STT

Legendary

Offline Offline

Activity: 3906

Merit: 1414

Leading Crypto Sports Betting & Casino Platform

|

|

November 27, 2021, 11:48:07 AM

Last edit: November 27, 2021, 11:59:39 AM by STT |

|

Simplicity says inflation is the increase in the monetary base. We then try to map out how that money filters and recirculates with additional Fractional-reserve banking leverage in the economy, this is all fuzzy data open to interpretation and opinion hence why politics has eclipsed economics. Stick to basics and we're into double digits of inflation in some years, far from impossible its just a repeat of history.

Humans are predictable in mistakes we just want to believe modern advancements nullified that but human nature hasn't changed massively over hundreds of years from my view even while civilizations develop, the base ideas to economics arent altered. Inflation is the monetary base expansion and the rest of various theories is an attempt to justify this debasement by the growth occurring, some link inflation as growth almost the opposite of the truth imo. Find a constant and questions are more easily answered, the economy is the people and growth is the work of those people not money expansion/inflation.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

|

|

|

|

|

|

Remember that Bitcoin is still beta software. Don't put all of your money into BTC!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

Leviathan.007

|

|

November 27, 2021, 03:34:32 PM |

|

The trend of the inflation rate is already clear even without the chart, that's clear to see the fiat currency and the money we get after doing hard work is becoming worthless and it doesn't matter where you leave, even of countries, you will see the inflation rate buy recently in America everything is becoming worst than ever and the inflation rate is rising more comparing to the last years however the covid and economic crisis can be a reason for this situation.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

sana54210

Legendary

Offline Offline

Activity: 3192

Merit: 1128

|

|

November 27, 2021, 07:24:24 PM |

|

Simplicity says inflation is the increase in the monetary base. We then try to map out how that money filters and recirculates with additional Fractional-reserve banking leverage in the economy, this is all fuzzy data open to interpretation and opinion hence why politics has eclipsed economics. Stick to basics and we're into double digits of inflation in some years, far from impossible its just a repeat of history.

Humans are predictable in mistakes we just want to believe modern advancements nullified that but human nature hasn't changed massively over hundreds of years from my view even while civilizations develop, the base ideas to economics arent altered. Inflation is the monetary base expansion and the rest of various theories is an attempt to justify this debasement by the growth occurring, some link inflation as growth almost the opposite of the truth imo. Find a constant and questions are more easily answered, the economy is the people and growth is the work of those people not money expansion/inflation.

That leverage is the main problem if you ask me. Even if there is a finite amount of money in the market right now, they could use it for something, do it a thousand times and repackage that thousand times into another time, then do it a thousand repackaging and call it another one and just keep doing that forever until there is no more repackage going around. So, there is a finite amount of money but somehow infinite amount of money spent, how? Simply because hedge funds and banks did it that way. Technically speaking there are more debts to be paid then the cash available. Sure there are "networths" which are higher than the debt totals in the world, but the cash in banks, the liquidity basically is a lot less than the debt we have globally. Which means even if everyone got their money together and wanted to pay off all the debt, we couldn't. How? If we can fix that, we can fix inflaiton problem. |

|

|

|

|

|

ven7net

|

|

November 27, 2021, 08:17:03 PM |

|

Yes, this is a sign of high inflation and perhaps this is just the beginning. The stock market, like the crypto market, has been filled with money printed in the United States for the past two years, which has already broken all records. All of this is implicitly leading not just to big inflation, but to hyper inflation, and now we are all witnessing this. Of course, at some point, this will increase the price of both company shares and cryptocurrencies, but in the end, all this will collapse, as has happened more than once. So a lot of interesting things await us in front of us, the main thing is to have time to fix the profit in time and probably to buy this profit.

|

|

|

|

|

|

TheGreatPython

|

|

November 27, 2021, 09:14:56 PM |

|

When we think of inflation we usually think of how much food, electricity or gasoline costs.

But there is another aspect as well: how much it costs us to buy financial assets.

Inflation is a pretty bad thing, you’re holding huge amount of money, but that money is totally useless, because things are costly in the market and before you know what’s happening you’re already done spending all the money on just a few things. The covid-19 situation has really turned a lot of economies around the world upside down and causing them all to struggle. It has been the same way in most countries, and it’s worst in a case whereby the government is filled with leaders that doesn’t care to carry out their responsibilities to the citizens. Inflation keeps going up and the cost of things are high, and people are now looking for ways to save their value. |

|

|

|

|

ninis45

|

|

November 27, 2021, 09:38:17 PM |

|

When we think of inflation we usually think of how much food, electricity or gasoline costs.

