Abiky (OP)

Legendary

Offline Offline

Activity: 3192

Merit: 1359

www.Crypto.Games: Multiple coins, multiple games

|

|

January 17, 2020, 05:54:12 PM |

|

Bitcoin sidechains prove to be a great scalability solution that would lose the burden on the main Bitcoin blockchain. New cryptocurrencies can be created in a form of a sidechain, to obtain the security of Bitcoin without sacrificing scalability. This, combined with the Lightning Network, should make Bitcoin a powerful blockchain ecosystem that's capable of withstanding anything along the way. So far, I'm aware of a sidechain called "Liquid" provided by Blockstream which makes use of the main Bitcoin blockchain for security. But I'm on the look for more sidechains that are available on Bitcoin today. If this turns out to become successful, mainstream developers could simply choose to create a sidechain that would become resistant against 51% attacks. There are so many small altcoins out there that could mitigate the risks of external attacks by becoming a Bitcoin sidechain. Any recommendations, or suggestions will be greatly appreciated. Thanks in advance.  |

|

|

|

|

|

|

|

|

|

|

Unlike traditional banking where clients have only a few account numbers, with Bitcoin people can create an unlimited number of accounts (addresses). This can be used to easily track payments, and it improves anonymity.

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

bitmover

Legendary

Offline Offline

Activity: 2296

Merit: 5914

bitcoindata.science

|

|

January 18, 2020, 12:43:55 AM |

|

Bitcoin sidechains prove to be a great scalability solution that would lose the burden on the main Bitcoin blockchain. New cryptocurrencies can be created in a form of a sidechain, to obtain the security of Bitcoin without sacrificing scalability. Scalability is not an issue for bitcoin network. This scalability drama is just a stupid idea that scammers who are trying to sell you their worthless tokens are trying to put into your head. And they are doing an amazing job Bitcoin was created not to be faster than currenty payment methods, visa is far enough. It was created to be decentralized, not owned by anyone. Any sidecoin, fork, altcoins or whatever will be owned by someone. SoI will just skip them and use visa. Not even the fastest and most centralized shitcoin is faster than visa. Bitcoin transactions are cheap, although they are not instant. But not even the banking system is. In a few years we will have lightning network to buy coffee and stuff, and to send real money we will use the bitcoin network, which is cheap but take a few hours to complete. That's just what we need. Thanks we don't need side coins. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

franky1

Legendary

Online Online

Activity: 4214

Merit: 4458

|

|

January 18, 2020, 01:15:54 AM |

|

be prepared for some silencing

its funny that the devs that made Liquid pretend its impossible to allow more than 2000tx to be confirmed in les than 10 minutes securely but meanwhile they are making other networks that can.

i wonder why

oh yea coz they get the transaction fee's from it

by the way liquid only does about 2tx a block on average and only plays with ~100tokens that are pretend btc

and lastly. its a POS network with 15 entities of power. so its aint decentralised

so although claimed as a fast network with dozens of exchanges and private businesses using it.. and all the other propoganda.. its actually not really used.. kind of a shame devs invested soo much time for personal gain while crapping all over the real bitcoins utility issues and refusing to correct those issues.

such a shame

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Abiky (OP)

Legendary

Offline Offline

Activity: 3192

Merit: 1359

www.Crypto.Games: Multiple coins, multiple games

|

|

January 18, 2020, 02:54:28 AM |

|

Scalability is not an issue for bitcoin network.

This scalability drama is just a stupid idea that scammers who are trying to sell you their worthless tokens are trying to put into your head. And they are doing an amazing job

Bitcoin was created not to be faster than currenty payment methods, visa is far enough. It was created to be decentralized, not owned by anyone.

Any sidecoin, fork, altcoins or whatever will be owned by someone. SoI will just skip them and use visa.

Not even the fastest and most centralized shitcoin is faster than visa.

Bitcoin transactions are cheap, although they are not instant. But not even the banking system is.

In a few years we will have lightning network to buy coffee and stuff, and to send real money we will use the bitcoin network, which is cheap but take a few hours to complete. That's just what we need.

Thanks we don't need side coins.

