Show Posts Show Posts

|

|

Pages: [1] 2 »

|

|

2

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: December 12, 2020, 11:28:32 PM

|

It seems that discussions are underway with Bittrex for a new listing (relisting) according to a private message discussion with my friend and lasvegas83 (main leader of the Cloak project) which states:

"Bittrex approved a relisting and we are currently negotiating the price".

@Kingoamn Maybe you'll get from bottom to top again? (I wish you this)

I remember Binance ejected Cloak in 7 days without any real justification,

listing Binance: https://www.binance.com/en/support/articles/360002826891-Binance%E4%B8%8A%E5%B8%82CloakCoin-CLOAK-

delisting: https://www.binance.com/en/support/articles/360023570292-binance-will-delist-cloak-mod-salt-sub-and-wings

Everything was published on Cloak's blog, Binance is like that apparently. The crypto Asian projects are more popular with Binance. Binance need volume and users... Just like Bittrex and others exchange because on the tax they do their business.

https://www.cloakcoin.com/en/blog/binance_delist

Yogibear hasn't left, he indicated, (like others) on the rocket chat at https://chat.cloakcoin.com/ that he's taking a step back because he's dedicating himself full time to his personal projects and that Cloak doesn't currently allow him to pay his bills, to know that he experienced like many here Cloak at +$5 (same for me, after the takeover by the new team in summer 2018) before being untied in coordination by Binance, Litebit, Bittrex in less than a few days= delisting result = create unprecedented panic sell (as often happens when a big delist platforms). This had the effect of slow down drastically everything over time. After this exclusion it seems that Cloak is still moving forward but at a very slow speed.

That said, Cloak is still functional, secure and reliable, and still uncracked! Cloak remains has an unique technology crypto multy solutions and when the last block is extracted many of us will have died of old age!

Maybe there will be updates in the official blog but I can't speak for the Cloak team. Personally, I'm not wondering what Cloak can do for me, but what can I do for Cloak at my level?

|

|

|

|

|

3

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: October 13, 2020, 01:05:58 PM

