Show Posts Show Posts

|

|

Pages: [1] 2 3 »

|

Magandang araw sa mga kababayan ko dito, mukhang magandang balita ito sa lahat ng mga nagtitiwala parin sa binance, dahil sa article na ito ay nagpahayag ng pag-asa ang binance sa ating mga lokal community dito sa ating bansa gagawin nila ang lahat para makacomply sa mga kailangan ng SEC natin dito. Basta huwag lang sana harangin o ipitin ng sec opisyales ang mga pagcomply ni binance. At sinabi rin na isa lamang pansamantala sa ngayon, at lagi narin sila magbibigay ng update sa atin kung ano na yung lagay ng kanilang ginagawang pagcomply sang-ayon sa spokesperson nila sa korea, so isa itong magandang balita sa ating lahat. Wait lang tayo ng short period of time, then yung binance apps hindi pa mapapatanggal dahil gusto rin naman marinig muna ng google at apple yung side ng Binance. Good news ito para sa akin. source: https://bitpinas.com/regulation/binance-responds-sec/ |

|

|

|

What is price action?Price action is "you" making trading decisions based on price formations and price patterns you see materializing in the market in "real time.".

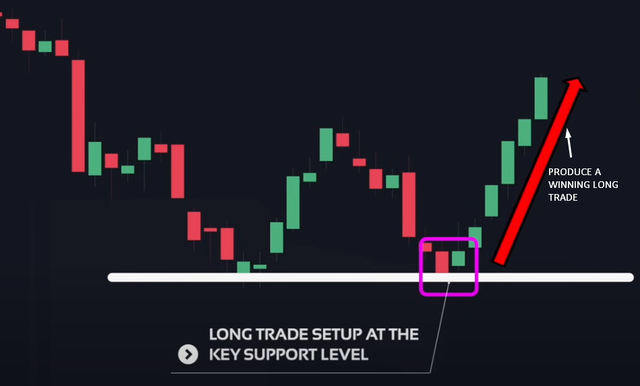

Market Structure and Key Levels: This involves identifying key levels of support and key levels of resistance because these levels present high-quality trade entry opportunities.

What are the key levels exactly?

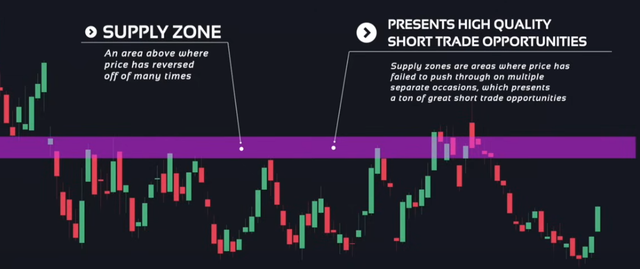

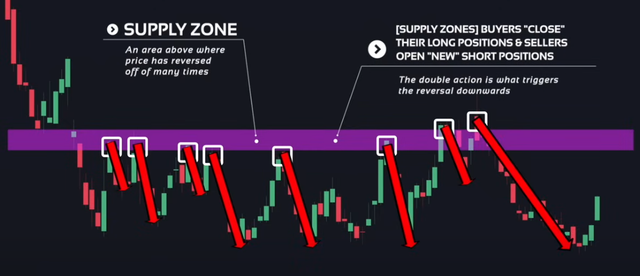

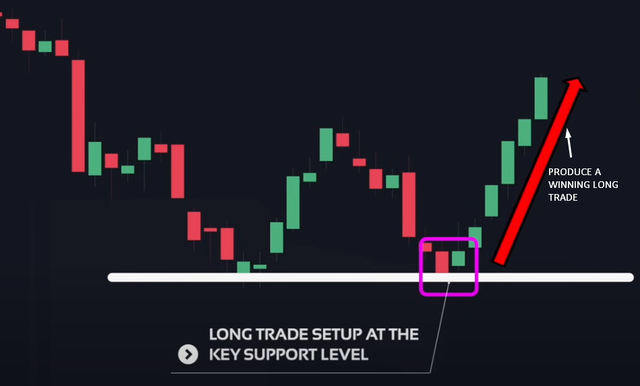

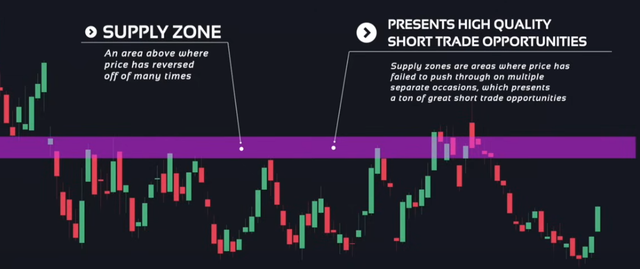

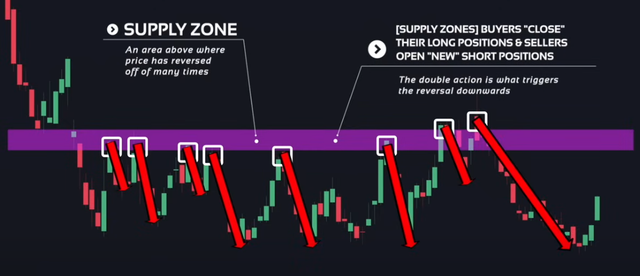

Key resistance levels Key resistance levels are areas above the price where the price has drastically reversed, which presents short-term trading opportunities when the price comes back to these levels. Price Action Psychology Behind Resistance Levels When the price comes up to a recently formed resistance level, it is deemed expensive within that particular moment in time, meaning less buying occurs, triggering the reversal downward.  Now, going in the opposite direction,  Key support levels Key support levels are areas below which the which the price has reversed drastically upwards, which present long-term trading opportunities when the price comes back to these levels.  Price Action Psychology Behind Support Levels Price Action Psychology Behind Support Levels When price comes down to a recently formed support level, it is deemed "cheap" within that particular moment in time, meaning value buyers will load up, triggering the reversal upwards. Supply and Demand + Multiple Reversals of Price: An area above, where price reverses off multiple times, is known as a "supply zone," and an area below, where price reverses off multiple times, is known as a "demand zone.".   Price Action Psychology Behind Supply Zones Price Action Psychology Behind Supply Zones The market is deeming this area of price as expensive, which results in buyers consistently deciding to close their long positions in this area and sellers choosing to hold this area strong and open new short positions.  In the opposite direction,   Price action psychology behind demand zones Price action psychology behind demand zones The market is deeming this area of price as cheap, which results in sellers consistently deciding to close their short positions in this area and buyers choosing to hold this area strong and open new long positions.

What is price action? https://www.investopedia.com/terms/p/price-action.asp

I'll stop here for awhile its a long tutorial, and I will continue on my free time again, hope this will give a knowledge somehow to everyone have a good day....

