Rampion

Legendary

Offline Offline

Activity: 1148

Merit: 1018

|

|

November 25, 2013, 05:02:41 PM |

|

To all of you panic buying because you missed the "greatest thing ever", mark this post, within 6 months you will be able to buy in much lower, I have a large buy order at $35 (just above the 2011 high).

if this were an established commodity like gold, copper, soybeans, or a currency cross, which I have been trading for 15 years, that is the smart buy point - not at $159

Poor OP, he was never able to buy $35 coins. Yep, $159 was not a smart buy point indeed, the price is now 5 times higher. |

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

Its About Sharing

Legendary

Offline Offline

Activity: 1442

Merit: 1000

Antifragile

|

|

November 25, 2013, 05:22:50 PM |

|

To all of you panic buying because you missed the "greatest thing ever", mark this post, within 6 months you will be able to buy in much lower, I have a large buy order at $35 (just above the 2011 high).

if this were an established commodity like gold, copper, soybeans, or a currency cross, which I have been trading for 15 years, that is the smart buy point - not at $159

Poor OP, he was never able to buy $35 coins. Yep, $159 was not a smart buy point indeed, the price is now 5 times higher. What a beautiful reminder of a thread.  And, in a couple of years (or less) it will be 5X higher than now. ($817 Stamp, so prediction of at least $4085) And the OP is calling for a complete collapse of BTC - https://bitcointalk.org/index.php?topic=338531.msg3644674#msg3644674Diversification isn't a bad insurance policy. IAS |

BTC = Black Swan.

BTC = Antifragile - "Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Robust is not the opposite of fragile.

|

|

|

wachtwoord33

Newbie

Offline Offline

Activity: 3

Merit: 0

|

|

November 25, 2013, 05:24:13 PM |

|

To all of you panic buying because you missed the "greatest thing ever", mark this post, within 6 months you will be able to buy in much lower, I have a large buy order at $35 (just above the 2011 high).

if this were an established commodity like gold, copper, soybeans, or a currency cross, which I have been trading for 15 years, that is the smart buy point - not at $159

Poor OP, he was never able to buy $35 coins. Yep, $159 was not a smart buy point indeed, the price is now 5 times higher. Maybe he bought back at $80? |

|

|

|

|

Rampion

Legendary

Offline Offline

Activity: 1148

Merit: 1018

|

|

November 25, 2013, 05:31:23 PM |

|

To all of you panic buying because you missed the "greatest thing ever", mark this post, within 6 months you will be able to buy in much lower, I have a large buy order at $35 (just above the 2011 high).

if this were an established commodity like gold, copper, soybeans, or a currency cross, which I have been trading for 15 years, that is the smart buy point - not at $159

Poor OP, he was never able to buy $35 coins. Yep, $159 was not a smart buy point indeed, the price is now 5 times higher. Maybe he bought back at $80? No, just read his post history (I did it with a sense of dark entertainment), he is currently saying that he is out because Bitcoin is a bubble and it will collapse because its needed too much money constantly flowing into Bitcoin to sustain the current price given the actual inflationary phase (3.600 coins are "created" every day). Its funny to see how the biggest bears and naysayers (Bitcoin is a ponzi, Bitcoin is a trojan horse planted by the financial elite, etc. etc.) are either those who a) sold and saw the choo choo train leaving the station (they took their dump and were caught with their pants down, they weren't able to jump back in) or b) those who just discovered Bitcoin and feel that its too expensive and only the "early adopters" can profit from it. Both are stupid points, Bitcoin is still in its infancy, and while the chances of it going to 0 remain high, its true potential is yet to be discovered. |

|

|

|

|

icem3lter

|

|

November 25, 2013, 05:41:28 PM |

|

No, just read his post history (I did it with a sense of dark entertainment), he is currently saying that he is out because Bitcoin is a bubble and it will collapse because its needed too much money constantly flowing into Bitcoin to sustain the current price given the actual inflationary phase (3.600 coins are "created" every day).