Agree. Bitcoin's slowness and high costs is more of a feature than a bug. This allows it to remain decentralized and resistant against censorship from third parties (mostly worldwide governments). With greater transaction capacity, you'd get lower security and censorship-resistance. There's no need to surpass existing traditional payment processors in terms of transaction capacity, since Blockchain was not meant to provide convenience over censorship-resistance. At least, that's how Satoshi intended Bitcoin to be in the first place. But I guess that most people prefer something that's faster and cheaper even if they have to sacrifice their freedom/security. The concept of "sidechains" is interesting because it allows developers to create altcoins that are completely secured by the main Bitcoin blockchain. In a crypto world where 51% attacks are common in small Blockchain networks, this feature (sidechain) is a must for developers looking to maintain their cryptocurrencies as secure as possible against external attacks. In terms of sidechains available on the Bitcoin blockchain, I'm only aware of "Liquid" which is heavily promoted by Blockstream. There could be other sidechains out there that could prove to be useful for the Bitcoin ecosystem. "Omni" might be another sidechain living on the Bitcoin blockchain that's certainly useful for issuing "tokens" just like Counterparty. The more sidechains there are, the better it'll be for extending Bitcoin's capabilities. At least, that's the way I see it. Bitcoin's Lightning Network is something entirely different that will serve well its purpose for delivering micropayments for Bitcoin at a fraction of the cost. Just my opinion  |

|

|

|

pooya87

Legendary

Offline Offline

Activity: 3444

Merit: 10524

|

|

January 18, 2020, 03:41:07 AM |

|

Scalability is not an issue for bitcoin network.

This scalability drama is just a stupid idea that scammers who are trying to sell you their worthless tokens are trying to put into your head. And they are doing an amazing job

Bitcoin was created not to be faster than currenty payment methods, visa is far enough. It was created to be decentralized, not owned by anyone.

actually scalability has been one of the biggest issues that bitcoin has always been facing and will continue to face forever. that is why dozens of developers have been working so hard for the past 5+ years to come up with different solutions to address this issue. from multiple raw block size change proposals (that include SegWit) to second layer solutions such as LN and everything in between. and by the way, scalability is not about being "fast" but it is about the ability to handle more transactions so that the system can handle the increased demand. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

davis196

|

|

January 18, 2020, 07:00:26 AM |

|

I think that increased scalability will make bitcoin into a worthless stablecoin.

The fluctuations between BTC supply and demand are making the BTC price so volatile.The built in blockchain transaction "limits" are the what creates that supply/demand fluctuations.The value of bitcoin would be way lower,if the blockchain could handle,let's say,100 million transactions per minute.

|

|

|

|

hugeblack

Legendary

Offline Offline

Activity: 2506

Merit: 3625

Buy/Sell crypto at BestChange

|

|

January 21, 2020, 02:24:42 PM |

|

Don't think about it as if it is black and white. We have the problem of scalability which is a problem that will face Bitcoin for long time.

Currently, there is no problem using Main bitcoin network, especially since it is decentralized, cheap and does not take long.

The problem lies in who wants to use BTC for daily transactions that require speed at the expense of decentralization, and here the role of the side networks can be.

In the future, more solutions will be developed to make the network more decentralized and capable of including more tx/S.

|

|

|

|

cr1776

Legendary

Offline Offline

Activity: 4018

Merit: 1299

|

|

January 21, 2020, 04:33:29 PM |

|

Bitcoin sidechains prove to be a great scalability solution that would lose the burden on the main Bitcoin blockchain. New cryptocurrencies can be created in a form of a sidechain, to obtain the security of Bitcoin without sacrificing scalability. Scalability is not an issue for bitcoin network. This scalability drama is just a stupid idea that scammers who are trying to sell you their worthless tokens are trying to put into your head. And they are doing an amazing job Bitcoin was created not to be faster than currenty payment methods, visa is far enough. It was created to be decentralized, not owned by anyone.