|

|

|

|

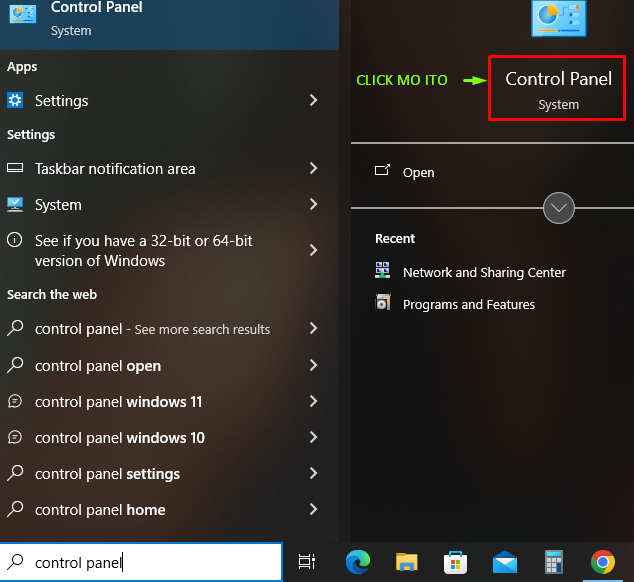

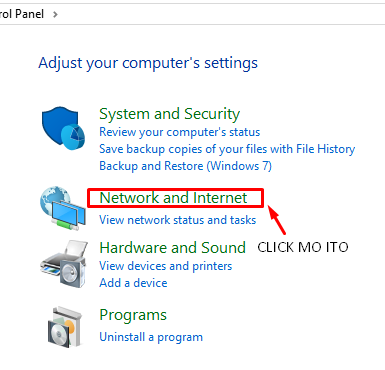

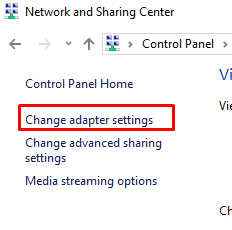

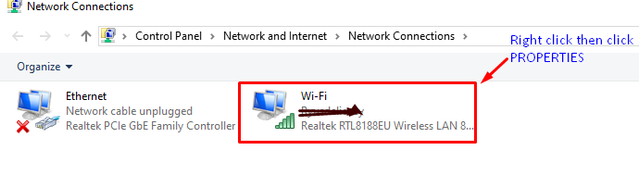

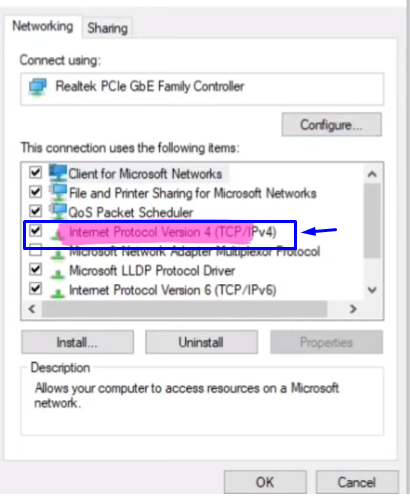

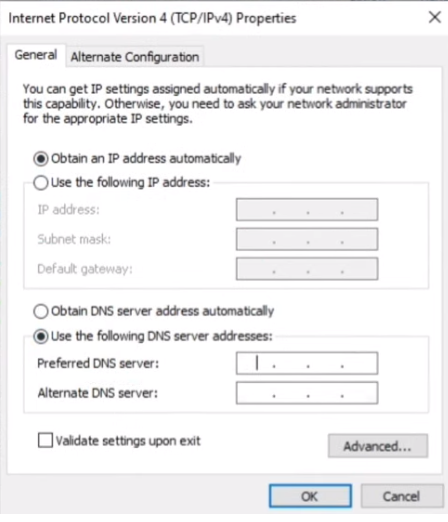

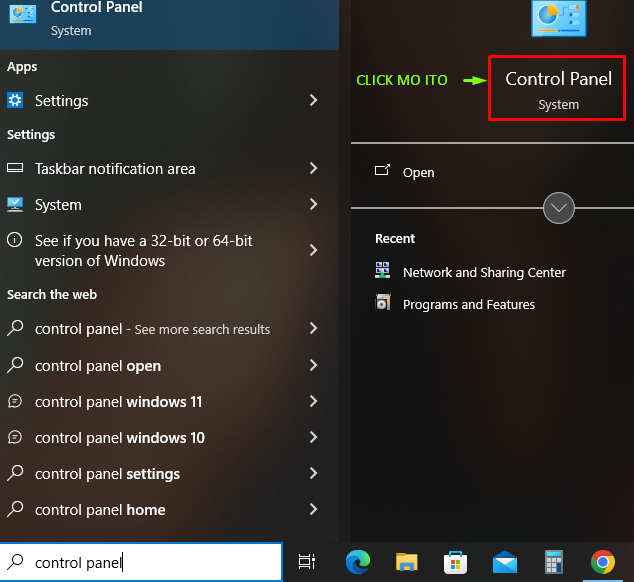

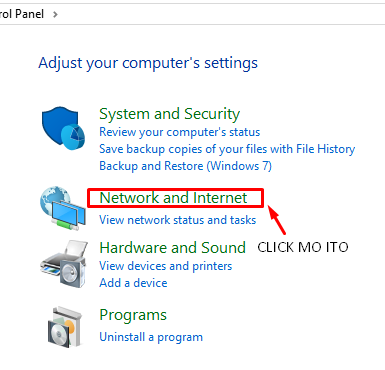

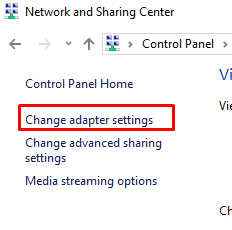

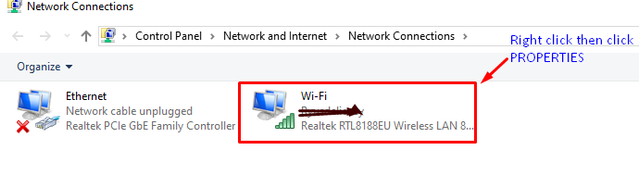

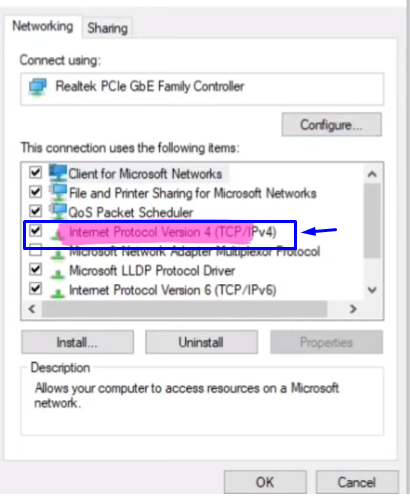

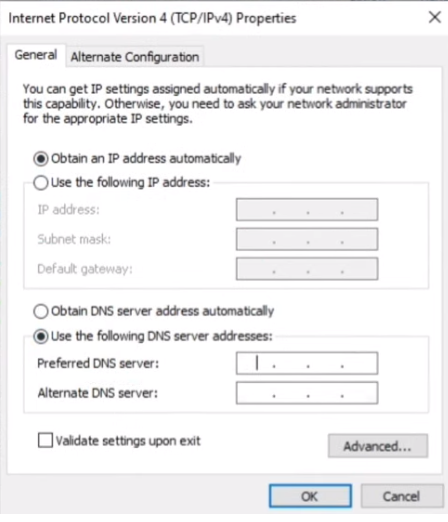

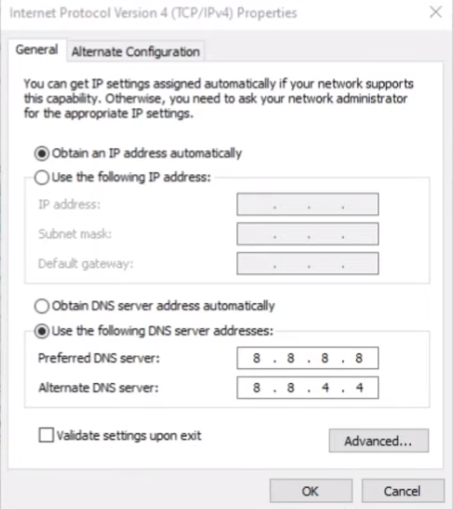

Magandang araw sa mga kababayan ko dito, marahil yung iba dito sa inyo ay hindi na maaccess ang Binance ngayon, na maaring yung iba ay naipit na yung fund nila dahil nagpasok parin kahit na alam nilang any moment ay mabablock na ito. At nangyari na nga, kaya ang tutorial na ito ay para sa mga ka lokal natin na hindi na nailabas pa ang kanilang fund at para mailipat nila sa ibang exchange platform. Magagagawa nio parin na makaaccess kay binance gamit ang tutorial na ito kahit hindi kayo gumagamit ng vpn, sundin nyo lang yung procedure sa ibaba. 1.  2.  3.  4.  5.  6.  7.  Yung sa no. 6 ililipat nio lang sa " USE THE FOLLOWING DNS SERVER ADDRESSES" tapos click nio lang okay then maaacess nio na ulit ang binance. Ngayon, kung gusto nio na ibalik ulit sa dati ay same procedure lang then ibalik nio lang ulit sa " OBTAIN DNS SERVER ADDRESS AUTOMATICALLY " tapos okay na balik ulit sa dati na wala na kayong access sa binance. Sana makatulong...  P.S ito ay magagawa lamang sa mga Windows desktop hindi sa mga mobile devices... Disclaimer: ang tutorial na ito ay ginawa para makapag-open parin kayo sa binance dun sa mga kababayan natin na may mga fund na naiwan, para magkaroon ng chance na mailipat sa ibang exchange habang hindi pa fully 100% ban ang binance dito sa bansa natin, so, after na magawa nio ito ay ibalik nio din sa original set-up yung DNS server nio, Salamat sa reminders ni @PX-Z

|

|

|

|

1. Basic Tutorial sa Trendline - https://bitcointalk.org/index.php?topic=5484859.msg63651322#msg636513222. Basic Tutorial sa Candlestick: https://bitcointalk.org/index.php?topic=5484362.0

