jaysabi (OP)

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

December 11, 2015, 05:44:52 PM |

|

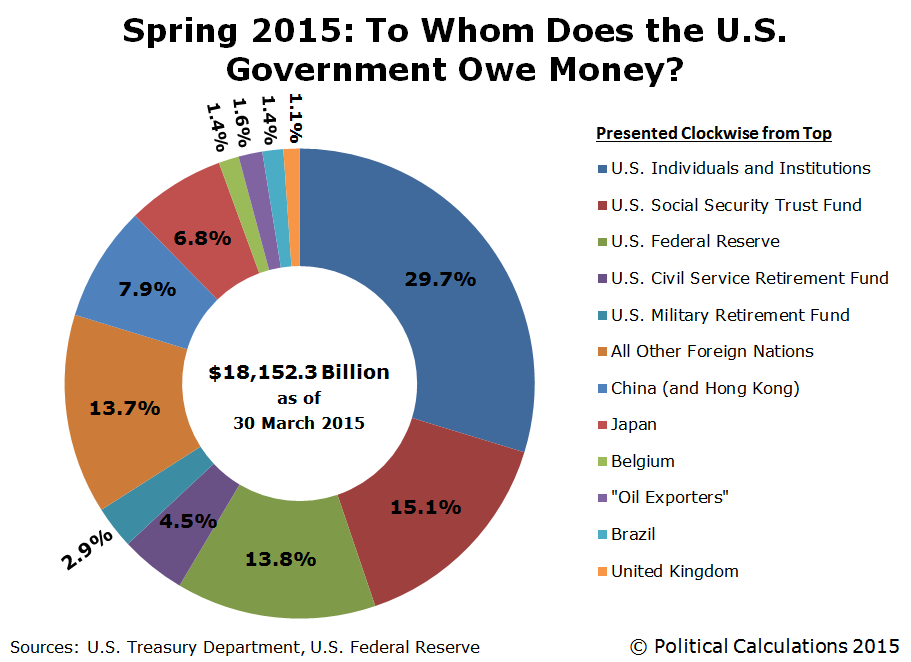

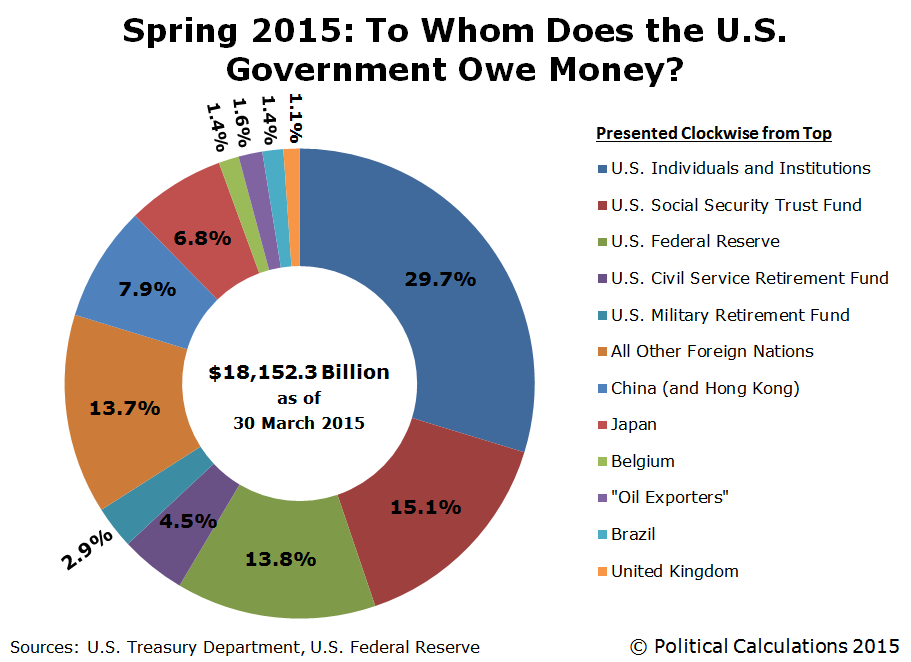

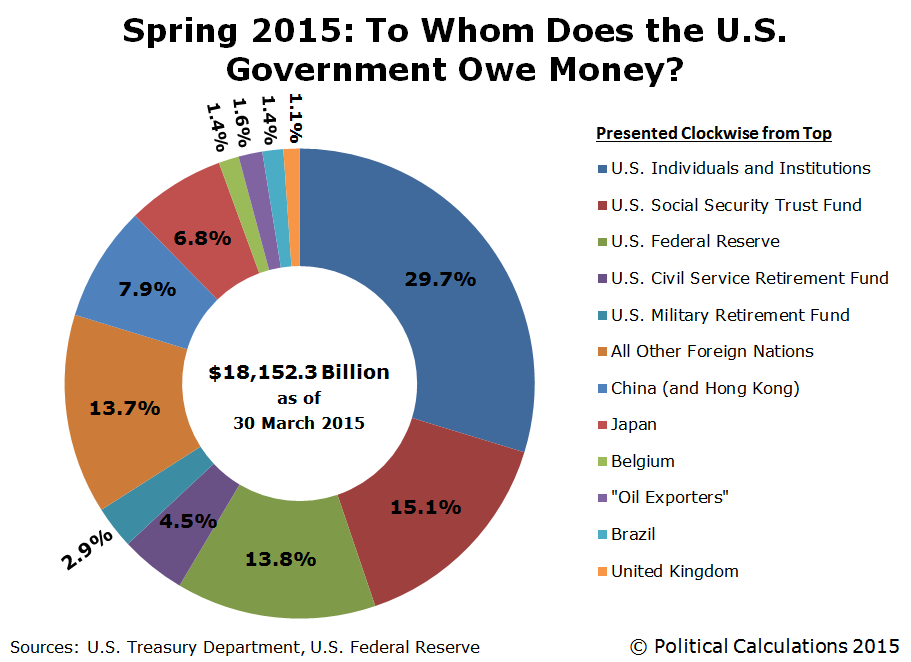

First 224 years of existence: 5.674 trillion dollars Next 8 Bush years: 4.350 trillion dollars Next 7 Obama years: 8.126 trillion dollars Compare what we've done in the last 15 years to what we did in the first 224 years. We've more than tripled in the last 15 years what it took 224 years to accumulate in debt. To be lazy and use stereotypes, democrats spend too much and republicans tax too little. The truth is that both parties spend too much and tax too little. The current war spending is not sustainable. The current tax rates are not sustainable. Social Security and Medicaid are about to explode in expenditures. You simply cannot cut this level of debt by only cutting spending or only raising taxes. It will take substantial efforts on both ends to put things in order, and then it will take disciplined restraint and political will to stay on course over several decades to begin to fix this process. Frankly, our politicians are not up to the challenge. Their incentive is re-election every 2 or 4 years, and this type of outlook is incompatible with the long-term approach necessary to fix what an utter mess the national finances have become. |

|

|

|

|

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, which will follow the rules of the network no matter what miners do. Even if every miner decided to create 1000 bitcoins per block, full nodes would stick to the rules and reject those blocks.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

Amph

Legendary

Offline Offline

Activity: 3206

Merit: 1069

|

|

December 11, 2015, 07:27:05 PM |

|

this should encourage more, the people to invest in bitcoin, and help growing an alternative way to the plague that was/still is our conventional money system

trusting fiat at present is more dangerous than investing in bitcoin, numerous case of money lost due to banks playing with people money

there was a case of a bank(here) suggesting to an old man to invest in a low risk investment that then is become a heavy risk one, and he lost 100k in euro, he commited suicide by hanging

|

|

|

|

|

tyz

Legendary

Offline Offline

Activity: 3360

Merit: 1531

|

|

December 11, 2015, 07:49:18 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

|

|

|

|

|

callynyan

Member

Offline Offline

Activity: 90

Merit: 10

|

|

December 11, 2015, 07:53:02 PM |

|

Buy bitcoin and gold.

They are the best vaults to survive the fallout.

People that did not buy bitcoin or gold will turn into ghouls!

|

|

|

|

|

spazzdla

Legendary

Offline Offline

Activity: 1722

Merit: 1000

|

|

December 11, 2015, 08:00:47 PM |

|

Buy bitcoin and gold.

They are the best vaults to survive the fallout.

People that did not buy bitcoin or gold will turn into ghouls!

The pigs will come for your money, hide it. |

|

|

|

|

OROBTC

Legendary

Offline Offline

Activity: 2912

Merit: 1852

|

|

December 11, 2015, 08:03:45 PM |

|

...

jaysabi

And those debt numbers are JUST the officially acknowledged US National Debt. Depending on whose numbers you believe, those debts (inc. unfunded liabilities) could be from $80 trillion to $220 trillion.

