|

BTCurious

|

|

November 27, 2011, 10:19:47 PM |

|

BTCurious, I think your best bet is to diversify diversity diversify. My thought would be 25% cash, 25% bank euro, 25% bank USD, 25% bitcoin. If one or two fail, you won't be wiped out, and if USD or BTC shoot up relative EUR, you might come out ahead.

But also, keep in mind that currency "failure" is a loose term: if EUR drops by 50% vs. USD, people will consider it to have "failed", but it will still be useful paper to own. Sounds reasonable. "25% cash" would still have to be cash in a certain currency though, and as such would only prevent against bank collapse. But in the event of a bank collapse my government ensures my savings up to a certain amount far above my current savings. So it might protect against a bank and government collapse, but the Netherlands seems rather unphased in the euro crisis, based on some graph that floated in front of my eyes (I haven't read up on economics). Then there's also the thing where I have no idea how to properly "invest in USD" or whatever, and it seems scary to do anything with more than half of my money. The best thing you can invest in is INDEPENDENCE. In knowledge, growing your own food, producing own energy, thinking without ait, being prepared for the worse. Growing your own food etc…? I thought I lived in a Western country. Investing a large portion of my time in things like that seems so… pointless. Maybe that's my habits speaking. No effect. People aren't gonna turn to bitcoins after whats happened to it. I'm considering at least investing more. I don't have a lot of money, but maybe people with more money would consider it too. Another sure consequence is that with a hypothetical return of national currencies in Europe, Bitcoin would immediately gain usefulness. I'd hate to go back to this misshapen quilt blanket of currencies… From a regular civilian point of view, the euro has been really convenient. Mark, Drachma, Guilder, Francs… Thanks but no thanks. |

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

wareen

Millionaire

Legendary

Offline Offline

Activity: 910

Merit: 1001

Revolutionizing Brokerage of Personal Data

|

|

November 27, 2011, 10:28:35 PM |

|

I'd hate to go back to this misshapen quilt blanket of currencies… From a regular civilian point of view, the euro has been really convenient. Mark, Drachma, Guilder, Francs… Thanks but no thanks.

I Agree. It was also very appropriate that the European Bitcoin conference was in a non-Euro country - it was a great demonstration for the immediate usefulness of Bitcoin. But anyway - having to exchange currencies again when traveling would probably be one of the less annoying consequences of a Euro collapse  |

|

|

|

eldentyrell

Donator

Legendary

Offline Offline

Activity: 980

Merit: 1004

felonious vagrancy, personified

|

|

November 28, 2011, 07:28:14 AM |

|

Oh, and beware. If euro fails there will be a war.

Wow, I didn't know Angela Merkel read this board. |

The printing press heralded the end of the Dark Ages and made the Enlightenment possible, but it took another three centuries before any country managed to put freedom of the press beyond the reach of legislators. So it may take a while before cryptocurrencies are free of the AML-NSA-KYC surveillance plague.

|

|

|

zby (OP)

Legendary

Offline Offline

Activity: 1592

Merit: 1001

|

|

November 28, 2011, 08:50:48 AM |

|

No effect. People aren't gonna turn to bitcoins after whats happened to it.

Strange how people interpreted it as if I suggested that EURO failure would move the BTC price up - while I clearly stated that it would mean ' risk off', selling of risky assets like bitcoins. But in the end it is possible that in a case of a full financial meltdown people will try out any crazy schema to get out of the trouble. |

|

|

|

|

wareen

Millionaire

Legendary

Offline Offline

Activity: 910

Merit: 1001

Revolutionizing Brokerage of Personal Data

|

|

November 28, 2011, 09:03:43 AM |

|

Strange how people interpreted it as if I suggested that EURO failure would move the BTC price up - while I clearly stated that it would mean 'risk off', selling of risky assets like bitcoins. But in the end it is possible that in a case of a full financial meltdown people will try out any crazy schema to get out of the trouble.

