paxmao (OP)

Legendary

Offline Offline

Activity: 2184

Merit: 1579

Do not die for Putin

|

|

February 24, 2022, 12:06:32 PM |

|

It is with sadness that I see how bitcoin has dropped (nothing new really) in sync with the global markets around 11% last week while the old gold, AKA simply "gold" has made a rush to 6.5% in the last month. Needless to say that this is related to the war in Ukraine and the prospects of instability, not that it was unexpected, tend to draw people towards gold.

I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

|

|

|

|

|

|

|

|

|

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

|

|

|

|

Similificator

|

|

February 24, 2022, 12:47:00 PM |

|

Well at least this serves as a good experience not just for the new ones but also for the oldies; that diversification is really the key to having good financial standing. The overused "never put all eggs in one basket" phrase has again been proven to be a valuable thing to absorb.

Not losing interest in crypto though. Bitcoin has been through a lot all throughout the years and has proven its resilience. The crypto industry is young which is why it still cannot avoid the ripples caused by the world affairs good or bad, and these ripples even turn into massive waves depending on how the majority of the people in this industry perceives information.

- I don't know if it's just me but, instead of panicking, I am getting excited to DCA the coins/tokens I already have along wih buying the ones that I couldn't due to expensive prices and lack of funds.

|

|

|

|

|

Jawhead999

Legendary

Offline Offline

Activity: 1638

Merit: 1156

|

|

February 24, 2022, 01:26:37 PM |

|

I think it's somewhat interesting to compare those assets performance on this conditions, they may thought Bitcoin isn't really safe compared to gold... so they convert their assets to gold. We can't deny how long gold existed and proven had a value until now, while Bitcoin still in process of mass adoption and the price is really affected by sentiment or bad news. Gold is still gold, nothing changes... it's an old investments.

Bitcoin could be considered as reserve of value, but not now. Maybe another reason of this decline is people believe this year Bitcoin will crash just like the 2017-2018 history.

|

|

|

|

The Sceptical Chymist

Legendary

Online Online

Activity: 3318

Merit: 6808

Cashback 15%

|

I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

Well stocks are a store of value, too. There's no rule that a store of value has to be perfectly stable--and not even gold is. Speaking of gold, I did indeed notice that it and silver had shot up overnight (or at least in the last 36 hours), and it was before I knew what was going on over there in Ukraine. When I saw that silver had surpassed $25/Oz. whilst bitcoin and nearly every single altcoin were sinking, I kind of suspected something was up. It is with sadness that I see how bitcoin has dropped (nothing new really) in sync with the global markets around 11% last week while the old gold, AKA simply "gold" has made a rush to 6.5% in the last month.

Paxmao, you've been around long enough to know swings like this are going to happen, and don't get too sad. Depending on the progression of the Russia/Ukraine conflict or its resolution, we might be seeing gold drop back to $1800/Oz. and bitcoin heading to the moon. In other words, this too shall pass. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

|

Zilon

|

|

February 24, 2022, 04:50:11 PM |

|

It is with sadness that I see how bitcoin has dropped (nothing new really) in sync with the global markets around 11% last week while the old gold, AKA simply "gold" has made a rush to 6.5% in the last month. Needless to say that this is related to the war in Ukraine and the prospects of instability, not that it was unexpected, tend to draw people towards gold.

Gold had to make such a bullish push because it's main reserve is in the us. Just the same way Russian Ruble weakens against USD so same also gave gold the major push. Us got the positive returns on the war effect. But Putin should try end this I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

Bitcoin is a decentralized gold so we don't expect everything around us affect its value. This asset belongs to us. I will say Bitcoin moved too fast in a short space of time all the way to an ATH of over $63k+ so it might take longer to see a new move up. But the fun fact is stocks get easily manipulated but Bitcoin is controlled by everyone in the network. |