Any sidecoin, fork, altcoins or whatever will be owned by someone. SoI will just skip them and use visa. Not even the fastest and most centralized shitcoin is faster than visa. Bitcoin transactions are cheap, although they are not instant. But not even the banking system is. In a few years we will have lightning network to buy coffee and stuff, and to send real money we will use the bitcoin network, which is cheap but take a few hours to complete. That's just what we need. Thanks we don't need side coins. But bitcoin's confirmation IS faster than current payment methods such as Visa. Visa's initial approval may be a few seconds, but you can contest a charge for months afterward so it is NOT confirmed for months. Bitcoin transactions are confirmed much faster than months. An hour or two. Bitcoin's initial broadcast to the network is a few seconds at most also. I do agree though, the scalability drama is just that, drama. With Lightning, you can have more or less instant broadcast and instant confirmations. Most (all) side chain functions can be duplicated faster and cheaper on things like lightning. Sidechains may be interesting for some uses, but federated sidechains that require trusted 3rd parties aren't very interesting except as experiments. |

|

|

|

|

bitmover

Legendary

Offline Offline

Activity: 2296

Merit: 5914

bitcoindata.science

|

|

January 21, 2020, 11:49:54 PM |

|

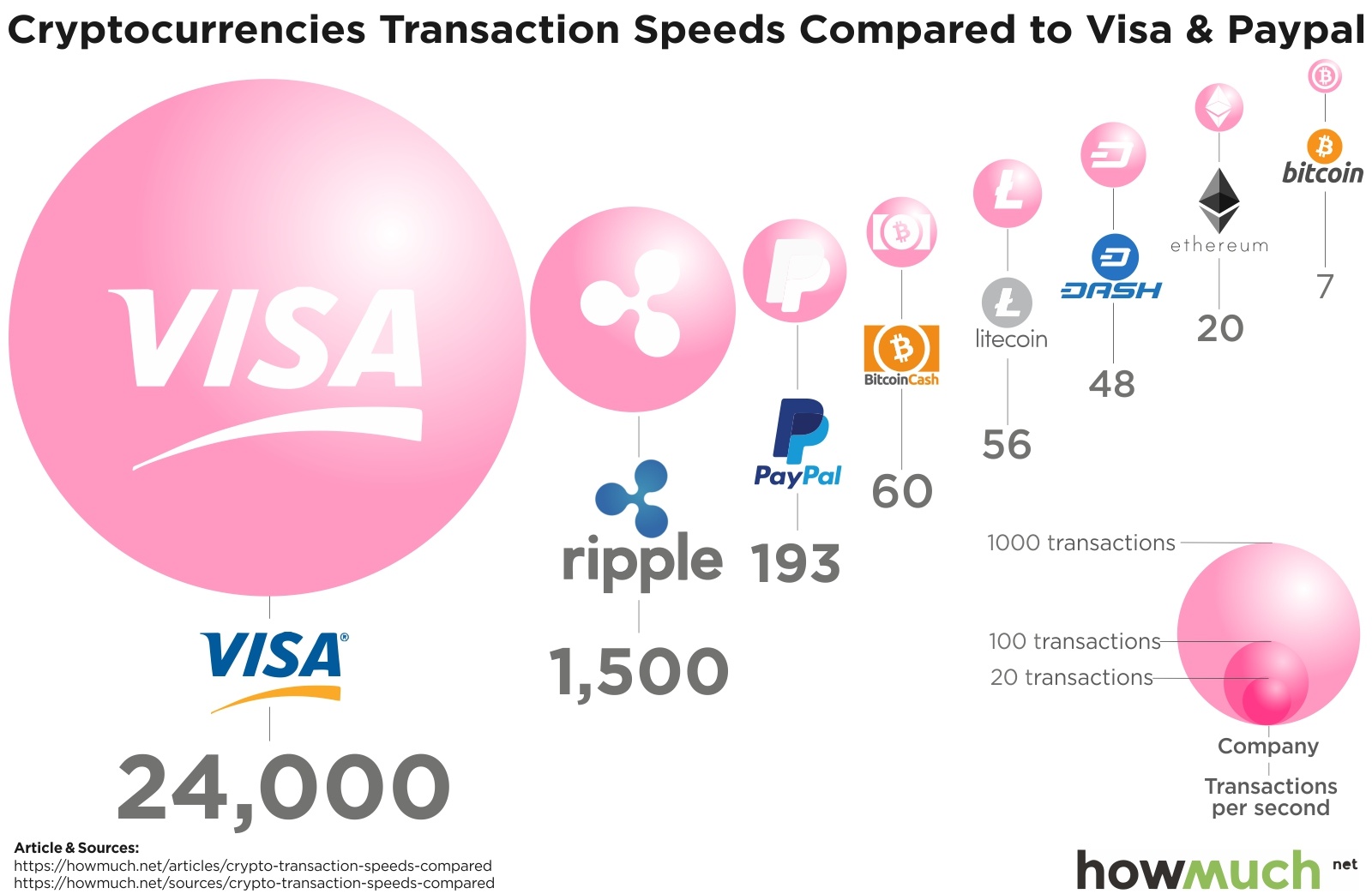

But bitcoin's confirmation IS faster than current payment methods such as Visa. Visa's initial approval may be a few seconds, but you can contest a charge for months afterward so it is NOT confirmed for months. Bitcoin transactions are confirmed much faster than months. An hour or two. Bitcoin's initial broadcast to the network is a few seconds at most also. No, that's not how it works. Visa transactions, or any bank transaction, can be reverted at any time. You can reverse a transaction from 1990 if the owner of the bank (or visa) wants. He can give you a negative balance as well, if you don't have the money to pay for the reversion of the transaction. This has nothing to do with confirmation time. When you hear people saying that bitcoin and blockchain are "immutable" , people are talking about this: Bitcoin transactions cannot be reverted. Banks are not immutable. Visa is by far the fastest method to confirm transactions. look at this graphic  https://howmuch.net/articles/crypto-transaction-speeds-compared https://howmuch.net/articles/crypto-transaction-speeds-compared |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2912

Merit: 1825

|

|

January 23, 2020, 06:47:50 AM |

