johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

September 19, 2013, 05:21:08 PM |

|

Why do they always use lots of vague terms like tightening, easing, tool box, taper ... when in reality it is only two actions: print more money or print less money  |

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

CurbsideProphet

|

|

September 19, 2013, 05:43:13 PM |

|

How can they stop printing at this point without crashing the markets?

They can't. Cheap money has turned from stimulus to entitlement. |

1ProphetnvP8ju2SxxRvVvyzCtTXDgLPJV

|

|

|

Morbid

Legendary

Offline Offline

Activity: 1202

Merit: 1015

|

|

September 19, 2013, 08:47:06 PM |

|

I agree. The Fed was expected to taper, and they didn't. I see this leading to more and more people wondering if it will ever stop.

the way i see it fed are doing QE every couple of years now indicating that they are buying some time for themselves. if we dont get another QE in 2015 then we need to brace ourselves as doom will be around the corner... |

|

|

|

|

|

bassclef

|

|

September 20, 2013, 12:29:31 AM |

|

Of course they're not going to end QE. It's the only thing propping up the markets since the 2008 crash.

|

|

|

|

|

Adrian-x

Legendary

Offline Offline

Activity: 1372

Merit: 1000

|

|

September 20, 2013, 12:56:25 AM |

|

The FED is holding on, waiting for Bitcoin to mature.

|

Thank me in Bits 12MwnzxtprG2mHm3rKdgi7NmJKCypsMMQw

|

|

|

|

Operatr

|

|

September 20, 2013, 01:13:38 AM |

|

This is the end game, the FED has basically admitted now that it can't stop QE and has no exit plan of any kind.

Though the unthinkable approaches as fiat nears its end, I can't wait to see how Bitcoin responds. If it was anything like Cyprus we may be in for a big surprise.

|

|

|

|

|

|

johnyj (OP)

Legendary

Offline Offline

Activity: 1988

Merit: 1012

Beyond Imagination

|

|

September 20, 2013, 11:15:36 AM |

|

I think they still have lots of room

It is easy to bribe people with printed money, so that eventually every one is bribed. Imagine that average Joe suddenly get a job with $10K per month, even the job itself is useless, he won't question it. And more importantly, he won't care about that some bankers earned $100K per month during the process

Commercial banks are like black hole, newly printed money must first satisfy their need and then the extra part will flow out to the society. For each 10 dollar went into commercial banks, maybe only 1 dollar eventually spent and created job

The only concern is hyperinflation, but that will not happen as long as the money printing speed is less than 100% per year and there are assets continuously absorb the extra money supply. Average Joe will not eat double amount of beef per day if his income doubled, but he might spend 100% more on his mortgage and get a newer larger house. That will not impact CPI directly

There is another concern about concentrated production power, e.g. a few multinational enterprises command most of the production in the world, thus rest of the people become jobless. But same, if they are bribed with enough money, they will eventually hire more and more people doing useless things, at mean time accumulate magnitudes higher money

And just like bitcoin, most of those money will first be hoarded when people's saving preference is high, but if the economy really improved after a while and those money are losing their value quickly, they will rush out to chase other things, thus accelerate the inflation. It is possible that we will see a 20% interest rate on USD by that time, maybe even a 50% interest rate can not save it

|

|

|

|

|

Pumpkin

|

|

September 20, 2013, 10:19:09 PM |

|

This really did not suprise the followers of the Austrian school of economics (Peter Schiff and many others).

As important as this is, it would be wishful thinking this will destroy the dollar. It will not. As long as the world accepts dollars, the Fed can print much much more and for a very long time.

|

|

|

|

|

Morbid

Legendary

Offline Offline

Activity: 1202

Merit: 1015

|

|

September 21, 2013, 12:07:15 PM

Last edit: September 21, 2013, 11:31:17 PM by Morbid |

|

This really did not suprise the followers of the Austrian school of economics (Peter Schiff and many others).

