adaseb (OP)

Legendary

Online Online

Activity: 3752

Merit: 1709

|

|

May 05, 2023, 04:10:55 AM |

|

So it seems every month there is some bank which collapses. And we might get another regional bank or two which is about to get seized this weekend. It leads me to think we will get a credit crunch again and another recession.

Now I am wondering what was the cause of this? Was it SBF? Obviously SBF is not to blame the bad management at these regionals however the way I see how it happened was…

SBF causes massive panic in the crypto world.

Leads to bank run on Silvergate which shows the Hold-to-Maturity losses

Some customers get worried of their deposits at other banks such as Silicon Valley and do a bank run.

Later Signature, Credit Suisse, First Republic experience more bank runs.

Now it’s WAL and PACW

So did this originate from SBF? Can he bad the actual cause of a huge financial collapse?

|

|

|

|

|

|

|

|

|

"In a nutshell, the network works like a distributed

timestamp server, stamping the first transaction to spend a coin. It

takes advantage of the nature of information being easy to spread but

hard to stifle." -- Satoshi

|

|

|

Advertised sites are not endorsed by the Bitcoin Forum. They may be unsafe, untrustworthy, or illegal in your jurisdiction.

|

be.open

Copper Member

Hero Member

Offline Offline

Activity: 2072

Merit: 900

White Russian

|

|

May 05, 2023, 05:50:13 AM |

|

So it seems every month there is some bank which collapses. And we might get another regional bank or two which is about to get seized this weekend. It leads me to think we will get a credit crunch again and another recession.

Now I am wondering what was the cause of this? Was it SBF? Obviously SBF is not to blame the bad management at these regionals however the way I see how it happened was…

SBF causes massive panic in the crypto world.

Leads to bank run on Silvergate which shows the Hold-to-Maturity losses

Some customers get worried of their deposits at other banks such as Silicon Valley and do a bank run.

Later Signature, Credit Suisse, First Republic experience more bank runs.

Now it’s WAL and PACW

So did this originate from SBF? Can he bad the actual cause of a huge financial collapse?

Of course, the SBF is not the cause of the huge financial collapse, it is simply the first victim and the weakest link in the chain that could not withstand the pressure of the Fed's monetary tightening. Raising rates is the real reason. In a decade of extremely low interest rates, banks have become too relaxed and accustomed to a policy of abundance of cheap money. Now they have to pay for it. |

|

|

|

|

EarnOnVictor

|

|

May 05, 2023, 06:29:50 AM |

|

So did this originate from SBF? Can he bad the actual cause of a huge financial collapse?

There is no link between SBF and his former FTX with what is happening in banks and financial institutions that are not related to crypto or had dealing with him and his former company. This could only affect the crypto space, and of which its effect has been weighed since months ago. This is practical, and what is happening to banks is as a result of their poor management and regulation, they were not overseen well. The US government and FED have exposed some of these banks which is what is leading to ripple effects. While a few want to use the bailout funds to restructure and strengthened themselves, so they reveal their condition easily. This is shameful, US banks are not to be trusted. |

| ..Stake.com.. | | | ▄████████████████████████████████████▄

██ ▄▄▄▄▄▄▄▄▄▄ ▄▄▄▄▄▄▄▄▄▄ ██ ▄████▄

██ ▀▀▀▀▀▀▀▀▀▀ ██████████ ▀▀▀▀▀▀▀▀▀▀ ██ ██████

██ ██████████ ██ ██ ██████████ ██ ▀██▀

██ ██ ██ ██████ ██ ██ ██ ██ ██

██ ██████ ██ █████ ███ ██████ ██ ████▄ ██

██ █████ ███ ████ ████ █████ ███ ████████

██ ████ ████ ██████████ ████ ████ ████▀

██ ██████████ ▄▄▄▄▄▄▄▄▄▄ ██████████ ██

██ ▀▀▀▀▀▀▀▀▀▀ ██

▀█████████▀ ▄████████████▄ ▀█████████▀

▄▄▄▄▄▄▄▄▄▄▄▄███ ██ ██ ███▄▄▄▄▄▄▄▄▄▄▄▄

██████████████████████████████████████████ | | | | | | ▄▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▄

