|

Natalia_AnatolioPAMM

|

|

August 02, 2015, 08:23:18 AM |

|

What is the longest run without a new ATH price bubble?

I am thinking that we are in a new era of Bitcoin. Can it stay like this for years?

We definitely are!!! And I'm pretty sure it will be like this for years. All signs are for that |

|

|

|

|

|

|

|

|

|

|

|

Make sure you back up your wallet regularly! Unlike a bank account, nobody can help you if you lose access to your BTC.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

NorrisK

Legendary

Offline Offline

Activity: 1946

Merit: 1007

|

|

August 02, 2015, 10:05:45 AM |

|

Every day we stay at this price range increases the likely hood of a total collapse. Which is already pretty much inevitable anyway.

Every day we stay at this price range increase the likey hood of bitcoin becoming stronger. Which is already pretty much inevitable anyway. Pllease get your facts straight  |

|

|

|

|

Derrike

Member

Offline Offline

Activity: 84

Merit: 10

|

|

August 02, 2015, 03:18:27 PM |

|

I don't think early Bitcoiners are back into Bitcoin at all

And this is the same thing what I said. I also said that why take risk in reinvesting the money to create a new bubble? Duh |

|

|

|

|

pitham1

Legendary

Offline Offline

Activity: 1232

Merit: 1000

|

|

August 02, 2015, 03:59:40 PM |

|

What is the longest run without a new ATH price bubble?

I am thinking that we are in a new era of Bitcoin. Can it stay like this for years?

We definitely are!!! And I'm pretty sure it will be like this for years. All signs are for that Yes, the long sought after stability seems to be here. A slow move upward wouldn't be too bad.  |

|

|

|

|

Borisz

|

|

August 02, 2015, 04:05:20 PM |

|

What is the longest run without a new ATH price bubble?

I am thinking that we are in a new era of Bitcoin. Can it stay like this for years?

We definitely are!!! And I'm pretty sure it will be like this for years. All signs are for that Yes, the long sought after stability seems to be here. A slow move upward wouldn't be too bad.  I still think that this has also to do with people hoping that there will be a huge spike when they can come off wining. |

|

|

|

|

kwukduck

Legendary

Offline Offline

Activity: 1937

Merit: 1001

|

|

August 02, 2015, 06:10:45 PM |

|

Early adopters have long cashed out and are living the rich life on your lost money. Every single bit coin you hold supports this theft of wealth.

|

14b8PdeWLqK3yi3PrNHMmCvSmvDEKEBh3E

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

August 03, 2015, 07:10:34 AM |

|

When the new breed of Bitcoiner who got burned buying at the top and then tried to get rich with altcoins realizes how useless altcoins really are, a lot of money will come flooding back to Bitcoin. My guess is that the market landscape will look very different in another 12 months.

According to coinmarketcap, today, BTC is already 86% of the crypto space. I don't think another 14% is likely to induce a new ATH. Though as soon as the banks figure out their 'Bitcoinless blockchain innovations' are unsecurable, we might see some real appreciation. |

Anyone with a campaign ad in their signature -- for an organization with which they are not otherwise affiliated -- is automatically deducted credibility points.

I've been convicted of heresy. Convicted by a mere known extortionist. Read my Trust for details.

|

|

|

DieJohnny (OP)

Legendary

Offline Offline

Activity: 1639

Merit: 1004

|

|

August 05, 2015, 05:09:35 AM |

|

When the new breed of Bitcoiner who got burned buying at the top and then tried to get rich with altcoins realizes how useless altcoins really are, a lot of money will come flooding back to Bitcoin. My guess is that the market landscape will look very different in another 12 months.

According to coinmarketcap, today, BTC is already 86% of the crypto space. I don't think another 14% is likely to induce a new ATH. Though as soon as the banks figure out their 'Bitcoinless blockchain innovations' are unsecurable, we might see some real appreciation. Would love to see a trend line price chart from coinmarketcap that shows the percent of crypto market cap occupied by Bitcoin over the last three years. |

Those who hold and those who are without property have ever formed distinct interests in society

|

|

|

|

Cconvert2G36

|

|

August 05, 2015, 05:15:01 AM |

|

When the new breed of Bitcoiner who got burned buying at the top and then tried to get rich with altcoins realizes how useless altcoins really are, a lot of money will come flooding back to Bitcoin. My guess is that the market landscape will look very different in another 12 months.

