|

I think everybody and their grandma has now already heard of the Samourai case.

I was thinking about if a service which could make CoinJoins easier would be possible in a totally compliant way, without any danger of it to be considered a "money transmitter" by any authority. (I still think the American authorities are wrong with Whirlpool being a "money transmitter", but I haven't seen the code, so I can't be sure.)

First, what do we need to build a CoinJoin facilitating service? First, some kind of storage for a pool of UTXOs which are available for CoinJoins. I guess Whirlpool did this in a centralized way on its server. But in theory this could be done by the users themselves: from the moment on they offer their own UTXO, they can get informations about other UTXOs which are available. (This is actually how JoinMarket seems to work afaik. But Joinmarket is not what I'm asking for - I'm thinking about a model to create a centralized service which could offer a fee but would be easier to use than JoinMarket.)

So the UTXOs would circulate in a P2P network completely independent from the centralized server.*

Second part would be the entity "building" the CoinJoin transactions. This could also happen in the P2P network. So basically, once an user sees enough UTXOs to form a CoinJoin, he uses let's say 5 or 10 UTXOs from this decentralized pool and builds his transaction, signs it and broadcasts it inside the P2P network, so all peers which have contributed UTXOs can sign it.

What can the centralized server do to make CoinJoins easy? As far as I have understood JoinMarket, you need a full node to participate there because otherwise there are security concerns, and thus it's limited to a relatively small and wealthy Bitcoin user group.

So the centralized server thus could simply offer you this service: a trusted Bitcoin Core node you can connect to and you can query as if it was your own Bitcoin Core node. So every user can always be sure that the UTXOs he uses for his CoinJoin transaction are really there.

Such a service would be able to charge a (low) fee, for example for a kind of API subscription, but would not be a money transmitter in any way as it's not at all involved in the creation of transactions.

This would make a JoinMarket-style CoinJoin network possible where users could participate with their SPV wallets (Electrum, Sparrow et al.).

Am I missing something? Does such a service perhaps already exist?

*Yes, chain analysis companies could of course use this P2P network too, but this would happen to all CoinJoin models.

|

|

|

|

Runes are one of the most hilarious* economic systems ever created, after perhaps BRC-20. 1. Someone creates a token with a specific name. 2. Other people can create their own units of these tokens. There is a limit, but usually it's not very low. 3. Then all try to sell their tokens, thinking there will be someone collecting them, either because of the "creative" name, or because it was created on a specific date (e.g. Halving Day). 4. Rinse and repeat (protocol is open, everybody can participate in each step). Basically it's like "you can create your own money! and you will be rich if you do that!" Are you really willing to waste thousands of dollars of transaction fees for that? Technically Runes is not much more advanced than Omni/Mastercoin which was created in 2013. More than ten years ago!

If you think Halving Day is special to create your own Rune, think again: During the halving day, 144 blocks approximately will be created. Each block normally has 1000-3000 transactions. 74% of them currenty are Runes according to this dashboard. This means probably more than 200.000 Runes will be created today. Now try to sell them all. Order books will be thick, but only on the ask side

*not in a positive way  |

|

|

|

Many Bitcoiners seem to take it for a "given" that Bitcoin's price moves in 4-year cycles ending with an ATH: - First cycle: 2009-13 - with ATH ~$1100

- Second cycle: 2013-17 - with ATH ~$19600

- Third cycle: 2017-21 - with ATH ~$69000

- Fourth cycle: 2021-25 - ATH: $???

There seems to be also a widespread acceptance that in the cycle there has to be a bear market with drastic price reduction (75%-93%). But what if this all is only a coincidence? Let's analyze the arguments for this assumption. I already will say that I'm myself not sure which is the correct answer. So maybe we come closer in the discussion.

1) First argument in favour of the "coincidence hypothesis": There were actually only two complete 4 year cycles.The argument is based mainly on the fact that 2009-2013 cannot be viewed as a single cycle, it was at least 2, perhaps 3 cycles. At least the high in 2011 ($32) followed by an extreme bear market with a very pronounced low ($2) should be viewed as a separate cycle. I think there are even reasons to assume that in 2013 we had a separate cycle too: The April high ($260) could have been seen as an important top too, if we take into account that the price then lowered over 80% in a few months to a low of $50. We could counter this argument saying that the market was immature back then and thus wild swings were normal. But I think we still can't say that 2009-13 was really a "cycle" like 2013-17 and 2017-21 were. There was, for example, no real crypto winter, perhaps late 2011/early 2012 but it was much shorter than in other occasions. And the 2021-XXXX cycle has probably not ended still. We don't know if the high will be in 2024, 25 or even later ... it could even be a Supercycle. 2) Second argument: Above all the bear markets were driven, in several occasions, by external factors and news.This is actually the strongest argument for the "coincidence" hypothesis, I think. Let's analyze first the most obvious case: the coronavirus pandemic in 2020-22. I think it was obvious that this event caused the crash in March 2020, which looked like a clear anomaly in the chart. But let's look further. In 2019, the price had actually come very close to the 2017 high. If the Covid crash didn't happen, it is quite likely that in early to mid 2020 already a new ATH could have been recorded - perhaps before the halving event. Maybe the top of this cycle could also already happened much earlier, perhaps even still in 2020, or in early 2021. So the second cycle could have already been in reality a 3 or 3.5 year cycle if Covid did not happen. But there's more. The deep 2015 crypto winter was very likely caused by the MtGox insolvency. We have to first realize what MtGox was in this era. MtGox was the only really relevant Bitcoin exchange. Yes, there was Bitstamp, BTC-E and some Chinese exchanges. But they had a very small market share. MtGox was completely dominant. And thus, I guess a large part of the then-Bitcoiners lost money in this insolvency. We could thus assume that the 2014-2015 crypto winter could have been much less deep in "normal conditions" without such a catastrophic event. And that could, again, have caused an early recovery of the price, with perhaps an ATH already in late 2015 or 2016. Or even earlier. We don't know and never will.

Okay, so there are mainly two arguments for the "coincidence hyptothesis". But why could this actually be good news? You could think now that this might be even bad: we couldn't be sure that there's a predictable event like the halvings which is followed by a bull market ... My theory: It could be good news because it means that it's not necessarily a "given" that Bitcoin has to crash as deep as it did in the past. So it's perhaps likely that future bear markets could be shorter and much less pronounced.If people understood that many bear markets were caused by external influences, this would already perhaps reduce the amount of panic in downward phases. I've already mentioned MtGox. But there's more: The 2022 crash could have been much less deep if neither Terra/Luna nor the FTX insolvency happened. And there was also the Ukraine war which brought deep uncertainty into the markets. Even if you don't agree, I think it's a fact that there is no "natural" force that drives Bitcoin prices down 70-80% or more in bear markets. In my opinion it's a combination of these "bad news" events, people panicking, and whales and speculators making profits shorting Bitcoin when they think a panic could occur. Like yesterday. There could be natural phases where the interest in Bitcoin dwindles, but that would probably not justify such deep crashes. BTC could behave more like other assets like big cap stocks, with occasional 20-30% crashes/bear markets but not much more.

What do you think? I'm still undecided, but I think the "coincidence hypothesis" is worthy to be discussed. |

