I know this is a necro thread, but 3.5 years ago I made the predictions below... model is still holding. I know the S2F model has more media these days, but it agrees almost exactly with what I was thinking when I wrote this thread. ... just saying. For speculation purposes, IF we continue the same exponential trend, we are looking for the following price targets (note we are a bit above where the trendline says we should be right now):

1 Jun 2017 : $1,243

1 Jul 2017 : $1,335

1 Aug 2017 : $1,436

1 Sep 2017 : $1,546

1 Oct 2017 : $1,660

1 Nov 2017 : $1,786

1 Dec 2017 : $1,918

1 Jan 2018 : $2,064

23 Mar 2018 : $2,500

8 Jun 2018 : $3,000

8 Oct 2018 : $4,006

1 Jan 2019 : $4,899

1 Jan 2020 : $11,630

1 Jan 2021 : $27,675  |

|

|

|

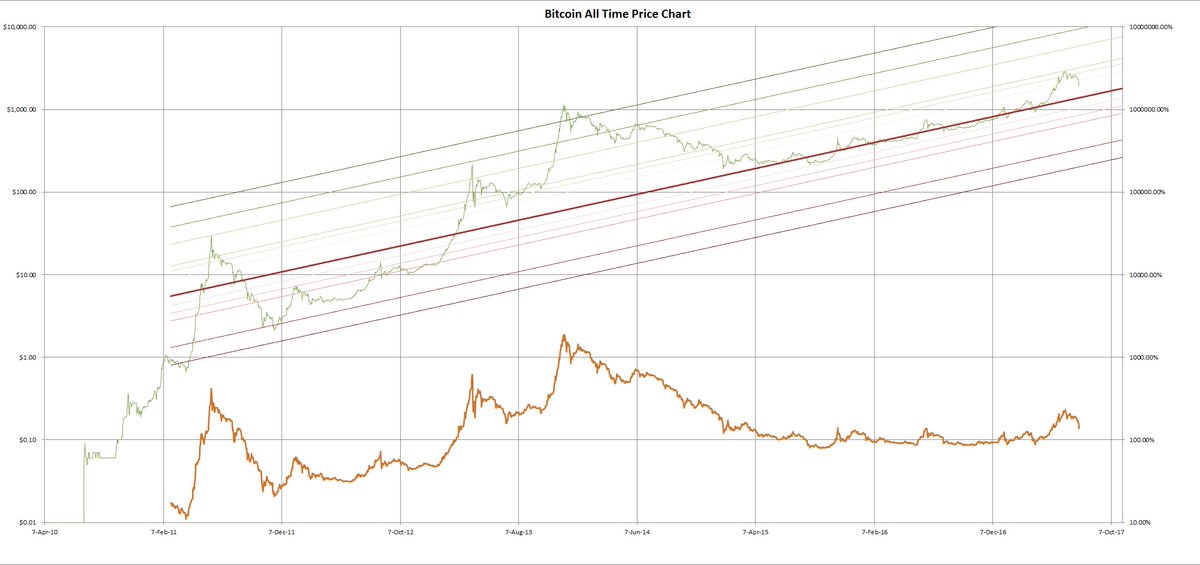

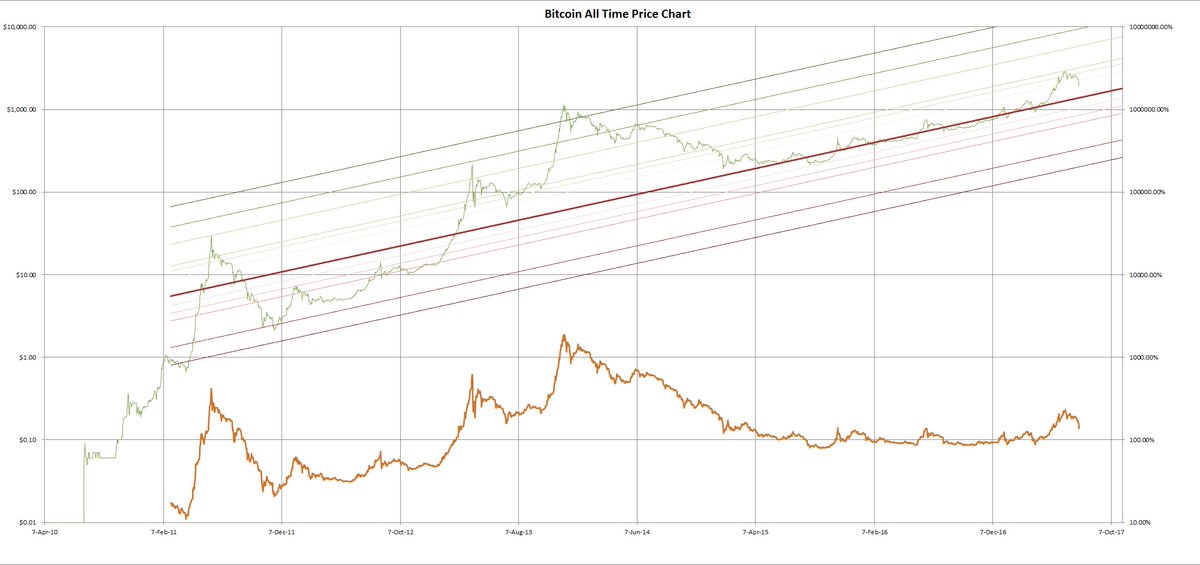

Updated graphic of how the trend has aged over time; the upper graph is the price (plotted on the logarithmic price scale on the left) with the forecast line in bold, and the bottom graph is the actual price graphed as a percentage of the trend predicted price, plotted on the logarithmic percentage scale on the right side.  |

|

|

|

Just posting a quick update. I admit I kinda "forgot" about BitcoinTalk in favour of Crypto Twitter these days, but thought I should at least update this - and yes, it's still relevant! So, when we had the pullback in November 2018 the price was way above the "forecast" price according to the model I outlined in 2017. I had hoped I was wrong and that price would keep above it, but lo and behold we swung around and pulled below it:

Date Forecast Price Actual Price % Actual of Forecast

1 Nov 2018 $4,240.84 $6,316.09 148.93%

1 Dec 2018 $4,553.19 $4,097.44 89.99%

15 Dec 2018 $4,706.72 $3,171.72 67.39% <== Lowest price since 2017

1 Jan 2018 $4,900.13 $3,710.86 75.73%

7 Feb 2019 $5,348.99 $3,365.06 62.91% <== Farthest below trendline

11 May 2019 $6,667.26 $6,901.48 103.51% <== First point above trendline since December 2018

16 May 2019 $6,746.70 $8,052.61 119.36%

What does it all mean? Maybe nothing, but the long term trendline has been a source of comfort to me, at least. It says the pullback in November was not at all unexpected since we were still so far above the "expected" price. It also says that since the over-correction, the trend has been "pulling" the price up. Note back in 2015-2017 when we stuck closely to the average price