Previous updates

January OPFebruary UpdateMarch UpdateApril Update

Halving:

BULLISHLast Month: BULLISH

Time Horizon: Medium

Rationale: Yes, if you read me in the past months you know this is the main reason I am bullish on bitcoin.

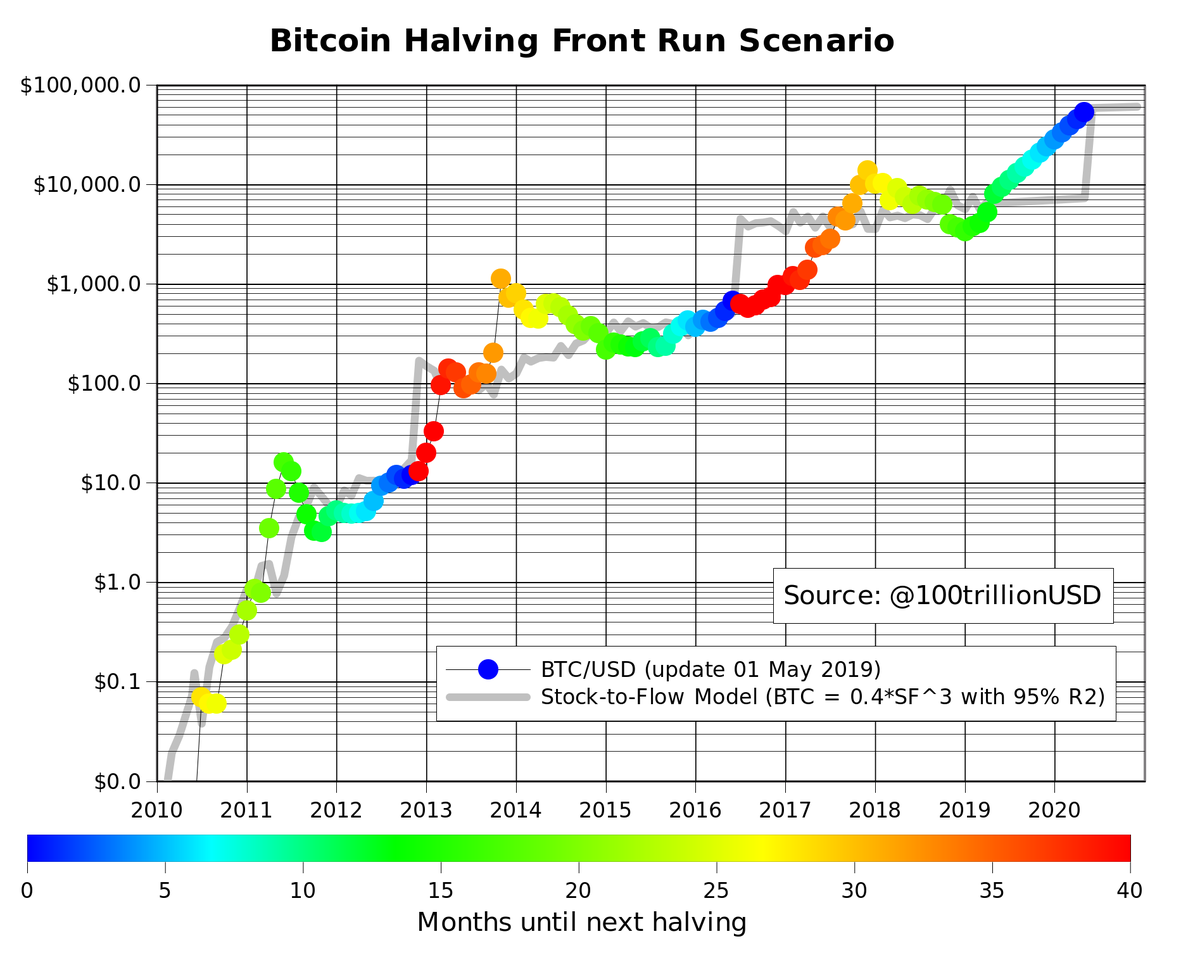

I was bullish for the halving even before getting in contact with PlanB (Twitter:

https://twitter.com/100trillionUSD), but he then more rigorously formalised what I had as a gut- feeling.

