I've seen a lot of comments about finding signal groups and the like. Well i have something that actually works but isn't a pump and dump get rich quick scheme by some influencer. I'm using these for swing trading to accumulate more bitcoin for myself, but it should work for alts, crypto stocks, even possibly the stock market if the correlation continues to be strong.

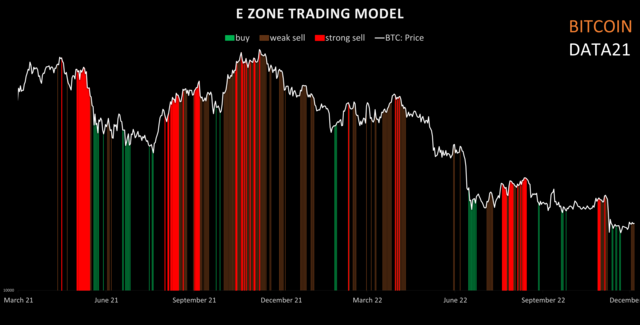

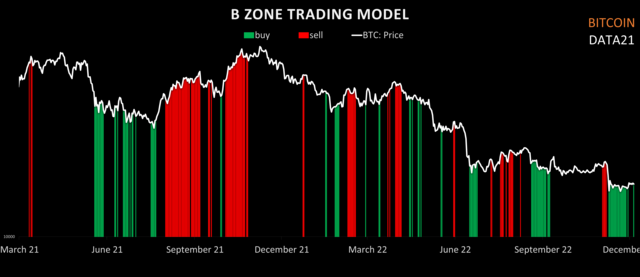

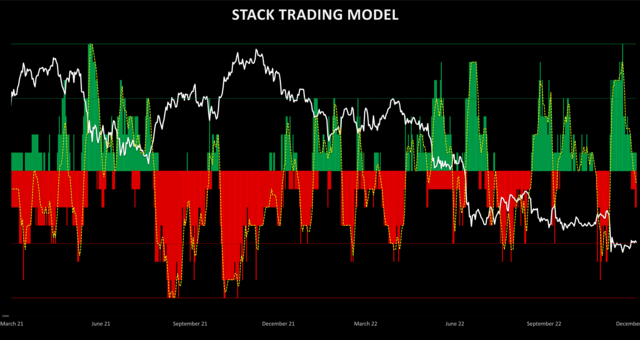

I created these using onchain data from March 2021 to November 2022. There are 3 models i used together. The first uses eth data, the second btc data, and the third is a momentum/strength model using both eth and btc. For whatever reason eth data is more accurate for trading btc than btc data. Here they are:

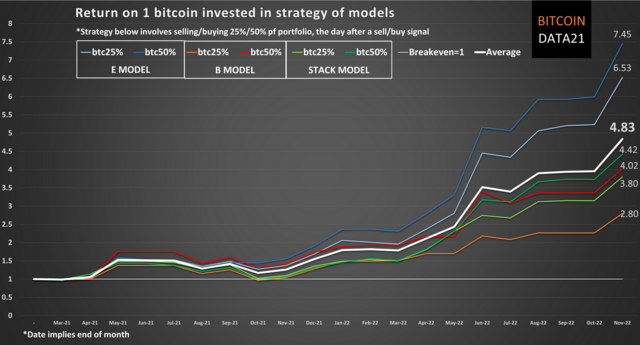

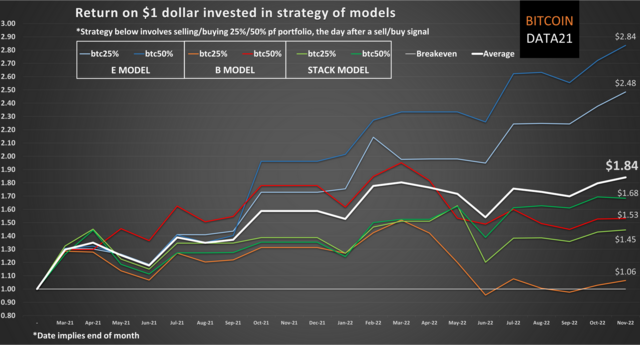

I know there is alot of distrust in onchain data since 2021 because of poor onchain analysis or incorrect interpretation of analysis. But if you look at the above there is clearly something to work with here. So i backtested some strategies aswell to see what could be gained. For all 3 models i took a strategy of selling/buying 25% or 50% of the portfolio the day after a sell/buy signal (the signal for the 3rd model is when the green or red bars hit the dotted lines - may be hard to see here, essentially means 4 out of a possible 7 metrics are saying to buy/sell). Here are the results valued in both btc (for the purists) and in fiat $ dollar:

As you can see the first shows the growth of starting with 1 btc in March 2021 till November 2022. The worst performing strategy still returned 2.8 btc, with the average across all strategies at 4.83 btc.

In dollar terms, $1 returned anywhere between $1.06 (+6%) and $2.84 (+184%), with an average of $1.84 (+84%)

Compare this to buying and holding assets over this timeframe : S&P500 +7% / GOLD +2% / NASDAQ -7% / BTC -62%

I plan on using this going forward, and i believe it has given enough signals in both directions to work well in the future. If anyone is interested they can check out my website that i set up (it is subscription based)

https://www.bitcoindata21.com/I will use this alongside other onchain metrics, orderbook analysis, macro, and sometimes technical analysis to derive even better results. This isn't built for day trading though ofcourse. If anyone has any comments, queries, or feedback, i'd be glad to answer.