increase per day, we bounced around +/- 20% of the trendline. So I would not be surprised if we do the same thing again. If so, I'll be happy... (Note we are about 20% above, and I an seeing people calling for a pullback now, which would again be in line with bouncing within that range of the trend...) Long term, the original numbers quoted below for future dates still holds. I'll try to post a graphic later. Cheers. For speculation purposes, IF we continue the same exponential trend, we are looking for the following price targets (note we are a bit above where the trendline says we should be right now):

1 Jun 2017 : $1,243

1 Jul 2017 : $1,335

1 Aug 2017 : $1,436

1 Sep 2017 : $1,546

1 Oct 2017 : $1,660

1 Nov 2017 : $1,786

1 Dec 2017 : $1,918

1 Jan 2018 : $2,064

23 Mar 2018 : $2,500

8 Jun 2018 : $3,000

8 Oct 2018 : $4,006

1 Jan 2019 : $4,899

1 Jan 2020 : $11,630

1 Jan 2021 : $27,675  |

|

|

|

Long term (since 2011), the price has had some large swings but overall maintained a roughly 0.24% per day increase (roughly 2% per week). Fluctuations now are less than in past years, meaning less dramatic increases - and less dramatic downturns as well. Graph up to mid-July, 2017:  If, on average, 2% per week increase isn't enough for you, then try the alts, but for now the trend indicates no signs of changing. Again, the long term strategy of HODL remains valid. |

|

|

|

|

Bitcoin will be whatever chain has the most hash power. It may indeed be BCC/BCH, especially if something fucks up and the 2x part of Segwit2x doesn't happen. We already know some Core developers are against it at all costs, so it's not a done deal.

IMO, we need ALL scaling options, including side chains and SW. However, the most important of all is the larger blocks. Long term, "Bitcoin" (the concept, and the recognized currency) will have larger blocks; so if the Core side never adopts it, or pushes it off too long, BCC/BCH will take over.

The short term price means nothing for the longer terms. Expect fluctuations, especially as people shore up their respective positions based on beliefs. In any case, it's not going away permanently. I think there will always be people that support it,

|

|

|

|

Hi,

yesterday yu changed the home page of bitcoinwisdom...

It was better before.

I really miss the old one.

Please, let the user choose, or do a page where is possible visualize the BTC market like before.

