dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 08, 2022, 03:19:19 PM

Last edit: October 27, 2022, 02:41:09 PM by dragonvslinux |

|

Update:After four months of consolidation near the lows, the Weekly RSI has finally managed to break back above 37.5, level previous identified as critical back in 2018 and 2020 in order to confirm a trend reversal.

As price today retests $22.5K, $500 short of the 200WMA, the Weekly RSI is now attempting to leave oversold conditions, for the first time since 2018:  While there is still the weekend to go before the Weekly close, and still plenty of time for price to get rejected at current levels (especially the 200WMA at $22,563) this would be the third time the RSI has left oversold on the Weekly, signalling the lows for bear markets in 2015 and 2018. Notably price is also testing the the 50 Month MA at $21.9K, after closing it's first ever month below this moving average.  There has additionally been a break-out of the symmetrical triangle that formed in recent weeks with reasonable volume and a target of around $26K. In the short and long-term, there remains a big volume gap between $22.5K and $29K, so original theories of a quick relief rally back to previous support looks likely. Clearing the 200WMA and $23K could see some serious volatility to the upside in the near future.

|

|

|

|

|

|

|

|

|

|

|

Bitcoin mining is now a specialized and very risky industry, just like gold mining. Amateur miners are unlikely to make much money, and may even lose money. Bitcoin is much more than just mining, though!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

Tytanowy Janusz

Legendary

Offline Offline

Activity: 2156

Merit: 1622

|

|

July 08, 2022, 03:32:10 PM Merited by JayJuanGee (1) |

|

Its also worth to add that short term price action together with volume is finally confirming what we see on weekly candles (possible bottom based on super oversold weekly rsi).

I'm talking about confirmation of W-pattern breakout on extreme high volume:

Current 1h BTC/USDT volume on binance spot is record high. 66k BTC worth around 1.5 billion $ just swapped hands. And it looks like the next candles will be even bigger.

That's 3x more than hourly candle that hit the bottom at 17,700 - June 18, 2022. That's 2x more than the 50k to 42k dump and a return to 47,500 - December 4, 2021, when hopes for a return to tu bull market were shattered. 50% more than during the bloody correction of May 19, 2021, when the bubble burst first time.

|

|

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 08, 2022, 03:36:44 PM |

|

Its also worth to add that short term price action together with volume is finally confirming what we see on weekly candles (possible bottom based on super oversold weekly rsi).

I'm talking about confirmation of W-pattern breakout on extreme high volume:

Current 1h BTC/USDT volume on binance spot is record high. 66k BTC worth around 1.5 billion $ just swapped hands. Very true, the volume spike can additionally be seen on the 4hr at the break-out level which is promising. Although at present it looks like price is at the resistance level of a W-pattern break-out, or Adam & Eve depending on pattern preference. The fact that the short-term is suggesting continuation of bullish momentum, and the long-term is signalling bearish exhaustion (RSI leaving oversold), is the type of bullish confluence within both time frames that we haven't seen for a long-time. For me price still needs to break $23K for confirmation, for longer-term it'll be a Weekly close above the 200WMA. |

|

|

|

el kaka22

Legendary

Offline Offline

Activity: 3500

Merit: 1162

www.Crypto.Games: Multiple coins, multiple games

|

|

July 08, 2022, 08:04:45 PM |

|

It is sure promising, and yet we are going to see a ton of people who will still sell their coins at these prices, and that baffles me. In any case, I already filled my bags, and I am ready to roll, I believe that we are going to end up with a good increase from here. It doesn't have to happen, it could reach to a 30k+ level not too later than now.