|

be prepared for some silencing

its funny that the devs that made Liquid pretend its impossible to allow more than 2000tx to be confirmed in les than 10 minutes securely but meanwhile they are making other networks that can.

Stop. That's another whole debate franky1, one that has been started, fought, and one side forked into an altcoin, and the other continuing on.

i wonder why

oh yea coz they get the transaction fee's from it

Or maybe they believe it's a better design-decision not to increase the base layer, which goes back to the scaling debate.

by the way liquid only does about 2tx a block on average and only plays with ~100tokens that are pretend btc

and lastly. its a POS network

Lies again?

with 15 entities of power. so its aint decentralised

No one said that it's decentralized. So what, it's a sidechain.

so although claimed as a fast network with dozens of exchanges and private businesses using it.. and all the other propoganda.. its actually not really used.. kind of a shame devs invested soo much time for personal gain

It's early. Let them have their fun.

while crapping all over the real bitcoins utility issues and refusing to correct those issues.

such a shame

Bitcoin Cash "fixed" them, but look, no users there too. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

puertorikosena

|

|

January 23, 2020, 11:23:57 AM |

|

Despite its slowness, the Bitcoin blockchain is currently the safest and truly decentralized, unlike other blockchains. As the creator intended, Bitcoin remains the number one cryptocurrency. In order to increase the speed, you need to sacrifice security, and this contradicts the main idea of creating bitcoin.

|

|

|

|

|

Abiky (OP)

Legendary

Offline Offline

Activity: 3192

Merit: 1359

www.Crypto.Games: Multiple coins, multiple games

|

|

February 07, 2020, 07:52:17 PM |

|

But bitcoin's confirmation IS faster than current payment methods such as Visa. Visa's initial approval may be a few seconds, but you can contest a charge for months afterward so it is NOT confirmed for months. Bitcoin transactions are confirmed much faster than months. An hour or two. Bitcoin's initial broadcast to the network is a few seconds at most also.

I do agree though, the scalability drama is just that, drama.

With Lightning, you can have more or less instant broadcast and instant confirmations.

Most (all) side chain functions can be duplicated faster and cheaper on things like lightning. Sidechains may be interesting for some uses, but federated sidechains that require trusted 3rd parties aren't very interesting except as experiments.