If the FED raises rates this month, the interest rates will cause our debts to rise even faster. Ugh.

* * *

callynyan

I don't about non-holders of BTC and gold becoming GHOULS, but point taken.

Both BTC and gold are excellent diversification vs. .gov malfeasance.

EDIT: You got it spazzdla, they are coming for whatever "Easy Money" they can steal. I cashed in my IRA (a USA pension scheme) in 2008.

|

|

|

|

|

|

virtualx

|

|

December 11, 2015, 08:06:18 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

Debts everywhere. Sustainable or house of cards? |

...loteo...

DIGITAL ERA LOTTERY | ║

║

║ | | r |

▄▄███████████▄▄

▄███████████████████▄

▄███████████████████████▄

▄██████████████████████████▄

▄██ ███████▌ ▐██████████████▄

▐██▌ ▐█▀ ▀█ ▐█▀ ▀██▀ ▀██▌

▐██ █▌ █▌ ██ ██▌ ██▌ █▌ █▌ ██▌

▐█▌ ▐█ ▐█ ▐█▌ ▐██ ▄▄▄██ ▐█ ▐██▌

▐█ ██▄ ▄██ █▄ ██▄ ▄███▌

▀████████████████████████████▀

▀██████████████████████████▀

▀███████████████████████▀

▀███████████████████▀

▀▀███████████▀▀

| r | | ║

║

║ | RPLAY NOWR

BE A MOON VISITOR! |

[/center] |

|

|

Yakamoto

Legendary

Offline Offline

Activity: 1218

Merit: 1007

|

|

December 11, 2015, 08:37:46 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

Debts everywhere. Sustainable or house of cards? House of cards. Unless you are interested in having a cup of coffee costing $30 in the future and realizing that any pay you get now will have very little value in the future, there is no way that countries can maintain a level of sustainable debt. There is no way it can continue to be propped up for lengthy periods of time. When a piece of paper has given value that only shrinks over time, there will eventually be many people who will question why it is worth doing anything now. |

|

|

|

|

|

Chronikka

|

|

December 11, 2015, 08:50:09 PM |

|

The shear numbers are of course increasing. But that has more to do with currency inflation than actually borrowing more money. Every major country on the planet has some debt, just like most people in this world have some financial debt. Its life. IMO what matters is not so much the total debt a country has, but the ratio of debt to GDP. That gives you an idea of how easily a country would actually be able to pay off its debt. In the case of the US, the ratio is estimated between 104-105% which is to say its essentially a 1:1 ratio. The GDP in the United States is about equal to its debt. That's pretty common and not really all that alarming. The ratio for the entire eurozone is about ~94% with some countries well above 100% Is debt high in the US? Yes certainly. But is it so bad that we need to stop everything and fix it now? No its not. By comparison, Greece who almost defaulted earlier this year, is somewhere north of 180% http://www.debtclocks.eu/ |

"The true sign of intelligence is not knowledge but imagination" -Albert Einstein

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

December 11, 2015, 08:54:26 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

This is just not true. National debt of Russia is 15% of GDP, national debt of Saudi Arabia is 8% of GDP. |

.

|

|

|

Monnt

Legendary

Offline Offline

Activity: 938

Merit: 1002

|

|

December 11, 2015, 08:56:21 PM |

|

The US economy no doubt will collapse very soon, it'll probably collapse instantly if China decides to sell all its US bonds on the forex markets.

|

|

|

|

|

|

Chronikka

|

|

December 11, 2015, 08:57:37 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

This is just not true. National debt of Russia is 15% of GDP, national debt of Saudi Arabia is 8% of GDP. Both of those countries you just mentioned also have rapidly depleting cash reserves, mostly thanks to the oil crash. They might not have as much debt but they're spending cash rapidly to prop up their economies. |

"The true sign of intelligence is not knowledge but imagination" -Albert Einstein

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

December 11, 2015, 08:59:16 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

I'll just leave this here https://en.wikipedia.org/wiki/File:Government_debt_gdp.jpg |

.

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

December 11, 2015, 09:04:38 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

This is just not true. National debt of Russia is 15% of GDP, national debt of Saudi Arabia is 8% of GDP. Both of those countries you just mentioned also have rapidly depleting cash reserves, mostly thanks to the oil crash. They might not have as much debt but they're spending cash rapidly to prop up their economies. The leftmost column is total reserves of Russian Central Bank. I don't see a rapid decrease there. |

.

|

|

|

Pab

Legendary

Offline Offline

Activity: 1862

Merit: 1012

|

|

December 11, 2015, 09:09:51 PM |

|

Yes debt everywhere,but if to think about all that financial instruments based on debts,derivatives,thatwe even dont know how many trilionsit is.NowEBC QE is not working,no landingin Europe,anysigne of inlation

So if Euro will fail,many economist is predicting that,whatwill happen with all that euro debt derivatives

Will be massive sell of before,total crash,look on stock today,all in reds,over2%on all major indexes

only btc express is moving up.What is going on,itis not fear before Fed

|

|

|

|

|

Chronikka

|

|

December 11, 2015, 09:20:20 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

This is just not true. National debt of Russia is 15% of GDP, national debt of Saudi Arabia is 8% of GDP. Both of those countries you just mentioned also have rapidly depleting cash reserves, mostly thanks to the oil crash. They might not have as much debt but they're spending cash rapidly to prop up their economies. The leftmost column is total reserves of Russian Central Bank. I don't see a rapid decrease there. The link you posted shows a drop in international reserves of more than 12% in the last year alone. Thats a pretty significant amount of money to me (More than $50 billion). Here is the same link in English for anybody that doesn't read Russian: http://www.cbr.ru/eng/hd_base/?Prtid=mrrf_m |

"The true sign of intelligence is not knowledge but imagination" -Albert Einstein

|

|

|

|

ridery99

|

|

December 11, 2015, 09:26:29 PM |

|

Not only the debt of the United States. Look around the world. The debts are exploding everywhere. Europe, China, Japan, Russia, Latin America, even in the Arabic states like Saudi Arabia.

There is no way out of this development.

It's just a side effect of printing money, relax  |

|

|

|

|

jaysabi (OP)

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

December 11, 2015, 10:53:38 PM |

|

...

jaysabi

And those debt numbers are JUST the officially acknowledged US National Debt. Depending on whose numbers you believe, those debts (inc. unfunded liabilities) could be from $80 trillion to $220 trillion.

If the FED raises rates this month, the interest rates will cause our debts to rise even faster. Ugh.

Well, it's what the debt actually is at present. Unfunded liabilities are not current debts, they are future debts. The law mandating their payment could change, or the demographics underlying their calculation could change before they actually need to be paid, or revenue could more than make up the difference by the time they are incurred in which case they wouldn't add to the debt at all. In any case, I didn't include them in my post because they're speculative. The debt numbers posted are the Treasury's numbers of debt currently incurred, but you're right that you shouldn't ignore the looming crisis unfunded liabilities pose, which is exactly what every politician is presently doing. |

|

|

|

Pab

Legendary

Offline Offline

Activity: 1862

Merit: 1012

|

|

December 11, 2015, 10:58:31 PM |

|

Debt economy crash begin http://carlicahn.com/The Securities and Exchange Commission agreed today to issue a proposed rule governing ETFs' use of derivatives -- a type of unregulated trading contract that's used to bet on an underlying asset such as a stock index or commodity. Such products include so-called leveraged ETFs, which use derivatives to multiply returns. One example is the Direxion Daily Emerging Markets Bull 3x Shares, an ETF that employs derivative contracts with such Wall Street firms as Citigroup (C - Get Report) , Deutsche Bank, and Bank of America Merrill Lynch (BAC - Get Report) http://www.thestreet.com/story/13394908/1/like-icahn-sec-sees-danger-ahead-in-these-risky-etfs.htmlChina sell offi nothing compare to that,hold your btc |

|

|

|

jaysabi (OP)

