Show Posts Show Posts

|

|

Pages: [1] 2 3 »

|

The SEC, known for its cautious approach to crypto, is aiming to increase regulations within the crypto market. They've previously targeted centralized entities like Coinbase, Binance, Kraken, and Ripple with lawsuits. Now, their sights seem set on Uniswap, the leading DEX [1]. A lawsuit against Uniswap seems imminent, and the chance of a successful negotiation appears slim. Uniswap Labs, the developers behind the protocol, have already declared their intent to fight the SEC in court. The SEC's lawsuit against Uniswap Labs faces hurdles due to Uniswap's decentralized nature. Uniswap Labs developed the Uniswap protocol, but it operates without a central authority. This makes it difficult for the SEC to pinpoint a specific entity to hold accountable in court. Uniswap functions primarily as a platform that facilitates trades between liquidity providers and users. It doesn't hold user assets or offer investment contracts, which are areas typically targeted by securities regulations. Since its launch in late 2018, Uniswap has operated without facing legal issues. However, a recent tokenomics update proposing to share Uniswap's revenue with UNI stakers [2] raises concerns about the SEC potentially classifying UNI as a security under the Howey Test [3]. While the legal outcome is uncertain, this update introduces a potential regulatory hurdle. The SEC's lawsuit against Uniswap, the leading DEX, has major implications for the entire DeFi ecosystem. Because many DeFi protocols share similar features with Uniswap, a win for the SEC could set a precedent for them to regulate the entire DeFi space. This outcome would significantly impact the future of the crypto market, as DeFi plays a central role in its growth. On the other hand, a win for Uniswap could limit the SEC's reach in the crypto industry. This could pave the way for the continued development of DeFi and other innovative crypto projects. While I believe Uniswap has a strong case against the SEC, their financial resources are a concern. Ripple's ongoing legal battle highlights the potential cost – hundreds of millions over several years. Uniswap Labs' estimated annual revenue of 17.2M USD [4] raises questions about their ability to sustain a similar fight. In a worst-case scenario, it would be crucial for Uniswap to receive financial backing from the Ethereum Foundation, major crypto players, and the community. I would like to know your opinion on this issue: - Is UNI token a security after the tokenomics update?

- Can UniSwap Labs win this lawsuit?

- Will the outcome of the lawsuit have a positive or negative impact on DeFi and the crypto market?

References:[1] The SEC’s Suit Against Uniswap Is an Opening Attack Against DeFi[2] Uniswap's UNI Gains 20% as Token Reward Proposal Inches Closer to Approval[3] Does Crypto Pass the Howey Test?[4] 2023’s top 5 DeFi protocols by revenue |

|

|

|

January 2024 marked a watershed moment for both BTC and the broader crypto market with the long-awaited approval of spot BTC ETFs in the US [1]. These ETFs act as a bridge, attracting traditional investors to BTC through established ETF providers. This influx of capital has the potential to bolster BTC price by increasing demand. While spot BTC ETFs currently acquire their holdings primarily through the OTC market, their influence extends beyond that. By absorbing buying pressure, they've helped reduce selling on CEXs, contributing to a positive price trend for BTC. However, this dynamic might shift after the upcoming BTC halving. If the OTC market lacks sufficient liquidity to meet ETF demand, the buying pressure from these funds could directly impact the BTC price on exchanges. In essence, spot BTC ETFs act as an amplifier. During bull markets, they magnify the upward trend by increasing overall buying pressure. Conversely, during bear markets, they could exacerbate the downward trend as traditional investors cash out on their holdings. The BTC market currently seems bullish due to the upcoming halving, potentially extending this uptrend for 12-18 months after the event. While I'm skeptical of spot BTC ETFs, questioning their role in fostering self-custody [2], I acknowledge their potential positive influence on BTC price. These ETFs might even be the reason BTC has already reached a new ATH before the halving [3]. The discussion above only covers the initial impact of spot BTC ETFs on the BTC price. In the long term, I believe its positive impact can be categorized into 3 stages: - Stage 1: Awareness and early adoption = Traditional investors seeking portfolio diversification are reached through advertising campaigns promoting spot BTC ETFs. These investors conduct their own research to learn more about Spot BTC ETFs. Investors in existing spot BTC ETFs from other countries may switch to US offerings due to their perceived higher reputation and lower fees.

This initial stage likely reflects the current market activity, as evidenced by a surge of new capital entering the market [4]. However, it's important to note that this influx might be temporary: the ease of entry and exit for these investors may lead to quick fluctuations based on overall crypto market sentiment. - Stage 2: Widespread adoption through investment consulting firms = Investment consulting firms will play a crucial role in driving mainstream adoption of spot BTC ETFs [5,6]. These firms are expected to recommend these ETFs to their clients, suggesting an allocation within their portfolios to potentially achieve higher returns. To facilitate informed decisions, consultants will provide detailed information about each available spot BTC ETF. This stage is likely to begin shortly after consulting firms complete internal training for their employees on the new investment option. With consultants actively promoting spot BTC ETFs, we can expect a significant and sustained increase in inflows into these funds.

- Stage 3: Discreet entry point for institutional investors = Traditionally risk-averse institutions, like pension funds, may gain exposure to BTC indirectly through synthetic ETFs offered by major investment funds [7,8]. These synthetic ETFs might hold a small allocation to underlying spot BTC ETFs, essentially giving investors exposure to BTC without them directly buying it. While still in early stages, spot BTC ETFs are poised to unlock a steady stream of investment, particularly from pension funds, into the crypto over the long term.

ETF providers are incentivized by fees to have a large amount of capital in their spot BTC ETFs. To attract investors, they might emphasize positive outlooks for BTC price growth. This focus on price appreciation could lead to marketing that emphasizes historical price charts, potentially influencing investor sentiment and price movement in the short to medium term (this year and next year). I would like to know your opinion on the multi-stage implications of spot BTC ETFs: - In your opinion, at what stage are we in this multi-stage process?

- Do you anticipate a further positive influence of spot BTC ETFs on BTC price itself?

- If you were a participant in a pension fund, would you be comfortable with a portion of your assets being automatically allocated to spot BTC ETFs?

References:[1] Spot Bitcoin ETFs Explained: Everything You Need to Know[2] BTC spot ETF: Wall Street's Trojan horse[3] BTC created new ATH before Halving: are you surprised?[4] Bitcoin ETF Tracker[5] Financial advisers seek guidance on recommending bitcoin ETFs[6] Report: Morgan Stanley 'Racing' to Offer Bitcoin ETFs to All Clients[7] Fidelity Unveils Crypto Exposure To Multi-Asset Etfs[8] Bitcoin ETFs poised for US pension plan inflows, Standard Chartered analyst says |