|

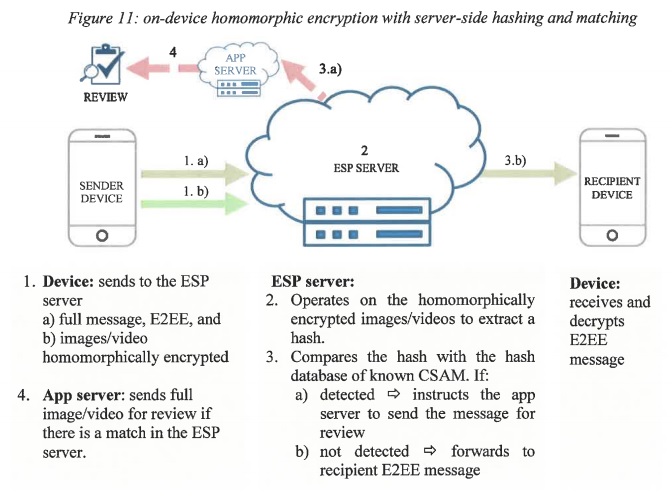

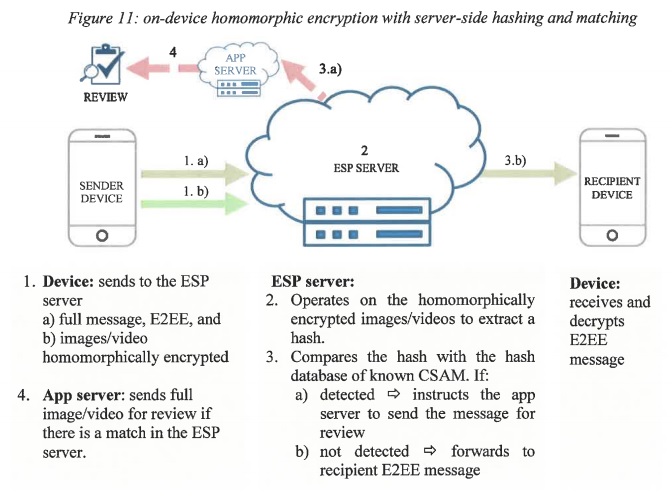

Source from: https://journalducoin.com/actualites/vie-privee-compte-pas-five-eyes-attaquer-chiffrement/Privacy, we don't know - Intelligence agencies and governments are looking for solutions to access the encrypted communications of the population. In their sights are the tech companies that produce end-to-end encryption tools. The Five Eyes call for the end of end-to-end encryption FVEY (Five Eyes) is the alliance of the intelligence services of the United States, the United Kingdom, Canada, Australia and New Zealand. This supranational alliance calls on technology companies to cooperate with governments. FVEY expects these firms to provide access to the encrypted content being exchanged on their platforms. Five EyesThe international declaration, dated Sunday 11 October, is also signed by government representatives from India and Japan. "Particular implementations of encryption technologies pose significant challenges to public security, including highly vulnerable members of our societies, such as sexually exploited children. We urge the industry to address our concerns when encryption is used in a way that completely excludes legal access to content. » The "reasonable and technically feasible" solutions proposed in this statement are as follows: Firstly, companies must design communication systems that enable them to act effectively against illegal content and activities. These systems should facilitate investigation and prosecution, while protecting vulnerable persons; Second, law enforcement authorities should be able to access the content of these systems, in a readable and usable format (subject to legally issued authorisation); Finally, technology companies should engage in consultations with governments to design such systems. In concrete terms, this means setting up backdoors. These secret breaches in the encryption functions would allow the authorities to access the content of exchanges. The European Union has the same desire The EU also wants to put an end to end-to-end encryption. It wants to combat child exploitation and paedophile crime. On 9 June, the European commission and the parliament's intergroup on the rights of the child hosted a webinar on the subject. Ylva Johansson, EU Commissioner for Home Affairs, called for "technical solutions" to the "encryption problem". The Politico website leaked the document describing these solutions. Paradoxically, the idea is to access encrypted data ... while keeping the benefits of encryption. Client-side scanning is considered particularly effective. This technique is used before the data is encrypted. The application scans their content in real time, on the user's device, and compares it with a "black list". First of all, the app hacks the user's data (unencrypted) before sending. Then the hashes are compared with the black list. This database includes hashes of data deemed illegal (e.g. child pornography images). If there is a match, the content of the message is deemed illegal and the application will not encrypt it. Homomorphic server-side encryption  A long-lasting war... everywhere The Chinese government has chosen this approach to combat the use of WeChat. Of course, it is the death knell for end-to-end encryption. End-to-end encryption means that only the sender and recipient of a message can access its content. By design, this technique does not allow the contents of the blacklist to be known. Indeed, the hash functions are one-way. As a result, only the holders of the illegal data can know whether the blacklisted hashes are limited to paedo-criminal content. The American agencies have been leading the fight against end-to-end encryption for several years. Now they can count on allied governments and European authorities. Of course, the fight against paedo-crime is more than commendable. However, tackling end-to-end encryption is a lost cause in the fight against this scourge. Criminals will only have to go through open source applications, not those of the big companies that will set up these surveillance systems.Cloak is a secure alternative that provides a concrete solution to the undesirable surveillance of your financial activities. |

|

|

|

|

4

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: September 17, 2020, 01:56:47 PM

|

Source https://www.perkinscoie.com/en/news-insights/anti-money-laundering-regulation-of-privacy-enabling-cryptocurrencies.htmlThis is an astonishing report in favor of so-called "anonymous" cryptomoney that has just come out. Contrary to what one might have thought, these would pose even less of a risk of money laundering than other cryptomoney schemes. Explanations. Anonymous cryptos can be compatible with regulations The law firm Perkins Coie provides an astonishing answer to the following question: "Is it possible for regulated entities to comply with anti-money laundering (AML) obligations when accepting anonymous cryptography? » "Amazing", because the experts' answer is a resounding yes! In a report published on September 15, Perkins Coie's lawyers have put several of these anonymous transaction cryptosystems under the microscope of regulatory compliance. Thus, 4 cryptos were put on the grill, as well as a method of anonymization: the unavoidable Monero (XMR), unfortunately very popular with hackers who love ransomwares; Grin (GRIN), based on the MimbleWimble protocol; Zcash (ZEC) and its optional shield transactions; Dash (DASH), a Bitcoin clone with anonymization options through its private send transactions; the CoinJoin method, which consists of mixing (or "mixing") Bitcoin transactions (BTC). Is Bitcoin more to be monitored than anonymous cryptos? "Anonymous cryptos have an inherent lower anti-money laundering risk than other cryptos when considering evidence of illicit use in practice. » Apart from their ability to protect the financial privacy of individuals and businesses, anonymous cryptos did not present any real problems in the regulatory framework defining Virtual Asset Service Providers (or VASPs). Lawyers cite regulations such as those of the New York Department of Financial Services (NYDFS), the Financial Services Agency (FSA) in Japan, the Financial Conduct Authority (FCA) in the United Kingdom, and the Financial Action Task Force (FATF) internationally. All would be compatible with anonymous cryptoactives. Indeed, the level of customer identification (KYC) of regulated VASPs would mean that anonymous transactions between individuals or businesses would not be a problem if they subsequently pass through these platforms. This type of cryptos would therefore not require further regulation, which would be deemed "too burdensome" by these lawyers. Indeed, they believe that the current regulations are a sufficient compromise between the prevention of money laundering and the development of innovative technologies, which are beneficial for the protection of privacy. It is therefore a real and argued plea in favor of anonymous cryptos that the lawyers of Perkins Coie have led here. But whether this will be enough to calm the regulatory fever of government authorities remains unfortunately very uncertain. The time will come when anonymous crypto will come back in force like Cloak coin, it is cyclical as in the whole crypto sphere sector. In addition Cloak coin has several added values that make it unique, cloakshield, enigma, mixing, everything is included to allow secure transactions from end to end and completely confidential. These are facts! Cloak coin has never been hacked unlike many other crypto currency mentioned above. It's a question of publicity finally, to be known and adopted it is necessary to be recognized. Cloak has everything to stand out. |

|

|

|

|

5

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: September 08, 2020, 08:47:47 PM

|

i m in cloak in and out from the real begining  maybe i wil come back dont know  The choice is yours it has always been  however, i can afford to share a piece of reflexion writing with you and the Cloak crypto community which i hope... will reason with you: To understand why the blockchain is important, look beyond the wild speculation about what is built underneath.