I agree on the long term part, can't say much about short term, but the long term bear exhaustion is a real thing, it can't be a bear forever, and eventually bears will have to stop and at that point we are going to go up and this was the first signal showing that they can't take it anymore.

|

|

|

|

|

goaldigger

|

|

July 08, 2022, 09:42:05 PM |

|

This has been discussed at the price of below $20k, and the oversold scenario changes significantly as we’ve seen a small pump with a huge volume, this might be a confirmation that we already bottomed out. The next scenario is to keep on pumping and break the resistance level. If we failed again, most probably this analysis will start over again. We should see those consistent small pumping, that can be a big game changer.

|

| │ | ███████████████████████

███████████████████████

███████████████████████

███████████████████████

███▀▀▀█████████████████

███▄▄▄█████████████████

███████████████████████

███████████████████████

███████████████████████

█████████████████████

███████████████████

███████████████

████████████████████████ | ███████████████████████████

███████████████████████████

███████████████████████████

█████████▀▀██▀██▀▀█████████

█████████████▄█████████████

████████▄█████████▄████████

█████████████▄█████████████

█████████████▄█▄███████████

██████████▀▀█████████████

██████████▀█▀██████████

▀███████████████████▀

▀███████████████▀

█████████████████████████ | | | O F F I C I A L P A R T N E R S

▬▬▬▬▬▬▬▬▬▬

ASTON VILLA FC

BURNLEY FC | │ | | │ | | BK8? | | | █▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄ | .

PLAY NOW | ▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄█ |

|

|

|

Tytanowy Janusz

Legendary

Offline Offline

Activity: 2156

Merit: 1622

|

|

July 10, 2022, 06:46:58 AM |

|

Very true, the volume spike can additionally be seen on the 4hr at the break-out level which is promising.

Looks like all this volume spike on 4h candle was only a wash-trading made because of the binance promotion - Binance Launches Zero-Fee Bitcoin Trading. CZ about the volume spike: "Think this is due to zero fees and people trying to gain VIP tiers. We will exclude Btc trading from VIP calculations. Remove all incentives to wash trade. Announcement with details coming shortly." https://twitter.com/cz_binance/status/1545451961222324225But it does not change the fact that bitcoin was never as oversold as it is now. |

|

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 10, 2022, 07:06:14 AM |

|

Very true, the volume spike can additionally be seen on the 4hr at the break-out level which is promising.

Looks like all this volume spike on 4h candle was only a wash-trading made because of the binance promotion - Binance Launches Zero-Fee Bitcoin Trading. The chart I was using was Coinbase, not Binance. I'm aware of the wash-trading that occurred there. Hence there was still a spike in volume on the 4hr, even if not enormous amounts of volume. There has additionally been a break-out of the symmetrical triangle that formed in recent weeks with reasonable volume and a target of around $26K.