Ok, so what do you think people would sell their Bitcoins for? USD? Gold? I don't think either is a very wise choice if the meltdown already happens. Since BTC are mostly traded for USD anyway, are highly liquid and far more resilient to confiscation / currency control measures I sure as hell would hold on to them in case of such a crisis. |

|

|

|

tvbcof

Legendary

Offline Offline

Activity: 4592

Merit: 1276

|

|

November 28, 2011, 09:09:14 AM |

|

No effect. People aren't gonna turn to bitcoins after whats happened to it.

Strange how people interpreted it as if I suggested that EURO failure would move the BTC price up - while I clearly stated that it would mean ' risk off', selling of risky assets like bitcoins. But in the end it is possible that in a case of a full financial meltdown people will try out any crazy schema to get out of the trouble. I doubt that that would be true. In a crisis such as this, I suggest that people will be buying damn near anything just to unload their EURO's. Additionally, there would almost certainly be capital controls and Bitcoin is probably second to none (litterally) in working around that sort of issue. I personally expect that were the EURO to fail, the USD would be not far behind (though it could go through some very interesting and rapid-cycle gyrations.) Since the whole thing seems like a distinct possibility to me, I have already taken steps to diversify and I choose BTC as a percentage of this diversification strategy and in part because I could imagine having control of some of them providing a certain amount of utility in a crisis situation. |

sig spam anywhere and self-moderated threads on the pol&soc board are for losers.

|

|

|

|

P4man

|

|

November 28, 2011, 09:51:36 AM |

|

A falling apart of the euro zone doesnt mean euro's will become worthless. They will just be converted in to whatever new/old currencies those counties adopt. There might be a haircut involved, but its not like you will be using 100 euro bills as toilet paper. I also think its unlikely the euro will disappear completely, its more likely a few countries will drop out.

The biggest opportunity for bitcoin in this context is not that it would be a safe storage of wealth (clearly its not), but that it could gain usefulness to avoid currency exchange costs.

|

|

|

|

zby (OP)

Legendary

Offline Offline

Activity: 1592

Merit: 1001

|

|

November 28, 2011, 10:20:42 AM |

|

Strange how people interpreted it as if I suggested that EURO failure would move the BTC price up - while I clearly stated that it would mean 'risk off', selling of risky assets like bitcoins. But in the end it is possible that in a case of a full financial meltdown people will try out any crazy schema to get out of the trouble.

Ok, so what do you think people would sell their Bitcoins for? USD? Gold? I don't think either is a very wise choice if the meltdown already happens. Since BTC are mostly traded for USD anyway, are highly liquid and far more resilient to confiscation / currency control measures I sure as hell would hold on to them in case of such a crisis. Answering your question - USD - from what I read on the Internet this is the usual direction in such cases because USD is still considered the safest and the most liquid currency. Also there is a lot of debt denominated in USD - so there can be a kind of short squeeze on dollars - and that is why liquidity matters and why gold can suffer for some time. All of this is what I recently learned from some internet pundits - I am still not very confident about this thinking and I am not convinced that it matters much for bitcoins. Also a drowning man will clutch at a straw - if the crisis gets really bad people will try all kinds of fringe investments and if that happens on a global or even just on a continental scale - then this could send bitcoin prices to the moon. |

|

|

|

|

netrin

Sr. Member

Offline Offline

Activity: 322

Merit: 251

FirstBits: 168Bc

|

|

November 28, 2011, 04:40:50 PM |

|

Humans are creatures of habit. With soveriegn debt crisis, what do people do? Buy more but different sovereign debt. It was amazing that with the US credit downgrade, US treasury yields appreciated. The logic may be that huge institutions with rating averages minimums were required to replace lower rated bonds and had no choice but to buy from the most liquid market - US Treasuries.

While EUR and USD are both looking bad, whichever one tumbles first, the other will climb. Mysteriously, people haven't yet lost faith in paper, they just shift from one paper to the other. I believe that bitcoin will behave much like CHF before Zurich pulled the plug. Representing only a tiny fraction of the European economy, what was only a trickle from EUR was a flood toward CHF. It would only take a few drops from the EUR ocean to make a tsunami in the BTC pond.

|

|

|

|

proudhon

Legendary

Offline Offline

Activity: 2198

Merit: 1311

|

|

November 28, 2011, 04:55:46 PM |

|

Humans are creatures of habit. With soveriegn debt crisis, what do people do? Buy more but different sovereign debt. It was amazing that with the US credit downgrade, US treasury yields appreciated. The logic may be that huge institutions with rating averages minimums were required to replace lower rated bonds and had no choice but to buy from the most liquid market - US Treasuries.

