Bytecoin Updates Its Software with the Most State of the Art in the World for Anonymous Cryptocurrencies https://www.ccn.com/bytecoin-updates-software-state-art-world-anonymous-cryptocurrencies/ Bytecoin, which is known as the fully-anonymous cryptocurrency which first implemented the CryptoNote protocol, is publishing a major software update. This update has proven to solve Bytecoin’s most essential technical issues as well as improve both the stability of the system and its reliability. According to the 2018 Bytecoin Roadmap, February 6th is the day when BCN users will be able to experience the new Bytecoin Beta Release. This massive update, according to the provided details, is the result of meticulous work conducted by Bytecoin’s team of anonymous developers and will lead Bytecoin to even greater popularity than ever before. To download the update and experience it for yourself, please follow this link. “Bytecoin is one of the most unique projects in the crypto world because it has existed for such a great length of time without updating its own imperfect software. But now, thanks to the painstaking work of our community and the Dev Team, we’ve built an absolutely new and entirely reliable software. This update will lead Bytecoin to completely new heights of success and help motivate more users to get involved in our ecosystem” – said Jenny Goldberg from the Bytecoin team. As for the back-end part of the update, the Bytecoin Development Team has decided to implement some essential features to improve the speed and reliability of the software. In addition to this, the release of this software will also appear in a new GitHub repository. Starting from the LMDB library, which has optimized the blockchain size, modified the daemon, reworked the block downloader, and provided a new API. Furthermore the Dev Team has mentioned early support for the “Send Proof” feature (a cryptographic object which proves that the creator of this object has really sent their coins). The front-end part has been updated significantly as well and mostly influenced by the major back-end implementations. The new design and variety of new features have been made available to implement by Bytecoin’s community of enthusiasts, working in tandem with the Dev Team. Also contained within are the builds, including early support for dynamic fees, a Wallet Service console, and some other minor improvements. “As soon as these beta-builds will be successfully tested, Bytecoin’s Developers will be able to proceed with improvements, such as a new stable API release and a hardfork on June 12th. We’d like everyone from the crypto community to take part in our beta-tests, to improve the final builds and make it the best it can possibly be,” – said Jenny Goldberg from the Bytecoin team. The Bytecoin Team has rushed into this year with a few essential marketing updates and it’s time for the Developers to release the new software versions. Moreover, according to Bytecoin’s 2018 Roadmap this coin is going to be heavily involved in the Asian market for the 1st quarter, and these events (including today’s release) are going to bring Bytecoin to new and even greater heights for the 1st fully-anonymous cryptocurrency. Fraudulent action on Telegram: Notification for the whole Cryptocommunityby BCN_official1 https://www.reddit.com/r/CryptoCurrency/comments/7vmnpg/fraudulent_action_on_telegram_notification_for/Hello Dear Cryptocurrency and Bytecoin Community, I am writing to you today to make you aware that Bytecoin has been experiencing a higher than average number of scammers through our Telegram channels. I just wanted to share my experience to help make other crypto communities aware of this situation. There a lot of scammers in many of the Telegram groups, please be cautious, never tell anybody your email, 2FA, or private information if you’re not absolutely sure who you are talking with. We wanted to share this in an effort for users to be more attentive regarding this issue and let other cryptocurrency groups be aware of this, in case they begin to experience the same issues. All the best, Jenny Goldberg Bytecoin Manager |

|

|

|

SECURITY Ledger Receive Address Attack https://www.docdroid.net/Jug5LX3/ledger-receive-address-attack.pdfOverview Crypto wallets consist of a private key for spending funds, and a public key for receiving funds. Modern Crypto clients usually create a new receive address after every transaction. This is done to better protect the privacy of the user, by spreading his funds across multiple addresses, rather than one. Receive addresses are normally generated automatically and are transparent to the wallet owner. The Attack Ledger wallets generates the displayed receive address using JavaScript code running on the host machine. This means that a malware can simply replace the code responsible for generating the receive address with its own address, causing all future deposits to be sent to the attacker. Because receive addresses are consistently changing as part of the usual activity of the wallet, the user has no trivial way (like recognizing his address) to verify the integrity of the receive address. As far as he knows, the displayed receive address is his actual receive address. What Makes This Even Worse - All the ledger wallet software is located in the AppData folder, meaning that even an unprivileged malware can modify them (no need to gain administrative rights). - The ledger wallet doesn’t implement any integrity-check/anti-tampering to its source files, meaning they can be modified by anyone. - All the malware needs to do is replace one line of code in the ledger software, this can be achieved with less than 10 lines of python code. - New ledger users would typically send all their funds to the wallet once initialized. If the machine was pre-infected, this first transaction may be compromised causing the user to lose all of his funds. - The attack changes the receive address during its generation, causing even the automatically generated QR to be updated to the attacker’s address. Meaning that both the string and QR representations of the address are compromised. Proof of Concept Open the file: C:\Users\%USERNAME%\AppData\Local\Google\Chrome\User Data\Default\Extensions\%EXTENSION_ID%\%EXTENSION_VERSION%\src\wallet\wallet.js Replace the line: return (_ref = this.wallet.cache) != null ? _ref.get(this.getCurrentPublicAddressPath()) : void 0; With: return “MY_MALICIOUS_ADDRESS”; The next time you receive funds, all the funds will be sent to MY_MALICIOUS_ADDRESS. Mitigation Un undocumented feature, that isn’t even part of the official “Receiving BTC to your Ledger” article, can in some cases help verify the integrity of the receive address. On the bottom right part of the receive screen, a small monitor button exists. Pressing this button will cause the receive address to show up on the hardware wallet’s screen. This can be used to verify that the address is valid and has not been tampered. Note that this process is not part of the default receive process, and is not enforced by the wallet. A proper solution would be to enforce the user to validate the receive address before every receive transaction, just like the wallet enforces the user to approve every send transaction. Also, this undocumented feature only exists in the Bitcoin App. The Ethereum App (and possibly other apps as well) has no mitigation, the user has no way to validate if the receive address has been tampered. Advice for Existing Ledger Customers If you’re using the Bitcoin App – Before every receive transaction validate the integrity of the address using the monitor button. If you’re using the Ethereum App – Treat the ledger hardware wallet the same as any other software- based wallet, and use it only on a Live CD operating system that is guaranteed to be malware-free. At least until this issue receives some kind of fix. Responsible Disclosure Unfortunately, Ledger doesn’t have an organized vulnerability disclosure program. Nonetheless we contacted the CEO and CTO of Ledger directly in order to privately disclose and fix the issue. We’ve received a single reply, asking to hand over the attack details. Since then all our mails have been ignored for 3 weeks, finally receiving an answer that they won’t issue any fix/change. Timeline: 4, January, 2018 – First contact with general information. 4, January, 2018 – CTO of Ledger requested the full details of the vulnerability. 4, January, 2018 – Full Details were sent. 10, January, 2018 – We’ve requested an update, no response. 13, January, 2018 – Again, we’ve requested an update, not response. 27, January, 2018 – CTO of Ledger replies that no fix/change would be done (our recommendation to enforce the user to validate the receive address has been rejected), but they will work on raising public awareness so that users can protect themselves from such attacks. |