Exactly. There's really no need to scale the Bitcoin blockchain as transactions are still faster than those performed on traditional payment processors like Visa or MasterCard. Scalability would sacrifice decentralization, which is not what Blockchain technology was created for in the first place. Satoshi intended Bitcoin to be a Peer-to-Peer Electronic Cash System that's free from middleman and counterparty risk. By increasing scalability, you'd have to increase storage/bandwidth requirements which leads to centralization of the Blockchain. In Bitcoin, it's possible to accept zero-confirmations which are broadcasted instantly across nodes on the network. Waiting for further confirmations (which take around 1 to 2 hours) from a transaction is just a preventative measure against double-spending. With the Lightning Network, the so called "scalability" issues are a thing of the past. It's a layer-two solution for the Bitcoin blockchain (we could say it's like a sidechain) which is isolated from the main chain. In case the Lightning Network fails, the main Bitcoin blockchain will continue to function as intended (unlike on-chain scalability like it's the case with both Bitcoin Cash and Bitcoin SV). The concept of "sidechains" is useful for creating new cryptocurrencies that would leverage the security of the main Bitcoin blockchain. They're pegged to Bitcoin making it difficult (or practically impossible) to perform 51% attacks on them. Sidechains or not, Bitcoin will do fine for the foreseeable future. What I do not like about sidechains is the introduction of "Federated Sidechains" like Blockstream's Liquid. This model requires a third-party which goes against what Satoshi intended in the first place. Because of the way Federated Sidechains are designed, people will most often stick to the main Bitcoin blockchain for true censorship-resistance. About sidechains on the Bitcoin blockchain, I've found out that they're still experimental. We have a few of them such as Drivechain, Rootstock, and even the Lightning Network itself. There's even Microsoft's decentralized identity solution (ION) built on top of the Bitcoin blockchain. The more sidechains there are on the Bitcoin blockchain, the more its functionalities will expand. Hence, sidechains are good in a way since they extend Bitcoin's capabilities far beyond reach. Just my thoughts  |

|

|

|

figmentofmyass

Legendary

Offline Offline

Activity: 1652

Merit: 1483

|

|

February 07, 2020, 08:05:52 PM |

|

What I do not like about sidechains is the introduction of "Federated Sidechains" like Blockstream's Liquid. This model requires a third-party which goes against what Satoshi intended in the first place. Because of the way Federated Sidechains are designed, people will most often stick to the main Bitcoin blockchain for true censorship-resistance. About sidechains on the Bitcoin blockchain, I've found out that they're still experimental. We have a few of them such as Drivechain, Rootstock, and even the Lightning Network itself. lightning =/= sidechain. it doesn't entail a second blockchain. it's more of a delayed settlement mechanism. every second layer solution comes with trade-offs, including sidechains. eg 3rd party trust (federated chains) or lower security (merge-mining). merge-mined sidechains can also adversely affect the mainchain in a tragedy of the commons scenario because, as peter todd points out, they are effectively block size increases. in other words, it's a way miners can increase the block size without network consensus. |

|

|

|

squatter

Legendary

Offline Offline

Activity: 1666

Merit: 1196

STOP SNITCHIN'

|

|

February 07, 2020, 08:33:26 PM |

|

The concept of "sidechains" is useful for creating new cryptocurrencies that would leverage the security of the main Bitcoin blockchain. They're pegged to Bitcoin making it difficult (or practically impossible) to perform 51% attacks on them. Unfortunately, no. Sidechains are much less secure than Bitcoin. With a federated sidechain, stealing all the bitcoins on the sidechain only requires collusion by 51% of trusted validators. With a drivechain, 51% of miners can collude to steal all funds on the sidechain. Visa transactions, or any bank transaction, can be reverted at any time. You can reverse a transaction from 1990 if the owner of the bank (or visa) wants. This isn't true. The filing window on chargebacks (enforced by both Visa and Mastercard) is 120 days, maximum. The filing window for ACH payments is 90 days. That's when payments like these can be reasonably considered "settled." |

|

|

|

bitmover

Legendary

Offline Offline

Activity: 2296

Merit: 5914

bitcoindata.science

|

|

February 07, 2020, 11:14:41 PM |

|

Visa transactions, or any bank transaction, can be reverted at any time. You can reverse a transaction from 1990 if the owner of the bank (or visa) wants. This isn't true. The filing window on chargebacks (enforced by both Visa and Mastercard) is 120 days, maximum. The filing window for ACH payments is 90 days. That's when payments like these can be reasonably considered "settled." You are talking about charge back, which is a money that the institution gives back to the client due to an error or scam. It is just a limit freely determined by them to keep our money due to their fault. This has nothing to do with transaction reversibility. If a judge determine that the bank charged you incorrectly, for example, that transaction can be reversed no matter how long it was. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