|

|

|

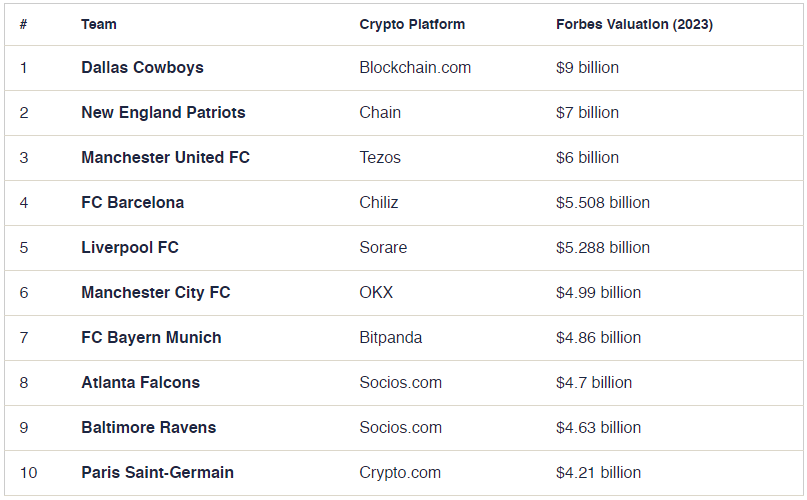

Beyond the headlines of overnight fortunes in BTC, memecoins, and airdrops, crypto is gaining mainstream traction through innovative advertising strategies. While I may not be a fan of spot BTC ETFs, Google's recent shift towards allowing ads for them is a significant step [1]. This opens the door for crypto to reach a vast audience of potential investors on the Google platform. Furthermore, the world of sports, with its billions of fans globally, presents another exciting avenue for crypto adoption. Sports aren't really my thing, and even e-sports leave me flailing. Before, I wouldn't have been able to tell you what AIG on a Manchester United shirt meant, or Emirates on a Chelsea shirt. But these days, I recognize OKX as the sponsor on Manchester City's jersey. My family, huge sports fans, are surprised to learn their favorite teams are all hooked up with crypto: Manchester United with Tezos, Barcelona with Chiliz, Bayern Munich with Bitpanda... [2]. Even legends like Cristiano Ronaldo and Messi are jumping on the bandwagon with their own NFT collections [3, 4]! It turns out, crypto is everywhere in sports – sponsoring teams, tournaments, and events across football, basketball, racing, and more [5]. The surging popularity of crypto companies as sponsors in sporting events comes as no surprise. Their financial windfall fuels high-profile sponsorships, putting their brands before a global audience of sports fans and athletes. This exposure fosters brand recognition and loyalty among fans, who are more likely to develop a preference for sponsor brands, from footwear and apparel to beverages and, most notably, jersey endorsements. It appears the golden age of banks and airlines dominating sports sponsorships has faded due to economic turbulence, paving the way for crypto companies to swiftly establish themselves as a new sponsorship powerhouse. I hope this new advertising channel offers a promising way to bring crypto to a massive new audience. Investors will likely be drawn to crypto's potential for growth and asset protection, injecting fresh capital to fuel the market's growth and maturity. We welcome these new investors not as liquidity providers, but as partners in building a more mature crypto ecosystem. I would like to know your opinion on the strategy of promoting crypto brands through sports: - Can sports effectively raise awareness and trust for crypto brands?

- Does sponsorship influence fans to trust the crypto brand associated with their favorite team or athlete?

- Does the frequent presence of crypto sponsorships in sports signal mainstream acceptance and growing popularity of crypto?

References:[1] Google Updates Advertising Policy for Crypto, Allows ETF Ads[2] Most Valuable Crypto-Backed Sports Teams in the World in 2024[3] The CR7 ForeverZone[4] Lionel Messi NFT Sold for $1 million on Ethernity[5] Why crypto companies are scooping up big sports sponsorships |

|

|

|

Stablecoins are a game-changer in the crypto market. They provide two key benefits: high liquidity and a safe haven for investors during periods of high volatility. These factors have fueled their rapid adoption. Tether's USDT is the current leader, boasting a market cap of $105 billion, which makes up a whopping 69% of the entire stablecoin market share [1]. Despite facing legal challenges in the past [2, 3], Tether has emerged as a dominant player in the cryptocurrency market. Its USDT stablecoin is widely accepted, integrated across 16 major blockchains [4]. Tether further bolsters its position by holding the 16th largest stake in US Treasury bonds [5]. Additionally, the company is involved in Bitcoin mining [6] and holds a significant amount of BTC, currently around 75k BTC valued at roughly 5B USD [7]. Back in 2017, the idea of Tether thriving in 2024 as the dominant stablecoin seemed far-fetched. Yet, here we are. But Tether's skyrocketing market cap has raised concerns. Many fear potential consequences for the crypto market if Tether's reserves aren't enough to truly back every USDT in circulation (meaning a 1:1 collateralization). However, an increase in USDT supply can indicate new money entering the cryptocurrency market. Since USDT is frequently used to buy other cryptocurrencies, this can lead to increased buying pressure, potentially pushing token prices up and contributing to a bullish trend. I think if Tether keeps issuing new USDT, it suggests that there's still demand for stablecoins, which could be a sign that investors are still entering the crypto market and the crypto market is still in an uptrend. I own USDT. I'm using Binance Simple Earn to earn interest on my USDT while I slowly buy Bitcoin through DCA strategy. USDT also helps me hedge against the weakening of my local currency compared to the USD. I hope the USDT market remains stable until I can convert my holdings to cash after uptrend. I would like to know your views on Tether: - Is USDT safer than other stablecoins in the market?

- Are Tether and USDT really important for the development of the crypto market?

- Could Tether collapse in the future?

References:[1] DefiLlama: Stablecoin Overview[2] Cryptocurrency firms Tether and Bitfinex agree to pay $18.5 million fine to end New York probe[3] CFTC Fines Tether and Bitfinex $42.5M for ‘Untrue or Misleading’ Claims[4] Tether Token (USDT) to Launch on Celo[5] Tether: the Q4 2023 report shows stellar profits[6] Tether plans major expansion into BTC mining with $500M investment: Report[7] Tether becomes seventh largest Bitcoin holder with recent $618 million purchase |

|

|

|

Chainlink stands out in the crypto market as a leader in oracle technology, a critical piece for DeFi and RWA integration. Notably, Chainlink's development thrived during the crypto winter. While many projects slowed down, Chainlink used this time to build partnerships and valuable solutions for the market. This focus on development has positioned Chainlink as a top contender, with some investors even considering it the third most valuable project after Bitcoin and Ethereum. Chainlink's developer community is among the most active in the blockchain space, averaging an impressive 451.23 GitHub events over the past month. This intense development activity, encompassing code updates, issue raising, and improvement suggestions, is a positive sign for Chainlink future. It suggests Chainlink's unwavering commitment to long-term growth [1]. In addition to oracle solutions, Chainlink's CCIP is a new development that has the potential to shake up the cross-chain landscape [2]. While I don't really understand the potential of CCIP and its full capabilities are still emerging, it presents itself as a possible competitor to existing solutions like Cosmos' Hub and Polkadot's Parachains. While Chainlink dominated the oracle scene last season, I'm eyeing potential challengers this year. While Band, DIA, and API3 exist, their customer base pales in comparison to Chainlink [3]. Tellor's recent price surge garnered attention, but it lacked real value. However, Pyth, a newcomer with a strong customer base and efficient services [4], has piqued my interest. Similarly, in the cross-chain space, I'm looking forward to projects like Cosmos, Polkadot, LayerZero, and ZetaChain potentially competing with Chainlink [5]. Healthy competition drives innovation across an entire field. This ensures users and the market benefit from the best, safest, most effective, and most affordable solutions. While I strongly support Chainlink, I believe continuous competition is crucial for its ongoing development and to prevent monopolies from stifling progress in the blockchain space. I want to know your opinion about Chainlink: - Will Chainlink continue to be a giant in the crypto market during this uptrend?

- Which project can compete with Chainlink in the oracle field?

- Which project can compete with Chainlink in the cross-chain field?

