"Gold collapsing. Bitcoin UP"

I LOL everytime.

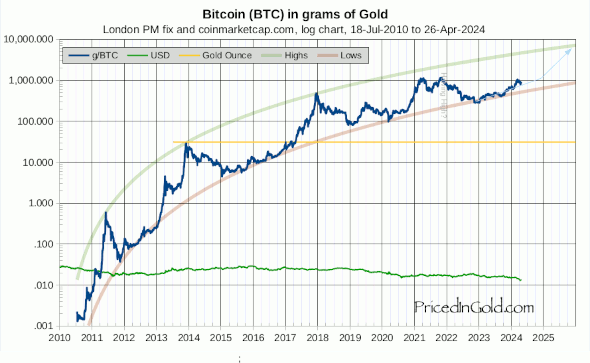

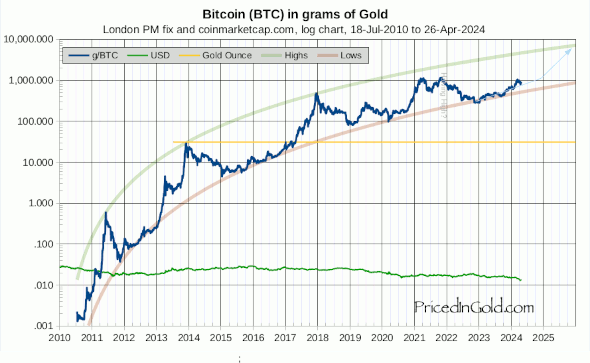

Collapsing in waves.  That chart sure looks pretty, but you should post a linear one, which shows a different picture  Everything that started at near zero and had fluctuations when it wasn't worth much and was eventually pumped way higher will have a similar chart in logarithmic scale. Price could go at double or single digits and still look like a decent uptrend in the chart you posted for someone who can't read a logarithmic chart like it's supposed to. You are saying there is nothing to worry if it even goes to double or single digits?  |

|

|

|

During the Silk Road Trial taking place right now, looks like evidence is being shown that Ross Ulbricht, accused of being "Dread Pirate Roberts" (DPR), the mastermind behind Silk Road 1.0, ordered Hell's Angels (a group of bikers) to kill a vendor on the Silk Road: https://twitter.com/sarahjeong/status/562316617103998979Sarah Jeong is a journalist who is posting real-time updates on the Silk Road trial directly from court. She writes: DPR pm commissioning the hit is very polite. "I would like to put a bounty on his head if it's not too much trouble for you." #SilkRoadTrialDPR pays Hells Angels $500k for tony76/nipplesuckcanuck and roommates. #SilkRoadTrial

Hell's Angels then takes $250k loss bc of Bitcoin price fluctuations. #SilkRoadTrialIt's still to be confirmed if this is all true, but, I just thought I posted this insane news. |

|

|

|

I don't ignore the long interest. It is half what it was earlier in 2014 and near the lowest levels for nearly a year.

Whereas short interest is highly correlated with the price and in a much higher range.

You ignore that coin supply is limited, regardless of the price per coin. You haven't been around long enough to see a bullish move in btc yet..

You don't know how much I have been around. I know a little thing or two about BTC and BTC trading, in case you were wondering, I didn't enter this game the same date (8 january 2015) of the creation of an account with the word "trollin" in it. This doesn't mean that I am here to post mindless trolling with this account (aside from a few pics and gifs for fun that is  ). I am here to post my opinions on bitcoin backed by concrete arguments and anybody is welcome to question them and discuss about them  I am perfectly aware of bitcoin price history and a lot of my threads are exactly about them  |

|

|

|

Considering how much money is on LTC swaps, yeah I can only imagine how many millions out of those $15 millions are dedicated to LTC. Like, who wouldn't have kept a long position on LTC since like july or something?

LTC price price dropped from more than $11 to $1 since longs have been at more than $15-20 millions. Whoever would have been so foolish to keep a long position in LTC that long would have been 100% margin called.

And they only dropped to like 10MM when BTC sank to $160, so why wouldn't it have all been margin called down to near zero? Your argument is that we should ignore the BTC shorts (which we know for a fact are BTC) because there are some 15MM in longs when we don't even know how much of that is actually against BTC. You then claim that LTC longs would have been liquidated going $11 -> $1, yet make no account for the fact that longs only went to $10MM going from $600 -> $160. -I didn't say we should ignore shorts. I said that in the current numbers they do not influence the price as much as inca is trying to show, at least not in the larger picture. Especially considering that longs are a lot more (and he is ignoring them while always talking about the shorts). -I said that I seriously doubt any significant portion of those USD swaps are used for LTC, considering how much little money is on the LTC swaps. Simple as that. No, below on 16.10.1987 is a crash. Post that date is post crash. Saying BTC has been "Crashing for months" is illogical.