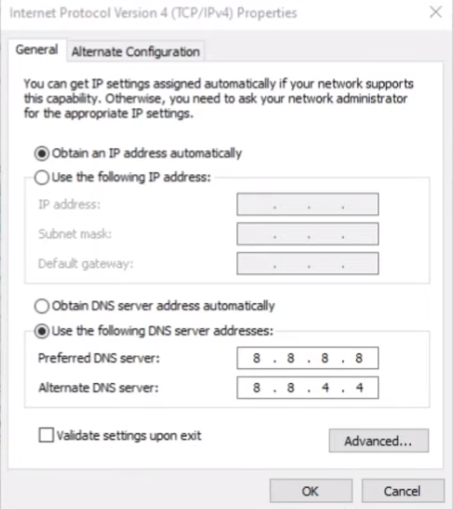

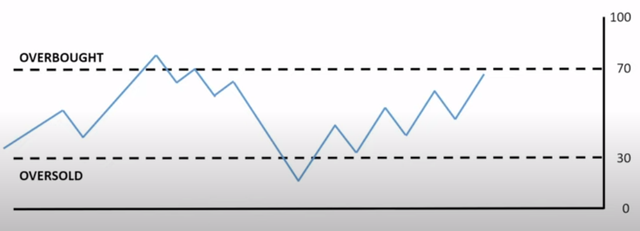

Ang Relative Strength Index ay isang oscilator o indicator na sinusukat ang momentum sa market. Sa topic na ito ay pag-uusapan natin ang mga sumusunod: * RSI formula * Pagsukat ng momentum gamit ang RSI * RSI levels 1. ito yung formula ng RSI: RSI = 100 - [100/1+RS] RS = Average Gains/Average Loses Siguro kung minsan napapaisip kayo kung ano ba ang koneksyon ng RSI lower timeframe? Sa lower timeframe kasi kahit scalping o day trade ang ginagawa mo ay kailangan mo paring tumingin sa higher timeframe. So hindi dahil ginagawa mo ang daily trade o scalping ka ay hindi mo na titignan ang higer timeframe. Dahil ito kasi ang magiging basis natin kung pano yung gagawin mong trade. 2. So para masukat natin yung momentum at yung posibilidad na pagbabago ng direksyon ng trend ay meron tayong tinatawah na 2 levels . Ito ay ang Overbought and Oversold levels.  Overbought kapag tumama sa 70 or above at yung Oversold naman ay kapag ito ay tumama sa 30 or below. Kung minsan naman may mga ibang gumagamit nitong mga traders bilang mga support and resistance levels, Pero mali yun. Dahil pwedeng manatili ng matagal sa ibabaw ng overbought level, or sa ilalim ng oversold levels kapag malakas ang momentum ng market. Ang RSI ay palaging Lagging and Leading Indicator. Lagging: ito ay palaging delayed ang binibigay na signal. - Kailangan munang gumalaw ng price bago ang indicator. Katulad ng ibang indicators ay nakabase ito sa mga nakalipas na market data. Leading: ito naman ay advance ang binibigay na signal . - Ito naman din ay nagpapakita ng mga signs na maari ng magbago ang direksyon ng market. Ang tanung pano naman yun? 1. Overbought and Oversold levels Kung mapapansin nio everytime na nagkakaroon ng pagtama ng overbought at oversold ay nagkakaroong ng reversal o pullback sa chart na ito. 2. Divergence Signal Nangyayari na ito kapag nagkakaroon ng salungat sa direksyon ng indicators. Katulad nalang ng nakikita niop sa imahe na yan sa itaas. 3. RSI Trendlines Dito naman mapapansin nio na nagkaroon nang advance or naunang break out sa RSI kumpara sa price chart. At tinatawag din ang RSI na leading indicator.

Reference: * https://coinswitch.co/switch/crypto/what-is-an-rsi-indicator-and-how-to-use-it-in-crypto-trading* https://www.lcx.com/what-is-the-relative-strength-index-rsi-indicator/ |

|

|

|

Basic Tutorial sa Candlestick: https://bitcointalk.org/index.php?topic=5484362.0

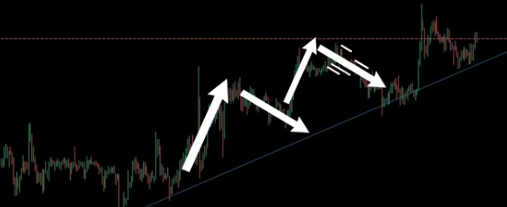

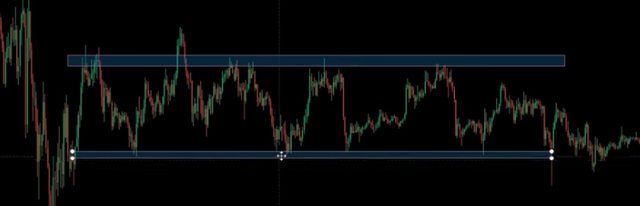

Hello magandang araw muli sa mga kababayan ko dito, ito ay pagpapatuloy lang ng aking Basic tutorial sa mga price movement gamit ng isa sa mga indicators sa Crypto Trading. Ngayon ay tuturuan ko kayo kung pano maghanap o magbasa ng price movement sa chart? pano tayo maghahanap ng trend sa chart? at kung pano ba natin maidentify kung pababa o pataas ba ang price gamit lang ang mga linya o line. Okay guys ito lagi nyong tatandaan na meron lang 3 movements na ginagawa ang market, at ito ay ang UPTREND, DOWNTREND, and CONSOLIDATION/RANGING huwag nyong kalilimutan ito, dahil ang mga yan ang mga galaw na ngyayari stockmarket, Forex at Bitcoin/Crypto trading industry. Simulan natin sa, UPTREND ibig sabihin kapag nakakakita ka ng ganitong movement katulad ng larawan sa ibaba ay pataas siya, na ang ibig sabihin ay gumagawa siya ng trend pataas kaya ito tinawag na uptrend.  Kapag madami siyang touch sa linya na nakikita ninyo ay ibig sabihin lang nito ay valid Trendline siya. Dahil ang trendline ay ginagamit as entry point. Ibig sabihin ulit ay everytime na didikit yung price candlestick sa trendline sa ibaba ay the idea is tatalbog ito or magbabounce siya. Basta every time na magtouch siya trendline sa ibaba ay ibig sabihin magbabounce pa siya ulit. Tandaan lamang natin na ang concept ng trading ay " We buy low, We Sell high" Ibig sabihin as long as na pinanantili nito ang presyo sa trendline ay magpapatuloy lang yan pagtaas. Ang isa pang senaryo naman ay sisirain nya yung market o magiiba naman ito ng trend na magiging DOWNTREND naman siya. Ngayon, pano natin malalaman na pababa na yung market? Ang sagot dyan ay kailangan ay sirain nya yung linya o trend.  Ngayon punta naman tayo sa 3 movement ang CONSOLIDATION O RANGING, ang criteria naman natin dito ay once na nakukulong lang yung price movement sa loob ng parang box o dalawang line, tapos ang touches naman nito ay straight lang, hindi siya pataas at pababa gaya ng nakikita ninyo sa larawan sa ibaba. Makikita nio sa larawan ay walang ranging market na ngyayari o walang trend, makikita nio ang ranging market price sa gitna ng Trend o trendline. Ngayon, yung mga galaw ng candlestick or yung ranging nya nakakulong lang yung galaw nila sa pagitan ng dalawang trendline. Ano ang ibig sabihin kapag nakakita ka nyan? Ang sagot dyan ay senyales yan na magpapatuloy yung kasalukuyang trend na ngyayari sa market, so ibig sabihinkung uptrend o downtrend ay magtutuloy-tuloy parin ito sa trend na nangyayari. Take note ngyayari lamang ang consolidation sa gitna ng trend, bukod dyan kung ano ang hinaba ng ranging ay ganun din ang magiging sukat o haba ng trend na ipagpapatuloy nya, tandaan nio yan. Kumbaga sa minamanehong sasakyan kapag may paahon kailangan may bwelo, dahil kung ano ang haba ng bwelo mo yun din ang magiging sukat ng pag-ahon o pag-angat ng sasakyan mo. Dahil pag- maiksi lang ang bwelo mabibitin ka sa pag-ahon ang resulta bababa ka ulit, ganun din sa trading kapag umaangat siya ng trend.

Reference: What is TRENDLINE? - https://www.babypips.com/forexpedia/trend-lineWhat is UPTREND and DOWNTREND? - https://www.wallstreetmojo.com/downtrend/What is CONSOLIDATION? - https://www.investopedia.com/terms/c/consolidation.asp

|

|

|

|

Basic Tutorial sa TRENDLINE: https://bitcointalk.org/index.php?topic=5484859.msg63651322#msg63651322

