Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

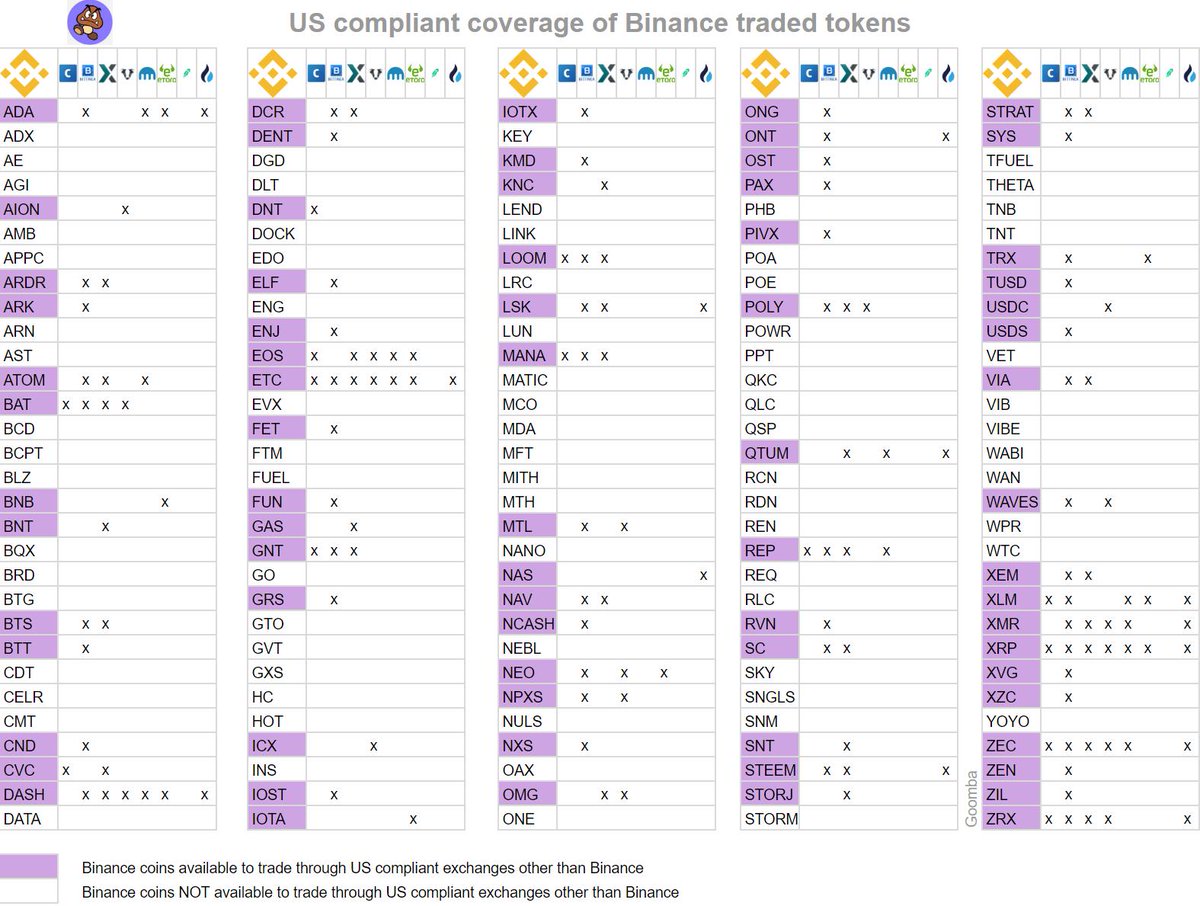

Credits for the image: https://twitter.com/remigoomba/status/1139766402930184192 Coins that are (probably) going to take the most damage: -ADX -AE -AGI -AMB -APPC -ARN -AST -BCD -BCPT -BLZ -BNB (I'm not counting eToro's inclusion as it doesn't really allow the deposits & withdrawals of the coins, only the fiat) -BQX -BRD -BTG -CDT -CELR -CMT -DATA -DGD -DLT -DOCK -EDO -ENG -EVX -FTM -FUEL -GO -GTO -GVT -GXS -HC -HOT -INS -IOTA (same case as BNB) -KEY -LEND -LINK -LRC -LUN -MATIC -MCO -MDA -MFT -MITH -MTH -NANO -NEBL -NULS -OAX -ONE -PHB -POA -POE -POWR -PPT -QKC -QLC -QSP -RCN -RDN -REN -REQ -RLC -SKY -SNGLS -SNM -STORM -TFUEL -THETA -TNB -TNT -VET -VIB -VIBE -WABI -WAN -WPR -WTC -YOYO Coins listed