|

|

|

Angeregt von den Bitcoin-ETFs habe ich mir eine Liste von Finanzprodukten zusammengestellt, die an den Börsen der Welt gehandelt werden oder anderweitig "reguliert" sind, und auf Altcoin-Werten basieren. Ich dachte ich mache einen Faden dazu auf, dann kann über diese Produkte diskutiert werden. (letzte Aktualisierung: 30. April 2024 - Ether ETFs in Hongkong eingetragen) Grayscale (USA) Grayscale ist der wohl größte Anbieter von Krypto-Finanzprodukten überhaupt und hat auch zahlreiche Altcoinprodukte im Angebot, darunter auch einige "Exoten". Übersichtsseite: Grayscale Crypto ProductsAltcoin-basierte Produkte: - GBAT - Grayscale Basic Attention Token Trust - BCHG - Grayscale Bitcoin Cash Trust - GLNK - Grayscale Chainlink Trust - MANA - Grayscale Decentraland Trust - ETCG - Grayscale Ethereum Classic Trust - ETHE - Grayscale Ethereum Trust - FILG - Grayscale Filecoin Trust - HZEN - Grayscale Horizen Trust - LTCN - Grayscale Litecoin Trust - GLIV - Grayscale Livepeer Trust - GSOL - Grayscale Solana Trust - GXLM - Grayscale Stellar Lumens Trust - ZCSH - Grayscale Zcash Trust Dazu kommen gebündelte Produkte: - DEFG - Grayscale Decentralized Finance Fund - GDLC - Grayscale Digital Large Cap Fund ETC Group (Deutschland/UK) Übersichtsseite: https://etc-group.com/products/Bei den Produkten dieses Anbieters handelt es sich um ETCs ("exchange traded commodities"), die "100% physically-backed" durch reale Kryptowerte sind. Die Kryptowerte werden von einer unabhängigen Einheit verwahrt, so dass bei Insolvenz die Anleger weiterhin Zugriff auf die Werte behalten. Die Produkte von ETC Group verleihen das Recht, sie jederzeit in "physische" Coins umzuwandeln (Abweichungen kann es bei "Staking"-Produkten geben). Ob es sich aber wirklich um Sondervermögen handelt bezweifle ich, wenn auch die ETC Group behauptet, ihre Struktur sei ähnlich des Jacobi Bitcoin ETF. Vielleicht kennt sich da jemand aus? Auf einzelnen Altcoin-Assets basierend: - ZETH - ETC Group Physical Ethereum - ELTC - ETC Group Physical Litecoin - ESOL - ETC Group Physical Solana - GXRP - ETC Group Physical XRP - RDAN - ETC Group Physical Cardano Weitere Produkte: - DA20 - MSCI Digital Assets Select 20 ETP - ET32 - ETC Group Ethereum Staking ETP dazu noch METR und KOIN, die aber wohl nicht altcoin-basiert sind. Coinshares (Jersey, gehandelt in der Schweiz) Übersichtsseiten: https://coinshares.com/products-serviceshttps://etp.coinshares.com/physicalFür die Coinshares ETPs gilt wohl ähnliches wie für die ETC Group Produkte (100% physical backed, unabhängiger Kryptoverwahrer). Altcoin-basierte Produkte: - Coinshares Physical Staked Ethereum - Coinshares Physical Litecoin - Coinshares Physical Staked Solana - Coinshares Physical Tezos - Coinshares Physical XRP - Coinshares Physical Staked Polkadot - Coinshares Physical Chainlink - Coinshares Physical Uniswap - Coinshares Physical Staked Cardano - Coinshares Physical Staked Algorand - Coinshares Physical Staked MATIC - Coinshares Physical Staked Cosmos Zu erwaḧnen wäre noch der BTF, ein ETF basierend auf Bitcoin- und Ethereum-Futures, der von der Tochtergesellschaft Valkyrie Funds gemanagt wird. 21Shares (Schweiz) Übersichtsseite: https://21shares.com/product21Shares bietet eine sehr große Auswahl von Altcoin ETPs. Es handelt sich hier wohl zwar um physisch gebackte Produkte, aber eher um Zertifikate (ETNs). Zumindest die ETC Group behauptet, die 21Shares Produkte seien weniger transparent. - AARB - 21Shares Arbitrum ETP - AADA - 21Shares Cardano ETP - ABCH - 21Shares Bitcoin Cash ETP - ABNB - 21Shares BNB ETP - AAVE - 21Shares Aave ETP - ADOT - 21Shares Polkadot ETP - AETH - 21Shares Ethereum Staking ETP - AFNT - 21Shares Fantom ETP - ALGO - 21Shares Algorand ETP - AMKR - 21Shares Maker ETP - AOPT - 21Shares Optimism ETP - ASOL - 21Shares Solana Staking ETP - ASTX - 21Shares Stacks Staking ETP - ATIA - 21Shares Celestia ETP - ATOM - 21Shares Cosmos ETP - AUNI - 21Shares Uniswap ETP - AVAX - 21Shares Avalanche ETP - AXML - 21Shares Stellar ETP - AXRP - 21Shares XRP ETP - AXTZ - 21Shares Tezos Staking ETP - ETHC - 21Shares Ethereum Core ETP - LIDO - 21Shares Lido ETP - LINK - 21Shares Chainlink ETP - MANA - 21Shares Decentraland ETP - POLY - 21Shares Polygon ETP - SAND - 21Shares TheSandbox ETP - TONN - 21Shares Toncoin ETP Dazu kommen einige indexbasierte Produkte, siehe diese Liste und diese Liste. Für Ethereum gibt es außerdem ein Short-Produkt. Hashdex (Brasilien) Übersicht: https://hashdex.com/pt-BR/products-overviewHashdex, bekannt auch für einen der ersten Bitcoin-ETFs weltweit, bietet einen "passiven Ethereum-Fonds", einen Ethereum-ETF (ETHE11) und verschiedene index-basierte Produkte an. Coinbase Derivatives (USA) Übersichtsseite: https://www.coinbase.com/es-LA/derivativesCoinbase betreibt eine Börse für Krypto-Derivate (auf denen auch einige andere Derivate, etwa Erdöl, zu finden sind). Diese sind "self-certified", aber afaik ebenfalls "reguliert", da sie der CFTC angezeigt werden müssen und diese dagegen Einspruch erheben kann. Bei den meisten handelt es sich um Futures. Nano Ether scheint ein kleiner gestückelter Ether-Future zu sein (0.10 ETH pro Contract). - Ether Futures - Litecoin Futures - Bitcoin Cash Futures - nano Ether Futures Geplant und der CFTC bereits gemeldet sind außerdem Dogecoin-Futures, die aber (Stand 7. April 2024) noch nicht handelbar sind. Ether ETFs in Hongkong (China) Für Ethereum gibt es seit Ende April 2024 Spot ETFs an der Börse Hongkong. - ChinaAMC Ether ETF - Harvest Ether Spot ETF - Bosera Hashkey Ether ETF WisdomTree (USA) WisdomTree bietet mit WTCFMEGA und WTCFMKT zwei Index-Produkte an, aber keine Produkte basierend auf einzelnen Altcoins.

Wer weitere Produkte (gerne auch auf anderen Märkten) kennt, kann diese gerne posten, ich nehme sie dann in die Liste auf. Auch Diskussionen zu einzelnen Produkten sollen hier möglich sein. |

|

|

|

Im Faden über virginoranges Strategie, um DCA zu verbessern, indem man sich nach dem Langzeittrend richtet, hatte ich die Idee eingebracht ein solches Modell etwas zu verfeinern, indem man versucht auch "externe Einflüsse" auf den Trend zu beachten. Damit sind Ereignisse oder Fakten gemeint, die den Trend beeinflusst haben könnten, ohne mit dem Trend selbst, oder noch besser: den fundamentalen Gründen für den Trend etwas zu tun zu haben. Auf Anregung von @Tubartuluk mache ich dafür einen eigenen Faden auf. Ein Beispiel, um was es geht:Bitcoin hat ja einen bisher positiven Langzeittrend beim Kursverlauf. Man könnte die Hypothese aufstellen, dass der Grund ist, dass immer mehr Menschen Bitcoin benutzen, bei gleichzeitig beschränkter Angebotsmenge. Die genaue Ursache ist aber erst mal egal. Wichtig ist, dass es einen solchen Trend gibt und man über diesen Trend eine Formel aufstellen kann, etwa mit Hilfe einer logarithmischen Regression (" Trolololo-Methode"). Nun kam es 2021 aber zum Corona-Crash, der den Preis aufgrund eines außergewöhnlichen Ereignisses wesentlich tiefer fallen ließ als in vergleichbaren Marktsituationen. Der Corona-Crash könnte den Kursverlauf der folgenden Jahre negativ beeinflusst haben. So hatten viele Bitcoiner erwartet, dass 2021 schon die 100.000 gerissen werden könnten, das Top lag aber "nur" knapp unter 70.000. Stimmt diese Hypothese, dann hätte der Corona-Crash den Langfristtrend nach unten verzerrt, und eine Formel, die diesen Trend darstellen soll, wäre womöglich "zu konservativ".

Könnte man solche "externen" Ereignisse quantifizieren? Man könnte dann eventuell besser verstehen, wie der grundlegende (also z.B. "adoptionsgeleitete") Kursverlauf-Trend aussieht, und kurzfristige Anomalien "herausfiltern". Die Idee sähe so aus: Man stellt sich eine Liste aus möglichen Kategorien von Ereignissen zusammen, die den Trend beeinflussen könnten, aber generell nicht viel mit allgemeinen Gründen für eine Bitcoin-Adoption zu tun haben. Beispiele: - Einschneidende positive/negative Ereignisse für die Weltwirtschaft allgemein (z.B. Corona)

- Entwicklung des Leitzinssatzes

- Bestimmte Nachrichten aus dem Bitcoin- und Krypto-Umfeld, die sich nur regional auswirken (also die allgemeine Adoption nicht beeinträchtigen) aber den Preis beeinflussen können (z.B. China-Mining-Bann, Anerkennung als gesetzliches Zahlungsmittel in El Salvador, Terra/Luna)