|

|

|

SECURITY Ledger Receive Address Attack https://www.docdroid.net/Jug5LX3/ledger-receive-address-attack.pdfOverview Crypto wallets consist of a private key for spending funds, and a public key for receiving funds. Modern Crypto clients usually create a new receive address after every transaction. This is done to better protect the privacy of the user, by spreading his funds across multiple addresses, rather than one. Receive addresses are normally generated automatically and are transparent to the wallet owner. The Attack Ledger wallets generates the displayed receive address using JavaScript code running on the host machine. This means that a malware can simply replace the code responsible for generating the receive address with its own address, causing all future deposits to be sent to the attacker. Because receive addresses are consistently changing as part of the usual activity of the wallet, the user has no trivial way (like recognizing his address) to verify the integrity of the receive address. As far as he knows, the displayed receive address is his actual receive address. What Makes This Even Worse - All the ledger wallet software is located in the AppData folder, meaning that even an unprivileged malware can modify them (no need to gain administrative rights). - The ledger wallet doesn’t implement any integrity-check/anti-tampering to its source files, meaning they can be modified by anyone. - All the malware needs to do is replace one line of code in the ledger software, this can be achieved with less than 10 lines of python code. - New ledger users would typically send all their funds to the wallet once initialized. If the machine was pre-infected, this first transaction may be compromised causing the user to lose all of his funds. - The attack changes the receive address during its generation, causing even the automatically generated QR to be updated to the attacker’s address. Meaning that both the string and QR representations of the address are compromised. Proof of Concept Open the file: C:\Users\%USERNAME%\AppData\Local\Google\Chrome\User Data\Default\Extensions\%EXTENSION_ID%\%EXTENSION_VERSION%\src\wallet\wallet.js Replace the line: return (_ref = this.wallet.cache) != null ? _ref.get(this.getCurrentPublicAddressPath()) : void 0; With: return “MY_MALICIOUS_ADDRESS”; The next time you receive funds, all the funds will be sent to MY_MALICIOUS_ADDRESS. Mitigation Un undocumented feature, that isn’t even part of the official “Receiving BTC to your Ledger” article, can in some cases help verify the integrity of the receive address. On the bottom right part of the receive screen, a small monitor button exists. Pressing this button will cause the receive address to show up on the hardware wallet’s screen. This can be used to verify that the address is valid and has not been tampered. Note that this process is not part of the default receive process, and is not enforced by the wallet. A proper solution would be to enforce the user to validate the receive address before every receive transaction, just like the wallet enforces the user to approve every send transaction. Also, this undocumented feature only exists in the Bitcoin App. The Ethereum App (and possibly other apps as well) has no mitigation, the user has no way to validate if the receive address has been tampered. Advice for Existing Ledger Customers If you’re using the Bitcoin App – Before every receive transaction validate the integrity of the address using the monitor button. If you’re using the Ethereum App – Treat the ledger hardware wallet the same as any other software- based wallet, and use it only on a Live CD operating system that is guaranteed to be malware-free. At least until this issue receives some kind of fix. Responsible Disclosure Unfortunately, Ledger doesn’t have an organized vulnerability disclosure program. Nonetheless we contacted the CEO and CTO of Ledger directly in order to privately disclose and fix the issue. We’ve received a single reply, asking to hand over the attack details. Since then all our mails have been ignored for 3 weeks, finally receiving an answer that they won’t issue any fix/change. Timeline: 4, January, 2018 – First contact with general information. 4, January, 2018 – CTO of Ledger requested the full details of the vulnerability. 4, January, 2018 – Full Details were sent. 10, January, 2018 – We’ve requested an update, no response. 13, January, 2018 – Again, we’ve requested an update, not response. 27, January, 2018 – CTO of Ledger replies that no fix/change would be done (our recommendation to enforce the user to validate the receive address has been rejected), but they will work on raising public awareness so that users can protect themselves from such attacks. http://cryptorus.info/ledger-addresses-man-in-the-middle-attack-that-threatens-millions-of-hardware-wallets/ |

|

|

|

SECURITY Ledger Receive Address Attack https://www.docdroid.net/Jug5LX3/ledger-receive-address-attack.pdfOverview Crypto wallets consist of a private key for spending funds, and a public key for receiving funds. Modern Crypto clients usually create a new receive address after every transaction. This is done to better protect the privacy of the user, by spreading his funds across multiple addresses, rather than one. Receive addresses are normally generated automatically and are transparent to the wallet owner. The Attack Ledger wallets generates the displayed receive address using JavaScript code running on the host machine. This means that a malware can simply replace the code responsible for generating the receive address with its own address, causing all future deposits to be sent to the attacker. Because receive addresses are consistently changing as part of the usual activity of the wallet, the user has no trivial way (like recognizing his address) to verify the integrity of the receive address. As far as he knows, the displayed receive address is his actual receive address. What Makes This Even Worse - All the ledger wallet software is located in the AppData folder, meaning that even an unprivileged malware can modify them (no need to gain administrative rights). - The ledger wallet doesn’t implement any integrity-check/anti-tampering to its source files, meaning they can be modified by anyone. - All the malware needs to do is replace one line of code in the ledger software, this can be achieved with less than 10 lines of python code. - New ledger users would typically send all their funds to the wallet once initialized. If the machine was pre-infected, this first transaction may be compromised causing the user to lose all of his funds. - The attack changes the receive address during its generation, causing even the automatically generated QR to be updated to the attacker’s address. Meaning that both the string and QR representations of the address are compromised. Proof of Concept Open the file: C:\Users\%USERNAME%\AppData\Local\Google\Chrome\User Data\Default\Extensions\%EXTENSION_ID%\%EXTENSION_VERSION%\src\wallet\wallet.js Replace the line: return (_ref = this.wallet.cache) != null ? _ref.get(this.getCurrentPublicAddressPath()) : void 0; With: return “MY_MALICIOUS_ADDRESS”; The next time you receive funds, all the funds will be sent to MY_MALICIOUS_ADDRESS. Mitigation Un undocumented feature, that isn’t even part of the official “Receiving BTC to your Ledger” article, can in some cases help verify the integrity of the receive address. On the bottom right part of the receive screen, a small monitor button exists. Pressing this button will cause the receive address to show up on the hardware wallet’s screen. This can be used to verify that the address is valid and has not been tampered. Note that this process is not part of the default receive process, and is not enforced by the wallet. A proper solution would be to enforce the user to validate the receive address before every receive transaction, just like the wallet enforces the user to approve every send transaction. Also, this undocumented feature only exists in the Bitcoin App. The Ethereum App (and possibly other apps as well) has no mitigation, the user has no way to validate if the receive address has been tampered. Advice for Existing Ledger Customers If you’re using the Bitcoin App – Before every receive transaction validate the integrity of the address using the monitor button. If you’re using the Ethereum App – Treat the ledger hardware wallet the same as any other software- based wallet, and use it only on a Live CD operating system that is guaranteed to be malware-free. At least until this issue receives some kind of fix. Responsible Disclosure Unfortunately, Ledger doesn’t have an organized vulnerability disclosure program. Nonetheless we contacted the CEO and CTO of Ledger directly in order to privately disclose and fix the issue. We’ve received a single reply, asking to hand over the attack details. Since then all our mails have been ignored for 3 weeks, finally receiving an answer that they won’t issue any fix/change. Timeline: 4, January, 2018 – First contact with general information. 4, January, 2018 – CTO of Ledger requested the full details of the vulnerability. 4, January, 2018 – Full Details were sent. 10, January, 2018 – We’ve requested an update, no response. 13, January, 2018 – Again, we’ve requested an update, not response. 27, January, 2018 – CTO of Ledger replies that no fix/change would be done (our recommendation to enforce the user to validate the receive address has been rejected), but they will work on raising public awareness so that users can protect themselves from such attacks. http://cryptorus.info/ledger-addresses-man-in-the-middle-attack-that-threatens-millions-of-hardware-wallets/ |

