LeGaulois (OP)

Copper Member

Legendary

Offline Offline

Activity: 2870

Merit: 4095

Top Crypto Casino

|

|

February 01, 2023, 07:20:31 PM |

|

I'm throwing out an idea. I definitely believe the dollar is going to lose its dominance and we will soon see the Dedollarisation. It was something that might have seemed absurd 20 years ago, but in the last 5 or 10 years it has become a serious idea and even concrete since the process has already started. Here is what has already been done in the last few years to replace the dollar https://en.wikipedia.org/wiki/Dedollarisation#Regional_developmentsThat's a lot of things right? It's just for the last decade. If we look at nowadays - Russia and Iran want to create an altcoin based on gold to trade with each other. - Brazil and Argentina want to create a common currency - El Salvador has adopted Bitcoin as an alternative currency - Iran is using crypto to avoid the US embargo - Countries like China and Europe have developed CBDCs - Russia has been buying gold on a large scale for the last 10-15 years, as have China and the other BRICS countries. At the same time, they have been dumping their US treasury bonds and reducing their dollar reserves. - According to the World Gold Council, central bank gold purchases are at their highest level since 1967 Why? It's pretty well explained here by an economist, and it talks about digital currencies. Basically, they have no choice. Central banks turn to gold as losses mount His conclusion seems correct to me The only reason central banks are buying gold is to protect their balance sheets from their own money destruction programs The Financial Times claims that central banks are already suffering significant losses as a result of the falling value of the bonds they hold on their balance sheets. By the end of the second quarter of 2022, the Federal Reserve had lost $720 billion while the Bank of England had lost £200 billion. The European Central Bank is currently having its finances reviewed, and it is predicted that it will also incur significant losses. The European Central Bank, the US Federal Reserve, the Bank of England, the Swiss National Bank, and the Australian central bank all “now face possible losses of more than $1 trillion altogether, as once-profitable bonds morph into liabilities,” according to Reuters . Why do central banks increase their gold purchases just as losses appear on their balance sheets? To increase their reserve level, lessen losses, and foresee how newly created digital currencies may affect inflation. Since buying European or North American sovereign bonds doesn’t lower the risk of losing money if inflation stays high, it is very likely that the only real option if to buy more gold. If central banks start issuing digital currencies, the level of purchasing power destruction of currencies seen in the past fifty years will be exceedingly small compared with what can occur with unbridled central bank control.

In such an environment, gold’s status as a reserve of value would be unequalled. Gold, bitcoin, a CBDC or whatever, or a mix of everything, for sure the Dollar will be no more the leading currency and a lot of things will be different. Now if we think about the USA, what will they do? Because don't think they will watch the story without trying to do something to stop it. That's a serious question I wonder. Wars or something else, not sure, but at the same time I'm thiking about the war in Ukraine and The USA 'too curious', China and Taiwan with the USA 'too curious' and so on... As POTUS, no idea what I could do. a new paradigm in policy will unavoidably emerge as a result of the disastrous economic and monetary effects of years of excessive easing, and neither our real earnings nor our deposit savings benefit from that. When given the choice between “sound money” and “financial repression,” governments have forced central banks to choose “financial repression.” |

|

|

|

|

|

|

|

|

Bitcoin mining is now a specialized and very risky industry, just like gold mining. Amateur miners are unlikely to make much money, and may even lose money. Bitcoin is much more than just mining, though!

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

|

|

|

Synchronice

|

|

February 01, 2023, 08:30:40 PM |

|

Since the end of 2019, the EU countries established INSTEX, a European special-purpose vehicle (SPV) to facilitate non-USD and non-SWIFT[23][24] transactions with Iran to avoid breaking U.S. sanctions. I'm sure the USA said little in response about the INSTEX but idk why, what's the point of sanctions if they have loopholes and and lightly to say, it's okay to use them. Gold, bitcoin, a CBDC or whatever, or a mix of everything, for sure the Dollar will be no more the leading currency and a lot of things will be different.

Now if we think about the USA, what will they do? Because don't think they will watch the story without trying to do something to stop it. That's a serious question I wonder.