Man kann nun bei jedem dieser Ereignis-Typen versuchen, einen Wert zu finden, der den möglichen Einfluss auf den Gesamttrend ausdrückt (z.B. 5% weniger Wachstum im Jahr als durch den "Normaltrend", der durch eine Formel ausgedrückt wird - siehe oben - zu erwarten wäre). Man stellt sich dabei die Frage: Wie könnte der Trend verlaufen sein, wenn dieses Ereignis nicht eingetreten wäre? Wie groß ist demnach der mögliche Einfluss auf den Preis? Ideal wäre es, wenn man dafür ein Software-Tool benutzen könnte, das solche (erst mal rein hypothetische) Werte mit Preisdaten der Vergangenheit kontrastiert. Ein solches Vorgehen hat eine Einschränkung: Ich würde es nie als einziges Tool für die Preisprognose verwenden, denn es sollte unmöglich sein, alle Einflüsse auf den Preis zu ermitteln und quantifizieren. Es gibt auch viele Ambiguitäten, also Ereignisse die zwar einen "externen" Grund haben, aber die Bitcoin-Adoption in der Tat verzögern könnten (z.B. eine lange weltweite Wirtschaftskrise). Solche Ereignisse dann herauszurechnen zu versuchen wäre ein Fehler, da ja der fundamentale Grund für den gedämpften Trend sich real auf Bitcoin auswirkt. Es wäre daher eine reine Ergänzung zu einem Modell, das rein auf dem bisherigen Kursverlauf basiert, wie @virginoranges oben verlinktes Modell. Dennoch sollte es möglich sein, einige wenige einschneidende Ereignisarten vom Langzeittrend zu isolieren. Viel mehr als 1-2 Ereignisse pro Jahr würde ich nicht verwenden. Auch können unterschiedliche Anwender zu anderen Schlüssen kommen, welche Ereignisse wichtig genug sind. Dazu wäre ja dann das Software-Tool da, und jeder Trader basiert seine Entscheidungen ja auf Grund von unabhängigen Informationen. |

|

|

|

After the ATH break, which came unexpectedly before the halving date, people started to talk again about a possible Bitcoin Supercycle. To know what the Bitcoin Supercycle is, you can read this article on Cointelegraph which is surprisingly good. In short: A Bitcoin Supercycle would break the "cyclic" nature of the Bitcoin price evolution we had in the last 11 years (since 2013), where sharp uptrends culminate approximately a year (or a bit more) after each halving and are followed by bear markets which go down more than 70% compared with the previous ATH. In a Supercycle, the price would continue its uptrend, perhaps a bit less steep than before, but we would not see a bear market of let's say more than 30-50%. My take on this theory is that the way people use Bitcoin and invest into it must be change fundamentally until this will happen. But we may already be close, and it is even possible that the next bear market will already be much softer than the previous ones. The current mentality of the Bitcoin community is still one of speculation "riding the waves" or "hoard and sell". Many will say that they're HODLing, but they will sell when they perceive the market has reached a top and will go down, or when there is already a clear downtrend. This is what has to change. Instead, we need: 1) More people HODLing for longer periods than 4 years. I'm aware that not everybody is able to do this, but people with some savings can. And they would help the Supercycle to materialize, and profit in the end. You have to take always into account: if the Supercycle is finally there, and you sold, then you'll very likely regret it. 2) More people using BTC as a currency. This does not mean only for "payments", but also for example for remittances or for crowdfunding businesses (that's why I in generally approve the ICO model, only that of course you have to be wary about scams). This creates additional liquidity, and liquidity is helpful to mitigate crashes because it creates thicker order books. And crashes are what people fear most, and what makes them panic sell, and ultimately drives BTC down. 3) More people buying into the falling knife in bear markets. Even with the current 70-80% bear markets, buying at less than ~33% of the previous top actually always has meant that you will be able to sell for profit in less than a year, and if you have 3 years time to HODL then you have profitted always even if you bought near the top (excluding the 69-73k run). 4) More people DCAing into Bitcoin, and not only while the bull roars. So basically when these four things occur, then the Bitcoin Supercycle is near, according to my personal opinion obviously. All these four items lower the probability for a deep bear market. This is also a self-sustaining pattern: if people see that bear markets aren't that scary anymore, they will HODL for more time and not panic sell. Some people may think that "the ETFs already fixed that". But I'm not so sure about this. The ETFs could create more long term investment (my item 1) and add liquidity (item 2), but the reality is also that the market can become saturated at some point (still not now, of course!) and then at local tops there could be more outflows than inflows due to profit taking. And from this point on, deep bear markets still would be possible. |

|

|

|

Estuve "hojeando" Coindesk hoy, y me encontré con un interesante artículo. Si bien creo que el texto podría ser considerado una publicidad encubierta para Ordinals y otros tokens, nombra algunos aspectos interesantes del halving que se viene. Por ejemplo, que será el halving que menos impacto tendrá en la rentabilidad de la minería, porque las comisiones por transacción ya constituyen una fuente de ingresos importante para los mineros, y por ende sus ingresos no bajarán tanto como en otras ocasiones. Pero la razón por la que abro este hilo es que se espera que haya una ola de especulación por colocar un satoshi en el bloque del halving (840000), porque el protocolo Ordinals permite rastrear y "vender" satoshis "raros" que hayan sido incluidos en bloques específicos. Los satoshis incluidos en el bloque del halving podrían ser considerados "rarezas" para coleccionistas, sobre todo el primero incluido en la lista de transacciones del bloque (ver Rarity en el documento de Ordinals.), el cual podría llegar a valer un millón de dólares. Ahora bien, pensé: ¿quién tendrá probablemente este Satoshi? ¿No es probable que sea un minero, o un pool, que se "asegure" este satoshi tan valioso como ingreso extra? No olvidemos que los mineros tienen el control sobre lo que incluyen en su bloque. Quizá también venderán este espacio a empresas vinculadas al mundo de los NFT ... Por ende me parece que el bloque del halving será valioso principalmente para los mineros. No solamente por este ingreso extra, sino también porque la especulación de los seguidores de Ordinals para colocar, por ejemplo, un NFT en este bloque, podría causar comisiones astronómicamente altas. Creo que en estos días antes del halving, por tales razones, podríamos ver en general un resurgimiento de Ordinals. Quizá sería buena idea tratar de prevenirse y no planear transacciones urgentes para este día ...  |

|

|

|

Abro este hilo para poder discutir un tema que si bien aparece cada rato en los medios, todavía no tengo claro si es factible, al menos a gran escala, pero sería un punto importante para refutar la idea de que "el Bitcoin es dañino para el clima/medio ambiente". En Bitcoincleanup (punto 3) y varios artículos en medios como Forbes a menudo se menciona la posibilidad que los mineros de Bitcoin estabilicen la red, usando los excedentes de electricidad cuando hay mucha generación renovable (solar y eólica) y la demanda no alcanza para absorberla. Para mí esto sería la forma más ecológica de minar (después de usar una instalación solar/eólica propia), ya que se gasta electricidad solamente en tiempos de abundancia. Sin embargo, hay varios problemas con el concepto: - En general se cree que minar es más beneficioso cuanto más tiempo están en operación los mineros. - Los mineros se deprecian por el progreso tecnológico, es decir si los apagamos, sufrimos un coste de oportunidad. - Cuando los ASICs se prenden y apagan más frecuentemente, es más probable que fallen, porque la mayoría de las fallas ocurren durante el proceso de arranque del hardware. Por otro lado el precio mayorista de electricidad en algunos países suele bajar hasta menos de 1 centavo de USD/kilovatio hora cuando hay mucho sol o viento. Hay algunos mercados mayoristas de electricidad dónde hasta se registran períodos con precios negativos. Yo se que hace rato algunos pequeños mineros "caseros" minan con instalaciones solares propias, es decir parece que los puntos detallados arriba no impiden totalmente este concepto. Pero como hay cada vez menos mineros caseros, para que una red se beneficie se debería poder aplicar a gran escala. La pregunta es ahora: ¿Existe esta forma de minería a gran escala o todavía es ciencia ficción? En este hilo se discuten modelos de mineros en EEUU como Riot que si bien minan durante gran parte del año, apagan su hardware en tiempos de excesos de generación eléctrica, recibiendo un descuento bastante generoso en la tarifa. Sin embargo, el estado de Texas, dónde Riot tiene sus instalaciones, tiene aún un 50% de generación eléctrica basada en combustibles fósiles, por lo tanto no se puede hablar realmente de "minería verde" si se usa no solo el excedente sino solamente apagan su hardware en tiempos de extrema escasez. Después están proyectos como el de Aspen Creek que ya se mencionó en este subforo, que cuentan con una granja solar propia. Pero no me queda claro si no "chupan" energía generada de fuentes fósiles cuando su granja solar no produce. La idea de este hilo es, además de discutir la factibilidad del modelo, buscar proyectos que sí existen y presentarlos aquí. Pueden ser los dos tipos de proyectos: - granjas de minería que minan únicamente con energía generada de las fuentes solar y eólica (no hidroeléctrica, biomasa y geotérmica porque esta casi nunca produce "excesos" y por lo tanto siempre termino siendo escasa, puedo elaborar si no se entiende ... Tampoco me refiero a la minería con gas venteado porque esta también produce CO2.) - granjas de minería que minan con energía de red pero solamente prenden sus instalaciones cuando hay un porcentaje muy alto de generación solar o eólica |