█ ▄▀▄ █▀▀█▀▄▄

█ █▀█ █ ▐ ▐▌

█ ▄██▄ █ ▌ █

█ ▄██████▄ █ ▌ ▐▌

█ ██████████ █ ▐ █

█ ▐██████████▌ █ ▐ ▐▌

█ ▀▀██████▀▀ █ ▌ █

█ ▄▄▄██▄▄▄ █ ▌▐▌

█ █▐ █

█ █▐▐▌

█ █▐█

▀▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▀█ | | | | | | ▄▄█████████▄▄

▄██▀▀▀▀█████▀▀▀▀██▄

▄█▀ ▐█▌ ▀█▄

██ ▐█▌ ██

████▄ ▄█████▄ ▄████

████████▄███████████▄████████

███▀ █████████████ ▀███

██ ███████████ ██

▀█▄ █████████ ▄█▀

▀█▄ ▄██▀▀▀▀▀▀▀██▄ ▄▄▄█▀

▀███████ ███████▀

▀█████▄ ▄█████▀

▀▀▀███▄▄▄███▀▀▀ | | | ..PLAY NOW.. |

|

|

|

Tytanowy Janusz

Legendary

Offline Offline

Activity: 2156

Merit: 1622

|

|

May 05, 2023, 06:43:16 AM |

|

So did this originate from SBF? Can he bad the actual cause of a huge financial collapse?

The total size of SBF and FTX collapse is around $10B. But a lot of that is air-inflated shitcoins. The real impact on the fiat positions of banks was probably negligible (like $1-5B?) compared to the whole catastrophe we are currently seeing:  In my opinion, not such businesses collapsed and the banks managed. For example evergrade: "How big is the Evergrande problem? $300 billion Evergrande, China's most indebted developer with $300 billion in liabilities, has been at the heart of the country's real estate troubles since last year. It defaulted on its US dollar bonds in December after scrambling for months to raise cash to repay creditors, suppliers and" https://www.cnn.com/2022/08/01/economy/china-evergrande-miss-deadline-restructuring-plan-intl-hnk/index.htmlThere is no need to look for the guilty among individual bank customers. the real problem is a broken banking and financial system. if everything worked well, then one client wouldn't be able to do anything dangerous |

|

|

|

|

|

gaston castano

|

|

May 05, 2023, 10:41:42 AM |

|

there are many complex factors that can contribute to a financial crisis or recession, and it's rarely the result of just one individual or event. While SBF's actions may have contributed to some level of panic in the crypto world, it's unlikely that they were the sole cause of a regional bank collapsing.

|

|

|

|

|

Smack That Ace

Legendary

Offline Offline

Activity: 1778

Merit: 1094

Assalamu Alekum

|

|

May 05, 2023, 10:52:06 AM |

|

()

So did this originate from SBF? Can he bad the actual cause of a huge financial collapse?

Even the collapse of this $1 trillion crypto industry will not affect the global financial markets, SBF is nothing. Just because he's the one who caused a storm in the crypto market doesn't mean he's big enough to cause a major crash in the world's finance. I see no connection between these two events. The collapse of the world financial system is also part of the world economy, and is inevitable. Let's not forget the failures of the past, and most recently, the economic crisis of 2008 and the collapse of Lehman Brothers. |

|

|

|

Gyfts

Legendary

Offline Offline

Activity: 2758

Merit: 1512

|

|

May 05, 2023, 01:38:10 PM |

|

Even the collapse of this $1 trillion crypto industry will not affect the global financial markets, SBF is nothing. Just because he's the one who caused a storm in the crypto market doesn't mean he's big enough to cause a major crash in the world's finance. I see no connection between these two events.

The collapse of the world financial system is also part of the world economy, and is inevitable. Let's not forget the failures of the past, and most recently, the economic crisis of 2008 and the collapse of Lehman Brothers.

