Bitcoin DCA Strategy ComparisonI was thinking about making a post on DCA. For the post, I will use these variables.

- Strategy 1 (Buying Every Month)

Amount to DCA: $100 per Month

When to Buy: 1st of Every Month

Duration: 1st Jan 2015 to 1st April 2022

- Strategy 2 (Buying on Monthly Red Candles)

Amount to DCA: $200 per Buying

When to Buy: Red Monthly Candle

Duration: 1st Jan 2015 to 1st April 2022

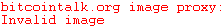

I made a Python code using CoinGecko Historical Data to get the information for Strategy 1.

For Strategy 2, I made a list of dates which had red candle, everything else was same.

Results:- Strategy 1:

No. of Buyings: 88

Amount Invested: 88x100 = $8800

Amount of BTC Own via Strategy 1: 8.079

BTCCost per BTC: 8800/8.079 = 1089.24

Current Profit: 8.079 * 43000 - 8800: $338,597

- Strategy 2:

No. of Buyings: 39

Amount Invested: 39*200 = $7800

Amount of BTC Own via Strategy 2: 6.268

BTCCost per BTC: 7800/6.268 = 1244.41

Current Profit: 6.268 * 43000 - 7800: $261,724

Strategy 1, i.e. buying on the 1st of every month is the clear winner.