|

|

|

The Bitcoin ETF approval by the SEC has marked the sentiment in early 2024 and may be a gamechanger of the whole cryptocurrency market. Taking into account the general view of the SEC about altcoins, at a first glance it seems unlikely that an ETF could be approved for a crypto other than Bitcoin in the short term. There are several Ethereum ETF applications, but there are doubts if the SEC considers ETH a commodity-like asset due to its centralized launch and management. It was always controversial if the SEC considers ETH a security, although they have eventually denied it. Now there are a few altcoins which might qualify as a similar "commodity"-like class of asset than Bitcoin, because they had a "fair" PoW distribution without relevant premine, which was similar to Bitcoin's. The biggest are Dogecoin (DOGE), Litecoin (LTC), Monero (XMR) and maybe Kaspa (KAS) and BCash (BCH). I consider Litecoin the most likely to be approved, for the following reasons: - There is already an ETF-like Litecoin product, the Grayscale Litecoin Trust. - Litecoin is one of the oldest altcoins. - XMR as a privacy coin is generally not looked at well by govermental actors. - KAS is quite new, and its launch was borderline fair (there was some mining on "Gamenet", where the coin was only known in a Discord group, and only some weeks later they really went public). - DOGE is perhaps the other one which could be accepted, but I guess many may consider it as a "joke coin", also the high volatility, dependant on Elon Musk's tweets, may play against it. - BCH? I don't know, the launch was of course identic to Bitcoin's, but the fork could be seen as a consensus break. I'm surprised to not see a thread about this topic here (there are several on Reddit though, like this one, or even one in r/CryptoCurrency). So let's discuss. Do you think a Litecoin ETF has a chance? Are there companies that are applying for a LTC ETF (Grayscale, according to the Reddit thread, seems to have announced interest)? |

|

|

|

En las últimas semanas pareció aparecer un patrón en el comportamiento del precio del Bitcoin: entre la noche del domingo al lunes y el miércoles temprano, parece darse la mayor probabilidad que se presenten movimientos bajistas. En otras palabras: El precio suele bajar entre domingo y martes/miércoles, y a mas tardar el miércoles durante la tarde, el precio muchas veces se recupera. La última ocasión fue justo esta semana, el 22 y 23 de enero, cuando el precio cayó de 41000 a 38500, para luego recuperarse un poco. Pero hubo varios ejemplos anteriores, siendo éstos los más recientes: - El 15 de enero (lunes): 43000 a 41500 - El 2 y 3 de enero (martes y miércoles): 46000 a 41500. En este caso justo el día anterior (un lunes) había subido. - 25 y 26 de diciembre de 2023: 43800 a 41600. - 11 y 12 de diciembre: 43900 a 40100 Obviamente no es algo que ocurre siempre, y algunos de los mayores dips de los últimos meses se dieron en otros días (principalmente, la baja de 49500 a menos de 42000 el 11 y 12 de enero, posterior a la aprobación del ETF, por ende fuertemente ligada a un evento particular). Pero algo podría haber.  Una explicación que dieron en el Wall Observer hace poco para los últimos dos "dips" (15 y 22/23 de enero) fue que los fines de semana, los fondos como Grayscale no realizan compras/ventas, y si deben vender BTC después de una semana que sus productos registran pérdidas, lo hacen generalmente a comienzos de la próxima semana. Como Grayscale registró pérdidas luego de la aprobación de los ETF, esto podría tener un granito de verdad. Otra explicación que recuerdo haber leído hace algunos años es que los fines de semana en muchos países no se realizan transacciones bancarias (al menos las gratuitas). Es decir que en general los fines de semana hay menos ingreso de fiat en los exchanges, lo que puede exagerar movimientos bajistas al terminar el finde, es decir hasta los lunes/martes se registra un mínimo, que puede reducir la cantidad de órdenes de compra. A medida que va avanzando la semana los exchanges nuevamente cuentan con más fiat fresco, hasta que los viernes el monto empieza a bajar nuevamente. La tercera explicación que conozco se da solo en algunas ocasiones y tiene que ver con los mercados de futuros y derivados de BTC: el famoso "CME gap". Las bolsas tradicionales como la CME cierran los fines de semana. Cuando el último precio del viernes es notablemente inferior al precio "spot" del lunes, el precio spot suele tender a "cerrar esta brecha" y bajar a comienzos de la semana. Sobre el tema ocasionalmente se ven memes y chistes en foros y comunidades, pero hay poca información seria. Me interesarían otras explicaciones y razones para este ¿fenómeno?  |

|

|

|

Recently the CBRC-20 token format from the Cybord project was published. It is an improvement of BRC-20, the Ordinals-based token format, which is available on Bitcoin, Litecoin and some other chains like Groestlcoin (GRS). On its website Cybord.org you can find lots of info, from technical data to examples. What is CBRC-20?CBRC-20 tokens work exactly like BRC-20 tokens. They can be minted and transfered with the Ordinals inscription mechanisms, which use a data item in a Taproot transaction. However, they consume less data, and thus the fees that have to be paid are smaller. I have investigated a bit: On a standard inscription you can save about 10-15% of the bytes, and thus of the fees. For example, a BRC-20 mint transaction pair with 400 bytes could be reduced to about 360. How do CBRC-20 transactions save data?BRC-20 transactions store the data in a very inefficient way: as JSON text. This means you have to use bytes for all brackets, colons, commas and other special characters. An example: {

"p": "brc-20",

"op": "mint",

"tick": "TOKX",

"amt": "200"

}

CBRC-20 uses a new field added in newer versions of the Ordinals protocol: the Metaprotocol field. There, the same values are stored in the following way: It is obvious that this consumes much less bytes: 21 instead of 52. But take into account this only makes the "content" part smaller, which in normal BRC-20 transactions had about 50-60 bytes. The rest of the transaction (inputs and any coin-transferring outputs), which are at least 250-300 bytes more, is identic. Personal opinionI still think that CBRC-20 is quite inefficient due to the overhead of ~50-110 bytes for the commitment transaction or output. For all ordinals-based protocols, you need two transactions (or a transaction and an additional output of another transaction). And I think on the Bitcoin chain only the most efficient token mechanisms, which put lots of the data offchain, like RGB and Taproot Assets should be used. However, I would not be against to these tokens used on chains like LTC and GRS, where you can create these tokens almost for free. It has to be noted however that even this format can still be improved, for example using Google's Protobuf format. In CRBC-20 you have to store the colons too as text, while in protobuf, you would use a binary data blob, which would save additional bytes (perhaps 5 to 10 depending on the operation). |

|

|

|

The whole mixer discussion and also the ever-tightening regulations of Bitcoin/cryptocurrency services let me think about if KYC at least could be more friendly. Particularly, if there are practices and methods which don't allow hackers to steal the identity of the service users, or to link different personal data together. Of course in general I strongly prefer non-kyc services ( for well-known reasons - read this excellent thread by 1miau). But in particular for the fiat-Bitcoin on- and offramping step the services are limited, above all in some lesser-known currencies. In reality, not the KYC data collecting itself is the most problematic step, but the verification process, which often involves images and videos of the user and his/her documents. So here I want to collect methods and "best" or "least worst" practices which at least make it more difficult to facilitate identity theft. - Offline verification services. In some countries "old-style" verification methods exist, like Postident in Germany. In these cases you go to a store, show your ID document, and the store employee thus confirms to the service provider that you are the person you impersonate. Sometimes, a copy of your ID document or passport has to be delivered, which makes the whole process a bit more vulnerable if this is stored digitally, but on the whole I think these methods are still preferrable because a black-and-white passport copy has often low resolution and would not be useful for a criminal trying to get an online KYC verification with your data. - Registration without email or phone. While email addresses or phone numbers seem not to matter that much if you have to submit an ID photo, selfie or video, they are elements which could be linked to the rest of your data, making the construction of a fake identity easier. Thus, a registration based, for example, on a public key/private key pair (like on the Nostr network), is a little bit less dangerous. - Selfies with dates and service names on paper (to link the photo/video to the registration date and the service). This is actually quite common, but I guess with the advent of AI imagery tools it is less efficient than it was before. (Edit: There are variants like a Street selfie where even more items are required to be present in the selfie like a sign with the street address, but these seem overly intrusive and carry other dangers, so I don't want to point out them as "good" examples here, even if they might make an identity theft more difficult too). - Transparency - it should be clear who does the KYC verification and who stores the personal data - the service provider itself or a third party, and data about the third party should be provided in the ToS of the service (Providers located in countries where the GDPR or other restrictive data protection laws exist should offer this). Do other such methods exist which still allow an trustable verification making identity theft difficult? Are there examples in the Bitcoin/crypto service world? I could imagine methods based on cryptography, where an image for example can only be considered valid if the user signs it digitally together with a message that links it to a service and date. It would be basically the "digital variant" of the third method mentioned above. But the problem here is that this would have to be an universal standard, because the photo could also be used on another service which requires it. |