But there is another aspect as well: how much it costs us to buy financial assets.

Inflation is a pretty bad thing, you’re holding huge amount of money, but that money is totally useless, because things are costly in the market and before you know what’s happening you’re already done spending all the money on just a few things. The covid-19 situation has really turned a lot of economies around the world upside down and causing them all to struggle. It has been the same way in most countries, and it’s worst in a case whereby the government is filled with leaders that doesn’t care to carry out their responsibilities to the citizens. Inflation keeps going up and the cost of things are high, and people are now looking for ways to save their value. Inflation seems to be felt by many countries, especially during the pandemic which is getting worse and this is felt by the lower middle class whose impact is very significant because they are no longer maintaining values but looking for values to survive while the government does not seem to want to be burdened by them and hands off |

|

|

|

aysg76

Legendary

Offline Offline

Activity: 1960

Merit: 2124

|

|

November 29, 2021, 12:48:57 PM |

|

Actually there are different metrics to measure inflation and it is surrounding us in every aspect of our life and sometimes we are just ignorant enough not to notice it.What you said is right that most of the time we are measuring inflation with rise in food items,gas prices and all that basic stuff but are not worrying about the big problems or that doesn't comes under our perspective easily.

The root cause of this inflation is dollar and fiat devaluing over time as most or say the trade is carried out in it and suppose you even earn $100 as profits from the stock and you keep that in your pocket will it still be worth $100 a year later also even though it is very near? The simple answer is NO because government has found a new game that is who will print more notes and sink their economic boats first.

Have you noticed about something called shrink inflation ever? It is paying same price for a product over some years but the company plays smart by reducing the quantity and packaging techniques we didn't notice them most of time.There are lot of things which we can take as inflation example like you have taken of stocks and S&P 500 but majority is busy at this time watching government decide their fate which is not gonna end up smoothly.

This is where btc enter the market and those who invest are the wise one's.The inflation chain is going to be more strong and you need something more strong to cut it and that's deflationary BTC

|

|

|

|

Silberman

Legendary

Offline Offline

Activity: 2506

Merit: 1334

|

|

November 30, 2021, 08:53:28 PM |

|

When we think of inflation we usually think of how much food, electricity or gasoline costs.

But there is another aspect as well: how much it costs us to buy financial assets.

Inflation is a pretty bad thing, you’re holding huge amount of money, but that money is totally useless, because things are costly in the market and before you know what’s happening you’re already done spending all the money on just a few things. The covid-19 situation has really turned a lot of economies around the world upside down and causing them all to struggle. It has been the same way in most countries, and it’s worst in a case whereby the government is filled with leaders that doesn’t care to carry out their responsibilities to the citizens. Inflation keeps going up and the cost of things are high, and people are now looking for ways to save their value. This is why the rich have so little cash around, they understand the system is rigged so it would be silly for them to keep a huge amount of cash around when inflation is going to destroy the purchasing power of that money, so they use all the money they have available to invest in whatever they want while just maintaining the minimum amount of cash necessary to keep their lives going, so in the end instead of being negatively affected by inflation they end up benefiting from it. |

|

|

|

|

|

Zilon

|

|

November 30, 2021, 09:13:12 PM |

|

The stock markets in each country are often effected by both domestic markets and international ones. There's lots of international interest in growth stocks in places like the US, and interest in dividend stocks internationally in places like the UK and Germany.

However, things like REITs will obviously have an impact on inflation as they can send up the cost of living.

Also currency strength also determines how much inflation this stocks incures. International interest doesn't have much effect when compared to currency printing and currency value. The strength of a currency matters in relation to the price of financial assets and with the recent economic crises in many nations most financial assets will see another ATH making the inflation more intense |

|

|

|

|

LUCKMCFLY

Legendary

Offline Offline

Activity: 2408

Merit: 1849

Leading Crypto Sports Betting & Casino Platform

|

|

December 02, 2021, 01:27:28 PM |

|

When we think of inflation we usually think of how much food, electricity or gasoline costs.

But there is another aspect as well: how much it costs us to buy financial assets.