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

December 11, 2015, 11:10:29 PM |

|

The shear numbers are of course increasing. But that has more to do with currency inflation than actually borrowing more money. Every major country on the planet has some debt, just like most people in this world have some financial debt. Its life. IMO what matters is not so much the total debt a country has, but the ratio of debt to GDP. That gives you an idea of how easily a country would actually be able to pay off its debt. In the case of the US, the ratio is estimated between 104-105% which is to say its essentially a 1:1 ratio. The GDP in the United States is about equal to its debt. That's pretty common and not really all that alarming. The ratio for the entire eurozone is about ~94% with some countries well above 100% Is debt high in the US? Yes certainly. But is it so bad that we need to stop everything and fix it now? No its not. By comparison, Greece who almost defaulted earlier this year, is somewhere north of 180% http://www.debtclocks.eu/Taking a snapshot at any individual moment isn't as useful as identifying the overall trend. In the past 15 years, debt:GDP ratio has risen 147% (from under 45% to over 110%). GDP Debt (FYE) Ratio Dec 31, 2014 16.15 trillion 17.82 110.34% Dec 31, 2013 15.76 trillion 16.74 106.22% Dec 31, 2012 15.38 trillion 16.07 104.48% Dec 31, 2011 15.19 trillion 14.79 97.37% Dec 31, 2010 14.94 trillion 13.56 90.76% Dec 31, 2009 14.54 trillion 11.91 81.91% Dec 31, 2008 14.58 trillion 10.02 68.72% Dec 31, 2007 14.99 trillion 9.01 60.11% Dec 31, 2006 14.72 trillion 8.51 57.81% Dec 31, 2005 14.37 trillion 7.93 55.18% Dec 31, 2004 13.95 trillion 7.38 52.90% Dec 31, 2003 13.53 trillion 6.79 50.18% Dec 31, 2002 12.96 trillion 6.23 48.08% Dec 31, 2001 12.71 trillion 5.81 45.71% Dec 31, 2000 12.68 trillion 5.68 44.79% Is a 110% ratio problematic? That single data point alone doesn't say. But in light of the trend (we were under 45% 15 years ago) and with medicare and social security expenses about to start exploding with the retiring baby boomers, yeah, it absolutely is crucial we address this now. We haven't at all over the last 15 years, despite knowing this looming crisis was coming, and we did nothing. We don't have the luxury of not acting anymore, or hoping that we can economic-growth our way out of this. We can't. |

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

December 11, 2015, 11:36:48 PM |

|

The shear numbers are of course increasing. But that has more to do with currency inflation than actually borrowing more money. Every major country on the planet has some debt, just like most people in this world have some financial debt. Its life. IMO what matters is not so much the total debt a country has, but the ratio of debt to GDP. That gives you an idea of how easily a country would actually be able to pay off its debt. In the case of the US, the ratio is estimated between 104-105% which is to say its essentially a 1:1 ratio. The GDP in the United States is about equal to its debt. That's pretty common and not really all that alarming. The ratio for the entire eurozone is about ~94% with some countries well above 100% Is debt high in the US? Yes certainly. But is it so bad that we need to stop everything and fix it now? No its not. By comparison, Greece who almost defaulted earlier this year, is somewhere north of 180% http://www.debtclocks.eu/Taking a snapshot at any individual moment isn't as useful as identifying the overall trend. In the past 15 years, debt:GDP ratio has risen 147% (from under 45% to over 110%). GDP Debt (FYE) Ratio Dec 31, 2014 16.15 trillion 17.82 110.34% Dec 31, 2013 15.76 trillion 16.74 106.22% Dec 31, 2012 15.38 trillion 16.07 104.48% Dec 31, 2011 15.19 trillion 14.79 97.37% Dec 31, 2010 14.94 trillion 13.56 90.76% Dec 31, 2009 14.54 trillion 11.91 81.91% Dec 31, 2008 14.58 trillion 10.02 68.72% Dec 31, 2007 14.99 trillion 9.01 60.11% Dec 31, 2006 14.72 trillion 8.51 57.81% Dec 31, 2005 14.37 trillion 7.93 55.18% Dec 31, 2004 13.95 trillion 7.38 52.90% Dec 31, 2003 13.53 trillion 6.79 50.18% Dec 31, 2002 12.96 trillion 6.23 48.08% Dec 31, 2001 12.71 trillion 5.81 45.71% Dec 31, 2000 12.68 trillion 5.68 44.79% Is a 110% ratio problematic? That single data point alone doesn't say. But in light of the trend (we were under 45% 15 years ago) and with medicare and social security expenses about to start exploding with the retiring baby boomers, yeah, it absolutely is crucial we address this now. We haven't at all over the last 15 years, despite knowing this looming crisis was coming, and we did nothing. We don't have the luxury of not acting anymore, or hoping that we can economic-growth our way out of this. We can't. Exactly. In healthy economy, budget deficit during recession periods is compensated by proficit during expansion periods. If government has persistent deficit, exhausts reserves and continues to accumulate the debt for many years in a row, it is not a recession, it is a depression. All so called "wealthy" countries are in a state of depression right now. Their governments increase dept to hide pathological economical problems. By doing this, they are just shifting a collapse to the future. This can not last for long. |

.

|

|

|

|

Chronikka

|

|

December 11, 2015, 11:52:46 PM

Last edit: December 12, 2015, 12:07:45 AM by Chronikka |

|

The shear numbers are of course increasing. But that has more to do with currency inflation than actually borrowing more money. Every major country on the planet has some debt, just like most people in this world have some financial debt. Its life. IMO what matters is not so much the total debt a country has, but the ratio of debt to GDP. That gives you an idea of how easily a country would actually be able to pay off its debt. In the case of the US, the ratio is estimated between 104-105% which is to say its essentially a 1:1 ratio. The GDP in the United States is about equal to its debt. That's pretty common and not really all that alarming. The ratio for the entire eurozone is about ~94% with some countries well above 100% Is debt high in the US? Yes certainly. But is it so bad that we need to stop everything and fix it now? No its not. By comparison, Greece who almost defaulted earlier this year, is somewhere north of 180% http://www.debtclocks.eu/Taking a snapshot at any individual moment isn't as useful as identifying the overall trend. In the past 15 years, debt:GDP ratio has risen 147% (from under 45% to over 110%). GDP Debt (FYE) Ratio Dec 31, 2014 16.15 trillion 17.82 110.34% Dec 31, 2013 15.76 trillion 16.74 106.22% Dec 31, 2012 15.38 trillion 16.07 104.48% Dec 31, 2011 15.19 trillion 14.79 97.37% Dec 31, 2010 14.94 trillion 13.56 90.76% Dec 31, 2009 14.54 trillion 11.91 81.91% Dec 31, 2008 14.58 trillion 10.02 68.72% Dec 31, 2007 14.99 trillion 9.01 60.11% Dec 31, 2006 14.72 trillion 8.51 57.81% Dec 31, 2005 14.37 trillion 7.93 55.18% Dec 31, 2004 13.95 trillion 7.38 52.90% Dec 31, 2003 13.53 trillion 6.79 50.18% Dec 31, 2002 12.96 trillion 6.23 48.08% Dec 31, 2001 12.71 trillion 5.81 45.71% Dec 31, 2000 12.68 trillion 5.68 44.79% Is a 110% ratio problematic? That single data point alone doesn't say. But in light of the trend (we were under 45% 15 years ago) and with medicare and social security expenses about to start exploding with the retiring baby boomers, yeah, it absolutely is crucial we address this now. We haven't at all over the last 15 years, despite knowing this looming crisis was coming, and we did nothing. We don't have the luxury of not acting anymore, or hoping that we can economic-growth our way out of this. We can't. Exactly. In healthy economy, budget deficit during recession periods is compensated by proficit during expansion periods. If government has persistent deficit, exhausts reserves and continues to accumulate the debt for many years in a row, it is not a recession, it is a depression. All so called "wealthy" countries are in a state of depression right now. Their governments increase dept to hide pathological economical problems. By doing this, they are just shifting a collapse to the future. This can not last for long. Pretty much the entire world is in some form of depression right now, US and Russia included. Russia's economy is collapsing, 4% GDP recession each of the last 2 quarters. The Ruble is down by nearly 50% since this time last year. Countries like the US are borrowing money to cover budget shortfalls, while countries like Russia are spending assets to do the same. Its just a difference in philosophy. Look at those numbers you posted a little closer. From 2000 to 2007 it rose 16% in the US. In 2008 the US economy took a nose dive, and it rose 8%. Then an additional 13% in 2009, followed by 9% in 2010. So in 3 years from 2007-2010 the US increased its debt to GDP ratio at more than double the rate of the previous 7-8 years. The government was borrowing money to cover itself until things stabilized and they're able to pay it down. Now that the economy is turning around the budget is becoming a big political topic here in the US and I expect something will be done about it soon. |

"The true sign of intelligence is not knowledge but imagination" -Albert Einstein

|

|

|

johnyj

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

December 12, 2015, 04:14:23 AM |

|

A forever expanding money supply and forever expanding debt, never be able to payback, thus everyone have some incentive to work. Debt is similar to dream, the ultimate incentive to work

|

|

|

|

|

mistanama

|

|

December 12, 2015, 12:03:54 PM |

|

The debt rises much faster than the GDP. It means those debts are not sustainable. That happened in Greece and a few other countries. The debt laden economy is not the way to go.