|

|

|

I'm currently searching for an advertising network that supports Bitcoin or other cryptocurrencies to pay for the ads. It's not necessary that's a crypto-related service, it can also be a traditional service where I could pay e.g. via some kind of gift cards which can be bought with Bitcoin or altcoins (hasn't to be anonymous, registration with real name/phone number is also ok). Until now the most trustworthy crypto ad service seems to be A-Ads (also called Anonymous Ads, link), which is online since 2013 (afaik) and Trustpilot looks quite good. There is also BuySellAds but that seems to be targeted to bigger customers, while what I'm searching is an Google-Ads-type service for small campaigns. My question is: - Does somebody here have experiences with them as an advertiser? (positive/negative, everything counts  ) - Does it make sense to advertise projects which are not crypto-related there? - What about international (non-English) traffic? I'm mostly interested in Spanish and German. - Are there other trustworthy crypto-accepting ad services? I have of course already googled a bit  There are several lists like this one, which show some alternatives to a-ads with even better impression/traffic statistics. But then I read also this article which strongly recommends against typical crypto ad services like CoinAd. Coinzilla or Bitmedia aren't described that negatively there but seem to be very crypto-focused, while at A-Ads I see also packages for campaigns which are not crypto (nor adult) focused. Adshares could be interesting perhaps, so I'd be interested in opinions about this one too. Edit: I added Bidvertiser to the services which seem interesting (a very traditional ad platform accepting Bitcoin), see the post here. So if somebody has experiences .. |

|

|

|

I would like to build a list of P2P and DEX-style exchanges which offer direct trades between fiat (no stablecoins) and altcoins. This does not include platforms where fiat trades are limited to BTC, and also no CEX platforms. As there seem to be not many options currently, I also integrate P2P platforms with KYC, although of course KYC-less platforms are preferred (Already checked kycnot.me website). If you know another service, post it in this thread, it is much appreciated! WARNING: I don't know all exchanges in this list, please do your own research about trustworthyness. This is for now only a plain link list, not a reviewed/curated list. If you know about one of the listed options being untrustworthy, please post your reasons and I'll investigate - if I find reasons I will remove the service or add a warning, depending on the severeness of the accusations. Also, if you used a service you can write a post about your experiences.

LocalMonero / AgoraDesk- Offered fiat/altcoin pairs: XMR with >20 currencies - Type: Website-based P2P exchange - KYC: No - URL: https://localmonero.co, https://agoradesk.com- Notes: Service both accessible by LocalMonero and AgoraDesk platform. AgoraDesk also offers Bitcoin trades. Has a long tradition and seems to be trustworthy. LitecoinLocal- Offered fiat/altcoin pairs: LTC with several currencies - Type: Website-based P2P exchange - URL: https://www.litecoinlocal.net/- KYC: ?? - Notes/ WARNING: Seems to have very low activity: when checked, the last trade was 4 months ago, also the prices seem completely off. Possibly not maintained properly, which means there's a high vulnerability to all kinds of attacks! LocalCoinSwap- Offered fiat/altcoin pairs: ETH, Tron, stablecoins and ERC-20 tokens to several currencies - Type: Website-based P2P exchange - URL: https://localcoinswap.com- KYC: No (not confirmed) - Note: Bitcointalk thread has low activity. Bitcoin.de- Offered fiat/altcoin pairs: LTC/EUR, ETH/EUR, BCH/EUR, BTG/EUR, DOGE/EUR, XRP/EUR, SOL/EUR, TRX/EUR - Type: Website-based P2P exchange - KYC: Yes - URL: https://bitcoin.de- Notes: Requires SEPA bank account and residence in European Union. Also offers Bitcoin/fiat trades. Has a quite long tradition and seems to be trustworthy, although there were problems with traders which used hacked bank accounts. |

|

|

|

Bitcoin's price seems to be caught in a limbo between bull and bear market. Even if we're still 60% above the November 2022 heights, there is again some fear lurking around. I think thus, it's time to remember why Bitcoin could be a much bigger success than it currently is. Some will know the blog article The Bullish Case for Bitcoin by Vijay Boyapati, which has been transformed into a general introductory book about Bitcoin. I agree with many of the ideas displayed in the article, but I get the impression that the linear "adoption timeline" the author pleads for, needs an update. Basically the author argues that Bitcoin adoption will have four stages: 1. Collectible: A thing some people like to collect, even if its value is still undetermined. 2. Store of value: An asset used to store an abstract "value", for example to invest money in it and get the same or more value/money in the future. 3. Medium of exchange: A currency used to purchase goods and services. 4. Unit of account: A currency which can be used as a base to calculate prices. We've successfully moved away somewhat from Phase 1. But I've got the impression that Bitcoin is currently caught in an intermediate "limbo" with characteristics of the first three stages, but without progress to evolve into the fourth (unit of account) stage. Even more: it seems that people's hopes currently are linked to the store of value concept, and usage as a medium of exchange was already more popular a few years ago. And as a store of value, it's only useful considering very long timespans (>2-3 years) due to harsh volatility. My theory is that the order for Bitcoin's "bullish case" has to be updated. For me the stages are: 1. Collectible 2. Medium of exchange 3. Store of value 4. Unit of account Why? There are basically two reasons. 1) The first one is liquidity and demand. Bitcoin's liquidity is better than 10 years ago, but hasn't made significant progress in the last 2-3 years. This makes its market still vulnerable to panic, FOMO, manipulation and other plagues which lead to its erratic price behavior. If Bitcoin was used more as a medium of exchange, it would have significantly higher liquidity. Because each time you buy and sell something for Bitcoin it's a market operation where you're establishing its value. Even more important: Each time somebody agrees to sell something for Bitcoin, this can be considered a buy offer in the order book. Thus, with more usage as medium of exchange and "boosted" liquidity, Bitcoin's volatility would probably lower, and it would become a safer store of value. Imagine you wouldn't have to fear an 70-85% depreciation in a bear market cycle but only 30% in the worst case. Would you invest more in it than now? People also seem to misunderstand the concept of "scarcity". Scarcity is not equal to "limited supply". Scarcity exists when there is more demand than supply. A limited supply helps, but it does not mean something is really scarce. Many altcoins have a more limited supply than Bitcoin but have dramatically failed. Demand is crucial. If demand is erratic and only depends on FOMO cycles, then no reliable store of value can be achieved. While if there is an explosion of merchants and everyday people accepting Bitcoin, then this means that there's also an explosion of demand. Again: Each of these offers is an offer in an imaginary orderbook where Bitcoin is traded against "real value". Of course if volatility lowers then the bull runs will become less steep too. But that isn't a problem because Bitcoin has anyway the potential for values largely above $100,000. And that leads us to the second issue: 2) Many people forgot why Bitcoin is such a big innovation. It is the first digital value exchange medium which lacks central intermediaries completely and thus has its known advantages like censorship resistance. All previous attempts needed some kind of "bank" controlling the system. This is Bitcoin's USP. Bitcoin can be used by anyone, anywhere (where there is Internet access) and anytime, without the need that someone "allows" you to do so. And this characteristic is most useful for a currency, not so much for a store of value. The internet (and this forum) is full of complaints about banks having closed accounts of people and made your life a pain. Bitcoin fixes this (And no, Ethereum and other centralized coins do not really fix it, as their censorship resistances is much lower). In my opinion, Bitcoin's big advantages all really shine when it's used as a currency. And thus long term success in the future depends if it's used as a medium of exchange or not. Once a path to currency usage becomes clear, Bitcoin will thus become a reliable store of value. Not before - before it will be subject to the same wild swings we've seen in the past years. I would even say: There'll be no $200,000+ ("digital gold") Bitcoin without usage as a currency.(And if you are worried about scalability: There's LN, there's even progress with sidechains, like projects like Stacks or Nomic and rollups show. It's nothing unsolvable.) |

|

|

|

AgoraDesk.com es una plataforma P2P para comprar y vender Bitcoin creada por el equipo detrás de LocalMonero.co. Además de que la plataforma permite ser usada sin JavaScript, AgoraDesk se compromete a preservar la simplicidad y la privacidad, de esta manera en ningún momento requiere verificación KYC/ID y nunca planea de introducirlo. Resumen- Sin verificación KYC/ID, portal Onion, portal I2P.

- Aplicaciones móviles de código abierto para Android & iOS.

- Versión del sitio que no require JavaScript. (carga por defecto cuando es accedida por Tor o I2P).

- Todas las monedas, todas las formas de pago, en cualquier lugar.

- Compraventa en línea y por efectivo de Monero (como LocalMonero).

- Compraventa en línea y en efectivo de Bitcoin (como en los otros sitios Local*).

- Completamente funcional si Google es bloqueada en tu navegador.

- Notificaciones móviles por Telegram (para recibir notificaciones push sobre tus trades).

- 2FA con aplicaciones TOTP como Google Authenticator y andOTP.

- Programa de afiliados - gana una comisión por invitar a usuarios que utilizen la plataforma para tradear.

