jaysabi

Legendary

Offline Offline

Activity: 2044

Merit: 1115

★777Coin.com★ Fun BTC Casino!

|

|

October 11, 2020, 03:56:54 AM |

|

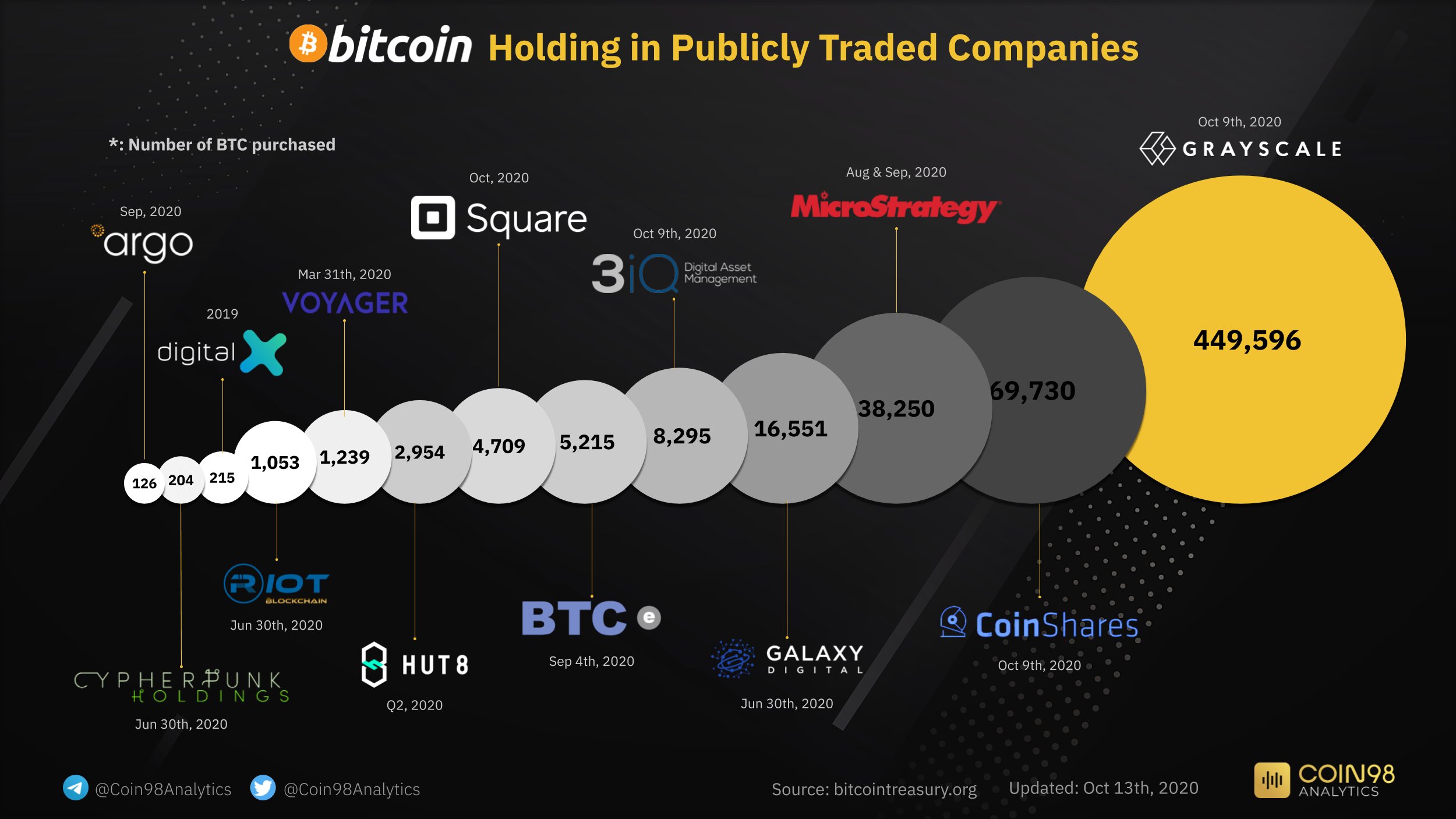

The more I look at the website, the more I like the idea, the less I like the implementation. The guys is doing several errors, on many levels: - He’s mixing companies putting value at risk investing in Bitcoin (Microstrategy, Square) with companies simply holding BTC on behalf of their clients (Grayscale, other ETP) and even miner with BTC inventories (HUT8)