This is correct. If you want to measure capability to cause a global financial crisis, take the total assets of an entity and subtract them by the liabilities. This applies to private companies and entire countries. Countries obviously have large debt issues so they bear risk of causing global financial issues the most. It tends to happen when their economies enter recession. The only players that actually matter are the U.S., China, and EU. If any one of these regions have issues, it can create a domino effect. FTX isn't enough within itself to affect the global economy on a level that'd be cause for concern. |

|

|

|

|

|

Merit.s

|

|

May 05, 2023, 02:01:57 PM |

|

SBF doesn't have anything to do with the collapse of banks in the US. Inflation is the cause because the world economy is facing hike in prices of commodities and the rest. Investors have seen that banks can't be trusted with their funds anymore,and they have being withdrawing their funds and investing into crypto to secure their investment from depreciation. Banks have been living a fake life, Fed has made money harder to obtain by banks and to raise short term interest rate. The banks has piled up debts upon debts and this is the consequence of their actions. It is good that we keep only our daily spending in banks and keep our savings in bitcoin to avoid all these mess from banks.

|

|

|

|

|

franky1

Legendary

Offline Offline

Activity: 4214

Merit: 4458

|

|

May 05, 2023, 02:09:50 PM |

|

SBF was trading non value FTT tokens

fiat banks were trading <1% treasury bonds that became worth less than face value

the next financial crisis of fiat will be the pensions deficits and how inflation has also hurt peoples pension payouts

|

I DO NOT TRADE OR ACT AS ESCROW ON THIS FORUM EVER.

Please do your own research & respect what is written here as both opinion & information gleaned from experience. many people replying with insults but no on-topic content substance, automatically are 'facepalmed' and yawned at

