|

1

|

Other / Meta / Re: Spent 5 minutes trying to login with Tor

|

on: December 22, 2017, 04:52:03 PM

|

Tor won't keep cookies by default because the browser is set to always use the firefox private browsing mode.

You can change that by typing about:preferences#privacy in your URL bar and unchecking "Always use private browsing mode";

Most people use Tor because they browse during work times at the office, so you can't afford leaving traces cookies or anything outside the RAM. In any case, just wanted to check in to say that the situation has gotten much better. We've either had a new batch of Tor nodes that aren't banned by gstatic.com or whatever website related to Google captcha, or theymos has done some tweaking, but im seeing way less banned nodes and I can usually get the captcha to show up after 2 or 3 attempts. |

|

|

|

|

3

|

Economy / Speculation / Re: Futures leading to ETF and direct hedge fund exposure?

|

on: December 04, 2017, 11:42:17 PM

|

Wondering what you all think will be the effect of the futures market on the adoption of Bitcoin in Wall St, including the time scale.

Two of the planned three Bitcoin Futures markets are starting in the next two weeks. One $100 billion hedge fund in I believe the UK has already said they will start offering direct exposure to Bitcoin once futures go online. Many financial experts expect that futures will lead to the SEC accepting Bitcoin ETFs.

Futures are a sideshow that won't affect the market. The real thing we want is direct exposure through ETFs and hedge funds. Do you think futures will lead to this and how long will it take until we have a bunch of hedge funds and approved ETFs operating in Bitcoin?

Im not sure if we want ETFs just yet... it's too early. Also there's no way an ETF is going to get approved anytime soon, every time someone has tried, they have failed. Notice that the SEC said that since Bitcoin cannot be regulated, an ETF for Bitcoin cannot pass. I don't see how Bitcoin can ever be regulated, since if it's regulated it's dead, so I don't see how we can ever have an ETF for Bitcoin. But that's irrelevant, we don't really need an ETF to go to the moon. CME and Nasdaq futures are enough for anyone with money to get in and drive the price to the next level. Some futures don't even allow shorting, but I think CME does, so that's a risk that they may try to short. Let's see how it goes for them, I think a lot of idiots are trying to short Bitcoin and they are going to lose their money when it pumps back quickly. But the thing about the futures is that they are cash settled, so shorting or going long in the futures doesn't matter, they're not actually buying or selling bitcoin, just betting on the price. They're not investing they're just gambling. So the futures aren't the thing we're looking for, thats just the catalyst to get Wall St interested in getting into Bitcoin. And yeah while SEC did reject ETFs due to lack or regulation, everything I read from financial people is that a regulated futures market will advance the case of ETFs even though the futures market is entirely separate from the bitcoin market, which doesn't really make sense but hey if it makes them approve ETF I'm all for that. And I mean I don't think ETFs will be approved in the next few months, but maybe starting in the summer I could see it happen, Bitcoin marketcap might be over half a trillion by then which should be big enough for ETFs to jump in. But yeah it all comes down to if the SEC will approve them. Well, an ETF would mean than some clueless boomer can go into a regular bank and tell them to buy Bitcoin for him. Ultimately they are not really buying Bitcoin, the bank is just buying something for you which it's not holding your own private keys, and if you are not holding private keys you are not buying Bitcoin, buy a promise that they will keep the keys for you. And how do we know that banks are actually buying the BTC to back everything up? it's supposed to be that way and it's supposed to be regulated, but who knows. I would like to see as many options as possible for people to get into Bitcoin but people should learn that if you are not holding the private keys you are not being part of Bitcoin. |

|

|

|

|

4

|

Economy / Speculation / Re: Futures leading to ETF and direct hedge fund exposure?

|

on: December 04, 2017, 05:22:54 PM

|

Wondering what you all think will be the effect of the futures market on the adoption of Bitcoin in Wall St, including the time scale.

