fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

November 03, 2022, 01:01:39 PM

Last edit: May 15, 2023, 11:16:14 AM by fillippone Merited by JayJuanGee (1) |

|

The Chinese Government is a big Whale, according to this tweet from Ki Young, CryptoQuant co-founder:  This puts the Chinese Government well ahead of Micheal Saylor’s Microstrategy as far as Bitcoin Stash is concerned. Of course, acquisition reasons are profoundly diverse: Microstrategy willingly bought those bitcoins because of an investment thesis, while the Chinese Government got in possession of those bitcoins as a part of asset seizure from illegal activities (PlusToken Scam, back in 2019). |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

zasad@

Legendary

Offline Offline

Activity: 1750

Merit: 4276

|

|

December 29, 2022, 04:22:41 PM Merited by JayJuanGee (1) |

|

https://www.sec.gov/Archives/edgar/data/1050446/000119312522313098/d398241d8k.htm"During the period between November 1, 2022 and December 21, 2022, MicroStrategy, through its wholly-owned subsidiary MacroStrategy LLC (“MacroStrategy”), acquired approximately 2,395 bitcoins for approximately $42.8 million in cash, at an average price of approximately $17,871 per bitcoin, inclusive of fees and expenses." https://cointelegraph.com/news/microstrategy-bitcoin-purchase-divides-the-crypto-communityhttps://twitter.com/saylor/status/1608086703843180544?"MicroStrategy has increased its #Bitcoin Holdings by ~2,500 #BTC. As of 12/27/22 @MicroStrategy holds ~132,500 bitcoin acquired for ~$4.03 billion at an average price of ~$30,397 per bitcoin. $MSTR"

|

|

|

|

|

Moeda

|

|

December 31, 2022, 06:03:29 PM Merited by fillippone (1) |

|

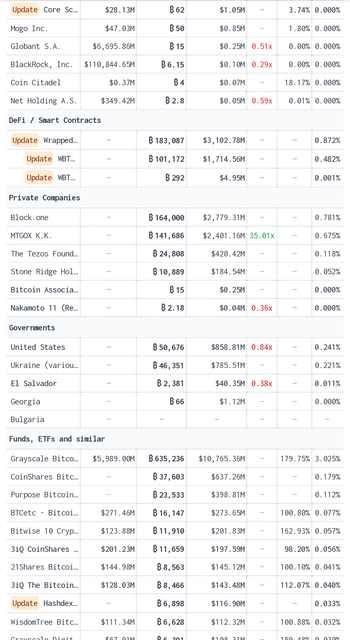

I found on Reddit a nice website. https://bitcointreasuries.org/As I already was keeping track of companies staking Bitcoins, I decided to create my own version of this website, using Google Drive: Bitcoin Treasuries (Link to Google Spreadsheet) This is something interesting for us to learn, because it is closely related to the condition of the Bitcoin market. With us being able to know who will enter the Bitcoin market, and how much they will invest, of course this will make the price of Bitcoin grow. Equally important, we also have to know when they will exit the stock exchange or withdraw their investment. This can also affect the market to drop. This is something difficult work that you work, I think we need appreciation with work like this. A little suggestion, if you work using MS Excel, you can connect directly between MS Excel and Googlesheet, so you only need to make changes in MS which can automatically change in Googlesheet. But I don't know if you do the same. |

|

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 06, 2023, 07:22:09 AM |

|

A little suggestion, if you work using MS Excel, you can connect directly between MS Excel and Googlesheet, so you only need to make changes in MS which can automatically change in Googlesheet. But I don't know if you do the same.

Thank you, but no, I work directly in Google sheet. Linking MS Excel would hinder the main reason why I use Google Sheets in the first place: being location/device agnostic. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Bushdark

Sr. Member

Offline Offline

Activity: 882

Merit: 262

Eloncoin.org - Mars, here we come!

|

|

January 08, 2023, 04:07:16 PM |

|

Do you know that https://bitcointreasuries.org/ had been sold and it's now https://bitcointreasuries.net? You can take a look https://bitcointreasuries.net to see the spread sheet of different companies both government and private limited treasuries. You will get update data about various holdings so in case of sells or buys .   It contains all available treasuries we need to know. I will work to improve this spreadsheet, trying to monitor the trickle down effect kickstarted by Microstrategy decision.

Square was an obvious follower. Now I am really curious who’s going down the same path.

Wow that is a good move and this would help you to keep records from time to time. I think China is one of the countries that has the largest holdings in Bitcoin. This is something interesting for us to learn, because it is closely related to the condition of the Bitcoin market. With us being able to know who will enter the Bitcoin market, and how much they will invest, of course this will make the price of Bitcoin grow.

I am very happy to come across this thread because this is an eye opening for those of us that are investors to know how the Bitcoin market had been splitted into different treasuries. This record is necessary for reference and educational purposes. At least it gives us a broad outlook of the entire market. This is something difficult work that you work, I think we need appreciation with work like this. A little suggestion, if you work using MS Excel, you can connect directly between MS Excel and Googlesheet, so you only need to make changes in MS which can automatically change in Googlesheet. But I don't know if you do the same.