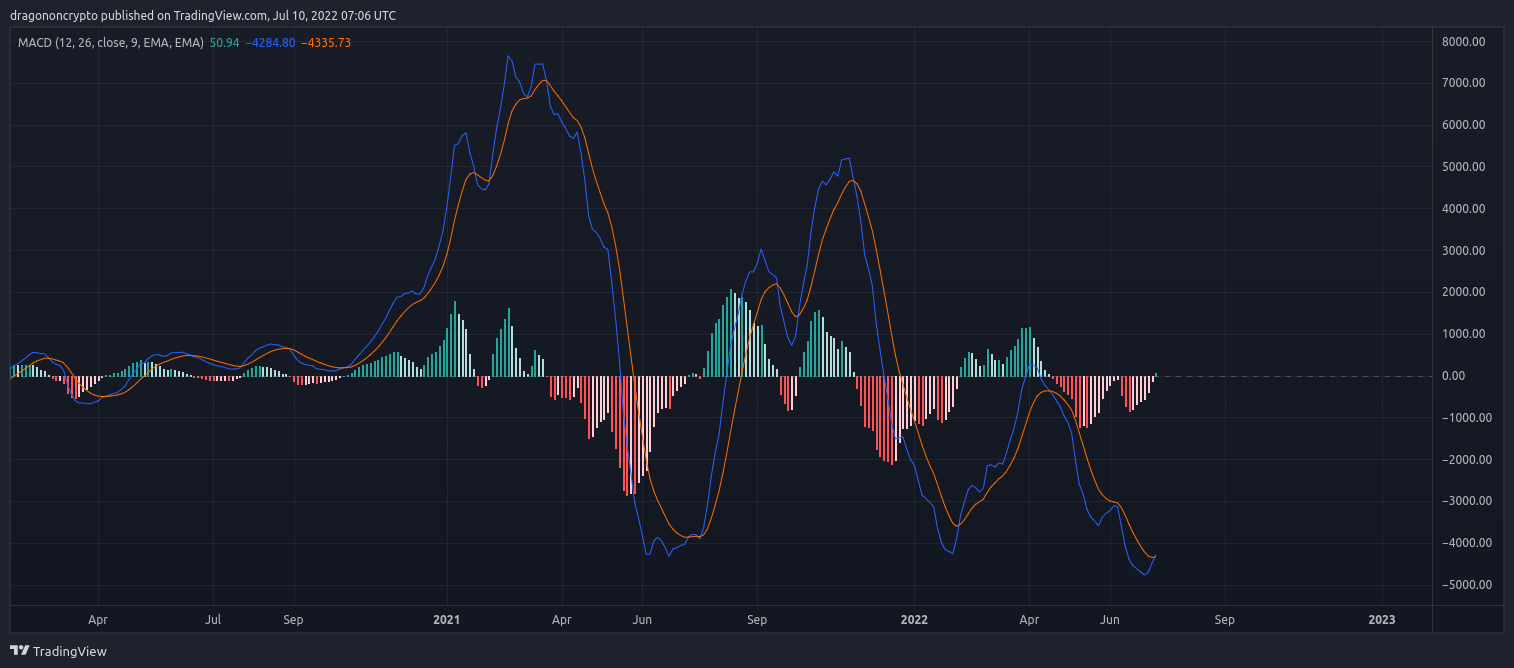

Now it looks like Bitcoin is in a short-term descending triangle since breaking out of the symmetrical triangle, with a target of $20K if it plays out, to the previous resistance trend-line. This would no doubt also return the Weekly RSI back to oversold conditions if it plays out. With news of MtGox coins redistributed next month it seems there could be some panic hitting the market very soon... MACD on 3 Day chart is currently bull-crossing, not seen since February, but won't confirm for another day and a half:  |

|

|

|

|

palle11

|

|

July 10, 2022, 03:10:55 PM |

|

This has been discussed at the price of below $20k, and the oversold scenario changes significantly as we’ve seen a small pump with a huge volume, this might be a confirmation that we already bottomed out. The next scenario is to keep on pumping and break the resistance level. If we failed again, most probably this analysis will start over again. We should see those consistent small pumping, that can be a big game changer.

I think we had a little pump of that yesterday when the price jumped to around above $22k but today dropped back. Well we never know where the buttom is yet but probably the momentum for bear volatility could be cooling down. Hopefully this week may have more bull volatility if the overbought is anything to work with. |

|

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 11, 2022, 07:12:07 PM |

|

Now it looks like Bitcoin is in a short-term descending triangle since breaking out of the symmetrical triangle, with a target of $20K if it plays out, to the previous resistance trend-line. Looks like the -4.5% target has been met from breaking down from the short-term (1hr) descending triangle to previous resistance trend-line after reaching $20,250:  Price is now at the volume point of control on the 4hr chart, where price needs to find buyers to continue higher and avoiding dropping to $19K support:  This would no doubt also return the Weekly RSI back to oversold conditions if it plays out. As anticipated, the Weekly RSI was rejected from leaving oversold conditions showing lack of confidence in the market, as well as initial rejection from the 200WMA.  Ideally price can still find support from previous break-out level, otherwise will continue to be in a range of $19K to $22K without much immediate direction. |

|

|

|

adaseb

Legendary

Offline Offline

Activity: 3738

Merit: 1708

|

|

July 12, 2022, 04:26:56 AM |

|

You need to realize that technical analysis is never 100%. It doesn’t take into account what is going on with the global markets.