Two of the planned three Bitcoin Futures markets are starting in the next two weeks. One $100 billion hedge fund in I believe the UK has already said they will start offering direct exposure to Bitcoin once futures go online. Many financial experts expect that futures will lead to the SEC accepting Bitcoin ETFs.

Futures are a sideshow that won't affect the market. The real thing we want is direct exposure through ETFs and hedge funds. Do you think futures will lead to this and how long will it take until we have a bunch of hedge funds and approved ETFs operating in Bitcoin?

Im not sure if we want ETFs just yet... it's too early. Also there's no way an ETF is going to get approved anytime soon, every time someone has tried, they have failed. Notice that the SEC said that since Bitcoin cannot be regulated, an ETF for Bitcoin cannot pass. I don't see how Bitcoin can ever be regulated, since if it's regulated it's dead, so I don't see how we can ever have an ETF for Bitcoin. But that's irrelevant, we don't really need an ETF to go to the moon. CME and Nasdaq futures are enough for anyone with money to get in and drive the price to the next level. Some futures don't even allow shorting, but I think CME does, so that's a risk that they may try to short. Let's see how it goes for them, I think a lot of idiots are trying to short Bitcoin and they are going to lose their money when it pumps back quickly. |

|

|

|

|

6

|

Economy / Economics / Re: IMPORTANT! - US Senate Bill S.1241 to Criminalize Concealed Ownership of Bitcoin

|

on: December 04, 2017, 12:00:10 AM

|

|

I don't see how people are surprised that if they used Coinbase or other similar services, would get any sort of privacy out of it. The only way to have privacy in this world is if you accept payments in BTC, if you mined the BTC, or if you buy it over the counter, the rest of methods will always leave a track so you better be ready to explain the taxman what you are doing there. I have nothing to hide because all my bitcoins are of legal origin, but I just want to ask:

If you own BTC, but you don't report it and they never know until you sell them to buy some real estate for example, what would they say? You were committing a crime in theory by not reporting that you had BTC, so what happens when you sell them to buy a house and they realize you had them but never reported them??

|

|

|

|

|

7

|

Bitcoin / Development & Technical Discussion / Re: Bitcoint-Qt and -wallet parameter : Can't specify a different folder ?

|

on: December 03, 2017, 11:46:18 PM

|

-wallet=<file> Specify wallet file (within data directory) (default: wallet.dat)

Any idea why this is ?

I would like to use my main laptop SSD to house the wallet.dat, and use an external USB drive to house the blockchain and other related data, and Bitcoin-Qt was having none of it.

Any idea what the rationale is for not allowing a different path to your wallet.dat ?

As far as I've read is not really a good idea to split contents of the bitcoin folder, it's better to have it all on the same place. I saw people asking if they could split the chainstate files to make it faster by putting them in an SSD and they got told that its not a good idea.. But if you want to change the data folder: "C:\Program Files (x86)\Bitcoin\bitcoin-qt.exe" -datadir=d:\BitcoinData This will put the entire data folder in another hard disk called D: in a folder called "BitcoinDat" for example. |

|

|

|

|

8

|

Alternate cryptocurrencies / Altcoin Discussion / Re: Replay Protection BTC/BCC

|

on: December 03, 2017, 04:26:47 PM

|

Looking to stay in BTC but hedge my bets, so I'm selling off a small portion of BTC. I'm concerned, however, about losing BCC in the process.

Let's say I have 0.2 BTC in a cold storage wallet that existed before the hard fork. If I send 0.1 BTC to an exchange (e.g. Kraken), will the cold storage wallet then contain 0.1 BTC and 0.2 BCC? Or will those 0.1 BCC be lost if I do not first split them from BTC?