|

|

|

|

stompix

Legendary

Offline Offline

Activity: 2870

Merit: 6282

Blackjack.fun

|

|

February 24, 2022, 09:06:20 PM

Last edit: June 12, 2023, 08:30:42 PM by stompix |

|

I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

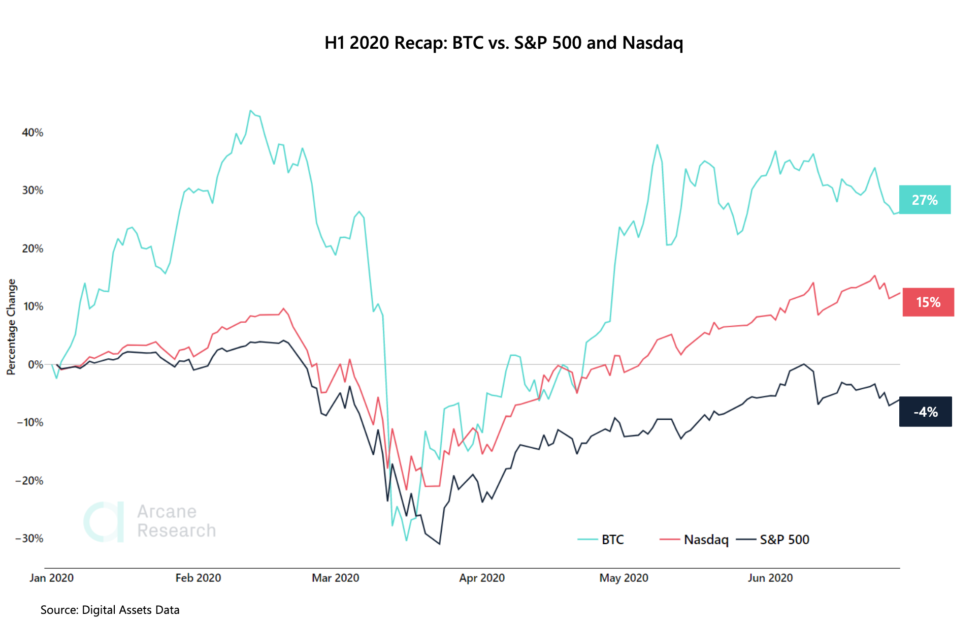

If still somebody says that BTC price is not correlated with stocks even after the April episode, I'm really going to virtually slap that guy... This is a graph from a previous discussion  SP, NASDAQ and Bitcoin today:  The same bouncing, from the start of the day bitcoin is up 2.4 %, S&P 500 1.5%, NASDAQ 3.4% and Dow 0.3%. I don't know where it got this tight up to the stocks but right now is swinging the same way around, of course, it has better gains than it and it's pretty normal for it but it will take the same hits. On the bright side, that means being a global currency or asset, it comes with pros and cons. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

|

Gozie51

|

|

February 24, 2022, 10:34:48 PM |

|

I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

Bitcoin will take back its place with time. I think if anything is happening in the region of Russia and Ukraine is not to be what is happening to bitcoin. Bitcoin is not fiat and not regulated so selling of your hodling only requires your decision and setting your order. So the bear is not because of the war but a drop correcting from December sales. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

Hydrogen

Legendary

Offline Offline

Activity: 2562

Merit: 1441

|

|

February 24, 2022, 11:24:53 PM |

|

I still think the overwhelming majority of gold supply is hoarded by central banks. They control a massive proportion of gold supply, which gives them all of the influence on price valuation.

Many have speculated the value of gold and silver should be trading higher than current market values. I think it would if independent precious metals traders represented a significant portion of precious metals ownership. But considering the massive multiple tons of gold held by central banks and the small shares of gold held by small traders who cannot afford to secure precious metals holdings. I think the natural reaction is to conclude that central banks hold all of the trading and valuation power as far as gold, silver and precious metals go. Which is why the price of gold isn't the result one would expect from typical market mechanics alone.

|

|

|

|

|

|

ajochems

|

|

February 25, 2022, 01:06:25 AM

Last edit: February 26, 2022, 12:01:11 AM by ajochems |

|

It is with sadness that I see how bitcoin has dropped (nothing new really) in sync with the global markets around 11% last week while the old gold, AKA simply "gold" has made a rush to 6.5% in the last month. Needless to say that this is related to the war in Ukraine and the prospects of instability, not that it was unexpected, tend to draw people towards gold.

I wonder if bitcoin can still be considered a reserve of vd alue when is following and correlating this much with stocks markets.