squatter

Legendary

Offline Offline

Activity: 1666

Merit: 1196

STOP SNITCHIN'

|

|

February 08, 2020, 02:05:44 AM

Last edit: February 08, 2020, 04:33:05 AM by squatter |

|

You are talking about charge back, which is a money that the institution gives back to the client due to an error or scam. It is just a limit freely determined by them to keep our money due to their fault. This has nothing to do with transaction reversibility. If you take chargebacks out of the equation, what situations are you even talking about? You're painting this situation where Visa (or any bank) can arbitrarily reverse payments from years or decades into the past. That's preposterous. No bank could ever trust the validity of any payment, ever, if that were true. Payments cannot be reversed after interbank settlement occurs because banks do not have the authority to steal each other's money. If a judge determine that the bank charged you incorrectly, for example, that transaction can be reversed no matter how long it was.

The bank isn't "reversing" anything. They are paying the damages ordered by a court judgment. That's an entirely new transaction. Let's apply this to Bitcoin: If BitPay charged me incorrectly and a judge ordered them to repay me, the same logic applies. BitPay would initiate a new refund transaction, not attempt to reverse the original one. Using your logic, this BitPay refund would indicate that Bitcoin is reversible back to the genesis block simply because past payments can be later refunded. Of course, we know that isn't true.  Hopefully this example shows that refunded transactions ≠ reversed transactions, and that bank payments cannot be "reversed" forever. Sorry to be long-winded, but there is a lot of misinformation around here about how the banking system works. Bitcoin's settlement time (minutes/hours) is drastically superior to Visa payments or ACH payments (months). Can't we just leave it at that? |

|

|

|

bitmover

Legendary

Offline Offline

Activity: 2296

Merit: 5914

bitcoindata.science

|

|

February 08, 2020, 01:02:48 PM

Last edit: February 08, 2020, 01:13:21 PM by bitmover |

|

If you take chargebacks out of the equation, what situations are you even talking about?

Chargeback 120 or 90 days is just an arbitrary value. Or do you think there is something like a lock time after 120 days, at 8pm, NYC time, that all transactions become irreversible? What if it is a Sunday, does the lock time goes to 121 or 118 days? That's makes absolutely no sense. That's just that: an arbitrary value when the bank decides that it will just reverse transaction by a court order (or someone else's order) You're painting this situation where Visa (or any bank) can arbitrarily reverse payments from years or decades into the past. That's preposterous. No bank could ever trust the validity of any payment, ever, if that were true.

Of course they can. Have you ever read those papers you signed when you opened your bank account? You basically signed that tour money is not yours and They can do whatever they please. This is no misinformation, I just signed some papers like that few month ago The system is based in trust, this is why bitcoin is revolutionary, because it is trust less and irreversible. I saw an antonopoulos video few time ago where he said he received some thousand dollars from a Russian. The Russian had a name similar to a terrorist , and the bank kept his money (that didnt even reach his account)for about 6 months. They only made the transaction go to his account balance after they were convinced that this wasn't a terrorist transaction. That's how banking system works. This is no misinformation. Things are arbitrary, no payment is definitive, and they control everything Thy can revser old transactions and give you a negative value. Or make a "new transaction, if you prefer that term. If in 2 years they decide that that russian is a terrorist, the money he received is going back to their security department and antonopoulos will have a negative balance (if he already spent it) That's the beautiful of centralized system. You can do whatever you want. We signed papers allow them to do so. The bank isn't "reversing" anything. They are paying the damages ordered by a court judgment. That's an entirely new transaction.

As it is a chargeback lol a new transaction You are comparing bitpay with a bank. You can't. If a judge determine bitpay has to reverse, and it doesn't make another transaction to pay for that money, bitpaybwill close it doors. Ok. But the judge cannot force that bitcoin to go back and forth. Bitpay may decide to never work again and keep that bitcoin for himself. So, to sum up: Bank transaction are not irreversible, even after 90 days. That's an arbitrary value that they won't revise their own mistakes after 90 days. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

squatter

Legendary

Offline Offline

Activity: 1666

Merit: 1196

STOP SNITCHIN'

|

|

February 08, 2020, 09:46:09 PM |

|

If you take chargebacks out of the equation, what situations are you even talking about?