on at least four of the mentioned exchanges: 1. ADA 2. BAT 3. DASH 4. EOS 5. ETC 6. REP 7. XLM 8. XMR 9. XRP 10. ZEC 11. ZRX These are supposed to get the least damage from the upcoming Binance's restriction. |

|

|

|

|

|

|

|

|

|

"Your bitcoin is secured in a way that is physically impossible for others to access, no matter for what reason, no matter how good the excuse, no matter a majority of miners, no matter what." -- Greg Maxwell

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

June 15, 2019, 07:10:25 PM |

|

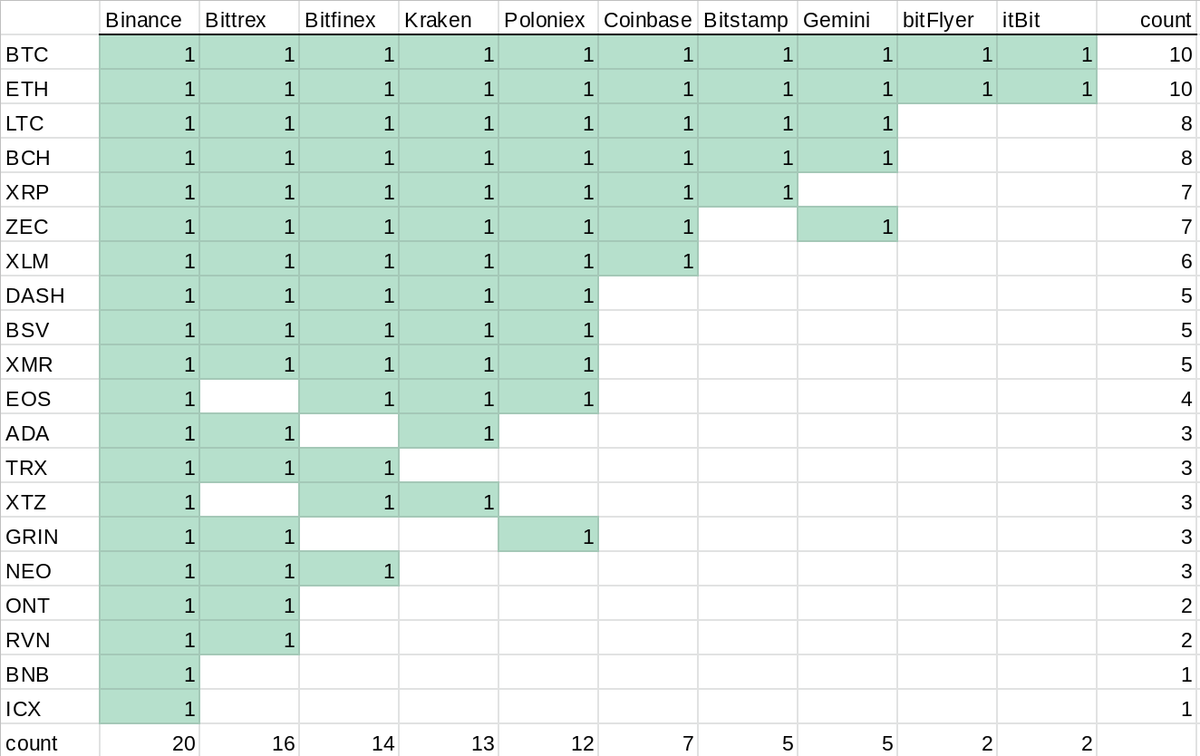

Some more useful spreadsheet work:  |

|

|

|

|

figmentofmyass

Legendary

Offline Offline

Activity: 1652

Merit: 1483

|

|

June 16, 2019, 05:38:16 AM |

|

Coins that are (probably) going to take the most damage:

makes sense to me. subtract capital from USA retail investors and the market should shrink. tokens that are obviously securities are gonna see less and less retail demand as they get removed from SEC-regulated markets. on the flip side, are we going to see more money flowing into more accessible traditional altcoins? ie regular POW/POS coins, not tokens. i reckon USA investors aren't just gonna leave altcoins altogether. they're gonna buy into coins that are still available to them. there's at least a couple hundred to choose from on bittrex! |

|

|

|

1Referee

Legendary

Offline Offline

Activity: 2170

Merit: 1427

|

|

June 16, 2019, 10:48:38 AM |

|

This once again shows that holding exotic coins is a super tricky investment beyond their own pumpy dumpy agendas. If this turns out to be a success, I'm certain that more countries will follow the same path because it's quite an effective way to combat the shitty side of crypto with little effort. Perhaps that this will help cleanse the crypto market sooner and I can only welcome these developments. It will lead to less outright scams and more potentially fruitful startups being given a chance to flourish. Coinbase and the rest of the US based exchanges must be happy with this.  |

|

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

June 20, 2019, 02:30:01 PM |

|

Coins that are (probably) going to take the most damage:

makes sense to me. subtract capital from USA retail investors and the market should shrink. tokens that are obviously securities are gonna see less and less retail demand as they get removed from SEC-regulated markets. on the flip side, are we going to see more money flowing into more accessible traditional altcoins? ie regular POW/POS coins, not tokens. i reckon USA investors aren't just gonna leave altcoins altogether. they're gonna buy into coins that are still available to them. there's at least a couple hundred to choose from on bittrex! It should happen, but so far, it's not happening. I've been keeping an eye on the promising coins that are available on other exchanges (ADA, STEEM, etc) as well as on the promising coins that are part of the list I've shared (includes WAN, WTC, etc). So far, the difference ain't very noticeable. But then again, there are still 82 days left, and US traders can freely trade all these coins till then. IMO, we'll get to see the noticeable difference when we're close to September. 90 days is still like an eternity in the crypto industry. However, I smell some real trouble for the coins I've listed in OP. See, Binance Jersey was launched back in January. After all these (six) months, no coin other than ETH, BTC, and BNB is listed there (LTC got listed there today). Similarly, we'll probably only see the very few majors in the start at the US version of Binance, and getting the listing of other sh!tcoins (especially the ones that aren't a part of top ten projects by marketcap) can take years. |

|

|

|

|

|

timerland

|

|

June 21, 2019, 09:37:31 PM |

|

makes sense to me. subtract capital from USA retail investors and the market should shrink. tokens that are obviously securities are gonna see less and less retail demand as they get removed from SEC-regulated markets.

on the flip side, are we going to see more money flowing into more accessible traditional altcoins? ie regular POW/POS coins, not tokens. i reckon USA investors aren't just gonna leave altcoins altogether. they're gonna buy into coins that are still available to them. there's at least a couple hundred to choose from on bittrex! It's similar to the situation in China in regards to exchanges. I would not panic too much over it. I don't think that the market will shrink at all just due to the fact that Binance has shut its door on US customers - crypto investors will find other ways, regardless of the exchange that they use, especially the whales who have a lot of vested interest already to continue trading and investing. I highly doubt that people are going to be stepping out of the crypto market just because of Binance's closure to the US alone. Though, I agree with the fact that we may see a reallocation of capital from less liquid coins, to more commonly traded coins within the crypto market, internally. These structural changes could certainly change the composition of the relative dominance of each coin, with highly liquid coins potentially now receiving more demand due to US investors. |

|

|

|

squatter

Legendary

Offline Offline

Activity: 1666

Merit: 1196

STOP SNITCHIN'