He made some money, so good for him. No need to blame OP he doesnt want to risk anymore. Those who bough Bitcoins from him can sell with profit if they need money as well, so all happy  It seems no matter what price you buy, if you wait you cant loose. Remember Bitcoin is deflationary. |

|

|

|

bitcool

Legendary

Offline Offline

Activity: 1441

Merit: 1000

Live and enjoy experiments

|

|

November 25, 2013, 05:51:24 PM |

|

I just wanted to share with you all one of the many bear heads mounted on my trophy wall...

Apparently OP is still around, hoping for a "collapse". lol. |

|

|

|

|

Rampion

Legendary

Offline Offline

Activity: 1148

Merit: 1018

|

|

November 25, 2013, 05:51:48 PM |

|

No, just read his post history (I did it with a sense of dark entertainment), he is currently saying that he is out because Bitcoin is a bubble and it will collapse because its needed too much money constantly flowing into Bitcoin to sustain the current price given the actual inflationary phase (3.600 coins are "created" every day).

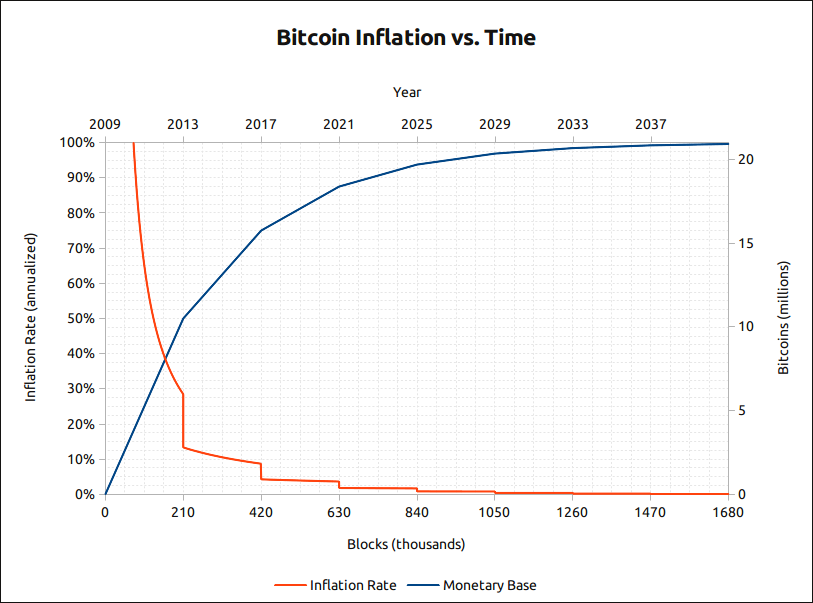

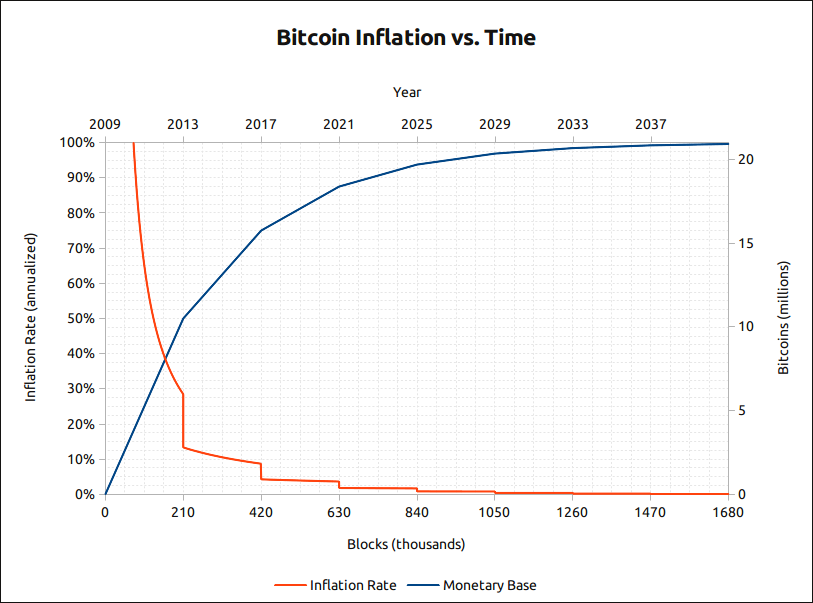

He made some money, so good for him. No need to blame OP he doesnt want to risk anymore. Those who bough Bitcoins from him can sell with profit if they need money as well, so all happy  It seems no matter what price you buy, if you wait you cant loose. Remember Bitcoin is deflationary. Not yet. This year's inflation rate is 12.5%. Next year (2014) inflation rate will be roughly 11.11%. Remember, Bitcoin will be inflationary till +2030.  |

|

|

|

Steelfox7

Member

Offline Offline

Activity: 68

Merit: 10

|

|

November 25, 2013, 05:56:44 PM |

|

Ouch.

|

|

|

|

|

|

wachtwoord33

Newbie

Offline Offline

Activity: 3

Merit: 0

|

|

November 25, 2013, 06:46:58 PM |

|

No, just read his post history (I did it with a sense of dark entertainment), he is currently saying that he is out because Bitcoin is a bubble and it will collapse because its needed too much money constantly flowing into Bitcoin to sustain the current price given the actual inflationary phase (3.600 coins are "created" every day).