New gold or old gold doesn't matter.Gold is a gold. When such situation came like war. Most of money in the war county will be saved with the an crypto assets or in the manual asstes like money. Investment of physical and touchable one was a good one.It can be sold for the immediate need with some good value.It doesn't mean of physical assets are not worth enough. |

|

████▄██████████▄

███▄████████████

▄███▀

████

████

████

▀███▄

███▀████████████

████▀██████████▀ |

▄██████████▄

████████████

███████████▀███▄

████████████████

████████████████

████████████████

▀███▄███████████

████████████████

████▀██████████▀ |

▄██▄█████████▄██▄

▀████▄█████▄████▀

▀████▄█▄████▀

███████████

▄████▀█████▀████▄

█████████████████

█████████████████

█████████████████

▀███████████████▀

|

▄███████████████▄

█████████████████

████▀███▀██████▀

███████▄█████▀

████▄▄██████████▄

█▀▀██████▀███████

█▄██████▄███▄████

█████▀███████████

▀██▀███▀████████▀ |

████▄███████████

████████████████

▄███▀███████████

████████████████

████████████████

████████████████

███████████▄███▀

████████████

▀██████████▀ | | | | ████████

██

██

██

██

██

██

██

██ | |

██

██

██

██

██

██

██

██

████████

| | | | | | .

Listed

on

| | BINANCE

KUCOIN

Gate.io | | |

|

|

|

Strongkored

Legendary

Offline Offline

Activity: 2758

Merit: 1112

Leading Crypto Sports Betting & Casino Platform

|

|

February 25, 2022, 04:29:04 AM |

|

I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

Bitcoin will still be considered a reserve of value and the decline in its price will not change about it especially for young investors who are tech savvy will very likely move from stock to bitcoin because the stock is quite shocked during a situation like this. While gold is still gold there is nothing old or new and will still be an option for traditional investors who prefer something calm. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

avikz

Legendary

Offline Offline

Activity: 3066

Merit: 1499

|

|

February 25, 2022, 05:26:12 AM |

|

It is with sadness that I see how bitcoin has dropped (nothing new really) in sync with the global markets around 11% last week while the old gold, AKA simply "gold" has made a rush to 6.5% in the last month. Needless to say that this is related to the war in Ukraine and the prospects of instability, not that it was unexpected, tend to draw people towards gold.

I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

Gold is just gold! Unless suddenly someone finds few thousand tons of new gold reserve, it will continue to dominate the market as a capital reserve asset. There's no competition really! Gold is the oldest and time tested investment since ita inception. People who think bitcoin will replace gold, are living in fool's paradise. That's why it is always better to have a diversified portfolio that includes all types of assets including cryptos. Bitcoin alone can't make your finance secure. |

|

|

|

zaim7413

Sr. Member

Offline Offline

Activity: 1232

Merit: 332

Vave.com - Crypto Casino

|

|

February 25, 2022, 07:53:00 AM |

|

..Snip..

I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

Still crossed my mind what happened to bitcoin (9 November 2021), Bitcoin high spike was able to beat the fame of gold as an investment instrument. With the strengthening of gold prices, many parties assess the supply of gold is hoarded by the central bank. But investor should still pay attention to Bitcoin price movements, it is quite interesting to see that gold and bitcoin are related. Gold can be an option to invest in the midst of economic uncertainty, because gold is a hedging investment. But Bitcoin investment will continue to be in demand because it is considered quite attractive and already very familiar so that it encourages great interest in trying out the crypto world. |

|

|

|

|

iamsheikhadil

|

|

February 25, 2022, 08:28:25 AM |

|

I think bitcoin might be looked at more negatively than in a positive manner in this tensed situations, because a major portion of the countries are actually not very friendly to crypto, and crypto doesn't have the long history of proven value as gold has, like, gold is considered as valued by probably 100% of the countries that exist, so, in these situations, fiat might be scrutinized, gold will be seen as positive while crypto negatively.

|

|

|

|

|

|

Ararbermas

|

|

February 25, 2022, 08:29:33 AM |

|

Bitcoin will take back its place with time. I think if anything is happening in the region of Russia and Ukraine is not to be what is happening to bitcoin. Bitcoin is not fiat and not regulated so selling of your hodling only requires your decision and setting your order. So the bear is not because of the war but a drop correcting from December sales.