Inflation is a pretty bad thing, you’re holding huge amount of money, but that money is totally useless, because things are costly in the market and before you know what’s happening you’re already done spending all the money on just a few things. The covid-19 situation has really turned a lot of economies around the world upside down and causing them all to struggle. It has been the same way in most countries, and it’s worst in a case whereby the government is filled with leaders that doesn’t care to carry out their responsibilities to the citizens. Inflation keeps going up and the cost of things are high, and people are now looking for ways to save their value. Inflation seems to be felt by many countries, especially during the pandemic which is getting worse and this is felt by the lower middle class whose impact is very significant because they are no longer maintaining values but looking for values to survive while the government does not seem to want to be burdened by them and hands off The best weapon against inflation is buying solid fiat, or gold, or the best BTC, if it is BTC better because in a fully inflationary economy, it does not matter that the BTC falls in price, in the same way it will continue to be worth a lot with respect to the internal economy that the country owns. Another way to protect against inflation is by buying material things that are later sought by people and at that time it is possible to sell more expensively, and resort to looking for extra income at all costs, starting a simple business that can give money is another way to attack the problem. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

shogun47

|

|

December 02, 2021, 02:32:20 PM |

|

When we think of inflation we usually think of how much food, electricity or gasoline costs.

But there is another aspect as well: how much it costs us to buy financial assets.

Inflation is a pretty bad thing, you’re holding huge amount of money, but that money is totally useless, because things are costly in the market and before you know what’s happening you’re already done spending all the money on just a few things. The covid-19 situation has really turned a lot of economies around the world upside down and causing them all to struggle. It has been the same way in most countries, and it’s worst in a case whereby the government is filled with leaders that doesn’t care to carry out their responsibilities to the citizens. Inflation keeps going up and the cost of things are high, and people are now looking for ways to save their value. Inflation seems to be felt by many countries, especially during the pandemic which is getting worse and this is felt by the lower middle class whose impact is very significant because they are no longer maintaining values but looking for values to survive while the government does not seem to want to be burdened by them and hands off The best weapon against inflation is buying solid fiat, or gold, or the best BTC, if it is BTC better because in a fully inflationary economy, it does not matter that the BTC falls in price, in the same way it will continue to be worth a lot with respect to the internal economy that the country owns. Another way to protect against inflation is by buying material things that are later sought by people and at that time it is possible to sell more expensively, and resort to looking for extra income at all costs, starting a simple business that can give money is another way to attack the problem. I think that running your business with products that are not prone to financial crises is most likely the best way to protect your wealth from inflation. When we come up with material things right now I guess one problem could be that markets are overheated already., wouldn't you agree? I am not necessarily talking about the housing market, but also about watches and other assets. Right now things are expensive. |

| | Peach

BTC bitcoin | │ | Buy and Sell

Bitcoin P2P | │ | .

.

▄▄███████▄▄

▄██████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀███████▀▀

▀▀▀▀███████▀▀▀▀ | | EUROPE | AFRICA

LATIN AMERICA | | | ▄▀▀▀

█

█

█

█

█

█

█

█

█

█

█

▀▄▄▄ |

███████▄█

███████▀

██▄▄▄▄▄░▄▄▄▄▄

█████████████▀

▐███████████▌

▐███████████▌

█████████████▄

██████████████

███▀███▀▀███▀ | .

Download on the

App Store | ▀▀▀▄

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▀ | ▄▀▀▀

█

█

█

█

█

█

█

█

█

█

█

▀▄▄▄ |

▄██▄

██████▄

█████████▄

████████████▄

███████████████

████████████▀

█████████▀

██████▀

▀██▀ | .

GET IT ON

Google Play | ▀▀▀▄

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▀ |

|

|

|

paxmao

Legendary

Offline Offline

Activity: 2198

Merit: 1587

Do not die for Putin

|

|

December 02, 2021, 09:11:47 PM |

|

You can choose any index, even the price of property and possibly the best would be a commodities index. They all tell the same story: while growth is stagnant and there has been a massive real economic impact from COVID, the cannons wielded by the central banks are sprouting all the printed money and that goes to either paying debts, buying goods, saving or - most commonly - into stocks investments 401k's and the like. With the massive amount of index investing, this graph is only natural.

|

|

|

|

2double0

Legendary

Offline Offline

Activity: 2618

Merit: 1105

|

|

December 02, 2021, 09:28:25 PM |

|

I think that running your business with products that are not prone to financial crises is most likely the best way to protect your wealth from inflation. When we come up with material things right now I guess one problem could be that markets are overheated already., wouldn't you agree? I am not necessarily talking about the housing market, but also about watches and other assets. Right now things are expensive.