The Internet bubble of the 1990s is generally regarded as a period of mad excess that ended in the destruction of hundreds of billions of dollars of wealth. What is less often discussed is how all the cheap capital of the boom years was used to finance the infrastructure on which the most important Internet innovations would be built after the bubble burst. It financed the roll-out of fibre optic cable, R&D on 3G networks and the construction of giant server farms. All this would make possible the technologies that are now the foundation of the world's most powerful companies: algorithmic research, social media, mobile computing, cloud services, analysis of large data sets, artificial intelligence, and so on.

We believe that something similar is happening behind the wild volatility and hype in the stratosphere of the crypto-money and blockbuster boom. Blockchain sceptics have grumbled with joy as cryptographic prices have plummeted from last year's dizzying highs, but they are making the same mistake as the crypto fanatics they mock: they associate price with intrinsic value. We can't yet predict what cutting-edge industries based on blockchain technology will look like, but we are confident that they will exist, because technology itself is about creating an invaluable asset: trust.

To understand why, we have to go back to the 14th century.

That's when Italian merchants and bankers began to use the double-entry method of accounting. This method, made possible by the adoption of Arabic numerals, provided merchants with a more reliable record-keeping tool and enabled bankers to assume a new and powerful role as an intermediary in the international payment system. Yet it is not only the tool itself that has paved the way for modern finance. It was how it was inserted into the culture of the day.

In 1494, Luca Pacioli, a Franciscan and mathematician, codified his practices by publishing a textbook on mathematics and accounting which presented double-entry accounting not only as a means of keeping track of accounts, but also as a moral obligation. In Pacioli's manner, for everything that merchants or bankers had of value, they had to give something back. Hence the use of offsetting entries to record separate balancing values: a debit coupled with a credit, an asset with a liability.

Pacioli's morally honest accounting granted a form of religious blessing to these previously decried professions. Over the following centuries, clean books were considered a sign of honesty and piety, enabling bankers to become payment intermediaries and speed up the circulation of money. This financed the Renaissance and paved the way for the capitalist explosion that was to change the world.

Yet the system was not immune to fraud. Bankers and other financial actors often failed in their moral duty to keep honest accounts, and they still do: just ask Bernie Madoff's clients or Enron's shareholders. Moreover, even honesty comes at a price. We have enabled centralised trust managers such as banks, stock exchanges and other financial intermediaries to become indispensable, turning them from intermediaries into gatekeepers. They charge fees and restrict access, create friction, limit innovation and reinforce their market dominance.

So the real promise of blockchain technology is not to make you a billionaire overnight or to give you the means to protect your financial activities from inquisitive governments. It could significantly reduce the cost of trust through a radical, decentralized accounting approach - and, by extension, create a new way of structuring economic organizations.

The need for trust and intermediaries allows giants such as Google, Facebook and Amazon to turn economies of scale and network effects into de facto monopolies.

A new form of accounting might seem like a boring accomplishment. Yet for thousands of years, since Hammurabi's Babylon, ledgers have been the foundation of civilization. Indeed, the exchange of values on which society is based forces us to trust each other's claims to what we own, what we have and what we owe. To build this trust, we need a common system for tracking our transactions, a system that gives definition and order to society itself. How else would we know that Jeff Bezos is the richest human being in the world, that Argentina's GDP is $620 billion, that 71% of the world's population lives on less than $10 a day, or that Apple shares trade at a multiple of the company's earnings per share?

A blockchain (although the term is vaguely used and often misapplied to things that are not really blockchains) is an electronic ledger, a list of transactions. These transactions can in principle represent almost anything. They could be real exchanges of money, as in the case of block chains underlying crypto-currencies such as Bitcoin. They could mark exchanges of other assets, such as digital share certificates. They may represent instructions, such as orders to buy or sell shares. They could include smart contracts, which are computerized instructions to do something (for example, buy a stock) if something is true (the price of the stock has fallen below $10).

A blockchain is a special type of ledger, in that instead of being managed by a single centralised institution, such as a bank or government agency, it is stored in multiple copies on several independent computers within a decentralised network. No single entity controls the ledger. All computers on the network can make changes to the ledger, but only by following the rules dictated by a "consensus protocol," a mathematical algorithm that requires the majority of the other computers on the network to agree to the change.

Once the consensus generated by this algorithm has been reached, all computers on the network update their copies of the ledger simultaneously. If one computer attempts to add an entry to the ledger without this consensus, or to modify an entry retroactively, the rest of the network automatically rejects the entry as invalid.

Typically, transactions are grouped into blocks of a certain size that are chained (hence "blockchained") by cryptographic locks, themselves a product of the consensus algorithm. This produces an immutable and shared record of the "truth", a record which, if properly prepared, cannot be altered.

Within this general framework, there are many variations. There are different types of consensus protocols, for example, and often disagreement on the safest type. There are public "no-permission" registries, to which anyone can, in principle, attach a computer and be part of the network; this is what Bitcoin and most other crypto-currencies belong to. There are also "authorised" private ledger systems which do not incorporate any digital currency. These can be used by a group of organisations that need a common record-keeping system, but are independent of each other and may not have complete confidence in themselves - a manufacturer and its suppliers, for example.