References:[1] Chainlink Dominates Crypto Landscape with Unparalleled Development Activity[2] Cross-chain by Chainlink[3] Decentralized Oracles[4] Pyth: Smarter Data for Smarter Contracts[5] Research: Cross-Chain Interoperability |

|

|

|

While insurance is commonplace for things like homes, cars, and even our health, it's not yet widely available for crypto. This gap exists because crypto are a relatively new asset class, and traditional insurance companies haven't established trust in the crypto industry. In the past, CEXs often created their own reserve funds to manage risk and compensate users in case of hacking incidents [1]. This approach highlights the current lack of mainstream insurance options for crypto. The landscape of digital asset security is evolving. Insurance giant Marsh is launching a significant development: an 825M USD insurance facility specifically designed for custodians of digital assets. This product caters to organizations that store assets in the most secure method against cyber-attacks – offline "cold storage". However, Marsh goes beyond traditional methods by also covering assets protected by innovative solutions like Multi-Party Computation, which fragments cryptographic keys for enhanced security, offering an additional layer of protection [2]. To me, this marks a significant leap towards both legitimizing and securing the crypto industry. By enabling CEXs to obtain insurance for assets held in cold storage, the process of safeguarding user funds becomes far more robust. This initial step will likely be followed by a wave of other insurance companies entering the market, offering competitive services. This increased competition will ultimately drive down costs and provide even better protection, fostering trust and accelerating mainstream adoption of crypto. As a CEX user, I appreciate the ease of use, variety of features, and deep liquidity offered by CEXs. Binance is my current platform of choice, and I'm interested in seeing if they'll adopt this new insurance product. I would like to know your views on crypto custody insurance: - Is insurance really important for CEXs and the crypto market?

- Would you trust CEXs more if they used crypto insurance services?

- Which CEX will be on board soonest to insure their users' assets?

References:[1] Secure Asset Fund for Users (SAFU)[2] Insurance Broker Marsh Introduces $825M Crypto Custody Coverage |

|

|

|

Within the crypto community, BTC has earned the nickname "Digital Gold" due to the expectation that it can rival gold in terms of market capitalization, value, economic influence, and widespread acceptance [1]. Recent months have witnessed a surge in Bitcoin's price, significantly outperforming gold. This trend is further emphasized by the shift in investment focus, with traditional investors moving away from spot gold ETFs and towards spot BTC ETFs [2]. Even gold advocate Peter Schiff, a long-time critic of Bitcoin, has publicly expressed regret over not investing in it earlier [3]. The increased media attention suggests BTC is gaining traction compared to gold, emerging as a potential frontrunner in the investment arena. In a surprising move, gold mining company Nilam Resources announced plans to enter the digital asset space. They signed a letter of intent to acquire a significant amount of Bitcoin and other digital assets. The deal hinges on acquiring full ownership of MindWave, a company holding a massive 24,800 Bitcoin. This substantial holding could be used as collateral to secure funding for Nilam's future projects [4]. Nilam's decision to acquire a significant amount of BTC underscores the growing recognition of Bitcoin as a valuable asset class. This move also shines a light on how the potential of BTC is attracting even gold-focused companies. While these companies may have traditionally favored gold due to its proven track record in wealth creation, Nilam's investment suggests that they cannot ignore the potential for future profits offered by BTC. Traditionally, accumulating gold was a preferred way to preserve wealth, as seen with our grandparents and parents. However, for my generation, crypto, particularly BTC, offers a more attractive alternative. Unlike gold, crypto allows for easier acquisition in smaller amounts and has the potential for higher returns. As a result, gold seems to be falling out of favor as a store of value. I would like to know your views on BTC and gold: - Are you investing in BTC or gold?

- Do you think BTC has become more attractive than gold in the investment sector?

- Have people like Peter Schiff accumulated a lot of BTC while still badmouthing BTC in the media?

References:[1] When will Bitcoin catch up with Gold in capitalization?[2] Gold Funds See Big Outflows Alongside Rush of Money Into Bitcoin ETFs[3] Gold Bug Peter Schiff Says He Wishes He'd Bought Bitcoin in 2010[4] Nilam Resources Enters Letters of Intent to Acquire 24,800 Bitcoin

Update 2024.03.27: The announcement raises doubts about its legitimacy because Nilam, a company with a market value of only $4 million, plans to purchase a massive $1.7 billion worth of Bitcoin. |

|

|

|

The concept of tokenization has been around since 2017. It essentially involves creating digital tokens on a blockchain that represent ownership rights in real-world assets. This "on-chain" approach facilitates easier exchange and trading, ultimately increasing the asset's liquidity [1]. This innovation has grabbed the attention of traditional financial giants like JPMorgan and BlackRock, fueling the RWA trend within the crypto market [2, 3]. Initially, the focus was on tokenizing securities for smoother trading. A surprise twist: instead of tokenizing securities, we've seen the securitization tokens with the launch of the BTC spot ETF in January [4]. This innovation allows traditional investors to easily purchase exposure to Bitcoin through ETF, bypassing the complexities of directly acquiring and storing BTC themselves. The BTC spot ETF has unlocked tens of billions of dollars in investment from traditional markets, fueling a surge in the price of Bitcoin. Notably, even though these ETF providers are currently acquiring their Bitcoin on the OTC market, the impact on the broader market is undeniable. As the price of Bitcoin rises, the entire crypto market expands, creating opportunities for crypto investors to profit. Larry Fink, CEO of BlackRock, once said: "ETFs are step one in the technological revolution in the financial markets. Step two is going to be the tokenization of every financial asset" [5], but if in the future, most securities can be tokenized, then BTC spot ETF can also be tokenized. Then we will have a crazy value chain: value (energy) => tokenization (BTC) => securitization (BTC spot ETF: IBIT, FBTC, HODL...) => tokenization (BTC spot ETF token: IBIT token, FBTC token, HODL token...). Tokens reverting to just tokens - a red flag for the market. While we envision integrating crypto into the stock market through tokenized securities, established financial institutions are already weaving traditional securities into the crypto market with a BTC spot ETF. It's worth noting that some crypto investors see the BTC spot ETF as a sign of Bitcoin's progress. However, I believe it might be a strategic move by the stock market to establish itself within the crypto sphere, potentially steering investors towards BTC spot ETF rather than encouraging them to understand blockchain technology and self-custody their Bitcoin. Could BTC Spot ETF be Wall Street's Trojan horse? I would like to know your opinion on this issue: - Do you support securitization or tokenization?

- BTC spot ETF is the maturity or degeneration of BTC?

- Does BTC spot ETF have any negative impact on BTC and the crypto market?

References:[1] Tokenization: Real World Assets, Real World Benefits[2] JPMorgan debuts tokenization platform, BlackRock among key clients: Report[3] The Rise of Real World Asset Tokenization (RWA): Unlocking Asset Liquidity[4] Spot Bitcoin ETFs Explained: Everything You Need to Know[5] BlackRock’s Larry Fink says bitcoin ETFs are just the first step in the technological revolution of finance |