|

|

|

EXCLUSIVE: Circle set to acquire Poloniex https://modernconsensus.com/2018/02/02/circle-set-acquire-poloniex/Modern Consensus has learned that Circle, the venture-rich mobile pay startup that competes with Venmo and makes sending money almost effortless, is deep in discussions to acquire Poloniex, the American cryptocurrency exchange that made its name by listing scores of altcoins on a platform that resembles a professional trading station. At press time, Modern Consensus was unable to confirm the terms of the deal. According to one highly placed source with knowledge of the discussions, “Circle and Poloniex agreed to terms and Circle has already approached the regulators. The regulators came back with a list of KYC demands [Know Your Customer] and Circle has agreed to meet all the conditions.” Poloniex is known to already feature some very stringent KYC requirements its customers must meet. For example, after initially allowing several accounts to be opened by a single user, the company now permits only one account per verified user. It sets limits on daily withdrawals similar to those found at other exchanges. It has also been plagued by the same customer support and verification backlogs that are bedeviling its rivals, often taking weeks to bump users up to the next level of verification status. Poloniex did not respond to a request for comment on the pending transaction; Circle replied to multiple requests with only a form letter. This story will be updated with further comment if either responds. At first blush, the matchup is at least somewhat surprising. Circle, which got its start as a quick and safe way to turn bitcoin into U.S.dollars, has been known for its mono focus on BTC. That’s the opposite of Poloniex, which lists a mind-boggling 68 different tokens. Where the Circle interface is all about customer ease of use, Poloniex looks much more like a Bloomberg Terminal, and features complex innovations like margin trading and lending, which aren’t offered by more beginner-friendly sites like Coinbase............. |

|

|

|

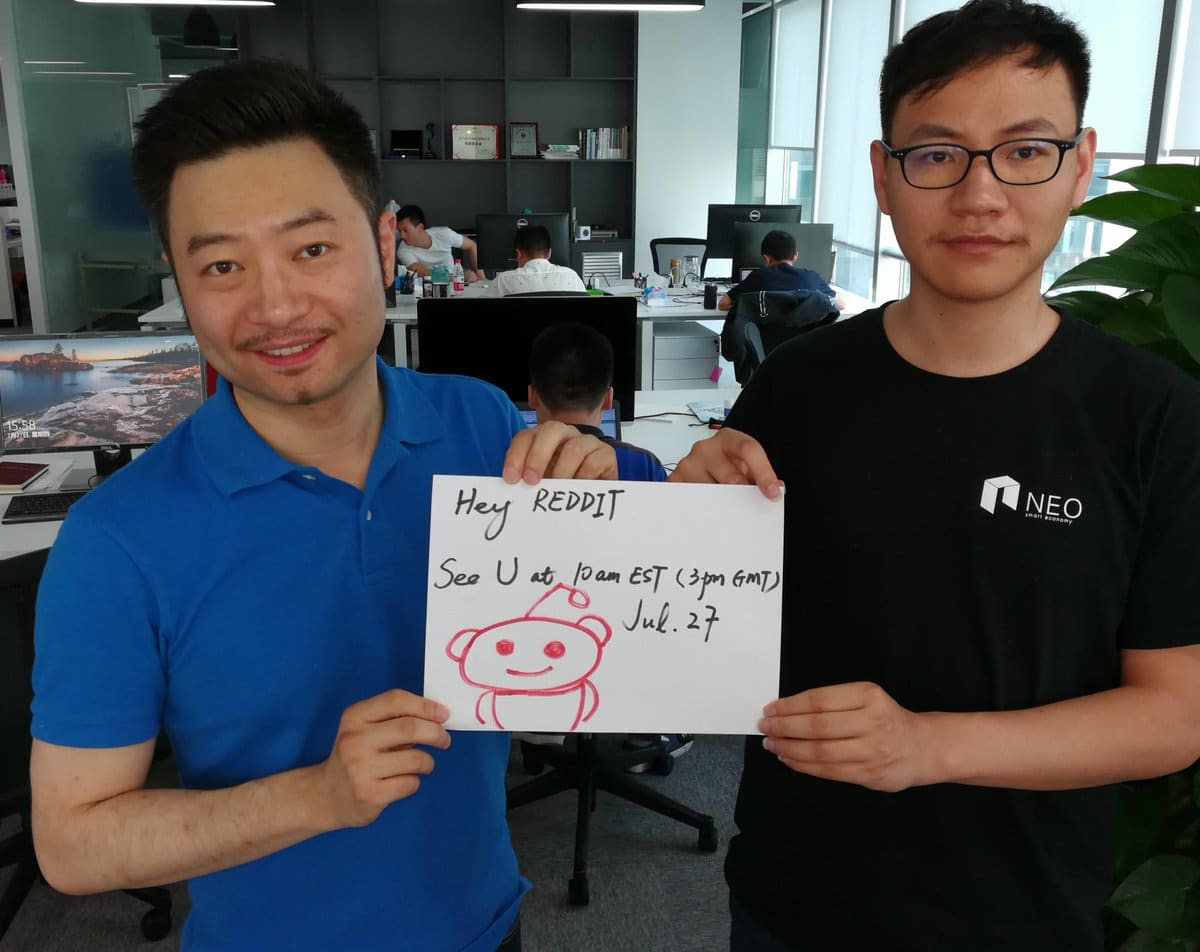

worth read... Analysis: NEO – Will It Replace Ethereum as the World’s ICO Platform? https://www.financemagnates.com/cryptocurrency/news/neo-one-replace-ethereum-worlds-ico-platform/Google/Baidu, Facebook/WeChat, YouTube/Youku, Twitter/Weibo – China has long been making its own equivalents of Western technology staples. As cryptocurrency has become more mainstream, Ethereum has become one such staple, and true to form, China has made its own – NEO. NEO was launched in December 2016 and has been steadily rising in price since July, collecting DApps as startups flock to it to launch their ICOs. It just finished hosting a conference in San Francisco which featured a lineup of new projects. But while many are calling NEO the Chinese Ethereum, in reality this is only partially accurate. The two blockchains do have similarities, but also several fundamental differences. Discover credible partners and premium clients at China’s leading finance event! So what is NEO? Can it be seen as a competitor to Ethereum? This article is an attempt to unpack this subject. Smart contracts/smart economy Ethereum has been the second most valuable cryptocurrency by market cap for a long time now. While Bitcoin’s value is largely based on the fact that it was the first cryptocurrency and thus the most well-established, Ethereum’s success is a result of its unique utility – it allows users to write their own smart contracts on top of its blockchain. A smart contract, or DApp, is a contract locked into code which requires a crypto-token to operate. It takes away the ability of people to cheat the contract, such as often happens in messy reality, because the contract when activated is permanent; the adjudicator is a computer. Smart contract creation is something that NEO, née AntShares, has in common with Ethereum. Both are open source platforms, and both are more than simply holding systems for currencies, although both have cryptocurrencies with real value. NEO currently has 27 DApps listed on its website, offering services from WiFi sharing to courier services to bad weather insurance. However, while Ethereum aims to “build a more globally accessible, more free and more trustworthy Internet” (official description), NEO aims to build a new economy entirely – a smart one. Ethereum has gone some way towards achieving its goal, being as it is the base platform for almost all of the world’s ICO projects. It wouldn’t be fair to compare success stories just yet, because NEO is newer and has a much grander aim. A smart economy is an entire economy based on smart contracts. In such a world, all physical assets would be represented digitally and all transactions and parties to those transactions registered with a digital identity. A digital identity will be mandatory for participation in the blockchain, and will be set by that blockchain (according to the X.509 certificate, which has been the international standard since 1988). In fact, NEO has already partnered with a project called TheKey – a blockchain-based identification verification tool “which is exclusively authorized by government authorities.” The word government brings us to another key difference between the two platforms. Government ............................. |