The common denominator is that it is mathematical rules and impenetrable cryptography, rather than trust in fallible humans or institutions, that ensure the integrity of the record. It is a version of what cryptographer Ian Grigg has described as "three-way bookkeeping": one entry on the debit side, another for credit and a third in an unchanging, undisputed shared ledger.

The advantages of this decentralised model become apparent when comparing the cost of trust in the current economic system. Consider this: In 2007, Lehman Brothers recorded record profits and revenues, all approved by its auditor, Ernst & Young. Nine months later, a fall in those same assets led the 158-year-old company to bankruptcy and triggered the biggest financial crisis in the last 80 years. Clearly, the valuations quoted in the books of previous years were very bad. And we learned later that Lehman's ledger was not the only one with questionable data. American and European banks have paid hundreds of billions of dollars in fines and settlements to cover losses caused by inflated balance sheets. This was a stark reminder of the high price we often pay for trusting numbers designed in-house by centralised entities.

The crisis was an extreme example of the cost of trust. But we also see that this cost is rooted in most other sectors of the economy. Think of all the accountants whose firms fill the world's skyscrapers. Their work, reconciling their firm's books with those of their professional counterparts, exists because neither party trusts the other's track record. It's a long, expensive, but necessary process.

The other manifestations of the cost of trust are felt not in what we do, but in what we cannot do. Two billion people are being denied bank accounts, keeping them out of the global economy because banks do not trust records of their assets and identities. Meanwhile, the Internet of Things, which it is hoped will contain billions of autonomous, efficiency-enhancing interacting devices, will not be possible if gadget-to-gadget microtransactions require the prohibitively expensive intermediation of centrally controlled ledgers. There are many other examples of how this problem limits innovation.

Economists rarely recognize or analyze these costs, perhaps because practices such as reconciliation of accounts are assumed to be an integral and inevitable feature of business (much as pre-Internet firms assumed that they had no choice but to pay large postal expenses at the post office. monthly bills). Could this blind spot explain why some influential economists have no hesitation in rejecting blockchain technology? Many say they cannot see the justification for its costs. Yet their analyses generally do not compare these costs with the social cost of trust that the new models seek to overcome.

However, more and more people understand this. Since Bitcoin's quiet publication in January 2009, its supporters have expanded considerably to include former Wall Street professionals, former Wall Street professionals, technology specialists from Silicon Valley, and development and aid experts from organisations such as the World Bank. Many see the rise of technology as a vital new phase in the Internet economy, one that is even more transformative than the first. While the first wave of online disruption saw brick and mortar companies being displaced by leaner digital intermediaries, this movement is challenging the very idea of for-profit intermediaries.

The need for trust, its cost and dependence on intermediaries is one of the reasons why giants such as Google, Facebook and Amazon are turning economies of scale and the benefits of network effects into de facto monopolies. These giants are, in fact, centralized ledger keepers, building vast registers of "transactions" in what is arguably the world's most important "currency": our digital data. By controlling these records, they control us.

The potential promise of overturning this entrenched, centralised system is an important factor behind the scene of the gold rush in the crypto-token market, with its rising but also volatile prices. There is no doubt that many investors, perhaps most of them, simply hope to get rich quickly and have little concern about the importance of the technology. But quirks like this one, however irrational they may be, don't appear out of nowhere. As with the advent of the transformative platform technologies of the past - railways, for example, or electricity - unbridled speculation is almost inevitable. Indeed, when a big new idea comes along, investors have no framework for estimating the value it will create or destroy, or for deciding which companies will win or lose.

Although major obstacles remain to be overcome before block chains can deliver on the promise of a more robust system for recording and storing objective truth, these concepts have already been tested in the field.

Open and freely accessible source code is the foundation of the future decentralised economy.

Companies such as IBM and Foxconn are exploiting the idea of immutability in projects that seek to unlock trade finance and make supply chains more transparent. Such transparency could also give consumers better information about the sources of what they are buying - if a t-shirt was made with workshop labour, for example.

Another important new idea is that of a digital asset. Before Bitcoin, no one could own a digital asset. Because copying digital content is easy to do and difficult to stop, suppliers of digital products such as MP3 audio files or e-books never give customers ownership of the content, but rent it out and define what users can do with it in a licence. This can lead to serious legal penalties if the licence is broken. That's why you can lend your Amazon Kindle book to a friend for 14 days, but you can't sell or give it away as a gift, like a paper book.

Bitcoin has shown that something of value can be both digital and unique. Since no one can change the register and "double the spending", nor duplicate a Bitcoin, it can be designed as a "thing" or a unique asset. This means that we can now represent any form of value, such as a title deed or a music track, as an entry in a blockchain transaction. And by digitising different forms of value in this way, we can introduce software to manage the economy around them.

As software elements, these new digital resources can be assigned certain "If X, then Y" properties. In other words, money can become programmable . For example, you can pay to rent an electric vehicle with digital tokens that are also used to activate or deactivate its engine, thus fulfilling the coded conditions of an intelligent contract . This is quite different from analogue tokens such as banknotes or metal coins, which are agnostic as to their use.

What makes these programmable money contracts "smart" is not that they are automated; we already have that when our bank follows our programmed instructions to automatically pay our credit card bill each month. It's that the computers running the contract are monitored by a decentralised blockchain network. This ensures that all signatories to an intelligent contract will be executed fairly.