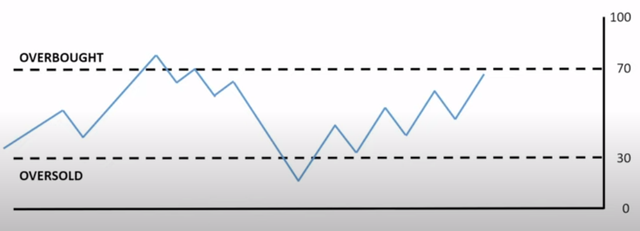

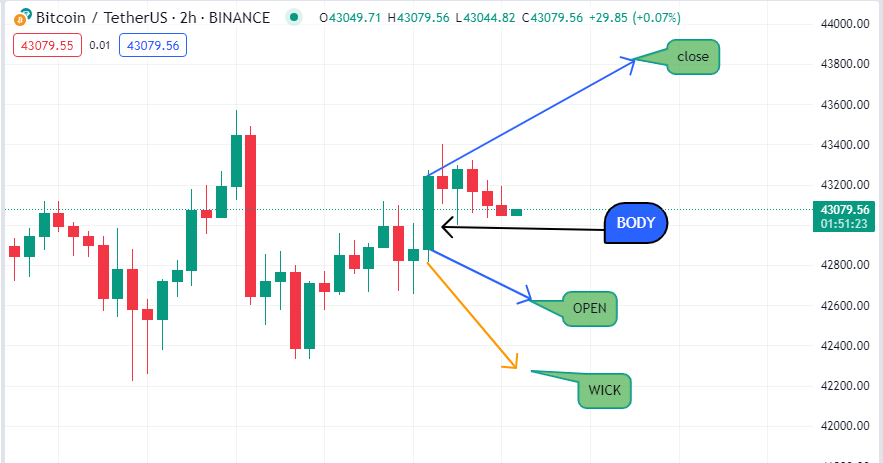

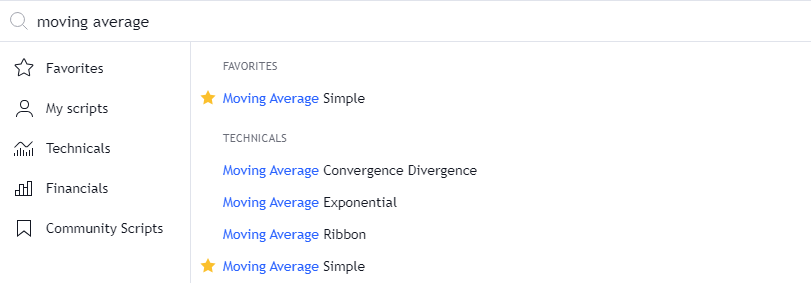

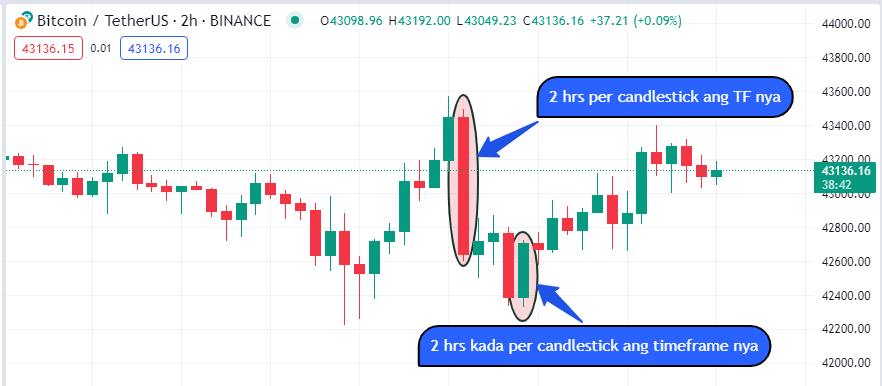

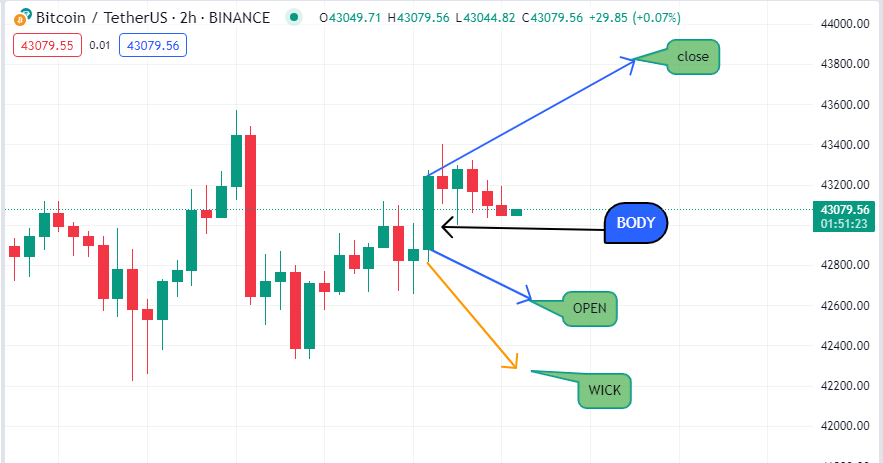

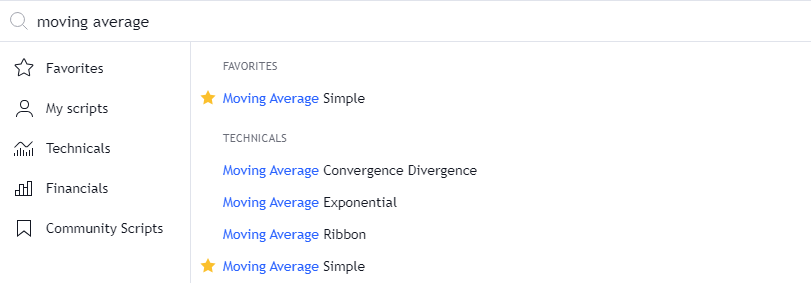

Magandang araw sa mga kababayan ko dito, itong gagawin ko na topic ay ginawan ko muna ng pagreresearch dito sa ating lokal para naman hindi paulit-ulit yung paksa na ating gagawin at napansin ko naman na wala pang nagbigay ng detalye ng pagtuturo tungkol sa basic study ng pagbabasa ng chart, para malaman naman nung iba dito sa atin kung pataas ba ang price o pababa ba ito. Ano nga ba ang candlestick? Indicators at timeframe? ito ang pag-aaralan natin today. Tara! samahan nyo ako mga kapatid kung kababayan sa paksang ito. Kung gagamit kayo ng chart, I suggest na gamitin ninyo ang https://www.tradingview.com/chart/OVK94s85/?symbol=SEE+ON+SUPERCHARTS para mas madali kayong makasunod sa sinasabi ko na tutorial.   Ngayon magsimula na tayo, kung titignan ang chart sa larawan na binigay ko, makikita nyo na merong Green at Red na kulay yan yung tinatawag na Candlestick. Yung green ang ibig sabihin nyan ay "Bullish" bakit ito tinawag na ganito? dahil ang bull kapag umatake yan ang pagsuwag nyan ng kanyang sungay ay laging pataas. Yung Red ay "Bearish" tinawag naman ito na ganito dahil ang Bear o Oso kapag umatake naman ng pagkalmot ay laging pababa, so gamitin nio nalang yung imahinasyon nio pagdating sa atake ng bull at bear para makuha nio ang ibig kung sabihin, basta ito yung basic na paliwanag dyan. Ang bawat candlestick dyan sa larawan na nakikita ninyo ay nagrerepresent yan ng timeframe, depende nalang yan kung anong gusto nyo na pagitan. Dyan sa larawan na binigay ko ay kada 2hrs ay magkakaroon ng panibagong candlestick or sa bawat 2 hrs na lilipas ay magpapalit ito ng candlestick, so kung 4hrs ang TF na pipiliin mo ay every 4 hrs naman ito magpapalit ng candle or kung 1 day TF naman ang pipiliin mo ay daily timeframe or 24hrs ay kada lilipas ang bawat araw magpapalit ng candle, so ganito nagwoworks ang timeframe, ganun lang kasimple yun maintindihan. Ipagpalagay natin na matatapos na yung 2 hrs timeframe nya at lilikha na ito ng panibagong candle at ang lumabas ay bullish o Green, ibig sabihin magsisimula siya sa ibaba yung open price nya, ngayon sa sa loob ng 2 hrs gagalaw ang price nya ng pataas at pababa sa linya na binuo nya, at kapag narating na ulit yung 2hrs or nahit na nya, ang mangyayari nyan ay magkoclose na ito ng candle gaya ng nakikita nio na image sa ibaba kapag bullish ang lumabas na candle.  Ngayon kapag sa Bearish naman ay sa taas magsisimula ang open price nito, then within 2 hrs timeframe ay gagalaw ulit ng taas baba yung price nya within the body or pwede rin lumampas sa body at yung sobra ay yung Wick na dinaanan at magsasarado naman ang price nito sa baba ng body, tulad ng nasa larawan sa ibaba,  Para hindi kayo malito o maoverwhelm agad, tuturuan ko muna kayo ng basic strategy ng wala muna kayong idadrawing sa chart para hindi kayo malito at ito yung mga tinatawag nating Indicator, ito yung ginagamit ng mga traders para matukoy nila kung taas ba o baba yung price ng isang coin o bitcoin. Since nasa trading view tayo iclick nio sa itaas yung indicators gaya ng nakikita ninyo sa larawan sa ibaba.   Ang criteria lang natin dito para MA o moving average ay everytime na ang price ay nasa itaas ng moving average dun tayo magbabuy, dahil ang concept natin palagi ay buy low sell high. Ibig sabihin hihintayin natin na magclose yung price sa ibabaw ng "Moving Average". Gaya ng nakikita ninyo sa larawan sa ibaba, na kung saan kung nasa itaas yung candlestick ng line o MA sa itaas tayo magsesell naman. Ganito lang kasimple gumamit ng indicators. Baligtad naman sa paibaba na kung saan nagclosed ang candle sa ilalim ng moving average. Kapag nasanay ka ng gumamit ng indicators ay for sure kahit papaano ay pwede ka ng makakuha ng profit sa crypto trading, dahil isa lang ito sa mga indicators na ginagamit para makakuha tayo ng profit sa crypto space.  Sana nakatulong ito kahit papaano sa iba, magandang araw....