It's not going to happen so easily and simply because the USA has the trump card. 1. China's debt is more than 250 percent of GDP, higher than the United States. 2. Europe defense relies on US 3. The USA is number one in almost every industry, including tech, medicine, engineering, etc. It has the best universities in the world, salaries here are the highest in the world (mostly). 4. USA is the top destination for immigration. The world is highly dependent on America and they aren't blind to not see the changes. It may sound crazy but they don't invest that much money in military to just make show and no, I don't mean they'll actually wage a war against countries to not abandon USD but probably you'll understand what I mean. |

|

|

|

Husires

Legendary

Offline Offline

Activity: 1582

Merit: 1284

|

|

February 01, 2023, 09:34:15 PM |

|

There are facts such as the dollar will lose its dominance, but the problem lies in finding an alternative that represents the global monetary reserve currency. Most of the countries you are talking about such as China, Brazil, Saudi Arabia, Iran, Russia, Switzerland do not have attractive currencies to be an alternative to the dollar. It is true that countries will begin to diversify their reserves, but The dollar will remain attractive.

If the process has begun, it will be long, and the percentage of the dollar will decrease as reserves in central banks and individuals, but without a world war, we will not see much change.

|

|

|

|

stompix

Legendary

Offline Offline

Activity: 2870

Merit: 6282

Blackjack.fun

|

|

February 01, 2023, 11:59:36 PM

Last edit: May 20, 2023, 07:14:26 PM by stompix |

|

If we look at nowadays

- Russia and Iran want to create an altcoin based on gold to trade with each other.

- Brazil and Argentina want to create a common currency

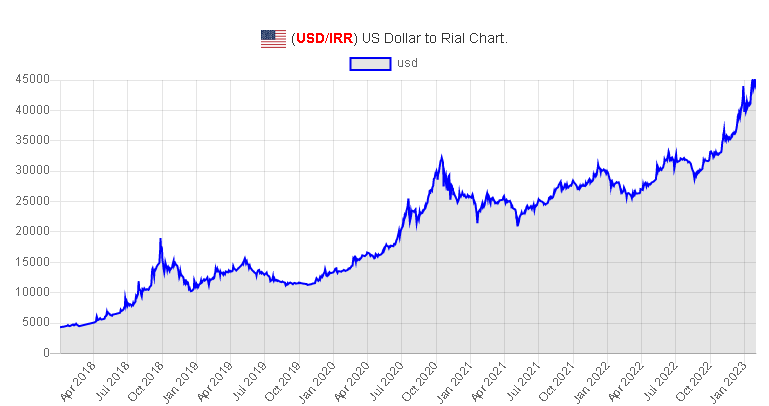

- Iran is using crypto to avoid the US embargo

it looks like:  This is the same thing that was tried a lot of times, it covered the news the same way and it didn't lead to anything because the major problem that the $ trade caused did not disappear when they started trading shitcoins. Why do some countries in the EU want their currency back? Because they want back the ability to devalue the currency, of printing money, of doing the same things that, well, they wouldn't be able to do with Bitcoin either for example. If I want to sell one of my products I look at the price It cost me to manufacture add the profit margin, arrive at 100 units of it, change that to $, and ask you the amount in $, what would change if I were to directly ask you 97 pesos? All this dedollarisation is a witchhunt started by the counties who see their economies in shamble because they can't prop their currency anymore, why do some still trade in $ when they are neighbors and they have their own depends on currencies and so on? Because they don't trust the other, that's why. And who is going to trust: - a common currency with one of the players being Inlfagentina or Defaultina? - a common currency of two countries where you're not allowed to trade in other currencies, where your $ is automatically converted to ruble and the other is one experiencing a 50% inflation and a devaluation of its own currency of nearly 10x in five years? Would you do business in this?  I find it really amusing, here we are on bitcointalk, and we are discussing on how some countries are planning to overthrow the $ by, creating their own shitcoins they can manipulate with ease!  Out of pure curiosity, how would those plans go along with the rest of the world adopting Bitcoin as Salvador did? |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

avikz

Legendary

Offline Offline

Activity: 3066

Merit: 1499

|

|

February 02, 2023, 04:18:53 AM |

|

It's a looooooooooong way to go! It is easier said than done!

De-dollarisation is needed to reduce the dominance of US. Still, in order to achieve this effectively, OPEC countries must come forward and announce that they will take their own coins/currencies in order to sell their oil and natural gas to the rest of the world. Unless such things happen, de-dollarisation will remain on paper but never be implemented.