I never thought of a way which can help me create products which can never be wasted and are not prone to financial crisis because if such products would have come in the market, every businessmen would be successful. No business comes without risks and businesses also run on commitments. If S&P 500 is rising only, I duly believe that inflation is not too far from hitting the markets when we will be paying very high against the earnings we get from our work. |

|

|

|

|

Fortify

Legendary

Offline Offline

Activity: 2660

Merit: 1176

|

|

December 02, 2021, 09:31:24 PM |

|

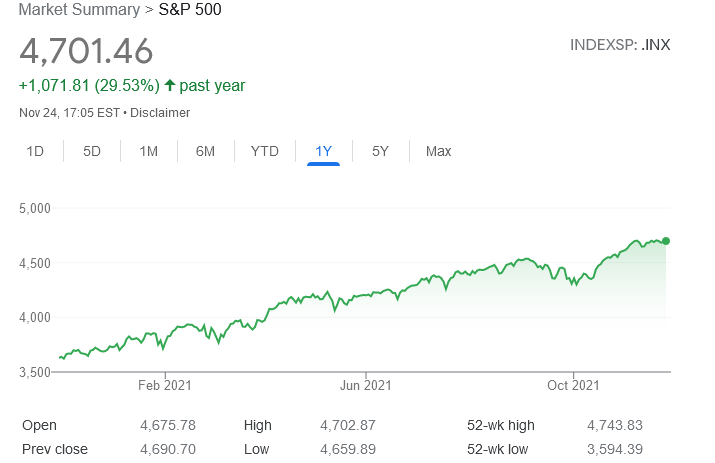

When we think of inflation we usually think of how much food, electricity or gasoline costs.

But there is another aspect as well: how much it costs us to buy financial assets.

The above chart at first glance may appear to be due to the strong performance of the 500 largest U.S. companies. But this is misleading: I believe it reflects more the effects of massive printing and inflation than how companies are doing.

The charts for the stock markets of countries with high inflation are similar: the more currency printing and inflation, the more the stock market rises.

That the S&P, which has an average return of about 10% on average has risen 30% in the last year is sobering. Let's think that in November 2020 we were already out of the stock market slump that was the COVID.

At the end of the day, anyone like me who has money invested in the S&P 500 can't be too happy about the 30% return because if we discount inflation it comes to almost nothing.

I'd say it's a clear sign that governments all around the world have been buying assets and printing money like crazy. It has been going on for far too long now, pretty much since the 2008 recession and it kicked back into overdrive mode at the start of Covid. Sure, they might have averted an immediate recession but it just tends to push the problem down the road and now we're starting to see runaway inflation. It's going to hurt a lot of people when interest rate rises kick in - credit has been so cheap for so long that people won't be able to cope when their mortgages start to double or triple in cost in a few years time. It was reckless behavior by central banks and rather lazy, they tend to change their minds and adapt too slowly while claiming to be super experts. |

|

|

|

|

|

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | | | 4,000+ GAMES███████████████████

██████████▀▄▀▀▀████

████████▀▄▀██░░░███

██████▀▄███▄▀█▄▄▄██

███▀▀▀▀▀▀█▀▀▀▀▀▀███

██░░░░░░░░█░░░░░░██

██▄░░░░░░░█░░░░░▄██

███▄░░░░▄█▄▄▄▄▄████

▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀ | █████████

▀████████

░░▀██████

░░░░▀████

░░░░░░███

▄░░░░░███

▀█▄▄▄████

░░▀▀█████

▀▀▀▀▀▀▀▀▀ | █████████

░░░▀▀████

██▄▄▀░███

█░░█▄░░██

░████▀▀██

█░░█▀░░██

██▀▀▄░███

░░░▄▄████

▀▀▀▀▀▀▀▀▀ |

| | | ██░░░░░░░░░░░░░░░░░░░░░░██

▀█▄░▄▄░░░░░░░░░░░░▄▄░▄█▀

▄▄███░░░░░░░░░░░░░░███▄▄

▀░▀▄▀▄░░░░░▄▄░░░░░▄▀▄▀░▀

▄▄▄▄▄▀▀▄▄▀▀▄▄▄▄▄

█░▄▄▄██████▄▄▄░█

█░▀▀████████▀▀░█

█░█▀▄▄▄▄▄▄▄▄██░█

█░█▀████████░█

█░█░██████░█

▀▄▀▄███▀▄▀

▄▀▄▀▄▄▄▄▀▄▀▄

██▀░░░░░░░░▀██ | | | | | | | .