- Cuentas, reputación y anuncios/trades XMR son compartidos con LocalMonero.

- API completamente funcional, similar a la API de LocalBitcoins, asegurando una migración fácil de tus bots de trading.

- Mecanismos complejos de busca de precio con el uso de fórmulas de precios y premios (premiums), no solamente para compraventas spot sino también para opciones.

Compra Bitcoins de manera anónima

|

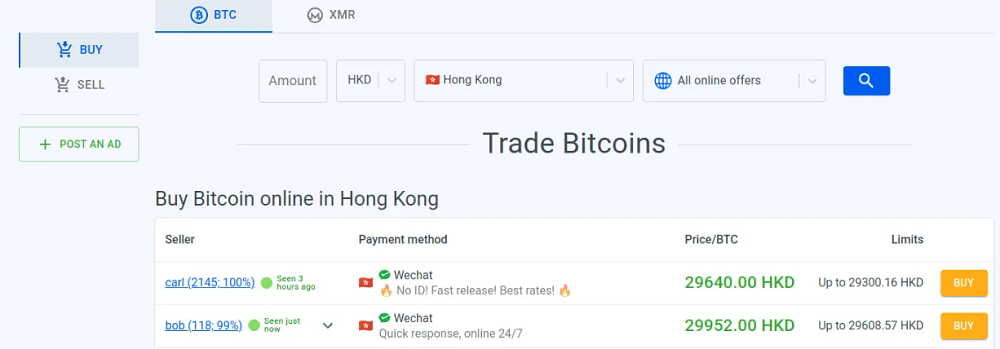

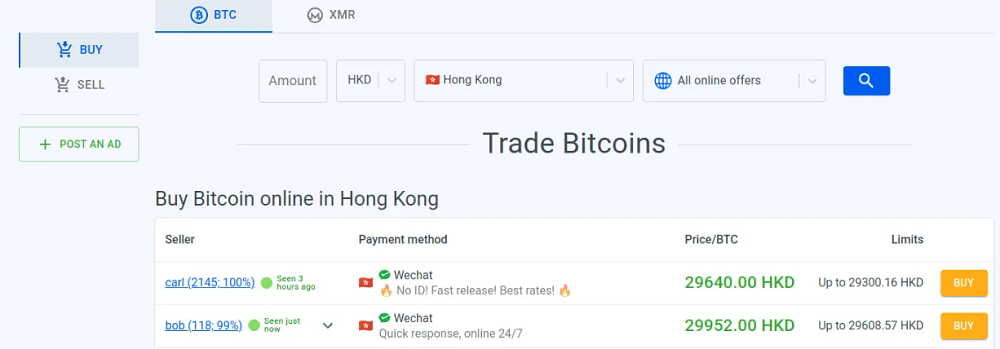

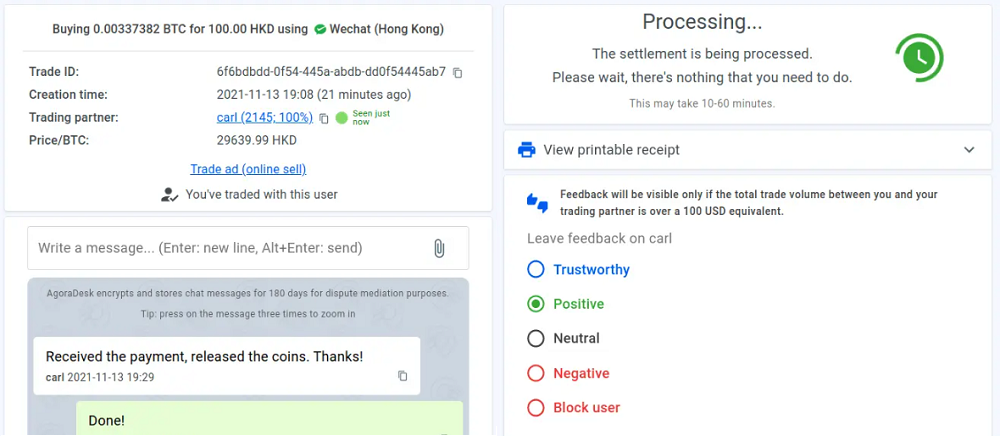

| Paso [1] | Registra una cuenta en AgoraDesk. Ve a la página principal - por defecto verás las ofertas principales para tu región. Puedes refinar tus resultados especificando un monto deseado y cambiando la moneda, el país o el método de pago; selecciona "Todas las ofertas en línea" ("All online offers" si usás el sitio en inglés) si no estás seguro cual es la forma de pago que quieras usar (selecciona un anuncio de un comprador o vendedor con muchos trades y buena reputación)

|

|

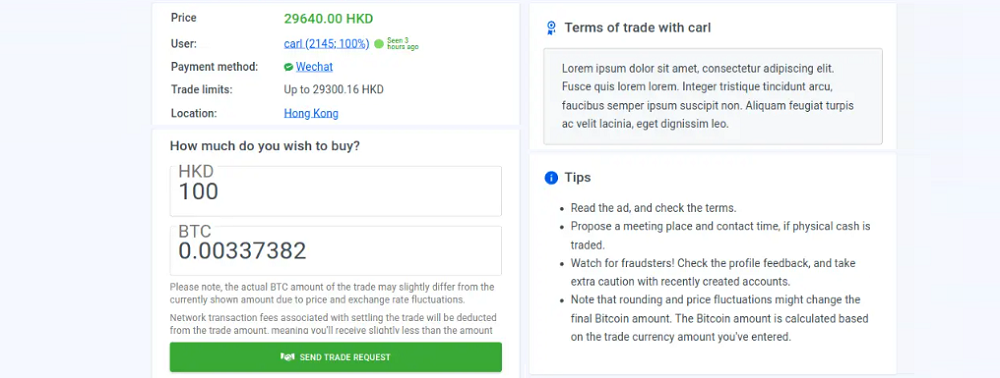

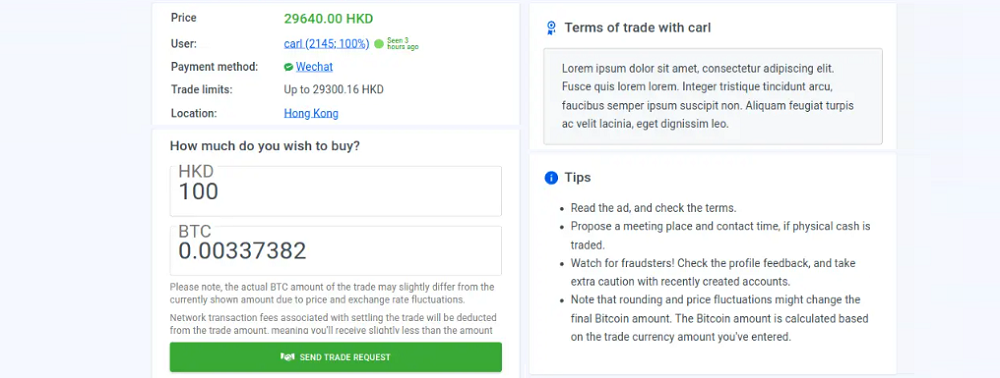

| Paso [2] | Después de apretar el botón "Comprar" ("Buy"), verás más información sobre el anuncio, incluyendo las condiciones de la compra/venta. Para comenzar con el trade, especifica cuantos Bitcoins quieres comprar y haz clic en el botón "Enviar solicitud para comerciar" ("Send trade request"). Nuevamente verás las condiciones del trade, leelas detenidamente una vez más para estar seguro que estás de acuerdo, y luego haz clic en "Acepta las condiciones" ("Accept terms").