|

|

June 21, 2019, 10:57:17 PM |

|

It should happen, but so far, it's not happening. I've been keeping an eye on the promising coins that are available on other exchanges (ADA, STEEM, etc) as well as on the promising coins that are part of the list I've shared (includes WAN, WTC, etc). So far, the difference ain't very noticeable. But then again, there are still 82 days left, and US traders can freely trade all these coins till then. IMO, we'll get to see the noticeable difference when we're close to September. 90 days is still like an eternity in the crypto industry. Nobody knows which coins will be listed on Binance US and which ones won't. Until then, the market can play dumb. Binance definitely likes to skirt the law and if there is any legal grey area, they will exploit it. They may end up listing lots of coins that will surprise us. However, I smell some real trouble for the coins I've listed in OP. See, Binance Jersey was launched back in January. After all these (six) months, no coin other than ETH, BTC, and BNB is listed there (LTC got listed there today). Similarly, we'll probably only see the very few majors in the start at the US version of Binance, and getting the listing of other sh!tcoins (especially the ones that aren't a part of top ten projects by marketcap) can take years.

That's a real possibility. However, I have a feeling Binance plans to make a much bigger splash with their US launch. I don't think it'll be as limited as Binance Jersey. |

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

June 22, 2019, 02:13:18 PM |

|

Another important deduction from the provided information in OP:

Coins listed on at least four of the mentioned exchanges:

1. ADA

2. BAT

3. DASH

4. EOS

5. ETC

6. REP

7. XLM

8. XMR

9. XRP

10. ZEC

11. ZRX

These are supposed to get the least damage from the upcoming Binance's restriction.

Adding this point in OP.

|

|

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

June 25, 2019, 08:54:29 PM |

|

I've been keeping an eye on the promising coins that are available on other exchanges (ADA, STEEM, etc) as well as on the promising coins that are part of the list I've shared (includes WAN, WTC, etc). So far, the difference ain't very noticeable.

1-week performance comparison: WAN = 28% down WTC = 33% down ADA = 14% down STEEM = 19% down |

|

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

July 21, 2019, 11:56:32 PM |

|

Seriously, there's still no difference in the pumps and dumps of the Binance coins that are listed on more US-supported exchanges and the Binance coins that are NOT listed on any US-supported exchange. There are about only 50 days left, and USA people still seem so relaxed. According to Alexa, about 25% of Binance's traffic belongs to the USA, and according to SimilarWeb, this percentage is about 15%. Eventually, IMO, we should get to see a nice dump on the coins and tokens which won't be available to Americans on nice exchanges after Binance.com trade suspension for US citizens. |

|

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

August 12, 2019, 07:23:56 PM |

|

This is a very major update! Exciting Developments Coming Soon for Binance UShttps://medium.com/binance-us/exciting-developments-coming-soon-for-binance-us-f79f86bdd9c6As in the article:  So if we short-list these coins, that are being explored for Binance US listing, we'll be left with the following: -ADX -AE -AGI -AMB -APPC -ARN -AST -BCD -BCPT -BLZ -BQX -BRD -BTG -CDT -CELR -CMT -DATA -DGD -DLT -DOCK -EDO -ENG -EVX -FTM -FUEL -GO -GTO -GVT -GXS -HC -INS -KEY -LEND -LRC -LUN -MATIC -MCO -MDA -MFT -MITH -MTH -NEBL -NULS -OAX -ONE -PHB -POA -POE -POWR -PPT -QKC -QLC -QSP -RCN -RDN -REN -REQ -RLC -SKY -SNGLS -SNM -STORM -TFUEL -THETA -TNB -TNT -VIB -VIBE -WABI -WAN -WPR -WTC -YOYO This is the list of coins (and tokens) to which US users won't have any access across major exchanges (Binance, Bittrex, Poloniex, Kraken, Huobi, Coinbase). |

|

|

|

|

gentlemand

Legendary

Offline Offline

Activity: 2590

Merit: 3013

Welt Am Draht

|

|

August 13, 2019, 09:16:53 AM |

|

I find it a bit weird BNB isn't considered to be somewhere in security territory. It was launched with an ICO and its value hangs on the success of one corporation. I suppose it's not ownership of Binance as such but it's one hell of a long way from something like BTC.

|

|

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

August 13, 2019, 05:41:33 PM |

|

I find it a bit weird BNB isn't considered to be somewhere in security territory. It was launched with an ICO and its value hangs on the success of one corporation. I suppose it's not ownership of Binance as such but it's one hell of a long way from something like BTC.