|

|

|

|

|

jaysabi (OP)

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

December 12, 2015, 01:33:47 PM |

|

The shear numbers are of course increasing. But that has more to do with currency inflation than actually borrowing more money. Every major country on the planet has some debt, just like most people in this world have some financial debt. Its life. IMO what matters is not so much the total debt a country has, but the ratio of debt to GDP. That gives you an idea of how easily a country would actually be able to pay off its debt. In the case of the US, the ratio is estimated between 104-105% which is to say its essentially a 1:1 ratio. The GDP in the United States is about equal to its debt. That's pretty common and not really all that alarming. The ratio for the entire eurozone is about ~94% with some countries well above 100% Is debt high in the US? Yes certainly. But is it so bad that we need to stop everything and fix it now? No its not. By comparison, Greece who almost defaulted earlier this year, is somewhere north of 180% http://www.debtclocks.eu/Taking a snapshot at any individual moment isn't as useful as identifying the overall trend. In the past 15 years, debt:GDP ratio has risen 147% (from under 45% to over 110%). GDP Debt (FYE) Ratio Dec 31, 2014 16.15 trillion 17.82 110.34% Dec 31, 2013 15.76 trillion 16.74 106.22% Dec 31, 2012 15.38 trillion 16.07 104.48% Dec 31, 2011 15.19 trillion 14.79 97.37% Dec 31, 2010 14.94 trillion 13.56 90.76% Dec 31, 2009 14.54 trillion 11.91 81.91% Dec 31, 2008 14.58 trillion 10.02 68.72% Dec 31, 2007 14.99 trillion 9.01 60.11% Dec 31, 2006 14.72 trillion 8.51 57.81% Dec 31, 2005 14.37 trillion 7.93 55.18% Dec 31, 2004 13.95 trillion 7.38 52.90% Dec 31, 2003 13.53 trillion 6.79 50.18% Dec 31, 2002 12.96 trillion 6.23 48.08% Dec 31, 2001 12.71 trillion 5.81 45.71% Dec 31, 2000 12.68 trillion 5.68 44.79% Is a 110% ratio problematic? That single data point alone doesn't say. But in light of the trend (we were under 45% 15 years ago) and with medicare and social security expenses about to start exploding with the retiring baby boomers, yeah, it absolutely is crucial we address this now. We haven't at all over the last 15 years, despite knowing this looming crisis was coming, and we did nothing. We don't have the luxury of not acting anymore, or hoping that we can economic-growth our way out of this. We can't. Exactly. In healthy economy, budget deficit during recession periods is compensated by proficit during expansion periods. If government has persistent deficit, exhausts reserves and continues to accumulate the debt for many years in a row, it is not a recession, it is a depression. All so called "wealthy" countries are in a state of depression right now. Their governments increase dept to hide pathological economical problems. By doing this, they are just shifting a collapse to the future. This can not last for long. Pretty much the entire world is in some form of depression right now, US and Russia included. Russia's economy is collapsing, 4% GDP recession each of the last 2 quarters. The Ruble is down by nearly 50% since this time last year. Countries like the US are borrowing money to cover budget shortfalls, while countries like Russia are spending assets to do the same. Its just a difference in philosophy. Look at those numbers you posted a little closer. From 2000 to 2007 it rose 16% in the US. In 2008 the US economy took a nose dive, and it rose 8%. Then an additional 13% in 2009, followed by 9% in 2010. So in 3 years from 2007-2010 the US increased its debt to GDP ratio at more than double the rate of the previous 7-8 years. The government was borrowing money to cover itself until things stabilized and they're able to pay it down. Now that the economy is turning around the budget is becoming a big political topic here in the US and I expect something will be done about it soon.I don't share this optimism. When republicans control things, they insist on tax cuts because the deficit is small. This makes absolutely no sense. If there is any deficit at all, it means the government isn't taking in enough revenue to cover its expenses. So tax cuts are the last thing it needs. It is always promised that tax cuts will improve the economy and bring in more revenue than the cuts cost, but this has never proven out. I fully expect that whatever party is in control after the next election, the deficit spending will continue, and republicans will talk about cutting taxes, regardless of whether they are in the majority or minority position. |

|

|

|

|

zodiac3011

|

|

December 12, 2015, 01:59:26 PM |

|

Buy bitcoin and gold.

They are the best vaults to survive the fallout.

People that did not buy bitcoin or gold will turn into ghouls!

well actually gold is better I think although bitcoin can be considered gold, gold represents for the value of currency as well as has physical value so buying gold should be better than bitcoin I think |

|

|

|

|

|

HeroCat

|

|

December 13, 2015, 01:24:51 PM |

|

Any state debt can be paid by taxes from all country people, simply just making taxes higher. In this case US debt looks like quite high - so I think US government have already plan what to do.  |

|

|

|

|

callynyan

Member

Offline Offline

Activity: 90

Merit: 10

|

|

December 13, 2015, 02:42:08 PM |

|

They can raise taxes and implement a negative interest rate.

When they do that, commodity and basic necessity product prices will skyrocket.

You can only pull the plug of the US Dollar, there is no cure for debtus-inflatus.

|

|

|

|

|

|

nonbody

|

|

December 13, 2015, 02:57:03 PM |

|

Any state debt can be paid by taxes from all country people, simply just making taxes higher. In this case US debt looks like quite high - so I think US government have already plan what to do.  They cannot impose unlimited taxes to the ppl without actually stimulating the economy. Otherwise the economy will collapse! U.S. Gov has to move cautiously! |

░░░░░░▄▄▄████████▄▄▄

░░░░▄████████████████▄

░░▄████████████████████▄

░█████▀░░░░░░░░░░████████

▐█████░▄████████░░███████▌

████████▀▀██████░░████████

████████▄▄█████░░░████████

██████████████░░░█████████

▐███████▀░░░░░░▄█████████▌

░██████▀░▐███████████████

░░▀███░░░░░░░░░░░░░████▀

░░░░▀████████████████▀

░░░░░░▀▀▀████████▀▀▀

|

2local | ... |

Sustainability and Prosperity.

Pre sale is going on | .... |

| .... |

| .... |

| .... |

...J O I N... | .... |

...Whitepaper... | .... |

░░░░░░▄▄▄████████▄▄▄

░░░░▄████████████████▄

░░▄████████████████████▄

░█████▀░░░░░░░░░░████████

▐█████░▄████████░░███████▌

████████▀▀██████░░████████

████████▄▄█████░░░████████

██████████████░░░█████████

▐███████▀░░░░░░▄█████████▌

| | |

I E O IN Livecoin.net Probit P2pPb2b from 11/02/2020

2local Sale |

|

|

|

|

OROBTC

Legendary

Offline Offline

Activity: 2912

Merit: 1852

|

|

December 13, 2015, 04:11:32 PM |

|

Buy bitcoin and gold.

They are the best vaults to survive the fallout.

People that did not buy bitcoin or gold will turn into ghouls!

well actually gold is better I think although bitcoin can be considered gold, gold represents for the value of currency as well as has physical value so buying gold should be better than bitcoin I think We have seen that BTC price and gold price, especially lately, do not move in tandem, therefore are both excellent candidates for diversification (my middle name). Unless one is very wealthy or knows a lot more than I do about computer science (BTC, cryptography, programming, etc.), having 1% to, say, 3% of your net in BTC seems about right. BTC is very volatile... But, should BTC jump to well over $1000, then any 1% that you invest there will more than double. If BTC goes for the moon (over $5000 price), then that little speculation will become very meaningful. * * * Holding gold (5% - 20%, again depending on circumstances and comfort level) is good too. Gold may save your financial butt in some SHTF hurricane scenarios too... |