|

|

|

Japan’s Financial Regulator Responds To Coincheck US$530M Hack https://coinjournal.net/japans-financial-regulator-responds-coincheck-us530m-hack/Japan’s Financial Services Agency (FSA) plans to take administrative actions against hacked cryptocurrency exchange Coincheck after the company announced the loss of 523 million units of NEM cryptocurrency (about US$530 million) from a hack. The FSA suspects that a lack of proper security measures allowed hackers to steal a record haul of cryptocurrency on Friday, according to a report by Nikkei Asian Review. The regulator will issue a business improvement order to Coincheck later on Monday and order the company to strengthen its safeguards to prevent a recurrence, Japan’s chief cabinet secretary Yoshihide Suga told a regular news conference. The theft is said to be the biggest-ever losses of cryptocurrency to hackers. Coincheck halted withdrawals and trading in all cryptocurrencies on Friday, except bitcoin, and said in a statement that it would return the stolen money to the roughly 260,000 affected users. According to the announcement, the refund will be done using the company’s own capital. No date has been set yet for the payments or for a restart of trading on the platform, Coincheck’s chief operating officer Yusuke Otsuka told reporters. Tracking the stolen funds NEM Foundation interview Coincheck hack NEM.io Foundation vice president Jeff McDonald interview with Inside NEM, Youtube The NEM.io Foundation‘s vice president Jeff McDonald said in a statement on Sunday that the organization was “working on solutions to do the most we can to help Coincheck and also ensure the NEM community is protected.” “We are currently reaching out to exchanges and exploring three different options,” McDonald said. “We also have a full account for all of Coincheck’s lost NEM cryptocurrency (XEM) on the blockchain. At this time, the hacker has not moved any of the funds to any exchange, nor to any personal accounts of NEM community members.” The foundation said it was developing an “automated tagging system” to follow the stolen funds and tag any account that receives the tainted money. In an interview with Inside NEM, McDonald said that when the stolen funds were moved out of Coincheck it appeared that the funds were stored in a hot wallet that had an exposed API and probably an exposed private key. Coincheck should have used NEM’s multi-signature contract and cold storage to secure the funds, he said. McDonald added that a NEM hard fork was out of the question. “A hard fork is not an option. The NEM protocol worked exactly as it was designed to work. It’s a terrible thing but I think if the funds were going to be returned that it would have to be the hacker returning the coins to Coincheck,” he said...... |

|

|

|

[Front-line] SAIC into the block chain car control will be applied Elastos system ( G.Tr.) http://tech.qq.com/a/20180127/016253.htmTencent Technology 2018-01-27 21:24 Tencent "front-line" author Zhang Fan January 27, Tencent "front-line" was informed that the country's largest car maker Shanghai Automotive Group and the blockchain project also to cloud Elastos reached an agreement. In the future, SAIC will use Elastos' blockchain technology to identify and connect and control the other sub-systems in the car to build a unified software development platform for smart cars. It is reported that the entire pre-research project is divided into four parts of the car center console, car controller, high-performance computers and mobile phone users. With the lightweight Elastos Runtime SDK, software developers no longer have to worry about details such as underlying communications, authentication, and packaging interfaces. Also to the cloud, said Elastos system to solve the communication link security, authentication, user identity and data security and licensing and other issues, which is the key to large-scale smart car business. Elastos is a distributed Internet operating system that addresses the non-orthogonal nature of smart contracts and virtual machine functions, adding N dimensions to Smartweb while retaining Trustzone capabilities. The project won Wu Han Han bit of the continent, fire currency network investment, the founder of Chen Rong, Han Feng. |

|

|

|

BOSCH’s New IoT Adaptor XDK110 And How It Is Related To IOTA (MIOTA) https://theindependentrepublic.com/2018/01/27/boschs-new-iot-adaptor-xdk110-and-how-it-is-related-to-iota-miota/ After the recent BOSCH x IOTA (MIOTA) partnership, where the first invested heavily into the IOTA Foundation, not only economically but also with brain power, lending Dr. Hongquan Jiang, partner of Robert Bosch Venture Capital (RBVC) to the IOTA Foundation’s Advisory Board, BOSCH didn’t had to wait long to launch their next commercial IoT hardware, the XDK-110. The XDK110 is a wireless sensor device to enable rapid prototyping of sensor-based products and applications for the internet of things (IoT). It thereby allows users a step in-between the first hardware prototype and series production, or simply as the first compact prototype. The device was built in a way that Bosch can easily adapt the product for mass production and the users’ unique sensor requirements. The XDK110 creates the opportunity for users to try out more advanced programming on the device itself to realize a sensor which processes data and reports events instead of simply transmitting raw data. The product XDK110 consists of the XDK110 sensor device, comes with an SW development environment called the XDK Workbench as well as access to the XDK developer community. XDK110 allows the user the ability to experiment with different ideas, with different sensor measuring principles, coupled together with different communication technologies. XDK110 thereby allows the user to better understand their end solution requirements, but also their potential series product before having to invest substantial sums of engineering development activity. XDK110 is built using a modular hardware and software platform, meaning that mass production of variations of XDK is easy, scalable and cost-effective for the user when moving forward with their idea. This universal programmable sensor device & prototyping platform for any IoT use case you can imagine wears built-in sensors including an Accelerometer, an Acoustic Sensor, a Digital Light Sensor, a Gyroscope, a Humidity Sensor, a Magnetometer, a Pressure Sensor, and a Temperature Sensor all in one single device. So how could IOTA (MIOTA) play its part, starting with BOSCH’s first IoT based hardware after the big partnership? We’re taking a speculative dive into possible scenarios where IOTA as a cryptocurrency, The Tangle as a network and IOTA Foundation‘s Data Marketplace could be involved with BOSCH‘s XDK project and other similar projects in the near future. “There is great potential through Distributed Ledger Technologies to make each IoT project more secure, efficient and provide increased transparency to consumers of IoT solutions,” says Dennis Boecker, Bosch IT global innovation lead and responsible for the Chicago Connectory, an Internet of Things (IoT) innovation space founded by Bosch and 1871. “Our goal is to increase the adoption of Distributed Ledger Technology throughout the Midwest region as IoT solutions and business models continue to grow.” “IOTA and Bosch have been in dialog about the convergence between the Internet-of-Things and IOTA’s Distributed Ledger Technology since late 2015 and built up a strong relationship,” says David Sønstebø, founder of the IOTA Foundation. “Our official collaboration on this laboratory for exploring this overlap cements both entities’ goal of enabling an open and secure IoT ecosystem.” The main product of the IOTA Foundation to date is The Tangle, an open source Distributed Ledger Technology (DLT) that goes beyond blockchain. The IOTA Tangle resolves the scalability challenges of existing blockchain technologies and makes it possible to transfer value without transaction fees. IOTA is uniquely suited for business model innovation in the emerging Machine-to-Machine (M2M) economy......  IOTA has a strong ecosystem, which is one of the largest in the DLT community. Corporations, startups, and independent developers are utilizing the technology to create new applications in a diverse number of areas, ranging from the Internet of Things to Smart Cities, Mobility, eHealth and even Web Payments. We see both entities being serious and focused on working together in order to upgrade and simplify the whole concept of The Internet Of Things (IoT) to the average consumer. One of the most anticipated, and probably one of the most unique, modules for IOTA is Masked Authenticated Messaging. MAM makes it possible for sensors and other devices to encrypt entire data streams and securely anchor those into the IOTA Tangle in a quantum proof fashion. Only authorized parties will be able to read and reconstruct the entire data stream. In essence, it works a lot like a radio where only those with the right frequency can listen in, in MAM only those with the right channel IDs get access to the data. We can expect many more announcements about MAM, as well as its applicability to industries such as Supply Chain, Banking and Industry 4.0. Another possible solution using both the XDK 110 and The Tangle, as well as IOTA as a medium would be IoT based intel exchange regarding specifics preset to be read, analyzed and exchanged between XDK 110 adaptors. For example, a construction company could enter The Tangle and purchase crucial information about a geolocation monitored by one or a node of XDK adaptors. The information exchange will be accurate, immediate and up to date. Most important it could be paid for using The Tangle’s native currency, which is no other than IOTA itself. The information exchange could be extended to the Data Marketplace where various buyers, both Corporate affiliates, and individuals could request desired information gathered by the XDK Network build on The Tangle and again pay for it using IOTA. The Foundation’s Data Marketplace has already proven its functionality in an earlier private beta where participants included Microsoft, Samsung, Orange, Volkswagen among decades of other industrial key players. We know that this is just the beginning of this long-anticipated relationship between the two parties and more practical use cases will keep showing up in the next months. Until then, let me know what you guys think about BOSCH’s XDK project and how else you think it could be used in the IoT? |