What it seems now is that a couple of countries are forming their own trading group where they can use their own currencies by avoiding USD. Its impact won't be seen unless they form an alliance and stand their ground on the decision of not taking USD for any of their international trades. Otherwise, it is just not going to help achieve the end objective.

|

|

|

|

Tytanowy Janusz

Legendary

Offline Offline

Activity: 2156

Merit: 1622

|

|

February 02, 2023, 12:48:12 PM |

|

Countries dedolarize (especially after us seizing Russia reserves after invasion on Ukraine) but individuals and companies are dollarizing which is reflected in growing DXY. Especially in hard times when local currencies face a risk of hyperinflation. I mean that USD is a peace of toilet paper, but there is no better alternative. Its the currency of the biggest economy of "west civilization". Civilization characterized by respect for private property and the individual human. So no one will go use china CBDC as china does not respect basic human rights (latest 0-Covid policy, 1-child policy just to serve as example). Also china is a potential US competition and in the event of a potential conflict, assets will be frozen. So the only people that will use China CBDC are china citizens and citizens of countries that are allies to china. So far its a long way to go with a high probability of failure. So far "dollars are involved in nearly 90% of all transactions.". |

|

|

|

|

NotATether

Legendary

Offline Offline

Activity: 1582

Merit: 6718

bitcoincleanup.com / bitmixlist.org

|

|

February 02, 2023, 01:11:21 PM |

|

It's not going to happen so easily and simply because the USA has the trump card.

1. China's debt is more than 250 percent of GDP, higher than the United States.

2. Europe defense relies on US

3. The USA is number one in almost every industry, including tech, medicine, engineering, etc. It has the best universities in the world, salaries here are the highest in the world (mostly).

4. USA is the top destination for immigration.

Economic changes shift economic (soft) power to other countries, while geopolitical changes shift geopolitical power (hard power). So far, with all this madness about debt ceiling limits being hit twice in 5 years, the economic power of the US is crumbling away. But it's still got a hefty amount of geopolitical power for now. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

Hydrogen

Legendary

Offline Offline

Activity: 2562

Merit: 1441

|

|

February 02, 2023, 02:21:58 PM |

|

Gold, bitcoin, a CBDC or whatever, or a mix of everything, for sure the Dollar will be no more the leading currency and a lot of things will be different. Now if we think about the USA, what will they do? Because don't think they will watch the story without trying to do something to stop it. That's a serious question I wonder. Wars or something else, not sure, but at the same time I'm thiking about the war in Ukraine and The USA 'too curious', China and Taiwan with the USA 'too curious' and so on... As POTUS, no idea what I could do. a new paradigm in policy will unavoidably emerge as a result of the disastrous economic and monetary effects of years of excessive easing, and neither our real earnings nor our deposit savings benefit from that. When given the choice between “sound money” and “financial repression,” governments have forced central banks to choose “financial repression.” While I disagree with notions of climate change being cyclical in nature. A case might be made for de dollarization and the demise of international reserve currencies being cyclical. Defined by boom and bust cycles paralleling the rise and fall of nations. Like the roll of a dice. There are many demographics and forms of influence in the world, who wish the cards to fall in their favor. 300 spartans were certainly impressive when they held off the persian army at thermopylae. They were great soldiers and warriors. How did sparta eventually fall? The same with the roman empire and other great nations. How did they eventually meet their end? It seems that many have forgotten some very basic lessons of the past. That is around the time that history usually repeats itself. |

|

|

|

|

hugeblack

Legendary

Offline Offline

Activity: 2492

Merit: 3625

Buy/Sell crypto at BestChange

|

|

February 02, 2023, 09:05:04 PM |

|

I began to see that there is a tendency not to move away from the dollar, but why countries do not exchange with each other away from the dollar, in a system closer to barter, and the reason for that is not because they do not want the dollar, but because of the US sanctions.

For many years, US administrations have been using the economy as a weapon, and the warhead here is the dollar. Therefore, exchanging goods between countries without dollars will avoid those sanctions that were generally linked to the dollar.

So far, there has not been an alliance to do this, but Brazil, Russia, China, South Africa, and here are attempts to include Saudi Arabia in that alliance, as an alternative to G7.

|

|

|

|

Gyfts

Legendary

Offline Offline

Activity: 2758

Merit: 1512

|

|

February 02, 2023, 09:45:26 PM |

|

Once USD reached a 40 year high of inflation over the last few quarters it became clear countries would no longer hold as much USD in their reserves if their purchasing power was dramatically decreasing by virtue of not spending the cash. Couple this with aggressive sanctions and asset seizures, doesn't make sense for a country to use USD if the currency becomes useless over time or if the U.S. government decides they want to seize the currency for their own political ambitions. Not too long ago the U.S. froze 7B in Afghanistan's assets and redistributed it to their own U.S. citizens. 7B is nothing to a large country but the idea of having cash assets seized on a whim would be concerning if your country's government becomes adversaries with the U.S.