Chargeback 120 or 90 days is just an arbitrary value. It is not arbitrary. All financial institutions in interbank settlement systems contractually agree to the same final settlement conditions. Some payment methods have far shorter settlement windows. Wire transfers can be permanently settled within minutes or hours. If you are defrauded into sending a bank wire that was settled through Fedwire, there is no way to reverse it. Your only choice is to pursue the fraudster in court and hope you can get a judgment forcing him to pay you back. Or do you think there is something like a lock time after 120 days, at 8pm, NYC time, that all transactions become irreversible? What if it is a Sunday, does the lock time goes to 121 or 118 days? That's makes absolutely no sense. Go ahead and prove otherwise. That's how bank settlement works. The terms are agreed to by account issuer and account holder. Once final settlement occurs, the transfer becomes irrevocable and unconditional because the involved financial institutions and the interbank settlement system (like Fedwire or CHIPS) all have contractual obligations to honor final settlement. If one bank customer screwed up and didn't dispute/cancel a transaction in time, nobody cares. The customer needs to pursue justice through the court system. The transaction will not be reversed. Of course they can. Have you ever read those papers you signed when you opened your bank account? You basically signed that tour money is not yours and They can do whatever they please. That's not true. My bank will not allow your bank to steal money from my account just because of some dispute from 1990, as you suggested. You would need to file a lawsuit against me, and at this point, the statute of limitations would likely have run out too. The system is based in trust, this is why bitcoin is revolutionary, because it is trust less and irreversible.

I saw an antonopoulos video few time ago where he said he received some thousand dollars from a Russian.

The Russian had a name similar to a terrorist , and the bank kept his money (that didnt even reach his account)for about 6 months.

They only made the transaction go to his account balance after they were convinced that this wasn't a terrorist transaction. What does that have to do with reversing transactions? Nobody claimed that the banking system is not based in trust -- completely separate issue. Now you are just conflating "trustless" with "irreversible." You were claiming that bank payments can literally never be settled, and are always reversible forever. I am disputing that claim. The bank isn't "reversing" anything. They are paying the damages ordered by a court judgment. That's an entirely new transaction.

As it is a chargeback lol a new transaction A judge ordering a defendant to pay damages ≠ a chargeback. It's ridiculous that you would suggest that. You're just refusing to address my arguments, while repeating (in different ways) that bank payments can always be reversed forever. You are comparing bitpay with a bank. You can't.

If a judge determine bitpay has to reverse, and it doesn't make another transaction to pay for that money, bitpaybwill close it doors. Ok.

But the judge cannot force that bitcoin to go back and forth. Bitpay may decide to never work again and keep that bitcoin for himself. I can't even decipher what you're saying. My point here still stands: If BitPay charged me incorrectly and a judge ordered them to repay me, the same logic applies. BitPay would initiate a new refund transaction, not attempt to reverse the original one. Using your logic, this BitPay refund would indicate that Bitcoin is reversible back to the genesis block simply because past payments can be later refunded. Of course, we know that isn't true. So, to sum up:

Bank transaction are not irreversible, even after 90 days. That's an arbitrary value that they won't revise their own mistakes after 90 days.

We can agree to disagree if you'd like, but I don't think you've even begun to prove your claims. I would reiterate: Bitcoin's settlement time (minutes/hours) is drastically superior to Visa payments or ACH payments (months). Can't we just leave it at that?

|

|

|

|

bitmover

Legendary

Offline Offline

Activity: 2296

Merit: 5914

bitcoindata.science

|

|

February 08, 2020, 11:39:04 PM |

|

Squatter

If a court decides that bitpay charged me incorrectly , in a bitcoin transaction, that transaction cannot be reversed. A judge can't even force bitpay to make a new transaction

A judge may force bitpay to disappear, but not to make a transaction.

If a judged decide that I must pay 0.1 btc to bitpay, I cannot be forced to do so

They may sell my house, but can't touch my btc.

However, if I own 10bucks in a bank account a judge can force the bank to make the transaction.

This is what you couldn't "decypher"

On the other hand, chargebacks really have nothing to do with transaction reversibility. As I said, it is a value that the whole banking system arbitrary decided not to correct their own mistakes.

120 days is not a technical reason, but merely convenience

It is convenience because a judge can determine the bank to pay for that chargeback even if it is years old.