*pic*

I never thought I would read that. If the chart I posted is not "crashing for months and months" I don't know what to say to you. Is "severe and ridiculously scary downtrend" better to you? Is this what we are doing? Discussing about definitions of what "crashing" means? |

|

|

|

Dotcom bubble

NASDAQ composite ≠ dotcom bubble You shouldn't post a chart of the NASDAQ composite, you should post a chart of World.com or Pets.com. Compelling. Continue holding WorldCom.  Never did. Just pointed out that if (NASDAQ Composite)=(crypto) => (a company listed on NASDAQ, e.g. WorldCom)=(Bitcoin). Seems self-evident, no?

The analogy of the internet works because bitcoiners represent the dudes that during early internet days wanted to buy “shares of the internet”, but since you can’t technically do that, they stick to pets.com because at least that investment could make them rich quick, in theory.

The analogy works perfectly.

Good job Nothatinjusttrollin, you just pulled off the impossible: you managed to get on my ignore list. I've been here for a long time already, and so far only 3 people or so ever made it to my ignore list, which means you have to do your very best to make it actually happen. Constantly repeating the same message ad nauseum serves no purpose at all. Yes Nothatin, the price will go down MUCH further, but no one needs that exact same message every hour. Sorry to hear that. I try not to post the same message every hour, I try to post arguments that are usually decently variegated. For example now with the dotcom analogy, on the other thread regarding longs and shorts on bitfinex, and on another of my threads talking about bid and ask sums on all exchanges over time, etc. I try not to be boring  |

|

|

|

Dotcom bubble

NASDAQ composite ≠ dotcom bubble You shouldn't post a chart of the NASDAQ composite, you should post a chart of World.com or Pets.com. Compelling. Continue holding WorldCom.  Never did. Just pointed out that if (NASDAQ Composite)=(crypto) => (a company listed on NASDAQ, e.g. WorldCom)=(Bitcoin). Seems self-evident, no?

The analogy of the internet works because bitcoiners represent the dudes that during early internet days wanted to buy “shares of the internet”, but since you can’t technically do that, they stick to pets.com because at least that investment could make them rich quick, in theory.

The analogy works perfectly.

|

|

|

|

Permabull logic:

Longs on bitfinex have been staying at more than $15 million for AGES (since when price was at $500-600 or more).

They have been taking ridiculous beatings but still manage to be at $15 millions now.

Shorts have been right since forever since we have been crashing for months, they are around $4.4 million now and they should all panic close because of little bounces creating a panic squeeze that is supposed to turn into the start of the next bubble or some shit.

Perhaps you need to consider the possibility that the USD Swaps includes LTC as well.  . For someone who thinks they have all the answers you certainly don't seem to really think your assumptions and conclusions through. And what is this "crashing for months"? Might want to review your understanding of the word crash. Considering how much money is on LTC swaps, yeah I can only imagine how many millions out of those $15 millions are dedicated to LTC. Like, who wouldn't have kept a long position on LTC since like july or something? LTC price price dropped from more than $11 to $1 since longs have been at more than $15-20 millions. Whoever would have been so foolish to keep a long position in LTC that long would have been 100% margin called. And what is this "crashing for months"? Might want to review your understanding of the word crash.

So this doesn't look like a crash to you?  |

|

|

|

|

What are you waiting bitcoiners? put your life savings in this shit!

This time is the moon for real. breaking the ATH and $10k soon after minimum. It's not like all the other 341341234109 times when price failed and dumped again!

You can trust me!

|

|

|

|

|

Permabull logic:

Longs on bitfinex have been staying at more than $15 million for AGES (since when price was at $500-600 or more).

They have been taking ridiculous beatings but still manage to be at $15 millions now.

Shorts have been right since forever since we have been crashing for months, they are around $4.4 million now and they should all panic close because of little bounces creating a panic squeeze that is supposed to turn into the start of the next bubble or some shit.

|

|

|

|

I little bump for my bull friends. Waiting for the "despair phase" to buy and trying to buy at the "capitulation bottom" expecting a new rally was maybe potentially profitable when price was at $2, or when it was at $50. On the other hand trying to do the same now at $150 after having reached $1200, a ridiculous pump&dump and an unsustainable level that requires enormous amounts of money pouring in exchanges every day, might not be that smart  |

|

|

|

Anyway, what is everyone's opinion. Are we in the process of leaving this bear market for good?

No. |

|

|

|

You bulls are so gullible it's fun. This time is for real? right? right?   Price pumpin'. When the pump is over, what's gonna happen next?   |

|

|

|

Bitcoiners: Screaming "new bull market incoming, to the moon" at every bounce during a neverending bearmarket since december 2013   Don't you worry, this time is for real. |

|

|

|

You bulls are so gullible it's fun. This time is for real? right? right?  |

|

|

|

The recent dumping is driven by leveraged shorting.