As important as this is, it would be wishful thinking this will destroy the dollar. It will not. As long as the world accepts dollars, the Fed can print much much more and for a very long time.

the problem is that big corporations observe how this is playing up.. there is a battle going on between rothchild and rockefeller clans. rocefeller's fed got over reliant of usd so they started to spin their reserve gold to make usd stronger believing that usd will stay where it was. now rothchild's biggest gold reserves are being moved to china/hong kong. it seems goldman sach in 2008 orcestrated the crash to cripple fed's dollar to the point for them to drain last of the gold reserves to cover national debt. in 2008 they didnt do that indicating that they simply dont have any gold there. the fed was expected to bring out the gold but that didnt happen. by doing first qe they shot themselves in the foot as by doing so they devalue the same dollar that they need to keep trust in. so all these wars happening is rockefellers last resort to throw overinflated dollar into new forced markets in puppet countries around the world. if usa went to syria last month then we wouldnt have a new qe. since they announced new qe it pretty much confirms that they still didnt manage to come out with any gold - obviously the clan will never put their own gold/wealth into saving their creation but use public's wealth instead via inflation. its all pretty devastating as usd is in neverending vortex as debt increases much faster than supply so more qes will follow OR default which will collapse the empire. now as we go in time whats stopping big whales (corporations) to stop accepting usd due to its constant devaluation and jump onto any other non-usd related currency? - nothing. once that happens usd will dip, other big entities will notice that and will also follow, once chain reaction begins it will default dollar within days. by the time the public is informed they will close the banks. with no money supply the looting will start immediately as all shops will close (why do they need to sell something for nothing). in first week food will ran out in supermarkets. no police. anarchy. criminals will emerge out of woodwork and there would be people with most guns holding onto areas. best scenario is to go out of populated areas as on second week we will experience hunger. the other currencies like eur or gbp will experience same thing almost immediatly as stock exchanges will crash their currencies as mass sale of stock begins. people.. get prepared. be smart. |

|

|

|

|

Lethn

Legendary

Offline Offline

Activity: 1540

Merit: 1000

|

|

September 21, 2013, 09:53:12 PM |

|

This really did not suprise the followers of the Austrian school of economics (Peter Schiff and many others).

As important as this is, it would be wishful thinking this will destroy the dollar. It will not. As long as the world accepts dollars, the Fed can print much much more and for a very long time.

Sure, they will, until a loaf of bread costs $10000000  |

|

|

|

|

viboracecata

Legendary

Offline Offline

Activity: 1316

Merit: 1000

Varanida : Fair & Transparent Digital Ecosystem

|

|

September 22, 2013, 06:21:28 AM |

|

this will not effect bitcoin price.  |

|

|

|

LiteCoinGuy

Legendary

Offline Offline

Activity: 1148

Merit: 1010

In Satoshi I Trust

|

|

September 22, 2013, 11:50:44 AM |

|

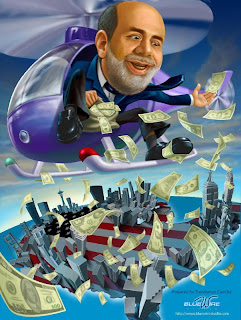

oh look, there he is   |

|

|

|

|

Pumpkin

|

|

September 22, 2013, 12:17:51 PM |

|

Except the helicopter money only goes to a very small number of selected people  |

|

|

|

|

Adrian-x

Legendary

Offline Offline

Activity: 1372

Merit: 1000

|

|

September 22, 2013, 09:13:15 PM |

|

Except the helicopter money only goes to a very small number of selected people  Only because it is too heavy to drop from a helicopter and you have to use trucks. |

Thank me in Bits 12MwnzxtprG2mHm3rKdgi7NmJKCypsMMQw

|

|

|

|

Pumpkin

|

|

September 22, 2013, 10:17:19 PM |

|

OMG  You, sir, should be the next Fed chairman! |

|

|

|

|

|

Alpaca Bob

|

|

September 22, 2013, 11:20:04 PM |

|

The FED is holding on, waiting for Bitcoin to mature.

That would be the plot-twist of the century. |

The Times 03/Jan/2009 Chancellor on brink of second bailout for banks

|

|

|

|

|

|

|

knight22

Legendary

Offline Offline

Activity: 1372

Merit: 1000

--------------->¿?

|

|

September 23, 2013, 05:10:21 PM |

|

QE is soooo effective, we should do the same to stimulate the bitcoin economy  -sarcasm- |

|

|

|

|