Original Topic: Everything you wanted to know about ES Volcano Bond and were afraid to ask!Author: fillippone

During di last event of “Bitcoin Week'', "Feel di Bit", in El Salvador last November 20th, President Nayib Bukele don tok am say project 4 di first El Salvador bitcoin bond issue, guynamed ESBB1.

Di project is quite convoluted, having financial, technological, and practical implications. We go cover am all , but I go try put eyes more on di economic and technical aspects of dis, leaving di discussion of di details of di Bitcoin City part of di citizenship project 2 oda threads.

1. Di MastaplanEl Salvador, na di only country wen bitcoin Don get legal tender, announced a debt issuance 2 raise capital in oda to "accelerate hyperbitcoinization and carry about a new financial system com dey on top of Bitcoin," na di tok wey Blockstream tok 4 in blog post. Half of di Proceeds of di bonds go be used to build a new city, guynamed “Bitcoin City”, in di Gulf of Fonseca, in di immediate vicinity of an active volcano, wey geothermal energy go be used not only 2 power di city itself bt also to mine bitcoins. Di city no get income, property, capital gain or labour taxes bot we go financed am only by a 10% sales tax.

As only half 4 di capital go be used to build dis “bitcoin infrastructure”, di oda half of di bond sale proceeds go be carry 2 pay a special “bitcoin dividend” to di bondholders, wch go significantly raise di final bond yield. Di plan na 2 use such capital go buy bitcoins 4 di market, hodl dem 4 five years, and den subsequently return part 4 di appreciation of dos to di investor across di last five years of di bonds in di form of an annual coupon payment wey dey financed by di sell of a corresponding amount 4 dos bitcoins.

Thirdly, di investor wey go buy more dan 100,000 USD of di bond go have di possibility 2 apply 4 El Salvador citizenship.

Di bond is meant for di full tokenised in a wholly digital form developed wit Blockstream. Dis go allow the decentralised exchange of di bond using di Liquid sidechain. Di bond wey u go buy dey possible in USD, BTC, and USDT, and, given di unique digital feature, d one wey u fit buy be 100 USD only. Dis feature go help “democratise access to di bond”.

If u wan talk about di mastaplan of El Salvador and di construction of di Bitcoin City, I go suggest you dis thread:

First Bitcoin City

2. The Bond details Small Intel don show so far. Di only intel are dos revealed at such a conference and a few later interviews with Bitcoin entrepreneur Samson Mow, as President Nayib Bukele no go di press conference wey go give plenty Intel.

Di termsheet 4 di bond wey dey published 4 di presentation slide reads like dis:

According 2 di Termsheet

- Di bond go be issue in January 2022. E go be US dollar-denominated (USD don get legal tender in El Salvador) and with a potential size for 1 billion.

- Di bond go mature in 10 years, or January 2032 and go pay an annual coupon for 6.5%.

- After di five years, di bond go start selling di same amount 4 bitcoin a quarter. Di sale don spread over plenty quarters to minimise market impact.

- Di bond go start to dey pay an additional “bitcoin dividend”, after u don buy first bitcoin. Di bond go dey pay an additional coupon determine as di 50% for di potential bitcoin gain 4rm sellin di 20% 4 for bitcoin hold by di bond. If di proceeds for such sale produce a profit, dis go be shared disame part with investor.

- No forget say di bone go use only 50% for di money buy bitcoin. Den “bitcoin dividend” go dey pay investor 50% for di gain wey dey make for 50% investment.

For di example now, u go dey c all cash flow for bond, di way wey di bitcoin price dey for second row:

Spreadsheet

Spreadsheet Blockstream, a Canadian blockchain solutions company, go help El Salvador to structure di bond, working in close connection over di last few months. In addition, di government go issue a few particular laws for Bitfinex actually to sell di bond:

El Salvador dey plan to form government securiti law and grant Bitfinex Securities licenses wey go process di bond issuance. Dis one go pave di way for oda Liquid security tokens like the Blockstream Mining Note (BMN) or Exordium (EXO) token wey go dey listed on a regulated El Salvadorian securities exchange.

E be like said dis one go take plenty time; providing di issuer and di operation arrangement for di legal framework witin wch to operate an incredibly demanding task. But, fot everything, dis one a di first experiment for many aspects to consider.

To watin sabi, dis bond go be first fully-fledged digital bond for di world. Di bond go be trade on Blockstream AMP, a platform used to issue, trade, and manage digital assets issued for di Liquid Network. Di trading activity go be entirely digital, 24/7 (weekends and bank holidays included den) over a blockchain (albeit a permissioned one) on a fully digital form: no be only di bond part for di trade go be digital, even di “purchase “ part go be full digital, through either fiat, BTC or stablecoins. This one go carry di costs down for both di issuer and investors.

Di actual trading go be done with the interface for Bitfinex, wch go provide onboarding, a matching engine, and order processing of di order and trade.

In this

spreadsheet , you can find a copy of the termsheet.

3. El Salvador as an issuer in traditional financeEl Salvador get poor financial situation. Di country get CCC+ rating. Essentially, deir financial stability don rated as “junk”.

