

July 08, 2014, 04:25:22 PM |

|

Don't think anyone really expecting 1M per coin. Even 5-10k per coin sound far fetch.

|

|

|

|

|

|

ThatDGuy

|

|

July 08, 2014, 07:42:29 PM |

|

Don't think anyone really expecting 1M per coin. Even 5-10k per coin sound far fetch.

I'm thinking that most who have been involved in the BTC space for more than a year would not consider 5k-10k/coin far fetched. |

|

|

|

|

|

indiemax

|

|

July 08, 2014, 07:50:11 PM |

|

I think 50 to 100k is possible in the far away future if a lot of things come together

1m is just a ridiculous number, far too abstract almost

Just because it seems "ridiculous" does not mean it isn't possible.  Many people thought $1000 a coin was a ridiculous price and it would never get there. Why don't you look at it this way. Once all the BTC is mined there will be 21,000,000 BTC in circulation. If one BTC is worth $1 then the market cap of bitcoin would be $21 million If one BTC is worth $100 then the market cap of bitcoin would be $2.1 Billion If one BTC is worth $1,000 then the market cap of bitcoin would be $210 Billion

If one BTC is worth $100,000 then the market cap of bitcoin would be $21 trillion If one BTC is worth $1,000,000 then the market cap of bitcoin would be $210 Trillion. As of 2012 the GDP of the US was ~15 trillion dollars and the GDP of the world was ~46 Trillion Does it still seem plausible for bitcoin to reach $1,000,000? Here's an idea, bear with me: This wikipedia article claims that the world GDP is ~85 trillion as of 2012: http://en.wikipedia.org/wiki/Gross_world_productAssuming that number is accurate - what if there's only 2.1 million coins available instead of 21 million? E.g. because most people will hold for very long periods of time, it's entirely possible that most of the value is concentrated in the number of coins being used for economic activity. Let's say only 10% of coins are "in play". Divide those 2.1 million by 1 billion people (smartphone users would be a good example) that have a need to use BTC for economic activity, and you have something like each person on average gets .0128 BTC. If BTC are 1 MM USD, then each person on average is responsible for 12,800 dollars of economic activity in BTC, with a market cap of 12.8 trillion USD. (Compared to the previous numbers 2.1 million coins available reduces this by a factor of 10x and the updated GDP halves it - with your numbers it's more like each person needs to be responsible for 250K of economic activity in BTC). This implies that the long term holders of bitcoin - people in the top 1% of ownership - will have a heavy incentive to cash out REALLY slowly (slow enough to maintain a nash equilibrium between new USDs going into BTC and their BTC cashing out to USD) - but they may not be able to coordinate well enough to maintain an equilibrium, causing a crash as the market gets flooded with BTC the first time someone cashes out hard and supply increases. I think BTC can easily hit 1 million USD assuming it becomes 'the paypal of smartphones', and as long as finance + tech sector maintains interest in it - a broad base of users who small amounts of value, and a large group of whales in semi-collusion or at least who recognize their own self interest and won't crash the system for a while. The question is, can it stay at 1 MM USD for even more than a single femtosecond, and who's going to be making money off of the short trades and the exchange vig?  The difference between IIRC the market cap @ $1000 was about $10 billion |

|

|

|

|

|

scarsbergholden

|

|

July 08, 2014, 08:21:50 PM |

|

I'm in the $1,000,000 camp. But I'm not unrealistic. It could take many, many years -- decades -- to get there. I'm patient.  |

|

|

|

|

CoinDiver

|

|

July 08, 2014, 08:55:01 PM |

|

What does GDP have to do with market cap?

There is 30 something trillion dollars in offshore bank accounts. How much in physical gold and silver? How about paper gold and silver? USD? EURO? 1m/btc would be easy if we reach universal adoption. Of course, you'll start to measure inflation (or deflation) by a basket of good purchased with btc... and measuring btcs value in fiat currency will be idiotic.

|

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

July 08, 2014, 09:31:42 PM |

|

What does GDP have to do with market cap?

There is 30 something trillion dollars in offshore bank accounts. How much in physical gold and silver? How about paper gold and silver? USD? EURO? 1m/btc would be easy if we reach universal adoption. Of course, you'll start to measure inflation (or deflation) by a basket of good purchased with btc... and measuring btcs value in fiat currency will be idiotic.