|

|

|

Despite Bitcoin's global popularity, the creator behind the pseudonym Satoshi Nakamoto remains shrouded in secrecy. Many have been captivated by this ongoing mystery. One individual, Australian computer scientist Craig Wright, has repeatedly claimed to be Satoshi Nakamoto since 2016. However, these claims have lacked any substantial evidence. In a recent lawsuit brought by the Crypto Open Patent Alliance (COPA) against Wright, a judge ultimately ruled that Wright failed to present any credible proof to support his assertions [1]. The court ruling aimed to resolve the controversy between the Bitcoin community and Craig Wright. Following the ruling, the price of Bitcoin Satoshi Vision (BSV) fell by 17% [2]. Some argue this drop reflects a belief that Satoshi Nakamoto, the creator of Bitcoin, envisioned a greater future for the Bitcoin than what the Bitcoin whitepaper outlines. This view is supported by recently revealed emails between Satoshi and Sirius [3]. BSV is a token built on a foundation of false promises. There's another point to consider. Craig Wright's claims of being Satoshi Nakamoto have been around for a few years now. Has this impacted Bitcoin's value? No. And what if the court rules in Wright's favor? Will it affect how we hold, use, or trade Bitcoin? The answer remains the same: No. As a huge Bitcoin enthusiast and admirer of Satoshi Nakamoto, I firmly believe Satoshi deserves anonymity. It's clear Satoshi intended this to safeguard Bitcoin's decentralized nature. Craig Wright's constant efforts to prove his identity go against this core principle. True potential Satoshi candidates like Dorian Nakamoto, Hal Finney, and Nick Szabo have consistently denied the claims, while those seeking notoriety resort to such impersonations. Bitcoin's value isn't tied to its creator, but rather to its robust features: a massive, decentralized network (over 50,000 nodes strong!), a highly secure proof-of-work protocol, freedom from financial institutions, and broad popularity among internet users. As long as these advantages persist, Bitcoin will remain valuable. Think about it - we use Google without knowing its founders, smartphones without knowing their inventors, and electricity without remembering its pioneer. These technologies thrived because they addressed real needs, not because of a single person. Bitcoin is no different. My belief in BTC's value as a store of wealth stems from its potential, not the identity of Satoshi Nakamoto. Satoshi's anonymity could be interpreted as an empowering act. It places the focus on us, the users, rather than a single individual. This suggests that Satoshi might view the Bitcoin community, the people who use and promote it, as the true driving force behind the Bitcoin, even more important than the creator. I'd like to hear your views on this issue: - Will the outcome of the lawsuit involving Faketoshi Craig Wright affect the value of BTC?

- Does Satoshi's true identity matter to your BTC investment?

- When will the community stop searching for Satoshi's identity?

References:[1] UK court rules Craig Wright not Nakamoto, ending long-standing drama[2] Satoshi’s Vision down 17% against Bitcoin after Craig Wright verdict[3] Satoshi - Sirius emails 2009-2011 |

|

|

|

The crypto community is wary of Central Bank Digital Currencies (CBDC) viewing them as a threat to financial freedom and crypto adoption due to potential government overreach [1]. However, CBDC deployed on blockchains like Ethereum offer intriguing possibilities. These CBDC could bypass traditional banks, increase transaction transparency, reduce costs, and potentially be more secure than existing stablecoins [2]. Notably, the Ethereum Foundation itself is open to CBDC deployment on their platform [3], and Ethereum's strong performance in decentralization, security, flexibility, and speed makes it a prime candidate for CBDC pilots [4]. Israeli crypto firm Bits of Gold is leading a pilot program for BILS, the first digital currency pegged to the Israeli Shekel. This pilot, conducted in cooperation with the Israeli Capital Market Authority (ICMA), paves the way for exploring a potential CBDC for Israel. What makes BILS interesting is its technical foundation. The developers opted for the Solana blockchain, known for its impressive speed ~65K tps and minimal transaction fees ~ 0.00025 USD per transaction [5]. Youval Rouach, Bits of Gold’s co-founder and CEO: “We are proud to introduce BILS, a ground-breaking development that literally connects digital currencies into the Israeli economy. The introduction of BILS marks a significant progression in integrating digital currencies into the Israeli economy, while expanding financial accessibility” [6].While concerns exist regarding some CBDC like Venezuela's Petro [7] or the lack of transparency surrounding China's e-CNY [8] and Russia's Digital Ruble [9], I believe CBDC implemented effectively can offer significant benefits. Israel, with its strong technological infrastructure and stable economy, could be an ideal testing ground for a CBDC. This could serve as a showcase for the positive aspects of CBDC. The selection of Solana blockchain is a promising development. It recognizes the value and reliability Solana has established over its four years of operation. This also signifies the expanding role of blockchain technology beyond DeFi and GameFi, reaching into the realm of CBDC. With Ethereum already involved, Solana's participation fosters healthy competition that can drive further innovation in the CBDC space. I would like to know your views on Israel's CBDC on the Solana blockchain: - Do you expect the positive values that Israel's CBDC will bring?

- Is Solana blockchain worthy of being chosen for this CBDC pilot?

- Are you ready to use CBDC on the Solana blockchain?

References:[1] A Central Bank Digital Currency Would Be Bad for the US [2] The Advantages—and Drawbacks—of Central Bank Digital Currencies[3] Blockchain Solutions for Central Bank Digital Currency (CBDC)[4] Mastercard’s CBDC pilot ventures into Ethereum and NFTs[5] What Is Solana (SOL) and How Does SOL Crypto Work?[6] Israeli Crypto Firm Launches Pilot for First Shekel-Backed Stablecoin[7] Venezuela Terminates Petro Cryptocurrency After 5 Years[8] China’s Digital Currency: The hopes and fears of the e-CNY[9] Digital Ruble: Definition, How It Works, History, and Goals |

|

|

|

The launch of a BTC Spot ETF has coincided with a significant rise in BTC price. Some believe the ETF is a major driver behind this surge, with BTC price even reaching a new ATH before the upcoming halving event - a phenomenon never seen before. Adding to the bullish sentiment, Michael Saylor's company, MicroStrategy, continues to aggressively accumulate BTC. They are even engaged in a kind of arms race with BlackRock to hold the most BTC [1, 2]. Saylor's unwavering commitment to BTC has earned him the reputation of being the most prominent "diamond hands" investor in the crypto world, surpassing even El Salvador's president, Nayib Bukele, in terms of fame. Michael Saylor has outlined the distinctions between investing in MSTR stock and a BTC Spot ETF [3]. While he emphasizes MSTR's advantages, the question remains: for investors, which is better - MSTR, whose value hinges heavily on its BTC holdings, or BTC itself?- In terms of profit: MicroStrategy's investment in BTC has been highly profitable. Since starting to buy BTC in August 2020, the company's stock (MSTR) has surged over 1220%. This is a significantly higher return than the roughly 500% gain in BTC price itself over the same period. This amplified gain is due to MicroStrategy's use of debt financing to buy more BTC. This strategy, called leverage, magnifies both profits and losses. While it has driven impressive returns so far, it also increases risk if the BTC price falls.

- In terms of credibility: some view MicroStrategy, a well-established company, as a more credible investment than BTC itself. They believe investors gain exposure not just to BTC but also to the experience of MicroStrategy's leadership [4]. However, Bitcoin's strength lies in its decentralized nature. Existing for over a decade, it operates independently of any individual, company, or government. This decentralization fosters trust for many investors, myself included, compared to a traditional public company.

While investing in MSTR could potentially offer higher returns, I prioritize self-custodying my BTC for greater control over my holdings. This means I rely on my own judgment, rather than trusting someone else's decisions, even a respected figure like Michael Saylor. Saylor has publicly stated MicroStrategy has no plans to sell its BTC [5]. However, I believe it's a question of when, not if, such a sale might occur due to unforeseen circumstances or a strategic shift by the company. I would like to know your views on investing in BTC and MSTR: - Do you choose to invest in BTC or MSTR? Why?

- Will MSTR continue to generate better returns than BTC?

- Is an investment in MSTR safer than an investment in BTC?