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3234

Merit: 5634

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

May 05, 2023, 03:08:37 PM |

|

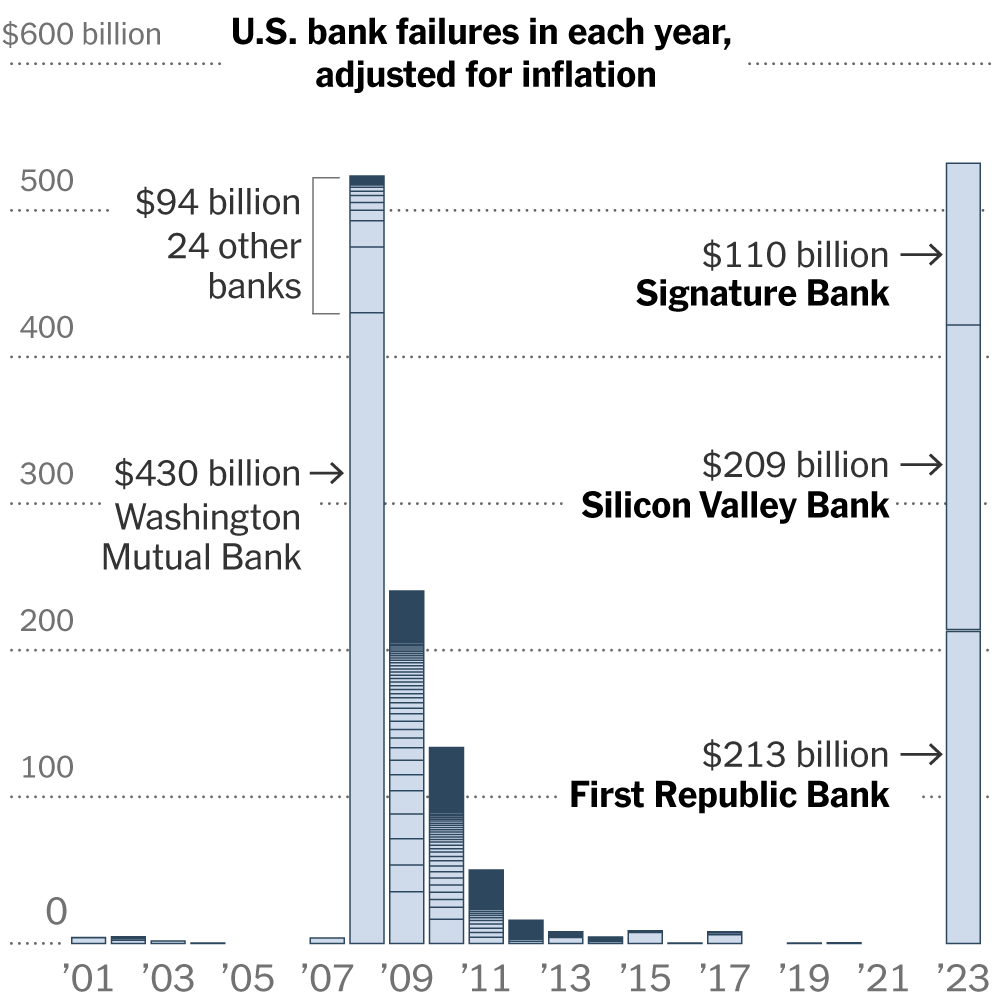

I can say that I agree with the majority that Mr. Bankman is certainly not to blame for what is happening with US banks because he and his company are actually trivial compared to the size of those banks that have already failed and those that will go in that direction. I read somewhere that the value of these three largest is estimated at around $530 billion, which is currently slightly less than the value of all BTC mined so far.

In addition, various analyzes have confirmed that the exposure of the aforementioned banks to crypto was very low, and that the collapse of FTX and the drop in the price of cryptocurrencies had almost no influence on the fact that they were poorly managed and that everyone from the FED down knew about it for years and they didn't do anything.

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

dothebeats

Legendary

Offline Offline

Activity: 3640

Merit: 1352

Cashback 15%

|

|

May 05, 2023, 06:26:50 PM |

|

SBF is a small drop in the pond, a really negligible loss on the grand scheme of things. He may have caused a lot of changes in the crypto market, but I don't think it's that severe that even the big banking institutions around the world are gravely affected. The banking industry falling apart is, IMO, more of an internal issue on how the banking system works and not really about crypto gaining prominence all over.

What I cannot comprehend is how these banks lose a lot of money but still are capable of operating and not getting behind bars. A lot of banks have gone under in the past but are still saved somehow, whereas other businesses are just left to rot with no aid whatsoever from the government.

|

.

.HUGE. | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

umbara ardian

Sr. Member

Offline Offline

Activity: 1344

Merit: 259

Tontogether | Save Smart & Win Big

|

|

May 05, 2023, 08:02:53 PM |

|

It is unlikely that a single individual like SBF is solely responsible for a potential upcoming global financial crash. Financial institutions operate in a complex and interconnected system, and events in one area of the system can have ripple effects throughout the system. While SBF and his former company, FTX, may not be directly related to the current issues in some banks and financial institutions, it's possible that broader economic and market conditions, including regulatory oversight and management decisions, may have contributed to the current situation.

|

| SUGAR | | | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | | | | | | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | ███████████████████████████

███████████████████████████

██████ ██████

██████ ▄████▀ ██████

██████▄▄▄███▀ ▄█ ██████

██████████▀ ▄███ ██████

████████▀ ▄█████▄▄▄██████

██████▀ ▄███████▀▀▀██████

██████ ▀▀▀▀▀▀▀▀▀ ██████

██████ ██████

███████████████████████████

███████████████████████████ | .

Backed By

ZetaChain | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | |

██ ██

██ ██

██ ██

██ ██

██ ██

██ ██ | | | |

|

|

|

vv181

Legendary

Offline Offline

Activity: 1932

Merit: 1273

|

|

May 06, 2023, 04:02:04 AM |

|

Would be too naive to apprehend SBF as the root cause of the recent banking crisis.