I agree. I guess Mr. CZ is afraid to admit it as it'll pretty much crash BNB value. Let's see what happens next... |

|

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

August 19, 2019, 03:24:21 PM |

|

|

|

|

|

|

squatter

Legendary

Offline Offline

Activity: 1666

Merit: 1196

STOP SNITCHIN'

|

|

August 19, 2019, 06:44:26 PM |

|

I find it a bit weird BNB isn't considered to be somewhere in security territory. It was launched with an ICO and its value hangs on the success of one corporation. I suppose it's not ownership of Binance as such but it's one hell of a long way from something like BTC.

Binance is playing with fire with that one. They burn BNB based on profits made -- lowering the circulating supply -- so it seems like there is indeed an expectation of profits. These are the four metrics of the Howey Test. BNB seems to fit every one: - It is an investment of money

- There is an expectation of profits from the investment

- The investment of money is in a common enterprise

- Any profit comes from the efforts of a promoter or third party

Arguably, they issued unregistered securities to US persons. I also don't think that's the only area where they have legal exposure to the SEC. |

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

September 08, 2019, 08:58:45 PM |

|

|

|

|

|

|

squatter

Legendary

Offline Offline

Activity: 1666

Merit: 1196

STOP SNITCHIN'

|

|

September 08, 2019, 11:29:13 PM |

|

To complete the onboarding process, users will be required to provide a valid government ID — driver’s license or a passport — and their social security number. Yikes, social security number? That will be a deal breaker for some. I passed on joining Gemini because they required SSN, so of course I won't be going anywhere near Binance.US, who is far less trustworthy. I wonder if this is just for AML compliance, or if they actually plan on sending 1099s to the IRS. |

|

|

|

Raja_MBZ (OP)

Legendary

Offline Offline

Activity: 1862

Merit: 1505

|

|

September 09, 2019, 12:29:55 AM |

|

To complete the onboarding process, users will be required to provide a valid government ID — driver’s license or a passport — and their social security number. Yikes, social security number? That will be a deal breaker for some. I passed on joining Gemini because they required SSN, so of course I won't be going anywhere near Binance.US, who is far less trustworthy. I wonder if this is just for AML compliance, or if they actually plan on sending 1099s to the IRS. Yeah, that's some serious ugliness. From US Binance's official Medium article: What will I need to register on Binance.US?

KYC (know your customer) will be required for trading on Binance.US. Setting up a new account will require a valid government ID (driver’s license or passport) and social security number (SSN) to register for access to the Binance.US marketplace, available in most U.S. states. The US traders are already expressing their hate in this regard on US Binance's official Twitter handle: You want a Social Security number for KYC? You realize our government instructs us NEVER to give out that information in this manor right? Everyone else is good with a Passport or Drivers license. Most of us will not be joining if an SSN is required. FAIL! Imagine asking for SSN from people when you just had a massive KYC leak. Tragic Why asking for SSN for account ? We are not opening a Bank account. Robinhood never asked for SSN ...and the best comment so far: Can I just post my SSN in my Twitter bio and you can collect it at your leisure? 'Cuz it's basically the same thing. |

|

|

|

|

|

|

figmentofmyass

Legendary

Offline Offline

Activity: 1652

Merit: 1483

|

|

September 11, 2019, 07:48:02 PM |

|

The wait is finally over! It seems like US Binance is going to start with the following assets:

-Bitcoin

-Ethereum

-XRP

-Bitcoin Cash

-Litecoin

-Tether

and so, there's no BNB! 5 coins + tether? what an epic disappointment! launching with less markets than coinbase seems like a horrible way to generate hype. i guess they are desperate to recapture USA traders ASAP because liquidity is leaving binance.com in droves now. i also wonder if they're launching this way so they can engage in listing pumps. supposedly they're gonna keep adding coins: After trading launches for this first phase, we will be continually adding to the selection of digital assets available for verified users to deposit and eventually trade on Binance.US. Trading availability of the digital assets we’re exploring will be based on our Digital Asset Risk Assessment Framework. the first condition makes it sound like privacy coins and obvious securities are off the table. |

|

|

|

|