Your change will be very appreciated

Best Regards

Matthew

I agree.. not sure what's with the change to the home page. Where did the Bitcoin market summaries go? |

|

|

|

We are now at 86,1% :-)

I don't know, how could they said it already 86,1%? As I have seen at https://coin.dance/blocks and : - segwit2x at 42,6% - emergent consensus 41,7% - segregated witness 33.8% am I misunderstand about it? Or segwit2x + emergent consensus = 84,3% ? Or anyone could mention a better site to watch over this consensus, thanks. It's actually 87.5% of blocks mined today; you have to look at the little line on coin.dance; the blue bar is of the last 1000 blocks. Signalling only began on Monday, but the current rate is about 87.5%. |

|

|

|

Is the SegWit coming or what? Everyone says different things

probably yes, but it's tricky, because it's a combination of segwith which require 95% and 2mb hard fork, and from my understanding some miners don't like that the hard fork it's done after the activation in segwit2x... then you have the UASF users that don't like miners, and don't like the fact that miners are agianst the second part of activation of segwit2x, the hard fork of 2mb, than the core team which is not pro all this ah soap opera indded Again bitcoin core could just block the hardfork yet correct? This compromise will just remove the segregated witness roadblock. I just can't see core rolling over on this and giving all this future power On development to the miners. Cave from their view on decentralization and If they believe themselves, still believe a hard fork is dangerous and impractical. It will likely be another year of FUD, if they can't even agree to meet in person. Imho. Damn well hope I'm dead wrong. While this appears to be a significant compromise from the miners (it is - they are giving in to the segwit pressure), this is really nothing more than trying to put in the place the Hong Kong agreement that was worked out 18 months ago and, had it been followed in good faith, would be COMPLETELY activated at this point. As soon as BTC1 is released, the miners will run it, and immediately signal support for SW2X; it will only be a short matter of time after that that SW itself will fully activate (see https://medium.com/@jimmysong/segwit2x-what-you-need-to-know-b747e6326266). It would be really sad if after all this Core still doesn't work with what is clearly most of the community. 90%+ of mining power as well as all the other Bitcoin company signatories of the New York Agreement. BTC1 will move ahead with implementing the block size increase, and then it would be up to Core to effect the network split by not working on it. So yes, core could block the 2MB blocksize, but they would definitely be in the minority at that point. And also be clearly demonstrating their bad faith and failure to support much (most?) of the Bitcoin community. |

|

|

|

No, it doesn't.  Look at the 24-hour totals... signalling only began on Monday. 79.17% in last 24 hours; they are basing the numbers on hashing power committed, which will eventually result in enough blocks.  |

|

|

|

This in particular could be very bullish for the price, Classic & UASF die, bitcoin goes to the moon, rejoice. I think this is great news. Support for segwit2x seems to be there, which should mean that no fork should be incoming, at least not imminently, as feared. That's great news. Let's just hope we can get past the next hurdle (block size increase), which is also a key part of the segwit2x agreement. Until that happens, we won't be fully able to go to the moon. |

|

|

|

|

Price overall in crypto has been rising a too fast as of late. Too many newbies who don't understand the tech or the cycles ("weak hands") bought in, and so the correction at the peak is turning into a bubble pop for the whole market. Not the end of crypto or bitcoin by any means, but not surprising. Weak hands are in it to make a quick buck, and are far to skittish to handle the crypto markets.

Once the market finds a bottom, I expect experiences Bitcoin trades to buy back in at a steep discount.

Nervousness could also be triggered or affected by the approaching August 1 UASF, and again, lack of understanding of markets magnifies this effect. Going to take while to settle down after that date, no matter which way it goes.

|

|

|

|

UPDATE: Just to get back to sanity check in all this redness, the long term trend was saying this is where we should be today, 15 June 2017:

Date Target 80% Lower Bound

15 Jun 2017 $1,285 $ 1028

At current weighted price of $2,337.11, we are at 181.86% of forecast value. For speculation purposes, IF we continue the same exponential trend, we are looking for the following price targets (note we are a bit above where the trendline says we should be right now):

1 Jun 2017 : $1,243

1 Jul 2017 : $1,335

1 Aug 2017 : $1,436

1 Sep 2017 : $1,546

1 Oct 2017 : $1,660

1 Nov 2017 : $1,786

1 Dec 2017 : $1,918

1 Jan 2018 : $2,064

23 Mar 2018 : $2,500

8 Jun 2018 : $3,000

8 Oct 2018 : $4,006

1 Jan 2019 : $4,899

1 Jan 2020 : $11,630

1 Jan 2021 : $27,675  Here's something also interesting... extrapolating that same price trend back into history, since 12 Feb 2013 (more than 4 years now), we have never been more than 20% below the trendline. Applying a 20% contingency to the above numbers would mean the following potential lower bounds:

Date Target 80% Lower Bound

1 Jun 2017 $1,243 $ 994

1 Jul 2017 $1,335 $ 1,068

1 Aug 2017 $1,436 $ 1,149

1 Sep 2017 $1,546 $ 1,236

1 Oct 2017 $1,660 $ 1,328

1 Nov 2017 $1,786 $ 1,429

1 Dec 2017 $1,918 $ 1,534

1 Jan 2018 $2,064 $ 1,651

23 Mar 2018 $2,500 $ 2,000

8 Jun 2018 $3,000 $ 2,400

8 Oct 2018 $4,006 $ 3,205

1 Jan 2019 $4,899 $ 3,919

1 Jan 2020 $11,630 $ 9,304

1 Jan 2021 $27,675 $22,140 |

|

|

|

Technical analysis on Bitcoin is like technical analysis on penny stocks - worthless as the price can easily be manipulated by a single or a small group of investors, is very subject to news events, and the market is too small and immature.

Ultimately, Bitcoin has been one of the truest experiments in financial circles. Been largely left to evolve on it's own. I don't doubt that whales do buy and sell to affect price, but I don't believe all prices trending is due to that. As I stated in the beginning of the thread, I think there's mostly organic growth, which is why you can see patterns. it certainly was easier to manipulate years ago, but it's getting harder and harder to do that now. |

|

|

|

Your decision to eliminate cycle 9 seems right. We are seeing a pump in cycle 11.

Do you think if the pattern is repeated, the climb will end soon? Less than a month?

It's hard to get a good read this time. Believe it or not, this actually looks like it's not a bubble, despite the significant price rise. We haven't seen anywhere near the rapid rises we had in previous bubbles. The longer we move up gradually, or experience sideways movements, the longer this run can continue. So at this point, I see no end in sight. Big question in my mind is what happens as we approach August 1st - we could experience some significant changes as we get closer, maybe part way through July. Long term, the trend over the last 4 years has been a rise of about 2% per week, on average. Currently we are about 220% of the forecast price of $1276, as predicated by that trend. While high, I don't think that's enough to result in a significant crash. Corrections yes, but growth still quite likely. Have you updated the cycles to know if this rise is the main bubble of the cycle and how long can it last? 1 month, 2 month... I've been watching it, but haven't come to any conclusions yet. It's interesting that the significant rise is much more gradual than we've previously had, which I think is good. We may be on a longer trend up swing, maybe even to the point of being able to sustain that growth long term, possibly indefinitely..? I'll hopefully post some updated analysis in the next week or so. |

|

|

|

Yup all good for us and bad for big boys, those with 200K+ bitcoins when price increases $1 they earn $200K profit potentially, when price drops $5 they are losing $1M potentially, it is indeed very hard to imagine the feelings of such a whale when price drops $200/ $400 then he/she will eat up himself/herself to the bone because of the potential loss of $40M/$80M that is a huge difference when you think about it.

When price drops 10% (~$300 today), they lose 10% value on paper, same as everyone else. Yes, it's more $$$, but they still keep 90% of the value, and their net BTC worth has tripled since March, just like any other holder from then or earlier. |

|

|

|

Your decision to eliminate cycle 9 seems right. We are seeing a pump in cycle 11.

Do you think if the pattern is repeated, the climb will end soon? Less than a month?

It's hard to get a good read this time. Believe it or not, this actually looks like it's not a bubble, despite the significant price rise. We haven't seen anywhere near the rapid rises we had in previous bubbles. The longer we move up gradually, or experience sideways movements, the longer this run can continue. So at this point, I see no end in sight. Big question in my mind is what happens as we approach August 1st - we could experience some significant changes as we get closer, maybe part way through July. Long term, the trend over the last 4 years has been a rise of about 2% per week, on average. Currently we are about 220% of the forecast price of $1276, as predicated by that trend. While high, I don't think that's enough to result in a significant crash. Corrections yes, but growth still quite likely. |

|

|

|

Three Thoughts on the “Crypto Bubble” The world believes gold is a reliable store of value to the tune of trillions of dollars. If and when the world believes the same about Bitcoin, it will be worth 100x-1000x what it trades for today, and that can happen at whatever is the speed limit of people “buying in.” https://medium.com/@jdh/three-thoughts-on-the-crypto-bubble-1b5d2dbb5c31 |

|

|

|

I'm looking at the charts, and BTC is rising at the same speed, or even faster than previous ATH's. Does this mean a crash could happen within the next few days? I'm not saying it'll drop back to around the 700's, but I wouldn't be surprised if it dropped back to 1200, 1300. What do you think?

The current rise is nowhere near what we have seen in the past in the run-ups to ATHs; currently over the last couple of days we are up less than 10% each day; over the past month the total increase has only been around 40%. Back in 2013 there were times where the price would double within a day, and daily fluctuations were at least 10%, day after day. |

|

|

|

|