This month I am posting a scenario that could break the halvening cycles we have observed in the past.

What if the more mainstream adoption and the presence of more "institutional money", more keen to

"efficient markets" (à la Fama) drives up the markets in anticipations of the halving and the subsequent stock to flow reduction?

Plan B added a few details on his explanation of the halvening effect follows a Power law in this

this tweet :

Well, what if market is already starting to price the effect of this halving before actually happening instead of following this?

#Bitcoin halving front run scenario, never happened before, but ..

Link to Tweet

Link to TweetI don't like to comment too much in the current price of BTC, but the sentiment is turning more and more bullish, and I think this kind of analysis is perfectly consistent with an anticipation of the halvening. Price used to rise sharply after the halvening, reacting to this and not actually anticipating it. What if this time is different?

Market doesn't like discontinuities, and so tends to anticipate drastic moves or changes in the protocol.

If had could move a critic to Satoshi for his whitepaper, I would say the choice of discrete halvening is not optimal, while a more smooth reduction of coinbase would have been better implementation. (While researching for this, I stumbled on

this thread, worth a read if interested).

Please note also that

S2F multiple is now available as an indicator in Tradingview.

A confirmation on how the halvening is going to impact bitcoin price development has emerged from Square quarterly results: Jack Dorsey's app has seen incredible growth in bitcoin selling activity, and if this is deemed to continue,

impact on daily mined bitcoins could be substantial:

It’s also important to important to consider the amount of BTC that Square is selling, not just sales in dollar terms. Assuming Q1's average Bitcoin price of around $3,790 (CoinMetrics & The Block), Square sold an approximated 17,300 BTC during that period — Cash App's fees and spreads not taken into account. During that same time frame, 162,000 BTC was mined, assuming that the Bitcoin network keeps to its standard emission rate of 1,800 BTC each day. This implies that Square's users absorbed 11% of all BTC mined through their purchases. Considering that the sale of coins emitted by miners is considered a perpetual negative catalyst for BTC, as miners often need to liquidate their stash to fund their operations, an 11% alleviation on this pressure, dubbed a "natural selling pressure" by some pundits, goes a long way.

Similar conclusion came from the

analysis of the GrayScale Bitcoin Trust, that bought more than 11,236 BTC in April alone.

Layer 2 applications:

BULLISHLast month status: BULLISH

Time Horizon: Long Term

Rationale: Bitcoin has a low throughput for his on-chain transaction. Corollary of this Bitcoin protocol feature, is that not every transaction need the level of security guaranteed by an on-chain transaction. So we are building other solutions on the base of Bitcoin Protocol, known as Layer 2 solutions.

This is an “invisible asset” for bitcoin adoption, allowing truly decentralized, trustless, instant payments with ridiculously low fees. This will allow the creation of a whole new industry of payment processors: ending point? Competition with credit cards.

In addition to that every Layer 2 progress allows further developments (layer 3 applications I cannot even think of) and in addition to that strengthens Layer One: the Bitcoin protocol, like a big Jenga game, where every superior layer presses and consolidate lower layers adding robustness and immutability to the protocol itself (immutability of a protocol should be considered a feature, not a bug. Research the DAO disaster for an example).

Comment: Lightning Network halted his massive growth and is now flat for the second month, metrics are almost unchanged MoM:

LN network capacity trend over the last 6 months: flat at the top continues!

as I said last month capacity is of course an important parameter, but not the only one to focus on, but there are other important factors to consider. Usability and broad user experience is one of the most important now and we saw various

improvements on the software itself and

third party support.

HodlHodl, a P2P exchange, went on with Lightning adoption and

went live with Lightning payments on their Testnet enabling users to buy and sell BTC directly from their LN Wallets.

Ln is the first L2 solution, but other L" options are starting to take shape: as I said last month we can expect a multitude of such solution, that in their turn can be base of higher levels.

Some other L2 solution are taking shape:

- Microsoft Launches Decentralized Identity Tool on Bitcoin Blockchain

Microsoft is launching the first decentralized infrastructure implementation by a major tech company that is built directly on the bitcoin blockchain. The open source project, called Ion, deals with the underlying mechanics of how networks talk to each other. For example, if you log onto Airbnb using Facebook, a protocol deals with the software that sends the personal information from your social profile to that external service provider. In this case, Ion handles the decentralized identifiers, which control the ability to prove you own the keys to this data.