With this technology, the computers of a shipper and an exporter, for example, could automate a transfer of ownership of goods once the decentralised software they both use sends a signal that a payment in digital currency - or a cryptographically unbreakable payment undertaking - has been made. Neither party necessarily trusts the other, but they can nevertheless carry out this automatic transfer without involving a third party. In this way, intelligent contracts take automation to a new level, enabling a much more open and comprehensive set of relationships.

Programmable money and smart contracts are a powerful way for communities to govern themselves in pursuit of common goals. They even offer a potential breakthrough in the "tragedy of communes", the long-standing idea that people cannot simultaneously serve their personal interest and the common good. This was evident in many of the blockbuster proposals of the 100 software engineers who took part in Hack4Climate at last year's UN climate change conference in Bonn. The winning team, with a project called GainForest, is developing a blockchain-based system that allows donors to reward vulnerable tropical forest communities for their demonstrable actions to restore the environment.

Yet this utopian, frictionless "symbolic economy" is far from reality. Regulators in China, South Korea and the United States have severely cracked down on token issuers and traders, viewing them as speculative schemes to make quick bucks that avoid securities laws rather than changing new business models. They are not entirely wrong: some developers have pre-sold tokens in "initial coin offerings" or ICOs, but have not used the money to build and market products. Public or "no-permission" blockchains such as Bitcoin and Ethereum, which offer the best promise of absolute openness and immutability, are facing growth difficulties. Bitcoin still cannot process more than seven transactions per second and transaction fees can sometimes rise, making it expensive to use.

In the meantime, centralised institutions that should be vulnerable to disruption, such as banks, are getting involved. They are protected by existing regulations, which are ostensibly imposed to keep them honest, but inadvertently constitute a compliance cost for start-ups. These regulations, such as the burdensome reporting and capital requirements imposed by the New York State Department of Financial Services' "BitLicense" on crypto-money transfer start-ups, become barriers to entry that protect incumbent operators.

But here's the thing: the open-source nature of the blockchain technology, its enthusiasm and the increasing value of the underlying tokens have encouraged a global pool of intelligent, passionate and financially motivated computer scientists to work to overcome these limitations. It is reasonable to assume that they will constantly improve the technology. As we have seen with Internet software, such open and extensible protocols can become powerful platforms for innovation. Block chain technology is evolving far too rapidly for us to assume that later versions will not be improved on the present, whether in Bitcoin's encryption-based protocol, Ethereum's smart contract-oriented block chain, or a as yet undiscovered platform.

The cryptographic bubble, like the Internet bubble, creates the infrastructure to build the technologies of the future. But there is also a key difference. This time, the funds raised are not used to subscribe to a physical infrastructure, but to a social infrastructure. It creates incentives to form global networks of collaborating developers, beehive minds whose interactive and iterative ideas are codified in lines of open-source software. This freely accessible code will enable the execution of countless ideas that are still unimaginable. It is the foundation on which the decentralised economy of the future will rest.

While few people in the mid-1990s were able to predict the emergence of Google, Facebook and Uber, we cannot predict which blockchain-based applications will emerge from the wreckage of this bubble to dominate the decentralised future. But that's what you get with scalable platforms. From the open protocols of the Internet to the essential components of algorithmic consensus and distributed record keeping in the blockchain, their power lies in creating an entirely new paradigm for innovators ready to imagine and deploy world-changing applications. In this case, these applications - in whatever form they take - will be aimed squarely at disrupting many of the control institutions that currently dominate our centralised economy.

|

|

|

|

|

6

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: September 08, 2020, 10:59:55 AM

|

loak was scam the dagger first topic c4shm3n has a lot of money in it he take over cloak coin then you had BOBSURPLUS he was in cloak tho cloak was from 2013 not 2014 Wink BOBSURPLUS that day he had 600 BTC +/_ thanks from my verry good engels Grin

You are talking about a story from 5 to 6 years ago concerning the historical pseudo-founders who were discarded.

Since Cloak has largely evolved, emancipated itself, its teams and its community too, there has been an audit of the code that has been produced and validated the safety and validity of anonymisation of the software systems deployed, moreover there have been new updates evolving until this month that support the extension of the guarantees of confidentiality, the implementation of enigma, cloakshield is active, byob function must be delivered.

During the last tests, it was to include CloakFX directly in the wallet functions but it seems that the HALDE has threatened heavy sanctions since it does not validate the Cloak / FOREX exchange membership concerning CloakFX. As soon as solutions for circumventing global surveillance systems are established, State authorities (even private) threaten or sanction without warning and censor the adoption (even with FUD) or manipulation of low-volume markets.

(like CZ who charged $1M to enable registration on Binance) these choices were validated and a jackpot was collected from discrete contributors and business angels to finance the registration on Binance.

This did not bother CZ who fired Cloak without any explanation, Binance took the money and offered a place on the platform for almost 15 months and ejected Cloakcoin.

This distribution plan to promote Cloak seems expensive, I agree, but what alternative solutions would you have found instead? What do you think could be useful to promote Cloak and stand out from the 9000 other crypto products? (maybe it is possible to implement your ideas now?).