|

|

|

|

|

mistanama

|

|

January 19, 2016, 04:39:18 PM |

|

The shear numbers are of course increasing. But that has more to do with currency inflation than actually borrowing more money. Every major country on the planet has some debt, just like most people in this world have some financial debt. Its life. IMO what matters is not so much the total debt a country has, but the ratio of debt to GDP. That gives you an idea of how easily a country would actually be able to pay off its debt. In the case of the US, the ratio is estimated between 104-105% which is to say its essentially a 1:1 ratio. The GDP in the United States is about equal to its debt. That's pretty common and not really all that alarming. The ratio for the entire eurozone is about ~94% with some countries well above 100% Is debt high in the US? Yes certainly. But is it so bad that we need to stop everything and fix it now? No its not. By comparison, Greece who almost defaulted earlier this year, is somewhere north of 180% http://www.debtclocks.eu/Taking a snapshot at any individual moment isn't as useful as identifying the overall trend. In the past 15 years, debt:GDP ratio has risen 147% (from under 45% to over 110%). GDP Debt (FYE) Ratio Dec 31, 2014 16.15 trillion 17.82 110.34% Dec 31, 2013 15.76 trillion 16.74 106.22% Dec 31, 2012 15.38 trillion 16.07 104.48% Dec 31, 2011 15.19 trillion 14.79 97.37% Dec 31, 2010 14.94 trillion 13.56 90.76% Dec 31, 2009 14.54 trillion 11.91 81.91% Dec 31, 2008 14.58 trillion 10.02 68.72% Dec 31, 2007 14.99 trillion 9.01 60.11% Dec 31, 2006 14.72 trillion 8.51 57.81% Dec 31, 2005 14.37 trillion 7.93 55.18% Dec 31, 2004 13.95 trillion 7.38 52.90% Dec 31, 2003 13.53 trillion 6.79 50.18% Dec 31, 2002 12.96 trillion 6.23 48.08% Dec 31, 2001 12.71 trillion 5.81 45.71% Dec 31, 2000 12.68 trillion 5.68 44.79% Is a 110% ratio problematic? That single data point alone doesn't say. But in light of the trend (we were under 45% 15 years ago) and with medicare and social security expenses about to start exploding with the retiring baby boomers, yeah, it absolutely is crucial we address this now. We haven't at all over the last 15 years, despite knowing this looming crisis was coming, and we did nothing. We don't have the luxury of not acting anymore, or hoping that we can economic-growth our way out of this. We can't. Exactly. In healthy economy, budget deficit during recession periods is compensated by proficit during expansion periods. If government has persistent deficit, exhausts reserves and continues to accumulate the debt for many years in a row, it is not a recession, it is a depression. All so called "wealthy" countries are in a state of depression right now. Their governments increase dept to hide pathological economical problems. By doing this, they are just shifting a collapse to the future. This can not last for long. Pretty much the entire world is in some form of depression right now, US and Russia included. Russia's economy is collapsing, 4% GDP recession each of the last 2 quarters. The Ruble is down by nearly 50% since this time last year. Countries like the US are borrowing money to cover budget shortfalls, while countries like Russia are spending assets to do the same. Its just a difference in philosophy. Look at those numbers you posted a little closer. From 2000 to 2007 it rose 16% in the US. In 2008 the US economy took a nose dive, and it rose 8%. Then an additional 13% in 2009, followed by 9% in 2010. So in 3 years from 2007-2010 the US increased its debt to GDP ratio at more than double the rate of the previous 7-8 years. The government was borrowing money to cover itself until things stabilized and they're able to pay it down. Now that the economy is turning around the budget is becoming a big political topic here in the US and I expect something will be done about it soon.I don't share this optimism. When republicans control things, they insist on tax cuts because the deficit is small. This makes absolutely no sense. If there is any deficit at all, it means the government isn't taking in enough revenue to cover its expenses. So tax cuts are the last thing it needs. It is always promised that tax cuts will improve the economy and bring in more revenue than the cuts cost, but this has never proven out. I fully expect that whatever party is in control after the next election, the deficit spending will continue, and republicans will talk about cutting taxes, regardless of whether they are in the majority or minority position. The US government should do something to cut the deficit or at least let it rise slower than the GDP rise. |

|

|

|

|

|

arbitrage

|

|

January 25, 2016, 09:31:44 AM |

|

Whole world's in debt! Only those people who don't have mortgages and don't owe something to banks have real liberty. Others are modern slaves!  |

|

|

|

|

yohanip

Member

Offline Offline

Activity: 118

Merit: 100

A Programmer

|

|

January 25, 2016, 10:11:24 AM |

|

So we are looking at the brink of the house of cards?

anyone could predict when will that occur? i have read and watch some videos out here around 2~3 years ago predicting the fall of the majors

would this become one of those hints?

|

|

|

|

|

|

arbitrage

|

|

January 25, 2016, 10:18:17 AM |

|

Problem is when US bubble explode every other country in the world will follow because,

dollar is the spare world carencie and is use to trade oil...

We can see many social unrests, maybe wars..That is not good!

|

|

|

|

|

|

arbitrage

|

|

January 25, 2016, 10:26:47 AM |

|

How to overcome this problem?

Why we can't just easy overthrown dollar and use gold standard, and bitcoin as new currency.

Whole dream won't happen, because they have better plans for us..

NWO!

|

|

|

|

|

btcprospecter

Sr. Member

Offline Offline

Activity: 504

Merit: 251

★777Coin.com★ Fun BTC Casino!

|

|

January 25, 2016, 10:34:14 AM |

|

There is no way this debt can ever be paid. At what point do they file for bankruptcy? I don't think replacing the financial system with anything will solve it. There is a storm coming and when it lands it's not going to be pretty.

|

|

|

|

|

Drekavac

|

|

January 25, 2016, 12:54:45 PM |

|

Economic slavery? But who asking all that money from you?  |

|

|

|

|

|

mcplums

|

|

January 25, 2016, 12:57:22 PM |

|

Here's what I don't understand.

All new money = debt. All debt comes with interest. Therefore there is not enough money to pay back the debt.

Money supply must be constantly increased to pay back old debt. Money supply can only be increased by going further into debt.

Governments therefore MUST run deficits to keep the money supply expanding so there is enough money to pay back old debts.

So what we are seeing MUST have happened at some point- constant deficits are the only way to keep the system working.

I remember reading somewhere that during Bill Clinton's terms, while there was a government surplus, the Fed were concerned about the effect this was having on the money supply. Government deficits are REQUIRED.

This seems clear as day to me yet it is not widely acknowledged to be so. Am I wrong? Or is everyone else wrong?

|

|

|

|

|

|

|

mOgliE

Legendary

Offline Offline

Activity: 1344

Merit: 1251

|

|

January 25, 2016, 02:24:13 PM |

|

this should encourage more, the people to invest in bitcoin, and help growing an alternative way to the plague that was/still is our conventional money system

trusting fiat at present is more dangerous than investing in bitcoin, numerous case of money lost due to banks playing with people money

there was a case of a bank(here) suggesting to an old man to invest in a low risk investment that then is become a heavy risk one, and he lost 100k in euro, he commited suicide by hanging

Dude, people trusted banks when they explained that subprimes were good and that "variable interest rates" didn't really mean variable. You really think people will even think about another way than banks? |

|

|

|

Bitcoinpro

Legendary

Offline Offline

Activity: 1344

Merit: 1000

|

|

January 25, 2016, 05:57:43 PM |

|

yup crypto has been planned for ages the debt bomb was all a big joke

China is screwed

|

WWW.FACEBOOK.COM

CRYPTOCURRENCY CENTRAL BANK

LTC: LP7bcFENVL9vdmUVea1M6FMyjSmUfsMVYf

|

|

|

OROBTC

Legendary

Offline Offline

Activity: 2912

Merit: 1852

|

|

January 25, 2016, 10:57:34 PM |

|

... If G. E. Griffin is right in his book ( The Creature from Jekyll Island, about the Federal Reserve, our nation's central bank), then the Debt was never even meant to be paid! As the US government has spent way beyond tax receipts, the Fed has bought the Treasury Bonds covering the deficits. And how did they get the money to buy all of those Treasuries? They printed it. Griffin writes at length showing that all of our currency (Federal Reserve Notes) is created when the Fed buys those bonds. This means that ALL of our "money" is now based on debt. Pay down the debt, money (Federal Resrve Notes) is destroyed... It's pretty weird and pretty ugly. Probably fewer than 1% in our country understand this.  |

|

|

|

|

mrhelpful

Legendary

Offline Offline

Activity: 1456

Merit: 1002

|

|

January 25, 2016, 11:25:40 PM |

|

yup crypto has been planned for ages the debt bomb was all a big joke

China is screwed

Not entirely, hasnt china been buying up our precious metals to serve their overpopulated country. Trying to replace u.s. currency making known world currency like u.s. did to their own as official denomination. I feel like if anything we`ll just keep kicking the can, by still printing more fiat till and I wont live around to see it. |

|

|

|

|

|

RealBitcoin

|

|

January 26, 2016, 02:19:22 AM |

|

Next 7 Obama years: 8.126 trillion dollars

Compare what we've done in the last 15 years to what we did in the first 224 years. We've more than tripled in the last 15 years what it took 224 years to accumulate in debt.

Eeeeehhh that's nothing. After you learn about the 1.6 quadrillion $ derivative market, you will see that the national debts are like a joke compared to it. |

|

|

|

mOgliE

Legendary

Offline Offline

Activity: 1344

Merit: 1251

|

|

January 26, 2016, 08:10:43 AM |

|

Next 7 Obama years: 8.126 trillion dollars

Compare what we've done in the last 15 years to what we did in the first 224 years. We've more than tripled in the last 15 years what it took 224 years to accumulate in debt.