Nothing. Even in the most optimistic case of bitcoin taking over, you can not compute the value. You can not predict how large part of the value each actor has produced, he wants to have in reserve, in the form of value compressed into bitcoins. You know, given the fact that his compressed value tokens are safe for plunder, an actor might want to have much more than now in reserve, consequently the value of all bitcoins might be larger than the current value of all fiat money. |

|

|

|

|

LiteCoinGuy

Legendary

Offline Offline

Activity: 1148

Merit: 1010

In Satoshi I Trust

|

|

July 08, 2014, 10:52:24 PM |

|

I think 50 to 100k is possible in the far away future if a lot of things come together

1m is just a ridiculous number, far too abstract almost

Not rediculous if hyper-inflation occurs...viva le US peso? wow, then you are a millionär and you can buy a bread for 30.000 USD each  |

|

|

|

|

DavidHume

|

|

July 08, 2014, 11:04:49 PM |

|

I think 50 to 100k is possible in the far away future if a lot of things come together

1m is just a ridiculous number, far too abstract almost

Not rediculous if hyper-inflation occurs...viva le US peso? wow, then you are a millionär and you can buy a bread for 30.000 USD each  It will work well for those who have debt or use debt to finance their purchase on bitcoin. |

|

|

|

|

BitDreams

|

|

July 08, 2014, 11:29:52 PM

Last edit: July 09, 2014, 01:03:01 AM by BitDreams |

|

Instead of the price of bitcoin, think of the value beneath that a bitcoin represents. Through an algorithm and one of bitcoins many up and coming add-on's a single satoshi could represent a mansion on the coast while another single satoshi represents a penny in your pocket. The bitcoin network, all the contracts, all the titles and deeds, the representations will weave themselves into everyone's everyday lives and therefore, eventually all of the wealth of the world would at one time or another be represented by transactions in the blockchain. The question is, do you have bitcoin? |

|

|

|

|

NetCastle

Newbie

Offline Offline

Activity: 72

Merit: 0

|

|

July 09, 2014, 12:16:01 AM |

|

|

|

|

|

|

greaterfool

Newbie

Offline Offline

Activity: 24

Merit: 0

|

|

July 09, 2014, 02:19:48 AM |

|

What does GDP have to do with market cap?

There is 30 something trillion dollars in offshore bank accounts. How much in physical gold and silver? How about paper gold and silver? USD? EURO? 1m/btc would be easy if we reach universal adoption. Of course, you'll start to measure inflation (or deflation) by a basket of good purchased with btc... and measuring btcs value in fiat currency will be idiotic.

Nothing. Even in the most optimistic case of bitcoin taking over, you can not compute the value. You can not predict how large part of the value each actor has produced, he wants to have in reserve, in the form of value compressed into bitcoins. You know, given the fact that his compressed value tokens are safe for plunder, an actor might want to have much more than now in reserve, consequently the value of all bitcoins might be larger than the current value of all fiat money. Hmm. I agree with most of this as well as the subsequent posts, but I don't think GDP (actually GWP, gross world product) is completely unrelated to value of bitcoin. Mind talking me through this? Of course we can't predict anything  Even modeling BTC network growth is hard, and I'm a network nerd. Predicting BTC value is economics mixed with voodoo and I'm out of my depth there. But here's how I think GWP fits in (please correct me if I'm wrong, but go into detail!): If a large number of people are holding long term, they're causing artificial scarcity for bitcoins. Assume that this takes a large number of BTC out of circulation for a decent amount of time. We've seen this with domain name squatters, we've seen it in the ip address black market, and we'll see it here - people like holding large swaths of imaginary numbers if they're scarce. *shrug* The remaining available coins value will be in their utility to the people who are actually using them - either you're holding, or you're engaging in a transaction, right? Buying phone cards, sending remittances, gambling, silk road, those are all part of the GWP. If the total value of these "utility coins" has to be more than the GWP to hit 1 million, that still tells us not much I think  But if the value is a factor of the current world GWP, that's a more likely scenario than "GWP has to double and everyone has to use BTC for all transactions that contribute to GWP in order for the spot price to be 1 MM". It's the difference between saying 25% of the world's population has to pay their rent at current market rates in BTC for a year in order for the spot price in BTC to hit 1 million that year vs 99% of the population has to pay for everything in BTC to hit 1 million. You can only subjectively say which is more likely, but the second scenario implies a LOT more effort and progress for BTC. The point the original poster was making was that somehow there wasn't enough money around for BTC to hit 1MM, and for my part - if a few billion people all start buying their shitty 99c smartpone apps in satoshi, and then move on to paying their phone bills and other utilities through that same mobile wallet, I think that's the quickest way we get there. Smartphone users are projected to hit 5 billion in 2017. Predicting what long term holders do is impossible, and I agree with your analysis there, but the people who will use bitcoin for some fraction of transactions made in their otherwise "normal" fiat lives must exist as a function of GWP, I can't see how they wouldn't. (Again, network geek heavy, econ lite, so be gentle  ) |

|

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

July 09, 2014, 02:42:30 AM |

|

What does GDP have to do with market cap?