- He’s adding CAD and USD values like they were the same currency, which is of course an error

- As pointed out by some sharp eyes, there are factual error is the links

This is why I am pledging to do an “improved” version of that website using my Google drive spreadsheet. Of course I will do a little bit of piggyback riding on the most tedious work, but I think the result will be more clear from a logical point of view. Yeah, I don't like including any company's whose business is selling/holding bitcoin to other people as a service. Companies like Grayscale or Coinbase own a lot of bitcoin, but it's on behalf of other people. That's not an indication of the business's conviction of the future of bitcoin. Square is different because it allows you to buy bitcoin but the company itself has invested its own assets in bitcoin. |

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

Karartma1

Legendary

Offline Offline

Activity: 2310

Merit: 1422

|

|

October 11, 2020, 10:24:11 AM Merited by fillippone (2) |

|

The more I look at the website, the more I like the idea, the less I like the implementation. The guys is doing several errors, on many levels: - He’s mixing companies putting value at risk investing in Bitcoin (Microstrategy, Square) with companies simply holding BTC on behalf of their clients (Grayscale, other ETP) and even miner with BTC inventories (HUT8)

- He’s adding CAD and USD values like they were the same currency, which is of course an error

- As pointed out by some sharp eyes, there are factual error is the links

This is why I am pledging to do an “improved” version of that website using my Google drive spreadsheet. Of course I will do a little bit of piggyback riding on the most tedious work, but I think the result will be more clear from a logical point of view. Yeah, I don't like including any company's whose business is selling/holding bitcoin to other people as a service. Companies like Grayscale or Coinbase own a lot of bitcoin, but it's on behalf of other people. That's not an indication of the business's conviction of the future of bitcoin. Square is different because it allows you to buy bitcoin but the company itself has invested its own assets in bitcoin. Yes, please. That's a super informative website but the way they implemented information is not efficient. It's a good start, and seeing your Holy Gray(l)scale spreadsheet I guess you can easily fork Bitcoin Treasuries and make it better. Please consider also to contact the webmasters directly as they ask in the footer  Did I get anything wrong? Please help me correct here https://github.com/nvk/bitcointreasuries.org/issues*Basis price is roughly calculated from available sources, currently mixed between time of purchase and balance sheet, help improve it! Why were NAV & AUM (ie GBTC) type products also added? After much reflection this was the conclusion. https://bitcointreasuries.org/whyWhy not private companies, like Tahinis? Only publicly traded companies can be easily verified. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15493

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 11, 2020, 10:37:24 AM |

|

Yes, please. That's a super informative website but the way they implemented information is not efficient. It's a good start, and seeing your Holy Gray(l)scale spreadsheet I guess you can easily fork Bitcoin Treasuries and make it better. Please consider also to contact the webmasters directly as they ask in the footer  Well, I tried to contact NVK, he’s notoriously not the most good minded toward well explained critics. So I decided to fork my own project. As I haven’t access to a website, I decided to go with the Google Spreadsheet, an instrument I am more familiar with. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Karartma1

Legendary

Offline Offline

Activity: 2310

Merit: 1422

|

|

October 11, 2020, 03:45:21 PM

Last edit: October 11, 2020, 04:10:08 PM by Karartma1 |

|

Yes, please. That's a super informative website but the way they implemented information is not efficient. It's a good start, and seeing your Holy Gray(l)scale spreadsheet I guess you can easily fork Bitcoin Treasuries and make it better. Please consider also to contact the webmasters directly as they ask in the footer  Well, I tried to contact NVK, he’s notoriously not the most good minded toward well explained critics. So I decided to fork my own project. As I haven’t access to a website, I decided to go with the Google Spreadsheet, an instrument I am more familiar with. I know what you mean. Anyway, since most of us are interested in a better version of Bitcoin Treasuries please share the spreadsheet when you have it (alpha, beta, delta, whatever version you might already have).  On a side note, now imagine what 5%, 10%, 15% of major global companies following Microstrategy’s bitcoin strategy could mean for bitcoin. Isn't it crazy?  EDIT: Jeez man! My bad! I can't believe I missed it.  |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15493

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 11, 2020, 03:52:24 PM |

|

I know what you mean. Anyway, since most of us are interested in a better version of Bitcoin Treasuries please share the spreadsheet when you have it (alpha, beta, delta, whatever version you might already have).  <...> Sorry, I tought it was clear enough on the OP message there is a link to the Excel Spreadsheet. Shall I make it more obvious? Never mind, I am editing it straight away. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

fiulpro

|

|

October 11, 2020, 04:33:21 PM |

|

And whosever here doubts that bitcoins is being used by big companies should note that:

these are the companies which are willing to share that they have invested in bitcoins.