Eeeeehhh that's nothing. After you learn about the 1.6 quadrillion $ derivative market, you will see that the national debts are like a joke compared to it. insert thank you gif. It's like nobody understands how insane it is to have a market exchanging 20 times the amount of goods that actually exist. It always creates a bubble, exactly what happened with the subprimes. The exchange market was 20 times the real one, banks where betting on bet of bet of bet of bets of subprimes. It doesn't work like this... |

|

|

|

|

JosNekoKopa

|

|

January 26, 2016, 09:49:24 AM |

|

US will bring whole world to knees when their bubble burst!

And i don't know if anything can be done to stop this madness..

|

|

|

|

|

|

Lutzow

|

|

January 26, 2016, 09:54:57 AM |

|

That's why US is no longer the number 1 country in the world unlike few decades ago. They've been printing money at will without anyone backing it unless you consider debt a good backer. The economy is credit-based which should only be temporary but it seems they got fond of it and made it permanent and what made it worse is that they keep on blowing the bubble to make it bigger.

|

|

|

|

|

JosNekoKopa

|

|

January 26, 2016, 10:14:23 AM |

|

There will be no safe place on planet when global collapse starts.

Bitcoin is very strong tied for dollar right now, and could be collateral?

|

|

|

|

|

|

a7mos

|

|

January 26, 2016, 10:36:51 AM |

|

America can have whatever debt they want as long as they have strong army to protect them, they can print the dollars that they want and pay it easily because dollar printing does not depend on any assests

|

|

|

|

|

|

JosNekoKopa

|

|

January 26, 2016, 11:08:51 AM |

|

America can have whatever debt they want as long as they have strong army to protect them, they can print the dollars that they want and pay it easily because dollar printing does not depend on any assests

Roman empire once was also strongest army in the world! But whole decline in culture and demise of empire starts when society were became adopt nemoral way of life with lot of spending money on games and exotic things.. Whole that circus we have now in US.. |

|

|

|

|

|

|

|

praprata

|

|

January 26, 2016, 04:38:59 PM |

|

US will bring whole world to knees when their bubble burst!

And i don't know if anything can be done to stop this madness..

Ofcourse every country have debt. Its not weird. But now they have made it known, therefore there is now a fuss about. |

,╓▄▄▄▄▄▄▄▄▄╓

╓▄█████████████████▄╖

╓▄█████▀▀'▒,,,,,╠'▀▀█████▄,

,▓███▀╜,▄▄███████████▄▄,╙▀████╖

▄███▀ ▄█████▀▀"``╙"▀▀█████▄ ▀███▄

▓███╜╓████▀ ,▄▄█████▄▄, ▀████,╙███▌

▓███`╔███▀ ╓▓███▀▀▀▀▀████╖ ▀███@"███▌

]███▌┌███▌ ▐███ ███▄ ▐███ ▐███,

▐███ ▐███ .███ ███ ███▌ ███▌

▐███ ▐███ '███ ███ ███▌ ███▌

]███@╙███@ ▀██▌ ,▄██▌ ▐███ ▐███`

▓███ ▐███▄ ╙██▀╩ 9███╜ ╔███▀,███▌

████,╙███▌ ▓███╜,████

▀███▄ ▀╜ ▀▀ ▄███▌

╙████▄, ╓▄████╜

╙█████▄▄╓, ,╓▄▄█████▀

▀▀█████████████████▀▀

'▀▀▀▀▀▀▀▀▀▀▀'

| CloakCoin | Trustless Anonymous Cryptocurrency | PoSA3

Forum | Bitcointalk | Twitter | Slack | Facebook | VK | Reddit | CloakTV | Instagram | IRC-Chat | Faucet

|

|

|

|

|

RealBitcoin

|

|

January 26, 2016, 05:36:01 PM |

|

insert thank you gif.

It's like nobody understands how insane it is to have a market exchanging 20 times the amount of goods that actually exist. It always creates a bubble, exactly what happened with the subprimes. The exchange market was 20 times the real one, banks where betting on bet of bet of bet of bets of subprimes. It doesn't work like this...

Well it's a global scam and a ponzi scheme, what did you thought it is? Bernie Madoff was Mother Teresa compared to the other banksters. The global debt/asset ratio is more like 2300% if we calculate the derivatives in  |

|

|

|

|

Rotator

|

|

January 26, 2016, 10:05:28 PM |

|

|

|

|

|

|

botany

Legendary

Offline Offline

Activity: 1582

Merit: 1064

|

|

January 27, 2016, 01:02:42 AM |

|

US will bring whole world to knees when their bubble burst!

And i don't know if anything can be done to stop this madness..

Ofcourse every country have debt. Its not weird. But now they have made it known, therefore there is now a fuss about. All countries have debt, but the US is different because 1) Its sheer scale. If the US sneezes, the rest of the world catches a cold. 2) The US debt is denominated in its own currency - USD. So technically they can devalue their currency (print more dollars) and repay the debt. |

|

|

|

|

foggyb

Legendary

Offline Offline

Activity: 1666

Merit: 1006

|

|

January 27, 2016, 05:02:06 AM |

|

US will bring whole world to knees when their bubble burst!

And i don't know if anything can be done to stop this madness..

Ofcourse every country have debt. Its not weird. But now they have made it known, therefore there is now a fuss about. All countries have debt, but the US is different because 1) Its sheer scale. If the US sneezes, the rest of the world catches a cold. 2) The US debt is denominated in its own currency - USD. So technically they can devalue their currency (print more dollars) and repay the debt. Only as long as partner countries continue to participate in the ponzi scheme. Eventually they will be forced to withdraw. |

I just registered for the $PLOTS presale! Thank you @plotsfinance for allowing me to purchase tokens at the discounted valuation of only $0.015 per token, a special offer for anyone who participated in the airdrop. Tier II round is for the public at $0.025 per token. Allocation is very limited and you need to register first using the official Part III link found on their twitter. Register using my referral code CPB5 to receive 2,500 points.

|

|

|

mrhelpful

Legendary

Offline Offline

Activity: 1456

Merit: 1002

|

|

January 27, 2016, 07:19:35 AM |

|

insert thank you gif.

It's like nobody understands how insane it is to have a market exchanging 20 times the amount of goods that actually exist. It always creates a bubble, exactly what happened with the subprimes. The exchange market was 20 times the real one, banks where betting on bet of bet of bet of bets of subprimes. It doesn't work like this...

Well it's a global scam and a ponzi scheme, what did you thought it is? Bernie Madoff was Mother Teresa compared to the other banksters. The global debt/asset ratio is more like 2300% if we calculate the derivatives in  This is pretty much sums it up. A Global Scam / Ponzi - since we all know fiat eventually turns the value of zero. Or similar how we see the zimbawae dollars where you see the crazy 1,000 dollar bills. |

|

|

|

|

Kakmakr

Legendary

Offline Offline

Activity: 3444

Merit: 1957

Leading Crypto Sports Betting & Casino Platform

|

|

January 27, 2016, 08:15:46 AM |

|

When you look at debt statistics over 224 years, you will have to look at other statistics too. For example the historical inflation rate for the same period. http://www.inflationdata.com/inflation/Inflation_Rate/HistoricalInflation.aspx The money 224 years ago, buy much less than what the currency <Dollar> is worth today. You also have to take the US population growth into consideration. The more people you have, the more resources you will need. <Higher unemployment = higher social responsibilities and funding> https://en.wikipedia.org/wiki/Demography_of_the_United_StatesThis will spiral down uncontrolled, if some of these other issues are not addressed. ^hmmmmm^ |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

mOgliE

Legendary

Offline Offline

Activity: 1344

Merit: 1251

|

|

January 27, 2016, 08:44:21 AM |

|

insert thank you gif.

It's like nobody understands how insane it is to have a market exchanging 20 times the amount of goods that actually exist. It always creates a bubble, exactly what happened with the subprimes. The exchange market was 20 times the real one, banks where betting on bet of bet of bet of bets of subprimes. It doesn't work like this...