There is 30 something trillion dollars in offshore bank accounts. How much in physical gold and silver? How about paper gold and silver? USD? EURO? 1m/btc would be easy if we reach universal adoption. Of course, you'll start to measure inflation (or deflation) by a basket of good purchased with btc... and measuring btcs value in fiat currency will be idiotic.

Nothing. Even in the most optimistic case of bitcoin taking over, you can not compute the value. You can not predict how large part of the value each actor has produced, he wants to have in reserve, in the form of value compressed into bitcoins. You know, given the fact that his compressed value tokens are safe for plunder, an actor might want to have much more than now in reserve, consequently the value of all bitcoins might be larger than the current value of all fiat money. Hmm. I agree with most of this as well as the subsequent posts, but I don't think GDP (actually GWP, gross world product) is completely unrelated to value of bitcoin. Mind talking me through this? Of course we can't predict anything  Even modeling BTC network growth is hard, and I'm a network nerd. Predicting BTC value is economics mixed with voodoo and I'm out of my depth there. But here's how I think GWP fits in (please correct me if I'm wrong, but go into detail!): If a large number of people are holding long term, they're causing artificial scarcity for bitcoins. Assume that this takes a large number of BTC out of circulation for a decent amount of time. We've seen this with domain name squatters, we've seen it in the ip address black market, and we'll see it here - people like holding large swaths of imaginary numbers if they're scarce. *shrug* The remaining available coins value will be in their utility to the people who are actually using them - either you're holding, or you're engaging in a transaction, right? Buying phone cards, sending remittances, gambling, silk road, those are all part of the GWP. If the total value of these "utility coins" has to be more than the GWP to hit 1 million, that still tells us not much I think  But if the value is a factor of the current world GWP, that's a more likely scenario than "GWP has to double and everyone has to use BTC for all transactions that contribute to GWP in order for the spot price to be 1 MM". It's the difference between saying 25% of the world's population has to pay their rent at current market rates in BTC for a year in order for the spot price in BTC to hit 1 million that year vs 99% of the population has to pay for everything in BTC to hit 1 million. You can only subjectively say which is more likely, but the second scenario implies a LOT more effort and progress for BTC. The point the original poster was making was that somehow there wasn't enough money around for BTC to hit 1MM, and for my part - if a few billion people all start buying their shitty 99c smartpone apps in satoshi, and then move on to paying their phone bills and other utilities through that same mobile wallet, I think that's the quickest way we get there. Smartphone users are projected to hit 5 billion in 2017. Predicting what long term holders do is impossible, and I agree with your analysis there, but the people who will use bitcoin for some fraction of transactions made in their otherwise "normal" fiat lives must exist as a function of GWP, I can't see how they wouldn't. (Again, network geek heavy, econ lite, so be gentle  ) Well you can continue to talk about GDP or GWP or whatever, both are fundamentally unmeasurable, and have no relation to the value of money. The same goes for the fundamentally unmeasurable velocity. And this ... The point the original poster was making was that somehow there wasn't enough money around for BTC to hit 1MM [...]

is totally absurd. There does not have to exist any money outside of bitcoin (although in the market, there always tend to be alternatives). And if there are alternatives, like fiat, and the demand to hold value in reserve in the form of money in total is fixed, less value to the alternatives just means higher value to bitcoin. The value is decided in the market from the mind of the actors in the demand and supply. The market consist of pairs, where each bitcoin supplier decides that it is worth it to trade a number of coins for a number of someting else. And vice versa for the bitcoin buyer. You could say the supply is the absens of demand to have, compared to the other good. What underlying reasons each actor has for his decision is unknown, maybe even for the individual actor himself. The urge to slush the money around doesnt give it any special value, only the demand to have or not to have. |

|

|

|

|

greaterfool

Newbie

Offline Offline

Activity: 24

Merit: 0

|

|

July 09, 2014, 03:19:53 AM |

|

Well you can continue to talk about GDP or GWP or whatever, both are fundamentally unmeasurable, and have no relation to the value of money. The same goes for the fundamentally unmeasurable velocity.