I think Google sheet is quite better for me. I think I will need to keep will these in my reference portfolio in case of necessity. |

▄▄████████▄▄

▄▄████████████████▄▄

▄██████████████████████▄

▄█████████████████████████▄

▄███████████████████████████▄

| ███████████████████▄████▄

█████████████████▄███████

████████████████▄███████▀

██████████▄▄███▄██████▀

████████▄████▄█████▀▀

██████▄██████████▀

███▄▄████████████▄

██▄███████████████

░▄██████████████▀

▄█████████████▀

█████████████

███████████▀

███████▀▀ | | | Mars,

here we come! | ▄▄███████▄▄

▄███████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀███████▀▀ | ElonCoin.org | │ | | .

| │ | ████████▄▄███████▄▄

███████▄████████████▌

██████▐██▀███████▀▀██

███████████████████▐█▌

████▄▄▄▄▄▄▄▄▄▄██▄▄▄▄▄

███▀░▐███▀▄█▄█▀▀█▄█▄▀

██████████████▄██████▌

█████▐██▄██████▄████▐

█████████▀░▄▄▄▄▄

███████▄█▄░▀█▄▄░▀

███▄██▄▀███▄█████▄▀

▄██████▄▀███████▀

████████▄▀████▀█████▄▄ | .

"I could either watch it

happen or be a part of it"

▬▬▬▬▬ |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

January 13, 2023, 11:31:20 PM |

|

Thanks for the heads up. Anyway the importance of this thread was do signal the fact that Bitcoin Treasuries do exist and Decisions are mad in order to grow that. Bitcoin is an institutionalised product nowadays, and the market correlation it exhibit with Nasdaq is a proof of that. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 11, 2023, 02:14:23 PM Merited by JayJuanGee (1) |

|

Tether recently released its latest financial statement. An interesting fact was reported from Cryptoslate: Tether attestation shows $1.5B worth of Bitcoin in reservesTether, is hodling Bitcoin and Gold against their USDt liabilities. Tether is holding bitcoin for 1.5 Billion, or 2% reserves, and gold for roughly double the amount. It is compelling to notice they are holding a non-yield bearing asset in the high-rate environment. They could invest all their reserves in Treasury bills which could yield a little less than one billion alone. (considering a 4.8 rate for a 1-year horizon. They instead bought Gold and Bitcoin, whose nominal yield is close to zero percent. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

May 11, 2023, 03:18:50 PM Merited by fillippone (3) |

|

Tether recently released its latest financial statement. An interesting fact was reported from Cryptoslate: Tether attestation shows $1.5B worth of Bitcoin in reservesTether, is hodling Bitcoin and Gold against their USDt liabilities. Tether is holding bitcoin for 1.5 Billion, or 2% reserves, and gold for roughly double the amount. It is compelling to notice they are holding a non-yield bearing asset in the high-rate environment. They could invest all their reserves in Treasury bills which could yield a little less than one billion alone. (considering a 4.8 rate for a 1-year horizon. They instead bought Gold and Bitcoin, whose nominal yield is close to zero percent. hahahahaha thanks for pointing out that "yield" angle. Not everyone (or business) is tempted by having to get yield on their holdings in order to attempt to preserve their wealth, and surely many of us likely realize that some of the yield products have their various kinds of risk, and maybe there might be some justification to keep some value in the yield products - but also realizing that there is risk - even USGovt products... and even with the UPs and downs of something like bitcoin, many of us have also seen that there are some days (short-periods of time) that you just need to "already be in it" when it might go on some kind of an UPpity rip and fail/refuse to come back down to the price point in which it had started such rip... and of course, future UPpity rips are not guaranteed, even if they have historically happened on quite a few occasions in bitcoinlandia.... ... so would it matter if you are in some kind of a "yield" product when the bitcoin rip ends up happening (if it happens?) when the yield might be paying a relatively high amount in dollars, but the dollar is devaluating so fast that the rip ends up showing the yield as the likely little dwarf that it is, relatively speaking. No one is going to say how much each of us (whether an individual or an institution or a government for that matter) should attempt to keep allocated in various kind of asset classes or how much we should be considering "yield" when comparing products, so each of us has to attempt to figure out those allocations for ourselves, and then let the chips lie where they will when several years play out in which there may well have appeared to have been some great short term measurements on some products, but then how did the various products perform, relatively speaking, on a longer timeline?.. .. many of us might have recalled many of the bullshit correlation-related talking points that were being thrown around in around March 2020 about bitcoin failing/refusing to perform as an "inflation hedge" or a store of value.. and yeah there can be some opportunistically ways to make those kinds of measures (and the talking points stay in people's heads too), and yet do the measures and talking points measure up to longer term reality in which so many folks who had been accumulating BTC at sub $10k price points at any point between mid-2018 and late 2020.. have seemed to have had built up a pretty decent solid base for their cost of bitcoin as compared to how other various asset classes have performed over the same period of time... and yeah, the jury is still out in terms of where bitcoin might be going from here as compared to other places that any of us (whether individual, institution or government) might choose to keep our value and how much do we feel that we "need to be" in yield bearing products as compared to sound money products... gold? who knows about gold? but still.. having that non-yield bearing bitcoin on the side does not seem to be a bad thing for those folks who are able to figure out how to accumulate it and feel comfortable in their having had secured it.. even if it might be in a place that cost money to store or does not bear yield. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 11, 2023, 04:54:09 PM Merited by JayJuanGee (1) |

|

thanks for pointing out that "yield" angle.