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄

░▀▄░▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄░▄▀

███▀▄▀█████████████████▀▄▀

█████▀▄░▄▄▄▄▄███░▄▄▄▄▄▄▀

███████▀▄▀██████░█▄▄▄▄▄▄▄▄

█████████▀▄▄░███▄▄▄▄▄▄░▄▀

████████████░███████▀▄▀

████████████░██▀▄▄▄▄▀

████████████░▀▄▀

████████████▄▀

███████████▀ | ▄▄███████▄▄

▄████▀▀▀▀▀▀▀████▄

▄███▀▄▄███████▄▄▀███▄

▄██▀▄█▀▀▀█████▀▀▀█▄▀██▄

▄██▀▄██████▀████░███▄▀██▄

███░█████████▀██░████░███

███░████░█▄████▀░████░███

███░████░███▄████████░███

▀██▄▀███░█████▄█████▀▄██▀

▀██▄▀█▄▄▄██████▄██▀▄██▀

▀███▄▀▀███████▀▀▄███▀

▀████▄▄▄▄▄▄▄████▀

▀▀███████▀▀ | | OFFICIAL PARTNERSHIP

FAZE CLAN

SSC NAPOLI | | |

|

|

|

jaberwock

Legendary

Offline Offline

Activity: 2548

Merit: 1073

|

|

December 03, 2021, 12:22:35 PM |

|

I'd say it's a clear sign that governments all around the world have been buying assets and printing money like crazy. It has been going on for far too long now, pretty much since the 2008 recession and it kicked back into overdrive mode at the start of Covid. Sure, they might have averted an immediate recession but it just tends to push the problem down the road and now we're starting to see runaway inflation. It's going to hurt a lot of people when interest rate rises kick in - credit has been so cheap for so long that people won't be able to cope when their mortgages start to double or triple in cost in a few years time. It was reckless behavior by central banks and rather lazy, they tend to change their minds and adapt too slowly while claiming to be super experts.

Sometimes I do ask myself, is it that the government doesn’t know the consequences of the actions that they are taking? How can a government that is filled with lots of people who can sit down and discuss any issue, not know that there are going to be consequences to the actions that they are going to be taking? Seriously, I do think about this a lot, because I’m sure that before the government takes any action there are lots of people there who would have to sit down and discuss about the action that the governments are going to take and whether it is a good one or not, and how it is going to affect the economy of the country. |

|

|

|

|

savetheFORUM

|

|

December 03, 2021, 08:43:59 PM |

|

I’m sure that before the government takes any action there are lots of people there who would have to sit down and discuss about the action that the governments are going to take and whether it is a good one or not, and how it is going to affect the economy of the country.

Yeah, this is what my assumption as well. Still, if governments really know the conditions and what it is going to lead to, but they still go ahead and take that same action that they know is going to be very bad for the country? Despite that there will be a lot of citizens who will complain and point out to them what are likely to be the consequences of those actions that they are about to take, but they still go ahead and do it. I really hope that they find a way to fix all these problems that they’re creating now that inflation is about to blow up because of it. |

|

|

|

|

Silberman

Legendary

Offline Offline

Activity: 2506

Merit: 1334

|

|

December 03, 2021, 09:41:23 PM |

|

I'd say it's a clear sign that governments all around the world have been buying assets and printing money like crazy. It has been going on for far too long now, pretty much since the 2008 recession and it kicked back into overdrive mode at the start of Covid. Sure, they might have averted an immediate recession but it just tends to push the problem down the road and now we're starting to see runaway inflation. It's going to hurt a lot of people when interest rate rises kick in - credit has been so cheap for so long that people won't be able to cope when their mortgages start to double or triple in cost in a few years time. It was reckless behavior by central banks and rather lazy, they tend to change their minds and adapt too slowly while claiming to be super experts.