Just told this to some guy here trying to split his Bitcoin Gold: https://bitcointalk.org/index.php?topic=2511551.msg25672481#msg25672481If you want to move your BCC, you have to first move your BTC to a different BTC address so there isn't a match on both chains. BUT if you are moving your BTC, you are free to move it, your BCC will stay where they are now on the BCC blockchain. So you have 1 0.2 BTC in "Address1" at the time of the split You recieved 0.2 BCC in "Address1" If you send 0.1 BTC to anywhere, you will have 0.1 BTC in "Address1" and 0.1 BTC in "Address2" You will still have 0.2 BCC in "Address1" in the BCC blockchain The problem would be if you tried to move your BCC from Address1 to another BCC address while Address1 from BTC chain still has funds. I hope this is not too annoying to understand and I hope this data is correct because that is the rule I've been following. Note that I still didn't even access my BCC because im too lazy to move my BTC coins to another wallet.. |

|

|

|

|

9

|

Bitcoin / Bitcoin Technical Support / Re: Core sometimes stalls syncing blocks when nothing holds it back

|

on: December 03, 2017, 04:07:59 PM

|

I've been suffering from this since the early bitcoin-qt days when I started on bitcoin... huge gaps between download activity.. I have no idea why this happens. While the validation process has gotten faster, these huge gaps still happen. I would tell you to check on your connectivity (open proper ports) but then again as far as I know I have that set up properly myself and these huge gaps where nothing happens are still happening. And indeed when I close it and open it again it starts downloading pretty much right away. Edit: unquoted OP because he doesn't like it  |

|

|

|

|

10

|

Bitcoin / Bitcoin Technical Support / Re: Question about BTG and breadwallet

|

on: December 03, 2017, 03:57:22 PM

|

Hello guys,

I have a question about claiming BTG from breadwallet.

So i have read you can claim them by converting your 12 word seed into an adress and then claim the BTG.

Can i then send this BTG to bittrex for example and sell them?

My main question is; is it worth it? Is this risky in the way that i might loose my BTC?

Cheers guys!

I don't know what breadwallet is because i've never used that software, but im just going to tell you that to be 100% safe, to access forked coins (irrespective of if it has replay protection or not) you must first empty your wallet (move your BTC to other BTC addresses). Then, this now empty wallet, can be used on a BTG wallet to access your BTG. Note that in the case of BTG, you will have whatever balance you had at October 24th which is when the snapshot was took as far as I can remember. Then you can send these coins to bittrex or wherever you want in safety, because the addresses no longer match in both chains. |

|

|

|

|

11

|

Economy / Speculation / Re: For all Europeans: BTC 10000 euro

|

on: December 03, 2017, 03:44:19 PM

|

Odd that EUR is so small. The tax situation is much friendlier than the US in most EU states, there are more Europeans, though of course USD is more global, and they're cleverer and more attractive than Americans too.

Spare a thought for us pathetic Brits. We've never really had a proper exchange with smooth banking. £10,000 isn't a million miles away now.

Are you sure? Isn't Bitcoin taxed in USD just as capital gain tax at 25% and at 15% if you hold for more than one year? I think in some countries in Europe it can be as high as near 50%... it's a scam to be honest. I have no idea about how taxes was because I never had any money before bitcoin.. the only advantage of being poor is that you don't need to stress about taxes because you are so poor that you don't even qualify to pay many taxes in most cases, even if in some countries the poorest still pay the highest taxes, in fact this is the case everywhere since corporations like google and amazon pay tiny amounts in Ireland etc... anyway don't wan't to derail this, my point is, I got no idea about taxes, so instead of fucking up im just going to hold it long term and worry about that later. |