While EUR and USD are both looking bad, whichever one tumbles first, the other will climb. Mysteriously, people haven't yet lost faith in paper, they just shift from one paper to the other. I believe that bitcoin will behave much like CHF before Zurich pulled the plug. Representing only a tiny fraction of the European economy, what was only a trickle from EUR was a flood toward CHF. It would only take a few drops from the EUR ocean to make a tsunami in the BTC pond.

Must. Resist. Temptation. To. Turn. Bullish... |

Bitcoin Fact: the price of bitcoin will not be greater than $70k for more than 25 consecutive days at any point in the rest of recorded human history.

|

|

|

|

BTCurious

|

|

November 28, 2011, 04:57:11 PM |

|

Must. Resist. Temptation. To. Turn. Bullish... You're having trouble not buying shitloads of bitcoins? Try me! I actually live in Europe! |

|

|

|

|

old_engineer

|

|

November 28, 2011, 07:46:07 PM |

|

Humans are creatures of habit. With soveriegn debt crisis, what do people do? Buy more but different sovereign debt. It was amazing that with the US credit downgrade, US treasury yields appreciated.

Eh, the downgrade was more a reflection of the pathetic ratings companies, the "Wall Street equivalent of the LA Clippers" as Nate Silver so aptly put it. The US can and will pay, and everyone knows it. The US economy is just so staggeringly huge - Walmart's revenue last year was about the same as the GDP of Sweden - the even if the political system is broken, they can still pay back debt eventually. While EUR and USD are both looking bad, whichever one tumbles first, the other will climb. Mysteriously, people haven't yet lost faith in paper, they just shift from one paper to the other. I believe that bitcoin will behave much like CHF before Zurich pulled the plug. Representing only a tiny fraction of the European economy, what was only a trickle from EUR was a flood toward CHF. It would only take a few drops from the EUR ocean to make a tsunami in the BTC pond.

I see the spike in CHF-EUR exchange rate in August, but how did they pull the plug? When talking about wealth storage, bitcoin is resistant to even breaks in the algorithm. The network might be down for a couple of days, like a bank's website going offline, but after the patch is applied, everything returns to normal. This happened once before when a 2 billion coin error was found. Must. Resist. Temptation. To. Turn. Bullish...

Holy shit, is proudhon questioning his bearishness? Even Nagle's trolling in a different thread seemed half-hearted. |

|

|

|

|

MoonShadow

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

November 28, 2011, 07:57:52 PM |

|

Oh, and beware. If euro fails there will be a war.

Wow, I didn't know Angela Merkel read this board. European peace and cooperation has a short history, and the collapse of this monetary union, even in the absence of the actual destruction of the currency itself, historical animosities are very likely to return to the surface of public discourse. It's already happened between Greece and Germany, with some Germans calling for Greece to sell off some of their prized islands and Greeks referencing the looting of Greece during WWII. Fringe political parties, with strong 'nationalistic' platforms have also been receiving more attention, and winning more seats, across all of Europe. Mish has predicted that the first polititian to openly declare the Machiart (sp?) treaty a dead letter will win in a landslide, no matter which country he hails from. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

tvbcof

Legendary

Offline Offline

Activity: 4592

Merit: 1276

|

|

November 28, 2011, 08:12:57 PM |

|

... Must. Resist. Temptation. To. Turn. Bullish...

Holy shit, is proudhon questioning his bearishness? Even Nagle's trolling in a different thread seemed half-hearted. Seems that the three little bears (Naggle, EdwardNN, and Proudhon) might be finding more bee stingers than honey in the valley of the Bitcoin market depth. |

sig spam anywhere and self-moderated threads on the pol&soc board are for losers.

|

|

|

MimiTheKid

Newbie

Offline Offline

Activity: 39

Merit: 0

|

|

November 28, 2011, 10:34:19 PM |

|

If a melt down happens, bitcoins will fall.