This is indeed a very interesting L2 application, as it has a non monetary nature.

Also we see the beginning of Layer3 solutions, albeit in a very embryonal stage:

- if we think at the Liquid sidechain as a L2 solution: Blockstream Releases First Enterprise-Grade Product on Liquid

Security tokens are coming to Bitcoin, courtesy of Blockstream.

The Bitcoin and blockchain technology company announced on May 15, 2019, the final day of the Consensus 2019 conference, that Liquid Securities, a platform for issuing and managing security tokens on its Liquid sidechain, is ready to go live. This platform will provide Liquid and its users with its first product to issue digital assets, a foundational milestone for bringing tokenization to the Bitcoin network.

- RIF Labs Launches 3rd-Layer Scalability Solution Capable of Processing Up to 5K TPS

“Essentially Rootstock aims to be what Ethereum is, a decentralized, Turing-complete smart contract platform. However, Rootstock aims to utilize the Bitcoin ecosystem rather than creating a new one from scratch.”

This is only the beginning.

There was also some FUD spread this month about a

LN node being to be considered a money transfer service, hence requiring a full licence. Of course this was quickly dismantled as ..FUD.

Transactions number:

NEUTRALLast month status: NEUTRAL

Time Horizon: Short Term

https://www.blockchain.com/charts/n-transactions-excluding-popular?daysAverageString=7×pan=2yearsRationale: transaction number can be interpreted as the “bitcoin heart beat”. If transactions are scarce means one of Bitcoin primary functions (“mean of value transfer”) is not properly working. Of course the advent of layer 2 solutions is going to make this measure less and less relevant in the future. But as far as L2 capacity is not comparable to the whole bitcoin capitalization, transaction number cannot be discarded.

Comment: Despite dramatic rise in BTC price during last month, transaction number has remained quite flat. Transaction number is in the high “recent range” and on various days broke the 400k daily confirmed transactions, the highest levels since November 2017, but failed breaking higher, following price.

Notably something moved also in the mempool, where there were some kind of actions after months of empty mempool, nothing too spectacular, probably some users still pay more fees than required.

This lack of fees could be worrisome for someone thinking about the miners after the halving: if block reward is halvening, miners must rely on fees to commit themselves to blockchain validation. The reality is that Bitcoin is scaling without impacting on the daily paid fees, and despite this

Bitcoin Miners Are Currently Earning 8x More in Fees Than All Other Cryptocurrencies Combined.As we said last month, the impact of Veriblock OP_Returns transactions and CoinJoin transactions is yet to be fully assessed. Time will tell if those two development are going to significantly impact on transactions number.

Bitcoin is working for what it was meant for by Satoshi:

BULLISHLast month status: BULLISH

Time Horizon: Long Term

Rationale: Bitcoin is digital gold. This means that can serve an uncensorable store of value in now derailed regimes. As more and more government indulges in hopeless funding/money printing options, in many cases BTC is the only way to preserve the right to defend your own wealth against (hyper)inflation

Last month we looked at Argentinian Volumes this month we look at Colombian Peso (we are looking at BTC volumes, as volumes in Pesos are irrelevant due to the inflation):

same is happening in Argentina, Peru, Tanzania, Kazakhstan and

many more other countries all over the World.

We can observe the transaction volume is somewhat elevated, and people keep buying Bitcoins to preserve value in an high inflation environment.

