Chart patterns, when combined with technical indicators, offer crucial insights to traders, enhancing their market analysis capabilities. These patterns serve as invaluable tools within a trader's toolkit. I made a short summary of another article for you, about the bump and reversal bottom (BARR) pattern. Thet

the source is here, where you can also learn about other chart patterns.

What is a Bump and Run Reversal Bottom (BARR) Pattern?The Bump and Run Reversal Bottom (BARR) pattern is characterized by three distinct phases: the lead-in phase, the bump phase, and the run phase. The lead-in phase is a period of gradual price decline, followed by a sudden and sharp price increase during the bump phase. The run phase is a gradual price decline that follows the bump phase.

Is the Bump and Run Reversal Bottom (BARR) pattern a Continuation or Reversal Pattern?The BARR pattern indicates a possible shift from a falling to a rising trend, as it is a reversal pattern. Although continuations sometimes occur, reversal is more likely and effective than continuations.

Bump and Run Reversal Bottom Pattern (BARR) Thomas Bulkowski conducted extensive research on chart patterns. He examined daily data of US stocks and found over 1099 trades based on the breakout Bump and Run Reversal Bottom pattern.

The pattern had the best overall performance rank among 39 chart patterns.

(EURUSDT D1 – Bump and Run Reversal Bottom Pattern (BARR))

How to Identify a Bump and Run Reversal Bottom (BARR) Pattern?The bump and Run Reversal Bottom (BARR) pattern has three phases: the lead-in phase, the bump phase, and the run phase. The lead-in phase involves a gradual price decline, while the bump phase is a sudden and sharp price increase. Finally, the run phase is a gradual price decline that follows the bump phase.

The trendline of the BARR pattern connects the lows of the lead-in phase and the bump phase. Once the price breaks through this trendline, it signals a potential trend reversal from a downward to an upward trend.

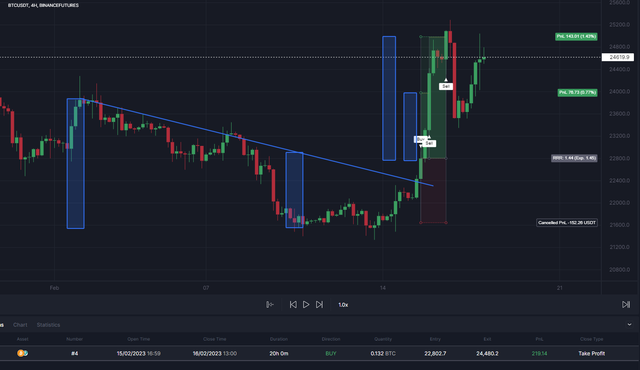

(BTCUSDT D1 – Bump and Run Reversal Bottom Pattern (BARR))

The volume trend during formation has no effect on the performance. But as prices break out of the formation and start moving higher, there is a significant increase in trading volume. Rising prices characterize the uphill run phase.

(GBPUSDT H4 – Bump and Run Reversal Bottom Pattern (BARR))

Where to Place Target and Stop Loss?Target: Measure the height of the bump and add it to the breakout point.

Stop-loss: Typically placed at the midpoint of the bump phase, aiming for a risk-to-reward ratio of at least 2R.

(ETHUSDT D1 – Bump and Run Reversal Bottom Pattern (BARR))

How to Trade a Bump and Run Reversal Bottom (BARR) Pattern Automatically?To use the BARR Pattern in your automated trading strategy, you can identify the pattern on the cleo.finance chart and use the pattern's lines as your automated entry and exit conditions, along with your stop losses and take profits. Then automate it. You also have the option to backtest the strategy using a manual backtester on the chart equipped with drawing tools. This allows you to simulate the BARR pattern on the chart and assess its effectiveness.