Referrence: What is candlestick? https://www.investopedia.com/terms/c/candlestick.aspWhat is Timeframe? https://fbs.com/analytics/guidebooks/timeframes-331What is Moving average? https://www.lcx.com/moving-average-ma-in-crypto-trading-explained/

|

|

|

|

Napanuod ko lang ito sa isang social media at siguro hindi naman masama na mag goodvibess naman tayo paminsan-minsan dito, May isang Manager ng banko ang labis na nagtataka kung bakit malaki palagi ang ginagawang withdrawal ng isang matandang babae sa kanilang banko kada lingguhan na pagbisita nito sa halagang 3 milyon pesos.

Manager: Lola, bakit ang laki ng halaga na winiwithdraw mo every week? ano ba ang trabahong pinagkakaabalahan nyo?

Lola: Wala lang iho, nagsusugal lang naman ako bilang libangan.

Manager: Weh! maniwala naman po ako sa ako sa inyo, napakimposible naman para sa halagang

winiwithdraw nyo dito sa banko namin.

Lola: Gusto mo pustahan tayo, huhulaan ko na hugis tatsulok ang itlog mo. At kapag mali ako sa sinabi ko babayaran kita

ng halagang 500 000 pesos.

Manager: Sigeh payag ako, sigurado naman akong hindi tatsulok ang hugis ng itlog ko.

Lola: Sigeh, bukas babalik ako dito kasama ng kaibigan ko.

Kinabukasan, bumalik ang matanda kasama ng kanyang kaibigan dun sa banko at andun yung Manager hinihintay

yung matanda. At pinakita nga ng manager ang kanyang ari sa matanda at natalo ang lola kung kaya't binayaran nga

ito ng lola sa halagang kanilang napag-usapan.

Manager: Pano ka naman nagkakaroon ng malaking pera eh talo ka naman sa naging sa pustahan natin lola?

Lola: huwag kang maingay dyan iho, dahil may pustahan din kasi kami nitong kasama ko na kapag pinakita mo ang ari mo sa aking harapan ay mananalo ako ng 3.5 Milyon pesos sa pustahan namin, dahil ang pusta nya sa akin ay hindi mo magagawang ipakita ang ari mo sa aking harapan.

Hahahahahahahaha    Disclaimer: for fun and entertainment lang po ito... |

|

|

|

This was just a joke story about gambling, Because when I read it and watched it, I laughed a little at the story, although it was just a barber story or a gossip story, it was funny to me actually. Narrator: There was a bank manager who noticed that they had a client who was withdrawing 3 million dollars every week, and when the old woman went to withdraw, the bank manager asked the old woman.

Bank Manager: What are you doing, ma'am? Do you have businesses?

Old Woman: Nothing; I just often bet as a hobby.

Bank Manager: Really, how do you do that, ma'am?

Old Woman: Nothing; it's simple if you think about whether to gamble or bet every week. Do you want us to bet?

Narrator: The bank manager thought and answered.

Bank Manager: Alright, what do we bet?

Old Woman: Okay, we bet that I will guess that your Penis egg is square-shaped; if I am wrong, I will pay you $50,000.

Bank Manager: Alright, I'm sure you're wrong in what you're saying.

Old Woman: Okay, let's meet tomorrow; I'm with my friend here at this venue.

Narrator: The next day, the old woman returned to the bank with her friend. The bank manager showed his penis egg by removing his pants and underwear, and the old woman lost their bet and gave him $50,000 as they had bet. But the bank manager spoke to her.

Bank Manager: Why did you bet with me when you knew that you would lose our bet?

Narrator: The old woman whispered to him and said,

Old woman: Don't be noisy, because she and I have a bet where we bet that you will show your penis in front of us for $500 000, and her bet to me is that you won't be able to show your dick. BOOM!! Hahahaha   |

|

|

|

Hello to all the members of this forum. Today I will give a review of Gamifi because many people still believe in this era that Gamifi is the future of gaming, which is a reason for investors to speculate that it will increase their market valuation. And when we talk about it, I just chose crypto gaming because there are so many of them. Apart from this, I was not based on the beauty of the graphics because the others are just tools or platforms for gaming. So my only focus here is on the value of the token itself and whether it has the potential to attract crypto investors. The kind who are not interested in games but in token valuation in the bull market and making money. Most people have this mindset in crypto. Have you noticed that the gamers who entered the crypto market during the last bull market had no idea about the trend of crypto, and when the market crashed, they disappeared? And the only ones who stayed were the crypto investors. So the gaming project we are looking for has potential in gaming and can attract outside players and speculators here in the market. Reminder: Please only invest what you can afford to lose. And I encourage you to do your research before investing.

1. Immutable X It is a layer 2 scaling solution for Ethereum but unlike another layer II. Its focus is on gaming, which can provide users with fast, secure, and gas-free transactions while still maintaining the security and decentralization that come from the Ethereum network. Its technology is a layer 2 scaling solution for gaming and NFT. And when it comes to the use case, it is designed for mainstream gamers. So they have this user-friendly wallet. Developers of games can mint IMX millions if they want to support Web3 games. In addition to this, IMX also has an NFT marketplace. And their games that use IMX are on their website. Tokenomics: https://www.coingecko.com/en/coins/immutable-xMarket cap: $2,702,545,213 Circulating Supply: 1,346,169,447 Total Supply: 2,000,000,000 Max Supply: 2,000,000,000 2. Gala gamesThis is a gaming platform that has the integration of blockchain technology, and they offer games here and also various NFTs where the players will have ownership and control over their in-game assets. Its founder is one of the founders of Zynga, who made Farmville before. In terms of technology, there is no difference from the first, as mentioned. When it comes to the use case, the only difference is ownership and the play-and-learn model. Tokenomics: https://www.coingecko.com/en/coins/galaMarket Cap: $759,434,565 Circulating Supply: 32,543,729,121 Total Supply: 32,542,890,615 Max Supply: 50,000,000,000 3. SandboxThis game is a virtual world where players can build or monetize their gaming experience on the Ethereum blockchain using sand tokens. It represents the integration of gaming and blockchain technology. Its use case is that it offers an interacting gaming experience metaverse where they can create their avatar. Apart from this, they can also monetize their gaming experience, and they can also buy and sell digital real estate here. Tokenomics: https://www.coingecko.com/en/coins/the-sandboxMarket Cap: $1,034,743,800 Circulating Supply: 2,237,731,926 Total Supply: 3,000,000,000 Max Supply: 3,000,000,000 4. IlluviumThis is the first interoperable blockchain game (IBG) open-world exploration game, and the battle game is also built on the ETH blockchain. The graphics of this game are beautiful, and the landscape has a unique ecosystem and challenges. The technology of the project is also the same as that of other gamefi projects decentralized with NFT integration. Its use case is auto-battle gameplay because the creatures here are NFT-based, so players can sell them or use them in the game, and it also has Defi elements where players can participate in yield farming and staking. Tokenomics: https://www.coingecko.com/en/coins/illuviumMarket Cap: $482,693,792 Circulating Supply: 6,213,811 Total Supply: 9,608,206 |