very true! And definitely it's up to us what will be our decision on this situation. Because to be honest i don't agree as well that this happening is all about the tension of both country (Russia VS Ukraine) reason market is still on bear market because it looks like a coincidence of the bearish season. And lastly they didn't mentioned bitcoin on their news about the situation. So i have doubts that this is happing only on bitcoin because of some Fuds in the internet that spreading negative news and keeps mentioning bitcoin on that war. |

|

|

|

|

NeuroticFish

Legendary

Offline Offline

Activity: 3654

Merit: 6371

Looking for campaign manager? Contact icopress!

|

|

February 25, 2022, 08:40:17 AM |

|

It is with sadness that I see how bitcoin has dropped (nothing new really) in sync with the global markets around 11% last week while the old gold, AKA simply "gold" has made a rush to 6.5% in the last month. Needless to say that this is related to the war in Ukraine and the prospects of instability, not that it was unexpected, tend to draw people towards gold.

My take is that both markets have their whales and manipulators. When the war has started gold was rising like crazy because old big wealthy entities tend to still use gold as reserve asset. On the same time Bitcoin and stocks were plunging. After Biden's announcement, suddenly, both have reversed. Bitcoin is like the war didn't start, gold is even lower, hence those believing in gold did a bad business by buying/FOMO-ing when the war started. As usual, there's no really good and bad, there's diversification and calm decisions vs FOMO/rushing everything. I hope that OP didn't buy gold  I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

Bitcoin was never a good reserve of value for short term. Even Saylor wrote it: investing into Bitcoin is for at least 4 years. Then you can take a look whether it's a store of value or good investment. For now it is. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

Wind_FURY

Legendary

Offline Offline

Activity: 2898

Merit: 1823

|

|

February 25, 2022, 09:27:18 AM |

|

It is with sadness that I see how bitcoin has dropped (nothing new really) in sync with the global markets around 11% last week while the old gold, AKA simply "gold" has made a rush to 6.5% in the last month. Needless to say that this is related to the war in Ukraine and the prospects of instability, not that it was unexpected, tend to draw people towards gold.

I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets.

It’s understandable that HODLers have their moments of frustration. But the market doesn’t “define” Bitcoin. It’s merely one of the ways the coins are distributed. It’s not always efficient, with the inefficiency especially displayed during a surge, and a crash that follows, but it always finds the mean. Does not hold the value? Zoom out. |

| .SHUFFLE.COM.. | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████ | .

...Next Generation Crypto Casino... |

|

|

|

|

jostorres

|

|

February 28, 2022, 01:48:29 PM |

|

Bitcoin will take back its place with time. I think if anything is happening in the region of Russia and Ukraine is not to be what is happening to bitcoin. Bitcoin is not fiat and not regulated so selling of your hodling only requires your decision and setting your order. So the bear is not because of the war but a drop correcting from December sales.

very true! And definitely it's up to us what will be our decision on this situation. Because to be honest i don't agree as well that this happening is all about the tension of both country (Russia VS Ukraine) reason market is still on bear market because it looks like a coincidence of the bearish season. And lastly they didn't mentioned bitcoin on their news about the situation. So i have doubts that this is happing only on bitcoin because of some Fuds in the internet that spreading negative news and keeps mentioning bitcoin on that war. Mentioned bitcoin in the news? but why will they do that? This breaking news is about the war and not with anything else. Bitcoin isn't tied to banks or the governments therefore the people that are affected by the wars can continue to transact, they either sell their bitcoins or use it for buying, this is why the price has dropped but it's up to you if you don't believe that. Another thing that I believed on why the price dumps is because of the fuds related to the war. whenever there's a negative event, fudsters then uses this opportunity to spread fuds because they know there are still weak handed hodlers that will panic and sell their assets. |

| | .

.Duelbits│SPORTS. | | | ▄▄▄███████▄▄▄

▄▄█████████████████▄▄

▄███████████████████████▄

███████████████████████████

█████████████████████████████

███████████████████████████████

███████████████████████████████

███████████████████████████████

█████████████████████████████

███████████████████████████

▀████████████████████████

▀▀███████████████████

██████████████████████████████ | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | ███▄██▄███▄█▄▄▄▄██▄▄▄██