FTX does make cryptocurrency spaces shaken up, but not it is recovered. After all, as others have said all FTX-related fall down effect is minuscule compared to those outside the cryptocurrency market. Suppose SBF mismanagement significantly contributes to the wide crises, the banking sector deserved to own that in the first place due to their acceptance of FTX. But that is surely not the case.

|

|

|

|

|

mindrust

Legendary

Offline Offline

Activity: 3248

Merit: 2424

|

|

May 06, 2023, 04:07:00 AM |

|

SBF has nothing to do with it. SBF was one of the results. The reason was the low interest rates. They kept the rates so low for so long and because of that crap exchanges and banks like FTX&First Republic Bank survived... Once they started to raise the rates, these shitty exchanges and banks started to go down. The rates imo should go up even more. We need more cleaning. All the scam exchanges and banks must go bankrupt.

|

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

adaseb (OP)

Legendary

Online Online

Activity: 3752

Merit: 1709

|

|

May 06, 2023, 04:18:08 AM |

|

Yes I know the real reason was interest rates but what made Silicon Valley bank fail shortly after the FTX collapse? Basically there was a massive bank run on Silvergate. We did not know they had to sell their bonds to make withdraws until their earnings came out. Their earnings came out in middle of January.

Then a month and a half later is when Silicon Valley collapse. Most likely many depositors decided it was too risky because they had tons of these HTM bonds and got out and let everybody else know to get their funds out also. Hence the bank run. Maybe it was all a coincidence.

|

|

|

|

vv181

Legendary

Offline Offline

Activity: 1932

Merit: 1273

|

|

May 06, 2023, 12:10:32 PM |

|

Yes I know the real reason was interest rates but what made Silicon Valley bank fail shortly after the FTX collapse? ~Hence the bank run. Maybe it was all a coincidence.

On the surface, FTX might seem correlated with the upheaval of massive bank runs prior to its closure. But in essence, bank systemic risk exposure contributes greatly to the extent its contagion is widespread. I think what I can speculate besides the obvious systemic risk is that FTX does greatly contribute to the panic that initially going on within the banking sector, also do in mind, the recent technology industries slowdown and macroeconomic condition. In the first event of the Silvergate and SVB worrying conditions are happening at almost the same time, so it is expected the public was indeed panicking. It does correlates but does not become the main factor of the collapses. |

|

|

|

|

Lucius

Legendary

Offline Offline

Activity: 3234

Merit: 5634

Blackjack.fun-Free Raffle-Join&Win $50🎲

|

|

May 06, 2023, 01:21:46 PM |

|

~snip~

Maybe it was all a coincidence.

I don't believe that there are coincidences, especially not in businesses worth hundreds of billions of dollars, but I do believe that there are events that can indirectly cause other negative events. I have already written what I think about all this, and all this is not my idea, but it was written about in the majority of influential media, and it is based on the FED report. Speculations are one thing, and facts are something completely different - I advise you to read the following article. The Federal Reserve blamed last month’s collapse of Silicon Valley Bank on poor management, watered-down regulations and lax oversight by its own staffers, and said the industry needs stricter policing on multiple fronts to prevent future bank failures. |

.

.BLACKJACK ♠ FUN. | | | ███▄██████

██████████████▀

████████████

█████████████████

████████████████▄▄

░█████████████▀░▀▀

██████████████████

░██████████████

█████████████████▄

░██████████████▀

████████████

███████████████░██

██████████ | | CRYPTO CASINO &

SPORTS BETTING | | │ | | │ | ▄▄███████▄▄

▄███████████████▄

███████████████████

█████████████████████

███████████████████████

█████████████████████████

█████████████████████████

█████████████████████████

███████████████████████

█████████████████████

███████████████████

▀███████████████▀

███████████████████ | | .

|

|

|

|

iv4n

Legendary

Offline Offline

Activity: 3136

Merit: 1172

|

|

May 06, 2023, 02:23:07 PM |

|

...

So did this originate from SBF? Can he bad the actual cause of a huge financial collapse?