Dis matter com preclude di country 4rm accessing traditional financial markets, as many money managers wey no fit buy Junk Bonds and dos wey go fit ask for high premiums to do so.

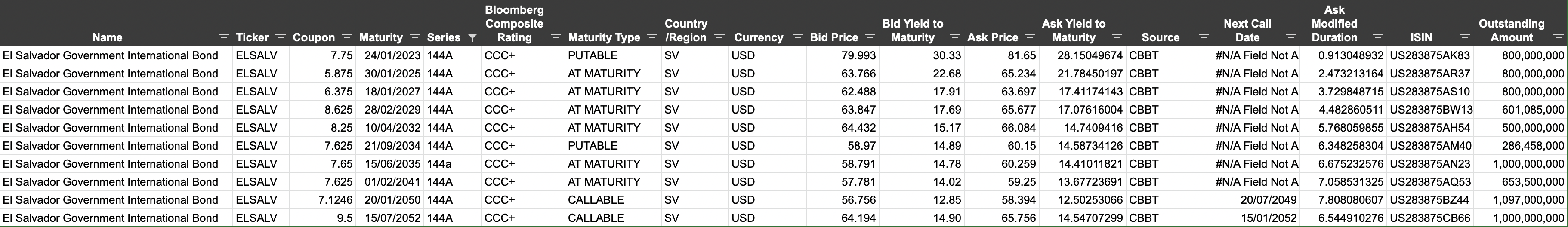

El Salvador get few outstanding bonds:

As u c am, na only 12 bonds maturing 4rm 2023 up to 2052. No forget dat di US has over a few hundred available bonds to construct disame bond curve.

Di yield curve as follows:

|  |

| El Salvador Yield Curve: it's inverted; shorter maturities wey dey ask for higher yield.

|

Dis graph plots di maturity date for El Salvador bond, coupling each maturity wit di associated yield: di resulting line is called the "Yield Curve" and plots di line wey we go like to use do exchange capital in time. Be4 be4, dos slopes are tilted upwards. Anyhow di issuer, if I borrow money, I want make I receive a higher premium for letting person use such for a long time becus for the credit risk. Credit risk, Na in be risk wey represent di borrower for not returning di moni, ideally increases wit time.

Smaller maturities dey ask for higher yields; dis one don dey common across distressed issuers. Reason am, di idea is following: if you manage to plan for the matter wey come first, later things go be much better, so small premium go be required. Dis produces dis weird "inverse" yield curves wey you no dey c together dey more credit-worthy issuers.

Since di Introductionfor di Bitcoin Law and di subsequent friction with the IMF, El Salvador bonds dey losing premium constantly, with yields going north (no forget say if di price for bond falls, di implied yields grow, an inverse relation).

|  |  |

| El Salvador Sovereign Yield Curve compared to wat it was three months ago.

A big shift upwards. Di current curve go be comparable wit above one in Google Sheets. | El Salvador 10Y yield during last months: up from 12.50% to 16.00%. |

ESBB1 go be somewhat depressed in terms of yield, considering di bonds in di curve. However, just no forget dat dis would include di small amount of bitcoin; incase of good underlying bitcoin appreciation, the final yield go be better.

4. Hw u go compares dis bone to traditional investment Since di conference, di Bitcoin community cheered di bond announcement, as seen as way to help di hyperbitcoinisation in El Salvador. Of course, Bitcoin City symbolised dis, but di bond carries anoda light financially.

Make I cut di matter short: dis bond is financial disaster.

An excellent analysis of dis concept 4rm a

Bloomberg article. Basically, buying an El Salvador Bond and using di residual amount to buy bitcoin currently produces a superior result. And dis hold tru in pretty much every possible future scenario. Even a very unpredictable scenario for bitcoin going to zero, the payoff go be better for di traditional finance bond. In an environment wer bitcoin dry go to zero, we go dey think why we go buy a Volcano Bond in di first time.

I dey run little computations in di spreadsheet. Even in di ultra-bullish case illustrated by Samson Mow, di Volcano Bond is inferior for di strategy for buying a traditional bond and investing di remaining change afta di bond purchase in bitcoin.

Putin 2geda watin dey write in the article, instead of buying the bitcoin bond, a superior strategy go be to buy a regular bond instead, for example, di EL SAVL 2032 with an annual 8.5% coupon, trading at 65 cents. Dis go imply a cash flow of 65,000 USD. Dis go leave di possibility to invest di residual 35,000 USD into bitcoin. Di combined investments go be superior for bitcoin bond 4 any state of world.

So na watin go make pipo buy a Vulcano bond if we just demonstrated dat it is an inferior choice?

Wel,Na disame tin reason dey bi: no be all investor get access to physical bitcoins.

Dis na di reason y dere is a market 4 vehicles like GBTC, future-based ETF, or even Microstrategy, or vaguely Bitcoin-related companies dat get purchased by investors in di desperate willingness to gain bitcoin exposure.