When I have more time I will look for more information regarding reversibility in bank transactions.

Actually, like the russian example I gave you, banking transactions are happening elsewhere, not in our account directly (the russian money went to the bank, but not to antonopoulos account). They are basically a custodial service.

In the mean time, try to find your terms and agreement you signed when you opened your bank account.

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

squatter

Legendary

Offline Offline

Activity: 1666

Merit: 1196

STOP SNITCHIN'

|

|

February 09, 2020, 03:04:12 AM |

|

Squatter

If a court decides that bitpay charged me incorrectly , in a bitcoin transaction, that transaction cannot be reversed. Obviously. I have extensively pointed out how the same is true of bank payments that have already gone through interbank settlement. A court may be able to compel a new payment to be made; they cannot reverse the original one. A judge may force bitpay to disappear, but not to make a transaction.

If a judged decide that I must pay 0.1 btc to bitpay, I cannot be forced to do so

They may sell my house, but can't touch my btc. They can seize your bitcoin wallets and liquidate them, legally. If you hide/encrypt them, how is that any different than lining the floorboards in my house with cash, or holding bank accounts in other people's names? If the courts can't find my money, they can't compel me to pay a judgment! This applies to all assets, not just bitcoins. None of this proves your claim that settled bank payments are reversible. However, if I own 10bucks in a bank account a judge can force the bank to make the transaction. This is all a straw man argument you're constructing. I am not arguing that a state cannot seize a bank account!  This is my argument: A court ordering someone to pay damages, or seizure of a bank account, is not a reversal of the original payment.When someone says "Bitcoin transactions are irreversible," they mean that transactions cannot be removed from the blockchain. In the same way, a court compelling someone to pay damages does not remove the original transaction from the banks' ledgers. Here's a way to make this particularly obvious: Court judgments are generally paid by check or bank wire transfer. In the case where a defendant is compelled to repay the plaintiff due to an erroneous Visa charge, the repayment would be done via a completely different payment method. Arguing that the original payment has been "reversed" (removed from the banks' ledgers) is therefore absurd. The defendant received a transaction and was later compelled to send a different transaction. Your fundamental argument is, "Bank payments can be refunded after the fact. Therefore all bank payments are reversible forever." Let's again apply to this to BTC in a simpler example: I send you some bitcoins. You send the bitcoins right back to me. Based on your logic, the original transaction has been "reversed" when in fact, both transactions will remain on the blockchain forever. You are conflating "reversals" with "refunds" and this is a very important distinction. There is good reason why people say that "Bitcoin is irreversible" instead of "Bitcoin is non-refundable." Bitcoin is obviously refundable. So are bank payments. That is all you've proven! On the other hand, chargebacks really have nothing to do with transaction reversibility. This is really getting quite absurd. Chargebacks are reversed transactions. Until final interbank settlement occurs, chargebacks can occur. After interbank settlement occurs, transactions are irreversible. It is convenience because a judge can determine the bank to pay for that chargeback even if it is years old. No. As a cardholder, you actually legally lose the right to dispute transactions after a certain period of time. Under the Fair Credit Billing Act, you have 60 days to dispute a credit card transaction. After that, you lose all legal protections. Under the Electronic Funds Transfer Act, you have only 2 days to dispute a debit card transaction before becoming liable for up to $500 in fraudulent activity. After 60 days, the bank has no obligation whatsoever to hear your claim. Furthermore, Visa and Mastercard enforce 60-120 day time limits for disputes in their cardholder agreements, which cardholders have already contractually agreed to. After these settlement windows expire, you have no legal basis to hold Visa/Mastercard or your bank liable for billing errors, processing unauthorized charges, etc. So, there is actually no legal basis whatsoever for what you're saying. You're just claiming that a bunch of stuff would happen, when it actually wouldn't. When I have more time I will look for more information regarding reversibility in bank transactions.

Actually, like the russian example I gave you, banking transactions are happening elsewhere, not in our account directly (the russian money went to the bank, but not to antonopoulos account). They are basically a custodial service. Again, nobody is disputing that banks hold custody of account holders' money. What I am disputing is your claim that banks can arbitrarily steal each other's money ("reverse transactions") after final interbank settlement has already occurred. |

|

|

|

|