Well, SBF did some things, FTX didn't collapse just like that... He is not the reason for some other financial institution collapse, simply their "owners, directors, boards, or whatever" decided to do the same thing as SBF. Similar things happened before, we can say many times... but with banks it's different, they can get help from governments (taxpayers) for "making terrible business mistakes that caused pretty big loses"... bonuses will be paid anyway. Financial crashes are nothing new... I guess that banks and governments are running the global show, so they are the ones who are responsible. |

|

|

|

Z390

Sr. Member

Offline Offline

Activity: 728

Merit: 303

Cashback 15%

|

|

May 06, 2023, 03:45:37 PM |

|

SBF has nothing to do with it. SBF was one of the results. The reason was the low-interest rates. They kept the rates so low for so long and because of that crap exchanges and banks like FTX&First Republic Bank survived... Once they started to raise the rates, these shitty exchanges and banks started to go down. The rates imo should go up even more. We need more cleaning. All the scam exchanges and banks must go bankrupt.

This is the same thing I keep telling my friends that are also crypto investors, we need all this cleansing to take place, that's the only way we can move forward in crypto and also all this cleansing comes with good buying opportunities, when there is fear there is always a once in a life time opportunity, this is why Crypto is so cool for me, because I like taking risks. SBF or FTX it doesn't matter, something must happen, if FTX failed to go down and still standing strong other ones will take the fall, something bad always happens it's been a long time coming in crypto space, global finance crash has nothing to do with the means SBF created, but they are all in the same box. |

.

HUGE | | | | | | █▀▀▀▀

█

█

█

█

█

█

█

█

█

█

█

█▄▄▄▄ | ▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀▀

.

CASINO & SPORTSBOOK

▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄▄ | ▀▀▀▀█

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▄█ | | |

|

|

|

lionheart78

Legendary

Offline Offline

Activity: 2898

Merit: 1152

|

|

May 06, 2023, 10:21:42 PM |

|

Now I am wondering what was the cause of this? Was it SBF? Obviously SBF is not to blame the bad management at these regionals however the way I see how it happened was… There is no other cause of bank failure the but the bank system itself. The banking system is full of flaws that slowly killing the Banking Industry. Like, in order to maintain their operation, they are bound to pay their employee and maintenance. So with greater expenses than profit, It is obvious that the banking system will surely collapse, they are just lucky because they have the support of the government, this at least prolong thier service.. SBF causes massive panic in the crypto world. Leads to bank run on Silvergate which shows the Hold-to-Maturity losses Some customers get worried of their deposits at other banks such as Silicon Valley and do a bank run. Later Signature, Credit Suisse, First Republic experience more bank runs. Now it’s WAL and PACW So did this originate from SBF? Can he bad the actual cause of a huge financial collapse?

I do not think it originates from SBF case. First SBF's company is servicing cryptocurrency people, so I do not think there is really any relation between the collapse of some bank to SBF. Second, the bank system is designed to fail unless there is constant refill of deposits . |

| | Peach

BTC bitcoin | │ | Buy and Sell

Bitcoin P2P | │ | .

.

▄▄███████▄▄

▄██████████████▄

▄███████████████████▄

▄█████████████████████▄

▄███████████████████████▄

█████████████████████████

█████████████████████████

█████████████████████████

▀███████████████████████▀

▀█████████████████████▀

▀███████████████████▀

▀███████████████▀

▀▀███████▀▀

▀▀▀▀███████▀▀▀▀ | | EUROPE | AFRICA

LATIN AMERICA | | | ▄▀▀▀

█

█

█

█

█

█

█

█

█

█

█

▀▄▄▄ |

███████▄█

███████▀

██▄▄▄▄▄░▄▄▄▄▄

█████████████▀

▐███████████▌

▐███████████▌

█████████████▄

██████████████

███▀███▀▀███▀ | .

Download on the

App Store | ▀▀▀▄

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▀ | ▄▀▀▀

█

█

█

█

█

█

█

█

█

█

█

▀▄▄▄ |

▄██▄

██████▄

█████████▄

████████████▄

███████████████

████████████▀

█████████▀

██████▀

▀██▀ | .

GET IT ON

Google Play | ▀▀▀▄

█

█

█

█

█

█

█

█

█

█

█

▄▄▄▀ |

|

|

|

|