References:[1] BlackRock and MicroStrategy in Neck and Neck Race As Firms’ Bitcoin Holdings Soar to Over $29,170,000,000 in BTC[2] Public Companies that Own Bitcoin[3] MicroStrategy Makes Its Case as Alternative to Spot Bitcoin ETFs[4] Is MicroStrategy (MSTR) A Better Investment Than Bitcoin? Experts Debate[5] Michael Saylor Suggests MicroStrategy Will Never Sell Its Bitcoin |

|

|

|

In a welcome break from past delays, the Ethereum Foundation delivered the DenCun upgrade on time in Q1 2024. This critical update lives up to its promise by significantly reducing transaction costs for users of layer-2 scaling solutions. Popular layer-2 solutions like Arbitrum, Optimism, Base, zkSync, and Zora have all seen transaction fees plummet to mere pennies per transaction [1]. This translates to a vastly improved user experience for anyone interacting with dApps built on these layer-2 solutions. As a result, Ethereum dApps could become significantly more accessible to a wider audience. While Layer-2 solutions offer significant benefits, there are ongoing discussions about potential trade-offs in decentralization and security [2]. Despite these considerations, I believe Dencun is a positive step for the long-term health of the Ethereum ecosystem. In fact, I often choose Optimism for my ETH transfers due to its advantages, but it's important to acknowledge these potential limitations. - Despite the Dencun upgrade's potential to directly benefit users by reducing transaction costs on layer-2 solutions, the prices of their native tokens (like ARB and OP) haven't shown a significant increase. This could be due to two factors: either the market already anticipated the positive impact of Dencun and priced it in before the upgrade, or investors are still cautious and favoring ETH itself.

- High Ethereum Layer-1 fees haven't deterred users completely. While Layer-2 solutions offer significantly lower fees (often 1000x lower) [3], trading volume on Ethereum remains high. Coinmarketcap data shows that Ethereum's daily volume ~3.15B USD dwarfs Layer-2 solutions like Arbitrum ~ 1.1B USD, Optimism ~128M USD, and Base ~155M USD [4]. This suggests that transaction fees are just one factor users consider when choosing a platform. Security, established network effects, and user familiarity with Ethereum may also be important.

I myself will continue to prioritize using Layer-2 while waiting for new scaling solutions for Ethereum Layer-1 in the future. I want to know your opinion on Ethereum Layer-2: - Are you using Ethereum Layer-2? Which one?

- Do you trust Ethereum Layer-2 solutions?

- Would you choose to invest in Layer-2 native tokens such as ARB and OP instead of ETH?

References:[1] Layer 2 Blockchains Become Cheaper After Ethereum's Dencun Upgrade[2] Debating Dencun: Will Ethereum's Big Update Help or Harm the Network?[3] Optimism Mainnet - L2 Gas Price Tracker[4] Coinmarketcap: Top Cryptocurrency Decentralized Exchanges |

|

|

|

In its early days (around 2009), Satoshi Nakamoto envisioned BTC as a replacement for fiat in everyday transactions. However, today, BTC and many other crypto function more as a store of value, similar to an investment. Their price fluctuations offer profit potential but also contribute to gradual inflation of crypto relative to fiat. This dynamic becomes even more complex when people choose to hold crypto assets like BTC, ETH, or USDT instead of fiat. This behavior stems from the belief that fiat are losing value over time, while crypto are expected to appreciate. The rise of crypto has the potential to significantly impact the role of fiat in the global economy. This could challenge governments' traditional control through mechanisms like money printing. Governments are taking various approaches to this new reality. The EU, for instance, has adopted a regulatory stance with the introduction of the MiCA law [1]. China, on the other hand, has opted for a stricter approach, aiming to ban crypto entirely [2]. The situation in Nigeria is more fluid, with the government's position yet to be solidified [3]. The Nigerian government recently took a hard stance on crypto, accusing it of contributing to the decline of the naira's value. This resulted in a ban on all crypto exchanges operating within the country [4]. Specifically, authorities suspect Binance of being involved in a massive, $26 billion illegal money flow that has harmed the Nigerian economy. To investigate these claims, they arrested two Binance executives and demanded user data [5]. Binance maintains its innocence and has called for the executives' swift release. While cooperating with the ongoing investigation, the company denies any wrongdoing [6]. This incident highlights a critical question: how should governments regulate crypto exchanges? The rapid growth of this industry has exposed gaps in oversight around the world, leaving policymakers scrambling to catch up. The recent actions by the Nigerian government highlight the ongoing tension between governments and crypto exchanges. I believe Nigeria's recent actions towards crypto appear to be overly restrictive and may hinder the technology's potential growth in the country. Crypto's decentralized structure ensures its existence independent of government approval. However, widespread adoption by governments is crucial for its robust growth. Government restrictions on crypto trading and CEXs can stifle market liquidity and discourage investor participation. This could hinder the influx of new capital and limit the crypto market's potential compared to more accepting environments, though DeFi and P2P transactions might persist. The recent crackdowns on crypto in countries like China and Nigeria, despite crypto's inherent resilience, raise my concerns about governments' ability to stifle its growth within their borders. If this trend continues and other governments follow suit, the potential consequences for the global crypto market could be far-reaching. Looking ahead, we need to see two key developments for crypto to flourish. Firstly, major governments should embrace crypto as a legitimate asset class by establishing a legal framework. This framework would allow for taxation of crypto income, similar to other investments. Secondly, the crypto community must strongly oppose and condemn any extreme measures aimed at stifling the market's growth. I would like to know your views on the acts of repression of the crypto market: - Can crypto continue to thrive without the support of governments?

- Do you think governments can suppress and restrain the crypto market with their power?

- If you were the head of government, would you accept or reject the crypto opportunity for your country?

References:[1] MiCA, EU’s Comprehensive New Crypto Regulation, Explained[2] China Never Completely Banned Crypto[3] An overview of cryptocurrency regulations in Nigeria[4] Nigeria targets cryptocurrency in bid to end naira freefall[5] Binance Executives’ Detention Could Spark Diplomatic Crisis in Nigeria[6] Binance says it trained investigators in Nigeria under government cooperation |

|

|

|

For greater control and security, we consider managing our crypto in a personal crypto wallet instead of leaving it on CEXs. To interact directly with blockchains and manage crypto, we need a crypto wallet application. In the past, I used the MEW website for Ethereum account management. Since 2020, I've preferred mobile apps, specifically TrustWallet on iOS. I still rely on it on my old iPhone for occasional crypto trades. While I've enjoyed using TrustWallet as a regular user - it's fast, user-friendly, and supports a wide range of blockchains [1] - recent security concerns require attention: SECBIT Labs, a security research firm (not affiliated with the SEC), identified a potential vulnerability in TrustWallet's iOS app. This issue allegedly stemmed from code using functions meant only for testing. These functions could have generated weak private keys, making it easier for attackers to steal crypto from affected accounts. The timeframe in question is for wallets created between February and August of 2018 [2]. While I'm glad I missed the 2018 TrustWallet vulnerability, it raises concerns about potential unknown issues. After all, even established hardware wallets like Ledger had problems recently [3]. While I've been a loyal TrustWallet user, recent events have prompted me to diversify my crypto storage. I'm trying out SafePal on iOS for additional security. Hardware wallets have also piqued my interest, and I plan to research and invest in one soon using some of my uptrend gains. There's no denying the convenience of mobile crypto wallets, but it's a trade-off for the enhanced security hardware wallets offer. I would like to know your views on crypto wallets: - Are you using TrustWallet? Will you continue to trust TrustWallet?

- Are you using other crypto wallet apps?

- Is a hardware wallet really necessary for your crypto investment?