Sometimes I do ask myself, is it that the government doesn’t know the consequences of the actions that they are taking? How can a government that is filled with lots of people who can sit down and discuss any issue, not know that there are going to be consequences to the actions that they are going to be taking? Seriously, I do think about this a lot, because I’m sure that before the government takes any action there are lots of people there who would have to sit down and discuss about the action that the governments are going to take and whether it is a good one or not, and how it is going to affect the economy of the country. There are two things that happen which causes politicians to act the way they do, to begin with they believe they are above the rest of the population, so even if what they do ends up affecting people they do not believe they will be part of the ones that are affected, the other reason is they believe this time will be different and they will be able to control the inflation they are generating, but we know that every single government before has thought the same and they have failed, and many times they will not realize their mistake until heads are rolling on the street, sometimes literally, but by that time it is too late to do anything about it. |

|

|

|

|

jrrsparkles

Sr. Member

Offline Offline

Activity: 2394

Merit: 257

Eloncoin.org - Mars, here we come!

|

|

December 04, 2021, 10:58:59 AM |

|

I can understand what you are trying to say its just the value of the stocks aren't really growing its in the green simply because of the value of our currency is dropping and especially after 2020 but 30% growth is really a good figure if we just look at it from the returns perspective but do we really make any profits? And don't forget the tax factor we also have to deduct the tax rates from the growth so companies are in more beneficial and making money not the actual investors.

|

▄▄████████▄▄

▄▄████████████████▄▄

▄██████████████████████▄

▄█████████████████████████▄

▄███████████████████████████▄

| ███████████████████▄████▄

█████████████████▄███████

████████████████▄███████▀

██████████▄▄███▄██████▀

████████▄████▄█████▀▀

██████▄██████████▀

███▄▄████████████▄

██▄███████████████

░▄██████████████▀

▄█████████████▀

█████████████

███████████▀

███████▀▀ | | | Mars,

here we come! | ▄▄███████▄▄

▄███████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀███████▀▀ | ElonCoin.org | │ | | .

| │ | ████████▄▄███████▄▄

███████▄████████████▌

██████▐██▀███████▀▀██

███████████████████▐█▌

████▄▄▄▄▄▄▄▄▄▄██▄▄▄▄▄

███▀░▐███▀▄█▄█▀▀█▄█▄▀

██████████████▄██████▌

█████▐██▄██████▄████▐

█████████▀░▄▄▄▄▄

███████▄█▄░▀█▄▄░▀

███▄██▄▀███▄█████▄▀

▄██████▄▀███████▀

████████▄▀████▀█████▄▄ | .

"I could either watch it

happen or be a part of it"

▬▬▬▬▬ |

|

|

|

RealMalatesta

Legendary

Offline Offline

Activity: 2338

Merit: 1124

|

|

December 05, 2021, 05:14:34 PM |

|

When we think of inflation we usually think of how much food, electricity or gasoline costs.

But there is another aspect as well: how much it costs us to buy financial assets.

As someone who lives in a nation with clear high inflation and not even debatable, I can tell you that even stocks do not go up when things goes to shit. Why? Because the value of money becomes so worthless and people become so poor that people can't even buy stuff from those companies who are in the stock market, which results with those companies losing customers and losing profits and that ends up with losing value in stock market. So, imagine an inflation so high that, even stock market doesn't go up when money becomes worthless. That is the true inflation, and god forbids any other nation to have something like that and I hope we will never have it again. |

|

|

|

|

|

teosanru

|

|

December 05, 2021, 07:33:50 PM |

|

When we think of inflation we usually think of how much food, electricity or gasoline costs. But there is another aspect as well: how much it costs us to buy financial assets. The above chart at first glance may appear to be due to the strong performance of the 500 largest U.S. companies. But this is misleading: I believe it reflects more the effects of massive printing and inflation than how companies are doing. The charts for the stock markets of countries with high inflation are similar: the more currency printing and inflation, the more the stock market rises. That the S&P, which has an average return of about 10% on average has risen 30% in the last year is sobering. Let's think that in November 2020 we were already out of the stock market slump that was the COVID. At the end of the day, anyone like me who has money invested in the S&P 500 can't be too happy about the 30% return because if we discount inflation it comes to almost nothing. No this can't act as a barometer for Inflation, If we are going to value everything that rises in price as Inflation then even Bitcoin will expand due to Inflation one day. It's true that the more the money is printed more the money reaches into the market and higher the stock prices rally, but this thing is generally temporary in nature because if the money printing isn't backed by enough economic development eventually it will fall one day because companies that would have promised these valuations won't be able to justify their valuation using their profits/ Revenues and eventually the market would fall like a house of cards when people would ultimately take their money out of overvalued stocks. |

|

|

|

|

|