███▄██▀▄█▄▀███▄██████▄█

█▀███▀██▀████▀████▀▀▀██

██▀ ▀██████████████████

███▄███████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

███████████████████████

▀█████████████████████▀

▀▀███████████████▀▀

▀▀▀▀█▀▀▀▀ | | OFFICIAL EUROPEAN

BETTING PARTNER OF

ASTON VILLA FC | | | | ██

██

██

██

██

██

██

██

██

██

██ | | | | 10% CASHBACK

100% MULTICHARGER | │ | | │ |

|

|

|

amishmanish

Legendary

Offline Offline

Activity: 1904

Merit: 1158

|

|

February 28, 2022, 04:29:19 PM |

|

Nothing to be sad about except probably accept that everything crypto, including Bitcoin, is basically a peace time solution and are not suitable for the imagined dystopias and wars. Bitcoin's network depends on an uninterrupted, peace-time supply of Electricity and great Network infrastructure. Both of these things are targeted in wars.

So while Bitcoin will still be good for safekeeping your wealth and taking it over the borders in wartime, that wealth will definitely fall down in value while uncertainties continue. Still, we cannot possibly be at war always and at war everywhere. So bitcoin is still a safe bet in the longer term. People haven't seen enough uncertainty to believe that for Bitcoin. They intuitively think of Gold as THE ASSET. So, no grudges against gold there. Bitcoin's still a baby for war times.

|

|

|

|

|

NeuroticFish

Legendary

Offline Offline

Activity: 3654

Merit: 6371

Looking for campaign manager? Contact icopress!

|

|

February 28, 2022, 05:34:34 PM |

|

Nothing to be sad about except probably accept that everything crypto, including Bitcoin, is basically a peace time solution and are not suitable for the imagined dystopias and wars. Bitcoin's network depends on an uninterrupted, peace-time supply of Electricity and great Network infrastructure. Both of these things are targeted in wars.

So while Bitcoin will still be good for safekeeping your wealth and taking it over the borders in wartime, that wealth will definitely fall down in value while uncertainties continue. Still, we cannot possibly be at war always and at war everywhere. So bitcoin is still a safe bet in the longer term. People haven't seen enough uncertainty to believe that for Bitcoin. They intuitively think of Gold as THE ASSET. So, no grudges against gold there. Bitcoin's still a baby for war times.

Gold is difficult to carry with you. Gold is heavy. Gold has to be declared at the border. One can easily hide with himself one or more copies of his wallet seed, sometimes even in the plain sight and go on. Even a hardware wallet is not a problem at the customs. Indeed bitcoin can be difficult to spend if electricity / internet is down (although smartphone + power bank can solve the problem if the electricity is not completely wrecked), but I don't know how many would accept gold either, since the risk of receiving counterfeit/something that's not gold is pretty high. I don't say gold is bad. What I say that neither of the two is perfect. |

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

TheUltraElite

Legendary

Offline Offline

Activity: 2856

Merit: 1220

Call your grandparents and tell them you love them

|

|

March 01, 2022, 02:12:33 PM |

|

It is with sadness that I see how bitcoin has dropped (nothing new really) in sync with the global markets around 11% last week while the old gold, AKA simply "gold" has made a rush to 6.5% in the last month. Needless to say that this is related to the war in Ukraine and the prospects of instability, not that it was unexpected, tend to draw people towards gold. While I never wish a war to happen, seeing one happen does make me feel bad for the people suffering there. Even then, a trader needs to know their advantages in time of an economic turmoil. Currently I see bitcoin as in a buying position with every down trend. Similar with metals like gold and stocks on the fiat market. I am getting stocks at much discounted rates and therefore I am buying them so I can sell in future. My point remains that, this is a bear market, whatever be the reason for it. Therefore we must capitalize on that and not feel sorry for not investing during such times. I wonder if bitcoin can still be considered a reserve of value when is following and correlating this much with stocks markets. Drop in price does not mean that the original pros and cons of bitcoin have changed. Those who buy bitcoin, accept the risk of the asset being volatile (though <10-15% per year). To me it is another asset worth putting money in, so I will do that. |

| R |

▀▀▀▀▀▀▀██████▄▄

████████████████

▀▀▀▀█████▀▀▀█████

████████▌███▐████

▄▄▄▄█████▄▄▄█████

████████████████

▄▄▄▄▄▄▄██████▀▀ | LLBIT | │ | CRYPTO

FUTURES | | | | | | | │ | 1,000x

LEVERAGE | │ | COMPETITIVE

FEES | │ | INSTANT

EXECUTION | │ | .

TRADE NOW |

|

|

|

|