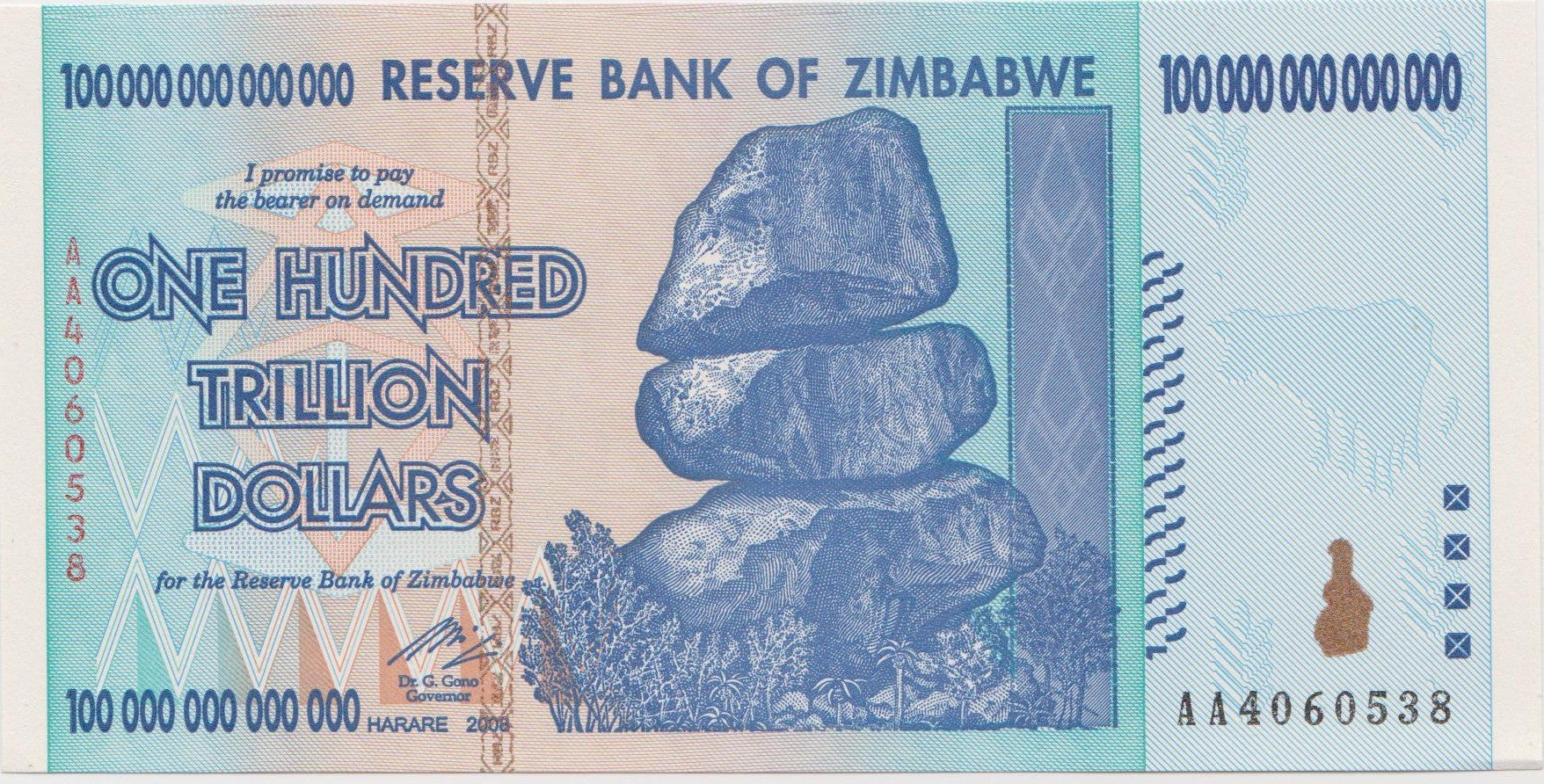

Speaking of high inflation the story of the month come from an usual suspect: Zimbabwe.

Do you remember Zimbawe?

Zimbawe is the realm of Mugabe, who once said:

"Where money for projects has not been found, we will print it"result:

well, they are in yet another "more of the same" iteration: Read "

A mouthful of Zollars" on "The Economist":

Unique addresses number is not picking up:

NEUTRALLast month status: NEUTRAL

Time Horizon: Medium Term

RATIONALE: unique addresses is a loose measure of users in the ecosystem. True, many users could share the same address (like exchange addresses used by many users) or vice-versa each user could have many addresses (think about someone trying to entangle his addresses in order to gain some degrees of privacy).

Addresses numbers are also used in some kind of Bitcoin valuations involving Metcalfe’s law, or a law trying do determine the value of a network, users being the asset of such network.

