The Parasitic Cycle: Finance Part II

Modern economics obscures the truth about the process of money creation. In

Finance Part I: Understanding the Parasite we explored how money is actually created. Today we explore the devastating economic consequences that inevitably follow.

Banking is a very treacherous business because you don't realize it is risky until it is too late. It is like calm waters that deliver huge storms.

The modern industrial economy is characterized by cyclical boom and bust. Massive growth is followed by recurrent busts. With only minor hand waving we are told by most economists that this "business cycle" is caused by mysterious and natural periodic shifts in savings and consumption. Karl Marx noticed that before the Industrial Revolution, these cyclical boom and busts did not occur. Marx concluded that the cycles must therefore be an inherent feature of capitalism. Various schools of modern economic thought, regardless of their other disagreements have all agreed on this sacred scripture. The business cycle (we are told) must be rooted deep within the free-market economy a natural boom and bust if you will. These crashes seem to just… happen.

We must go further back in history to find a true counter to the modern narrative. David Hume and David Ricardo would not have agreed with current orthodoxy. Hume was the first to point out that another critical institution had developed and grown strong alongside the industrial system. This wondrous creation of wealth

extraction creation is our fractional reserve banking system. Could this powerful institution be responsible for the cycles? Ludwig von Mises answered this question definitively in 1912 with his book Theory of Money and Credit.

Mises saw that true cause of the recurrent boom and bust cycles was fractional reserve banking. Banks create money, but each loan they make creates more debt than money. To pay back these loans the interest due must in be drawn from the larger economy. This interest can only be paid via two mechanisms.

1) Someone somewhere in the economy must take out even more debt to pay the initial loan.

Or

2) Somewhere debt must go into default and its underlying collateral seized.

The bank's costs to create money are fixed at a low price by the central bank (not the free market). Central banks keep this rate at the lowest possible level that avoids significant inflation. It is "good for the economy" or so we are told. Debt requires ever more debt to sustain.

Credit creation makes it appear as if the supply of "saved funds" ready for investment has increased, for the effect is the same: the supply of funds for investment purposes increases, and the interest rate is lowered. Borrowers, in short, are misled by the bank inflation into believing that the supply of saved funds (the pool of "deferred" funds ready to be invested) is greater than it really is.

When interest rates are artificially low, entrepreneurs are led to believe the income they will receive in the future is sufficient to cover their near term investment costs. In an environment where the money supply is continually expanding via debt, entrepreneurs mistakenly conclude that investments are really available for long term projects when in fact the pool of available funds has come solely from artificial credit creation that can and will be contracted at will by the banking sector. Entrepreneurs see spending in the economy and assume consumer demand exists for their projects when in fact consumer demand is artificially and unsustainably elevated.

As bank credit percolates through the economy it moves downward from business borrowers to landowners and capital owners who sold assets to the newly indebted entrepreneurs, and finally onto other factors of production like wages, rent, and interest.

No punch bowl stays full forever. The artificial boom from artificial credit raises prices and if left unchecked runaway inflation. Banks cannot allow that. As inflation picks up the central bank overseer signals the end of the party. Interest rates are rise and the squeeze begins.

When banks start to squeeze (often in response to inflation) the party quickly ends and there is a critical economy wide liquidity shortage. By definition there is never enough money to pay off debt. Without sufficient new debt what existing liquidity exists must be redirected towards an ultimately unpayable debt. Assets must be sold and prices drop. Investors suddenly find their projects are unsustainable; banks call in loans and then seize the underlying collateral capturing the work and effort of the investor.

Some investments made during the artificial monetary boom were inappropriate and "wrong" from the perspective of the long-term financial sustainability. Others should be sound but nevertheless fail due to the economic distortion and contraction triggered by sudden credit tightening.

The boom is revealed for what it is, a period of wasteful malinvestment, a "false boom" where the investments undertaken during the period of fiat money expansion are revealed to lead nowhere but to insolvency and unsustainability. Seizure of collateral and general price deflation or reduction in inflation ensues. The longer the false monetary boom goes on, the bigger and more speculative the borrowing, the more wasteful the errors committed and the longer and more severe will be the necessary bankruptcies, foreclosures and depression.

As we have seen, an increase in the supply of money benefits the early receivers, that is, the government, the banks, and their favored debtors or contractors, at no point is this more true than at the bottom of the business cycle when asset prices are artificially depressed and only favored borrowers are allowed to borrow. It is at the bottom that favored insiders can still borrow allowing assets to be purchased at depressed prices.

In any economy not on a 100% percent commodity or cryptocurrency standard, the money supply is thus used as a vehicle for wealth extraction. Monetary inflation and the inevitable resulting parasitic cycle erroneously referred to as the "business cycle" is the method by which the banking system, and favored political groups are able to partially expropriate the wealth of other groups in society. Those empowered to control the money supply issue new money to their own economic advantage and at the expense of the remainder of the population. The parasitic cycle is a direct result of fractional reserve banking. The creation of new money is limited only by the top down imposed cost set by the central bank. This value is not set by individuals optimizing their economic savings decisions but a single top down controller, a controller who's charter mandates it to act in the best interest of its member banks.

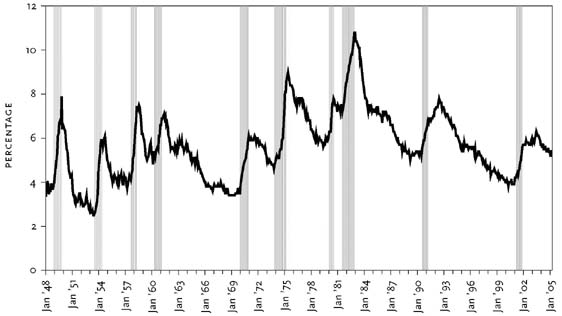

The empirical evidence is strongly on the side of the view that deviations from full employment are often the result of spending shocks. Monetary policy, in particular, appears to have played a crucial role in causing business cycles in the United States since World War II. For example, the severe recessions of both the early 1970s and the early 1980s were directly attributable to decisions by the Federal Reserve to raise interest rates. On the expansionary side, the inflationary booms of the mid-1960s and the late 1970s were both at least partly due to monetary ease and low interest rates. The role of money in causing business cycles is even stronger if one considers the era before World War II. Many of the worst prewar depressions, including the recessions of 1908, 1921, and the Great Depression 1930s, were to a large extent the result of monetary contraction and high real interest rates.

Figure 1: Unemployment Rate and Recessions

Once inflation is safely tamed and another cycle of assets seized, the central bank signals the start of the next "boom" and low rates are initiated once more with the goal of "helping reduce the unemployment" caused by the "business cycle". However, the parasitic cycle is self-limiting. It only works if banks can identify individuals with collateral to

harvest lend to. Eventually those people run out of assets to seize. The highly productive learn to avoid debt whenever possible and thus partially opt out of the game.

Once the parasitic cycle has run its course banks need a way to forcibly harvest the wealth of those who opt out of the system. To succeed they need a more efficient suction mechanism. Specifically they need powerful centralized government and taxation powers. Stay tuned for Finance Part III.

Finance Part I: Understanding the ParasiteFinance Part II: The Parasitic CycleFinance Part III: Divide, Conquer, EnslaveReferences:

Murray N. Rothbard, Economic Depressions: Their Cause and Cure

https://mises.org/daily/3127Ludwig von Mises Institute, Austrian Business Cycle Theory

http://wiki.mises.org/wiki/Austrian_Business_Cycle_Theory#cite_note-6Christina D. Romer, Business Cycles

http://www.econlib.org/library/Enc/BusinessCycles.html