|

|

|

Good day to everyone on the forum today. The only thing we're going to talk about is how to profit in crypto. This is one of the most frequently asked questions among crypto investors, particularly newcomers and those who have been around for a while. What are the issues that must be addressed? What signs are available to determine where the top market has arrived? So that we don't buy at the peak of the bull market. Assume you were one of the top buyers in the 2017 bull market and purchased Bitcoin for $19,000, or in the 2021 bull market, you purchased Bitcoin at a price of $69,900, believing it would rise further. In short, you were able to FOMO; you have no knowledge of technical analysis. The top buyers in 2017 would have recovered in 3 to 4 years if they hadn't panic sold in 2018, but the top buyers in 2021 are still underwater, or others cut at a loss and sold at a loss. Normally, no one can anticipate where the exact top of the market will be, and anyone who can predict is not certain of what they are saying; in short, everything is just guesswork. And if someone claims certainty in his projections, this is the number one red sign in the world of finance. But this is what people like to hear, and it is something that many people do. And if you trust these folks who claim that what they say is genuine, you will be completely lost, with a 99% likelihood of becoming wrecked. Today, we are discussing the absolute peak of the market, not the local cap; this is distinct. However, you may utilize the others on the list that I will provide. You can use it on any coin you own. Because this is applicable not only to Bitcoin but also to other cryptocurrencies. Because you might assume this is a reversal if it happens to another cryptocurrency. With a negative 90% scroll down from the top and hold your baggage for 3-4 years. How many of us have been through something similar? So this is just for investors and holders, not day traders, so that when you make a profit, you, like me, will wonder whether to sell or hold. And surely these signs will help each other holders and investors so that you can decide on the crypto assets you hold. Especially if the signs appear at the same time, our assumption that we are close to the top of the market or that we are already at the top is getting stronger. LET START: 1. Over extended price movement The image you see is an example of a parabolic curve, which occurs when the price of cryptocurrency or Bitcoin has risen too much and takes on a parabolic shape. It usually has numerous bases, however this section is a little tough. This is where cryptocurrency market behavior comes into play. It is 96x, just like Bitcoin from the bottom in 2015, from $200 to $19,000 in 2017. He only surged 21x throughout the 2018-2021 bitcoin bull market, therefore based on market behavior, his rise declined with time. As a result, we should aim to place our profit objective below the 21x rally. If Bitcoin doubles in the next bull market, it will be worth between $150 000 and $250 000. At current pricing, our goal is to profit because it is only conceivable to happen in 10x-16x Bitcoin, but altcoins can make 100x to 1000x profit, depending on how new the altcoins are. since, in my opinion, the new cryptocurrency will actually climb higher in these scenarios since it lacks bag holders who are entrenched in the previous bull market and are ready to exit. That is why, with altcoins, it is up to us to decide when we want to exit and profit. 2. Reaching personal target goalsThis is the simplest: individuals who invest should have personal objective goals, and when those goals are met, we will sell immediately. We don't care if it goes 100x or if the token is held; let's get it done first. That's fine as long as we've met our goal. Others, particularly newcomers, have a problem in that they don't have an exit strategy; they simply buy tokens and then wish for the moon. Others, referring to themselves as long-term holders, just see purchasers and experience a price drop and fear, selling quickly, or see that the token purchased has pumped 1%, selling immediately or taking profit. When hybrids achieve a 1% profit, they quickly become day traders, and long-term holders. So, what is your goal before you buy a token? Long-term investors or day traders? Because you can establish your profit target once you have recognized yourself in the crypto space market. So, what is your goal before you buy a token? Day trading or long-term investing? Because you can establish your profit target once you have recognized yourself in the crypto space market. It's simple: when I buy a token and it goes 5x or 10x, I'll sell it; or after bitcoin halving, I'll just wait a few months and see a 1000x rally in the tokens I hold; I'll sell it; or when I have reached your personal goals, such as you want to buy something and the value of your tokens has reached that, then sell it, and there's no need to look at the chart or think that the value I might miss it. Your tokens can really rally, but they can also crash. As a result, it is case-by-case. 3. Divergence between price and network activityThis suggests that there is a distinction between the two indicators, and that their movements are opposed. For instance, asset prices rise but network activity falls. The movement's direction is different because we can only state that the token's movement is healthy if the price value rises and network activity rises as well. it is increasing for a reason, and that reason is that the project is in high demand. In crypto, we can see network activity in onchain statistics, such as transaction volume and active wallets. The development of new wallets is increasing, which suggests that there are more users coming in or keeping tokens. The network cost is rising, as is the hashrate for proof-of-work coins such as Bitcoin, and the staking metrics for proof-of-consensus networks are rising as more individuals stake tokens. However, if there is little network activity and the price rises, it does not rise, and there is not much happening in the onchain activity, indicating a divergence in the price movement in the network activity. Then you should probably consider taking a profit now, because the price pump that occurs for the token you own could be caused by market makers or hundreds of individuals. And, sooner or later, the price will come down. Hope this will give help additional knowledge to everyone  |

|

|

|

|

In the topic I covered today, let's talk together about the idea of debt, why it is bad for the majority, and why it is used as a tool for the advancement of the few. If we observe people in debt, it's like your friend who borrows a cellphone, your neighbor who owes a motorcycle and vehicle, and the person you know who borrows to build their house. We can notice and see that most of them are not happy. Because instead of enjoying the money owed, it becomes a burden because it is automatically deducted from their wages at work. And this is often the reality of a person's life in debt.

Even so, using debt is not bad at any time. It is true that many people have become miserable because of debt, but if you are strategic and use it to build an asset, it can help you get rich or get out of life. And this is possible. In fact, all the successful entrepreneurs we know use debt to grow their businesses so they can maintain their lifestyle, and this is called leverage. Instead of using your own money to build assets, you will use other people's money as capital. Instead of waiting for a short period of time, you can start now with just your simple idea and the money of other people.

Let's discuss this matter, friends. If others don't already know, there are two types of debt. This is bad debt, and the second is good debt. And we know that this concept was explained by Robert Kiyosaki.

* Bad debt: This is what makes a person suffer, because it is the things that give us liabilities or the ones that decrease in value, such as gadgets and cars. And the common problem with these loans is that you will pay them with high interest.

* Good debt: this is the type of debt that will make a person rich. Or else you will also earn money because, instead of using it for your needs, you will use it to build an asset. Which, if you handle it properly, can give you extra income.

So that we can give more clarity to good debt, I will give an example: You want to build your own business; you have a product, a business plan, and a marketing strategy. But the problem is that you lack capital. And the amount you need is $1,000. So what you did was share this idea with friends who you think have the potential to become investors. You explained it well, presented it well, and they liked it and were willing to invest. And you convinced your friend to borrow money, and you will pay him back in two years with interest. Then you started your business immediately; people liked it, and it became profitable immediately in the first year. It gives you constant income, and it continues to grow.

After two years, you have paid your friend. And your business just keeps growing. And it all started with an idea. Your idea is to build a business, and you use other people's resources as a tool to build your own assets. But it's an important reminder that you also need to be doubly careful when using debt. Although this is a good tool, you must work yourself out to handle it properly.

what I means you must know how to handle money. Must have skills, such as COMMUNICATION, LEADERSHIP, NEGOTIATION, SELLING and INTRAPERSONAL. Because if you borrow money and use it in your business, it doesn't mean that everything will be okay immediately and your business will grow automatically. It's just that not every time the weather agrees with what you want to happen in your life.

|

|

|

|

Why should we care? Of course, it can help us forecast where the price of the cryptocurrency we wish to trade will go in the market or in the future. Because, as the saying goes, "A trader can use a market price to describe the human thought process that underpins a market's movement."

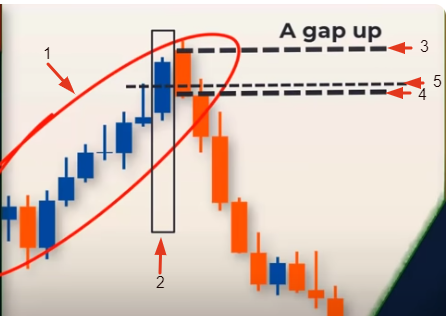

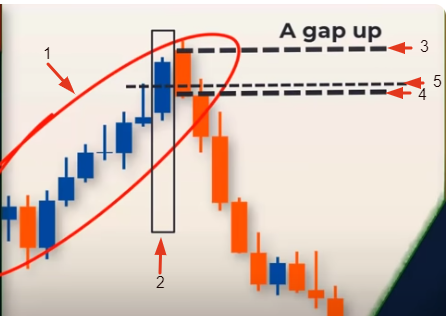

[a]Dark Cloud CoverCandlestick patterns indicating a potential reversal to the downside appear at the top of an uptrend and consist of a large bullish candle followed by a bearish candle that creates a new high before closing lower than the previous midpoint bullish candle.   5 criteria for the dark cloud cover 5 criteria for the dark cloud cover

1. Existing Bullish uptrend 2. Bullish candle within that uptrend 3. A gap on the following day 4. The gap up turn into a down candle 5. Below the midpoint of the previous candle  Trading RULES: Trading RULES:1. An uptrend must be clearly present on the price chart 2. The dark cloud cover must be formation must be present 3. The second bar within the dark cloud cover must be outside upper Bollinger band line 4. Enter a sell order at the break and close of the low of the second candle within the dark cloud cover. 5. The stop loss must be placed above the high of the second bar of the dark cloud cover formation. 6. Exit: the price crosses below the Bollinger band centerline and then closest above it. or price touches the lower Bollinger band line.  ----- TO BE CONTINUED------ |

|

|

|

I just observed a kid on Twitter doing a Bitcoin payment transaction at McDonald's, and it's amusing to see that they can do it. However, I feel bad for the kid because he spent something like 170,000 Sats or something. Its parent must have a sizable amount of Bitcoin. But even so, I'm still in awe of how these kids were raised by their parents since even at such a young age, they are progressively learning about the idea and features of how important Bitcoin is to them. I respect parents who do an excellent job of educating their kids. Reference: https://twitter.com/naiivememe/status/1705167273609368057 |

|

|

|

|

Good day! Did you know that promotion is associated with making wise investments? While traditional investment requires capital, I have investments that are free. Yes, you heard right about free investment that can help you succeed and advance in life. But wait, before you think badly of me, let me finish reading this topic that I made.

Just a disclaimer: this is only for the open-minded. I am not open-minded just for pyramid networking schemes. But open-minded to succeed. So if you are ready, you who are reading this, this topic is for you.