|

|

|

Strategic Partnership between TRON and GSC Makes One Hundred Million Users Get Access to TRON Network https://medium.com/@Tronfoundation/strategic-partnership-between-tron-and-gsc-makes-one-hundred-million-users-get-access-to-tron-a6c58e6a6c9eToday, TRON announced that it has built a strategic partnership with GSC (Global Social Chain). In the future, TRON will provide GSC with great support in aspects of fund, technology and infrastructure, and GSC will carry out optimization based on TRON Network, in order to jointly facilitate development of blockchain-based social system. GSC (Global Social Chain) is the world’s first new generation of social network chain that owns hundreds of millions of social users. This social chain is determined to use block chain technology to subvert centralized social networks such as Facebook, WeChat, etc., which plays a dual role as “manager” and “arbiter” simultaneously for the former social networking platforms. GSC Foundation has a long-term relationship with Mico as the most important Strategic Partner. Mico is a mobile social platform for the global market, which was launched in February 2015. With its original “intelligent social recommendation system based on interest”, Mico has created its own territory in the giant global social market, quickly accumulating hundreds of millions of users and entered the top five social tables in more than 60 countries, becoming the world’s premier open social platform. A social matrix is built around the social platform on Mico, including Mico, Kitty Live, Waka, and YAY. Mico is the largest social platform among strangers in Southeast Asia and Middle East and owns more than one hundred million registered users. It was once rated as the best App by Google. Kitty Live is one of the most popular streaming Apps in Southeast Asia and owns 20 million registered users. The cooperation between TRON and GSC means that at least 120 million users of social and streaming platforms will get access to TRON Network. This will significantly expand the blockchain-based online entertainment business.  “As a trailblazer that integrates blockchain and social & online entertainment, TRON has made remarkable achievements. Our partnership with TRON is the natural result of our shared goal of optimizing social experience with blockchain. In the future, we want to make more beneficial attempts based on TRON’s main chain, in order to bring young people around the world the best social experience,” said Sean Su, chairman of GSC Foundation. “Currently, GSC and its partner Mico have owned more than one hundred million global users. In particular, they are very popular in Southeast Asia. Their favorable user base will become the key factor for GSC to outperform its competitors. In the future, TRON will support Mico in aspects of fund, technology and infrastructure, in order to continuously optimize social experience through blockchain,” said Justin Sun, founder of TRON.  |

|

|

|

MATRIX's Chief AI Scientist named NVIDIA partner prof http://www.nvidia.com/object/professor_partners_bios_yangdong.htmlProfessor Partner Bios & Links Yangdong (Steve) Deng Yangdong (Steve) Deng received his Ph.D. degree in Electrical and Computer Engineering from Carnegie Mellon University, Pittsburgh, PA, in 2006. He received his ME and BE degrees in Electronic Department from Tsinghua University, Beijing, in 1998 and 1995, respectively. His Ph.D. research focuses on a new 3-dimensional (3-D) VLSI integration scheme. Due to its die-to-die stacking architecture enhanced by an incremental testing methodology, the proposed 3-D integration scheme could significantly improve the fabrication yield. He developed the first generation 3-D VLSI layout design tools. He also evaluated the performance gain of implementing several real world designs including a microprocessor into 3-D integration. His work was introduced in a special topic session on International Solid State Circuit Conference, 2005. During his Ph.D. research, he also developed an efficient algorithm to optimize the interconnection network for System-on-Chips. The work opened up a new research direction to optimize system interconnection by taking into account the predicted layout information. He joined Incentia design Systems in 2004 as a senior software engineer (before finishing his Ph.D. dissertation). From 2006 to Feb. 2008, he was with Magma Design Automation as a software architect. In both companies, he had been developing leading edge physical design tools. He was one of the main developers of Magma’s new Talus million-gate IC design toolkit. He received an award from Magma Design Automation for his contribution to the NEC project. Since Mar. 2008, he has been with Institute of Microelectronics, Tsinghua University as an associate professor. His research interests include parallel electronic design automation (EDA) algorithms, electronic system level (ESL) design, and parallel program optimization. His research is supported by the EDA Key Project of China Ministry of Science and Technology, Intel University Program, NVidia Professor Partnership Award and others. He is going to the principle investigator of the Parallel Electronic Design Automation Project sponsored by the National High Technology Research and Development Program of China (863 Program). Besides his research publications, he coauthored a textbook book, Structural VLSI Design and High Level Synthesis (in Chinese). Published by Tsinghua Publishing House, the book was nominated by China Department of Education as the official graduate textbook on digital system designs and was extensively used by Tsinghua and other China universities since 2000. He organized and taught two 5-day short courses on CUDA based massively parallel programming, which are the first teaching practices to systematically disseminate CUDA expertise in China. |

|

|

|

http://cityofzion.io/dapps/2CITY OF ZION IS LAUNCHING ITS SECOND DAPPS COMPETITION COMPETITION DETAILS The City of Zion (COZ) Council is happy to promote the second NEO dApps competition. Individual developers or teams are invited to join the NEO Discord #develop channel and submit their work to compete for 10 prizes of 1350 GAS. Winners of the #1 competition may submit apps to be judged, but will not be eligible for prizes. ENTRY SUBMISSIONS Submissions will open on 25 January 2018 and close on 25 February 2018. Any entries after this deadline will not be accepted as part of this competition. Applications can be made in teams or by individuals. Winners will be selected as per the voting process laid out in City of Zion governance item 7. Evaluated topics: - Smart contract application novelty and technical impressiveness. - Overall impact and importance to ecosystem. - Quality of documentation (english required). - Community presence (participation on CoZ channels). SUBMISSION REQUIREMENTS All submissions should be a working minimal viable product (MVP). The dApps submitted should have been demonstrated to work on testnet environments to be eligible for rewards. Smart contract code must be MIT licensed and properly documented. The remainder of the business logic, or supporting features around it can be fully proprietary. COMPETITION PRIZES On the 9th of March 2018 the City of Zion council will announce a list of 10 winners in Discord and on this competition page. Each winner will receive 1350 GAS to launch their applications, from which at least 500 GAS should be used to deploy the dApp. SUPPORT Source code for winners of last competition can be found in here. For the submission the City of Zion council will provide testnet NEO and GAS for developers and teams on our Discord. SUPPORT NEO STACK EXCHANGE! The Neo Blockchain Stack Exchange site was proposed in order to give developers like you a place to ask questions, get answers, and discuss the Neo blockchain with each other. We're about halfway there to getting the site to Beta status, and every commit to the proposal helps. Commit to the Neo Blockchain proposal here!