He made some money, so good for him. No need to blame OP he doesnt want to risk anymore. Those who bough Bitcoins from him can sell with profit if they need money as well, so all happy  It seems no matter what price you buy, if you wait you cant loose. Remember Bitcoin is deflationary. Not yet. This year's inflation rate is 12.5%. Next year (2014) inflation rate will be roughly 11.11%. Remember, Bitcoin will be inflationary till +2030. https://images.weserv.nl/?url=www.mattwhitlock.com/Bitcoin%20Inflation.png&fnrNo, it has a static supply of 21M BTC. It's irrelevant whether these have been issued or not. |

|

|

|

|

Cabal

Newbie

Offline Offline

Activity: 3

Merit: 0

|

|

November 25, 2013, 06:51:18 PM |

|

Many of the fly-by-night currencies have no confidence (if you can call it such a thing). Be wary. |

|

|

|

|

Rampion

Legendary

Offline Offline

Activity: 1148

Merit: 1018

|

|

November 25, 2013, 06:54:58 PM |

|

No, just read his post history (I did it with a sense of dark entertainment), he is currently saying that he is out because Bitcoin is a bubble and it will collapse because its needed too much money constantly flowing into Bitcoin to sustain the current price given the actual inflationary phase (3.600 coins are "created" every day).

He made some money, so good for him. No need to blame OP he doesnt want to risk anymore. Those who bough Bitcoins from him can sell with profit if they need money as well, so all happy  It seems no matter what price you buy, if you wait you cant loose. Remember Bitcoin is deflationary. Not yet. This year's inflation rate is 12.5%. Next year (2014) inflation rate will be roughly 11.11%. Remember, Bitcoin will be inflationary till +2030.  No, it has a static supply of 21M BTC. It's irrelevant whether these have been issued or not. Wrong. It's not irrelevant at all - the first mining halving deeply affected price, and so will do subsequent mining halvings. Right now there are 3.600 newly minted coins EVERY DAY - the reduction of that (which is the inflation rate) will have a profound impact on BTC economy. It's just that noobs repeat like a Mantra that "BTC is deflationary" because they have read that on Wikipedia, while they do not realize that BTC is currently in a heavily inflationary phase. |

|

|

|

Rampion

Legendary

Offline Offline

Activity: 1148

Merit: 1018

|

|

November 25, 2013, 07:56:29 PM |

|

No, it has a static supply of 21M BTC. It's irrelevant whether these have been issued or not.