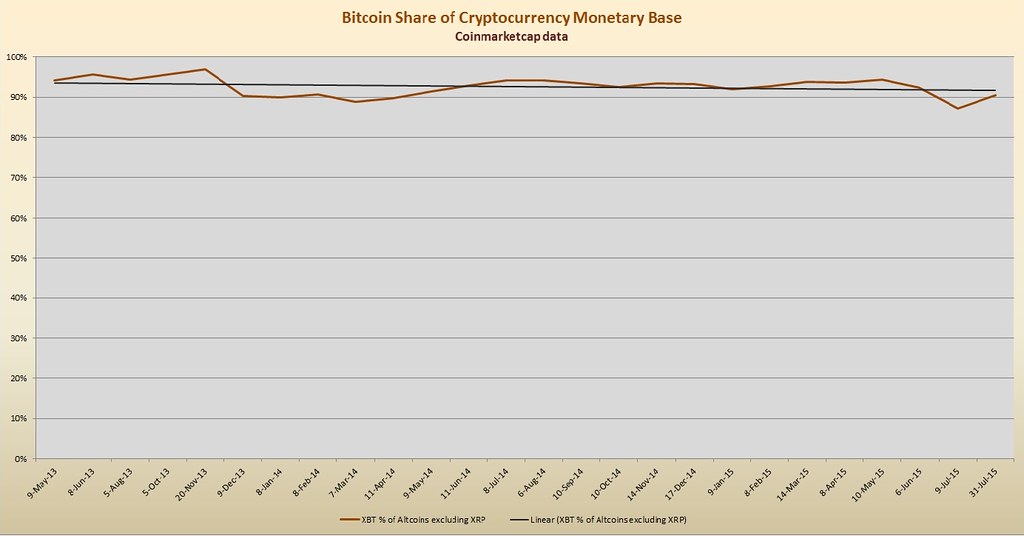

According to coinmarketcap, today, BTC is already 86% of the crypto space. I don't think another 14% is likely to induce a new ATH. Though as soon as the banks figure out their 'Bitcoinless blockchain innovations' are unsecurable, we might see some real appreciation. Would love to see a trend line price chart from coinmarketcap that shows the percent of crypto market cap occupied by Bitcoin over the last three years. Not sure about the "trend line price chart" but here's a chart: there is competition from altcoins to consider. If we leave 99% of the market on the table because of ultraconservatism about blocksize, we let an altcoin have all that, and Bitcoin gets swept by the wayside. And guess which one ends up more decentralized.

This important comment made me think that it's a good time to review just how Bitcoin has fared against the altcoins since a useful comparison has been made possible by coinmarketcap. Using the Wayback machine I got one data-point (aggregate values in USD) for each month as close to the 9th (first one) as possible. The chart below shows Bitcoin's monetary base (or market cap) as a percentage of all cryptocurrency excluding Ripple.  There is a very slight trend down (black), exacerbated by the recent LTC ramp, probably pre-halving noise as smooth says. I have shown the y-axis from 0% to avoid the scarier looking trend when base-lined at 80%. This chart is interesting because it shows that despite the acrimonious 1MB debate it is not yet having a serious effect on price, and similarly the 1MB is not yet crippling user volumes and driving up usage (and therefore enhanced value) of alternative crypto. Yesterday, we had a BIP [77? 103?] from Pieter, which is extremely welcome and the first official solution from the 1MBers in Core Dev. Unfortunately, this BIP pursues minimal change, with 2MB blocks only in 2021 and 10MB blocks (effectively the same capacity as Dogecoin today), in 2030. Personally, I think this will leave a severe bottleneck in Bitcoin throughput by about Q2/Q3 2016 and the major risk of a sharp change down in trend in the chart above. |

|

|

|

|

jbreher

Legendary

Offline Offline

Activity: 3038

Merit: 1660

lose: unfind ... loose: untight

|

|

August 05, 2015, 06:36:55 AM |

|

According to coinmarketcap, today, BTC is already 86% of the crypto space. I don't think another 14% is likely to induce a new ATH.

Though as soon as the banks figure out their 'Bitcoinless blockchain innovations' are unsecurable, we might see some real appreciation.

Would love to see a trend line price chart from coinmarketcap that shows the percent of crypto market cap occupied by Bitcoin over the last three years. Not sure about the "trend line price chart" but here's a chart: Interesting. I wonder what the rationale is for excluding Ripple? (Fun fact - back near its public announcement, Ripple for some period had a market cap greater than Bitcoin's). Perhaps because it is the only significant alt that does not trace ancestry of the bulk of its code to Bitcoin? Bitcoin's share of the overall crypto space is one of my major indices. While I check it nearly daily, I don't bother to write it down. I include Ripple. If it dips below 83% or so, I go looking for a reason. |

Anyone with a campaign ad in their signature -- for an organization with which they are not otherwise affiliated -- is automatically deducted credibility points.

I've been convicted of heresy. Convicted by a mere known extortionist. Read my Trust for details.

|

|

|

|

Cconvert2G36

|

|

August 05, 2015, 06:43:17 AM |

|

Create an altcoin with you owning all 140,000,000 total coins, sell one for $30, leaving you with 139,999,999 of them. Your new coin has a market cap bigger than bitcoin.

|

|

|

|

|

|

Natalia_AnatolioPAMM

|

|

August 05, 2015, 07:37:30 AM |

|

Early adopters have long cashed out and are living the rich life on your lost money. Every single bit coin you hold supports this theft of wealth.

what makes you say that? That's not true |

|

|

|

|

Derrike

Member

Offline Offline

Activity: 84

Merit: 10

|

|

August 05, 2015, 08:46:13 AM |

|

Early adopters have long cashed out and are living the rich life on your lost money. Every single bit coin you hold supports this theft of wealth.

what makes you say that? That's not true Yup that's true. Early adopters have made a lot of money by selling Bitcoins in 2013 pump. |

|

|

|

|

|