If we keep getting high inflation every month then we will keep dipping and there is no technicals on CPI. It’s based on factors that traders can’t control. Hence why it’s called speculation because nobody knows what will happen. If it was easy such as using some RSI then everybody would be millionaires.

|

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 12, 2022, 09:32:04 PM |

|

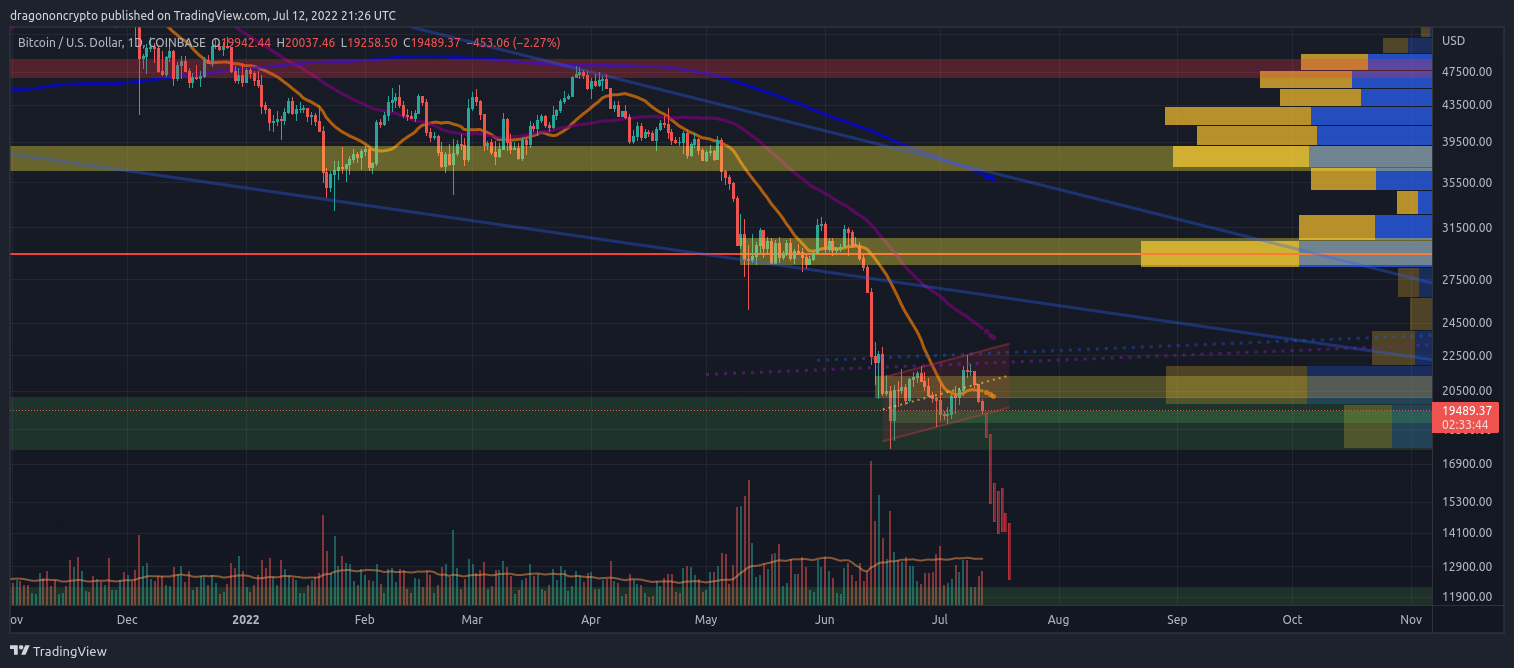

You need to realize that technical analysis is never 100%. It doesn’t take into account what is going on with the global markets. Nothing is 100%, any decent analyst knows this. Same as fundamentals reflecting immediate short-term price or the macro economic environment directing long-term price. While the correlation between the bearish economic overall bearish sentiment is dragging Bitcoin's price down, you can't rely on this 100% of the time. At some point the correlation will break, like we've seen time and time again. If we keep getting high inflation every month then we will keep dipping and there is no technicals on CPI. Not true, there is no 100% guarantee that Bitcoin "will keep dipping". This is common mistake that speculators make, such as yourself in this case, that certain price movements "will happen", instead of "most likely" to happen. I personally find it ironic that speculators will claim TA is not 100%, but then use another form of analysis will provide 100% certainty that price will go up or down. It’s based on factors that traders can’t control. Hence why it’s called speculation because nobody knows what will happen. If it was easy such as using some RSI then everybody would be millionaires.