I understand your point -- that the bitcoins already exist, but they just haven't been released yet. However, you can't value them fully because they are not actually part of the money supply. On the other hand, they do have a present value which is greater than 0. His point *might* be that Bitcoin has a fixed supply that cannot be changed (unless there is a hard fork); thus the money supply is predictable and cannot be altered by third parties. That's one of the *fundamentals* that make Bitcoin very attractive, but that doesn't mean that BTC is currently deflationary: in fact it is the opposite. I'm refuting the mantra some noobs repeat like its some versicle of the bible, implying that the BTC/USD exchange rate is growing "because BTC is a deflationary currency". That's simply false and a silly, oversimplified statement that shows little understanding on the matter: the BTC/USD exchange rate is growing because the demand is exceeding the supply for many reasons, among which the incredible fundamentals and revolutionary aspects of BTC - but that doesn't change the fact that we are currently in a heavily inflationary phase. Plus, what "watchwoord" says is extremely wrong (the inflation rate being irrelevant). We are currently living an inflationary phase - when we reach the deflationary phase Bitcoin will face a huge and uncharted challenge: will the miners be able to cover their costs only by fees? In any case, the inflation rate has a DEEP impact on the economy, it's not irrelevant at all - I guess we all saw how the price skyorocketed after the last mining halving, the bubble started just there. |

|

|

|

|

beetcoin

|

|

November 25, 2013, 07:59:44 PM |

|

Appreciate the revival. I don't understand why anyone would sell everything.

I started buying Bitcoin in April, and it was simply the good fortune of a funding delay that kept me from buying above $200. I remember feeling bad for anyone who purchased near the peak price -- I assumed we'd see new highs eventually, but didn't know when. Little did I know that in a matter of months, even those peak buyers would see their Bitcoins triple in price.

the funny part was he was talking down to the people who thought buying in at $159 was a good idea. i mean, he called everyone naive.. lol. the fact is that nothing is for certain, and those who believe otherwise are just fools. |

|

|

|

|

wachtwoord33

Newbie

Offline Offline

Activity: 3

Merit: 0

|

|

November 25, 2013, 08:02:51 PM |

|

No, it has a static supply of 21M BTC. It's irrelevant whether these have been issued or not.

I understand your point -- that the bitcoins already exist, but they just haven't been released yet. However, you can't value them fully because they are not actually part of the money supply. On the other hand, they do have a present value which is greater than 0. Well I disagree that we're currently inflationary (or have ever been) and therefore I think it has no impact on value. I do agree that the it influences supply and therefore price. |

|

|

|

|

Its About Sharing

Legendary

Offline Offline

Activity: 1442

Merit: 1000

Antifragile

|

|

November 25, 2013, 09:51:50 PM |

|

No, it has a static supply of 21M BTC. It's irrelevant whether these have been issued or not.

I understand your point -- that the bitcoins already exist, but they just haven't been released yet. However, you can't value them fully because they are not actually part of the money supply. On the other hand, they do have a present value which is greater than 0. His point *might* be that Bitcoin has a fixed supply that cannot be changed (unless there is a hard fork); thus the money supply is predictable and cannot be altered by third parties. That's one of the *fundamentals* that make Bitcoin very attractive, but that doesn't mean that BTC is currently deflationary: in fact it is the opposite. I'm refuting the mantra some noobs repeat like its some versicle of the bible, implying that the BTC/USD exchange rate is growing "because BTC is a deflationary currency". That's simply false and a silly, oversimplified statement that shows little understanding on the matter: the BTC/USD exchange rate is growing because the demand is exceeding the supply for many reasons, among which the incredible fundamentals and revolutionary aspects of BTC - but that doesn't change the fact that we are currently in a heavily inflationary phase. Plus, what "watchwoord" says is extremely wrong (the inflation rate being irrelevant). We are currently living an inflationary phase - when we reach the deflationary phase Bitcoin will face a huge and uncharted challenge: will the miners be able to cover their costs only by fees? In any case, the inflation rate has a DEEP impact on the economy, it's not irrelevant at all - I guess we all saw how the price skyorocketed after the last mining halving, the bubble started just there. Technically we are in an inflationary phase. Whether it is heavy or light probably depends on how we choose to look at it. What is interesting is that BTC, practically speaking is deflationary right now, as the demand is greater than the supply. So the word "inflationary" to me, might be technically correct, but looking at he huge demand and rising price (if that continues) we will continue to see BTC as essentially deflationary. And judging by the world economic situation continuing to darken, I don't see the deflationary "argument" changing. IAS |

BTC = Black Swan.