Plenty moni managers get constraints on wat dey can buy as investments. And many of dos can no buy simply physical bitcoins, or even dey could theoretically buy di thing; den dey go have compliance, custodial, fiscal, or accounting problems.

So yes, mani suboptimal investment vehicles exist 4 dis very right reason.

Di problem wit dis particular bond is dat I fin it difficult 4 an investment manager wey no fit buy bitcoin to buy a Junk Bond not traded on a traditional financial market. Plenty managers have a threshold for the creditworthiness of the debt issuers, and 4 sure, di rating of El Salvador is well below dis threshold, sitting at CCC+.

Also, a problem is di nature for di digital bond, were dere is no centralised venue for trading, wch go spell issues 4 plenty investors.

5. How dis bond is innovating di financial system Dere is a fascinating detail about di bond. Dis na di first full digital bond in di world. Plenty experiments have been done, but dis na di first time a sovereign entity has issued a digital bond dat can also be transacted wit digital assets, namely BTC and USDT. Blockstream, wech by di way, is an unlisted Canadian firm, issued a similar bond, but I guess di scale is so different.

Dere is an exciting part about dis in di Stephan Livera podcast:

Stephan Livera:

True, true. Na so, you go reason di matter too. And so I reason am, in terms of operationally, E go be essentially trading, E fit be say you go be become customer at Bitfinex to get the bond? Or how you go tak buy am?

Samson Mow:

Right. Na di Bitfinex go be di first exchange wey go dey release di bond. So dey go dey gettin di first license, allowing dem to issue dis security. So I reason am say anyone dat want di first bond go buy am through Bitfinex, but once you have it — so let tak one step back — dese bonds are issue as a token on di Liquid network, and dey do have a permissioned part, and dat done with Blockstream AMP, our asset management platform. So it’s effectively a two-of-two multisig. So go to Bitfinex, do your KYC, dey go add you to di AMP allowlist, and den if two of us don dey AMP allowlist, den we go withdraw am go any wallet dat supports Liquid in AMP assets. And we can OTC trade it back and forth wit one anoda, jus lik di Blockchain Mining Note. So dey get a Telegram channel wey people are already trading di BMN OTC daily. But marketplace no dey. Dey no get secondary exchange marketplace, but dey go still freely trade am. And that go be the same case for any bondholder. So you go still trade am and buy and sell am 2geda wit other bondholder.

So na here we get full digital, decentralised OTC trading environment. Dis one na di future for traditional markets. But I reason am say few institutional players don dey ready for dat.

Dis one na no be only 4rm technological point of view, as implementing make dis be trivial, but above all, 4rm a compliance and regulation point of view.

Just don't forget dat even if dese bonds can be traded in a decentralised way, dey no dey decentralised at all. Dere is central registrar anyway.

Again on di SLP:

Stephan Livera:

You go fit comot di token for bond to your Blockstream Jade and have it on day. And so actually, I dey curious den as well, like how E go even work if, as an example, make we say you lost di seed words for your Blockstream Jade—how that aspect go even work? Dey get central registrar of am? Abi na wat AMP dey providing here abi?

Samson Mow:

Yes, effectively. So AMP go allow di service to blacklist dose tokens becus dey don lost now. And becus it is—like, dis one no decentralised, right? make we no show say dese bonds are decentralised. Dey are not. Dey be security, and na why you go do KYC, and dey have to add you among di whitelist so dat you go dey able to trade am and withdraw 4rm di exchange, of course. So watin go happen for di service will blacklist dose old tokens and den issue new ones for you. So di net circulating supply will not change becus some of di tokens no even circulation, but way dey to get dem back. And we’ve had dat with EXO 4 Infinite Fleet. Someone lost deir keys, actually. So dey are going to get new tokens from STOCKR. So dere is recourse if you lose your key—no be Bitcoin. Na bond tokenised wit Bitcoin in it.

Dis one dey fast fast.

Di failure to understand dat centralisation of di asset control and di centralisation of di exchange are two separate concepts is a classic error plenty legacy financial institutions mak daily while speaking of "blockchain" and "decentralised assets".

In addition to dat, anoda fast aspect is di technology behind am. All your favourite digital assets, NFT, tokens or whatever thin you are interested for di based on some shitty blockchain, namely ETH. No be this one. D technology here na 100% Bitcoin. Liquid na Bitcoin Sidechain. All dis is being made wit "traditional, slow, polluting" Bitcoin technology.

Also, dis na significant selling point for bond and, for sure, an actual use case test for Liquid to become di backbone for new financial market.

6. further resources

Fillippone "everythin wey you want no about.." threads:

Dis post dey eligible for my project:

I am a strong believer in the utility of local boards.

I de lucky enough to express myself in at least a couple of languages, but I no dis is not di case 4 everyone.

lot of users post only in di local boards becus of a variety of reasons either language or cultural barriers, lack of interest or whatever oda reason.

I personally no a lot of very good users (4rm di italian sections mainly, 4 obvious reason) who do post in di international sections.

I think say all dose users dey are missing a lot of good contents posted on the international (english) section or on other boards.

If you no you can help here, go visit di thread!

[/quote]