References:[1] Trust Wallet Review 2024 – Everything You Need to Know[2] Old Trust Wallet iOS vulnerability from 2018 may still affect some accounts[3] What We Know About the Massive Ledger Hack |

|

|

|

After weathering the storm of the FTX collapse in 2022, Solana has staged an impressive comeback in 2023. This resurgence is evident not only in the surging price of the SOL token and the growth of the Solana ecosystem, but also in a groundbreaking new market trend: physical products offering significant benefits within the Web3 space. The Sagaphone, the first Web3 phone to hit the crypto market, exemplifies this exciting development. Solana's Saga smartphone, launched with much fanfare in May 2023, failed to impress in the Android market. Priced at a premium 1K USD at launch, it was eventually slashed to 599 USD in August due to poor sales. Tech reviewer Marques Brownlee even went as far as calling it the "worst phone of 2023." Honestly, I wouldn't touch one with a ten-foot pole. My trusty old iPhone seems miles ahead! However, the memecoin BONK created the plot twist. Sagaphone owners received an airdrop of 30M BONK tokens, with a total value of around 1K USD. This unexpected gift surge in demand for Sagaphones. Strangely, a Sagaphone with the 30M BONK tokens (not yet received by the seller) was resold for 5K USD on eBay. This is illogical as the buyer could have directly purchased 160M BONK tokens for the same 5K USD at the current market price. Perhaps the buyer was speculating on receiving future airdrops from other new projects within the Solana ecosystem [1]. Solana's Chapter 2 Smartphone, priced at $450, has seen a surge in pre-orders following the success of the Saga phone. The device garnered 25K pre-orders within the first 24 hours and surpassed the entire first-year sales of its predecessor, the Saga, with 30K pre-orders within 30 hours [2]. I think that the Solana development team might be prioritizing initiatives like smartphone production and memecoin creation over addressing network stability concerns  The Web3-phones wave is gaining momentum beyond just one blockchain platform. In February 2024, Aptos, a Layer 1 blockchain, teamed up with Jambo Technology to launch a new $99 Web3 smartphone targeting emerging markets [3]. This trend continued yesterday, March 11th, when Ninety Eight, the creator of the Coin98 DeFi ecosystem, unveiled their own $99 JamboPhone specifically designed for the Asian market [4]. While these budget-friendly Web3 phones may come pre-loaded with blockchain/crypto apps to simplify Web3 access, there are concerns about their hardware quality. Smartphones under 100 USD are unlikely to meet all my expectations on its durability and performance. The concept of blockchain on mobile devices has come a long way. We've seen early efforts like the Electroneum project, which allowed direct mining of ETN tokens on smartphones [5]. Similarly, the Samsung Galaxy S10 offered built-in support for blockchain wallets [6]. These were significant steps in making blockchain technology more accessible. However, with the widespread adoption of smartphones and the ease of installing popular crypto wallet apps like MetaMask, Trust Wallet, and SafePal, dedicated Web3-phones seem less valuable today. They often function as regular smartphones with a few pre-installed crypto applications (which users can likely install themselves anyway) or bundled with NFTs promising future airdrops. While potential airdrops from Web3-phones are intriguing, I'm happy with my current iPhone for now. The existing crypto wallet apps allow me to access and use Dapps just fine. Plus, I trust Apple's proven security track record more than I do some of the newer, less established Web3 phone brands. I would like to know your opinion on the Web3-phones trend: - Are you willing to buy Web3-phones?

- Will Web3-phones become a trend for other blockchains to follow?

- Are Web3-phones really necessary for the crypto/blockchain market?

References:[1] Solana Saga Phone Labeled ‘Failure of 2023’ Despite Surge in Demand[2] Solana’s Chapter 2 Smartphone Breaks Saga’s Annual Sales Records in Hours[3] Aptos to Launch Smartphone to Boost Web3 Access in Emerging Markets[4] Coin98 Super Wallet Pre-installed on JamboPhone, Fostering Web3 Adoption Across Asia[5] Electroneum Mining: How to mine ETN in 2023[6] The Best Blockchain Phones to Consider in 2022 |

|

|

|

The year 2009 marked the birth of blockchain technology, driven by the innovative proposal of Satoshi Nakamoto for Bitcoin. Since then, blockchain has undergone significant development, with new features and capabilities emerging. The concept of consensus protocols, which was initially limited to Proof-of-Work (PoW) in Bitcoin, has expanded to include various mechanisms like Proof-of-Stake (PoS), Delegated Proof-of-Stake (DPoS), and many more. These include Proof-of-History (PoH), Practical Byzantine Fault Tolerance (PBFT), Proof-of-Burn (PoB), Proof-of-Capacity (PoC), and Proof-of-Elapsed Time (PoET)... [1, 2]. As a user, I've interacted with several blockchains, but the intricacies of these consensus protocols remain beyond my current understanding. My ability to evaluate blockchains is primarily based on user experience factors like transaction speed (tps) and transaction fees. There's often an inherent relation between these two aspects: faster blockchains tend to have lower fees, and vice versa. My crypto journey began in 2017, and I've explored various blockchains like Litecoin, Dogecoin, Ethereum, and more recently, Solana and Avalanche. But interacting with the Bitcoin network through Electrum was a unique experience. While Bitcoin transaction fees are generally higher, I managed to get them down to around 1.5 USD during the peak of the Inscription craze [3]. I'm a big fan of the Bitcoin blockchain, but high transaction fees and slow confirmation times can be frustrating. I've experienced this with other blockchains too - Ethereum fees reached up to 20 USD in 2021! In contrast, blockchains like EOS and Solana offer near-instantaneous transactions with fees under a penny [4]. I also recognize the value of decentralization and stability offered by other blockchains, their transaction fees, typically ranging from 1 to 10 USD, are necessary to incentivize miners who secure the network. This highlights the inherent challenges of the blockchain trilemma [5]. However, as a user, I find the Solana blockchain very attractive. It boasts a large ecosystem with a good variety of Dapps (decentralized applications) that cater to user needs, all while offering blazing-fast transaction speeds and remarkably low fees. I haven't personally experienced any outages, it's possible my limited use (primarily for occasional token swaps) has shielded me from such occurrences. This isn't financial advice for SOL or any other token. I'm simply sharing my personal experience using popular blockchains. I only hold a small amount (a few dozen USD) in ETH, BNB, and SOL. These funds are primarily for transaction fees on DEXs, not long-term investments like BTC. In hindsight, I might have missed an opportunity by not accumulating more ETH and SOL during the recent crypto winter. I would like to know your views on blockchains in the market: - What is your favorite blockchain and why: speed, transaction fees, profits?

- How often do you use that blockchain and for what purpose?

- Do you hold and consider the native token of that blockchain as a long-term investment?

References:[1] Analysis of the main consensus protocols of blockchain[2] Consensus Algorithms in Blockchain[3] Bitcoin Average Transaction Fee[4] Solscan: Fee tracker[5] The Security Trilemma and the Future of Bitcoin |

