Meuh6879 (OP)

Legendary

Offline Offline

Activity: 1512

Merit: 1011

|

|

June 02, 2017, 09:35:52 PM |

|

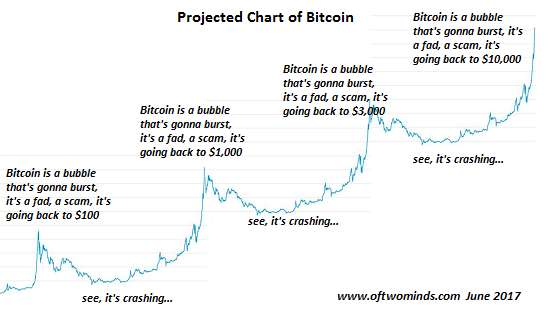

Source : http://www.zerohedge.com/news/2017-06-02/projecting-price-bitcoinThe true potential value of cryptocurrencies will not become visible until the global economy experiences a catastrophic collapse of debt and/or a major fiat currency. These events are already baked into the future, in my view; nothing can possibly alter the eventual collapse of the current debt/credit bubble and the fiat currencies that are being issued to inflate those bubbles.

The skeptics will continue declaring bitcoin a bubble that's bound to pop at $3,000, $5,000, $10,000 and beyond. When the skeptics fall silent, the potential for a bubble will be in place.  |

|

|

|

|

|

|

|

There are several different types of Bitcoin clients. The most secure are full nodes like Bitcoin Core, but full nodes are more resource-heavy, and they must do a lengthy initial syncing process. As a result, lightweight clients with somewhat less security are commonly used.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

d5000

Legendary

Offline Offline

Activity: 3892

Merit: 6089

Decentralization Maximalist

|

|

June 02, 2017, 11:35:12 PM |

|

While I agree with the network effect being important and difficult to calculate, I'm a bit skeptic about the conclusion this article draws - it's only one more of the ultra-bullish "predictions" I saw in the last months.

First, Bitcoin is not the only cryptocurrency in the market. There are thousands. There are several worst-case scenarios where Bitcoin could lose value in the future.

Second, there are also other interesting ideas for private currencies, like "baskets" of goods and services. These cannot be easily realized with Bitcoin. With Ethereum and Bitshares it's possible, but it has some hassles, and I think this model would have more success when managed by a "democratic" organization (like an association or foundation or even an "informal organized group").

Third, a part of the "mass adoption" dream of Bitcoin is already priced in its present value. With present use as a currency Bitcoin would have a value of less than $100 (rough estimation).

If everything goes well, I expect however higher Bitcoin prices in the future ($20K perhaps) but not hundreds of thousands or millions like this article suggests.

|

|

|

|

|

cryptonia

|

|

June 03, 2017, 02:36:47 AM |

|

Also blockchains contain encrypt manipulate and transmit data. that makes them very different to gold or fiat

|

|

|

|

|

aso118

Legendary

Offline Offline

Activity: 1918

Merit: 1012

★Nitrogensports.eu★

|

|

June 03, 2017, 02:45:29 AM |

|

The underlying assumption between every projection on cryptocurrencies is the rate of adoption. If adoption fails to take off, Bitcoin will die a slow death. Only when the adoption increases significantly does the network effect kick in.

|

|

|

|

cpfreeplz

Legendary

Offline Offline

Activity: 966

Merit: 1042

|

|

June 03, 2017, 02:48:04 AM |

|

Third, a part of the "mass adoption" dream of Bitcoin is already priced in its present value. With present use as a currency Bitcoin would have a value of less than $100 (rough estimation).

Your high school math teacher would be very angry with you. You didn't show your work! The underlying assumption between every projection on cryptocurrencies is the rate of adoption. If adoption fails to take off, Bitcoin will die a slow death. Only when the adoption increases significantly does the network effect kick in.

I couldn't have said it better myself. We're nowhere close to that yet. |

|

|

|

|

|

Pearls Before Swine

|

|

June 03, 2017, 02:56:03 AM |

|

Ahem. This is how all bubbles start, with a new technology that's gonna change the world. Railroads, cars, planes, internet, radio. All their stocks got hyped to the point where a bubble formed, and they all popped. Any time you think "it's different this time!", it's not.