|

|

|

|

12

|

Economy / Speculation / Re: Bitcoin Can Be 1 Million in 2020

|

on: December 02, 2017, 07:28:37 PM

|

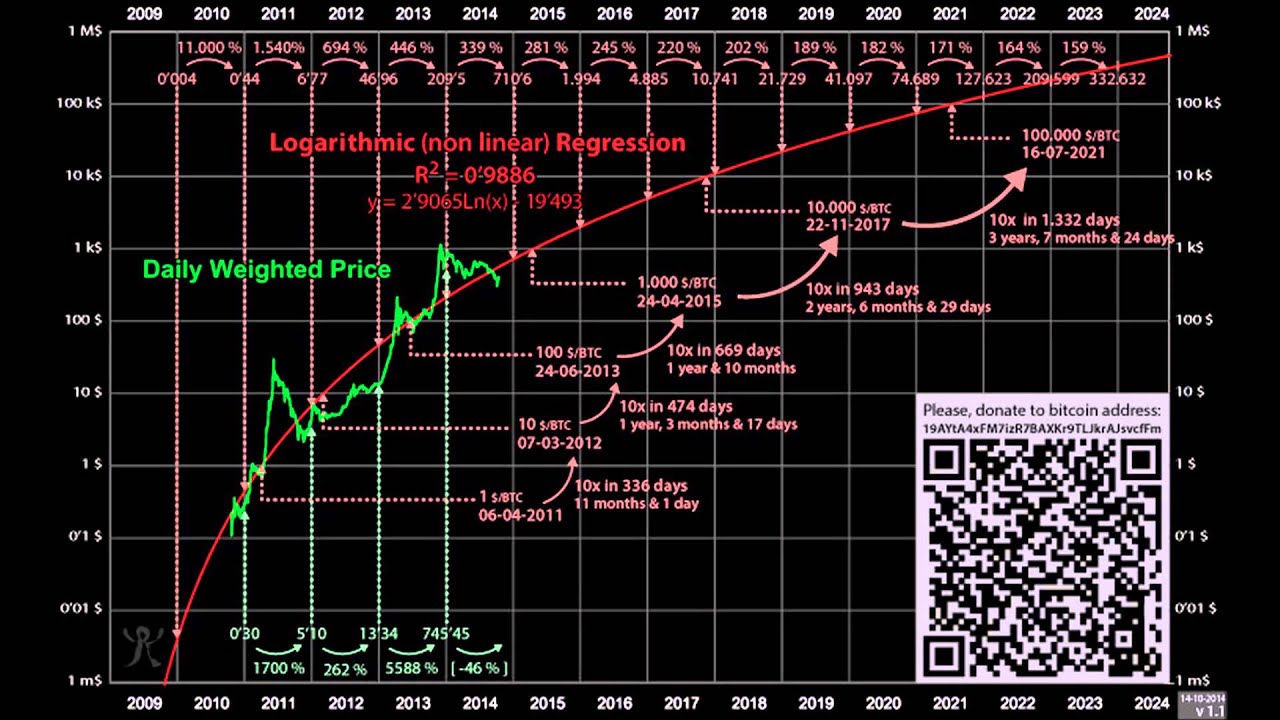

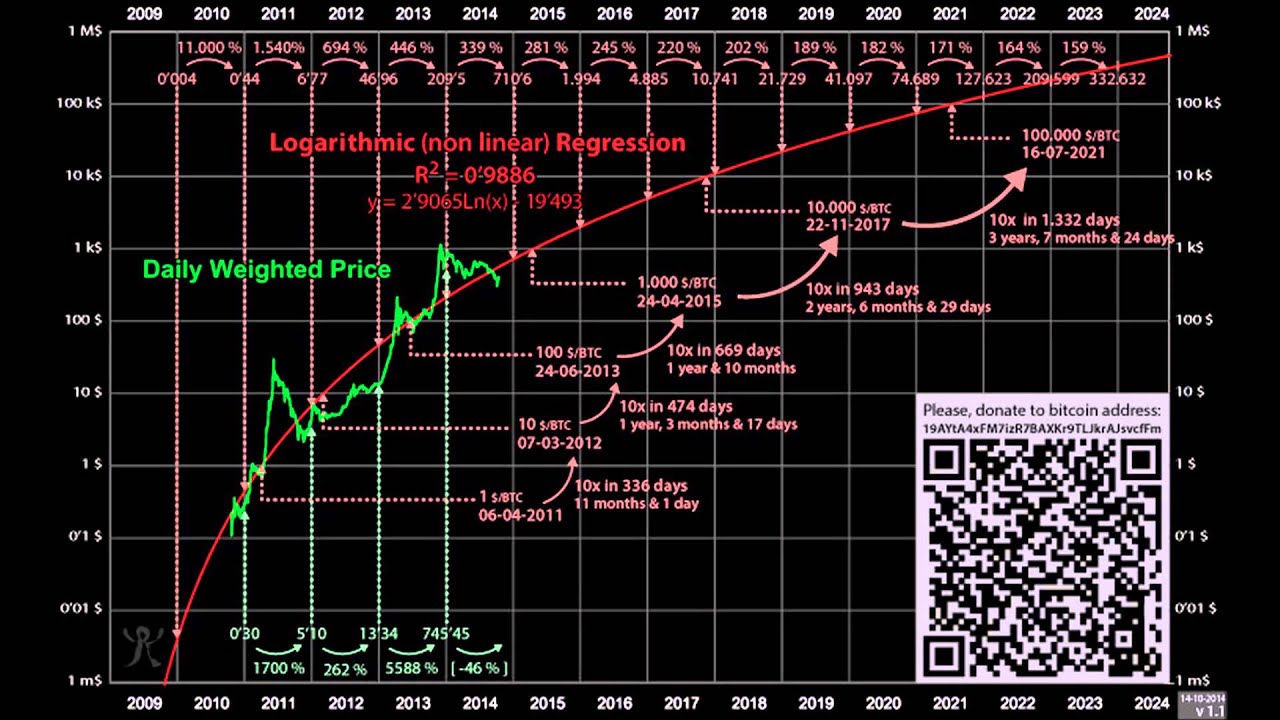

This prediction right there is the most impressive I have seen, maybe Tim Drapper used this same model for his very accurate prediction (which he almost nailed, in fact, he was a bit too conservative, since he said early 2018). Take a look at this:  If this model is correct, somewhere in the 2030 decade it should reach $1,000,000 $100,000 will be meet around 2021. The decade of 2020 may not still meet 7 figures. I think this model is to be taken very seriously, given past performance. Fundamentals are fantastic for Bitcoin next year with lightning networks solving scaling issues, which makes it bullish and this bull traction may be the beginning of the $100,000 bull run, coupled with CME and NASDAQ futures. |

|

|

|

|

13

|

Economy / Speculation / Re: FANTASTIC !!! --- 3 years ago Tim Draper predicted $10K per Bitcoin by 2018 !

|

on: December 02, 2017, 07:06:48 PM

|

He is definetely the brilliant clever guy   Nah, he's not "definitely the brilliant clever guy"...you're just succumbing to the natural human tendency to find connections and relationships between things that don't really exist. His prediction was just a guess. There's zero way he could have created a financial model to calculate the prediction. He