BTC = Antifragile - "Some things benefit from shocks; they thrive and grow when exposed to volatility, randomness, disorder, and stressors and love adventure, risk, and uncertainty. Robust is not the opposite of fragile.

|

|

|

Rampion

Legendary

Offline Offline

Activity: 1148

Merit: 1018

|

|

November 25, 2013, 10:16:14 PM |

|

No, it has a static supply of 21M BTC. It's irrelevant whether these have been issued or not.

I understand your point -- that the bitcoins already exist, but they just haven't been released yet. However, you can't value them fully because they are not actually part of the money supply. On the other hand, they do have a present value which is greater than 0. His point *might* be that Bitcoin has a fixed supply that cannot be changed (unless there is a hard fork); thus the money supply is predictable and cannot be altered by third parties. That's one of the *fundamentals* that make Bitcoin very attractive, but that doesn't mean that BTC is currently deflationary: in fact it is the opposite. I'm refuting the mantra some noobs repeat like its some versicle of the bible, implying that the BTC/USD exchange rate is growing "because BTC is a deflationary currency". That's simply false and a silly, oversimplified statement that shows little understanding on the matter: the BTC/USD exchange rate is growing because the demand is exceeding the supply for many reasons, among which the incredible fundamentals and revolutionary aspects of BTC - but that doesn't change the fact that we are currently in a heavily inflationary phase. Plus, what "watchwoord" says is extremely wrong (the inflation rate being irrelevant). We are currently living an inflationary phase - when we reach the deflationary phase Bitcoin will face a huge and uncharted challenge: will the miners be able to cover their costs only by fees? In any case, the inflation rate has a DEEP impact on the economy, it's not irrelevant at all - I guess we all saw how the price skyorocketed after the last mining halving, the bubble started just there. Technically we are in an inflationary phase. Whether it is heavy or light probably depends on how we choose to look at it. What is interesting is that BTC, practically speaking is deflationary right now, as the demand is greater than the supply. So the word "inflationary" to me, might be technically correct, but looking at he huge demand and rising price (if that continues) we will continue to see BTC as essentially deflationary. And judging by the world economic situation continuing to darken, I don't see the deflationary "argument" changing. IAS Probably the fact that BTC is designed to be deflationary n the future it's a key factor on the demand being greater than the supply. It's more "the promise" of a deflationary currency that a deflationary currency itself (at the moment). In fact, I think the inflation rate is tied with the volatility. In its current phase Bitcoin appreciates and depreciates very fast: in 2012 it lost 96% of its value, 75% in April 2013; that's not how a deflationary currency behaves, that's the kind of dynamics you see in a penny stock market. In the next yeaes the inflation rate will go down, the market cap will grow and the distribution will even. At that point I'd expect much less volatility and a behavior in line with what Bitcoin is designed to be, a deflationary currency. |

|

|

|

EcuaMobi

Legendary

Offline Offline

Activity: 1862

Merit: 1469

https://Ecua.Mobi

|

|

November 25, 2013, 10:38:43 PM |

|

So interesting to read this just 7 months later. I wonder if this will be a 10.000-BTC-pizza-like post in a few years.

|

|

|

|

|

neordicICE

|

|

November 25, 2013, 10:46:40 PM |

|

At 2020 there will be interesting times, 90% of Bitcoins in circulation, and major merchants accepting BTC already. Wouldnt surprice me if the price was $158.500 / BTC. One thousand times more than OP sold  |

|

|

|

|

rizzeren

Newbie

Offline Offline

Activity: 10

Merit: 0

|

|

November 25, 2013, 10:52:02 PM |

|

Sorry for the loss for the OP, but I did the excact same thing. I cashed out earlier this year in the $120 range thinking it would stay there in that interval for a long time - boy was I wrong:(

|

|

|

|

|

|