The RSI on the Weekly is merely mimicking the overall bearish sentiment, that of price strength struggling to leave oversold conditions, highlighting considerable weakness. This is exactly what you'd expect to see if there was considerable bearish sentiment in the market. Likewise recent short-term analysis has been aligned with the overall bearish macro economic environment, that of anticipating price failing to break out higher and instead falling lower. As a trader, its not about controlling price, it's about analysing what the most likely direction is going to be. As you said, TA, as well as other forms of analysis, are all forms of speculation at the end of the day.

As for current price in the short-term, it appears to be forming a bear flag, completely negating any bullish sentiment from the break-out of symmetrical triangle, that ultimately failed:  After breaking $20K we naturally came back down to the $19K support levels where there is some volume support. More relevantly, if this is a bear flag and price breaks local support, the target would be around $12.5K if it plays out, very much the bearish target many have had their eyes on for sometime now. Price will need to reclaim $20K levels relatively quickly to avoid falling considerably lower.  Furthermore, after failing to leave oversold conditions on the Weekly, as well as getting rejected from the 200WMA, price has since fallen -6% indicating some follow through after rejection, as opposed to consolidation at higher levels. There is really nothing bullish I can see right now without $19K levels holding as support and $20K being reclaimed, despite how oversold price already is. |

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 14, 2022, 02:55:36 PM

Last edit: July 14, 2022, 03:42:32 PM by dragonvslinux |

|

There is really nothing bullish I can see right now without $19K levels holding as support and $20K being reclaimed, despite how oversold price already is.

Time to re-test resistance around $23K? Price has so far been holding $19K and and already tested $20K levels (volume point of control) prior to getting short-term rejection:  The upwards trending support has now been tested 3 times, while the upwards sloping resistance only twice so far in-between support tests. While the likelihood would be rejection from $23K levels (where the 200WMA is priced) based on the bear flag that's currently forming, a re-test of resistance to further confirm such a bear flag is looking increasingly likely as price consolidates relatively sideways. If we keep getting high inflation every month then we will keep dipping and there is no technicals on CPI. Not true, there is no 100% guarantee that Bitcoin "will keep dipping". This is common mistake that speculators make Despite bearish CPI news yesterday, price notably increased 4.75% on the day, suggesting that the bearish news had already been priced in. The panic causing a -5% drop when the news arrived so far only shows that it was a sell the rumour event, as opposed to sell the news event. That said, further rejection from $20K levels and breaking $19K levels could lead to much lower prices and confirmation of a bear flag break-down. if this is a bear flag and price breaks local support, the target would be around $12.5K if it plays out, very much the bearish target many have had their eyes on for sometime now.

|

|

|

|

Husires

Legendary

Offline Offline

Activity: 1582

Merit: 1284

|

|

July 14, 2022, 03:48:34 PM |

|

That said, further rejection from $20K levels and breaking $19K levels could lead to much lower prices and confirmation of a bear flag break-down.

If this is confirmed and the price returns to a target around 12.5 thousand dollars, what is your analysis of what will happen? Will it be very fast and return to these levels again (Big V shape,) or will we remain at that level for several months, especially since the news of the recession has begun to spread, which may affect demand and its impact on miners “if the price falls” |

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 14, 2022, 04:08:30 PM |

|

That said, further rejection from $20K levels and breaking $19K levels could lead to much lower prices and confirmation of a bear flag break-down.