literally, just got lucky. And if he'd made some other prediction no one would have even remembered that he was wrong as we approach the start of 2018. So you think his investments into twitter, Tesla, bitcoin and skype was merely a guess ?   Just one investment into Skype brought him $400 mln when it was sold to Ebay. Also it was his idea in 1996 to automatically attach advertising messages to the bottom of outgoing Hotmail emails. Yep, and this guy was deemed insane to buy 40,000 BTC back then. We had nobel prizes claiming how "bitcoin was a bubble and was going to crash". And now here we are, as they say, time puts everyone on their on place, and bitcoin believers have been compensated with great wealth, haters have been punished for doubting it. The good news is the fact that this has only begun. They are saying Mike Novogratz is too bullish with his $40,000 prediction for 2018, and just like Tim Drapper, he will come short (notice how Tim said 2018, and we crossed $10,000 before 2018). We will cross $40,000 next year and once again doubters will have a lesson on what exponential growth means. |

|

|

|

|

14

|

Other / Meta / Re: Satoshi IP Address

|

on: December 02, 2017, 04:28:37 PM

|

I was doubting this but theymos actually said it: I'll probably release Satoshi's PMs and logged IPs addresses in ~8 years. This'd probably be of great historical interest. (Though he always used Tor, as far as I can tell.)