Well, when I see the Tether balance sheet I cannot avoid thinking that all those profits are nothing else someone else's loss. In this case Tehter is ripping of their own user base of their credit risk reward. Lending your federal coin to the US yields 4.5%. Lending your shitcoin to Tether Inc. yields 0%. So this 4.5% is captured by Tether itself! |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

JayJuanGee

Legendary

Offline Offline

Activity: 3710

Merit: 10212

Self-Custody is a right. Say no to"Non-custodial"

|

|

May 12, 2023, 03:24:17 AM |

|

thanks for pointing out that "yield" angle.

Well, when I see the Tether balance sheet I cannot avoid thinking that all those profits are nothing else someone else's loss. In this case Tehter is ripping of their own user base of their credit risk reward. Lending your federal coin to the US yields 4.5%. Lending your shitcoin to Tether Inc. yields 0%. So this 4.5% is captured by Tether itself! Gosh, I don't know fillippone. We seem to be looking at this from a different kind of a perspective, and it is not like either one of us is necessarily wrong, but just coming at the issue from a different angle .. and I am not even sure how useful a seemingly kind of conspiratorial approach (that you seem to be angling) is very helpful in terms of Tether to be playing some kind of zero sum game with their customers, and it seems to me that "so far" Tether has been amongst the best of "stable" coins in terms of being able to ongoingly and persistently achieve objectives of retaining a pretty stable peg to the dollar, so in some sense, it seems to me that their main job would be to make sure that they have sufficient assets in reserve to maintain their peg and to be able to sustain any attacks that might come upon their peg or even liquidity attacks or even other ways that sometimes there might be inconsistencies in the market or even where $800 million of their money gets taken by a company in Panama (perhaps facilitated by the USA) which seems to have been something that happened to them around 2016 or so. ... so yeah don't lose client money or rug pull clients would be important, and whether Tether might be making money (or yield) in any kind of way seems to hardly be an issue... because they also have expenses to operate and likely deserve to have various kinds of profits if they are able to accomplish profits without taking it from their clients or engaging in unlawful or unethical behaviors. I would imagine that their clients have a variety of reasons that they might be in tether, either temporarily or in longer term bases, and it seems that tether is not designed to produce yield or to incentivize deposits by advertising yield, because if they were to offer yield then maybe they would end up devolving into some shitcoin or unstable asset or some kind of ponzi scheme like a variety of their emulator copy cat coins that try to act like they have reserves and they do not.. .. and there is no real evidence that Tether has not been maintaining reserves, even if they might not have had all of their reserves held in the same kinds of assets, and I don't see any reason for their not attempting to make sure that the value that they hold is potentially earning yield for them in a variety of ways - even though of course, your initial post had to do with a certain quantity of Tether's reserves remaining in non-yield bearing assets - bitcoin and gold.. and surely I thought that you might have had been wanting to make another point in regards to the sound money (and diversification ideas) rather than maybe your suggestion that "maybe Tether should share some of its yield with customers?"... to the extent that might have been what you were suggesting.. hahahahahaha? sounds kind of like something a Tether hater would proclaim, since there have been claims that Tether is going to zero and Tether is insolvent and blah blah blah since at least 2015-ish and I recall the Tether is a scam arguments being made before the Panama bank (perhaps backed by the USA government) took Tether's fund so that the USA government could proclaim that Tether was not sufficiently solvent and/or backed by dollars (that had just been taken from them) blah blah blah. |

1) Self-Custody is a right. There is no such thing as "non-custodial" or "un-hosted." 2) ESG, KYC & AML are attack-vectors on Bitcoin to be avoided or minimized. 3) How much alt (shit)coin diversification is necessary? if you are into Bitcoin, then 0%......if you cannot control your gambling, then perhaps limit your alt(shit)coin exposure to less than 10% of your bitcoin size...Put BTC here: bc1q49wt0ddnj07wzzp6z7affw9ven7fztyhevqu9k

|

|

|

fillippone (OP)

Legendary

Offline Offline

Activity: 2156

Merit: 15470

Fully fledged Merit Cycler - Golden Feather 22-23

|

|

May 17, 2023, 12:10:10 PM Merited by JayJuanGee (1) |

|

Tether is going to be the biggest Bitcoin treasury (soon) Tether to invest up to 15% of its profits in bitcoinTether is set to purchase bitcoin on a regular basis from its profits.

It held $1.5 billion in bitcoin as of the end of the first quarter, accounting for about 2% of its reserves.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|