|

|

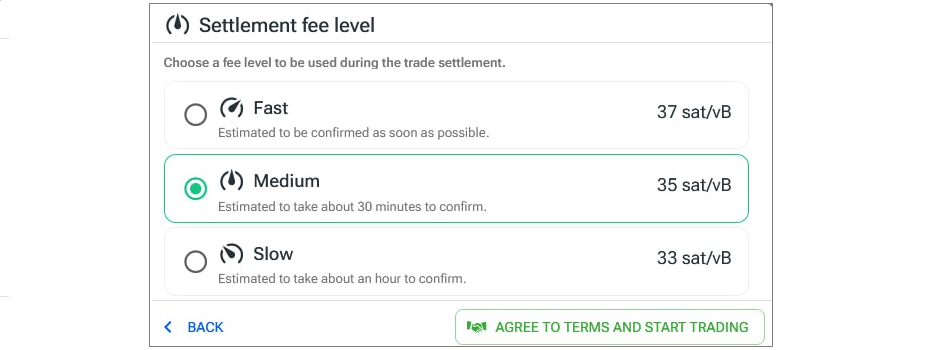

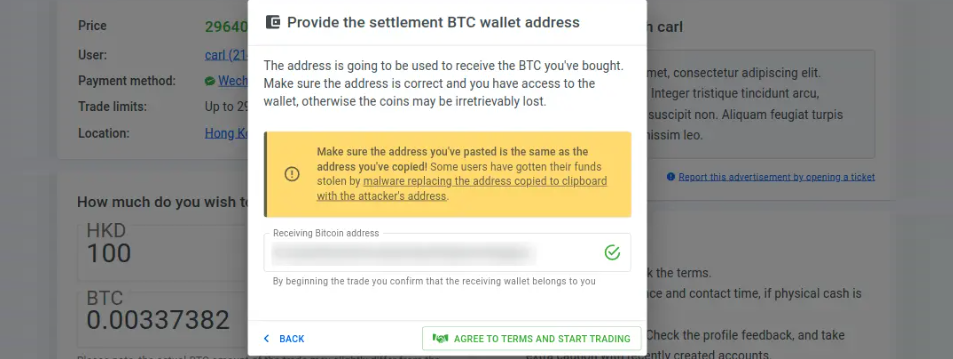

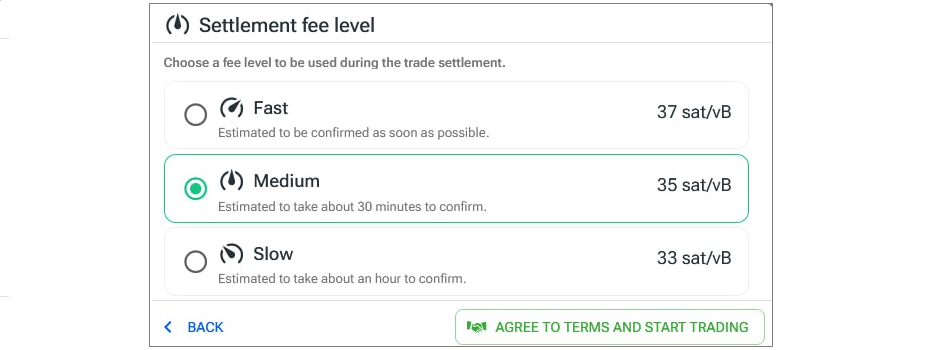

| Paso [3] | En el nuevo menu que aparece podrás seleccionar la comisión que quieres usar para la liquidación de tu transacción (en inglés: "Settlement Fee Level"). Dependiendo de la urgencia que tengas, puedes seleccionar tres niveles de comisión (Fast/rápido, Medium/medio y Slow/lento). La comisión que hayas seleccionado puede ser aún menor en el momento de la transacción si el monto transferido es muy bajo (esta selección es automática). Cuando estés conforme con tu selección, haz clic en "Acepte los términos y comience a operar" ("Agree to terms and start trading").

|

|

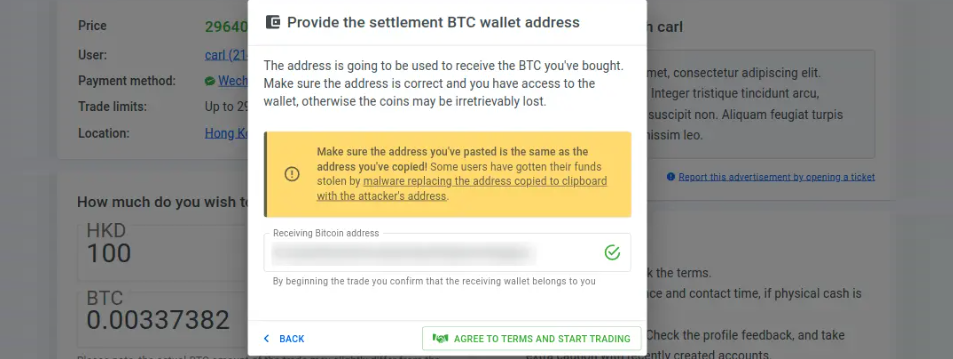

| Paso [4] | Luego se te pedirá que especifiques tu dirección de la cartera para la liquidación (settlement) del trade. Esta es la dirección a la cual los coins que has comprado serán enviados. Si no tienes una cartera personal de BTC, puedes usar la cartera Electrum. Copia tu dirección de la cartera y pégala en el campo para la dirección del monedero (en inglés: Receiving Bitcoin address), Asegurá que la dirección pegada es la misma que la que has copiada, para evitar perder tus coins. Ten en cuenta que la cartera que has usada para la finalización del trade tiene que ser tuya, es decir carteras controladas por terceros no están permitidas. Una vez terminado, haz clic en el botón para comenzar a operar ("Start trading").

|

|

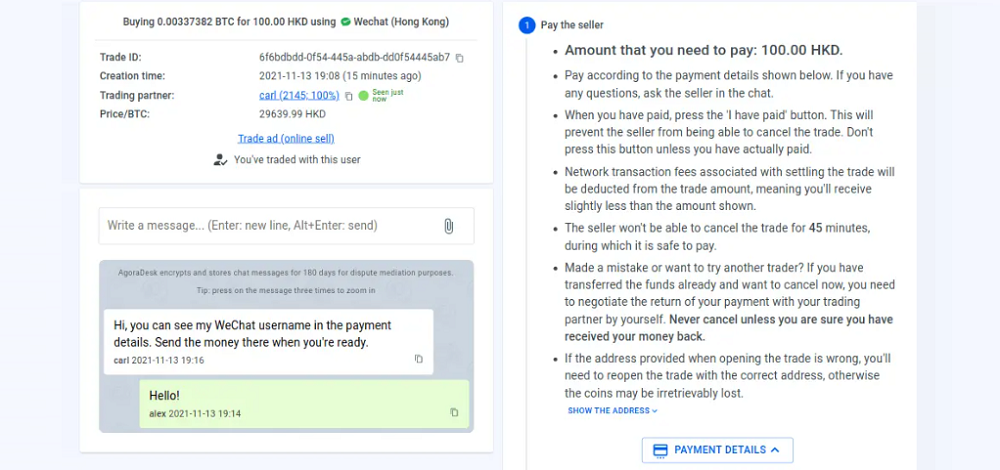

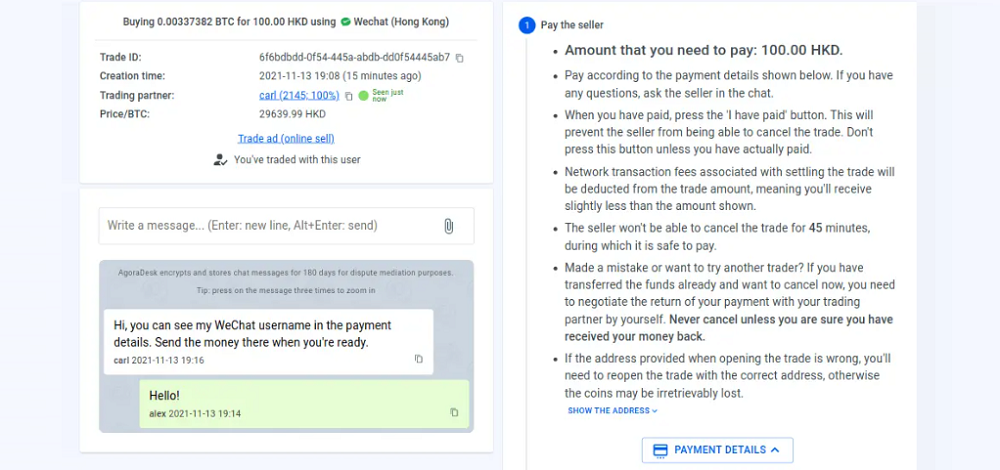

| Paso [5] | Una página sobre el trade será abierta en tu navegador. Comunicate con el vendedor a través del chat del trade para asegurarte que el vendedor esté disponible para recibir tu pago. Realizá el pago de acuerdo a las instrucciones del trader e inmediatamente haz clic en el botón que confirma que hayas pagado ("I have paid"), esto notificará al vendedor que el pago está completo y previene que cancele el trade.

|

|

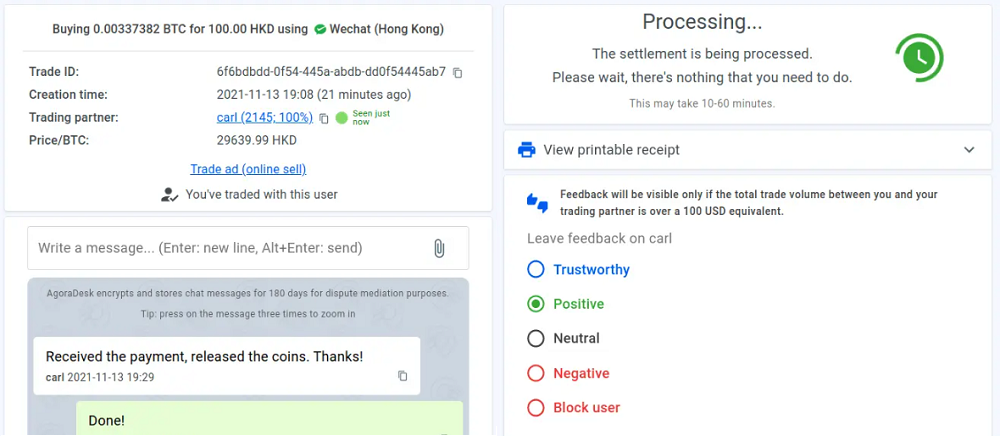

| Paso [6] | Una vez que el vendedor haya confirmado que recibió tu pago, iniciará la liquidación (en inglés: settlement) de la operación. Verás que el estado cambiará a "Processing". En este momento ya no tienes que hacer nada más - los coins serán transferidos automáticamente a la dirección de la cartera que hayas provista para la liquidación. Esto tardará un tiempo (normalmente entre 10 y 60 minutos).