So if that post was in 2013, in about 2021 he would release the data, which in my opinion is an huge mistake. Remember how much criticism Mike Hearn got when he released all these (supposedly real) emails? I think theymos would get a lot of shit from the community if he released that. Even if it would be "safe" to release the tor IP's because tor IP's are pretty useless and due the amount of time that has passed now (I think even a real IP would be useless to de-anonymize him since most ISP don't save logs for that long) it would go against one's privacy, I don't think satoshi would like that. Honestly im curious to see if satoshi ever said anything further when it comes to blocksize, forks and other controversial topics privately, but then again, it's better that we stop worshiping anyone including satoshi and think for ourselves. |

|

|

|

|

15

|

Other / Meta / Re: Caution: My Hero account has been potentially compromised

|

on: December 02, 2017, 04:20:05 PM

|

|

That's a lot of signatures. I verified the message of all of them on my Bitcoin Core node and it seems all of them are correct, so im sure that you will eventually get your account back, just keep trying, theymos and cyrus are very busy. Currently more and more people keep getting hacked, just look on the page 1 of the meta section. This must definitely be a database hack or something, it doesn't seem normal, but then again, this is one of the biggest forums i've ever seen, so maybe the rate of hacks to users is actually reasonable, hard to say.

|

|

|

|

|

16

|

Economy / Speculation / Re: Let's get real, $20k by April, $50k+ 2018, $100k+ 2019

|

on: December 01, 2017, 11:49:03 PM

|

I'm not even kidding guys. It has become clear that Bitcoin is entering the mass market now, though still just at the very start of it. While the 11x in the past 11 months has been astounding, this is just the beginning.

We will see 6 figures before 2020. Bitcoin user adoption is gonna grow from a couple dozen million now to hundreds of millions the next two years. Institutional investment in Bitcoin is gonna grow from basically non-existent now to a major new asset class for wall street in the next two years. $100k in two years might actually be a low prediction.

Im hoping that the lightning network comes by late 2018, or at least that's what Matt Corallo aka TheBlueMatt on twitter has guesstimated. If LN can come and they can get it done right, then we can finally "bank the unbanked" and everyone will be able to transact in the global bitcoin economy, fast and cheap. Store of value + fast velocity transactions all on the same currency would easily make it go several trillion dollars up on the marketcap, surpassing gold. Only at $1Trillion, i think the price would be sitting around $80,000, considering the available supply et al. We have definitely been surprised with the $10k correction becoming true, and im sure we will be surprised again rather soon. The future is brighter than ever for bitcoin now that we don't have the hardfork trolls anymore. Don't fall for the FUD, specially when they come from legacy banking CEO dinosaurs. That would be great if LN arrives by end of 2018. Personally I'm not even sure LN will be THE solution. It's what everyone talks about but after hearing about how Ethereum's Raiden Network would work (which is their LN equivalent) I have some serious doubts about LN. Even if it does provide the solution Bitcoin is looking for, I'd be surprised if it hit before 2019. I mean I'm just guessing, but I would think maybe it would hit testing by the end of this year and then maybe a few months later sometime in 2019 it would go live, and then you need all the clients to implement LN transactions, and you need the actual LN nodes to be set up. I don't see it really being in use until close to 2020. I mean hell Segwit activated months ago and it still has barely even been implemented into clients, segwit transactions are at like 10-12% right now. But yeah if LN is a good solution, whenever it is all set up and in use Bitcoin will finally be the global payments solution that it is trying to be. Though I'm pretty damn sure well before that happens the Core team is gonna have to agree to fork to larger blocks or else we're gonna have really high fees for a couple years and that will hurt Bitcoin. Well, im just quoting a guy that works on LN like Matt Corallo, he said that late 2018 is a decent guess-estimation of when things could be primed for mainstream usage. I think with segwit we can keep the blockchain at pretty low fees until then. Note that the blockchain only gets expensive in very particular moments: https://jochen-hoenicke.de/queue/#30dThere is a ton of spam from attackers out there, when they run out of money, the blockchain becomes pretty cheap to use, and with segwit just with cents you can be transacting. We can keep it accessible for most uses until LN is available pretty easily. Also I've heard Raiden is a "poor man's" LN. Don't know the technical details but that's what I've heard. And LN is backed by none other than Nick Szabo, so it is pretty serious, this is not some gimmick solution as some haters like to make it appear to be. |