At the same time :

there are many more companies which are investing in cryptocurrencies like Bitcoins but hiding it for their privacy.

Investing in cryptocurrencies is a bit thing for sure now and people have to understand that not even governments can control it. They can regulate but not control.

It's a pretty cool thing to see them developing towards cryptocurrencies. Good luck for your project.

With Bitpanda investing 100.9 million dollars I believe we should be pretty optimistic.

|

|

|

|

el kaka22

Legendary

Offline Offline

Activity: 3514

Merit: 1162

www.Crypto.Games: Multiple coins, multiple games

|

|

October 12, 2020, 05:28:58 PM |

|

I have always said that there could be something like a treasury in the crypto market that would be more like sp 500 type of company that holds all the big cryptos all together equally and you would be buying it to say "I invest into future of crypto prices" and not because you think one or the other coin goes up. Right now, there is nothing like that, there is only coins you can buy, but you can't just buy "future of crypto prices" type of deal, there is no top 10 coins all together market, there is no top 50, it is only just the coins you can buy and that will change.

This is the start, you invest into stuff like square or microstrategy and all which in return would be like investing into crypto currency future, but we should also have a whole market maker thing as well and exchanges could do that for sure.

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15493

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 13, 2020, 09:51:20 PM

Last edit: May 16, 2023, 01:15:54 AM by fillippone |

|

<...>

Maybe the heading just needs to be updated to something more reflective of what you're tracking.

The column was meant to be exactly the percentage of the BTC investment over the market capitalisation. The purpose was to tell how much the firm is a “bitcoin firm”. If the firm put all his asset in bitcoin, then the bitcoin investment would be equal to his market capitalisation (like Grayscale, basically). A little bit of circular reference here?  Bitcointreasuries.com copied exactly my computation: BTC% represents BTC total value over market capitalisation. Maybe NVK is reading this thread? |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Bitcoin_Arena

Copper Member

Legendary

Offline Offline

Activity: 2030

Merit: 1788

฿itcoin for all, All for ฿itcoin.

|

|

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15493

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 14, 2020, 10:56:54 AM |

|

Not only @Square, in 2020 there are more than 10 Public Companies investing in $ BTC, with a total value of over $ 6 billion, equivalent to nearly 600,000 BTC. $BTC BTC Nice sumup! I think it has been already mentioned in the thread, or at least I saw this. The Norvegian Sovereign Fund is a huge beast with more than 1 trillion USD of AUM. 600 bitcoin is less than peanuts for them! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

Mauser

|

|

October 14, 2020, 11:07:48 AM |

|

I am not sure how accounting works on crypto currencies for corporations, but I think it's different to just buying treasuries. There is more risk involved on cryptos, but therefore you get a lot of upside potential in bitcoins compared to very low returns on treasuries. I think for companies to buy bitcoins to invest excess cash is a good idea. But the opposite sounds a bit risky in my opinion. If a company would issue treasuries as a form of financing it would mean they get the bitcoins today and have to repay them at a future date. With bitcoin price so strong lately there are many indicators for the price to go up on the next few years. I would prefer to own the bitcoins instead of selling them. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15493

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 14, 2020, 11:20:41 AM

Last edit: October 14, 2020, 11:38:02 AM by fillippone Merited by JayJuanGee (1) |

|

This is a tricky one. Stone Ridge Capital is an asset Management firm. They gave 10,000 BTC in custody to their New York Digital Investment Group (NYDIG) subsidiary, to have those securely stored. They have several crypto funds dedicated to various cryptos. In 2019 they even published a paper called " Buying Bitcoin". Apparently, what they have done here is very similar to Microstrategy's decision, they even adopted the same language. This means this is not their customer's Money, but it is theirs. But the language is very confusing, because they also state that many of their funds, even traditional ones, allocate between 1% and 5% into digital assets. So the exact nature of that funds remains unclear. I will try to find out more about this. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

henmark

|

Yes, I have known about this Microstrategy and Galaxy digital holding. Then it was today that I saw news of Square INC saying that they have invested in bitcoin. Truth is a lot of institutions are becoming interested in bitcoin and as time goes a lot of them are buying and investing in Bitcoin.