COMMENT: Unique Bitcoin addresses slightly raised during last month, almost touching 600,000 the maximum level since last year. Chain activity picking up is a good sign, above all because , as we have seen, this didn't reflected in a raise in fees.

It's worth remembering that 600,000 active is a LOT of transactions, and Bitcoin has 3x daily active addresses than the second most used crypto, and only 3 other cypto surpass 100K active daily addresses

according to LongHash.

Source:

https://www.blockchain.com/charts/n-unique-addresses?timespan=2years&daysAverageString=7

NVT:

BEARISH Previous month Status: BEARISH

Time Horizon: Medium Term

RATIONALE: Network Value to Transaction (NVT) is defined as the Bitcoin Network Value over the Daily Transaction Volume and be interpreted for Bitcoin in the same way P/E ratio for a stock-market. More insight and details on the interpretation of such signal can be found in the resource links at the end of the post.

COMMENT: NTV continued to slide down, but remain far-above the levels that have typically marked price bottoms (NTV Ratio is flat over last month and @60, is above 40 signals a bottom on the market). Risk on the downside have somewhat muted, but the recent price actions diverges from NVT signal, calling in a pullback, even thou, comparing to what we said last month, bottom is probably already in.

Realized Cap:

NEUTRALPrevious Month: NEUTRAL

Time Horizon: Medium Term

RATIONALE: The realized cap attempts to improve the market cap by valuing different part of the Bitcoin supply at different prices , instead of using the daily close as market cap does: every coin, or more properly every UTXO is valued at the price of their creation. In a less technically correct explanation let’s say that while Market Cap use the last traded price and multiplies it times by the coins in circulation, Realized Cap computes the total value paid for each coin at the price they last moved on the blockchain .You can look at this indicator as an improvement to the market capitalization, a very misleading indicator for crypto currencies, trying to capture the “true hodling value” of Bitcoin.

COMMENT: Price action in last month drove realized cap marginally higher, the divergence we observed last month disappeared and now both indicator are pointing north, so picture has marginally improved for second month in a row.

MVRV:

NEUTRAL Previous month: NEUTRAL

Time Horizon: Medium Term

RATIONALE:

MVRV (Market Value to Realised Value Ratio) is an indicator was designed by David Puell and Murad Mahmudov and is simply the ratio of Market Cap / Realised Cap. It’s useful for getting a sense of when the exchange traded price is below “fair value” and is also quite useful for spotting market tops and bottoms. Refer to linked Woobull website for an in-depth explanation.

COMMENT: Market price movement last month made this indicator continue his rise from 1.25 to 1.75, as we said this is reinforcing the idea bottom has been priced in, and bodes well for further upside. Still not in full Bullish territory for the moment thou.

USD Exchange Trade Volume:

NEUTRALPrevious month Status: BEARISH

Time Horizon: Medium Term

https://www.blockchain.com/charts/trade-volume?daysAverageString=7×pan=2yearsRATIONALE: Exchange traded futures are the closest instrument to Bitcoin Wall Street can touch to gain exposure to the cryptocurrency. Provided the price will follow quite closely the Bitcoin price, or what can be observed in the relevant “walled gardens” used to settle the futures, what is interesting for us is the contract volumes, that can give us a few hints of the interest Wall Street has towards the digital gold.

COMMENT: Overall traded volumes are on the rise since a few months:

Spot volumes increased sharply from 325 billion USD in March, from 352 billion USD in April.

Meanwhile, futures volumes from bitFlyer Lighting and BitMEX combined around the 50 billions mark similarly to the previous month.

These volumes should be reliable and not impacted by fake figures.

Regulated bitcoin derivatives product volumes are dominated by CME, who saw a 263% increase in average trading volume in April. This is followed by Grayscale’s GBTC product, and the dying CBOE’s bitcoin futures. CME’s bitcoin futures product volumes increased from 70.5 million USD to 256 million USD in April. Meanwhile, Grayscale’s bitcoin trust product (GBTC), also increased in terms of average trading volume in April to 29.7 million USD (239%).

Exchange traded futures still represent a tiny fraction of total futures trading in Bitcoin: futures represent roughly 24% of trading in Bitcoin (76% being spot transactions), and only 6% of this 24% is traded on traditional exchange traded Futures. This data is constant since last month, but bigger shares has been captured by CME that has been trading a record volume of 6.6 USD Billions.

