|

1

|

Economy / Trading Discussion / Re: The Illusion of Trading Success

|

on: Today at 11:19:46 AM

|

...You ask yourself why don't they stop all these bs and just go back to real trading and you will immediately answer yourself that trading is hard work...

I'll add another reason. Teaching inherently brings a guaranteed profit and can never bring a loss, which is very often faced by traders. In addition, you do not need to hold a large deposit that would allow you to trade. |

|

|

|

|

2

|

Economy / Trading Discussion / Re: Invest To Learning First

|

on: Today at 11:13:13 AM

|

This is what many have failed to understand, yes you can avoid paying tutors or mentorship classes but you canít jump the getting knowledge of a thing part, this days technology provides free access to Learn freely although sometimes I mostly advice getting a little mentorship and then growing on your own. A clear example of those who skip the knowledge are those that pay for signals on trading, and then later after losing money they still head back to getting the knowledge.

One of the problems faced by a beginner who wants to gain knowledge is choosing a mentor. It is at this stage that he can easily lose his money by giving it to scammers who pose as experienced traders offering mentoring. |

|

|

|

|

3

|

Other / Beginners & Help / Re: Risk management is very essential during this post-halving season

|

on: April 29, 2024, 11:33:13 PM

|

We know that Bitcoin halving has just happened and that after the halving there is always high volatility and uncertainty which can affect an investor's strategy..

The cryptocurrency market is inherently highly volatile, regardless of the halving date. You must be prepared for any developments in the market. You should always follow the Risk management strategy, and this should be the most important rule for you. |

|

|

|

|

4

|

Economy / Trading Discussion / Re: Invest To Learning First

|

on: April 29, 2024, 10:26:30 PM

|

|

No matter how banal it may sound, but practice shows that you either spend money on training, or start trading and lose the money that you could have spent on training. But many choose the second option, as it seems to them less expensive.

|

|

|

|

|

5

|

Other / Beginners & Help / Re: Is it advisable for a beginner to invest in a newly launch project?

|

on: April 29, 2024, 04:20:36 PM

|

... first thing you should do is to make a deep research about the project before looking out to make investment...

It will be difficult for a beginner to conduct proper research on the project due to lack of knowledge and experience. Therefore, it is better to refrain from investing in new projects, giving preference to coins that have long proven themselves on the positive side of investors. |

|

|

|

|

6

|

Economy / Trading Discussion / Re: Best Exchanges Nowadays

|

on: April 29, 2024, 03:50:08 PM

|

Binance bought Coinmarketcap since 3 or more years ago. It is better not to fully believe in anything that you saw there. It is better to use Coingecko. Sometimes Binance will not be on number 1 on Coingecko but it is always in number 1 on Coinmarketcap.

Thanks for letting me know that, I really didn't know that and I just checked it and you are right! We'll it's true that there's a difference between the statistics of those two but still it's not bad to use both of it for comparison and cross referencing as both of them are reliable in my opinion. Anyway I am just curious is there any other known cryptocurrency data aggregator than those two? There are a very large number of such ratings, but their quality is much lower compared to the above. But I believe that https://cryptorank.io not only is it not inferior to Coingecko and Coinmarketcap, but in some cases it surpasses them. |

|

|

|

|

7

|

Economy / Trading Discussion / Re: Trading Leverage

|

on: April 29, 2024, 02:43:14 PM

|

I know you gave an example only but in this volatile market, stop loss with 1 - 2 % will be terrible. I know stop loss, stop limit orders are very helpful to minimize loss and avoid serious loss in a market crash but 1 - 2 % should not be used as a limit to exit the market with either Stop loss or Stop limit order.

Yes, indeed, I have given these figures as an example. Nevertheless, these figures are quite real if you open a long position from support and, accordingly, short from resistance. In this case, you will have a very small loss if the price moves in the opposite direction to your expectations. |

|

|

|

|

8

|

Economy / Trading Discussion / Re: TRADERS are not UNEMPLOYED

|

on: April 28, 2024, 11:33:07 PM

|

...However, traders are advised to have a fairly stable side income to support their finances because the market always moves freely and unpredictably...