|

|

|

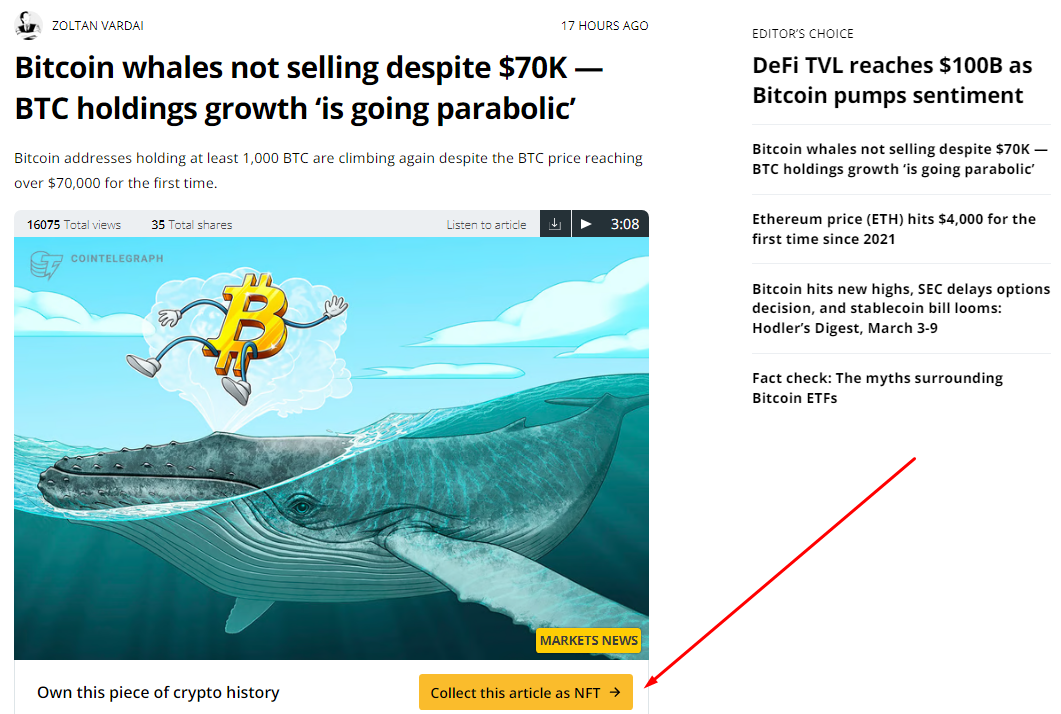

NFTs have become a familiar sight in the crypto market, with even high-profile figures like former President Trump launching their own collections [1]. This growing popularity extends beyond individual creators. Recently, I came across an interesting development on Cointelegraph, a leading independent news source in the blockchain and cryptocurrency space. Even this prominent crypto media platform has unveiled its own NFT collection. I want to be clear that this isn't promotional content or financial advice. I'm simply sharing my fascination with the innovative ways NFTs are being used in the crypto market. For example: the article "Bitcoin whales not selling despite $70K — BTC holdings growth is going parabolic" [2] mentions NFTs being minted, with costs between 173 USD and 208 USD [3]. For me, that's a significant amount. Instead, I could buy roughly 140-170 MATIC tokens, potentially a better investment during this apparent uptrend. This minting cost likely covers transaction fees on the Polygon blockchain and benefits Cointelegraph. Trying to find out more, it turns out that Cointelegraph launched a groundbreaking NFT collection in mid-2022, allowing users to own a piece of cryptocurrency history. This "Historical NFT Collection" offers a unique way to commemorate pivotal moments in the industry. By minting an article as an NFT, we transform from reader into owner of crypto history [4]. Interestingly, the Cointelegraph Historical Collection has appeared on the Rarible NFT marketplace [5], with one even reaching a staggering asking price of 38K WETH, roughly equivalent to 152M USD [6]. This outlier price likely reflects enthusiasm rather than a realistic market value. Most NFTs in the collection are priced much lower, around 20 USDC, which is even less than the cost of minting itself. This suggests that current owners are either strong Cointelegraph supporters or believe in the long-term potential of these NFTs as historical crypto artifacts. As an investor, I prioritize economic fundamentals. While I see potential in NFTs, particularly for raising awareness among Cointelegraph's audience, I'm unsure about their current valuation. Therefore, for my investment strategy, I'm considering MATIC tokens instead of minting Cointelegraph NFTs. Alternatively, I might invest in FLOW tokens, the native token of the NFT-focused Flow blockchain, based on my belief in a potential NFT market resurgence this year. It's important to remember that this is not financial advice for either MATIC or FLOW tokens. I want to know your opinion about Cointelegraph NFT: - Do you support Cointelegraph issuing its own NFTs?

- What do you think about the NFT minting fee of 173 - 208 USD? Would you mint an NFT or buy MATIC?

- Will the NFT trend come back soon in the uptrend of 2024-2025?

References:[1] Trump’s Digital Trading Cards Sell Out Again For $4.6 Million—But It’s Unclear How Much He Made[2] Bitcoin whales not selling despite $70K — BTC holdings growth ‘is going parabolic’[3] Cointelegraph article #125884 in Latest News 9 March, 2024[4] Turn Cointelegraph articles into NFTs — Early access for 500 readers[5] Rarible: Cointelegraph Historical Collection[6] Cointegraph article #105593 from Thu Mar 30 2023 |

|

|

|

Grayscale Investments is the world's largest digital asset manager, which offers a famous Bitcoin investment product called GBTC. Inclusion in Grayscale products like GDLC or their other trusts [1] is seen as a positive sign for a cryptocurrency. It signifies recognition from a leading investment firm and can lead to more stable buying pressure due to Grayscale's involvement. Grayscale Investments introduced a new fund, the Grayscale Dynamic Income Fund (GDIF). This fund offers investors a chance to earn rewards by staking 9 crypto. The GDIF specifically focuses on these nine crypto assets: Aptos (APT), Celestia (TIA), Coinbase Staked Ethereum (CBETH), Cosmos (ATOM), Near (NEAR), Osmosis (OSMO), Polkadot (DOT), SEI Network (SEI), and Solana (SOL). GDIF eliminates the technical hurdles of staking for investors. Grayscale takes care of everything, from strategically allocating investors capital across various staking assets to managing the staking and unstaking process to maximize returns. Investors will simply invest in GDIF shares, and Grayscale will handle the rest: staking tokens, converting the earned rewards to USD weekly, and distributing them to investors quarterly [2]. Due to eligibility requirements, I wouldn't be able to invest in the GDIF at this time @@ GDIF is limited to qualified clients with a minimum of 1.1M in assets under management or a net worth of 2.2M. The launch of GDIF is interesting in light of the growing trend of staking and restaking. It highlights Grayscale's attentiveness to investor demand for participation in staking rewards. The GrayScale GDIF inclusion is likely to boost the value of the associated tokens by attracting new investors. This increased demand could lead to significant price growth in the future. Early signs of this potential growth are already evident. Following Grayscale's GDIF announcement on March 5th [3], these tokens experienced significant price increases (calculated from the lowest price on March 5th to their highest price since then). These increases include: APT: +22%, TIA: +19%, ATOM: +32%, NEAR: +70%, OSMO: +26%, DOT: +33%, SEI: +57%, SOL: +39%. The timing of these price surges suggests a strong correlation with Grayscale's announcement, indicating a potential cause-and-effect relationship. I'm currently focused on DCA into BTC. After the upcoming Bitcoin halving, I plan to diversify my portfolio by adding altcoins through DCA as well. Several altcoins have caught my eye, including APT, ATOM, DOT, NEAR, and SEI. While I might have missed the absolute bottom price for these coins this year, I believe they still hold potential. And I acknowledge the early adopters and holders of these tokens. Here's to their success! I'd like to know your opinion on GDIF: - Do you think GDIF will become a new bullish driver for the 9 tokens on the list?

- Do you hold any tokens on GDIF's list?

- Has GDIF caught your attention and are you planning to invest in the tokens on the GDIF list?