And this ... The point the original poster was making was that somehow there wasn't enough money around for BTC to hit 1MM [...]

is totally absurd. There does not have to exist any money outside of bitcoin (although in the market, there always tend to be alternatives). And if there are alternatives, like fiat, and the demand to hold value in reserve in the form of money in total is fixed, less value to the alternatives just means higher value to bitcoin. The value is decided in the market from the mind of the actors in the demand and supply. The market consist of pairs, where each bitcoin supplier decides that it is worth it to trade a number of coins for a number of someting else. And vice versa for the bitcoin buyer. You could say the supply is the absens of demand to have, compared to the other good. What underlying reasons each actor has for his decision is unknown, maybe even for the individual actor himself. The urge to slush the money around doesnt give it any special value, only the demand to have or not to have. [/quote] I think this is reflecting a conflation of two questions in the original thread title - does BTC have a certain value vs. can you swap out BTC for a certain amount of USD. And wait, GWP is fundamentally unmeasurable? That seems strange. If you believe it's fundamentally unimportant for this calculation, that's one thing, but you're saying that the sum total of world economic activity is something that we can't measure, or at least make an educated guess at within an order of magnitude, and that it's not a relevant economic indicator? Here's a chart from the world bank measuring current world GDP: http://data.worldbank.org/indicator/NY.GDP.MKTP.CD/countries/1W?display=graphtIs the world bank lying to me?  |

|

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

July 09, 2014, 04:00:59 AM |

|

Well you can continue to talk about GDP or GWP or whatever, both are fundamentally unmeasurable, and have no relation to the value of money. The same goes for the fundamentally unmeasurable velocity. And this ... The point the original poster was making was that somehow there wasn't enough money around for BTC to hit 1MM [...]

is totally absurd. There does not have to exist any money outside of bitcoin (although in the market, there always tend to be alternatives). And if there are alternatives, like fiat, and the demand to hold value in reserve in the form of money in total is fixed, less value to the alternatives just means higher value to bitcoin. The value is decided in the market from the mind of the actors in the demand and supply. The market consist of pairs, where each bitcoin supplier decides that it is worth it to trade a number of coins for a number of someting else. And vice versa for the bitcoin buyer. You could say the supply is the absens of demand to have, compared to the other good. What underlying reasons each actor has for his decision is unknown, maybe even for the individual actor himself. The urge to slush the money around doesnt give it any special value, only the demand to have or not to have. I think this is reflecting a conflation of two questions in the original thread title - does BTC have a certain value vs. can you swap out BTC for a certain amount of USD. And wait, GWP is fundamentally unmeasurable? That seems strange. If you believe it's fundamentally unimportant for this calculation, that's one thing, but you're saying that the sum total of world economic activity is something that we can't measure, or at least make an educated guess at within an order of magnitude, and that it's not a relevant economic indicator? Here's a chart from the world bank measuring current world GDP: http://data.worldbank.org/indicator/NY.GDP.MKTP.CD/countries/1W?display=graphtIs the world bank lying to me?  Yes, they are neo keynesians. Their GWP measures GWP, not the world's production. Look into it. Apart from inaccuracies in the actual reporting of numbers from the field, it is also a question of what to include and what not to include. The broken window fallacy. They can have some fun with that number, and others, but history shows they are still in the fog. |

|

|

|

|

|

twiifm

|

|

July 09, 2014, 04:11:56 AM |

|

A self taught armchair economist doubting people that have studied this subject all their life. Hmm. Who should is more credible ?😁

|

|

|

|

|

Erdogan

Legendary

Offline Offline

Activity: 1512

Merit: 1005

|

|

July 09, 2014, 09:50:19 AM |

|

A self taught armchair economist doubting people that have studied this subject all their life. Hmm. Who should is more credible ?😁

You don't know how I got my knowledge, nor my profession, nor the exact type of chair I prefer. I am certainly not interested in discussing things in the form of flinging names of professors around. If you guide your investments from what the best known and educated people around say, you would not have bitcoins yet. |

|

|

|

|

|

hodap

|

|

July 09, 2014, 03:50:58 PM |

|

A self taught armchair economist doubting people that have studied this subject all their life. Hmm. Who should is more credible ?😁

You don't know how I got my knowledge, nor my profession, nor the exact type of chair I prefer. I am certainly not interested in discussing things in the form of flinging names of professors around. If you guide your investments from what the best known and educated people around say, you would not have bitcoins yet. Powerful fact. Academic type are so over hyped. |

|

|

|

|

|