Having blabbed all that, I don't think we're in a bubble exactly. But if the price keeps rising like it is, it's going to crash down to earth just like everything before it. You watch.

|

|

|

|

|

DayVid_GI_DEV

Newbie

Offline Offline

Activity: 41

Merit: 0

|

|

June 03, 2017, 03:03:51 AM |

|

Ahem. This is how all bubbles start, with a new technology that's gonna change the world. Railroads, cars, planes, internet, radio. All their stocks got hyped to the point where a bubble formed, and they all popped. Any time you think "it's different this time!", it's not.

Having blabbed all that, I don't think we're in a bubble exactly. But if the price keeps rising like it is, it's going to crash down to earth just like everything before it. You watch.

What goes up, must come down. |

|

|

|

|

AjithBtc

Sr. Member

Offline Offline

Activity: 1666

Merit: 276

Vave.com - Crypto Casino

|

|

June 03, 2017, 03:08:06 AM |

|

Ahem. This is how all bubbles start, with a new technology that's gonna change the world. Railroads, cars, planes, internet, radio. All their stocks got hyped to the point where a bubble formed, and they all popped. Any time you think "it's different this time!", it's not.

Having blabbed all that, I don't think we're in a bubble exactly. But if the price keeps rising like it is, it's going to crash down to earth just like everything before it. You watch.

Agreed, we're not in a bubble. It's the normal growth of the crypts as the inflow increasing periodically. But the second thing doesn't look appropriate, crash is realistic but with bitcoin it differs. Unlike market shares it won't be sustaining long in the crash. In a short time lapse it retains. |

|

|

|

pooya87

Legendary

Offline Offline

Activity: 3430

Merit: 10500

|

|

June 03, 2017, 03:22:11 AM |

|

i don't get what this new wave of way of thinking is coming from but it has just been a thing recently!

for years whenever you looked around on the social media everyone was excited to say "we spent bitcoin", and acknowledge bitcoin as a currency. then recently i keep hearing some people starting to insist on convincing others that bitcoin is not a currency but a store of value!

nice chart by the way...

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

dinofelis

|

|

June 03, 2017, 03:36:50 AM |

|

Crypto is something truly revolutionary, but not what we think it is. It has not much to do with "currency". Crypto is essentially the purest form of "speculative financial asset". Most speculative financial assets have some or other link with the real economy, apart from gold. Real estate, stock, derivatives etc .... are formulated in such a way that their value is somehow linked to something in the real economy (you could say that the real economy is the random generator that is trusted by the financial players to give the outcome of their speculative game). Crypto has invented the "economy-less derivative". Financial institutions had invented de facto such kind of assets to be able to gamble big time - which led to the banking crisis of 2007-2008. Since the financial sector is much more restricted now in the speculative games it can play, and technology was ripe, a new "Wild Wild West" speculative asset had a market opportunity: crypto.

Regularly, the financial world looks for such assets to speculate on when they have too much easy money on their hands, and are in need of bubbles. Crypto is the perfect asset for that. When financial markets are in the stock market and gamble with stock (like before 1929 or dot-com), or they gamble on real-estate (Japan in the 90-ies, US/Spain/... real estate bubble) or they invent unfathomable derivatives (2007), financial markets live off irrational bubbles ; the problem is, most of the time, they use "real-economy connected" assets to gamble on, and at a certain point, the disparity between the fundamentals and the market value indicates a bubble. Crypto has the advantage to be a purely speculative asset without almost any "real economy connection": it is a token on which to gamble, and the market price is PURELY determined by other gamblers.

I think there are still a lot of legal barriers for big finance to enter crypto, but I think they are just having wet dreams of being able to play with it. Crypto will be banks and financial institutions' best friends, and if the legal barriers fall, it will most probably be one of the better bubbles out there, paling the 1929 or 2007 banking crisis: crypto has the potential to cause one of the biggest financial catastrophes of history if it seriously takes off (no, it won't be its cure, it will be its cause).