And then there is the legal context, for the moment cryptoes offering anonymity are discarded by the centralized exchanges, pointed out by the regulators, but don't be under any illusion, Cloak is not dead, on the contrary, once this cycle is over it can be reborn like a phoenix but it won't be without you.

See how crazy the prices are to be registered on a centralized platform applying the KYC rule. That's why the brilliant answer ByoB was born.

The idea of the ByoB function is to create a dedicated DEX to emancipate itself from the centralised exchanges under KYC and stand up against the state regulator, Cloak's slogan is "be your own bank" - not for nothing, it's usually appropriate.

From a marketing point of view if Cloak does not fight to be known then there will be less adoption, less users and therefore less liquidity other than in Bitcoin BTC. The mechanics of communication need to be adjusted and properly coordinated so that the product can be presented or distributed to more people (multilingual and multicultural).

(Other crypto teams spend huge amounts of money to make sure they are known via armies on the networks, others use much more aggressive methods) This is not what Cloak does.

Cloak coins has not been hacked and continues to offer the deep Un-traceability & decentralized digital durrency of transactions. It is an operational system (25 asymmetric RSA hops) completely different from Monero XMR which also offers anonymity. Cloak which allows transactions to be transacted cheaply and quickly (almost immediately).

Adopting Cloak is not a political gesture in itself, it's just a fair and useful choice of life for its users and its community.

Even if you have nothing to blame yourself for, nothing illegal here, you may not want a third party to follow your transactions or worse, listen to your network ports! Nothing prevents you from using an anonymity transfer solution or a perennial confidentiality to carry out your transactions, this is what Cloak offers and even allows an annualized return of 6% (staking) to the contributors and maintainers of the network.

Using https://www.cloakcoin.com this choice is up to you. |

|

|

|

|

7

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: September 07, 2020, 01:34:55 PM

|

Exchanges listings are valuable as attention-grabbers on Cloak life

Yeah for sure, everything is precious! updates, contributors, team, devs, investors, exchanges, social networks relays, shops, publicity, conferences, contests, audits, roadmaps, byob anonymous atomic swap release, com........... |

|

|

|

|

8

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: September 07, 2020, 11:17:16 AM

|

Cloakcoin Features

Once you see the features that Cloakcoin brings to the table you might agree that it has been

somewhat overlooked. Or you might see why it is being overlooked. Let’s get an idea of what

advantages you might get from using Cloakcoin.

Faster Transactions – Cloakcoin was designed with 60 second block times, making it ten times

faster than Bitcoin in processing transactions. Of course it doesn’t have the volumes of major

coins yet, so we have to wait to see how it would perform under much heavier transaction

volumes.

Completely Anonymous and Private – This is where Cloakcoin shines. User identity is never

revealed when transacting with Cloakcoin, making it one of the most secure of the privacy coins.

It achieves this through its proprietary Enigma technology, which will be discussed in more

depth later.

Safe and Secure – The combination of open-source blockchain technology guarantees the

security and safety of Cloakcoin.

Decentralization – Cloakcoin is fully decentralized, using proof-of-stake mining to secure the

network. This decentralization and PoS system also provides an incentive for users to hold

coins in their wallets in a process called staking.

Staking Rewards – Any user who chooses to hold CLOAK in their wallet can stake those coins

and receive a reward for doing so. Staking rewards amount to 6% annual return, which is the

incentive for users to help secure the network. Users can also elect to process Enigma

transactions to get additional rewards.

User Friendly – This is an often overlooked aspect of many blockchains and cryptocurrencies,

but the truth is most people aren’t going to use overly-complicated systems. Cloakcoin is userfriendly and simple to grasp. There are no detailed technical instructions, and users can be sending and receiving CLOAK anonymously within minutes of installing their wallet.

Cloakcoin from the Beginning

As was mentioned earlier Cloakcoin was developed and released in 2014, although it has undergone major improvements since that initial release. One thing that hasn’t changed over the years though is the decentralized and distributed nature of Cloakcoin.

Even more importantly is the evolution of the privacy function of Cloakcoin. With the upgrade to Enigma, Cloakcoin became a complete and total anonymous privacy coin. Unlike other coins there is no way to follow a trail on the blockchain to determine where CLOAK tokens may have come from. User privacy is always protected and the fungibility of the currency is maintained.

The implementation of a hybrid Proof-of-Work / Proof of Stake consensus system ensures users have an incentive to hold CLOAK coins, helping to lift the value of the cryptocurrency, and to help secure the network by processing Enigma transactions. Adding to the ease of use for Cloakcoin users is a native wallet that allows users to easily send, receive, store and stake their CLOAK. Staking CLOAK yields a 6% annual return. Like other forms of digital currency CLOAK can be exchanged easily on the open market and can be used a means of payment for those that accept CLOAK tokens. These payments allow users to “cloak” the transaction, hiding any association between buyers and sellers. This is accomplished via an inventive coin mixing system dubbed “Enigma

ENIGMA Technology and Privacy

Cloakcoin has CloakShield, which is an onion type protocol, enabled by default to provide endto-end encryption and secure communications for every transaction. This technology alone allows nodes to avoid any analysis of the traffic routed through them. However at the next level of privacy and anonymity is ENIGMA. This technology uses as many as 25 hops with symmetric RSA encryption and an ECDH key exchange. ENIGMA was created by the Cloakcoin team and provides a secure and private means for conducting transactions on the blockchain.