Free Investment:

1. Education: Education is not only obtained in school; it can also be obtained in our community, inside the house, on the internet, in books, among friends. There are also free platforms such as Youtube, LinkedIn, and others. In other words, you don't have to enroll in thousands of courses if you don't finish them or buy books you haven't started reading. So while you have access to free education, take advantage of it. There are even times when, when we talk to people who don't know, we learn, right? Their mistakes in life, how they act, spend, and earn Apparently, education is a continuous process; when you stop learning, that means you stop growing.

2. Network: This is not the networking that others think of here. This is not inviting acquaintances or friends to scam you. What I'm saying is "building a network." When you build a connection, for example, by simply helping your neighbor, it can give you or us a network because we meet different people every day. Who knows, one day or not, we know that our neighbor will help us one day so that you can have a good opportunity or job or have a good client. Even on the internet, connecting with like-minded people like us can go a long way toward your advancement.

3. Time: What do you have now that older people don't have? that even if they want to do it or work more and expand their wealth, they don't have it anymore. Of course, invest your time in what will grow you and not in what will destroy your dreams. Three hours of hanging out with gossipy people is equal to 3 hours of free learning a course, or 3 hours of playing play station games is equal to 3 hours of doing a freelancing business, which is equal to value. Let's always remember that when time is wasted, you can't take advantage of it. As the saying goes, "Time is money, time is gold, time is fleeting. And there are many other things that are equal to time. So make sure you can use the time on things that will help you grow. Time is free, but the things that equal it are not free.

4. Health: This is also a free investment that we can make, whether it's physical or mental. Regular exercise and a balanced diet will give us energy and clear thinking. Let's not underestimate having a healthy mind and body, because it is one of our investments in the struggle of life. Did you know that a bedridden person prays that they can get up and do what they want in life? They regret why they didn't take care of their bodies when they were in their prime when they had the chance. So you are now able to take care of your health for a clearer future. You don't want what you're struggling with now to be eaten by others because your health can't handle it anymore.

5. Cultivation or skills: you don't need to pay for training in schools or an online academy to have skills. Did you know that humans are capable of learning from the environment, what they see, what they experience, and even just their imagination? The skills that I have today I only got for free because of the different ways that we have now in this generation.

6. Financial Literacy: learn about money and how it moves or circulates. And how can it be attracted? There are many resources on how we can grow our financial literacy, learn how to manage finances, use free budgeting apps, watch financial vlogs, and read vlogs about finances. And save for your goals. Actually, we don't need to pay a financial advisor because we can study it; sometimes we are led by laziness, so we prefer to pay someone else to study our personal finance. Success is not only measured in money but also in personal growth.

I wish that in some other ways we discussed here may give help to others or everyone here in the forum...

|

|

|

|

Hello everyone! Today we will talk about the inverse correlation of Bitcoin with the US dollar and why, usually, when the dollar increases, the price of Bitcoin most likely decreases. What are the factors in the movement of the price of Bitcoin and the US dollar? Most crypto traders do not know this; all they know is that on the part of Bitcoin, the price of BTC will increase because there is an upcoming halving next year. There is a narrative in the Bitcoin ETF: no one can stop the increase in the price of Btc, or only the traders who are only focused on the technical saw a good analysis, like the newbie traders who say that at 12k, the value of Btc will fall because there is a lot of liquidity here, said in their crystal ball, and they will say the phrase " Believe in me." So, if you notice, they are all pertaining to Bitcoin. they forget the other side of the coins that also affects the movement of BTC, and that is the US dollar. There are trades in the Bitcoin-USD pair that they do not understand, which means that they are trading against the US dollar when they take a long position, and when they take a short position, it means that they are trading against the BTC, which means that they favor the US dollar in an opportunity like this. In short, investors or traders prefer to exchange their Bitcoin for US dollars. That's when the demand for US dollars is higher than BTC. And this is where we will talk about the movement between the two. Which is where we will tackle the technical comparison and fundamental aspects of them that will surely help not only newbies but also traders and other communities here on the forum platform. You will surely learn a lot here on the topic we will talk about. So let's start with the technical analysis. Let's compare the movement of Bitcoin with the US dollar index, or DXY. What is DXY? This is the measurement value of the US dollar relative to a foreign currency. This is where the US dollar's performance is measured compared to other world currencies. When it is higher than 100, it means that the US dollar is strong, it is possible that the interest rate is high, and there are many other factors that affect that. And when the index is below 100, it also means that the US dollar is weak. So here in the picture that we can see is a trading view, as seen below.  The one on the right is Bitcoin, and the one on the left is DXY. In the month of May 2021, you will see that this is the height of the Bitcoin rally, that he reached 60k, and everyone is bullish. And on the other side, the US dollar area is already at the bottom. And when the month of December 2021 comes, Bitcoin will have reached the ATH of 69k and fallen to the 50k price level. But most of the time this is just a pullback, even though it has formed a lower high already, almost completing the bearish pattern, and this time the bulls still have a price target of 100k, which is what most people think will happen. But most of the time, the bearish signal is ignored. Because the belief of the majority is that it will continue to rise. But if we also look at those times in the month of December 2021, Dxy was rallying. It has a higher high and a higher low, a sign of strength in the US dollar and a sign of weakness in Bitcoin. We already have a sign that the bull market is over, the bear market is waving, and the rally for the US dollar is starting at this time. And if we know them, we will be more careful and not just submit to the different beliefs of others. What is behind this rally by DXY? The answer is nothing but " inflation." Because in the month of December 2021, US inflation is at 7%. Although the Fed during these times did not raise the interest rate at that time, this was the anticipation payoff, so DXY rallied, which coincided with the decrease in BTC. During Dxy's 2022 period, this is the continuous increase of Dxy's interest rate in America, which in turn is the continuous fall of Btc. And in November 2022, DXY shaved the market top, and in November 2022, BTC also shaved the market bottom, as you can see in the picture. Dxy gradually decreased from the top, and Btc also gradually rose from the bottom. But we have a break out here, like in the picture below.  The break out of Btc's structure is only going down, Let's just remember that during those times, Dxy was still above 100, which shows that the US dollar is still strong. And at that time, the Federal reserve had no plans to cut, so the reaction of the price of Btc and the US dollar was just like that. Because if the FED cuts the interest rate, it means they already defeat the inflation, then the US dollar will weaken again. Because investors will turn to risk assets including Bitcoin. And if we look at the history of the Fed fund rate below;  During the 2016-2017 bull market, the only interest rate was below 2%, it was the time of Bitcoin halving and there were only a few constitutional investors during these times who participated and Michael Saylor was not there at this time. . And then 2018 bear market, the interest rate is still rising, only falling above 2%. Then the rate was cut, this is the time of the covid era where they have to print money. And since it's still a bull market, the interest rate is almost 0%, it results in a full blown bull market. And because of the amount of money printed, inflation increased, they had to control it, so in 2022, the interest rate will increase one after the other, reaching the level of the 2008 financial crisis of 6%. So we are still hearing a lot that it could still end up in recession. But even so, there is not in all cases what is called inverse correlation. Because there are also many fundamental factors that affect Btc that have nothing to do with the US dollar. Just like the Technological changes, Regulatory news, related to Btc. And with the US dollar, we also need to know the things that affect it. Because Dxy does not move for no reason, and it is the reserve currency of the world and anything that happens has an effect on it. And of course the number one thing that affects the US dollar is the interest rate. Because if we don't know anything about it, it appears that we are tradig blindly. So, that's all I hope everyone who reads this will learn something God bless us all here.

[1] what is DXY? https://www.axi.com/int/blog/education/indices/us-dollar-index[2] What is inflation? https://www.investopedia.com/terms/i/inflation.asp |