If this is confirmed and the price returns to a target around 12.5 thousand dollars, what is your analysis of what will happen? Will it be very fast and return to these levels again (Big V shape,) or will we remain at that level for several months, especially since the news of the recession has begun to spread, which may affect demand and its impact on miners “if the price falls” I don't think that's possible to tell right now. To some degree it depends on when it happens, how long it takes to get there, macro-economic factors, any fundamentals that may be relevant. If you look at recent bottoms: - In March 2020 price capitulated -50% within a week (largely based on liquidations) and there was more of a V-shaped recovery only taking 6 weeks

- In January 2015 at the final end of capitulation with a similar -50% drop, price recovered half of the drop the same week before trading sideways for approximately 10 months

- In November 2018 with a -50% drop taking mainly two weeks, there was more of a rounding bottom that took a few months

What do all of these bottoms have in common? Not a lot in reality, they were each unique in their own way and considerably different. The only correlation is that a -80+% correlation twice previously led to at least a years worth of consolidation, even if price can retrace most of the bear market during that period (like in 2019). It's possible that if price drops to $12K it could be back at $24K within a few weeks, likewise it could trade between $12K and $24K for up to a year. There could be a rounding bottom for a few months before price returns to $45K, or something completely different (probably this option imo). So when the only correlation is that each bottom has been different in it's structure as well as time, then it's probably best to expect something different this time around. I also wouldn't put too much faith into a bear flag target, the odds of it reaching this target isn't that high (around 60-70% maybe). It does line-up with volume support and around a -82% correction overall, but generally speaking breaking down from a bear flag is more relevant as a bearish continuation pattern, and therefore expecting a considerable lower low, as opposed to any accurate target that comes from it. |

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 15, 2022, 10:06:30 AM |

|

Time to re-test resistance around $23K? Price has so far been holding $19K and and already tested $20K levels (volume point of control) prior to getting short-term rejection:  As Bitcoin continues to trend higher after reclaiming $20K, price is now at the equivalent level of $31K at the beginning of June based on moving averages on the 4hr (circled). Price is attempting to rise above the downward sloping (bearish trending) 200MA (blue line) while the 50MA crosses above in a bullish manner (purple line). This could very much be the point of rejection, or break-out to higher highs.  Price is otherwise at the mid-level of the bear flag now, after additionally reclaiming the volume point of control from the past 6 weeks. While the short-term target remains $23K as part of a bear flag structure, this would likely also line-up with the Weekly RSI attempting to leave oversold conditions again where price is likely to see resistance, after already facing rejection last week.  If price can get to $23K and hold this level (or above) with the RSI closing the week out of oversold territory, it could be very bullish setup for however. With Bitcoin rallying since the "bearish" CPI news, this increases the chances of a decoupling from traditional markets and the overall bearish macro-economic sentiment. Although it seems unlikely, this is currently the reality of the situation so far. |

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 16, 2022, 10:38:10 AM |

|

Price is attempting to rise above the downward sloping (bearish trending) 200MA (blue line) while the 50MA crosses above in a bullish manner (purple line). This could very much be the point of rejection, or break-out to higher highs.  Currently seeing some healthy consolidation after reaching the mid-level of the trading channel. Price remains within the bear flag fractal targeting $23K in the near term (before end of week ideally) and trying to find support from volume point of control. With the 50 & 200 MAs on the 4hr as well as 1hr crossing, bulls are trying to maintain momentum, however similar to early June both these 4hr MAs are still trending downwards (bearish) even with a bull-cross. Either way, it's been a month of sideways price action between $18K and $22K, so price is due a break-out out of the current trading range in one direction or another.  While there generally are enough bullish factors for a relief rally, such as 3 Day RSI (again) finally leaving oversold conditions, Pi Cycle Indicator signalling a bottom (that correctly called the top in April 2021), overall there still remains a lack of confluence with miners continuing to capitulate. To say further confirmation is needed to call even a local bottom would be an understatement, as price remains within a bear flag targeting $12.5K. If price can get to $23K and hold this level (or above) with the RSI closing the week out of oversold territory, it could be very bullish setup