There might still be some of them that we don’t know, because they have not come out to say that they have invested in Bitcoin. Although I am not really sure about this, but it can still be possible, because you can’t really tell who is investing in cryptocurrency unless they say so.

|

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15493

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 17, 2020, 07:17:27 PM |

|

<...>

Although I am not really sure about this, but it can still be possible, because you can’t really tell who is investing in cryptocurrency unless they say so.

Actually we are talking about listed companies. Listed companies have an obligation to disclose on their balance sheets what kind of investment they have (or if not in the proper balance sheets, in documents strictly related to it). So I guess it is indeed pretty easy to list those kind of investments. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15493

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 18, 2020, 12:23:36 PM |

|

Cointelegraph summarises what we already know: bitcoin is in the #phase5: The next big treasure: Corporations buy up Bitcoin as a treasury reserve

The entry of firms like Square, MicroStrategy and Stone Ridge may open the BTC floodgates and provide “confidence for the rest to follow.”

In the article they summarises the past investments and ask different experts the rationale behind this. Saifedean Ammous, gives his point of view together with some market analysis. Even if the thesis are very different, the outcome is the same: portfolio allocation should include more bitcoin. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15493

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

October 21, 2020, 02:10:02 PM |

|

Small funds are growing: Canada’s first public Bitcoin fund hits $100M markCanadian digital asset manager 3iQ has recorded a major milestone fo its public Bitcoin (BTC) fund.

The Bitcoin Fund — Canada’s first Bitcoin fund listed on a major stock exchange — has crossed the $100 million market cap threshold, 3iQ announced in an Oct. 20 tweet.

Well, with a rising Bitcoin, it's easy to see the AUM numbers inflate. Brace yourself for Grayscale announcements. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

stompix

Legendary

Offline Offline

Activity: 2884

Merit: 6320

Blackjack.fun

|

|

October 21, 2020, 07:59:43 PM |

|

There is one thing I'm curious about it and it might be interesting to observe, that's if the info will be available which it should in my opinion.

With all the news about PayPal, I was wondering about something, Revolut offers currently the same thing as PayPal will do at the start and they claim they are holding the equivalent of your bitcoins with their custodian. But Revolut is a privately owned company so they don't have to publish any data about this, Paypal, on the other hand, is a public company so not only can they be audited but they are also as far as I know bound to make an annual report on their business.

Does that mean that at the end of the year we're going to be able to see how much BTC are they holding for their customers?

This is going to be pretty interesting, if it's like that can we expect this to happen at the end of 2020?

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

ingiltere

Legendary

Offline Offline

Activity: 2982

Merit: 1488

Rollbit.com Crypto Futures

|

|

October 21, 2020, 09:04:16 PM |

|

Last week I saw same website on Twitter, I think that's really useful if they update it constantly.

I feel confident about Bitcoin's growth after all these big companies get millions of dollars worth of BTC.

Remember these are on the record investments, I'm sure there is much more than this in otc trades and untrackable positions. For example I know big guys in my country already had hundreds of BTC accumulated and they haven't stopped yet.

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

exstasie

Legendary

Offline Offline

Activity: 1806

Merit: 1521

|

|

October 21, 2020, 09:43:10 PM |

|

There is one thing I'm curious about it and it might be interesting to observe, that's if the info will be available which it should in my opinion.

With all the news about PayPal, I was wondering about something, Revolut offers currently the same thing as PayPal will do at the start and they claim they are holding the equivalent of your bitcoins with their custodian. But Revolut is a privately owned company so they don't have to publish any data about this, Paypal, on the other hand, is a public company so not only can they be audited but they are also as far as I know bound to make an annual report on their business.

Does that mean that at the end of the year we're going to be able to see how much BTC are they holding for their customers?

This is going to be pretty interesting, if it's like that can we expect this to happen at the end of 2020?

I have a feeling it won't be that informative. Financial statements are generally stated in fiat terms. All of the cryptocurrencies Paypal holds would probably be lumped together in fiat terms under a line item like "intangible assets." Apparently that's how Square is reporting their holdings, although I'm not 100% clear on the accounting nuances involved. https://www.forbes.com/sites/shehanchandrasekera/2020/05/21/how-are-cryptocurrencies-classified-in-gaap-financials/#50d7b93565b2 |

|

|

|

|