|

|

|

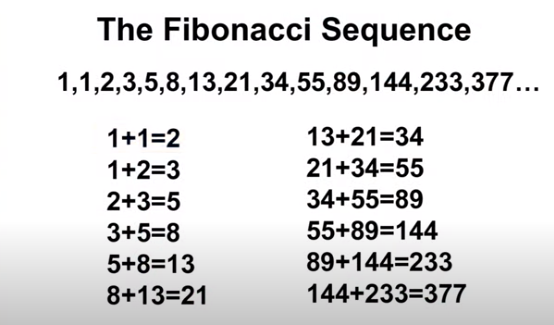

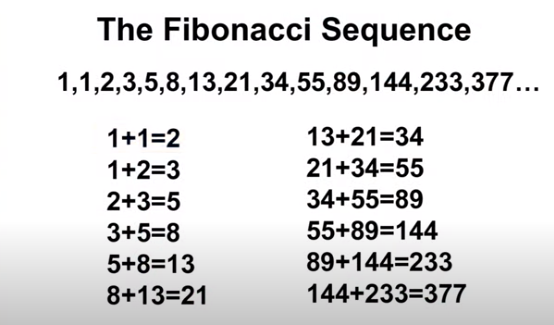

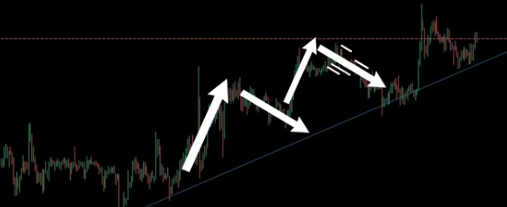

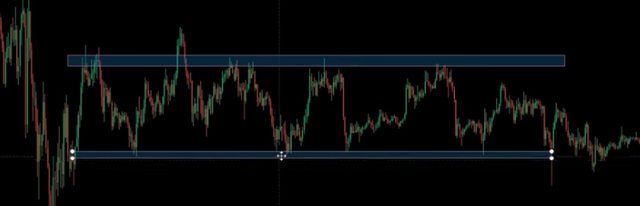

Hello and good day to everyone! This time I will give a guide on how to use Fibonacci retracement. A powerful tool that will surely help us or anyone in trading because it is very simple and available on all platforms. If you want to know where it is used or if it is effective, What is the Fibonacci retracement? This concept is derived from the Fibonacci Sequence, which was invented by Leonardo Fibonacci, an Italian math expert, in the 13th century. And the Fibonacci Sequence is the sequence of numbers on a consistent basis, an example is in the picture below:  The reason is that almost everything in the world is associated with Fibonacci. That's why advocates think that the Fibonacci movement is possibly also related to this. Because in any market, the price does not run in a straight line, Instead, there is often a pullback or retracement. But how do we know how far the price pullback will go? And this is where the Fibonacci retracement comes in. On any trading platform like Bitget, Binance, Bybit, and other exchanges, we have a Fibonacci tool that we can use. This is what it looks like:  But before we can use it, we need to identify the market structure first. We are looking for a swing-high and swing-low, and the market must be trending because we don't see anything like that in the trading range, and normally the price is just equal, like in this picture below.  What we see in the picture is the latest swing-high and Swing-low, the swing-high is the newly formed price. Now Fibonacci will be used this time from the Swing-Low, as in the image below, and you will drag it to the Swing-Hi, as in the image below.  We can see in the Fibonacci retracement in the picture that it has levels. But we often don't use the others. We only have to pay attention to these 3 levels, which are 38.2, 50.0, and 61.8. This 61.8 is what they call the Golden Ratio because it is said to be the most reliable of those three levels. But for me, that depends on a case-by-case basis. That's why, in the example you see, he has already bounced to the 38.2 level, but if that fails, the 50 or 61.8 level can follow. But the chart does not always look like that. Now, let's look at the downtrend market.  Now we can see the levels at which the price can be rejected. Take note, normally, when the trend is strong, it often bounces at 38.2 levels or even 23, but as the pullback deepens and exceeds 61.8 levels, it means that the trend is weakening and it can go into a trend reversal. The Fibonacci retracement is a powerful tool, but we cannot use it alone. Since we do not make decisions based only on what we see in the Fibonacci retracement, of course we need to accompany it with other confirmations. For example, we are trading with a trend that we use a moving average, support and resistance, and a reversal candlestick, but as I said before, Fibonacci retracement does not work all the time, so we still have to manage the risk of every trade we do because there is no perfect trade in each of the tools we use. So it is not surprising that many people find it difficult to understand trading because of the randomness that it shows, like what you set up yesterday was effective and the next day it was not. That's all I hope this will help to everyone who wants to explore their knowledge

WHAT IS FIBONACCI RETRACEMENT? |

|

|

|

Good day to all my forum members here, Let me share a little bit if I know about how to do a pullback trading strategy and it's also good for beginners here, because it's very simple to do it and even if we already have Another trading strategy is that we can incorporate this so that we don't miss the opportunity of a good trade and we don't just rely on one strategy.  So now let's find out what is Pullback Trading or we can also call it Retracement. Because the price does not run in a straight line, we normally see a pull back. When the market is trending upward there is always a pull back. Let's just remember that this is a battle between Buyers and Sellers. When the buyers side is strong we will see an uptrend and when the seller sides are strong we will see a downtrend.  Because of the uptrend market there is a pullback, because the sellers temporarily have overpower over the buyers.  Every pullback we see is a failed attempt of a reversal.  In this case, we can take advantage if we know how to identify a pullback properly. It depends on the timeframe in which we are trading because that happens in any time frame. So we are looking at 3 key levels to identify the possible pullback. In an uptrend market we are not able to buy immediately before a breakout. So what we do is we wait for a pullback and this often happens at Support and Resistance.  When the market goes uptrend there is always a pullback, but it depends on how strong the trend is. If the trend is very strong, then the pullback is not that deep. And this normal pullback picture that we see does not reach its previous swing low.  In this case, in our example, this is his previous resistance that can serve as support because it has been broken.   So let's see if the price approaches to take a long position. And of course we will not forget our stop loss that has a distance from the support that depends on risk management.  In this case the trend is not in our favor, so it is also important that we know the historical movement of the assets so that we know the precious support and resistance where the price can bounce.  same concept in the short position in the dwontrend market, all we are looking for is the key levels like support and resistance where the price can be rejected. Like the example in the picture below dwontrend market.  We can see here how the previous support that may have become resistance levels is repeatedly rejected.  The good things is we can also do this strategy in the trading range market. As long as the swing Hi-low is far apart to have a chance of profitability. |

|

|

|

Isn't it stressful when we spend more than expected, right? especially if we follow a budget, having a smart spending habit is a good way to avoid such situations or events. 1. Make a realistic budget In budgeting it is important that we consider everything. It should be realistic and achievable, It cannot be said that the budget is only 20$ for a week for food if you are 8 people who will eat at home. Plan what to eat every day and budget for it. Write down all the ingredients or how much to buy and how much it will cost in pmashae or gasoline if there is a car. Do everything with consideration and do it consistently. Stop yourself from buying things you don't need, like buying coffee at starbucks when you can just buy 3 in 1 sachet coffee that just tastes like coffee. Because if we cannot prevent such expenses, include them in the budget. 2. Find out what triggers the cost It's important that we know this if it's stress, boredom, pressure from friends, need to follow the trend and so on. It is important that we have discipline in these things if you want to avoid overspending. For example, if you're bored, you hang out online shopping at Lazada, Amazon, and others, this habit should be replaced with something more productive, such as cleaning the house and others where you can avoid it and do something good. 3. Break down luxury expenses Try to list the things you have spent and separate the luxury and the things you have spent. It is important that you know what is really needed and the word I deserve it. 4. Make the 24 hour rule This rule helped me when I was building in this way. Because when I want to buy something, I put it off for 24 hours, and during this time I learn how to assess these things. Usually the excitement we experience disappears immediately after a few hours. You imagine the sacrifices you will make when you accomplish them. Like the small savings you have or sometimes we will even borrow the money we will use here. At least in this way we can avoid impulsive buying or bursts of emotion. 5. Set a budget Allocate a limit on expenses, know all areas of expenses from food, rent, electricity, water, shopping and other things related to spending. Once you set all of your spending limits, make sure to follow them and do it because everything will be ignored if you don't do it. I hope this somehow helped us and the community here on the forum.

Other source: https://www.incharge.org/financial-literacy/budgeting-saving/how-to-cut-your-expenses/https://www.mymoneycoach.ca/blog/how-to-stop-spending-money-7-tips.html |

|

|

|

Magandang araw mga kapwa ko pinoy dito, meron akong ginawa na paksa dito sa forum sa ibang seksyon at ito ay medyo kakaibang pangyayari na kung saan ay yung hacker na yung gumawa ng masama dahil sa pagnanakaw ng pondo na kanyang nilooban na platform ay siya pa ang bibigyan ng rewards na worth 6M$ ibalik lang yung ninakaw nya. Hindi ko alam kung matatawa ako o maaawa sa biniktima nya. Kung ikaw yung ninakawan ganun din ba yung gagawin mo? Kung sa akin siguro mangyari yun, malamang ganun din siguro ang gawin ko kesa naman lahat ay hindi mabalik sa akin. Source: https://bitcointalk.org/index.php?topic=5462454.new#new |

|

|

|

Now, let's have an update about the curve finance. recently it had an issue where a hacker entered it and it happened on July 30, 2023. So what Curve did was they offered the hacker to return its fund and they will give 10% bounty rewards. And it will not be charged or imprisoned. The offer was accepted and the stolen assets were returned. But the hacker did not complete its full refund from other pools. Because it has a deadline now it has passed. Now the rewards are offered just to identify the attackers. Also, what do you think is the reason and why did the hacker return the funds to another protocol? he said He doesn't want to ruin the project. and that's not the reason he's afraid of being identified. Because it seems that what the hacker wants to release or make him look like is that the authorities cannot identify him. Let's see what happens here, because we know that the hacker is not invincible because there are and still are others caught. What happened to the Bitfinex hacker even after a long time was still caught. But if it turns out that a north Korwan hacker was able to access curve finance, it is unlikely to be recovered for sure. Source: https://m.investing.com/news/cryptocurrency-news/curve-finance-opens-bounty-after-exploiters-return-deadline-expires-3146166 |

|

|

|

|