DEXs represent only a small fraction of global spot exchange volume (0.14%, without a clear trend over last months), trading a

monthly total of 447 million USD in March.

An important limit is that on these exchanges it's not possible to trade stablecoins, that represent roughly the 80% of spot volumes:

Crypto to crypto exchange trading volume, it represented 84.5% of total spot volume in April, so probably this means fresh money slowly crawled from FiatMoney or Bitcoin to Stablecoins volume down to other altcoins.

Despite the bullishness on last month report, DEX's are still failing to materialize any impact on the big pictures: Binance DEX is still of the chart, also no news from other Dexs' regarding further expansion or result of LN implementation (like HodlHodl LN tests we reported about in the last post).

Cumulate short positions built on the month of April, as expected went rekkt and were closed in the red:

We told you so.

Exchange Scrutiny:

BULLISHTime Horizon: Long Term

Previous month Status: BULLISH

Rationale: exchanges are the weak link in the Bitcoin ecosystem: poor operations, subpar technologies, prone to frauds, scams and every kind of market rigging schemes (pump and dumps, market manipulations etc: basically every illicit operation banned in traditional financial markets since 20 years ago, to say the least). Every month news report of lost founds, hacked accounts, founder's frauds. Every news is a Darwin's push for the Bitcoin ecosystem toward a more efficient functioning.

COMMENT: Another month has passed, another round of hacked accounts at exchange. we first started the month with

7000 BTC stole from Binance.

Not surprisingly investors are keen to own GBTC shares: that trust shares are priced at a 30% average premium over theoretical BTC par value, but the custody is so simplified and streamlined many investors thinks it's worth it.

Let's say investors are flocking to most reputable account to hold and secure their cryptoassets at a state of the art level:

Coinbase Custody Now Has $1 Billion of Crypto Under Management. Other smaller exchanges are struggling with the scale of investment required to stay in the competitive arena.

The smaller ones are just begging for funding to stay alive, whilst other bigger, Like Kraken are trying to fund themselves trying to

siphon funds from customers selling shares at a vastly overvalued levels.

Some analysis also traced the origin of this month rally movement to People wanting to get out troubled exchanges.

Chain analysis saw outflows from Bitfinex in 1.7 billions, probably related to the Thether issues (Bitfinex cold wallet chan be tracker

here). BTC Price on the exchange experienced high premium over other venues (up to 6%). This should be a thing of the past as

Blockstream has integrated Liquid into Bitfinex, allowing faste and effortless BTC transaction towards other exchanges.

HODL Waves:

BULLISHTime Horizon: Long Term

Previous month Status: BULLISH

RATIONALE: Bitcoin HODL Waves is a visualization by

Unchained Capital, it shows the cross section of Bitcoin held in wallets grouped by the age since they last moved. The upper contours, represent supply (old coins that have remained unmoved) while the lower contours represent new demand (coins that have recently shifted). The composite view clearly shows each bull cycle bringing in new demand. This visualization is useful for locating exactly where the market timing is during its long term oscillations between bull and bear phases.

TL,DR: The area Above each line is the amount of "coins" not moved since the relevant time horizon.

COMMENT: The chart is a continuation of last month's with all lines pointing south: not only 12m is pointing down but now also 18m becomes evident: strong hands are still hodling strong!

A few interesting reports:

Bitcoin Models reference list:

Bonus Section:

BEST Tweet of the month:

Twitter link

Twitter linkYet another time someone is blatantly proposing to Shut down Bitcoin. Bitcoin is a competitive push for Fiat money. Fiat money can beat BTC not with governments banning BTC, but becoming better (becoming hard money) and making BTC useless in the first place (almost impossible).

Another good read on the topic.

Why Outlawing Cryptocurrency Purchases is a Terrible IdeaAnother bad example of "Shut Down Bitcoin proposal":

Joseph Stiglitz: ‘We should shut down the cryptocurrencies’

As usual I would like to thanks everyone who contributed to this post, in particular the guys in the Bitcoin Pump! thread on the Italian board for invaluable exchange of ideas and help in keeping track of news, as well as the whole WO's family for moral support and entertainment.

What are your thoughts?

Poll

Poll