Bitcoins are based on the people, who trust the system. If the trust gets lost, ....

Old euros you can burn to heat your soup. For bicoins you need a computer, electri...

So maybe the rest of the world stores bitcoins, but the europeans cannot/won't do this.

Why? Because they notice now that money (also bitoins) isn't worth too much. The "real" things help you, feed you, make your life easier. To store money doesn't make any sense.

Especially the USD isn't any help any more. The europeans have got so much Dollars, because of the high debts of the US-government and the american people, they don't need more. And: The USA has got the same "european" problems. Exactly the same, but more debts and less resources to cope with them.

No currency is the problem and can't be a solution. Most of the time, it's just the trading-mechanism.

The europeans are learning this now. And they are taking the expensive way.

|

|

|

|

|

|

old_engineer

|

|

November 28, 2011, 10:35:44 PM |

|

Seems that the three little bears (Naggle, EdwardNN, and Proudhon) might be finding more bee stingers than honey in the valley of the Bitcoin market depth.

Some predictions haven't quite come true, and I have great respect for anyone that changes their opinions based on new evidence: Get ready for $1 bitcoins at the end of this month.

Full disclosure: my only prediction was three weeks ago, and though technically it was broken, no one had a chance to buy when it was sub $2.00: My prediction: prices won't drop below $2 or go above $4 this year.

I'm still standing by this, and will buy more if it drops below $2, and sell if it approaches $4 before the end of the year. |

|

|

|

|

MoonShadow

Legendary

Offline Offline

Activity: 1708

Merit: 1007

|

|

November 28, 2011, 11:41:58 PM |

|

If a melt down happens, bitcoins will fall.

Bitcoins are based on the people, who trust the system. If the trust gets lost, ....

Old euros you can burn to heat your soup. For bicoins you need a computer, electri...

So maybe the rest of the world stores bitcoins, but the europeans cannot/won't do this.

Why? Because they notice now that money (also bitoins) isn't worth too much. The "real" things help you, feed you, make your life easier. To store money doesn't make any sense.

Especially the USD isn't any help any more. The europeans have got so much Dollars, because of the high debts of the US-government and the american people, they don't need more. And: The USA has got the same "european" problems. Exactly the same, but more debts and less resources to cope with them.

No currency is the problem and can't be a solution. Most of the time, it's just the trading-mechanism.

The europeans are learning this now. And they are taking the expensive way.

Wow, this prediction is based upon a particularly error filled view of economics. So if the Euro begins to really collapse, the European "1%" are just going to throw up their hands and say, "Well, it was good while it lasted"? Of course not, they are going to scramble to do whatever they can to save as much of their wealth as they can in any fashion that they can. I find it unlikely that Bitcoin will benefit in any significant way, but the US $ certianly would. Gold would. Silver might. Bitcoin just isn't a large enough of an economy to absorb even a small portion of the needs of Europe at this time, and anyone with enough money to bother would be able to understand that up front. |

"The powers of financial capitalism had another far-reaching aim, nothing less than to create a world system of financial control in private hands able to dominate the political system of each country and the economy of the world as a whole. This system was to be controlled in a feudalist fashion by the central banks of the world acting in concert, by secret agreements arrived at in frequent meetings and conferences. The apex of the systems was to be the Bank for International Settlements in Basel, Switzerland, a private bank owned and controlled by the world's central banks which were themselves private corporations. Each central bank...sought to dominate its government by its ability to control Treasury loans, to manipulate foreign exchanges, to influence the level of economic activity in the country, and to influence cooperative politicians by subsequent economic rewards in the business world."