By using the unique ENIGMA technology uses can be sure their coins are sent completely anonymously, without the need to trust the nodes involved from stealing their funds or leaking their private data.

The Cloakcoin team has also emphasized that they do not support or condone the use of their technology to conduct any type of illegal transaction or activity.

Cloakcoin Team

Cloakcoin seems to have a pretty big team comprised of members with a wide variety of experience. Taking a look at the tech talent, we have the two lead devs which are “Deepend” and “anorak” whose real names are William Danielson and Ante Beslic. William is the Tech lead and is a C++ developer with two decades of experience in software engineering. Ante is the wallet developer who has extensive experience in front end development. He worked extensively with William in order to shape Cloakcoin into what it is today.

The Cloakcoin project manager is “lasvegas89” who’s real name is Steven Kendar. He joined the Cloak project back in 2014 and was the right hand man of the then project manager. He took over that role recently and is trying to push the Cloak project forward. There are a number of other team members which we wont go into here.

What is interesting to note is that the Cloak project has focused a lot of attention on local community co-ordinators and marketing professionals. Hopefully this could increase awareness above the current levels.

Cloakcoin Roadmap

This further development has been laid out in the Cloakcoin whitepaper https://www.cloakcoin.com/user/themes/g5_cloak/resources/CloakCoin_Whitepaper_v2.1.pdf where they plan to work on three main features of the protocol. These include three main components, two of which relate to the PoS algorithm whereas the third is to do with the way enigma transactions are split and combined.

Combining & Splitting of Transactions

As mentioned, the current Enigma protocol will allow for one single cloaked transaction. The developers say that they are currently busy working on an update that would allow multiple transactions to be combined into a single “super transaction”. This transaction will then contain multiple cloaked transactions which would have the affect of obfuscating any one particular transaction through safety in numbers. The developers want to give the user the ability to choose the number of co-operative transactions that will be required for the transaction.

You can think of it as analogues as the “Mixin level” that is applied on the Monero network when it comes to the number of decoy outputs. Finally, the developers also want to provide users with the ability to cloak a large number of CLOAK as a series of smaller transactions. You can think of this as order batching of the Enigma and CloakCoin transactions. The developers would like to make this compatible with combined Enigma transactions.

under development Adding anonymous decentralized exchanges (DEX) integrated BYOB

The Cloak coin Blockchain carries within it an ideal: to allow users to keep control of their funds in complete discretion. The decentralized exchange will be based on the Cloak Chain and will allow operators to issue and exchange digital assets without having to deposit in a central exchange.

Being auditable and at the same time Trustless without any necessary trust; you will be able to buy, sell and exchange cryptocurrencies 24/7 from anywhere in the world without having to disclose your identity while maintaining full control of your funds and private keys.

Scalability

First of all, the Cloak DEX, by allowing to pass on-chain exchanges. More scalable with its hybrid consensus Cloak Chain network is created to avoid congestion and bottlenecks in transactions.

Cost per transaction

The cost is an advantage for each transaction because it represents an extension to allow a more global adoption.

Interoperability

Computer interoperability or interworking is the ability of Cloak DEX to work and interact with other blockchains is also integrated and allows this possibility.

Cognosec Security Audit

The security audit carried out by Cognosec found that security for the blockchain, network and wallet were quite robust. The primary focus for remediation was in the Enigma code, and several recommendations were made by Cognosec in their audit report https://www.cloakcoin.com/user/themes/g5_cloak/resources/CloakCoin_Audit_Report.pdf. Since the security audit this past January 2018 changes have been made to improve the security of Cloakcoin even further. The next audit come in 2021.You will have understood that the future belongs to you, adopt and use Cloak can be a smart choice.

This way you keep control over your own funds and personal data. Everyone is solely responsible for their own portfolio, as Satoshi Nakamoto originally imagined when he created the Bitcoin protocol.

I agree with your analysis. When the time of anonymous crypto returns Cloak will shine again like a phoenix, I suggest not to give up under any circumstances. Cloak solution is a product that is functional and evolving. It's a question of trust. The last blocks will be undermined and most of us will be so old that Cloak will continue to serve and help your and your loved ones in the name of some respectful anonymity. See that everything is cyclical whether you like it or not - it's just the way it is. It's not surprising that Cloak may be back at $2 in a few months or years, but this will only happen if there is a certain dynamic, a community, a usefulness that is exploited and put forward. The more Cloak will be known, used, then the more Cloak will become valuable, it's as simple as that. The devs and the team are not dead, they are on the sidelines to go to other perspectives, all the contributors are valuable as they have been since the beginning. Cloak can become great again, but not without the help of all of us. If you understand that 18 minutes a day can be useful, then you have understood how to make his greatness evolve. Making Cloak a great moment again 🙏 is everyone's business. |

|

|

|

|

12

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][PART] Particl ● Infinite P2P Anon Marketplaces ✧ Live ✧ ● RingCT ● v2.3.2

|

on: March 04, 2020, 05:13:14 PM

|

Small Team with great vision and an already working decentralized marketplace. I like this project as well and was able to do some first successful buy orders. Nice project  What did you buy on the marketplace if I can ask? Is there anything that you would like to see? Personally I bought a Macbook, and some alcohol, and would be happy to buy again things like that  i have just seen the rise in the thread personally i find very well to be able to generate a passive income in (PART) without effort in without a MasterNode. Particl Staking dividends are very convenient here! |

|

|

|

|

14

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: February 09, 2020, 02:43:25 AM

|

Are there clowns at the controls?