If you really manage to become a good trader, then you will not need additional income, no matter which way the market is moving, you will always be able to make a profit from it. The only problem is that a very small part of those who decided to make money by trading become good traders. |

|

|

|

|

9

|

Economy / Trading Discussion / Re: If all your wages were paid in USDT, would you accept it?

|

on: April 28, 2024, 11:02:55 PM

|

...Personally, I would accept being paid in USDT, as I have in my past online jobs, and I had many options to trade them for Bitcoin or other coins, or to easily exchange them for fiat(our local currency). The question here concerns the method of payment, not storing all your salary or savings in USDT, which would be a bad choice due to the risks of de pegging of stable coins. But as long as you are being paid in USDT or another stablecoin, you can trade it safely with minimal risks in that period only.

I think that none of the forum participants will have any problems exchanging USDT for any other cryptocurrency or fiat currency. Therefore, our main task is to earn as much as possible, and at the same time we should not care in what currency the salary will be paid. |

|

|

|

|

10

|

Economy / Trading Discussion / Re: Trading Leverage

|

on: April 28, 2024, 10:42:00 PM

|

...For example we take $1,000 and bet on the rising price of bitcoin with a 5x leverage if the price goes up by 10% we make a profit of $500 which is a gain of 50%. However, if the price falls by 10% we make a loss of $500 and lose half of our initial amount. ..

I think that in this case it is necessary to use a stop loss. In this case, you can reduce your losses if the price moves in the opposite direction to your expectations, for example 1-2%. Thus, your loss will not be 500 dollars, but 50-100, depending on the level at which you set the stop loss. |

|

|

|

|

11

|

Economy / Trading Discussion / Re: Do you need help?

|

on: April 27, 2024, 10:30:49 PM

|

...I too have faced all this and was treated for a year and i know exactly how to get rid of it

If you need any help,you can write me in pm...

To provide psychological assistance, you must have professional training, which is obvious that you do not have. Thus, your gratuitous help can bring a person, instead of mental relief, an aggravation of psychological problems. |

|

|

|

|

12

|

Economy / Trading Discussion / Re: I believe crypto prices in general will pop after May 1-2. Here is why.

|

on: April 27, 2024, 10:18:16 PM

|

I believe that crypto prices in general, I'm not thinking of any one specific coin, will pop up somewhat on or after May 1-2...

Have you thought about the fact that prices on the market may also change in either direction as early as April 30, if a decision is made regarding CZ. And which way the market will move will depend on what kind of decision it will be in relation to the founder and former CEO of Binance. |

|

|

|

|

13

|

Economy / Trading Discussion / Re: If all your wages were paid in USDT, would you accept it?

|

on: April 27, 2024, 02:06:21 PM

|

...And I suppose I would not be the only one with that kind of problem, and even if it did not existed, I am sure many people on this forum will never accept to receive stable coins as their main source of income, since we know that those coins can collapse at any given time, and we have witnessed examples of this recently.

I believe that there is no difference in which coins you receive your salary, if this coin can be converted to another currency at any time. And I am sure that if the management of the company where you work really starts paying salaries in stablecoins, then you will not change your place of work, but simply exchange stablecoins for the currency of the country where you live. |

|

|

|

|

14

|

Other / Beginners & Help / Re: Has Anyone Used This Crypto Recovery Service?

|

on: April 27, 2024, 12:32:29 AM

|

...Do you believe what they have to say?

You have to accept the fact that your coins are irretrievably lost. If you continue to look for similar services that promise you to get your money back, then you should be prepared for the fact that your losses will only increase. |

|

|

|

|

15

|

Other / Beginners & Help / Re: After the dip in crypto, when are we expecting ath?

|

on: April 26, 2024, 11:11:09 PM

|

...was told that this year is the best time to invest in crytocurrency due to the bitcoin halving which has taken place. ..

The best time to invest is when the market is at the bottom. This means that you had to buy cryptocurrency at the end of 2022 in order to fix your profit in parts now. It was at that time that Bitcoin reached its minimum price in this cycle and, accordingly, at the same time, altcoins also had a minimum price. But you did not buy then, and now, when the price of many coins has increased several times, you have decided to buy them. |

|

|

|

|

16

|

Economy / Scam Accusations / Re: Crypto scam

|

on: April 26, 2024, 10:26:51 PM

|

...Can anyone advise me on this?