- Carroll Quigley, CFR member, mentor to Bill Clinton, from 'Tragedy And Hope'

|

|

|

MimiTheKid

Newbie

Offline Offline

Activity: 39

Merit: 0

|

|

November 29, 2011, 12:00:31 AM |

|

With the European 1% you mean the richest ones? This ones are searching for investments. They are spending all the money they have. None of them tries to have a big bank account, or anything like that. The money is spent into companies (especially startups), properties, cars... They use currencies for transactions or speculation. The speculation-part is the fun/casino-part. Gold/Silver can be ok, but seems to be quite overpriced, because everyone is looking for investments. And these properties became part of the casino. @US$-benefits: The Euro startet 1:1 to the dollar. And now? Investments in the US didn't pay of for europeans. And for storing value? Look what happend after 2002. http://finance.yahoo.com/echarts?s=EURUSD=X+Interactive#chart3:symbol=eurusd=x;range=my;indicator=volume;charttype=line;crosshair=on;ohlcvalues=0;logscale=on;source=undefined The investors learned that the FED is printing money. |

|

|

|

|

netrin

Sr. Member

Offline Offline

Activity: 322

Merit: 251

FirstBits: 168Bc

|

|

November 29, 2011, 01:51:16 AM

Last edit: November 29, 2011, 02:01:55 AM by netrin |

|

Eh, the downgrade was more a reflection of the pathetic ratings companies, the "Wall Street equivalent of the LA Clippers" as Nate Silver so aptly put it. The US can and will pay, and everyone knows it. The US economy is just so staggeringly huge - Walmart's revenue last year was about the same as the GDP of Sweden - the even if the political system is broken, they can still pay back debt eventually.

A credit rating is not determined by the size of an economy, but upon default risk and inflationary risk. At 100% debt to GDP, deficits of 37.5% of the annual budget, more monetization scheduled, an aging population, engaged in multiple wars, the United States certainly represents an inflationary risk. You must be getting your opinion spoon fed directly from the Treasury Dept. AA+ was grossly generous. I see the spike in CHF-EUR exchange rate in August (6 September), but how did they pull the plug?

The same way all nations are devaluing their currencies: printing more paper. http://www.snb.ch/en/mmr/reference/pre_20110906/source/pre_20110906.en.pdfBitcoin just isn't a large enough of an economy to absorb even a small portion of the needs of Europe at this time...

That is precisely why EUR/BTC will go up! |

|

|

|

|

old_engineer

|

|

November 29, 2011, 04:36:54 AM |

|

Eh, the downgrade was more a reflection of the pathetic ratings companies, the "Wall Street equivalent of the LA Clippers" as Nate Silver so aptly put it. The US can and will pay, and everyone knows it. The US economy is just so staggeringly huge - Walmart's revenue last year was about the same as the GDP of Sweden - the even if the political system is broken, they can still pay back debt eventually.

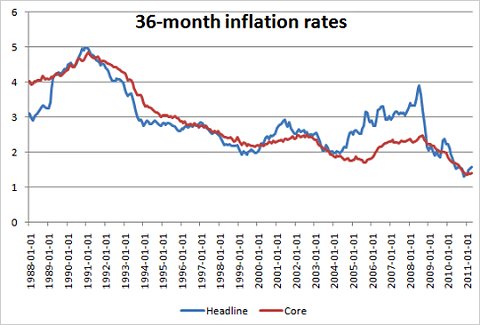

A credit rating is not determined by the size of an economy, but upon default risk and inflationary risk. At 100% debt to GDP, deficits of 37.5% of the annual budget, more monetization scheduled, an aging population, engaged in multiple wars, the United States certainly represents an inflationary risk. You must be getting your opinion spoon fed directly from the Treasury Dept. AA+ was grossly generous. I see what you're saying in theory, but practice appears to disagree, with the inflation rate down since 2000, when the US had 60% debt to GDP ratio, a $236 billion surplus, and zero wars:  It seems clear to me that there's more to exchange rates than your theory. My thought is that exchange rates reflect who's the least fucked-up of countries, not who's the best. And while the US is undoubtedly dysfunctional, the EU is even more fucked with a lack of meaningful regional monetary policy, and a commitment to austerity that's strangling their economy. And for whatever it's worth, I'm a Krugman and Roosevelt Institute fan. |

|

|

|

|

|