|

|

|

|

|

|

coupable

|

|

February 02, 2023, 10:04:39 PM |

|

In the eighties, the dollar represented 80 percent of the monetary reserves of countries, but this confidence did not last long during the next twenty years. As the reserves in dollars decreased to only 50 percent in 2022. Over the past twenty years, many events have occurred that made the world lose confidence in America as the master of the modern world. The 2008 crisis was one of the most important of these events, in addition to the geopolitical changes that the dollar is strongly affected by. If we look at nowadays

- Russia and Iran want to create an altcoin based on gold to trade with each other.

- Brazil and Argentina want to create a common currency

- El Salvador has adopted Bitcoin as an alternative currency

- Iran is using crypto to avoid the US embargo

- Countries like China and Europe have developed CBDCs

- Russia has been buying gold on a large scale for the last 10-15 years, as have China and the other BRICS countries. At the same time, they have been dumping their US treasury bonds and reducing their dollar reserves.

- According to the World Gold Council, central bank gold purchases are at their highest level since 1967

- The Kingdom of Saudi Arabia is considering the option of creating a currency between it and China to facilitate exchanges. - Central African Republic also has adopted Bitcoin as an alternative currency. I really hope that this global campaign to get rid of the dollar will continue, but no one knows what direction events may take, because America will certainly not remain a spectator. |

|

|

|

|

Hispo

Legendary

Offline Offline

Activity: 1190

Merit: 2104

Leading Crypto Sports Betting & Casino Platform

|

|

February 04, 2023, 02:30:18 AM |

|

Whether we like it or not, the United States Dollar is not going anywhere in the short and mid term.

It would be very childish of us to believe that the government of that country will stay still while others try to dethrone its position as the world's currency.

I mean, even during there challenging times and after the massive emission of FIAT by the federal reserve, the USD continue to perform well against other FIAT currencies around the word, so I do not see any change in the status quo going on.

It would take something very drastic to happen for USD get dished, in my opinion.

|

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

pooya87

Legendary

Offline Offline

Activity: 3430

Merit: 10521

|

|

February 05, 2023, 04:31:02 PM |

|

and the reason for that is not because they do not want the dollar, but because of the US sanctions.

I'm surprised to keep seeing this statement on the bitcoin forum from old bitcoin users. Do you guys think Satoshi created Bitcoin because he was under sanctions too? Or do you think he saw the flaws in the existing payment systems and fiat currencies and decided to create an alternative that addresses those flaws? What does Satoshi explain in the first part of the whitepaper? Is it not the flaws in the existing systems and how Bitcoin fixes them? That's the same when it come to dedollarisation or dumping US dollar. There is a big flaw in using dollar which is why no country in the world including US want to use dollar, so they all seek a replacement. The flaw is pretty simple to understand too, US keeps printing dollar without any kind of limit, at any time they want. Then they use all the dollars that were printed out of thin air to other countries to purchase actual goods, energy, services, etc. (Imagine that next time you want to go to the grocery store instead of using your hard earned cash you use your printer to print some money and then use that to buy groceries!) What this cases is inflation in any country that uses dollar (including US) because they use dollar and this is exactly why everyone would love to dump it. In short this is how United States exports its inflation.The only reasons why they haven't done it completely yet are the fear of US (see Iraq, Libya, Syria, and a dozen other countries that were destroyed when they "thought" about dumping dollar) and also because they couldn't come to agreement about the replacement.... until now... |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4453

|

|

February 05, 2023, 05:22:59 PM |

|

is it de-dollarisation... or simply dollarocide

either way

the game of international settlements is simple

shift to e-bucks e-yuan e-quid (name them how they like)

then hyper-inflate the old fiat

then when $1bill fiat is a loaf of bread. pay off national fiat debt for only 31k loaves of bread instead of 31 trillion loaves of bread value

but here is the thing

while fox news plays the racist music of "china bad"

the BIS still operates between US and China

and in a CBDC they will again.

the e-bridge is the CBDC version of the IMF

and they will still trade

they just dont want small businesses and people to be trading with china and russia. (the lower levels)

.. as for the dollarocide..

well yea a country of only 300m, vs countries of 1billion +. obviously US dominance has been faked by manipulating forex markets in US favour and the pumps of minting green paper to make the US look bigger.. yes there will be a switch

just the question becomes which more populated country will become #1 when the top world leaders re-draw the leader board. will it be based on populous, on countries with most human rights laws.