|

|

|

|

17

|

Economy / Speculation / Re: Let's get real, $20k by April, $50k+ 2018, $100k+ 2019

|

on: December 01, 2017, 07:07:49 PM

|

I'm not even kidding guys. It has become clear that Bitcoin is entering the mass market now, though still just at the very start of it. While the 11x in the past 11 months has been astounding, this is just the beginning.

We will see 6 figures before 2020. Bitcoin user adoption is gonna grow from a couple dozen million now to hundreds of millions the next two years. Institutional investment in Bitcoin is gonna grow from basically non-existent now to a major new asset class for wall street in the next two years. $100k in two years might actually be a low prediction.

Im hoping that the lightning network comes by late 2018, or at least that's what Matt Corallo aka TheBlueMatt on twitter has guesstimated. If LN can come and they can get it done right, then we can finally "bank the unbanked" and everyone will be able to transact in the global bitcoin economy, fast and cheap. Store of value + fast velocity transactions all on the same currency would easily make it go several trillion dollars up on the marketcap, surpassing gold. Only at $1Trillion, i think the price would be sitting around $80,000, considering the available supply et al. We have definitely been surprised with the $10k correction becoming true, and im sure we will be surprised again rather soon. The future is brighter than ever for bitcoin now that we don't have the hardfork trolls anymore. Don't fall for the FUD, specially when they come from legacy banking CEO dinosaurs. |

|

|

|

|

18

|

Economy / Speculation / Re: Mark Cuban douchebag

|

on: December 01, 2017, 04:48:24 PM

|

So why is he always spouting off about how btc is in a bubble and will fall hard soon and continues to be proven wrong but he just keeps flapping his gums? Is he that butthurt he didn't buy when it was cheap or is he that stupid he doesn't understand what btc is?

All the sharks in the sharktank are fucking assholes, but he is really embarrasing himself.

When did he say it is a bubble? As far as I know, Mark Cuban has switched positions and now he is recommending people to invest a small amount of their portfolio on bitcoin, even on ethereum too. Look at this video: https://www.youtube.com/watch?v=vYdrMXkYQfMAlso he's trying to get an ICO going: https://www.cnbc.com/2017/06/29/mark-cuban-who-just-called-bitcoin-a-bubble-says-he-plans-to-invest-in-another-digital-coin.htmlThis guy clearly doesn't care about anything bitcoin has to offer, he just wants to get more $$$ out of it, so whenever he feels like wanting to short, he will FUD it, whenever he wants to buy back the dip, he will buy then pump it. Don't fall for their manipulation, long term we are only going higher. |

|

|

|

|

20

|

Economy / Economics / Re: Bitcoin drop about 20% after Lloyd Blankfein comments.

|

on: November 30, 2017, 08:06:30 PM

|

CEO of the USA Investment bank, Lloyd Blankfein said "something that move 20 overnight do not feel like a currency. It is vehicles to perpetrate fraud" after this comment on Thursday bitcoin lose over 20% and I was panic to sell off my holding. But thank God the bitcoin has started recovering as we can see that it is currently above $9,700. I think this is another caculated attacked on bitcoin image in other to create FUD.

Why are any of you still paying attention to whatever the fuck these scammers to say? First JP Morgan CEO Jamie Demon comments FUD on Bitcoin a bunch of times and each time it goes higher after the dip. And then the Goldman Sachs' CEO Lloyd Blankfein comments on how Bitcoin is volatile and not a currency, not even a creative or funny comment, just the same regurgitated nonsense we've heard a million times. If Bitcoin is volatile is because of panic selling idiots falling for the FUD each time. As we shed them out on the long term everyone holding will have strong hands and they will not sell every time the mainstream media tells you to do so. |

|

|

|

|