|

|

|

|

NULS' Price Hovers At $4.60 — But Could It Be An Ethereum Killer? http://www.ibtimes.com/nuls-price-hovers-460-could-it-be-ethereum-killer-2645545CEO David Gobaud recently announced his new company Mobius Network is moving away from Ethereum to a competing blockchain. He isn’t the only one. Just last month, the mobile messaging company Kik said it too was moving its Kin project away from Ethereum. According to the team, Ethereum was only able to handle about 10,000 users, which was not enough to handle the millions it anticipates will be using Kin in the near future. So does this mean Ethereum is doomed? Is Ethereum going the way of AOL or Myspace, as Gobaud suggested? Maybe, but we are not quite there yet. The Ethereum team is definitely scrambling to fix things before it loses the lead. It is looking at “on-chain” scaling solutions such as Plasma, which will require more hard forks if implemented. There are also “off-chain” scaling solutions it can embrace such as Raiden Network, which will offload transactions from the blockchain. Many ERC-20 based token companies are looking at this solution right now. NULS And “Generation 3” Coins Just like how new enterprise clients are not waiting for Ethereum to fix their issues, nor are the competitors. We now have a whole new generation of blockchains being developed that promise to fix what Ethereum struggles with. They are considered “generation 3” enterprise platform coins. Generation 3 coins primarily focus on two main things. The first is super-high throughput, which allows thousands to millions of transactions to be conducted per second. The second is interoperability between blockchains. Since there are more and more blockchains being released in the cryptocurrency space, generation 3 platforms are built so that all these blockchains can talk to each other and become a bigger ecosystem. NULS is a new company out of China currently developing a new generation 3 platform. The cryptocurrency’s jumped to a high of $8.50 a couple of weeks ago — and we’ll get to why that’s important in a bit. NULS is taking a modular approach with its blockchain, meaning everything is treated like it’s a module. This includes its smart contracts, ledger, storage, network, accounts, consensus and processor. The reason for this is that any of the modules within the blockchain can be removed and upgraded without taking the whole thing down. That means hard forks are a thing of the past. Why NULS’s Modular Approach Is Significant The modular approach also helps with transactions and interoperability. NULS is built to handle sidechains, which are separate blockchains that share resources with the main blockchain. With this kind of setup, many of the operational transactions with messaging, voting, payments and accounting are offloaded and therefore not clogging up the main blockchain. Extending on the benefit of being modular, NULS built the platform to work with many different kinds of consensus mechanisms. That means sidechains or other blockchains that might be utilizing POS, POW, DPOS, and POC can all talk to each other and with NULS. NULS has already announced its first client is InChain. InChain, which occupies the anti-counterfeit space and has some ties to the Chinese government, will be occupying their own sidechain that will utilize the NULS blockchain. That is only the beginning. I spoke with the English community manager from NULS and he said the interest in NULS is high and there might be more partnerships announced soon. NULS’ Price Potential I think NULS is one of the most undervalued coins within the cryptocurrency space right now. Currently, NULS is priced $4.60 with an overall market cap around $110 Million. The decrease from its highs are from the correction the whole market experienced the last few weeks. Take a look at NULS in comparison with some of its competitors: Cardano: $17 Billion EOS: $9 Billion ICON: $3 Billion Ardor: $1 Billion Based on the current price and market cap position, NULS is 10 times cheaper than its nearest competitor — and 100 times less than Cardano or EOS. That alone makes me extremely excited about the potential. NULS’ main platform launch is coming in March, and that is much further along than some of the other generation 3 platforms. From a technology perspective, the modular approach of upgrades and the unique consensus mechanism that allows it to communicate with basically any blockchain really gives NULS a leg up. Getting in with NULS at these levels is the same as getting in Ethereum, Ripple, NEO a year ago when they were dirt cheap. I see NULS with moonshot potential which means it can grow 10 to 20 times in the near future. With adoption, NULS has 100 times potential in the long term. |