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

|

Casdinyard

|

|

February 05, 2023, 09:51:35 PM |

|

There are facts such as the dollar will lose its dominance, but the problem lies in finding an alternative that represents the global monetary reserve currency. Most of the countries you are talking about such as China, Brazil, Saudi Arabia, Iran, Russia, Switzerland do not have attractive currencies to be an alternative to the dollar. It is true that countries will begin to diversify their reserves, but The dollar will remain attractive.

If the process has begun, it will be long, and the percentage of the dollar will decrease as reserves in central banks and individuals, but without a world war, we will not see much change.

Exactly. Forget about it being publicly attractive. No coin is as dominant and as efficient as the dollar you'll have to admit it. Diversification isn't necessarily resulting to these countries relinquishing support from the dollar, save for I guess, Russia, China, and Iran, which is what dedollarisation is in essence. Sure, they can hog as many of their resources as they can, but when it comes to international commerce, dollar remains supreme. And until a currency efficient enough is made to challenge it, this will be the case. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

|

coupable

|

|

February 05, 2023, 11:23:41 PM |

|

There are facts such as the dollar will lose its dominance, but the problem lies in finding an alternative that represents the global monetary reserve currency. Most of the countries you are talking about such as China, Brazil, Saudi Arabia, Iran, Russia, Switzerland do not have attractive currencies to be an alternative to the dollar. It is true that countries will begin to diversify their reserves, but The dollar will remain attractive.

The dollar will remain attractive because it is the only one able to buy gold, oil and all precious metals. It is literally the world's currency. Alternatives to the dollar can be used, but not completely. This is in addition to the fact that the dollar is the most important weapon of the United States, and it takes care of its interests by preserving the dollar in the global markets to ensure that it avoids a decline in demand for it. |

|

|

|

|

iv4n

Legendary

Offline Offline

Activity: 3122

Merit: 1172

|

|

February 06, 2023, 09:05:36 AM |

|

is it de-dollarisation... or simply dollarocide

...

The best would be de-fiatisation or fiatocide! All fiat currencies are pretty much the same shit, just different names, and colors... and of course, some stink more and some less! All of them are too corrupt, I simply can't imagine how that can be fixed. I don't think we will see some big changes on the global financial stage in the near future, but again some conflicts around the world look dangerous and I am afraid in case of escalation, things can change pretty quickly! |

|

|

|

franky1

Legendary

Offline Offline

Activity: 4200

Merit: 4453

|

|

February 06, 2023, 08:27:00 PM |

|

over a centuries we have seen a few passings of the batten

we had the roman, ottoman, british then american empire. to mane a few

we also seen the IMF dominate in recent century but now we are seeing the echos of things like the WEF and BIS lean more to central america euro rather than north america

the BIS is becoming more powerful and eco-political than the IMF was

il be interested in seeing how central banks move to more of a BIS policy maker than the IMF in 2025

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

trendcoin

Legendary

Offline Offline

Activity: 2184

Merit: 1131

|

|

February 06, 2023, 08:28:01 PM |

|

source: blntbyzt.com Previous global reserve currencies did not last forever either. The dollar will certainly lose this position one day. Silver, which was added to gold coins later, caused inflation and destroyed previous empires. The dollar, which is completely paper, will also lose its hegemony one day. It's an inevitable end, but it's hard to accurately predict the timing of that inevitable end. I think that's why limited supply assets like Bitcoin and Gold are so valuable. |

Darbeciler emperyalistlerin işbirlikçileridir...

|

|

|

|

davis196

|

|

February 07, 2023, 07:25:33 AM |

|

I wouldn't call "dedollarisation" the process which you are describing.

It's just a bunch of countries with totalitarian regimes deciding not to use US dollars. Most of those totalitarian regimes (excluding China) are under western sanctions, so they are trying to show muscles by saying "F**k U!" to the USA and the US dollar.

Does it work? Not really. Is the US dollar under danger because of this? I don't think so. At least not in the upcoming several decades.

I don't mind the US dollar losing a part of it's global dominance. The USA has been exporting inflation for the last 20 years. Maybe this process would lower the global inflation levels, because the world would become less dependent by the money printing machine of the Federal Reserve.

|

|

|

|

|