This is essentially due to the "collectible" nature of most crypto, without value capping, which makes it a gambler's asset like no other. This is why we see it bubbling, and growing at the same time: it is a highly unstable asset, the perfect wet dream for financial institutions. The bubble it might blow could very well be much, much higher than what we're used to, so this ride can go very very high.

|

|

|

|

|

DayVid_GI_DEV

Newbie

Offline Offline

Activity: 41

Merit: 0

|

|

June 03, 2017, 06:45:15 PM |

|

There's still the question of adoption. More and more people are accepting crypto as currency. If the rate of this takes off, is it possible that the USD (or other world currencies) could collapse? Or would they simply create their own "USDCOIN" and convert to block chain technology?

|

|

|

|

|

DayVid_GI_DEV

Newbie

Offline Offline

Activity: 41

Merit: 0

|

|

June 03, 2017, 07:06:35 PM |

|

Crypto is something truly revolutionary, but not what we think it is. It has not much to do with "currency". Crypto is essentially the purest form of "speculative financial asset". Most speculative financial assets have some or other link with the real economy, apart from gold. Real estate, stock, derivatives etc .... are formulated in such a way that their value is somehow linked to something in the real economy (you could say that the real economy is the random generator that is trusted by the financial players to give the outcome of their speculative game). Crypto has invented the "economy-less derivative". Financial institutions had invented de facto such kind of assets to be able to gamble big time - which led to the banking crisis of 2007-2008. Since the financial sector is much more restricted now in the speculative games it can play, and technology was ripe, a new "Wild Wild West" speculative asset had a market opportunity: crypto.

Regularly, the financial world looks for such assets to speculate on when they have too much easy money on their hands, and are in need of bubbles. Crypto is the perfect asset for that. When financial markets are in the stock market and gamble with stock (like before 1929 or dot-com), or they gamble on real-estate (Japan in the 90-ies, US/Spain/... real estate bubble) or they invent unfathomable derivatives (2007), financial markets live off irrational bubbles ; the problem is, most of the time, they use "real-economy connected" assets to gamble on, and at a certain point, the disparity between the fundamentals and the market value indicates a bubble. Crypto has the advantage to be a purely speculative asset without almost any "real economy connection": it is a token on which to gamble, and the market price is PURELY determined by other gamblers.

I think there are still a lot of legal barriers for big finance to enter crypto, but I think they are just having wet dreams of being able to play with it. Crypto will be banks and financial institutions' best friends, and if the legal barriers fall, it will most probably be one of the better bubbles out there, paling the 1929 or 2007 banking crisis: crypto has the potential to cause one of the biggest financial catastrophes of history if it seriously takes off (no, it won't be its cure, it will be its cause).

This is essentially due to the "collectible" nature of most crypto, without value capping, which makes it a gambler's asset like no other. This is why we see it bubbling, and growing at the same time: it is a highly unstable asset, the perfect wet dream for financial institutions. The bubble it might blow could very well be much, much higher than what we're used to, so this ride can go very very high.

Crypto has the potential to cause the biggest financial catastrophe in history. Could it be possible for it to be the cause AND the cure also as well? |

|

|

|

|

mindrust

Legendary

Offline Offline

Activity: 3234

Merit: 2417

|

|

June 03, 2017, 07:14:13 PM |

|

I read the article on zerohedge the day it was posted. It is a brilliant article which shows us why bitcoin is invincible. Old timers who compare bitcoin to gold and think bitcoin is just another tulipmania which is about to die. They do miss the main point(s).

1) If we were able to trade tulips P2P through the world since the year 16xx's, we would still be doing it. We would have named it, Tulipcoin.

2) Bitcoin is different than tulips because tulip trading died because people just couldn't trade it anymore. The government banned it. Bitcoin is invincible in this regard.

Even if they close all the exchanges, shut all the miners down, bitcoin will still keep being traded. The trading volume will drop %99, the prices will drop %99 but it won't die completely. It will always find users. That is why bitcoin is no tulips. Not even close.

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

cpfreeplz

Legendary

Offline Offline

Activity: 966

Merit: 1042

|

|

June 03, 2017, 07:27:39 PM |

|

Bitcoins ain't no good. Invest in shitcoins. See signature.

FIFY. Now that we're finally out of that 2013-2015 slump people are rushing to get bitcoins again. We're just back on track to where we should have been in 2014. More people are adopting bitcoins, more places are accepting it, more countries are declaring it legal currency. It's not a fad or whatever. This is the real value of bitcoins. Get on the bus or or watch it drive away. |

|

|

|

|

|

pixie85

|

|

June 03, 2017, 08:00:10 PM |

|

There's still the question of adoption. More and more people are accepting crypto as currency. If the rate of this takes off, is it possible that the USD (or other world currencies) could collapse? Or would they simply create their own "USDCOIN" and convert to block chain technology?