|

|

|

An Inside Look at TRON (TRX) Founder Justin Sun https://theindependentrepublic.com/2018/01/26/tron-trx-founder-justin-sun/#mobile-site-navigationTRON (TRX)–Adapted from his recent interview with Tron.Live, here are a few insights from Xu Le (CEO of Game.com, a major partner of TRX) into the tireless, and at times controversial founder of Tron, Justin Sun. Overcoming TRON Skeptics Le admits that when he first looked into Tron, predating the partnership with Game.com, he was skeptical of both the project and its outspoken founder, “When Justin introduced Tron in China, I’ve actually seen his whitepaper. That time, I’m quite ignorant and thinking that isn’t this just imagining things out of thin air? I couldn’t see how these pieces will come together.” Le’s initial impression of Tron is in line with the criticism many have towards Justin Sun and the TRX white paper: an outspoken founder who has made bold claims that seem too large to fill. The white paper, in particular, has drawn controversy in its English translation with claims of plagiarism. It’s worth remembering that Tron is in its nascent form, having only come online since August 2017. The white paper could be a rushed effort, it could be a limitation of proper translation to Western business, or it could be the source of evolution. Tron and Justin Sun have made big claims. But so has every cryptocurrency. The goal of Bitcoin is to create a currency as ubiquitous as government fiat that it could be a replacement. There are many advantages to Bitcoin: decentralization, security, deflation, etc. that have drawn excitement to the tune of a 200 billion USD market capitalization. But if you asked any politician or Wall Street banker if Bitcoin can replace US dollars (insert your country of choice here), you would get a resounding no. That doesn’t make Bitcoin any less compelling. If anything, the loftier the goal and expectation, the greater the excitement created. Justin Sun has a similar sentiment with Tron. For every naysayer and reputation-smearer TRX has, there is another investor motivated to support the project. So while the current manifestation of Tron may be out of proportion with realized expectations, that could all change within the next six months. Xu Le is willing to give Justin Sun the benefit of the doubt, content with the idea that he doesn’t have to understand the broader picture of Tron or have a definitive road map. Instead, he is interested in investing in a partner he finds to be highly motivated and potentially visionary: i.e. Justin Sun. Impressed by Justin Sun’s Determination When asked about his initial impression of Justin Sun, Le gave this response, “After [the China Ban], an ordinary person just won’t know the pressure that Justin has gone through. Despite this, Justin was able to revitalize Tron in a global market and in such a large scale, getting Tronix listed on so many exchanges, doing a lot of PR, and so on. So, no matter how Tron will perform in the future, what we are seeing today is how determined a person can be and how one is able to cope with such a tremendous pressure and do it well.” Tron presents a bit of an anomaly in the world of cryptocurrency. Many investors and enthusiasts are spurred by the idea of decentralization–the lack of any singular or collective controlling authority. Many people think the technology should speak for itself. This camp finds Tron an enterprising project, but one muddled by the peddling of its founder. However, this concept of crypto-backers wanting a lack of authority is unfounded in the history of cryptocurrency. Bitcoin benefited tremendously from the input and direction of Satoshi Nakamoto, so much that he has developed cult status in both the cryptosphere and general public in solving the mystery of his identity. People treat Satoshi’s vision for Bitcoin with the same dogma and reverence they would the U.S. constitution, which has led to a heated debate and division over hard forks. Bitcoin Cash is held entirely in the vice grip of a handful of players, the most vocal of which is Roger Ver. Ver has become the primary arbiter for the promotion and continuance of Bitcoin Cash, an occurrence few BCH holders seem to mind–even going so far as to promote Ver’s heavy-handed antics. Litecoin has also suffered the withdrawal of Charlie Lee’s dramatic exit from Litecoin, leaving many LTC fans reeling in the aftermath. Cryptocurrency does not have to be beholden to a central player, but it’s hard to deny the market craves a figurehead for news, direction and assurance for the coins they are investing in. Many projects in the space have suffered, at least in terms of monetary capitalization, from the lack of a consistent place to feel “the pulse” of what’s going on with the currency. Even the top 100 of market capitalization is littered with coins that may or may not be dead in the water–it’s hard to tell without an authority figure to gauge upon. Think of cryptocurrency investing like angel investing: each coin presents an interesting, potentially novel technology that is attempting to solve a problem. You should research the tech, the problem, and the potential wealth that could be generated, but you should also be looking at the team. Justin Sun has the credentials. He has proven to be a determined and tireless advocate for his currency. He has built an impressive number of partnerships for a company that has only been in operation for less than six months. You can bet, even with the price of TRX plummeting, that this will not be the end of Justin Sun’s commitment to growing his product. If there is any reason to be bullish on the price of TRX it’s this: Sun will almost certainly find a way to bring the price of TRX back to its previous ATH, which constitutes a gain of over 300%. Ability to Grow TRONIX At one point in the interview, Le is asked candidly his opinion of Justin Sun. His response tells volumes on the future of Tron and the value of Tron partnerships, “When a person is able scale something from scratch to a global large scale, we can gauge one’s ability form this. Tron went from a market cap of $2 billion to an all time high of $16 billion market cap after partnering with us…What we should focus on is this young man’s determination, endurance, and execution of tasks under pressure.” Le comments upon the plunging market capitalization and price of TRX but also contends the point with the overall dip in the crypto marketplace. Instead, as he says, it’s more important to look past the fluctuations in TRX valuation and instead focus on what Justin Sun was able to accomplish: scaling a company from the ground floor to 10 billion+ in five months. Now we realize: it’s crypto. Billion dollar valuations are a dime a dozen, and market capitalization has less meaning when compared to the traditional stock market. But, the sudden rise of Tron proves two things: Justin Sun can drum up enough excitement to draw significant media attention and investor dollars, and there is now a nucleus of followers with a significant stake in seeing Tron flourish. Both bode well for Tron’s long-term price and ability to bounce back from the recent drop. TRON in 2018 Here’s what you should do if you are a current investor of TRX or waiting on the sideline to buy in at the low price: read Xu Le’s take on Justin Sun and that of other CEOs Tron is partnering with. Ignore the negative press and FUD campaign and instead focus on the broader picture Sun has for Tron and what TRX’s valuation could be a month, a year, three years from now. Cryptocurrency has created a horde of myopic traders and enthusiasts. It’s like watching people stuck in traffic. They jump from one lane to the next, hoping to speed ahead. Practice patience. Start studying the market, the technology and what the team behind each company brings. TRX is under a hellstorm of bad publicity, most of which is through no fault of Sun or the Tron project. TRX created an overwhelming amount of jealousy in its meteoric rise to the top ten of market capitalization. It then created an equal amount of animosity in investors spurned by the sudden drop. But the vitriol is largely undeserved. Sun, in his short stint in the spotlight, has proven to be a special founder, not all that dissimilar from a Steve Jobs. He aims big with his project, but he also expects big to occur. So while you can ridicule Tron for its most recent drop in price, you can’t rule out that Justin Sun is exactly the type of founder to steer his project back into the green and to new highs. |

|

|

|

Chinese Initial Coin Offering Ban May End In 2018https://usethebitcoin.com/chinese-initial-coin-offering-ban-may-end-2018/Cryptocurrencies and Initial Coin Offerings (ICOs) have been hardly punished in China with regulations. But apparently, new regulations prepared for 2018 would end the ban over ICOs. The information has been released by China’s People’s University Law School vice president Yang Dong. New Regulations Ahead – The End of the ICO Ban? The Southeast Asia Blockchain Summit was important for the cryptocurrency community. Mr Yang Dong has spoken there and commented that he believes that the cryptocurrency trading and ICO ban would not continue indefinitely. When China decided to ban ICOs, the market reacted by losing almost 50% of its value. Bitcoin, which previously reached $5,000 fall down to $3,000 dollars. China has taken the decision to ban Initial Coin Offerings due to the fact that some of them where fraudulent or wanted to steal money. That’s why ICOs were obliged to return the funds received to their owners. Yang, who is also director of the Centre for Financial Technology said during an interview: “Good ICO projects are allowed to develop in a legal and risk-controlled environment rather than simply adopting a one-size-fits-all approach. The China Securities Regulatory Commission may launch equity crowdfunding pilot program in the near future, which will be an opportunity for ICO to get in compliance.” About China we have also heard that miners would not be able to keep with their activities. According to local media, the rumours about a cryptocurrency mining ban were not real and tried to spread fear in the cryptocurrency community. Local governments from several provinces have been welcoming mining activities in some industrial parks. Miners do not create pollution, od not disturb people in the area and they do not need government loans. But China is not the only market that has been suffering from strict regulations. South Korea has been in the news because of possible regulations that could affect Cryptocurrency trading and other activities. But at UseTheBitcoin we have stopped spreading FUD explaining that a possible cryptocurrency trading ban is illegal in the Asian country. It will be important to follow which regulations will be available now on in China and how ICOs will be able to operate in this Asian country.

http://Chinese Scholar: China To Release New Policy On Cryptocurrency And ICO in 2018http://news.8btc.com/chinese-scholar-china-to-release-new-policy-on-cryptocurrency-and-ico-in-2018"First of all, the ICO itself should have a (legal) position. It is a financial innovation, which should be regulated by the government by sandbox etc. Good ICO projects are allowed to develop in a legal and risk-controlled environment rather than simply adopting a one-size-fits-all approach. Second, the ICO should be regulated as securities, or as pilot program for equity crowdfunding. China’s CSRC may launch equity crowdfunding pilot program in the near future, which will be an opportunity for ICO to get in compliance."