|

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

|

July 17, 2022, 10:23:41 AM

Last edit: July 17, 2022, 09:19:44 PM by dragonvslinux |

|

Price remains within the bear flag fractal targeting $23K in the near term (before end of week ideally) and trying to find support from volume point of control.  Price has so far avoided rejection from the 50 & 200 MA bull-cross on the 4hr, instead finding support from volume point of control, unlike in early June when price was unable to sustain above the 200 MA (as circled):  The bear flag fractal remains in tact as price continues to move towards the upper bound of the trading channel while also attempting to leave dense trading volume area between $20K and $21.3K [correction], generally considered short-term resistance. Rejection from current price levels would confirm a lower high on this time-frame, confirming resistance from higher levels. A continuation to the upside would otherwise make re-testing $23K much more likely, even if getting rejected from this level (where the 50 Day MA) remains highly likely. If price can get to $23K and hold this level (or above) with the RSI closing the week out of oversold territory, it could be very bullish setup

The Weekly RSI is again attempting to leave oversold conditions for the second consecutive week (currently at 30.03) as the week turns positive. Therefore closing today (end of week) >30 could certainly see some follow through as has been the case in previous bear market bottoms of 2015 and 2018. Based on past price action, the RSI is unlikely to return to oversold conditions once it has left this territory.  Getting rejected from leaving oversold conditions for a second consecutive week would otherwise be considered bearish and would likely lead to a continuation of downward price action, showing that patient sellers are taking advantage of selling any dead cat bounces so as to avoid selling into long-term oversold conditions. To put it simply: without leaving oversold conditions, price is unable to recover, only consolidate at best. |

|

|

|

|

bittraffic

|

|

July 17, 2022, 10:37:18 AM |

|

I'm actually monitoring the weekly charts with RSI indicator which obviously had been down to 26 in last month but one thing that somehow reminds me is that if the monthly chart's RSI dive below 50, it almost assured that it could also go below 30. I couldn't be sure but I've read its a golden rule for RSI. Something a trader will have to be prepared that once the daily chart indicates overbought, it could also dump sooner.

|

|

|

|

dragonvslinux (OP)

Legendary

Offline Offline

Activity: 1666

Merit: 2204

Crypto Swap Exchange

|

if the monthly chart's RSI dive below 50, it almost assured that it could also go below 30.

I'm not convinced that's usually the case with the RSI, regardless of time-frame, as 50 is merely part of the neutral level: <30 Oversold 30-40 Bearish 40-60 Neutral 60-70 Bullish >70 Overbought It's more common that once the RSI turns bearish (<40) it get's oversold (<30). Likewise if it turns bullish (>60) it get's overbought (>70). But even this isn't that reliable. As for Bitcoin's Monthly RSI, it has never been bearish, only neutral at worst like at the moment (41.66 lowest reading). It's not that Bitcoin is different, it's that it has never been in a long-term downtrend. In this context, long-term as in Monthly moving averages trending downwards and price below them. It could obviously happen, but without the RSI turning bearish, there's nothing to suggest that right now.  Generally speaking this is what makes the Monthly RSI for Bitcoin relatively useless while instead the Weekly RSI is much more reliable. |

|

|

|

buwaytress

Legendary

Offline Offline

Activity: 2786

Merit: 3437

Join the world-leading crypto sportsbook NOW!

|

|

July 17, 2022, 01:01:09 PM |

|

Checking in my current favourite thread in speculation, quite interesting developments over just the last few days, some unexpected rallies -- despite the worse-than-expected news -- leading us to this second consecutive attempt to pull away from the oversold currents.

Am only thinking now what it would mean, if it successfully leaves oversold territory only to return to it again, say, in the next few weeks as that schedule's packed full of expected bearish news (bearing in mind again, pricing in has already happened, but thinking in scenario of worst-than-expected news).

|

|

|

|

|