It's too good to be true. I am sure that their main goal is to get access to the 1.5 ETH that they are asking to deposit into your wallet. It is possible that they have already gained access to your wallet when you joined their site and, accordingly, it will not be difficult for them to withdraw these coins to their wallet. |

|

|

|

|

17

|

Economy / Trading Discussion / Re: Trading Leverage

|

on: April 26, 2024, 10:03:10 PM

|

After all, everyone knows that one of the advantages of futures trading is opening short positions, which is impossible to do in the spot market. And since we are dealing with a highly volatile market, then you can choose for yourself the minimum leverage of x1 to open a short position.

With Margin and Futures trading, people can open short position that they can not do with Spot trading. However, with Margin and Futures trading, they will have to face with more manipulation from market whales and exchanges. Centralized exchanges have data on opened positions of their users and they can use available data to manipulate market price to kill long and short positions. At the end, centralized exchanges are winners. People will long or short positions will be liquidated but they can not complain and can not get money back as it is part of the game with Margin and Futures trading. I understand that margin trading is not acceptable for all participants, but I am sure that everyone who lost money using leverage, they all violated risk management. And the fact that you cannot adhere to the risk management strategy is not a reason to refuse to open short positions when the market is in a bearish stage. |

|

|

|

|

18

|

Local / Альтернативные криптовалюты / Re: Coinlist - хайп площадка токенсейлов

|

on: April 25, 2024, 10:33:32 PM

|

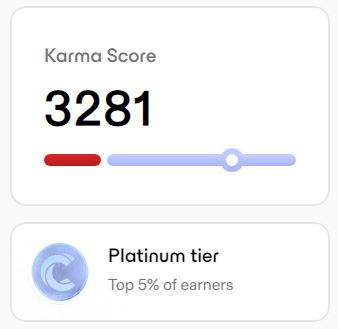

Немного перенервничал от чтения чатиков по поводу новой кармы. Все в общем не так плохо. Всю свою старую карму можно заклеймить тут: https://coinlist.co/karma Я все удачно заклеймил, все очки кармы остались на месте. Сколько было, столько и получил. Но клейм будет доступен только до 15 мая этого года. Ваша старая карма сгорит, если ее не заклеймить. У меня ранее было 2750 кармы, после последних изменения размер кармы увеличился до 3281. Собственно никаких существенных изменений не произошло: у кого ранее было достаточно кармы для получения приоритетки, те и сейчас смогут регулярно получать аллокацию.  |

|

|

|

|

19

|

Economy / Trading Discussion / Re: Trading Leverage

|

on: April 25, 2024, 10:08:15 PM

|

...However, this factor does not apply to Bitcoin or crypto in general, where the daily fluctuations are already so enormous that trading without leverage is already worthwhile with small positions ... or not.

You shouldn't be so categorical) After all, everyone knows that one of the advantages of futures trading is opening short positions, which is impossible to do in the spot market. And since we are dealing with a highly volatile market, then you can choose for yourself the minimum leverage of x1 to open a short position. |

|

|

|

|

20

|

Economy / Trading Discussion / Re: A trader lost over $1 Million + on Binance Future trading

|

on: April 25, 2024, 09:38:20 PM

|

...If you read through this page, there were some news that Coinbase is going to list pepe but then it was rumors then and he decide to play the game by opening long position to close on the news but the market moves the other way and he got liquidated by 100% which is abnormal and then he went and cried on Twitter how he had nothing to start from and Binance help him to rectify the issue by reducing the liquidation to 85% and he got back the rest of PNL on his wallet... If a trader does not adhere to risk management, then his position will be liquidated sooner or later. And I cannot sympathize with such traders who are to blame for the loss of money themselves. But it surprises me that Binance has reduced the liquidation percentage to 85%. It turns out that now every trader who has received liquidation can ask for a Binance to reduce the liquidation percentage. |

|

|

|

|