References:[1] GrayScale: Crypto Products[2] GrayScale: Grayscale Dynamic Income Fund[3] Grayscale announces fund aimed at optimizing staking rewards |

|

|

|

Fueled by BTC historic achievement of reaching a new ATH before its next halving event, the cryptocurrency market is buzzing with activity. This is a unique occurrence in Bitcoin's history, and it has propelled BTC into the mainstream media spotlight. News magazines and national television stations are frequently discussing Bitcoin, reflecting the public's growing fascination with this digital asset and the potential for significant investment returns. Major corporations are recognizing the potential of BTC and are looking for ways to benefit from it. While large-scale investment might only be practical for a select few like Tesla or MicroStrategy, accepting BTC payments offers a more accessible entry point for most businesses. In fact, several companies already embrace this method, including tech giants like Microsoft and AT&T, alongside familiar brands like KFC [1]. The travel industry is also jumping on board, with Travala.com, a leading crypto-friendly platform, having previously accepted bookings using nearly 100 cryptocurrencies, including BTC [2]. Travala has launched a new initiative to capitalize on the growing popularity of BTC. The program offers top-tier travelers a compelling incentive: 10% cashback on their travel bookings in the form of BTC. This strategy aims to not only encourage users to book more travel through Travala but also introduce them to the world of crypto. Travala.com CEO Juan Otero: “Bitcoin is here to stay, and it’s now becoming more appealing to mainstream audiences, thanks to the recent approval of the first spot Bitcoin exchange-traded fund” [3].Travala's new BTC rewards program capitalizes on BTC's popularity, making it a highly sought-after incentive for travelers. For many, these earned BTC could be their first foray into crypto, potentially turning them into long-term crypto users and investors. I believe that this innovative program is a win-win, attracting new customers to Travala while boosting brand awareness within the crypto community. Inspired by Travala's idea, I predict a future where many companies offer similar loyalty programs. Beyond its role as a currency, BTC is increasingly recognized as a valuable brand. I, for one, would be eager to participate in programs that reward everyday purchases with BTC, from groceries and beauty products to airline tickets. I would like to know your opinion on the wave of BTC adoption by companies: - Do you think BTC programs will be useful for companies in their efforts to reach users?

- Are you willing to receive rewards in BTC when using future services?

- If you have your own company, are you willing to accept BTC or launch BTC programs?

References:[1] Who Accepts Bitcoin as Payment?[2] Travala: Payment options[3] Travala’s new Bitcoin rewards program targets top-tier travelers as BTC fever rises |

|

|

|

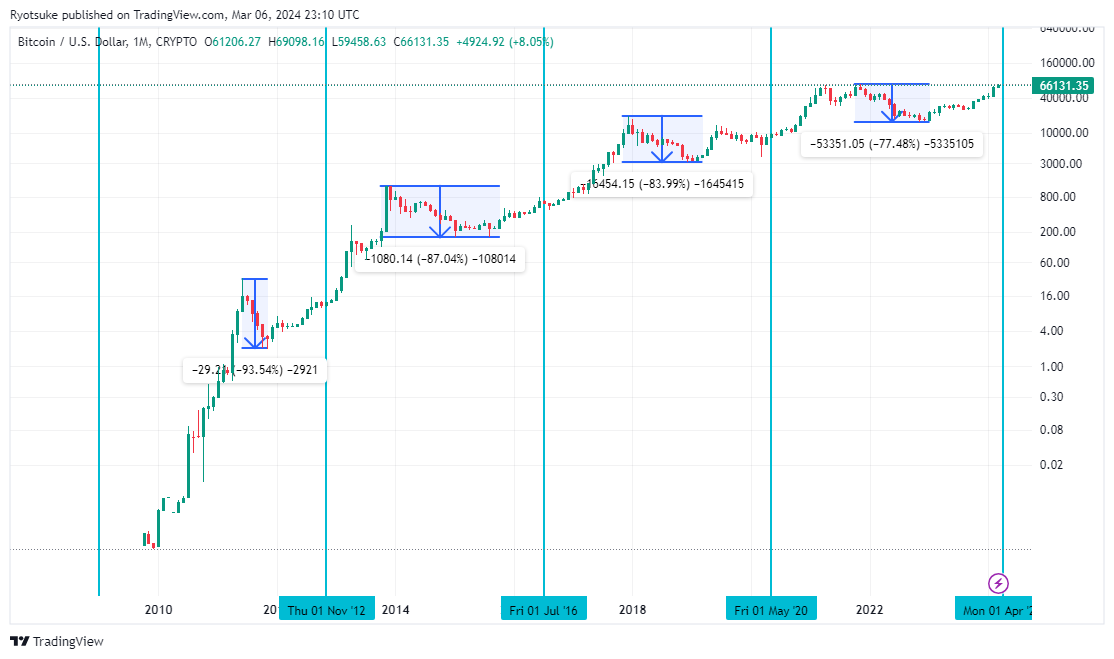

Introduced in 2008 by Satoshi Nakamoto, BTC was envisioned as a new global currency for the internet age [1]. While Satoshi intended for widespread adoption, BTC has primarily become a store of value. While I believe everyone should have access to Bitcoin, with its open network allowing anyone to create an account and transact, it's important to acknowledge that profiting from BTC may not be the chance for everyone. Throughout Bitcoin's history, periods of thrilling price surges have been followed by sharp corrections. During these downturns, also known as crypto winters, Bitcoin's price has fallen by a staggering 77% to 93% compared to its previous peak. In simpler terms, the price has dropped 4-10 times. These harsh winters act as a crucible, testing the resolve of Bitcoin holders. Those who remain confident in Bitcoin's long-term potential, often referred to as "diamond hands," are contrasted with those who hate BTC, or "anti-fans." Michel Saylor, the CEO of MicroStrategy, has become a well-known figure in the cryptocurrency world. He is credited with leading MicroStrategy's strategy of accumulating Bitcoin since 2020, which has resulted in a significant profit for the company: over $6 billion from its 193K BTC budget [2]. Additionally, the company's MSTR stock price has seen a substantial increase: over 800% in 3.5 years. However, Saylor's approach has also attracted criticism in the media in 2022 [3]. Even more famous than Michal Saylor is Nayib Bukele, the president of El Salvador, the first country in the world to accept Bitcoin (BTC) as legal tender alongside the US dollar in 2021 [4]. In addition to helping people access financial services without relying on banks, reducing transaction and remittance costs, and attracting tourists and foreign investment, the reserve of 2,380 BTC accumulated through mining and DCAing BTC has also helped El Salvador earn a profit of over 40% [5]. However, we also cannot forget that in 2022, Nayib Bukele and the El Salvador government faced criticism daily from a range of critics, from large organizations to individual market participants, on financial news sites, social networks, and YouTube [6]. I believe that Nayib Bukele has taken a risk with his entire political career to bring El Salvador into the Bitcoin era, and he is fully deserving of being re-elected president of El Salvador to contribute more in the next term [7]. Nayib Bukele: “When Bitcoin’s market price was low, they wrote literally thousands of articles about our supposed losses. Now that Bitcoin’s market price is way up, if we were to sell, we would make a profit of over 40% (just from the market purchases), and our main source of BTC is now our citizenship program”.Major media outlets can be seen as capitalizing on both positive and negative aspects of Bitcoin (BTC) to capture readers' attention. For instance, The New York Times frequently reports on recent BTC price surges [8]. However, during the 2022 crypto winter, they also published an article exploring the link between cryptocurrency investment and the "dark tetrad" personality traits: narcissism, Machiavellianism, psychopathy, and sadism [9]. Holding Bitcoin (BTC) long-term requires resilience, as the market can be volatile. While some humorously say "the best way to hold BTC is to go to jail" (meaning you're forced to hold), even strong believers can find it difficult during periods of decline. For me, holding BTC is not a coincidence, it is a rational choice!I want to know your opinion on the success of BTC holders: - Is the profit of BTC holders just from luck?

- Are you a BTC holder? What makes you keep believing and holding BTC?

- When will you hold BTC until?

References:[1] Satoshi - Sirius emails 2009-2011[2] MicroStrategy's Michael Saylor Made $1.2 Billion In 3 Days Following Bitcoin Boom[3] Michael Saylor Bet Billions on Bitcoin and Lost[4] El Salvador To Make Bitcoin Legal Tender: A Milestone In Monetary History[5] El Salvador Bitcoin holdings hit record $164M as BTC profits pass $50M[6] El Salvador’s bitcoin experiment: $60 million lost, $375 million spent, little to show so far[7] Nayib Bukele re-elected as El Salvador president in landslide win[8] New York Time: Bitcoin[9] Bitcoin fans are psychopaths who don’t care about anyone, study shows |

|

|

|

|