QB.COM offers a CLOAK trading contest with a >>Minimum price to be traded: $4 USDDT at rate<< while the current price is $0.20 on livecoin and stex the only two other exchanges "100% operational" but where KYC is required (anonymous currency?!) trading and distribution of CLOAK for mass adoption. Did you notice that there is a problem there ?! it's equivalent on qb.com of +12.000$ in USDT to start the contest. Do you really think you can make volume with this rotten strategy?

i agree with your post. it's true and logical. at $4 imposed by qb.com exchange there will be zero volume because nobody will buy for $4.00 since the real price is $0.20. after qb.com will be able to delist Cloak very quickly and you will have lost the registration fees that they will not refund you. marketing strategy is not very coherent here. https://notice.qb.com/detail/?noticeId=269 Yes it's a waste of time/energy and financing to get CLOAK adopted like this with the constraints imposed by QB.COM Should focus on Claok's Decentralized exchange DEX to appear in the next wallet and devote the marketing, advertising, conference budgeter here. But risk of liquidity problem especially if KYC is imposed (Know your customer rules= photo I.D capture, proof of address snapshot, bank statement). It's up to everyone to see. If KYC is not imposed in DEX, there is a strong chance of success, but the SEC Securities and Exchange Commission will not fail to impose sanctions if this is the case. |

|

|

|

|

15

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: February 09, 2020, 02:32:53 AM

|

Are there clowns at the controls?

QB.COM offers a CLOAK trading contest with a >>Minimum price to be traded: $4 USDDT at rate<< while the current price is $0.20 on livecoin and stex the only two other exchanges "100% operational" but where KYC is required (anonymous currency?!) trading and distribution of CLOAK for mass adoption. Did you notice that there is a problem there ?! it's equivalent on qb.com of +12.000$ in USDT to start the contest. Do you really think you can make volume with this rotten strategy?

i agree with your post. it's true and logical. at $4 imposed by qb.com exchange there will be zero volume because nobody will buy for $4.00 since the real price is $0.20. after qb.com will be able to delist Cloak very quickly and you will have lost the registration fees that they will not refund you. marketing strategy is not very coherent here. https://notice.qb.com/detail/?noticeId=269 |

|

|

|

|

16

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: February 03, 2020, 06:07:58 PM

|

|

This is very positive because India - RBI - in India is an ambitious strategy of the Reserve Bank of India to amplify the adoption of blockchain technology and cryptography in the private and public sectors by 2025. The legal status of cryptography is confirmed, a CBDC, digital rupee, will be created. Trading is still prohibited but cryptography is not illegal. Can now use Cloak coin to make their transactions and transfers of dematerialized values in complete confidentiality.

|

|

|

|

|

19

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CRW] CROWN (MN-PoS) | Platform | NFT framework | Governance | Masternodes

|

on: January 20, 2020, 02:50:43 PM

|

According to the rating agency FCAS it is described that: Crown's market dynamics are good because the support has been resisting for several months now and this has a direct impact on the health of the ecosystem and developments. In the long run, it is appreciated that Crown offers a clear vision of the product's elements, an added value that is not found everywhere. The users and markets that determine the health of the project seem to be on board and always loyal. After all, Crown's roadmap is so much about providing future business intelligence solutions to help blockchain organizations drive growth. This can have a huge impact on companies and users today. In this circonstance the quality audit is very positive |

|

|

|

|

20

|

Alternate cryptocurrencies / Announcements (Altcoins) / Re: [ANN][CLOAK] Private, Secure, Untraceable & Decentralized Digital Currency

|

on: January 18, 2020, 10:53:39 AM

|

if you have time

I was just answering your question  I just stumbled on the post it seems very interesting, I didn't know CLOAK but it's a nice discovery all this information is like an eco for me. The interest of hiding your private life is important to me, not for illegal things but simply to remain discreet. How do you get the 6% interest?

Very simple you buy Cloak in an exchange: https://www.livecoin.net/en/trading/CLOAK_BTChttps://app.stex.com/en/basic-trade/pair/BTC/CLOAK/1D- You download the Cloak wallet on your computer: https://www.cloakcoin.com/en/wallets- You install the wallet taking care to create your password and then save (one outside your computer your seed or .dat file) offline backup storage is ideal. Then wait for the synchronization with the Cloak blockchain. Then you create a receiving address in the tab (receive funds) in your wallet. Send your funds from the exchange to your wallet with the previously created receive address (receive funds). Wait for the funds to be displayed Then activate the mining go to parameter and select: (Unlock for Mining) Then leave the wallet connected to the internet 24/24 and you will receive free Cloak every day = 6% of the value of the number of chips you store in your wallet / per year so calibrated on a daily basis. Also works with a Raspberry Pi so very energy efficient. Well, I followed the instructions and the result is a success! Thank you for your help |

|

|

|

|

take me to other moons Baby

take me to other moons Baby

maybe i wil come back dont know

maybe i wil come back dont know