Yes it's possible, but I'd say world reserve currencies will be kept afloat for a long time until a real collapse happens. The inflation will continue and what now costs $100 will be $200 in 10 years. You'll need a million to buy a house and new cheap cars will cost at least $20000, that's a near future. A 100 years ago people were working for $1 per hour, now they need at least $10, when we reach $100 per hour you'll know your fiat is hyperinflated and collapsing. |

|

|

|

|

buwaytress

Legendary

Offline Offline

Activity: 2786

Merit: 3437

Join the world-leading crypto sportsbook NOW!

|

|

June 03, 2017, 08:44:17 PM |

|

While I agree with the network effect being important and difficult to calculate, I'm a bit skeptic about the conclusion this article draws - it's only one more of the ultra-bullish "predictions" I saw in the last months.

First, Bitcoin is not the only cryptocurrency in the market. There are thousands. There are several worst-case scenarios where Bitcoin could lose value in the future.

Second, there are also other interesting ideas for private currencies, like "baskets" of goods and services. These cannot be easily realized with Bitcoin. With Ethereum and Bitshares it's possible, but it has some hassles, and I think this model would have more success when managed by a "democratic" organization (like an association or foundation or even an "informal organized group").

Third, a part of the "mass adoption" dream of Bitcoin is already priced in its present value. With present use as a currency Bitcoin would have a value of less than $100 (rough estimation).

If everything goes well, I expect however higher Bitcoin prices in the future ($20K perhaps) but not hundreds of thousands or millions like this article suggests.

You've got very good points there, especially with the notion of increased (not mass I think) adoption already priced in. That's not the only thing... I believe speculators are trying to predict based on history and pricing these events in as well: 1. Future halving in 2019/20 2. More coins lost in Mt. Gox like events 3. near term scarcity at exchanges |

|

|

|

DayVid_GI_DEV

Newbie

Offline Offline

Activity: 41

Merit: 0

|

|

June 03, 2017, 11:43:12 PM |

|

This is where I get a little confused. I thought the beauty of block chain, was that events like Mt.Gox wouldn't happen.

|

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4442

|

|

June 04, 2017, 12:07:58 AM |

|

This is where I get a little confused. I thought the beauty of block chain, was that events like Mt.Gox wouldn't happen.

well the beauty of gold is that things like hackers cant scam your credit card.. but if you put your gold into a storage box and not care who has the key.. then someone can steal it. the point of bitcoin is not to use things like mtgox!!! i have never been victim to exchange hacking. my hoard has remained in my sole control. the only time it leaves my control is when spending it. but then its not my problem anymore, its the recipients. bitcoin is not about using online wallet. but some people cannot look passed the fiat mindset, to be in self control.. so end up being lazy and "trusting" others to hold their value because its all they have ever known |

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

DayVid_GI_DEV

Newbie

Offline Offline

Activity: 41

Merit: 0

|

|

June 04, 2017, 01:01:32 AM |

|

This is where I get a little confused. I thought the beauty of block chain, was that events like Mt.Gox wouldn't happen.

well the beauty of gold is that things like hackers cant scam your credit card.. but if you put your gold into a storage box and not care who has the key.. then someone can steal it. the point of bitcoin is not to use things like mtgox!!! i have never been victim to exchange hacking. my hoard has remained in my sole control. the only time it leaves my control is when spending it. but then its not my problem anymore, its the recipients. bitcoin is not about using online wallet. but some people cannot look passed the fiat mindset, to be in self control.. so end up being lazy and "trusting" others to hold their value because its all they have ever known That makes more sense now. I would imagine any exchange could be hacked whether it be crypto or fiat. I have major trust issues. That's why I ask a lot of questions. Playing around in those exchanges is a gamble anyway. |

|

|

|

|

DayVid_GI_DEV

Newbie

Offline Offline

Activity: 41

Merit: 0

|

|

June 04, 2017, 02:56:54 AM |

|

How does anyone else on this thread feel about blockchain being used for things other than currency? For example: voting polls

|

|

|

|

|

|