Well it's a global scam and a ponzi scheme, what did you thought it is? Bernie Madoff was Mother Teresa compared to the other banksters. The global debt/asset ratio is more like 2300% if we calculate the derivatives in  Well I wouldn't call him a saint ^^ But truth is banks are screwing the world, and still people are here whining about terrorism, immigrants and shit like that... Hang the bankers, then you'll see it'll be far easier. |

|

|

|

|

|

markj113

Legendary

Offline Offline

Activity: 2254

Merit: 1043

|

|

January 27, 2016, 06:16:25 PM |

|

You must be the only person to believe that data lol Most financial experts agree that official figures coming out of China are a little economical with the truth. Also where does China's growth come from - Exports. If the west goes tits up no one will be buying fancy electronic gadgets. |

|

|

|

|

|

|

|

Drekavac

|

|

January 27, 2016, 06:28:05 PM |

|

You must be the only person to believe that data lol Most financial experts agree that official figures coming out of China are a little economical with the truth. Also where does China's growth come from - Exports. If the west goes tits up no one will be buying fancy electronic gadgets. i'm not an expert but they producing something cheap low quality, and selling it world wide.. Lots of people buying their product because they don't have US standard! Countries of third world and Europe. |

|

|

|

|

MoneyChanger

Member

Offline Offline

Activity: 107

Merit: 10

|

|

January 27, 2016, 08:24:53 PM |

|

No matter whole world is in economic slavery..

In China people works for few dollars a day.They sleep bunch of them in one room.

How many Americans stayed without place to sleep?

What happens to people savings in US?

EU is in economic and political crisis,war refugees..

CHAOS !

|

|

|

|

|

|

onlinedragon

|

|

January 27, 2016, 08:26:56 PM |

|

Thy just press some new money this is not something new. So far they always get permission to press new money and so this will keep going on.

|

|

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

January 27, 2016, 11:07:45 PM

Last edit: January 28, 2016, 01:09:31 AM by yvv |

|

No matter whole world is in economic slavery..

In China people works for few dollars a day.They sleep bunch of them in one room.

How many Americans stayed without place to sleep?

What happens to people savings in US?

EU is in economic and political crisis,war refugees..

CHAOS !

Shit! We all will die! |

.

|

|

|

elite3000

Legendary

Offline Offline

Activity: 1073

Merit: 1000

|

|

January 28, 2016, 01:02:02 AM |

|

At least the US debt is more or less stable right now, less than 19T.

But for how long?

|

|

|

|

|

Chinatsu

Member

Offline Offline

Activity: 74

Merit: 10

|

|

January 28, 2016, 01:06:10 AM |

|

Lets see how would trump lessen this.

|

|

|

|

mOgliE

Legendary

Offline Offline

Activity: 1344

Merit: 1251

|

|

January 28, 2016, 08:39:33 AM |

|

Lets see how would trump lessen this.

WE KILL MEXICAN! AND CHINESE! NO MORE DEBT! |

|

|

|

markj113

Legendary

Offline Offline

Activity: 2254

Merit: 1043

|

|

January 28, 2016, 09:10:32 AM |

|

At least the US debt is more or less stable right now, less than 19T.

But for how long?

Stable lol. You need to check out debtclock - http://www.usdebtclock.org/ |

|

|

|

|

mOgliE

Legendary

Offline Offline

Activity: 1344

Merit: 1251

|

|

January 28, 2016, 09:46:54 AM |

|

At least the US debt is more or less stable right now, less than 19T.

But for how long?

Stable lol. You need to check out debtclock - http://www.usdebtclock.org/Stable. Like stabely going to the moon xD |

|

|

|

Richard1972x

Full Member

Offline Offline

Activity: 224

Merit: 100

★YoBit.Net★ 350+ Coins Exchange & Dice

|

|

January 28, 2016, 10:30:19 AM |

|

Yeah, the deficit of the US has really exploded. Imagine 20 years ago und er Clinton the budget was covered, there was no deficit. How long will this last? Not so long any more I guess!

|

|

|

|

romero121

Legendary

Offline Offline

Activity: 3178

Merit: 1213

|

|

January 28, 2016, 10:57:43 AM |

|

At least the US debt is more or less stable right now, less than 19T.

But for how long?

These has got exploded just by the election campaigns that were going on over the united states. This debt does't hit them any time. Even though they are stable within a short term their debt getting vanished off |

|

|

|

|

arbitrage

|

|

January 28, 2016, 12:49:26 PM |

|

They cannot change nothing right now bubble is going to burst.

Whole system must be changed from the roots.. And they must bring back Gold standard!

Economic growth will be slower but more secure from banks and their hazardous games of inflation money.

|

|

|

|

|

mOgliE

Legendary

Offline Offline

Activity: 1344

Merit: 1251

|

|

January 28, 2016, 12:51:28 PM |

|

They cannot change nothing right now bubble is going to burst.

Whole system must be changed from the roots.. And they must bring back Gold standard!

Economic growth will be slower but more secure from banks and their hazardous games of inflation money.

Economic growth shouldn't even be an important parameter. It's totally stupid to create an economy where growth is mandatory! Because the base principle of growth is that it can't go to the infinite and beyond! We have only limited resources >< |

|

|

|

Paashaas

Legendary

Offline Offline

Activity: 3430

Merit: 4358

|

|

January 28, 2016, 03:25:35 PM |

|

A small gem of an article from Jim Sinclair's Mineset demonstrates one example of this debt problem. What a clear presentation of the increasing debt load, and decreasing wealth, of Americans, pretty scary   http://www.jsmineset.com/2016/01/26/29101/ http://www.jsmineset.com/2016/01/26/29101/ |

|

|

|

|

|

Capitascism

|

|

January 28, 2016, 07:12:56 PM |

|

Can fall of US economy create more space for BTC?

|

*************************Too many scams beware******************************************

|

|

|

actmyname

Copper Member

Legendary

Offline Offline

Activity: 2562

Merit: 2504

Spear the bees

|

|

January 28, 2016, 07:40:18 PM |

|

Sure, they have a humongous debt, but the problem is that if the countries decide to cash out on the debts (which they absolutely won't) then that will ruin the global economy pretty badly. Why take large amount when you can slowly take advantage of trading for a long amount of time?

|

|

|

|

|

Capitascism

|

|

January 28, 2016, 07:48:39 PM |

|

Bad scenario would be economic crisis part 2!

When we will have World government i'm tired?

|

*************************Too many scams beware******************************************

|

|

|

darkangel11

Legendary

Offline Offline

Activity: 2352

Merit: 1347

Defend Bitcoin and its PoW: bitcoincleanup.com

|

|

January 28, 2016, 07:55:40 PM |

|

So the debt is impossible to manage already. What now? Worldwide panic or a fast reset and revolution?  If the debt is in hands of bankers they should already know what's coming and start packing their bags. Nobody is going to make money out of thin air to pay them back. |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

|

Capitascism

|

|

January 28, 2016, 08:10:51 PM |

|

Debt is not problem at all. Debt is instrument of slavery!

And if you cannot repay your debt you can lose everything even freedom.

How to overcome this? Who creating this situation?

|

*************************Too many scams beware******************************************

|

|

|

darkangel11

Legendary

Offline Offline

Activity: 2352

Merit: 1347

Defend Bitcoin and its PoW: bitcoincleanup.com

|

|

January 28, 2016, 08:29:10 PM |

|

Debt is not problem at all. Debt is instrument of slavery!

And if you cannot repay your debt you can lose everything even freedom.

How to overcome this? Who creating this situation?

Debt starts to be a problem when a country has to pay it back not an individual. It can start an unemployment crisis and lead to a wave of bankruptcies. |

| | .

.Duelbits. | │ | ..........UNLEASH..........

THE ULTIMATE

GAMING EXPERIENCE | │ | DUELBITS

FANTASY

SPORTS | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

████████████████▀▀▀

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | .

▬▬

VS

▬▬ | ████▄▄▄█████▄▄▄

░▄████████████████▄

▐██████████████████▄

████████████████████

████████████████████▌

█████████████████████

███████████████████

███████████████▌

███████████████▌

████████████████

████████████████

████████████████

████▀▀███████▀▀ | /// PLAY FOR FREE ///

WIN FOR REAL | │ | ..PLAY NOW.. | |

|

|

|

mrflibblehat

Sr. Member

Offline Offline

Activity: 350

Merit: 250

★YoBit.Net★ 350+ Coins Exchange & Dice

|

|

January 29, 2016, 01:27:10 AM |

|

I think debt is the US in intentional.

From what I understood even if you have money (cash) and a clean record you cannot buy stuff there.

You have to have a loan first and pay it back, thus creating a history that represents the fact that you are indeed the kind of person that is capable to pay a loan back, then you can get a credit card, because without one you can't get internet subscription, energy subscription, you can't rent a place and so on.

|

|

|

|

Moneyburner

Member

Offline Offline

Activity: 112

Merit: 10

|

|

January 29, 2016, 01:42:15 AM |

|

The big debt numbers are scary and ultimately no good, however I'm more concerned with the credit drop we saw a year or two ago

|

|

|

|

botany

Legendary

Offline Offline

Activity: 1582

Merit: 1064

|

|

January 29, 2016, 01:57:26 AM |

|

US will bring whole world to knees when their bubble burst!