| | | __________________________ | |

Esto es una traducción al castellano del hilo original en inglés de AgoraDesk. No soy representante de AgoraDesk, solo traductor  Me parece que el representante oficial es la cuenta @LocalMonero.

|

|

|

|

Ayer un diario argentino reportó que hay cada vez menos Bitcoins en los exchanges centralizados. Llegamos ahora a un mínimo que no se ve desde el 17 de diciembre del año 2017. Esto también lo confirmó un reporte de Glassnode. Yo me pregunté si eso es una buena o una mala señal (al igual que el artículo, pero basado en otras hipótesis): - Si es debido a la tendencia que muchos se concientizaron sobre los peligros de dejar BTC en los exchanges después de "la debacle de FTX", y por ende los movieron a una cartera autocustodiada (con tus propias claves) es una buena señal. - Si la gente está más segura de que el Bitcoin va a subir, y por ende saca los BTC de los exchanges y empieza a hodlear, también es una buena señal. Esto hará que en un evento de pánico haya menos BTC en condiciones de ser vendidas instantáneamente. - Sin embargo, también hay una interpretación un poco menos favorable: Podría ser que el interés en tradear Bitcoin en los exchanges bajó en general, y que los que sacaron sus Bitcoins de allí son hodlers convencidos y ballenas. En este caso es probable que haya menos ingreso de usuarios nuevos de BTC, y no sería un panorama tan positivo. Basado en estas consideraciones armé una pequeña encuesta: ¿Cambiaron su actitud con respecto a dejar BTC en exchanges centralizados (CEX) después de 2022? ¿Ya antes habían dejado de usar CEX como cartera, o directamente se pasaron a DEX? ¿O siguen en la misma? Obviamente también pueden comentar y postear experiencias, teorías y opiniones. |

|

|

|

I was inspired by the thread about "unavoidable" middle men in the crypto sector, which unfortunately went into a completely different direction, and also a bit by this DEX proposal. Escrow services, like P2P exchanges, have existed since Bitcoin trading exists. And while there have been attempts to create mechanisms to avoid them to eliminate all middle men or human interventions (Bisq's security deposits, to the very recent DEX proposal I detailed above), no one has succeeded when we talk about fiat/BTC exchanges. In the field of crypto-to-crypto exchanges, atomic swaps have conquered a small niche, but I expect it to grow. This is due to them being almost completely trustless, and even the optionality problem (that one of the exchange partners can leave the trade) can be potentially solved. But for fiat/crypto I see currently no way to replace escrow services, even in the long term. With very few exceptions but which are not for everyone, like person-to-person exchanges in "real life", and some exotic methods like trading cryptocurrencies for HDD space (via a crypto platform like Sia), and of course direct BTC-to-goods/services trades. The reason is probably that there is no universally verifiable way to transfer fiat money (other than stablecoins). There seems to be always a way to game the system, and it needs the intervention of an human escrower with a certain expertise to avoid them. Escrowers know that even if some documents are easily faked, there are others which are very difficult for the scammer to provide in a timely manner, and thus if they're required in the right moment provide a high probability to catch a scammer. So, even in a "completely decentralized" Bitcoin setting where people try to avoid centralized exchanges, escrow services and P2P exchanges may be a kind of business which will last forever? Or do you think there will be a technologic revolution eventually that makes them obsolete? What I definitely think is that there could be improvements for P2P trades/escrows. For example, digitally signed bank receipts about transfers could become more popular, and that would make escrowers' work much easier and straightforward. |

|

|

|

Ich dachte, ich mache aus gegebenen Anlass einen Thread auf, in dem unsichere Tools und Apps für den Umgang mit Bitcoin gemeldet werden können.

Die "Techniker" werden es sicher schon mitbekommen haben, aber am 9. August wurde beim populären Kommandozeilen-Tool "Libbitcoin Explorer" in den Versionen ab 3.0, auch unter dem Kürzel bx bekannt, eine schwere Sicherheitslücke veröffentlicht. Es betrifft das Tool bx seed, mit dem Schlüsselpaare und Passphrasen generiert werden können. In den letzten Tagen kam es zu mehreren Diebstählen. Das Problem: Die Entropie des Zufallsgenerators ist mit 32 bit sehr gering, was aber bis vor kurzem niemand gemerkt hat (es gab zu wenige Reviewer bei der Software). Das heißt: Seit 2016 werden mit diesem Tool unsichere Schlüsselpaare generiert. Tragisch: Libbitcoin wird auch im bekannten Buch "Mastering Bitcoin" empfohlen. Wer noch Schlüssel besitzt, die mit diesem Tool generiert wurden, sollte seine BTC schleunigst verschieben (sofern sie noch da sind)! Auch Altcoins können betroffen sein. Mehr Info hier: https://milksad.infoIm englischen Forum gibt es bereits Threads dazu, z.B. hier: https://bitcointalk.org/index.php?topic=5462652.newDas betroffene Tool (nicht mehr nutzen!) https://github.com/libbitcoin(Sollte das Thema schon irgendwo im deutschen Forum existieren - hab nix gefunden - bitte löschen oder anhängen  ) |

|

|

|

This is a bit of a spin-off of this thread where I wrote about why most premined altcoins are likely to fail. But if a premine isn't a good idea (for a real, long-term Bitcoin competitor), how to launch a coin, being able to pay for development and some marketing? I've collected some possible strategies which don't hurt decentralization too much. The following list are methods I would approve, from "simple" to "sophisticated": - 1. Invest in mining and mine strongly at the start, without instamining*. The simplest one. This requires some initial capital if the goal is really to mine a good amount, but it is the fairest launch policy.

- 2. Collect donations before and during the launch.. Also a simple one, which needs no further explanation. The advantage from 1) is that you don't need that much capital, but the disadvantage is that you need good fundraising/communication/PR skills and maybe connections to interested businesses.

- 3. Create a side business, e.g. an exchange, and earn money primarily with this business. This one also needs some capital. But if the coin becomes popular, it ensures a first mover advantage and can be quite profitable.

- 4. Create a token on the new coin's token platform and sell it, for example as an utility token. If you are a developer, you can accept the token for development work, or if you own any business, for the business's products. Utility tokens for existing services have the advantage that for example in Europe they often don't need regulatory approval.

- 5. Don't start a new coin, but mine or buy up a dead coin which was launched fairly. This is a quite simple method if you don't have the fundraising skills and/or mining equipment for method 1. I'm quite sure this method could become popular, so old almost dead fairly launched coins may not be a bad investment. In some cases, such coins were rebranded (Zelcash/Flux, Burst/Signum).

- 6. Voluntary developer fees. As a variant of method 2, you can publish an implementation of the coin where by default a part of the transaction fees or the miner reward goes to a development team. As long as you always can forfeit and not pay the fee without any disadvantage, this is simply a donation, and is thus acceptable for me.

*I define an instamine as "mining before publishing the source code and announce the launch" -- but this is in my opinion equivalent to premining, so I don't recommend it if the goal is really to be able to market a "fair launch". Also I don't like the method of simply forking an old coin like BCH did, because in this case you have modified its consensus with a centralized decision - for me these coins are "contamined" forever, BCH will never be BTC even if it tries hard. Method 1 (mining at the start) has several variants which can increase your possibility to mine with a relatively low difficulty without recurring to a full-fledged instamine: - Beta/Test version launch: You can declare the first version as "experimental", "beta" or "test". For example, you could clarify that the protocol can change during this phase, but the mined coins stay valid. - Announce the launch but don't be too vocal about it. This is approximately what Steem did, and called sometimes "stealth mining". I think it's still an acceptable launch policy. Nobody can force you to make marketing. - Local community launch: Launch the code repo/installation instructions or announce the coin in a language other than English. This was not well looked at in the past, but I consider it acceptable. Why should everybody accept English supremacy? Isn't that Anglocentrism? My personal favorites are methods 3, 4 and 5. These are really open methods, accessible to almost anybody, while 1 and 2 require investments or relatively controversial sub-strategies (the variants below), and 6 is a gamble, because it can be seen as "centralism" if abused. If anybody knows more methods, I'm happy to add them to the list! |

|

|

|

|