Please stop with this unbelievable bullshit. You have been telling us that these months crashes have been manipulation with leveraged selling. Stop. Shorts on bitfinex have never exceeded something like 30k BTC. Now they are lot less. Even if they would have always been 30k BTC, that amount is a drop in the ocean compared to the daily volume during volatile times on all exchanges. Absolutely nothing, they don't have much influence. In case you were wondering, your short interest is somewhat correlated with price movements because the latter influences the former, not the other way around. Stop with this bullshit that the "shorters have to buy back". Sure they technically do, but that doesn't have much influence in the price per se and the longers are in the same situation, with the difference that the trend is still down (shorters are making profit, longers not really) and that longs are a lot more as always. I have corrected you before. A few days ago you didn't even know what 'short interest' was.. The 10,000 additional short contracts that have been bought from $300 down to where we are now are extremely important in terms of setting the price. Only someone being totally disingenious like you would say otherwise. Let us take the dump last night as an example. 5000 btc dumped onto the bid orderbook on bitfinex to scare the bids down. At the same time 5000 new shorts opened. Coincidence? Hmm. You don't think buying 5000 btc if the price moves up forcing shorts to cover makes a difference? It is most of the orderbook on finex to bring the price back to $240 you simpleton. You never corrected me in anything regarding actual content of the arguments, only on what was the best term/expression for the same concept we were talking about (short interest/number of BTC swaps). I know more than you about shorts and longs since I actually trade (not right now tho), you don’t. Dude, shorts were at 28k recently, they have been squeezed to 15k, now back to around 20k. 5k-10k BTC fluctuations once or twice in the span of months. Go look at the volume on all exchanges. Does it look like 5k-10k fluctuations once every few months have an influence on the BIG PICTURE of the price (nobody cares about little moves you are talking about, they are just noise, whether up or down). No they don’t. Again, they are a drop in the ocean compared to what China (that moves this market whether you like it or not, and yes the recent pump&dump to $300 was mostly them as always) or all the other exchanges combined can move during volatile times. Again, quantity of BTC swaps (or “short interest”) are correlated with price movements because the latter influences the former, in the larger picture. You just HODL and buy more whenever you can, you don’t trade, so why are you talking about something you don’t know much about? If you are talking about the shorters “that have to buy back”, why are you ignoring the longers?"Short interest bubble". More like "long interest bubble" lol |

|

|

|

Another observation from another thread: It helps to put a year chart up. In that you can see long interest is down 50% whilst short interest is up about 100%.

We may go lower. But 5000 shorts opened up on finex alone in the last 20 dollar drop. A single buy will squeeze us straight back to 240 if they capitulate.

Yeah, and while we're at it why don't we mention that price is 80% less from the ATH, which means that those shorts hold a much lower USD value? 1k BTC during the ATH is not the same as 1k BTC now. Longs = 15 millions Shorts = 4.4 millions Again, stop with this "shorters have to buy back so the bottom will soon be in" nonsense. |

|

|

|

The recent dumping is driven by leveraged shorting.

Please stop with this unbelievable bullshit.  You have been telling us that these months crashes have been manipulation with leveraged selling. Stop. Shorts on bitfinex have never exceeded something like 30k BTC. Now they are lot less. Even if they would have always been 30k BTC, that amount (or at least how much that amount can change and effectively influence the price) is a drop in the ocean compared to the daily volume during volatile times on all exchanges. Absolutely nothing, they don't have much influence (not for major price movements anyway). In case you were wondering, your short interest is somewhat correlated with price movements because the latter influences the former, not the other way around. Stop with this bullshit that the "shorters have to buy back". Sure they technically do, but that doesn't have much influence on the price in the large picture per se and the longers are in the same situation, with the difference that the trend is still down (shorters profit, longers not really) and that longs are a lot more as always. |

|

|

|

Fun fact: Once we reach the bottom shorters need to buy back in! Unrealized profits are no real profits. So every bear has to buy at some point (soon).

Too bad that there is no guarantee that there will be a final bottom anytime soon or ever, we are still going down and longs (that are still a lot more than shorts) have to sell back too as we go down... |

|

|

|

Fun fact: Once we reach the bottom shorters need to buy back in! Unrealized profits are no real profits. So every bear has to buy at some point (soon).

Indeed, hence the rally to $310 and the halving of the BTC Swaps on Finex from around 30K, to 12K. In the past day or so, the BTC swap volume on that exchange has risen back up to 20K which will explain the slight price slippage in BTC. Guess a whole pile of capital is anticipating yet further selling pressure coming to market early next week. I myself (if I was still tarding Bitcoin) wouldn't short here tbh. I believe that Bitcoin is going ultimately to double figures (or a lower low at the very least), but it would be entirely typical for Bitcoin to have another rally, testing and possibly breaching the recent $310 high. Perhaps it will be these over eager shorts getting squeezed which will ultimately take Bitcoin there. Mat you are still trading bitcoin. You couldnt resist and bought back in remember? Trading BTC ≠ helping the bulls If someone buys just to dump higher soon after it's not helping your cause... |

|

|

|

Look at the bears go 1-2% decline in price and they start gigglin like a schoolgirl It's cute  True. Haha. -28.78% in last 30 days , still funny? +10000% in 4 years. Yep, hilarious Keep telling yourself that as we go down and down and down and down and down and down and down and downIf it makes you feel good about it... |

|

|

|

|

. For someone who thinks they have all the answers you certainly don't seem to really think your assumptions and conclusions through.

. For someone who thinks they have all the answers you certainly don't seem to really think your assumptions and conclusions through.