|

|

|

|

Cryptocurrency Industry Spotlight: Who is NEO’s Da Hongfei? https://coincentral.com/cryptocurrency-industry-spotlight-neos-da-hongfei/Who is Da Hongfei? Da Hongfei is the founder of NEO, a blockchain platform for distributed apps. He is also the founder and CEO of Onchain, a blockchain development company for enterprise and institutions. Both projects are headquartered in China and were the first blockchain development projects based in China. Hongfei has earned his status as blockchain and cryptocurrency pioneer in Asia. He is now one of the most respected experts in crypto, especially when it comes to Chinese user adoption, enterprise applications, and government regulation. In this spotlight, we’ll take a look at Hongfei’s career in crypto and dive deeper to understand his role in the greater cryptocurrency landscape. Da Hongfei and the Blockchain World Da Hongfei’s cryptocurrency story kicks off in 2014 with the founding of Antshares (now known as NEO) and Onchain. The Founding of NEO (Antshares) Antshares began in February 2014. It was designed to be a platform for building decentralized apps. The first of its kind in China, Antshares paved the way for future Chinese blockchain projects. NEO NEO’s technology allows for smart contracts (like Ethereum). However, NEO runs a virtual machine that allows developers to code these contracts in C#, Java, Python, or other popular coding languages. You no longer need to know a new language to code smart contracts. In April 2016, the team released a whitepaper on a new type of consensus protocol (dBFT – delegated Byzantine Fault Tolerance), the first from China. This is the protocol that NEO nodes use to reach consensus and finalize transactions. dBFT allows NEO to maintain a transaction speed of 1,000 TPS, with optimization this can go up to a much higher level. Compare that to Ethereum’s 15 transactions per second, and you get a sense that NEO is built for large-scale, high-frequency use. The Founding of Onchain Hongfei and Antshares CTO Erik Zhang also founded Onchain around the same time. This company approaches enterprise blockchain use from the other direction. They provide consulting and development services to the many private companies interested in blockchain.  Onchain started seeing some high-speed velocity in 2016, further developing Antshares and becoming the first Chinese blockchain company to join Hyperledger, which has helped to further develop Onchain’s product called DNA. DNA, or Distributed Networks Architecture, enables the integration of business systems and the support of cross-chain interoperability. DNA’s design allows blockchain to be applied to a variety of uses cases while collaborating with government regulations, deciding on a consensus protocol, being unable to connect with other blockchain applications, or even finding developers to build out your own blockchain or applications. OnchainIn June 2016, Onchain partnered with Microsoft China. Onchain also partnered with FaDaDa to found Legal Chain to address several inadequacies of legal digital applications. Onchain was also voted KPMG’s top 50 Fintech Companies in China, and announced a partnership with Alibaba for a email evidence repository for enterprises powered by blockchain. Essentially, DNA is a platform that allows other existing platforms to utilize blockchain technology without having to reinvent the wheel. OnChain’s DNA aims to facilitate mainstream adoption and cross-chain communication. Synergy Between NEO and Onchain: Da Hongfei’s Master Plan For context, the relationship between NEO and Onchain is that of Ethereum and Enterprise Ethereum. Onchain works on blockchain projects with large enterprises and has collaborated with the Chinese government in the past, which ultimately helps the NEO ecosystem. The NEO ecosystem develops the platforms for future blockchain growth in China. In the future, as well see later in this article, NEO will bridge the gap between private institutional blockchains and public ones, creating a unified blockchain economy. To find out more about Onchain and NEO, I recommend our guide on NEO. Consulting the Chinese Government One of the most notable and often understated roles Hongfei has played has been establishing a constructive line of communication with Chinese government officials. China cracked down on cryptocurrencies in the wake of ICO-mania, where dubious ICO projects were flying out of the woodwork at the expense of naive investors. As one of the world’s leaders in tech innovation and home to a huge population of entrepreneurs and developers, closing the curtains on crypto would have been an extremely unfortunate missed opportunity. Hongfei played an instrumental role in working with the Chinese government before and after the ban to create a healthy atmosphere for blockchain innovation in China without the scammy projects. Hongfei’s Reaction to the Chinese ICO Bubble Hongfei compared the ICO situation to that of the early 2000s dot-com bubble, “When you started a business that ended in ‘dot com’, you could easily attract capital. The same is what you see with the ICO buzz.” He went on to say that new technologies will always generate bubbles, because investors get excited more quickly than the technology can develop to keep up. However, after bubbles, the technology always catches up and the market recovers. Although the cryptocurrency situation in China is far more complicated than just a few pesky scammy ICOs, it’s worth noting Hongfei’s influence. As the founder of Onchain and NEO, a smart contracts ecosystem that supports the development of dapps, Hongfei was able to take ownership of the cleaning of the space. The battle for crypto in China is far from over, but by having more positive figures in the space like Hongfei, the conversation can continue towards innovation rather than destruction. China’s Plan China recently published their 13th Five-Year Plan, which touched on the prioritization of blockchain development in the next five years. In 2017, China’s Central Bank also published a similar plan on Fintech development with the goal of “Strengthen foundation, Increase safety, Promote innovation, Develop standardisation and Improve regulation” Additionally, the Ministry of Industry and Information Technology of the People’s Republic of China published “The National Blockchain Standard”, which Onchain was one of the first to pass this new standard. The Future Hongfei has big plans for the future of Onchain and NEO. 2016 and 2017 generated the biggest buzz for NEO yet, and the momentum continues for both endeavors. Hongfei is optimistic for Onchain’s future as well: “Our vision is to make Onchain a truly universal Blockchain framework. Utilizing different plug-in modules, our framework could be applied for a public chain, a consortium chain or even a private chain. Our cross-chain adaptor module, currently under development, creates interoperability among these different chains.” -Da Hongfei, Oct 5th, 2016. NeoX + Onchain The master plan ultimately involves synergy between NEO and Onchain. While it won’t come in the near term, expect NEO and Onchain’s services to link within the coming years. NEO already has plans for NeoX, their platform for cross-blockchain transactions. If successful, NeoX could link private blockchains to the larger public market. A blockchain crossing tool like that could be as useful as APIs are in web development, allowing for some private code to be interoperable with a public ecosystem. This would enable the interoperability between blockchains whether public or private. Once connected, NEO and Onchain will hold a complete ecosystem of technology. They could intermediate a whole new blockchain-driven economy. This is Da Hongfei’s master plan. It’s brilliant, and so far he’s executing well. Conclusion Da Hongfei is one of the premier luminaries in crypto right now. His connections within the Chinese government, status as a pioneer in Chinese crypto, and position at the helm of two major Chinese blockchain companies means he’ll be a key player in the development of cryptocurrency. If you’d like to see Da Hongfei speak, you can catch him at Blockchain Connect in San Francisco on January 26th, 2018. Snag 30% off tickets with the code ‘coincentral’. [SOLD OUT]  Additionally, Da Hongfei will be speaking and touching on “The New Vision” for NEO at the first NEO Developers Conference in San Francisco on January 30th and 31st, 2018.  |

|

|

|

How WePower’s blockchain-based energy financing will revolutionize traditional financing for renewable energy systems https://medium.com/wepower/how-wepowers-blockchain-based-energy-financing-will-revolutionize-traditional-financing-for-f93cf11a7145Mobilizing finance for investment and innovation in low-carbon renewable power systems is a key driver for climate change mitigation. There are currently many ways to finance renewable power systems including traditional private equity financing, tax equity, renewable energy bonds, leases, power purchase agreements and more recently crowdsourcing, property assessed clean energy, virtual net metering and other creative methods for financing renewable energy projects. Traditional project finance is subject to geographic, government, and regulatory uncertainty based on different rules and regulations depending on where renewable energy systems are being developed. As well, a major bottleneck limitation with traditional renewable energy financing is that most projects require power offtake agreements such as Power Purchase Agreements (PPAs) to be in place before financing is approved creating many risks for developers. This creates a situation where many projects are not approved due to the financing methodologies requiring that the entire projects output be accounted for over the life of the project typically 15 to 20 years. What this typically means is that the entire energy output of the renewable power system must be bought with a guarantee for the life of the project limiting projects to those who can commit to 15- 20 years of green energy purchases. WePower is a blockchain-based green energy trading platform. WePower enables renewable energy producers to raise capital by issuing their own energy tokens. These tokens represent energy they commit to produce and deliver. Energy tokenization standardizes, simplifies and opens up a globally energy investment ecosystem. As a result, energy producers can trade directly with the green energy buyers (consumers and investors) and raise capital by selling energy upfront, at below market rates. Energy tokenization ensures liquidity and extends much needed access to capital.......... |

|

|

|

|