And i don't know if anything can be done to stop this madness..

Ofcourse every country have debt. Its not weird. But now they have made it known, therefore there is now a fuss about. All countries have debt, but the US is different because 1) Its sheer scale. If the US sneezes, the rest of the world catches a cold. 2) The US debt is denominated in its own currency - USD. So technically they can devalue their currency (print more dollars) and repay the debt. Only as long as partner countries continue to participate in the ponzi scheme. Eventually they will be forced to withdraw. They have huge investments in USD now. They have vested interests in ensuring that the dollar stays strong. They won't rock the boat.  |

|

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

January 29, 2016, 01:59:00 AM |

|

US will bring whole world to knees when their bubble burst!

And i don't know if anything can be done to stop this madness..

Ofcourse every country have debt. Its not weird. But now they have made it known, therefore there is now a fuss about. All countries have debt, but the US is different because 1) Its sheer scale. If the US sneezes, the rest of the world catches a cold. 2) The US debt is denominated in its own currency - USD. So technically they can devalue their currency (print more dollars) and repay the debt. Only as long as partner countries continue to participate in the ponzi scheme. Eventually they will be forced to withdraw. They have huge investments in USD now. They have vested interests in ensuring that the dollar stays strong. They won't rock the boat.  Don't worry. There is always an idiot on the boat who will. |

.

|

|

|

|

zivone

|

|

January 29, 2016, 02:06:54 AM |

|

The largest portion of U.S. debt, 68 cents for every dollar or about $10 trillion, is owned by individual investors, corporations, state and local governments and, yes, even foreign governments such as China that hold Treasury bills, notes and bonds.To put China's ownership of U.S. debt in perspective, its holding of $1.2 trillion is even larger than the amount owned by American households.

It's always China... I am imagining what would happen if China controls US in the future...

|

|

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

January 29, 2016, 02:13:41 AM |

|

The largest portion of U.S. debt, 68 cents for every dollar or about $10 trillion, is owned by individual investors, corporations, state and local governments and, yes, even foreign governments such as China that hold Treasury bills, notes and bonds.To put China's ownership of U.S. debt in perspective, its holding of $1.2 trillion is even larger than the amount owned by American households.

It's always China... I am imagining what would happen if China controls US in the future...

You will see some beautiful colors in New York and California. https://www.google.com/search?q=communist+party+of+china&client=ubuntu&hs=Rj0&channel=fs&source=lnms&tbm=isch&sa=X&ved=0ahUKEwjm6uz3-M3KAhVCdR4KHUN9BwEQ_AUICCgC&biw=1237&bih=657 ) Edit: And be sure these ugly colors will go to hell: https://www.google.com/search?q=%D0%BF%D0%B8%D0%B4%D0%B5%D1%80%D1%81%D1%82%D1%8B+%D1%84%D0%BB%D0%B0%D0%B3&client=ubuntu&hs=Pm0&channel=fs&source=lnms&tbm=isch&sa=X&ved=0ahUKEwiCouHP-c3KAhVG6x4KHV3CC68Q_AUIBygB&biw=1237&bih=657#channel=fs&tbm=isch&q=gay+flagMWHAHAHA!!! |

.

|

|

|

|

zivone

|

|

January 29, 2016, 02:19:04 AM |

|

|

|

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

January 29, 2016, 02:37:36 AM |

|

Sure, pollution is where production is. They would not mind to share some of their pollution with US consumers of Chinese goods for sure. |

.

|

|

|

DrLove2048

Member

Offline Offline

Activity: 84

Merit: 10

|

|

January 29, 2016, 02:40:51 AM |

|

US is very debt driven society, you need to have good credit to buy anything on credit, but you can't do that until you have credit. whole thing is a mess

|

|

|

|

btckold24

Sr. Member

Offline Offline

Activity: 434

Merit: 250

★Bitvest.io★ Play Plinko or Invest!

|

|

January 29, 2016, 03:37:52 AM |

|

this whole country has been run by morons the last 50 years.

The fact that we are in this crazy debt but still help other countries is moronic.

Lets help ourself first and get out of debt.

|

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

January 29, 2016, 03:52:46 AM |

|

this whole country has been run by morons the last 50 years.

The fact that we are in this crazy debt but still help other countries is moronic.

Lets help ourself first and get out of debt.

The fact is that you are not helping other countries. You government wastes your money to establish prostitute dictatorships around the world. This is the reason why common people start to hate you, common Americans. You have to do something about it. |

.

|

|

|

mOgliE

Legendary

Offline Offline

Activity: 1344

Merit: 1251

|

|

January 29, 2016, 09:28:15 AM |

|

this whole country has been run by morons the last 50 years.

The fact that we are in this crazy debt but still help other countries is moronic.

Lets help ourself first and get out of debt.

What other country are you helping? Cause here in Europe we'd rather let you go back to your continent please...  |

|

|

|

|

arbitrage

|

|

January 29, 2016, 10:38:57 AM |

|

this whole country has been run by morons the last 50 years.

The fact that we are in this crazy debt but still help other countries is moronic.

Lets help ourself first and get out of debt.

No they are not morons! They are just puppets! They are just profession actors like Ronald Reagan, Arnold Schwarzenegger.. They just doing what they must! Do you know who runs this world? |

|

|

|

|

Kenid

Newbie

Offline Offline

Activity: 48

Merit: 0

|

|

January 29, 2016, 12:25:50 PM |

|

The big debt numbers are scary and ultimately no good, however I'm more concerned with the credit drop we saw a year or two ago

The US banks have lent a lot of money to oil companies. Some of these debt will not be repaid due to the low oil price. It might affect the whole banking system. |

|

|

|

|

|

AtheistAKASaneBrain

|

|

January 29, 2016, 04:26:35 PM |

|

QE4 is coming soon. USA and EUR and CHN will keep getting deeper and deeper into their own demise no matter how high or low the price of their currencies go, the only way is down, and we are going to be getting closer to the final crash day by day. No amount of QE can save this this flawed system.

|

|

|

|

|

|

arbitrage

|

|

February 01, 2016, 03:35:01 PM |

|

If you watch through history always when there is global crisis you can expect some war for dominance for world resources. This time this is oil, Tomorrow we will have war for water..We humans are doomed to failure!

|

|

|

|

|

mOgliE

Legendary

Offline Offline

Activity: 1344

Merit: 1251

|

|

February 02, 2016, 09:06:02 AM |

|

If you watch through history always when there is global crisis you can expect some war for dominance for world resources. This time this is oil, Tomorrow we will have war for water..We humans are doomed to failure!

Not sure it will be for water. Water is a problem only for some countries. But did anyone watched The Big Short? It says that the genius who predicted the subprimes crisis is currently investing only in water related business! |

|

|

|

yvv

Legendary

Offline Offline

Activity: 1344

Merit: 1000

.

|

|

February 03, 2016, 03:18:40 PM |

|

|

.

|

|

|

|

|

mavrick951

Member

Offline Offline

Activity: 97

Merit: 10

|

|

February 04, 2016, 10:49:22 AM |

|

They stop stop pressing money already! What is the end of the line for this crazy debt spiral?

|

|

|

|

|

pitham1

Legendary

Offline Offline

Activity: 1232

Merit: 1000

|

|

February 05, 2016, 01:52:40 AM |

|

They stop stop pressing money already! What is the end of the line for this crazy debt spiral?

There is no end. There is only hope that the music never stops and nobody is left holding a big pile of debt.  |

|

|

|

abokhalel2

Member

Offline Offline

Activity: 233

Merit: 10

|

|

February 05, 2016, 05:08:41 AM |

|

The US Debt Just Exceeded $19 Trillion. This is unbelievable!

|

|

|

|

|

|

RealBitcoin

|

|

February 05, 2016, 08:18:48 AM |

|

The US Debt Just Exceeded $19 Trillion. This is unbelievable!

No it's not, it will probably double the next years. It is really getting big. |

|

|

|

qiwoman2

Legendary

Offline Offline

Activity: 2114

Merit: 1023

Oikos.cash | Decentralized Finance on Tron

|

|

February 05, 2016, 09:49:04 AM |

|

The debt in the United States and elsewhere is what is creating more and more wars and hardship for billions of people around the world. If governments don;'t get their houses in order how do they expect the people to trust them or try to do any better? This is why it is important for our generations and the next to fight for more sustainable living systems. This American dream is now imploding on it's own people.

|

|

|

|

|

RealBitcoin

|

|

February 05, 2016, 10:00:38 AM |

|